Mutton Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437483 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Mutton Market Size

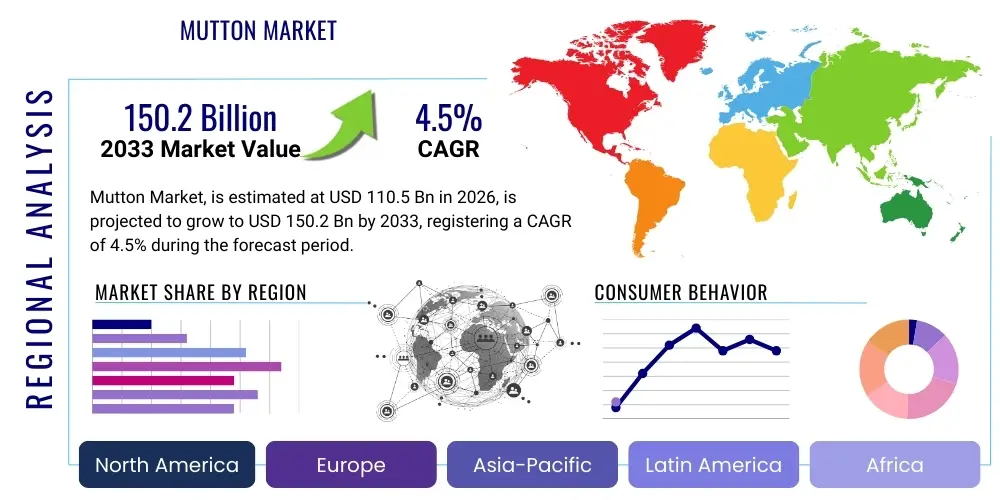

The Mutton Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 110.5 Billion in 2026 and is projected to reach USD 150.2 Billion by the end of the forecast period in 2033.

Mutton Market introduction

The Mutton Market encompasses the global production, processing, distribution, and consumption of meat derived from domesticated sheep, specifically adult sheep (mutton) and younger sheep (lamb). Mutton is highly valued globally for its distinctive flavor profile, nutritional density, and cultural significance, particularly in regions such as the Middle East, Asia Pacific, and parts of Europe. The product spans various forms, including fresh cuts, frozen carcasses, and processed items like sausages, canned goods, and ready-to-eat meals. The inherent high protein content, essential vitamins (B12, niacin), and minerals (iron, zinc) present in mutton bolster its demand among health-conscious consumers. Furthermore, ongoing innovation in slaughtering techniques, packaging technologies, and cold chain logistics ensures product safety and extends shelf life, facilitating easier global trade and accessibility for both commercial and residential consumers.

Major applications of mutton span across the food service sector, including high-end restaurants and catering services, and the extensive retail sector, which covers supermarkets, butcheries, and online platforms. The increasing globalization of culinary trends, coupled with rising disposable incomes in emerging economies, significantly boosts the inclusion of mutton in diverse diets beyond traditional consumption hubs. The versatility of mutton allows its integration into sophisticated European dishes, rich Asian curries, and traditional Middle Eastern preparations, driving sustained demand. Key benefits contributing to market growth include its superior nutritional profile compared to some other red meats, its vital role in celebratory and religious observances worldwide, and the established, sustainable farming practices employed in major exporting nations like Australia and New Zealand. These factors solidify mutton's position as a premium protein source globally.

Driving factors for the Mutton Market expansion are primarily rooted in demographic shifts and evolving consumer preferences. The burgeoning global population necessitates increased food production, placing pressure on the livestock industry to meet demand. Simultaneously, urbanization and Westernization trends in populous regions like India and China are leading to higher per capita meat consumption, including mutton. The growing awareness regarding food provenance and quality is pushing retailers to stock premium, grass-fed, and ethically raised mutton products. Additionally, infrastructural improvements in cold chain logistics, especially across Asia Pacific, allow for the efficient and safe transportation of chilled and frozen mutton products, overcoming previous geographical barriers and fostering robust international trade, thereby maintaining market momentum into the forecast period.

Mutton Market Executive Summary

The Mutton Market is experiencing robust expansion driven by shifting dietary habits favoring high-quality protein sources and the strengthening of global supply chain capabilities. Key business trends indicate a strong focus on vertical integration among major producers, aiming to control quality from farm to table, thereby optimizing efficiency and profitability while ensuring compliance with stringent international food safety standards. There is a discernible trend towards sustainable livestock farming and the adoption of traceable meat solutions, often utilizing blockchain technology, in response to growing consumer scrutiny regarding environmental impact and animal welfare. Furthermore, strategic mergers and acquisitions are consolidating market power among large players, allowing them to leverage economies of scale and penetrate high-growth regional markets more effectively. The expansion of ready-to-cook and convenience mutton products caters to busy urban lifestyles, representing a significant avenue for business growth and diversification across various income demographics.

Regionally, the Asia Pacific (APAC) market remains the dominant force, not only due to its massive consumption base but also because of traditional and cultural prominence of mutton, particularly in countries like China, India, and Turkey (often categorized within the broader Asian consumption pattern). However, North America and Europe are exhibiting high-value growth, driven by specialty imported cuts, premium pricing for ethically raised lamb/mutton, and the burgeoning popularity of ethnic cuisines that heavily feature the product. The Middle East and Africa (MEA) region is critical due to religious consumption patterns (e.g., during Eid al-Adha), sustaining a consistent, high-volume import demand, particularly from Australasian suppliers. These regional dynamics highlight a bifurcated market strategy: volume maximization in APAC/MEA and value maximization in developed Western markets, necessitating tailored marketing and product development strategies.

In terms of segment trends, the frozen mutton segment is projected to witness faster growth than the fresh segment, primarily due to advancements in freezing technology that preserve texture and taste, making frozen products highly suitable for long-distance trade and bulk purchases by the food service industry. The Distribution Channel segment sees hypermarkets and online retail channels increasing their market share significantly, reflecting modern consumer preference for centralized, convenient shopping experiences. The application segment remains heavily weighted towards direct retail consumption, though the processing industry, utilizing lower-grade cuts for prepared meals and flavorings, is rapidly expanding. Producers are strategically targeting the high-end HORECA sector by offering specialized, aged, and premium mutton cuts, capitalizing on the rising global demand for sophisticated culinary experiences and premium restaurant offerings.

AI Impact Analysis on Mutton Market

User queries regarding the impact of Artificial Intelligence (AI) on the Mutton Market primarily revolve around operational efficiency, livestock health monitoring, and supply chain transparency. Common concerns focus on how AI can optimize feed conversion ratios, predict disease outbreaks in large flocks, and automate complex tasks within processing plants, thereby reducing labor costs and improving yield. Users are highly interested in the capacity of machine learning algorithms to forecast market demand volatility, allowing producers and processors to adjust slaughter schedules and inventory levels accurately, minimizing waste and maximizing profitability. A central theme is the expectation that AI-driven traceability systems, utilizing computer vision and advanced data analytics, will revolutionize food safety compliance and provide end-to-end provenance verification, addressing increasing consumer demands for trustworthy and ethical sourcing information.

The application of AI in livestock management is transforming traditional farming methods into precision agriculture. AI systems, integrated with IoT sensors, are used for continuous monitoring of sheep behavior, vital signs, and grazing patterns. This data-driven approach enables early detection of illnesses, optimizing veterinary intervention and reducing mortality rates, which directly enhances the volume and quality of mutton production. Furthermore, algorithms are employed to analyze genetic data and performance metrics to optimize breeding programs, leading to breeds that offer better growth rates and superior meat characteristics. In the production phase, AI-powered grading systems use image analysis to assess carcass quality, fat distribution, and muscle yield with high precision, standardizing quality control far beyond manual assessment capabilities.

Downstream, AI is fundamentally changing logistics and consumer interaction. Machine learning models analyze vast datasets of consumer purchasing behavior, seasonal demand, and geopolitical factors to generate highly accurate sales forecasts, guiding inventory management for retailers and minimizing product spoilage. Within the processing supply chain, AI optimizes routing and cold chain logistics, ensuring minimum transit times and stable temperatures, crucial for preserving the quality of fresh and frozen mutton during international transport. The ability of AI to swiftly process and verify blockchain data enhances supply chain trust, providing consumers with verifiable evidence of the mutton's origin and ethical journey, thereby reinforcing brand loyalty in a competitive global market.

- AI-driven precision livestock farming optimizes feed efficiency and monitors flock health using IoT sensors.

- Machine learning algorithms enhance demand forecasting, reducing inventory holding costs and minimizing product waste.

- Computer vision systems automate carcass grading and quality control in processing facilities, ensuring consistent product standards.

- AI supports advanced genetic selection for sheep breeding programs, improving meat yield and quality characteristics.

- Integration of AI with blockchain technology facilitates real-time, tamper-proof traceability from farm to retail shelf.

- Predictive maintenance analytics applied to processing machinery minimizes downtime and ensures operational continuity.

DRO & Impact Forces Of Mutton Market

The Mutton Market is fundamentally shaped by a complex interplay of demand drivers, operational restraints, strategic opportunities, and influential external forces. Key drivers include the robust population growth globally, particularly in meat-consuming regions, and the increasing incorporation of mutton into diverse international cuisines, fueled by globalization and cultural exchange. However, the market faces significant restraints, primarily stemming from volatility in feed costs, environmental concerns related to methane emissions from livestock, and the intensive labor required for sheep farming and processing. Opportunities are found in the expansion of export markets via advanced free-trade agreements, the development of value-added processed mutton products, and leveraging digitalization for enhanced supply chain efficiency and consumer engagement. The collective effect of these elements dictates market direction and competitive intensity, influencing investment decisions across the entire value chain.

One of the primary driving factors is the perception of mutton as a superior, high-quality red meat, particularly in emerging economies where rising middle-class disposable incomes allow consumers to trade up from cheaper protein alternatives. Religious and cultural festivals, which often mandate the consumption of lamb or mutton, provide reliable, periodic spikes in demand, particularly across Asian and Middle Eastern markets. Conversely, a major restraining force is the susceptibility of sheep flocks to diseases like foot-and-mouth disease, which can devastate supply, necessitate extensive culling, and trigger temporary export bans, causing severe market disruptions. Furthermore, regulatory hurdles related to international trade tariffs, coupled with fluctuating foreign exchange rates, pose ongoing challenges for major exporting nations, impacting final consumer prices and trade volumes globally.

Strategic opportunities abound in technology adoption and market diversification. The implementation of sustainable farming practices, such as carbon sequestration techniques and precision grazing, offers significant opportunities for producers to command premium prices and appeal to environmentally conscious consumer segments in developed nations. There is substantial potential for growth in the ready-to-eat and chilled prepared meals sector, capitalizing on the demand for convenience. The impact forces acting upon the market are highly dynamic, including intense competition from alternative protein sources (both plant-based and cultivated meat), which pressures mutton producers to emphasize the natural, nutritional, and unique characteristics of their product. Policy changes regarding land use, animal welfare standards, and global climate agreements necessitate continuous adaptation, making regulatory compliance a significant ongoing impact force that shapes future market structure and operational costs for all stakeholders.

Segmentation Analysis

The Mutton Market segmentation provides a granular view of market dynamics based on distinct product characteristics, consumer purchasing preferences, and end-use applications. Analyzing these segments is crucial for stakeholders to tailor their product offerings, distribution strategies, and pricing models to specific consumer groups and industry requirements. The market is primarily segmented by Type (Lamb and Mutton), Processing Form (Fresh, Frozen, Processed), Distribution Channel, and Application (Food Service and Retail/Household Consumption). The clear distinction between 'lamb' (meat from young sheep, typically perceived as tender and premium) and 'mutton' (meat from adult sheep, often used in rich, slow-cooked dishes) heavily influences pricing and target clientele across regional markets, especially in Western economies.

The growth dynamics within these segments are asymmetrical. While fresh mutton remains popular in traditional retail settings and high-turnover butcheries, the frozen segment is gaining momentum due to enhanced cold chain infrastructure and the necessities of long-distance international trade, which allows key exporters to maintain market access year-round. The processed segment, encompassing items like sausages, kebabs, and pre-marinated cuts, offers higher margins and taps into the consumer demand for convenience and diverse flavor profiles. Effective segmentation analysis allows companies to optimize resource allocation, focusing investments on segments exhibiting the highest potential CAGR, such as the online distribution channel or the value-added processed products sub-segment, ensuring market competitiveness and strategic relevance.

- By Type

- Lamb (Meat from younger sheep, generally preferred in North America and Europe)

- Mutton (Meat from mature sheep, traditional preference in Middle East and Asia)

- By Processing Form

- Fresh/Chilled Mutton

- Frozen Mutton (Whole Carcass, Cuts)

- Processed/Value-Added Mutton (Canned, Sausages, Ready-to-Cook)

- By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Traditional Butcheries and Wet Markets

- Online Retail and E-commerce Platforms

- By Application

- Food Service Industry (Hotels, Restaurants, Cafes, Catering - HORECA)

- Retail Consumption (Direct household purchases)

- Processing Industry (Further processing into meals, ingredients)

Value Chain Analysis For Mutton Market

The Mutton Market value chain is a multi-layered structure beginning with upstream production and culminating in downstream consumer sales. The upstream segment involves critical activities such as sheep breeding, feed cultivation, and livestock rearing, where technological integration through genomics and precision agriculture is rapidly increasing efficiency and sustainability. Key players in this phase include genetic suppliers, specialized feed manufacturers, and farm operators. Maintaining robust animal health programs and adhering to stringent welfare standards are essential inputs at this stage, setting the foundational quality and cost structure for the entire chain. Challenges often arise from environmental variability, land availability, and the global volatility of input costs, particularly for grains and supplements necessary for large-scale operations.

The midstream sector is dominated by processing, including slaughtering, grading, cutting, and specialized packaging (Modified Atmosphere Packaging or vacuum sealing) to ensure product longevity and safety. This stage is capital-intensive and subject to rigorous government inspection and hygiene regulations. Direct and indirect distribution channels then move the product towards the consumer. Direct channels involve producers selling directly to local butcheries or operating farm-to-fork retail outlets, which allows for higher margin capture and better control over the brand narrative. Indirect channels rely heavily on third-party logistics (3PL) providers specialized in cold chain management, wholesalers, and large food distributors who facilitate the movement of large volumes of frozen and chilled products across international borders, especially vital for major exporters like Australia and New Zealand.

The downstream activities center on retail and final consumption. Key distribution points are supermarkets and hypermarkets, which command significant buying power and shelf space, offering convenience and consistent supply to the masses. The role of online retail is increasingly important, providing personalized delivery options and accessing niche consumer segments interested in specialty, high-value cuts. Effective value chain management focuses on optimizing efficiency at the processing stage and minimizing wastage during logistics, as the perishable nature of fresh mutton dictates strict adherence to temperature controls. The final link, consumer purchase, is highly influenced by branding, perceived quality, ethical sourcing certifications, and competitive retail pricing, completing the complex flow from farm pasture to plate.

Mutton Market Potential Customers

The Mutton Market serves a diverse range of potential customers, spanning commercial entities, institutional buyers, and individual retail consumers, each characterized by distinct purchasing behaviors and product requirements. A primary customer segment is the Food Service Industry, which includes high-end hotels, sophisticated restaurants (HORECA sector), and institutional catering services (e.g., airlines, hospitals). These buyers require large volumes of standardized, often premium-grade cuts (such as loins and racks of lamb) with consistent quality and supply chain reliability. Their purchasing decisions are highly influenced by price stability, chef preferences for specific meat characteristics (e.g., marbling, flavor profile), and the supplier's ability to meet stringent health and safety certifications required for commercial kitchen operations.

Another major segment constitutes the retail and household consumers, who purchase mutton primarily through supermarkets, traditional butcheries, and increasingly, e-commerce platforms. This segment is highly fragmented and sensitive to factors such as cultural affinity, price, packaging format (e.g., family packs vs. individual portions), and convenience (e.g., pre-cut or marinated options). In regions like the Middle East and South Asia, cultural and religious events significantly boost household demand for specific cuts and volumes. The rise of conscious consumerism means that retail buyers are increasingly seeking products certified as organic, grass-fed, or ethically raised, compelling retailers to demand higher standards from their suppliers and offer premium-priced alternatives.

A crucial, though often invisible, segment is the Processing Industry, which includes manufacturers of ready meals, pet food, and specialized meat extracts or flavorings. These customers typically purchase lower-value cuts, trimmings, and by-products in bulk. Their procurement criteria are focused heavily on cost efficiency, chemical composition, and high volume consistency, rather than aesthetic appeal. This industrial segment contributes significantly to reducing waste in the overall value chain by ensuring utilization of the entire carcass. Targeting these varied customer profiles requires producers and distributors to employ differentiated sales strategies, product processing methods, and logistics frameworks to effectively meet the diverse specifications of commercial, industrial, and retail buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 110.5 Billion |

| Market Forecast in 2033 | USD 150.2 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JBS S.A., Tyson Foods, Inc., Minerva Foods, Australian Lamb Company, Alliance Group, Silver Fern Farms, Fonterra Co-operative Group, R.M. Horton, Dunbia, OSI Group, Vion Food Group, Cargill, Inc., Danish Crown, Cranswick PLC, Thomas Foods International, New Zealand Lamb Company, National Beef Packing Company, LLC, Marfrig Global Foods S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mutton Market Key Technology Landscape

The Mutton Market is rapidly integrating advanced technological solutions across the entire production cycle, from genetic selection to final retail sale, primarily aimed at improving efficiency, ensuring food safety, and meeting sustainability mandates. In the upstream farming sector, genomics and advanced breeding technologies are utilized to develop resilient sheep breeds with superior growth rates and desired meat quality attributes, such as optimal fat-to-muscle ratio. Furthermore, the deployment of Internet of Things (IoT) sensors and drones facilitates precision grazing management, allowing farmers to monitor pasture health and animal location in real-time. This not only optimizes resource utilization, like water and feed, but also contributes significantly to reducing the environmental footprint associated with livestock farming, aligning operations with modern climate objectives.

The processing and midstream segments rely heavily on automation and sophisticated quality assurance tools. Automated robotic cutting systems are replacing manual labor in high-volume processing plants, increasing speed, consistency, and worker safety while minimizing microbial contamination risks. Crucially, the implementation of blockchain technology is revolutionizing traceability. Blockchain systems provide an immutable ledger that records every transaction and movement of the mutton product, from the farm gate through processing, logistics, and retail. This enhanced transparency is vital for establishing consumer trust, especially in high-value export markets where provenance and ethical sourcing claims are critical determinants of purchasing decisions.

In the downstream supply chain and logistics, temperature monitoring systems and specialized Modified Atmosphere Packaging (MAP) technologies are paramount to extending the shelf life of chilled mutton and reducing spoilage during long-haul transportation. The widespread adoption of Enterprise Resource Planning (ERP) systems, integrated with Machine Learning (ML) analytics, allows major distributors to optimize complex international shipping routes and warehousing operations, reacting dynamically to supply chain disruptions or sudden shifts in regional demand. This combination of advanced robotics, digital traceability, and sophisticated logistical technology ensures that the mutton products arriving at the consumer are of the highest quality, safely handled, and ethically verifiable, driving competitive advantage in a globalized industry.

Regional Highlights

The global Mutton Market exhibits highly differentiated regional dynamics, with Asia Pacific (APAC) maintaining its position as the largest market both in terms of production volume and absolute consumption. This dominance is attributed to high population density, deep-rooted cultural reliance on mutton, particularly in Central Asian, South Asian, and Middle Eastern influenced cuisines (including China and India), and rising disposable incomes fueling demand for premium protein. Within APAC, China is rapidly transforming, moving from a self-sufficient production base to becoming a significant importer, driving global trade flows. The logistical infrastructure supporting cold chain delivery is continually improving across Southeast Asia, facilitating greater market penetration for imported frozen mutton and lamb products, which often compete on quality with domestic supplies.

Europe and North America represent high-value markets, characterized by strong demand for specialized, premium lamb cuts, predominantly grass-fed products imported from Oceania. European consumption is highly seasonal, often spiking during holidays, and is strongly influenced by stringent regional regulations concerning animal welfare and food safety. The UK, France, and Germany are key consumers, often valuing traceability and specific quality certifications. North America, particularly the U.S., relies heavily on imports to meet domestic demand, where consumers show increasing preference for convenient, pre-portioned lamb products suitable for modern cooking styles. These markets are driven less by volume and more by value, quality assurance, and ethical provenance, allowing premium exporters to command higher price points.

The Middle East and Africa (MEA) region is critical due to its cultural and religious significance of mutton consumption. Demand is robust and relatively inelastic, particularly in Gulf Cooperation Council (GCC) countries which lack sufficient domestic production capacity and rely almost entirely on imports. Countries like Saudi Arabia and the UAE are major buyers, demanding substantial volumes for both household consumption and large-scale food service operations. South America, while primarily focused on beef exports, is developing its sheep farming sector, with countries like Brazil and Argentina focusing on improving genetic stock for niche regional markets. The diversity in demand drivers—cultural necessity in MEA, volume in APAC, and premium quality in Europe/NA—underscores the need for geographically tailored market strategies by global producers.

- Asia Pacific (APAC): Dominates in volume and consumption; driven by cultural cuisine, high population, and expanding middle class in China and India.

- Europe: High-value market focused on premium, grass-fed, and ethically sourced lamb; strong regulatory environment regarding animal welfare.

- North America: Significant importer of high-quality lamb; increasing demand for convenient and specialized cuts; growth fueled by rising ethnic food popularity.

- Middle East and Africa (MEA): High and steady demand due to religious and traditional practices; dependent on imports, particularly in GCC nations.

- Latin America: Emerging exporter focusing on improving breed quality and accessing regional meat markets; potential for niche market development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mutton Market.- JBS S.A.

- Tyson Foods, Inc.

- Minerva Foods

- Australian Lamb Company

- Alliance Group

- Silver Fern Farms

- Fonterra Co-operative Group

- R.M. Horton

- Dunbia

- OSI Group

- Vion Food Group

- Cargill, Inc.

- Danish Crown

- Cranswick PLC

- Thomas Foods International

- New Zealand Lamb Company

- National Beef Packing Company, LLC

- Marfrig Global Foods S.A.

- Cranswick PLC

- Creekstone Farms

Frequently Asked Questions

Analyze common user questions about the Mutton market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the Mutton Market growth globally?

Market growth is predominantly driven by increasing global population and rising disposable incomes, particularly across Asia Pacific and the Middle East, leading to higher per capita meat consumption. Furthermore, the globalization of ethnic cuisines and improvements in cold chain logistics facilitate greater international trade and accessibility of high-quality mutton and lamb products worldwide, sustaining robust demand.

How does sustainability and ethical sourcing influence consumer choice in the Mutton Market?

Sustainability and ethical sourcing are significant purchasing determinants, especially in developed markets like North America and Europe. Consumers increasingly seek verifiable certifications for grass-fed, organic, and ethically raised mutton, pushing producers to adopt precision farming and blockchain traceability technologies. This focus creates a distinct premium market segment where compliance with high environmental and welfare standards is non-negotiable for brand loyalty.

Which regional segment holds the largest share in the Mutton Market, and why?

The Asia Pacific (APAC) region currently holds the largest market share, driven by its massive consumer base, strong cultural preference for mutton in celebratory and daily cooking, and rapid urbanization. While production varies, high consumption volumes in populous nations like China and India, coupled with critical import demand from the Middle East, solidify APAC's dominance in total market value and volume throughput.

What are the main technological advancements impacting the efficiency of mutton production?

Key technological advancements include the application of genomics for improved breeding programs, the integration of IoT sensors and AI for precision livestock monitoring and health management, and the use of automated robotic systems in processing plants to increase speed and hygienic standards. Additionally, blockchain technology is vital for enhancing supply chain transparency and ensuring end-to-end product traceability for consumers.

What is the competitive landscape regarding frozen versus fresh mutton products?

While fresh mutton remains locally popular, the frozen segment is gaining significant competitive traction due to advancements in freezing techniques that preserve quality and the necessity of long-distance international trade. Frozen mutton allows major exporting countries to supply global markets consistently, offering stable supply and competitive pricing to the food service industry and large retailers worldwide, especially where fresh local supply is insufficient or seasonal.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager