Music publishing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435184 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Music publishing Market Size

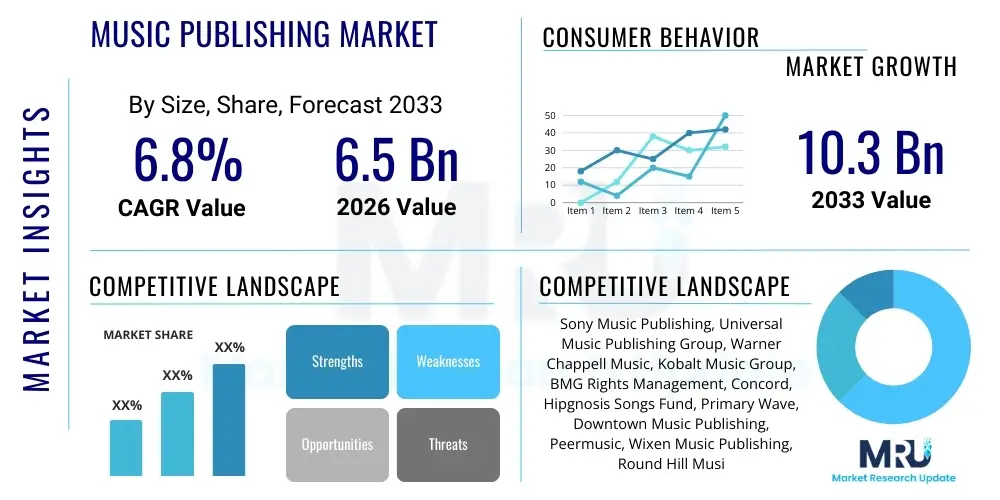

The Music publishing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Music publishing Market introduction

The music publishing market centers on the ownership and administration of musical compositions, distinct from sound recordings. This sector encompasses the strategic management of copyrights, licensing songs for use across various media, and ensuring the accurate collection and distribution of royalties to songwriters and composers. Publishers act as essential intermediaries, safeguarding intellectual property and monetizing compositions through diverse revenue streams, including performance royalties (from radio, venues, streaming), mechanical royalties (from physical sales, downloads, and interactive streaming), and synchronization royalties (sync licenses for film, television, video games, and advertising).

Driving factors for the significant expansion of this market include the explosive global growth of digital music streaming platforms (such as Spotify, Apple Music, and Tencent Music), which have exponentially increased the volume of performance and mechanical royalty payments. Furthermore, the rising demand for licensed music content across rapidly expanding global audiovisual production sectors, particularly within Over-The-Top (OTT) streaming services and video game development, fuels synchronization licensing revenues. Technological advancements, particularly in data analytics and blockchain technology, are also improving the transparency and efficiency of royalty tracking and payment systems, reducing friction within the complex global licensing landscape.

The principal application of music publishing lies in the monetization of intellectual property rights associated with musical works. Key benefits provided by the industry include career development and financing for songwriters, robust global copyright protection, and streamlined licensing processes for commercial users. Publishers leverage their expertise and international networks to maximize the value of their catalogs, making the market a vital component of the broader global music ecosystem that bridges creators with commercial opportunities in an increasingly digital consumption environment.

Music publishing Market Executive Summary

The music publishing market is characterized by robust M&A activity, driven by institutional investors and private equity firms seeking stable, long-term returns from proven intellectual property assets, viewing music catalogs as highly desirable uncorrelated assets. Key business trends involve aggressive catalog acquisitions, leveraging high valuations fueled by the predictable revenue streams generated by global streaming growth. Publishers are increasingly investing in advanced metadata management and rights administration technology to handle the massive volume of micro-transactions generated by digital consumption, ensuring precise royalty distribution and maintaining competitive edge in a technologically complex ecosystem.

Regionally, North America and Europe currently dominate the market due to mature regulatory frameworks, strong copyright protection, and high consumer spending on digital music services. However, Asia Pacific (APAC) is emerging as the fastest-growing region, powered by rapid urbanization, increasing penetration of smartphones, and the localization of international streaming platforms. Emerging markets in Latin America and Africa are showing significant potential, offering long-term growth opportunities as digital infrastructure improves and local music ecosystems mature, leading to higher rates of formal music consumption.

Segment trends highlight the shift towards performance royalties as the dominant revenue source, primarily driven by interactive streaming, which generates both mechanical and performance income simultaneously. The synchronization segment is experiencing significant growth, particularly in areas related to gaming and immersive digital content, where publishers are forging new partnerships for interactive media licensing. Furthermore, independent publishers and self-published artists are utilizing new distribution platforms and centralized rights management tools, challenging the traditional market dominance of the major integrated publishing companies.

AI Impact Analysis on Music publishing Market

Common user questions regarding AI's impact on music publishing frequently center on the ethical implications of AI-generated compositions, the challenges of copyright ownership for works co-created with artificial intelligence, and how automation will affect human songwriter careers. Users are highly interested in AI’s ability to optimize royalty collection, predict hit potential, and automate synchronization licensing processes. The primary concern is whether AI tools will dilute the value of human-created music or if they represent efficiency gains for rights management. The summarized key themes indicate users expect AI to radically improve administrative efficiency (metadata tagging, rights tracking) but concurrently anticipate significant legal and ethical challenges regarding authorship and intellectual property rights in the rapidly evolving creative landscape.

The integration of artificial intelligence (AI) technologies is fundamentally reshaping operational efficiencies and creative processes within the music publishing domain. AI is primarily deployed in two critical areas: optimizing administrative functions and aiding in music generation/curation. For administrative tasks, machine learning algorithms are utilized to process vast quantities of streaming data, accurately attributing usage to the correct composition, thereby significantly improving the speed and accuracy of royalty calculation and distribution, a crucial efficiency gain in a high-volume transaction environment. This enhanced data handling addresses a longstanding industry pain point regarding opaque and delayed payments.

From a creative perspective, AI tools are emerging that can assist songwriters in composition, generate tailored background music for sync purposes, or even mimic the style of existing artists. While these tools offer new avenues for content generation and reduce the cost associated with producing library music, they introduce complex legal ambiguities regarding copyright eligibility and ownership. Publishers are actively formulating policies and developing technological countermeasures to differentiate between human-authored works and those derived significantly from machine learning models trained on copyrighted material, ensuring catalog integrity and compliance in the face of generative content explosion.

- AI enhances metadata accuracy and catalog tagging for improved discoverability and licensing.

- Automated royalty tracking systems reduce leakage and increase efficiency in payment distribution.

- Generative AI tools accelerate the creation of production music and licensed content for B2B applications.

- Predictive analytics powered by AI assist publishers in catalog acquisition, identifying high-potential compositions based on listener data.

- Legal complexity increases concerning authorship, copyright duration, and remuneration models for AI-assisted works.

- Deepfake music detection technologies become necessary to protect artist rights and prevent unauthorized use of vocal and compositional styles.

DRO & Impact Forces Of Music publishing Market

The Music publishing Market is profoundly influenced by the intersection of digital consumption, regulatory evolution, and technological innovation, creating a dynamic environment where growth (Drivers) is frequently tempered by structural complexities (Restraints), opening avenues for novel revenue streams (Opportunities). The central Impact Forces revolve around the tension between maximizing digital revenue streams through efficient royalty collection and navigating the fragmented global legal landscape governing intellectual property. Key market drivers include the sustained global subscriber growth of streaming platforms and the increasing valuation of music copyrights as stable financial assets, attracting significant external capital investment.

Restraints largely stem from regulatory hurdles and the inherent complexities of global rights administration. The discrepancies in mechanical royalty rates across different territories, ongoing disputes over digital service provider (DSP) licensing terms, and the persistent challenge of music piracy, particularly in developing economies, continue to exert downward pressure on potential revenue optimization. Additionally, the sheer volume of metadata required to accurately track compositions across thousands of global endpoints creates administrative overhead, necessitating continuous investment in sophisticated rights management systems.

Opportunities are centered on emerging technological applications and new consumption formats. The rise of immersive technologies, such as virtual reality (VR) and augmented reality (AR), alongside the metaverse, presents entirely new synchronization licensing categories. Furthermore, the adoption of blockchain technology holds the promise of establishing immutable, transparent ledgers for rights ownership and transaction history, potentially revolutionizing how royalties are tracked and paid. Successful market players are those who can capitalize on these opportunities by integrating technology while proactively addressing legislative and legal challenges.

Drivers

The primary driver sustaining market growth is the continued global expansion of digital music consumption, specifically through subscription streaming services. As more users transition from free ad-supported models to paid subscriptions, the pool of royalty-generating revenue expands substantially. This reliable growth trajectory has elevated music publishing assets to a preferred investment class, attracting large-scale financial institutions and private equity, which in turn drives up catalog valuations and fuels further market consolidation and technological investment.

Another significant driver is the globalization of content creation and consumption. Synchronization revenue is experiencing unprecedented growth due to the proliferation of high-budget original content produced by global streaming giants like Netflix, Amazon Prime Video, and Disney+. These platforms require vast amounts of licensed music for diverse international audiences, significantly increasing the demand for sync licenses across varied genres and regional catalogs. This expansion provides publishers with multifaceted monetization opportunities far beyond traditional broadcast media.

Restraints

A major restraint is the perpetual challenge associated with fragmented intellectual property laws across international jurisdictions. Royalty rates, licensing requirements, and copyright enforcement mechanisms differ significantly by country, making global administration exceptionally complex and costly. This fragmentation creates leakage, where royalties are collected but not accurately or efficiently distributed due to conflicting legal requirements and administrative bottlenecks in emerging markets.

Furthermore, ongoing litigation and regulatory uncertainty surrounding digital mechanical royalty rates, particularly in major markets like the U.S. and E.U., pose financial risks and operational unpredictability for publishers. Disputes between publishers, songwriters, and DSPs over the fair valuation of compositions in the streaming economy often lead to protracted legal battles, diverting resources and occasionally suppressing overall revenue growth potential until legal precedents are established and widely adopted.

Opportunities

The integration of music into new digital environments, such as interactive gaming, fitness applications (e.g., Peloton), and decentralized autonomous organizations (DAOs), represents a significant opportunity. These platforms require flexible and innovative licensing models, moving beyond traditional sync licenses into complex interactive performance rights. Publishers capable of creating tiered, dynamic licensing structures for these digital ecosystems will capture substantial new market share.

Additionally, the focus on enhancing data transparency through advanced technologies, notably distributed ledger technology (DLT) or blockchain, offers an opportunity to build trust and efficiency within the publishing value chain. Implementing shared, immutable ledgers for ownership registration and transaction tracking could significantly reduce administrative costs, resolve disputes faster, and ensure that micro-royalties generated by high-volume streaming are accurately attributed, ultimately optimizing revenue for rights holders globally.

Segmentation Analysis

The Music publishing Market segmentation is primarily analyzed across revenue streams, allowing stakeholders to assess the relative performance and growth trajectories of different monetization models. The core segments include performance, mechanical, and synchronization royalties, each reflecting distinct uses of musical compositions. Understanding the shifting balance between these revenue sources, particularly the increasing dominance of streaming-driven performance and mechanical income, is critical for strategic decision-making in catalog management and technology investment. Segmentation also covers the type of publisher (major vs. independent) and the end-use application, providing a granular view of market dynamics across diverse commercial sectors.

- By Revenue Source

- Performance Royalties (Public performance, broadcasting, streaming public performance)

- Mechanical Royalties (Physical sales, downloads, interactive streaming mechanical)

- Synchronization (Sync) Royalties (Film, TV, Advertising, Video Games, Digital Content)

- Print Royalties

- By Publisher Type

- Major Publishers (e.g., Sony Music Publishing, Universal Music Publishing Group)

- Independent Publishers

- Self-Published Artists/Songwriters

- By Application/End-Use

- Audiovisual Content (Film, Television, OTT Platforms)

- Advertising and Commercials

- Interactive Media and Gaming

- Digital Streaming Services

- Radio and Live Venues

Value Chain Analysis For Music publishing Market

The music publishing value chain is highly interconnected, beginning with the creative upstream activities of songwriters and composers and culminating in the complex downstream distribution of royalties to rights holders. Upstream analysis focuses on the creation and initial registration of musical works, where publishers play a critical role in signing talent, providing advances, and managing initial copyright registration globally. This phase is characterized by talent scouting and catalog building, where strategic decisions determine the long-term value potential of the composition portfolio.

Downstream activities involve the multifaceted processes of licensing, tracking usage, and collecting royalties. This involves interactions with Performing Rights Organizations (PROs) and Collective Management Organizations (CMOs), which handle the bulk of public performance licensing. Distribution channels are highly varied, encompassing direct licenses negotiated with major users (like film studios or DSPs) and indirect licensing via PROs for general public performance. The proliferation of digital streaming has necessitated robust data infrastructure to accurately map composition usage across platforms worldwide, transforming royalty tracking into a data-intensive technological challenge.

The modern value chain is defined by the tension between centralized rights collection (via large PROs) and direct deals with digital services. Direct licensing allows publishers greater control and potentially faster remuneration, while reliance on indirect channels ensures broad coverage and compliance across small venues and international territories. Enhancements in data exchange and standardization protocols are crucial for minimizing leakage and maximizing the efficiency of the entire royalty distribution pipeline, ensuring that the monetary value accurately flows back to the creators and rights administrators.

Music publishing Market Potential Customers

Potential customers and end-users of musical compositions primarily comprise entities that require the legal use of music for commercial or public communication purposes. This vast ecosystem includes major global digital streaming platforms (DSPs) which require blanket licenses for mechanical and performance rights to offer their services. Furthermore, the film, television, and advertising industries represent significant customers, relying heavily on synchronization licenses to score their content and commercials, often seeking music that evokes specific emotional responses or fits specific budgetary constraints.

The fastest-growing segment of potential customers includes interactive media developers, specifically video game publishers and virtual reality platform creators, who demand complex, multi-territory licenses for interactive music use. Beyond media production, physical venues (concert halls, restaurants, retail stores) and broadcast media (radio and cable television networks) are foundational customers, paying performance royalties collected via PROs for public performance rights. Publishers tailor their catalogs and licensing structures to meet the unique legal and creative demands of each customer category, from mass-market DSPs needing broad access to production houses requiring niche, high-value sync placements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony Music Publishing, Universal Music Publishing Group, Warner Chappell Music, Kobalt Music Group, BMG Rights Management, Concord, Hipgnosis Songs Fund, Primary Wave, Downtown Music Publishing, Peermusic, Wixen Music Publishing, Round Hill Music, Pulse Music Group, Spirit Music Group, SESAC, ASCAP, Broadcast Music Inc. (BMI), Reservoir Media. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Music publishing Market Key Technology Landscape

The modern music publishing market relies heavily on a sophisticated technological infrastructure designed to manage immense volumes of data and ensure equitable distribution of micro-royalties. The central pillar of this landscape is the deployment of advanced Rights Management Systems (RMS) and robust digital asset management (DAM) platforms. These systems must integrate complex databases of musical works, proprietary International Standard Musical Work Code (ISWC) identifiers, and extensive metadata to track usage across thousands of global digital endpoints. The necessity for real-time tracking, driven by the instantaneous nature of streaming, demands highly scalable and cloud-based solutions capable of processing billions of transactions efficiently.

A transformative technology gaining momentum is Blockchain or Distributed Ledger Technology (DLT). Blockchain offers a solution to the long-standing problem of opaque and decentralized rights ownership records. By establishing an immutable, shared ledger for registering ownership, licensing agreements, and transaction history, DLT can significantly reduce administrative overhead, minimize disputes over rights attribution, and accelerate royalty payments. Major publishers and rights organizations are currently piloting DLT implementations to assess their feasibility in creating a globally standardized and transparent system for digital music rights management, potentially bypassing current inefficiencies inherent in fragmented international PRO systems.

Furthermore, Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into the operational core. AI is utilized for enhanced metadata tagging, automatic identification of unlicensed uses, and predictive analytics to forecast the commercial success of new compositions, thereby optimizing investment in catalog acquisitions. The continuous development of automated monitoring tools and digital fingerprinting technology ensures that publishers can accurately police unauthorized usage across social media and user-generated content platforms, maximizing revenue capture in areas that were historically difficult to monitor and enforce.

Regional Highlights

- North America (NA): Dominates the global music publishing market in terms of revenue and technological innovation. The U.S. market, supported by robust legislative frameworks like the Music Modernization Act (MMA), drives significant mechanical royalty growth through the Mechanical Licensing Collective (MLC). High consumer spending on subscription services and aggressive synchronization demand from Hollywood and Silicon Valley content producers cement its leading position. The region serves as the primary testbed for blockchain and AI integration in rights management.

- Europe: Represents the second largest market, characterized by strong, albeit fragmented, collective management organizations (CMOs). European legislation, particularly relating to digital single market directives, heavily influences licensing and digital rights negotiations. Key markets like the UK, Germany, and France maintain high performance and mechanical royalty rates, alongside a flourishing independent publishing sector supported by national cultural funding and strong domestic consumption.

- Asia Pacific (APAC): Exhibits the highest growth potential, fueled by massive population bases, increasing internet penetration, and the rapid rise of local streaming services (e.g., Tencent Music, Gaana). China, India, South Korea, and Japan are pivotal, presenting unique challenges regarding licensing compliance and enforcement but offering explosive long-term subscriber growth. The market dynamic is often defined by hybrid models that blend localized digital platforms with global repertoire licensing agreements.

- Latin America (LATAM): A rapidly maturing market transitioning from piracy-heavy environments to digital consumption. Brazil and Mexico are leading the charge, showing strong year-over-year growth in streaming subscription revenues. Publishers are focusing on strengthening relationships with local PROs and investing in digital education to ensure higher collection rates and combat high levels of leakage often seen in the region.

- Middle East and Africa (MEA): Currently the smallest but fastest-evolving region. Growth is sporadic, driven primarily by mobile-first content consumption and localized streaming efforts, particularly in the UAE, Saudi Arabia, and South Africa. Challenges include underdeveloped regulatory structures and economic volatility, necessitating highly customized and flexible licensing strategies tailored to emerging consumer habits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Music publishing Market.- Sony Music Publishing

- Universal Music Publishing Group

- Warner Chappell Music

- Kobalt Music Group

- BMG Rights Management

- Concord Music Publishing

- Hipgnosis Songs Fund (Acquirer of catalogs)

- Primary Wave Music Publishing

- Downtown Music Publishing

- Peermusic

- Wixen Music Publishing

- Round Hill Music

- Pulse Music Group

- Spirit Music Group

- Reservoir Media

- SESAC

- ASCAP

- Broadcast Music Inc. (BMI)

- The Mechanical Licensing Collective (MLC)

- Tencent Music Entertainment Group (TME)

Frequently Asked Questions

Analyze common user questions about the Music publishing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary revenue source driving growth in the music publishing market today?

The primary revenue source driving market growth is Performance Royalties generated from interactive digital streaming services. The vast global subscriber base of platforms like Spotify and Apple Music creates billions of micro-transactions, increasing the volume and consistency of performance and associated mechanical royalty payments worldwide.

How is the valuation of music publishing catalogs determined, and why are they currently highly valued?

Catalog valuation is typically determined using a multiple of Net Publisher Share (NPS), which is the net income remaining after writer shares and administrative fees. Catalogs are highly valued—often 15x to 25x NPS—because they offer predictable, long-term, uncorrelated financial returns, underpinned by contractual copyrights that generate annuities over decades, making them attractive to institutional investors.

What role does blockchain technology play in optimizing music publishing operations?

Blockchain technology promises to create a transparent, immutable ledger for registering music rights ownership and tracking usage transactions globally. This implementation aims to streamline complex international royalty collection, reduce administrative friction and leakage, and ensure faster, more accurate payment distribution to rights holders.

What are Synchronization Royalties and why are they becoming increasingly important?

Synchronization (Sync) Royalties are payments received for licensing the right to synchronize a musical composition with visual media, such as film, television shows, advertisements, and video games. Sync revenue is increasingly important due to the proliferation of global Over-The-Top (OTT) content platforms and the massive growth in interactive media and gaming requiring complex licensing deals.

What key challenges do independent music publishers face in the current market environment?

Independent publishers primarily face challenges related to technological scale and administrative complexity, specifically in effectively tracking micro-royalties across global DSPs without the resources of major entities. Additionally, they must compete with major publishers in catalog acquisition, often leveraging flexibility and niche focus to retain competitive advantage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Music Publishing Market Statistics 2025 Analysis By Application (Commercial, Commonweal), By Type (Performance, Digital, Synchronization, Mechanical), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Music Publishing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Acquiring Songs, Administering Copyrights, Exploiting the Artistic Material), By Application (Commercial, Commonweal, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager