Multiphase Flow Meter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431913 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Multiphase Flow Meter Market Size

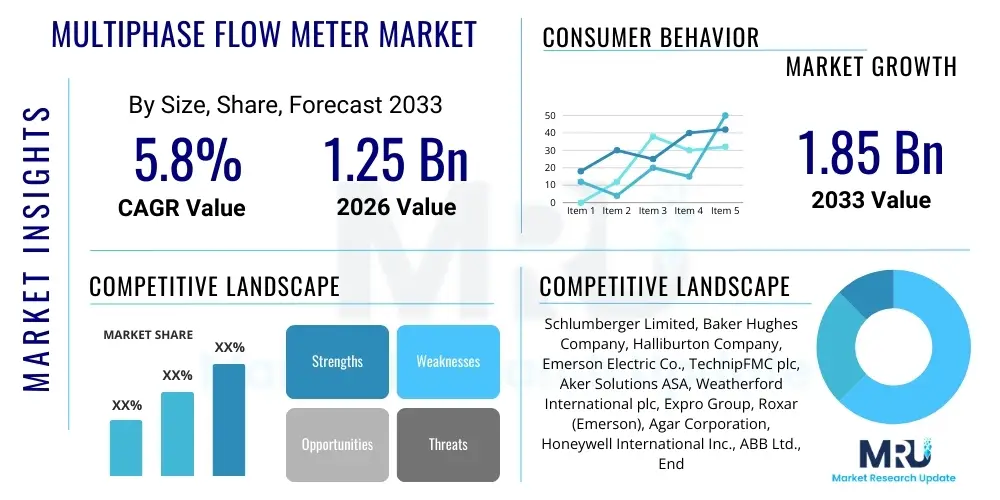

The Multiphase Flow Meter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Multiphase Flow Meter Market introduction

The Multiphase Flow Meter (MPFM) Market encompasses highly specialized instrumentation designed to measure the individual flow rates of crude oil, natural gas, and water simultaneously, without requiring prior separation of the phases. This technology is critical in the upstream oil and gas sector, particularly in subsea and challenging reservoir environments, where traditional test separators are impractical or cost-prohibitive. MPFMs utilize advanced measurement principles, often combining nuclear, electrical, or acoustic methods with sophisticated signal processing, to provide real-time, accurate data essential for reservoir management, production optimization, and well testing. The intrinsic complexity of accurately measuring dynamic, varying phase fractions under high pressure and temperature conditions defines the competitive landscape and technological focus of this specialized industry segment. These meters are deployed across various stages of hydrocarbon production, from exploration to mature field operations, significantly enhancing operational efficiency.

Multiphase flow meters are primarily applied in production allocation, well intervention management, and continuous monitoring of challenging or marginal wells. Their primary benefit lies in providing continuous, instantaneous measurements, which drastically reduces the need for frequent well testing using conventional test separators, leading to significant cost savings and reduced environmental footprint. Furthermore, the real-time data provided by MPFMs enables operators to detect anomalies such as water breakthrough or gas coning faster, facilitating timely intervention and maximizing ultimate oil recovery. The driving factors behind the market’s expansion include the escalating global demand for energy, the increasing focus on optimizing production from mature oil fields, and the rising complexity of developing deepwater and unconventional resources, where accurate and cost-effective flow assurance technologies are paramount.

The core functionality of these devices addresses the inherent challenge of handling complex fluid streams where phase fractions change rapidly, especially in remote or subsea locations where accessibility is limited. Major applications span initial well testing during exploration, continuous production surveillance in fields lacking dedicated separation infrastructure, and optimizing chemical injection strategies. The superior data quality and operational flexibility offered by MPFMs compared to traditional methods position them as indispensable tools for modern petroleum engineering practices, directly contributing to improved reservoir surveillance and asset integrity management across the globe.

Multiphase Flow Meter Market Executive Summary

The Multiphase Flow Meter market is characterized by robust growth driven by sustained investments in deepwater exploration and production (E&P) activities, particularly in regions like the Gulf of Mexico, Brazil, and West Africa. Business trends indicate a strong shift toward digitalization and integration of flow measurement data with broader reservoir modeling and production optimization software platforms. Leading industry players are focusing on developing hybrid technologies that combine different physical measurement principles, such as incorporating Venturi meters with gamma fraction meters, to enhance accuracy and reduce operational sensitivity to varying fluid properties. Strategic mergers, acquisitions, and technological collaborations aimed at expanding product portfolios and geographical reach are key business strategies defining the competitive dynamics, with companies striving to offer compact, modular, and reliable subsea solutions that minimize intervention requirements.

Regionally, North America, driven by the revival of offshore drilling and the need for enhanced monitoring in unconventional plays, maintains a significant market share. However, Asia Pacific is anticipated to exhibit the fastest growth rate, fueled by substantial upstream investments in countries such as China, India, and Malaysia, focusing on maximizing output from existing and newly discovered offshore assets. The Middle East remains a crucial region due to large-scale infrastructure projects requiring sophisticated flow assurance tools for managing complex heavy oil reservoirs. Segment trends highlight the growing preference for non-radioactive MPFMs, driven by increasing regulatory scrutiny regarding nuclear sources, and a strong uptake of compact and portable MPFMs designed for quick deployment in marginal field operations and troubleshooting applications.

The market structure reflects a concentrated competitive environment dominated by a few major providers known for their established technology expertise and robust service capabilities. The transition towards permanent subsea installations is a major trend impacting the market structure, necessitating equipment capable of surviving extreme pressures and temperatures for decades without failure. Furthermore, the rise of specialized service providers focusing purely on calibration, maintenance, and data interpretation services for these complex meters is contributing to the overall market ecosystem maturity. Overall, the market's trajectory is firmly linked to the long-term outlook of the global upstream oil and gas sector, particularly high-cost recovery projects where flow assurance reliability is mission-critical.

AI Impact Analysis on Multiphase Flow Meter Market

Users commonly inquire about how Artificial Intelligence (AI) can enhance the accuracy, reliability, and predictive maintenance of Multiphase Flow Meters, especially concerning the interpretation of complex, noisy measurement signals and drift correction over long operational periods. The key themes revolve around AI's ability to model and compensate for fluid property variations (e.g., changes in salinity, viscosity, and gas-liquid ratio) that traditional deterministic models struggle to handle, thereby reducing measurement uncertainty. There is significant expectation that AI-driven diagnostics will revolutionize operational efficiency by predicting equipment failure before it occurs, optimizing calibration schedules, and enabling real-time autonomous adjustments of meter parameters in dynamic downhole environments. Furthermore, users anticipate AI will play a critical role in integrating MPFM data seamlessly with large-scale digital twins of reservoirs and production systems, allowing for holistic production optimization decisions.

- Enhanced Data Interpretation: AI algorithms (e.g., Neural Networks) process raw sensor data to extract more accurate phase fractions than conventional models, reducing inherent measurement noise.

- Predictive Maintenance: Machine learning models analyze historical performance metrics and operating conditions to forecast potential meter failures or degradation, minimizing downtime.

- Real-Time Calibration and Drift Correction: AI continuously monitors meter bias and applies autonomous adjustments to maintain accuracy despite changes in fluid composition or temperature/pressure.

- Optimization of Well Testing: AI rapidly analyzes MPFM measurements to determine optimal choke settings and production rates, accelerating the well testing process.

- Integration with Digital Twins: AI facilitates the incorporation of high-frequency MPFM data into complex reservoir simulation models for holistic production system optimization and surveillance.

- Anomaly Detection: Machine learning identifies subtle deviations in flow patterns indicative of issues like sand production, emulsion formation, or hydrate blockage earlier than human operators.

DRO & Impact Forces Of Multiphase Flow Meter Market

The Multiphase Flow Meter market is strongly influenced by critical drivers, structural restraints, and emerging opportunities shaping its future trajectory. A primary driver is the increasing difficulty and expense associated with separating multiphase flows in challenging environments, especially deepwater and subsea installations, making MPFMs a more cost-effective and operationally superior alternative to traditional separators. Technological advancements, particularly in non-intrusive and non-radioactive measurement techniques, are also significantly propelling market adoption by addressing regulatory concerns and simplifying operational deployment. The global imperative for enhanced oil recovery (EOR) strategies necessitates precise, continuous measurements of fluid output from individual wells, providing a foundational demand for MPFM technology in optimizing reservoir performance.

Restraints, however, pose structural challenges to widespread adoption. The high capital expenditure associated with purchasing, installing, and calibrating advanced MPFMs remains a significant barrier for smaller operators or brownfield projects with limited budgets. Furthermore, the inherent complexity and susceptibility of these devices to fluid characteristics, such as high water cut or extreme viscosity changes, necessitate frequent, specialized calibration and maintenance, which adds to the operational cost and often requires proprietary expertise. Market reluctance also stems from the perceived reliability issues in extremely hostile operational environments and the difficulty in establishing universal standards for performance verification across different vendors and technologies, leading to customer skepticism in highly critical applications.

The primary opportunities center around the transition to intelligent oilfields and the widespread adoption of Industry 4.0 principles, enabling MPFMs to become integral components of fully automated production systems. The development of permanent subsea metering systems represents a high-growth segment, leveraging the technological leap toward remote, autonomous subsea production systems. Additionally, the expansion into adjacent markets, such as geothermal energy production and specialized chemical processing, where complex, multi-component fluid measurement is required, presents diversification opportunities. Key impact forces include regulatory pressure favoring continuous environmental monitoring, the fluctuating global price of crude oil impacting E&P budgets, and the sustained pace of innovation in sensor technology, specifically aiming for lower-cost, more robust meters suitable for mass deployment across conventional onshore fields.

Segmentation Analysis

The Multiphase Flow Meter Market is meticulously segmented based on key criteria including the technology employed, the type of application (such as onshore or offshore), the operational environment (e.g., flow regimes), and the components used (hardware versus software/services). This segmentation helps in understanding the varying demands across the highly diverse oil and gas value chain. Technology segmentation is critical, differentiating between meters based on their measurement principles, such as combination meters (utilizing gamma fraction combined with Venturi), dual-modality meters, and newer, non-intrusive electromagnetic or acoustic techniques. The application segmentation clearly distinguishes the high-specification, rugged subsea meters required for offshore deepwater projects from the more accessible, portable meters used for temporary well testing onshore.

By phase fraction, the market divides into meters optimized for high gas volume fraction (GVF) applications, typically requiring specialized high-velocity handling capabilities, and those optimized for low GVF or high water cut conditions, demanding robust phase discrimination algorithms. Component analysis separates the revenue streams derived from the initial sale and installation of hardware components, which represent high capital expenditure, from the ongoing recurring revenue generated through software licenses, calibration services, maintenance contracts, and data interpretation services. This service segment is growing rapidly, reflecting the industry's shift towards outsourced expertise for complex instrumentation management, often bundled with AI-driven diagnostic tools.

The comprehensive understanding of these segments allows stakeholders to tailor their product development and marketing strategies, ensuring that specialized equipment meets the stringent requirements of specific operational environments, such as high-pressure/high-temperature (HPHT) wells or highly corrosive sour gas fields. The fastest-growing segment is anticipated to be the services component, driven by the need to maximize the operational lifespan and accuracy of expensive installed hardware through rigorous, data-driven maintenance protocols, ultimately reducing the total cost of ownership for operators globally.

- By Technology:

- Separation Technology

- Non-Separation Technology (Wet Gas Flow Meters, Full Multiphase Flow Meters)

- Hybrid Metering Systems

- By Application:

- Well Testing and Monitoring

- Production Monitoring and Allocation

- Pipeline Management

- Permanent Subsea Installation

- By Operational Environment:

- Onshore

- Offshore (Shallow Water, Deepwater)

- By Component:

- Hardware (Meters, Sensors, Data Acquisition Units)

- Software and Services (Calibration, Maintenance, Data Analytics, Flow Assurance Modeling)

- By Phase Fraction:

- Low Gas Volume Fraction (GVF)

- High Gas Volume Fraction (GVF) (Wet Gas Metering)

Value Chain Analysis For Multiphase Flow Meter Market

The value chain for the Multiphase Flow Meter market begins with upstream activities focused on research, development, and sophisticated sensor manufacturing. This involves high-tech processes for creating specialized components like gamma ray sources (for meters using nucleonic technology), high-frequency acoustic transducers, electrical impedance probes, and robust, high-pressure housing materials, often sourced from specialized material science suppliers. The intellectual property and proprietary algorithms developed during the R&D phase constitute a significant portion of the product's value. Following component manufacturing, system integration and assembly occur, where various sensors, processing units, and communication modules are combined, rigorously calibrated, and certified for hazardous environments, making quality control a critical value-adding step in the middle of the chain.

Downstream activities involve the distribution channel, dominated by a mix of direct sales and specialized indirect channels. Due to the high-value, complex, and highly customized nature of MPFMs, major manufacturers often engage in direct sales and engineering consultation with large multinational oil and gas operators (IOCs and NOCs). This direct model ensures detailed technical support and customization specific to the end-user's reservoir and flow conditions. Indirect distribution is primarily handled by authorized agents, local distributors, or engineering, procurement, and construction (EPC) firms that integrate these meters into larger field development projects, particularly in geographically challenging regions, providing local support and logistics coordination.

The ultimate delivery of value resides in the post-sales service and data utilization phase. Direct involvement is crucial here, as specialized field engineers are often required for initial commissioning, ongoing sophisticated recalibration, and performance monitoring. The trend towards integrating meters with cloud-based analytics platforms means that the value chain extends into the provision of data services and flow assurance modeling, turning the meter from a mere instrument into a crucial data generation node for production optimization. This comprehensive service model strengthens manufacturer-operator relationships and secures recurring revenue streams long after the initial sale, reinforcing the importance of proprietary service expertise within the total value delivered.

Multiphase Flow Meter Market Potential Customers

The primary end-users and buyers of Multiphase Flow Meters are predominantly entities engaged in the exploration, extraction, and monitoring of hydrocarbon resources. This includes major International Oil Companies (IOCs) such as ExxonMobil, Shell, and BP, who utilize MPFMs extensively for managing their complex deepwater and unconventional assets where accurate well-by-well production allocation is paramount. National Oil Companies (NOCs), including Saudi Aramco, Petrobras, and Equinor, represent massive potential customers, especially as they undertake large-scale field redevelopment and enhancement projects aimed at maximizing recovery from mature reservoirs, requiring vast deployments of reliable monitoring technology.

Independent Oil and Gas Operators also constitute a significant customer base, particularly those focusing on niche or challenging fields, where the economic viability often hinges on precise, low-intervention monitoring solutions that MPFMs provide. Furthermore, specialized oilfield service companies (OFS), like Schlumberger and Halliburton, often act as indirect buyers, purchasing MPFMs to integrate into their overall well testing and production optimization service packages offered to their clientele. These OFS companies are crucial for market penetration due to their global reach and established relationships with field operators.

The purchasing decisions are driven by factors such as the total cost of ownership (TCO), the demonstrated long-term reliability in harsh conditions (e.g., high H2S content or sand production), and the ease of integration with existing SCADA and production control systems. Emerging customer segments include operators in the Carbon Capture, Utilization, and Storage (CCUS) sector and geothermal energy producers, both of whom require specialized, multi-component flow measurement solutions, broadening the traditional customer base beyond strictly hydrocarbon production into adjacent energy industries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger Limited, Baker Hughes Company, Halliburton Company, Emerson Electric Co., TechnipFMC plc, Aker Solutions ASA, Weatherford International plc, Expro Group, Roxar (Emerson), Agar Corporation, Honeywell International Inc., ABB Ltd., Endress+Hauser Group Services AG, Fuji Electric Co. Ltd., Siemens AG, Proserv Group, MPFM Technology, Caltex Industries, Jiskoot Ltd., Tenaris S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Multiphase Flow Meter Market Key Technology Landscape

The technological landscape of the Multiphase Flow Meter market is defined by a continuous push towards non-intrusive, non-radioactive, and highly accurate measurement techniques capable of handling the increasing severity of operational environments. The dominant technologies historically involve a combination approach: using a Venturi meter for total flow rate measurement and a nucleonic (gamma ray densitometry) or electrical impedance technique to determine the phase fractions (oil, gas, water). While highly effective, the regulatory hurdles and logistical complexities associated with radioactive sources are accelerating the development and commercialization of alternative technologies. Manufacturers are heavily investing in electromagnetic, acoustic, and microwave-based measurement systems that offer comparable performance without the environmental and safety liabilities linked to nuclear sources, marking a crucial shift in the technology paradigm.

A significant area of innovation involves advanced signal processing and modeling, moving beyond simple linear calibration curves to utilize complex numerical methods, often integrated with machine learning algorithms. Modern MPFMs are essentially integrated computational systems that use multiple sensors—pressure, temperature, conductivity, and differential pressure—to feed data into a unified, high-speed processing unit. This facilitates dynamic compensation for real-time changes in fluid properties, ensuring measurement accuracy is maintained even as water cut increases or gas quality varies. Furthermore, the push towards subsea deployment necessitates technology centered on extreme reliability, requiring robust materials science, redundant sensor architecture, and low-power consumption designs capable of operating autonomously for decades underwater without human intervention.

The development of wet gas meters, a specialized subset of MPFMs designed to accurately measure high gas volume fraction (GVF) flows with minimal liquid components, continues to be crucial for gas condensate fields. Moreover, the integration of fiber optic sensing technologies is emerging as a promising future direction, offering immunity to electromagnetic interference and enabling distributed, real-time measurements across the flow line. This continuous innovation, supported by standardized communication protocols (such as MODBUS or OPC UA for industrial IoT), ensures that MPFM data can be reliably transmitted and integrated into broader digital oilfield infrastructure, maximizing the strategic value derived from these critical instruments.

Regional Highlights

The global distribution of the Multiphase Flow Meter market revenue is directly correlated with global E&P spending and the concentration of complex offshore oil and gas developments. North America, particularly the U.S. Gulf of Mexico and Canadian offshore areas, holds a substantial market share, driven by a mature oilfield services sector, technological early adoption, and sustained investment in deepwater infrastructure. The demand here is primarily focused on high-specification, reliable subsea meters for permanent installations, supported by a strong regulatory push for accurate environmental and production monitoring. The region benefits from significant R&D capabilities, often pioneering the introduction of next- generation non-nuclear metering solutions.

Europe, driven largely by North Sea operations (Norway and the UK), represents a mature but technologically demanding market. Operators in this region prioritize lifecycle cost reduction and enhanced reliability for aging assets, favoring integrated service contracts and highly specialized MPFMs capable of handling high water cut and challenging flow assurance issues common in mature fields. Latin America, dominated by Brazil (pre-salt layer development), is one of the fastest-growing offshore markets, demanding advanced subsea MPFMs for complex, high-pressure, high-temperature reservoirs, positioning it as a key investment area for global suppliers seeking long-term growth.

The Middle East and Africa (MEA) region is characterized by substantial onshore and shallow water developments requiring flow assurance solutions for heavy oil and complex reservoir management. National Oil Companies here are undertaking ambitious digitalization initiatives, driving demand for MPFMs as critical data inputs. Asia Pacific (APAC) is projected for rapid growth, fueled by increasing E&P investments in offshore territories like Indonesia, Malaysia, and Australia, coupled with China's focus on domestic resource exploration, leading to significant procurement of both conventional and portable well-testing MPFMs.

- North America (U.S., Canada): Focus on deepwater subsea metering and high-tech non-nuclear solutions; major hub for innovation and early market adoption.

- Europe (Norway, UK): Market driven by decommissioning efficiency and maximizing recovery from mature North Sea assets; high demand for reliable, long-life systems.

- Asia Pacific (China, Malaysia, Indonesia): Fastest-growing region, characterized by increasing offshore capital expenditure and expansion of local manufacturing capabilities.

- Middle East (Saudi Arabia, UAE, Qatar): Steady demand driven by large-scale oilfield optimization projects and investment in digitalization across mature onshore fields.

- Latin America (Brazil, Mexico): High growth attributed to pre-salt offshore developments requiring specialized, high-pressure multiphase flow solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Multiphase Flow Meter Market.- Schlumberger Limited

- Baker Hughes Company

- Halliburton Company

- Emerson Electric Co.

- TechnipFMC plc

- Aker Solutions ASA

- Weatherford International plc

- Expro Group

- Roxar (Emerson)

- Agar Corporation

- Honeywell International Inc.

- ABB Ltd.

- Endress+Hauser Group Services AG

- Fuji Electric Co. Ltd.

- Siemens AG

- Proserv Group

- MPFM Technology

- Caltex Industries

- Jiskoot Ltd.

- Tenaris S.A.

Frequently Asked Questions

Analyze common user questions about the Multiphase Flow Meter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Multiphase Flow Meters (MPFMs) and conventional separators?

MPFMs measure the individual flow rates of oil, gas, and water simultaneously in real-time within the flowline without physically separating the phases, offering continuous monitoring and greater operational efficiency, whereas conventional separators require a bulky, physical process to separate and measure phases intermittently.

Are Multiphase Flow Meters suitable for permanent subsea installations?

Yes, modern MPFMs are increasingly designed for permanent subsea deployment, utilizing robust materials and redundant architecture to ensure long-term, high-reliability operation in harsh deepwater environments, minimizing the need for costly vessel-based interventions.

What technological advancements are driving the market away from nuclear-based MPFMs?

The market is shifting toward non-radioactive technologies, including advanced acoustic, electrical impedance, and microwave measurement systems, driven by strict global regulations, reduced licensing complexity, and the lower logistical burden associated with non-nuclear sources.

How does the Gas Volume Fraction (GVF) affect MPFM accuracy and operational choice?

GVF is critical; high GVF flows (wet gas) require specialized wet gas meters or MPFMs optimized for high velocity and gas dominance, while low GVF flows, typically dominated by liquids, require high accuracy in determining water cut, often driving the selection of different sensor combinations and signal processing algorithms.

Which geographical region is expected to show the fastest growth in MPFM adoption?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily fueled by substantial E&P investments in offshore fields in countries like China, Malaysia, and Indonesia, necessitating sophisticated tools for production monitoring and field optimization.

The Multiphase Flow Meter Market stands at a pivotal juncture, reflecting the broader energy industry's dual mandate of maximizing hydrocarbon recovery while minimizing operational costs and environmental impact. The integration of advanced sensor technologies, coupled with sophisticated AI and machine learning capabilities, is transforming MPFMs from simple measurement devices into intelligent, predictive assets integral to the digital oilfield ecosystem. Future market growth will be intrinsically linked to success in standardization, reduction of total cost of ownership, and the seamless provision of data-as-a-service offerings, particularly in the complex and capital-intensive deepwater and unconventional resource sectors. Manufacturers who successfully navigate the transition toward non-nuclear, high-reliability, and service-centric business models are best positioned to capture the accelerating market demand throughout the forecast period.

Technological maturity in flow measurement is expanding the scope of MPFM applicability beyond conventional oil and gas. The rising focus on energy transition applications, specifically in CCUS projects where the accurate monitoring of injected CO2 mixtures is vital for safety and regulatory compliance, represents a significant untapped opportunity. As global energy demand stabilizes and E&P capital discipline tightens, operators will increasingly favor MPFM solutions over traditional test separators, driving volume growth not just in new field developments but also in upgrading and optimizing existing mature infrastructure globally.

The highly competitive nature of the market necessitates continuous investment in R&D, particularly in miniaturization, power efficiency, and increasing the robustness of electronic components to withstand extreme downhole conditions. Strategic partnerships between established hardware providers and specialized software analytics firms are expected to define the next generation of product offerings, ensuring that measurement accuracy is complemented by actionable, predictive insights. This convergence of hardware precision and data intelligence solidifies the MPFM market's critical role in the future of energy production management.

Further analysis of the value chain reveals that intellectual property protection and proprietary calibration methodologies are major sources of competitive differentiation. Companies that can provide certified, traceable measurement uncertainty guarantees across the widest range of fluid conditions hold a significant advantage. The post-sales service ecosystem, encompassing field support, preventative maintenance contracts, and rapid diagnostics, is arguably becoming more important than the initial hardware sale, driving sustained revenue and solidifying long-term customer engagement in this specialized industrial domain.

Regulatory frameworks across different regions also exert significant influence. For instance, stringent environmental reporting requirements in regions like the North Sea and the Gulf of Mexico necessitate highly accurate and audited flow measurement data, favoring advanced MPFMs that offer continuous, tamper-proof logs. This regulatory pull factor ensures continuous demand for high-end, reliable equipment, reinforcing the high-barrier-to-entry nature of the market and favoring established vendors with proven field track records and regulatory compliance certifications across multiple operational jurisdictions.

The Multiphase Flow Meter market’s sustained expansion is ultimately a reflection of the industry’s shift toward data-driven decision- making. The meters provide the high-fidelity, instantaneous data required to feed sophisticated operational models, allowing for precise control over choke settings, chemical injection, and lifting methods (like gas lift). This capability to micro-manage production on a well-by-well basis is essential for maximizing the economic lifespan of reservoirs, making the investment in MPFM technology a strategic imperative rather than a mere operational expenditure for major upstream players worldwide.

The segmentation based on application highlights a critical division between temporary and permanent installations. Temporary (or portable) MPFMs are utilized during exploration and initial well testing, offering flexibility and mobilization efficiency, typically favoring smaller, lighter units. Conversely, permanent subsea units are characterized by extreme durability, long design life (20+ years), and redundancy, reflecting the multi-million dollar commitment associated with deepwater field development. Understanding these distinct customer needs informs product design, pricing strategies, and service level agreements across the market.

Focusing on the regional dynamics further clarifies the market’s exposure to geopolitical risks and commodity price volatility. While short-term crude oil price drops can temporarily curb E&P spending and delay capital projects, the long-term necessity of flow assurance, especially in challenging deepwater fields with significant upfront investment, ensures that demand for high-quality MPFMs remains resilient compared to more discretionary E&P equipment purchases. The strategic nature of these assets underpins the market's fundamental stability over the forecast horizon.

In conclusion, the Multiphase Flow Meter Market is highly technical, structurally complex, and strategically vital to the future efficiency of global hydrocarbon production. Driven by technological migration toward non-nuclear solutions and integrated digital intelligence, and supported by robust demand from deepwater and mature fields, the market is poised for steady, sustainable growth, solidifying its position as an indispensable element of modern reservoir management and production optimization.

The continuous evolution in communication protocols and data security also plays a crucial role. As MPFMs become integrated into larger Industrial Internet of Things (IIoT) frameworks, ensuring secure, encrypted data transmission from remote and subsea locations is paramount. Vendors are investing heavily in cyber-secure architectures to protect highly sensitive production data from external threats, adding another layer of complexity and value to the overall MPFM solution package, particularly appealing to security-conscious national energy entities and global IOCs.

Finally, emerging market participants often specialize in niche segments, such as portable meters for unconventional shale plays or retrofit solutions for aging infrastructure. These smaller players often drive rapid innovation in specific areas, such as low-cost sensor arrays or rapid deployment mechanisms, forcing major incumbents to continuously update their product lines to maintain competitive relevance and market leadership across the diverse array of applications globally.

The specialized nature of MPFM installation and commissioning requires highly skilled technical personnel, a factor that influences the geographical footprint of service providers. The scarcity of specialized expertise, particularly in emerging markets, contributes to the high value placed on comprehensive service agreements offered by global market leaders, further cementing their dominance in the overall value proposition beyond the initial product sale, reinforcing a high-margin, service-heavy business model.

The industry's increasing emphasis on environmental, social, and governance (ESG) factors also indirectly boosts MPFM demand. Accurate flow measurement enables better inventory tracking and helps operators detect and mitigate fugitive emissions (like methane leaks) faster than traditional methods. The ability of MPFMs to provide real-time phase data supports more efficient operational procedures, contributing directly to reduced energy consumption and a lower overall carbon footprint for production operations, aligning with corporate sustainability objectives.

Considering the detailed technical requirements and the high cost associated with failure in critical subsea environments, procurement processes for MPFMs are typically rigorous, involving extensive field testing and long qualification periods. This barrier to entry favors established companies with proven track records and substantial financial resources for ongoing certification and compliance testing. The need for specialized manufacturing facilities and highly controlled calibration loops further consolidates market power among the top-tier suppliers.

In summary, the confluence of deep technical necessity, regulatory incentives for precise monitoring, ongoing digitalization efforts, and sustained global upstream investment creates a strong, long-term foundation for the Multiphase Flow Meter Market. The market's complexity demands a specialized approach, emphasizing reliability, integration capability, and the provision of continuous, high-value data analytics services to maintain competitive advantage.

The projected CAGR of 5.8% for the market indicates a healthy growth trajectory, largely insulated from minor short-term commodity price fluctuations due to the necessity of these instruments in major, long-cycle capital projects. This steady growth reflects confidence in the long-term viability of complex hydrocarbon extraction and the fundamental, irreplaceable role MPFMs play in optimizing these operations. The continued technological maturity, specifically the reduction of measurement uncertainty and the improvement of non-intrusive technologies, will unlock further market penetration across conventional onshore assets previously deemed too cost-sensitive for early-generation MPFMs.

The market environment fosters continuous technological iteration. Current research focuses on developing completely sensorless MPFM solutions utilizing advanced computational fluid dynamics (CFD) and sophisticated pressure wave analysis, potentially lowering hardware costs and maintenance requirements significantly in the future. While still nascent, these emerging technologies promise to disrupt traditional measurement paradigms and further democratize access to high-accuracy flow data across the entire spectrum of oil and gas operations.

Finally, the strategic relevance of MPFMs extends to fiscal metering applications, although this requires extremely high levels of verifiable accuracy and regulatory certification (such as custody transfer standards). While most MPFMs serve allocation and optimization purposes, the eventual ability of next-generation meters to meet strict fiscal standards would open up another massive market segment currently dominated by traditional single-phase custody transfer meters, representing a substantial long-term opportunity for market expansion and value capture.

The increasing complexity of reservoir fluids, often involving high levels of H2S, CO2, and abrasive solids (sand), demands material science excellence in meter construction. Vendors must utilize highly resistant alloys and specialized coatings to prevent corrosion and erosion, ensuring the meter maintains its calibration and integrity over its full operational life. This requirement for extreme material robustness further emphasizes the high capital and R&D investment necessary to compete effectively in this technologically demanding sector.

The market dynamic is also influenced by the lifecycle cost management strategies of major operators. By providing highly reliable, durable meters that require less frequent intervention and calibration, vendors allow operators to realize significant operational savings over the lifespan of a field. This Total Cost of Ownership (TCO) calculation, rather than just the initial price, is often the decisive factor in high-stakes deepwater procurement decisions, driving demand towards quality and proven endurance over low-cost alternatives.

The transition to renewable energy sources, while an existential long-term factor for the oil and gas industry, paradoxically drives the need for optimization in remaining hydrocarbon assets. Operators must maximize returns from existing wells to fund the transition, making real-time, high-accuracy production surveillance provided by MPFMs more critical than ever before to ensure financial viability and efficiency in a carbon-constrained world.

The increasing utilization of standardized industrial communication protocols, such as OPC UA and MQTT, ensures seamless integration of MPFM data into broader production control and asset performance management (APM) systems. This interoperability significantly reduces the cost and complexity of integrating new MPFMs into legacy infrastructure, accelerating the replacement cycle of older, less accurate measurement technologies across both onshore and offshore facilities worldwide.

Moreover, the demand for portable or trailer-mounted MPFMs has seen resurgence, particularly in mature onshore regions like North America and the Middle East, for rapid well testing and diagnostic troubleshooting. These systems offer operational flexibility, allowing operators to quickly assess well performance characteristics without committing to expensive permanent installations in marginal fields, addressing a critical need for flexible, temporary monitoring solutions across diverse geographical settings.

In conclusion, the sophisticated requirements of the modern energy industry—reliability, accuracy, environmental compliance, and cost efficiency—all converge to solidify the importance of the Multiphase Flow Meter Market. The ongoing fusion of advanced sensor physics with AI-driven data processing guarantees that MPFMs will remain a cornerstone technology in the global pursuit of optimized energy extraction for the foreseeable future.

The robust market projections are further supported by the necessary infrastructural upgrades in developing energy markets. As countries in Africa and parts of Asia develop their indigenous oil and gas capabilities, they often leapfrog older measurement technologies, directly adopting advanced MPFMs for greenfield projects, driving localized growth spikes and increasing the global installed base of these sophisticated instruments.

Finally, the competitive strategy of major players involves bundling MPFMs with broader flow assurance consulting and services. This strategic move helps clients interpret complex measurement data and translates it into direct operational improvements, moving the vendor relationship beyond a simple transaction to a long-term partnership focused on maximizing the client's production uptime and profitability, reinforcing the service-centric nature of the market evolution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager