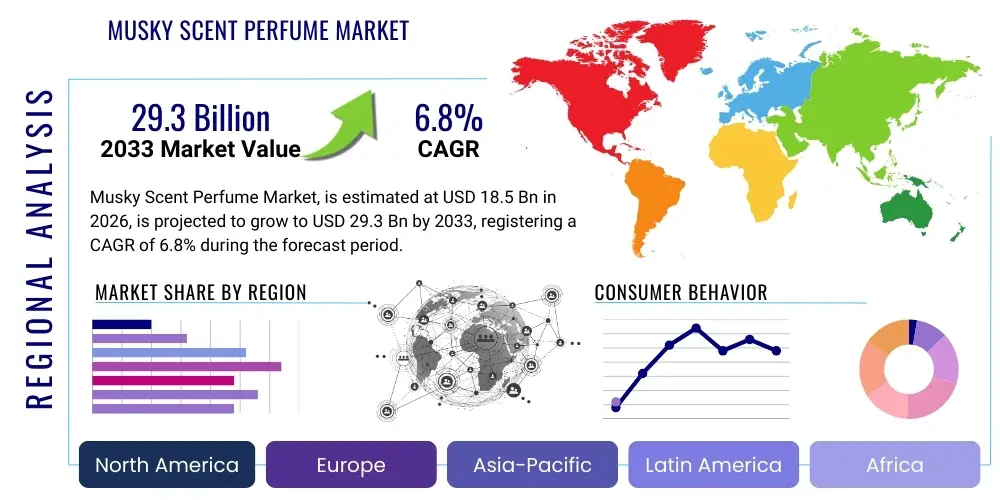

Musky Scent Perfume Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435454 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Musky Scent Perfume Market Size

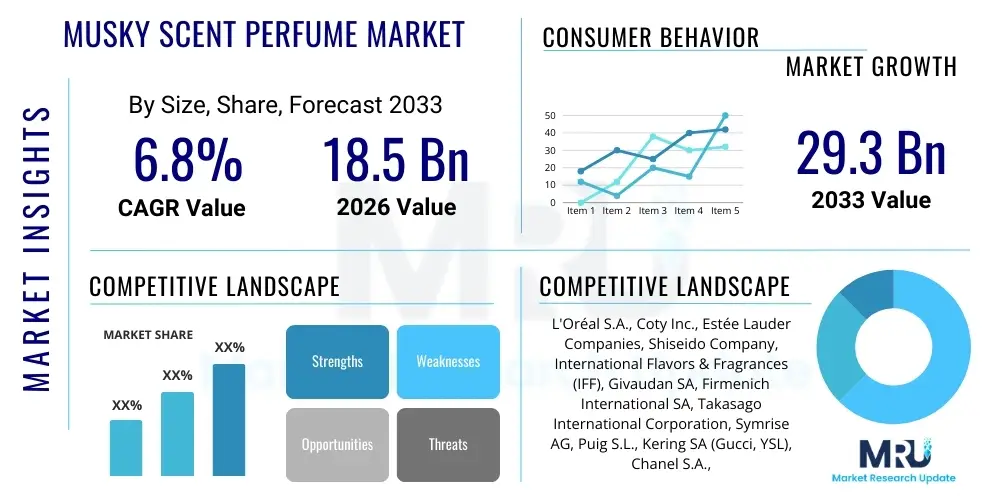

The Musky Scent Perfume Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $29.3 Billion by the end of the forecast period in 2033.

Musky Scent Perfume Market introduction

The Musky Scent Perfume Market encompasses fine fragrances utilizing various musk components, historically derived from animals but now predominantly synthesized using sophisticated chemical compounds. Musk is highly valued in perfumery for its unique ability to provide foundational warmth, longevity (fixative properties), and a sensual, skin-like aroma that complements other volatile ingredients. The shift from classical, heavy nitromusks to modern, cleaner polycyclic and macrocyclic musks—often referred to as 'white musks'—has been a major technological evolution, catering to contemporary consumer preferences for subtle yet persistent scents. These modern iterations are essential for nearly all fragrance compositions, acting as foundational anchors in complex formulations across high-end niche brands and mass-market products alike.

Major applications of musky scents extend beyond fine fragrances (Eau de Parfum, Eau de Toilette) into personal care items such as lotions, soaps, and deodorants, where their fixative qualities enhance the overall scent profile and product performance. The driving factors behind market expansion include increasing global demand for luxury and personalized fragrance experiences, rising disposable incomes in emerging economies, and the growing trend of layering fragrances, where musky base notes are indispensable. Furthermore, the unisex fragrance segment heavily relies on sophisticated musky accords, as they offer a versatile and universally appealing scent foundation that transcends traditional gender classifications, thereby broadening the consumer base significantly. Ethical sourcing and sustainability concerns have catalyzed innovation in synthetic musk research, ensuring a steady, compliant supply chain.

The intrinsic benefits of musky compounds, such as their low volatility and excellent blending capabilities, ensure they remain critical components in perfumers’ palettes. They contribute significantly to the perceived quality and lasting power of a perfume, directly influencing consumer purchasing decisions regarding scent endurance. The market is characterized by intense competition and continuous innovation, particularly focused on developing sustainable, high-impact musk substitutes that comply with stringent global regulatory standards set by bodies like the International Fragrance Association (IFRA). The market’s future trajectory is closely tied to advancements in green chemistry and the ability of manufacturers to respond to increasingly sophisticated consumer demands for clean, transparent, and ethically produced scents.

Musky Scent Perfume Market Executive Summary

The global Musky Scent Perfume Market is experiencing robust growth driven by the premiumization of fine fragrances and the surging popularity of niche perfumery houses which frequently highlight sophisticated musk blends. Business trends indicate a strong move toward direct-to-consumer (D2C) models, especially within the luxury segment, allowing brands better control over storytelling and consumer data, essential for marketing highly personal products like musky scents. Furthermore, there is a pronounced merger and acquisition activity among raw material suppliers and major fragrance houses, aimed at securing intellectual property related to novel, compliant musk compounds and ensuring supply chain resilience against geopolitical and regulatory volatility. The increasing consumer awareness regarding ingredient safety and transparency is forcing established players to invest heavily in clean label initiatives, particularly concerning synthetic musk usage, driving substantial R&D expenditure.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China and India, is emerging as the fastest-growing region, fueled by the rapid urbanization, increasing middle-class income, and the adoption of Western luxury grooming habits. North America and Europe, while mature markets, continue to dominate in terms of innovation and premium segment consumption, driven by high consumer spending on high-end niche and designer fragrances that use complex, multi-layered musk bases. Regulatory environments in Europe, specifically concerning the Restriction of Hazardous Substances (RoHS) and REACH, significantly influence ingredient formulation globally, necessitating continuous reformulation efforts to maintain market access and consumer trust, thereby shaping regional product offerings and supply dynamics significantly.

In terms of segmentation, the Eau de Parfum (EDP) category holds the largest market share due to consumer preference for higher concentration and longer wear time associated with musky base notes, justifying higher price points. The Unisex segment is projected to exhibit the highest CAGR, reflecting broader societal shifts towards non-gendered beauty and fragrance consumption, where subtle, versatile musk profiles play a central role. Distribution channel trends show a persistent shift towards online retail and specialized e-commerce platforms, offering consumers access to a wider variety of niche and international musky fragrance brands, complemented by personalized digital consultation services and targeted advertising strategies focusing on sensory experience and ingredient provenance.

AI Impact Analysis on Musky Scent Perfume Market

User questions regarding AI in the Musky Scent Perfume Market frequently center on themes such as: "Can AI replicate the complexity of natural musk?", "How is AI used to predict fragrance trends?", "Will AI personalize my scent experience?", and "What role does machine learning play in sustainable musk sourcing?". These inquiries highlight a consumer expectation that AI should enhance both the creative process—leading to highly tailored and novel scents—and the ethical/sustainability aspects of production. Consumers are cautiously optimistic about AI's potential to maintain or even improve the quality and safety of synthetic musks while ensuring greater product diversity. Concerns often revolve around the potential erosion of the human perfumer's artistry, though the general expectation is that AI will act as a powerful formulation assistant rather than a replacement.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming both the supply chain and the creative formulation process within the musky scent sector. AI algorithms are now capable of rapidly analyzing millions of existing formulas, consumer feedback data, and chemical property databases (such as odor threshold and stability) to identify novel synthetic musk molecules with desirable olfactive properties and favorable regulatory profiles. This high-throughput computational screening drastically reduces the time and cost associated with traditional research and development, accelerating the introduction of new, sustainable musk alternatives that address safety concerns related to older compounds. Furthermore, ML models are being employed to optimize manufacturing processes, predicting yield fluctuations in chemical synthesis and minimizing waste, directly impacting cost efficiency and environmental footprint.

In the realm of consumer interaction, AI-powered recommendation engines are becoming indispensable tools for online retailers, analyzing past purchases, stated preferences, and even personality traits derived from social media data to suggest personalized musky fragrance profiles. This hyper-personalization not only enhances the consumer experience but also provides brands with invaluable data on granular preference shifts, such as the increasing demand for cleaner, laundry-like musks versus heavier, ambery musks. Moreover, AI assists in dynamic pricing strategies and optimizing inventory management based on precise demand forecasting, which is particularly challenging in the high-volatility luxury fragrance market. The integration of AI ensures that production aligns more closely with consumer desire, reducing overstock and ensuring the timely launch of trend-compliant musky fragrances.

- AI-driven personalized fragrance recommendation systems enhancing consumer discovery.

- Machine learning algorithms optimizing chemical synthesis of novel, compliant synthetic musks.

- Computational models predicting global olfactive trends and demand for specific musk types.

- Automation of quality control and regulatory compliance checks for raw material purity.

- Supply chain optimization through predictive analytics minimizing inventory risk and material sourcing delays.

- Enhanced virtual try-on experiences leveraging AI to articulate scent narratives digitally.

DRO & Impact Forces Of Musky Scent Perfume Market

The Musky Scent Perfume Market operates under a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the critical Impact Forces that shape its growth trajectory. The primary driver is the pervasive use of musk as a crucial fixative and foundational note across almost all fragrance categories, ensuring consistent demand from both mass and luxury segments. Coupled with this is the rising global disposable income, particularly in high-growth economies, enabling consumers to trade up to premium and niche musk-heavy fragrances. Opportunities are largely concentrated in sustainable innovation, specifically the development of biodegradable, non-bioaccumulating synthetic musks (green chemistry), which offers manufacturers a strong competitive advantage and addresses growing ecological consumer concerns. These proactive measures allow companies to preemptively navigate stringent future environmental regulations, establishing market leadership in sustainable perfumery.

However, the market faces significant restraints, most notably the continuous regulatory scrutiny over certain older, synthetic musk compounds (such as nitromusks and some polycyclic musks) due to potential health and environmental concerns. Organizations like IFRA frequently update standards, forcing costly reformulation and supply chain disruption, particularly for legacy products. Another substantial restraint is the pervasive presence of counterfeit and unauthorized luxury fragrance products, which erodes brand equity and presents significant safety hazards to consumers due to unknown ingredients. The high volatility of raw material costs, including specialized chemicals and essential oils used in conjunction with musks, also poses a consistent pressure on profit margins, especially for mass-market brands attempting to maintain affordable price points amidst inflationary pressures.

The combined impact forces dictate that market success hinges on a dual strategy: aggressive innovation in sustainable chemistry to mitigate regulatory and environmental risks, and sophisticated branding and digital marketing to differentiate authentic luxury products from counterfeits. Demographic shifts, such as the increasing purchasing power of Generation Z and Millennials, who prioritize ethical sourcing and unique scent profiles, represent a powerful positive impact force, driving demand for unique, artisanal musky fragrances. Conversely, economic slowdowns or global health crises, by impacting consumer discretionary spending, can quickly suppress demand for non-essential luxury items like high-end perfumes. Manufacturers who invest strategically in transparency and ethical sourcing are best positioned to capitalize on opportunities while mitigating regulatory and consumer backlash risks, ensuring long-term market sustainability and leadership.

Segmentation Analysis

The Musky Scent Perfume Market is systematically segmented based on Product Type, Consumer Type, and Distribution Channel, reflecting diverse consumer preferences and purchasing behaviors across the global landscape. Analyzing these segments provides strategic insights into areas of highest growth potential and market saturation. The segmentation by Product Type differentiates products based on fragrance concentration, directly impacting the longevity and intensity of the musky notes, which subsequently influences pricing and consumer perception of value. Consumer Type segmentation reveals critical demographic trends, such as the rise of the unisex category, challenging traditional marketing boundaries. Distribution channel analysis highlights the shifting power dynamics between brick-and-mortar retail and the rapidly expanding digital marketplace, crucial for optimization of marketing spend and logistical efficiency.

Within Product Types, the Eau de Parfum (EDP) segment typically commands the highest market share and revenue growth, owing to its concentrated formulation that maximizes the lasting power of heavy base notes like musk. Consumers are willing to pay a premium for EDPs that offer superior longevity and sillage, crucial characteristics for fragrances featuring complex musky accords. The Eau de Toilette (EDT) and Eau de Cologne (EDC) segments serve the mass and daily-wear markets, though even these lighter concentrations rely on subtle white musks for a clean finish and foundational stability. The shift towards higher concentrations indicates a consumer trend valuing performance and perceived quality over sheer volume, bolstering the premium segment's profitability.

The distributional shift is particularly noteworthy; while specialty stores and luxury department stores remain vital for experiential, high-touch customer interaction necessary for luxury musk fragrances, the online retail segment is expanding at an accelerated rate. E-commerce platforms facilitate global access to niche, independent perfumers who often feature unique, artisanal musky blends that bypass traditional retail gatekeepers. This digital accessibility, coupled with personalized digital marketing campaigns and virtual consultation tools, is reshaping how consumers discover and purchase musky scents, pushing established brands to adopt omnichannel strategies that seamlessly blend physical discovery with digital convenience, particularly for repurchase cycles of established musky favorites.

- Product Type

- Eau de Parfum (EDP)

- Eau de Toilette (EDT)

- Eau de Cologne (EDC)

- Other Concentrated Forms (Attars, Perfume Oils)

- Consumer Type

- Men

- Women

- Unisex

- Distribution Channel

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Stores (Sephora, Ulta, Niche Boutiques)

- Supermarkets/Hypermarkets

- Department Stores

Value Chain Analysis For Musky Scent Perfume Market

The value chain of the Musky Scent Perfume Market begins with the upstream procurement of raw materials, which is bifurcated into the highly sophisticated chemical synthesis of synthetic musk molecules (e.g., Galaxolide, Habanolide) and the cultivation/processing of natural ingredients (essential oils, alcohol base). Chemical companies and specialized fragrance ingredient houses like IFF and Givaudan dominate the supply of synthetic musk compounds, which requires significant R&D investment for compliance and purity. This upstream segment is characterized by high technical barriers to entry and intense regulatory oversight. The downstream process involves the blending and compounding of the musky concentrate with other aromatic chemicals and a solvent (usually ethanol) to create the final fragrance product, a stage where proprietary formulation expertise and brand identity are established by the perfume manufacturers.

Manufacturing and packaging constitute the midstream of the value chain, where the emphasis is placed on adherence to strict Good Manufacturing Practices (GMP) and the aesthetic quality of packaging, which significantly contributes to the luxury positioning of musky scents. Distribution channels form the critical link to the end-consumer. Direct distribution occurs through brand-owned boutiques and proprietary e-commerce sites, offering maximum control over pricing and customer experience. Indirect distribution relies on an intricate network involving wholesalers, retailers (specialty stores, department stores), and increasingly, third-party global e-commerce platforms. The success of the distribution strategy hinges on maintaining channel integrity to prevent counterfeiting and ensure product freshness and authenticity, which is crucial for high-value musky fragrances.

The downstream activities involve rigorous marketing, sales, and post-sales consumer engagement. For musky scents, storytelling around the origin, complexity, and longevity of the fragrance is paramount, often employing sophisticated digital marketing campaigns and influencer endorsements to connect with target demographics. The indirect distribution network, especially specialty retail, offers crucial sensory testing opportunities for consumers before purchase, a necessary step for complex musky compositions. Value chain optimization is currently focused on leveraging blockchain technology to enhance transparency in raw material sourcing (proving the synthetic, ethical nature of the musk used) and improving inventory traceability across the indirect channels to combat unauthorized gray market diversion, thereby strengthening consumer trust in the authenticity of luxury purchases.

Musky Scent Perfume Market Potential Customers

Potential customers for the Musky Scent Perfume Market span a broad demographic spectrum but can be primarily categorized based on their purchasing motivation and preference for scent intensity and profile. The primary end-users are individual consumers seeking fine fragrances for personal use and self-expression. Within this group, there is a significant division between consumers of luxury and niche brands, who seek complex, long-lasting, often bespoke musky accords, and consumers of mass-market or everyday fragrances, who prioritize clean, subtle, laundry-fresh musks in their daily routine. The Millennial and Gen Z demographics represent a key growth segment, showing a pronounced preference for unisex musky fragrances that are ethically sourced and aligned with clean beauty standards, driving demand for innovation in sustainable musk substitutes and transparent ingredient lists.

The secondary customer segment includes institutional buyers such as high-end hotels, corporate offices, and spas, which utilize musky scents in ambient diffusers and professional product lines to create a specific brand atmosphere—a practice known as scent marketing. Musky notes, due to their comforting and grounding nature, are frequently chosen for these professional applications to evoke a sense of warmth, luxury, and tranquility. Furthermore, other consumer product manufacturers represent a crucial B2B customer base; these companies purchase musky compounds and bases as ingredients for their own lines of personal care products, including high-end cosmetics, hair care, and sophisticated laundry detergents, leveraging the fixative and masking properties of musk to enhance their overall product fragrance.

Geographically, customers in established markets (North America and Western Europe) are highly sophisticated, driving demand for innovative, complex niche fragrances and premium pricing, viewing perfumes as a form of liquid art and personal identity statement. Conversely, customers in fast-growing regions like APAC are rapidly adopting fragrances, often entering the market through designer brands but showing an increasing appetite for global niche and artisanal musky scents as discretionary income rises. Targeting potential customers effectively requires tailored marketing: appealing to the experiential and ethical values of Western consumers while addressing the brand aspiration and luxury signaling needs of consumers in emerging markets, all while emphasizing the enduring comfort and sophistication that musky notes provide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $29.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Coty Inc., Estée Lauder Companies, Shiseido Company, International Flavors & Fragrances (IFF), Givaudan SA, Firmenich International SA, Takasago International Corporation, Symrise AG, Puig S.L., Kering SA (Gucci, YSL), Chanel S.A., Dior (LVMH), Hermes International, Natura &Co Holding S.A., Ajmal Perfumes, Rasasi Perfumes Industry LLC, Arabian Oud, Swiss Arabian Perfumes Group, REPLICA (Maison Margiela) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Musky Scent Perfume Market Key Technology Landscape

The technological landscape underpinning the Musky Scent Perfume Market is dominated by advancements in synthetic chemistry, focusing heavily on generating macrocyclic and polycyclic musk compounds that offer superior olfactive profiles while adhering to increasingly stringent safety and environmental regulations. A key technological area is Green Chemistry, which seeks to develop production methods that minimize waste, reduce energy consumption, and utilize renewable feedstocks. This includes enzymatic synthesis and biosynthesis techniques aimed at creating musk molecules that are intrinsically safer, less persistent in the environment, and offer novel, nuanced scent characteristics previously unattainable through traditional petroleum-based synthesis. The implementation of high-throughput screening technologies, often coupled with AI, allows fragrance houses to rapidly test thousands of potential musk candidates for stability, odor intensity, and regulatory compliance, accelerating the innovation cycle significantly.

Encapsulation technology represents another critical advancement, directly addressing a primary consumer desire: scent longevity. Traditional perfume application results in rapid evaporation, especially of top and heart notes, leaving only the heavier musky base notes remaining. Advanced microencapsulation techniques allow for the fragrance oil, including musky molecules, to be contained within tiny polymer or lipid shells. These shells are designed to release the scent gradually over time or upon friction (rubbing the skin or clothing), significantly extending the perceived wear time and ensuring a consistent scent profile throughout the day. This controlled-release technology is particularly beneficial for musky scents, as it helps maintain their foundational presence without becoming overpowering immediately after application, leading to a more sophisticated and enduring consumer experience.

Furthermore, digital tools and analytical technologies are reshaping the quality control and development process. Gas Chromatography-Mass Spectrometry (GC-MS) coupled with advanced spectral libraries is essential for ensuring the purity and consistency of synthetic musk batches and detecting trace impurities that could affect regulatory status or performance. Increasingly, manufacturers are utilizing computational toxicology models and Quantitative Structure-Activity Relationship (QSAR) analysis to predict the safety profile of new musk molecules before physical synthesis, minimizing costly and time-consuming in vivo testing. This technological reliance on predictive modeling and advanced analytical instrumentation ensures both compliance with global safety standards and continuous innovation, allowing perfumers to explore the vast olfactive space of musks more efficiently and responsibly than ever before.

Regional Highlights

Regional dynamics play a significant role in shaping the Musky Scent Perfume Market, influenced by cultural preferences, economic factors, and regulatory environments. North America, characterized by high disposable income and a strong preference for luxury and niche fragrances, remains a dominant force in innovation and consumption. The US market drives demand for sophisticated, clean white musks and highly personalized scent layering, often leveraging digital channels for discovery and purchase. Consumer awareness regarding ingredient transparency is very high, pushing brands to prioritize ethical sourcing and compliant synthetic musks. The market here is mature but constantly refreshed by new niche brands and collaborations.

Europe holds the largest market share globally, largely due to its historical legacy as the epicenter of fine fragrance production (France, Italy). This region is defined by strong regulatory pressures (REACH, IFRA), which necessitate continuous reformulation, driving investments in green chemistry for musk development. European consumers favor both classic, powdery musks and innovative, complex blends, often associating high-end perfumes with heritage and craftsmanship. The premium and ultra-luxury segments are robust, with consumers frequently purchasing through specialty boutiques and department stores for the experiential value.

The Asia Pacific (APAC) region is projected to register the fastest CAGR. This growth is powered by expanding urban populations, rising middle-class affluence, particularly in China, South Korea, and India, and the growing influence of Western beauty standards. APAC consumers often prefer lighter, more subtle musky scents, often encapsulated in EDP or EDT formats, suitable for warmer climates and conservative scent traditions. E-commerce penetration is extremely high, making online retail the primary growth engine for global brands entering these diverse markets. The Middle East and Africa (MEA) region, particularly the Gulf Cooperation Council (GCC) countries, exhibits a unique demand for highly concentrated musky oil perfumes (Attars) and heavy, animalic musk interpretations, reflecting deep-rooted cultural appreciation for strong, luxurious, and persistent fragrances. Traditional retailers and specialized local perfumeries remain dominant distribution channels in this region.

- North America: Strong demand for clean, subtle white musks; leadership in niche and personalized fragrance adoption; high e-commerce penetration.

- Europe: Largest market share; strict regulatory environment driving green chemistry innovation; consumer preference for classic luxury and artisanal musk blends.

- Asia Pacific (APAC): Highest projected growth rate (CAGR); driven by China and India; preference for lighter concentrations and clean scent profiles; massive growth via online retail.

- Middle East & Africa (MEA): High demand for concentrated, traditional Attars and strong, complex musky and oriental fragrances; cultural importance of scent; strong presence of specialized local perfumeries.

- Latin America: Growing consumer base responding well to affordable luxury and celebrity-endorsed fragrances; significant market potential driven by Brazil and Mexico's large consumer populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Musky Scent Perfume Market.- L'Oréal S.A.

- Coty Inc.

- Estée Lauder Companies

- Shiseido Company

- International Flavors & Fragrances (IFF)

- Givaudan SA

- Firmenich International SA

- Takasago International Corporation

- Symrise AG

- Puig S.L.

- Kering SA (Gucci, YSL)

- Chanel S.A.

- Dior (LVMH)

- Hermes International

- Natura &Co Holding S.A.

- Ajmal Perfumes

- Rasasi Perfumes Industry LLC

- Arabian Oud

- Swiss Arabian Perfumes Group

- REPLICA (Maison Margiela)

- Ramon Monegal Perfumes

- The Body Shop International (Natura)

- Penhaligon's

- Jo Malone London (Estée Lauder)

- Maison Francis Kurkdjian (LVMH)

- Byredo (Puig)

- Le Labo (Estée Lauder)

- Acqua di Parma (LVMH)

- MCM Worldwide

- Ormonde Jayne

- Serge Lutens

- Diptyque

- Molton Brown

- By Kilian (Estée Lauder)

- Tiziana Terenzi

- Xerjoff

- Perris Monte Carlo

- Memo Paris

- Parfums de Marly

- Baccarat (LVMH)

- Tom Ford Beauty (Estée Lauder)

- Marc Jacobs (Coty)

- Versace (Coty)

- Gucci (Kering)

Frequently Asked Questions

Analyze common user questions about the Musky Scent Perfume market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of musk in modern perfumery?

Musk primarily serves as a foundational base note and fixative, anchoring more volatile fragrance components, thereby increasing the perfume’s longevity, depth, and overall sillage. It also imparts a characteristic warm, sensual, skin-like aroma.

Are musky perfumes still sourced from animals?

No. Due to ethical concerns and regulatory restrictions, virtually all musky perfumes today utilize synthetic musk compounds (like macrocyclic and polycyclic musks, often called 'white musks'), which are chemically synthesized alternatives to natural musk.

Which segmentation segment is expected to show the highest growth rate?

The Unisex Consumer Type segment is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting global shifts towards non-gendered beauty products and the universal appeal of complex, versatile musky scent profiles.

How do regulatory standards impact the Musky Scent Perfume Market?

Regulations set by bodies like IFRA severely impact the market by restricting or banning certain synthetic musk compounds due to environmental or health concerns, forcing companies to invest continuously in R&D to reformulate products using compliant, often newer, green chemistry alternatives.

What role does Green Chemistry play in musk fragrance production?

Green Chemistry is crucial for developing sustainable and ethically sourced musk substitutes that are biodegradable, non-toxic, and synthesized using environmentally friendly processes, addressing consumer demand for clean and transparent fragrance ingredients.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager