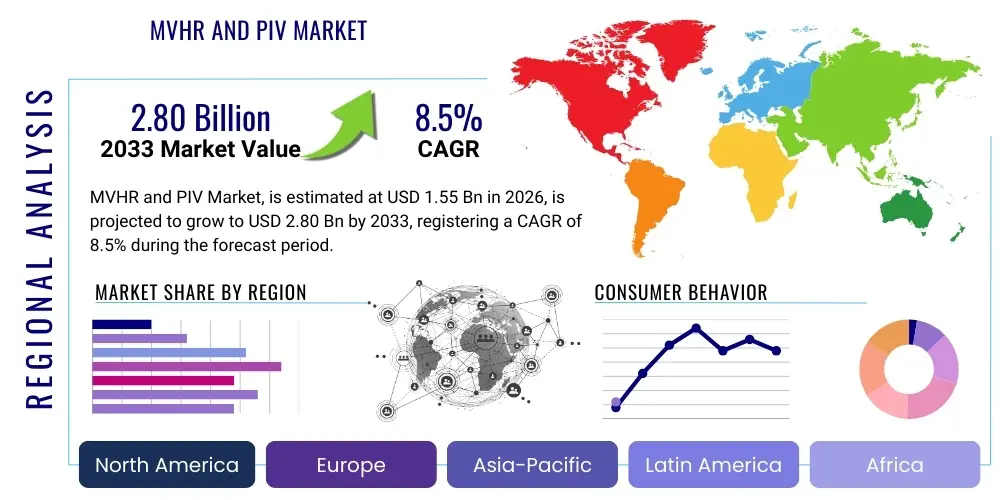

MVHR and PIV Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438705 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

MVHR and PIV Market Size

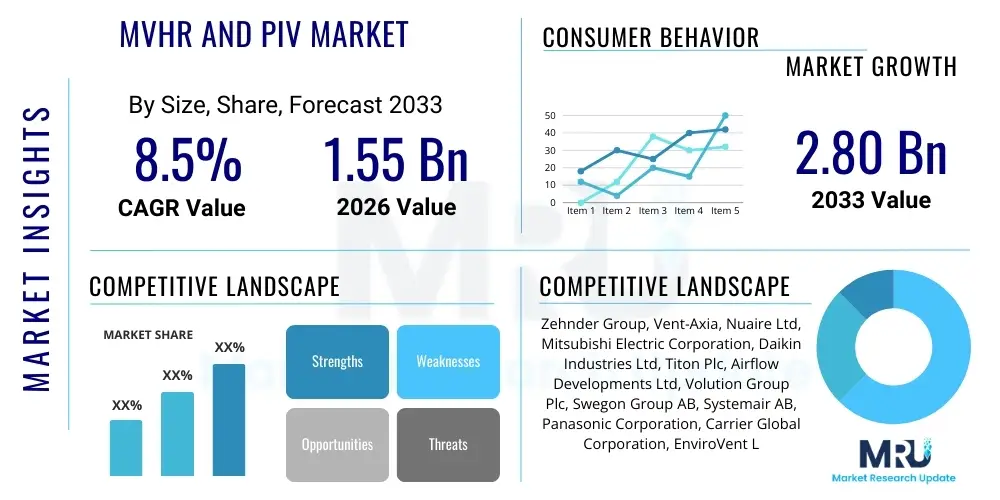

The MVHR and PIV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.55 Billion in 2026 and is projected to reach USD 2.80 Billion by the end of the forecast period in 2033.

MVHR and PIV Market introduction

The Mechanical Ventilation with Heat Recovery (MVHR) and Positive Input Ventilation (PIV) market encompasses advanced ventilation solutions designed to maintain high Indoor Air Quality (IAQ) while minimizing energy consumption. MVHR systems function by continuously extracting stale, moist air from wet rooms (kitchens, bathrooms) and supplying filtered, fresh air to habitable spaces (living rooms, bedrooms). Crucially, these systems recover up to 90% of the heat energy from the extracted air and transfer it to the incoming fresh air supply, dramatically reducing heating costs. PIV systems, alternatively, work by gently introducing fresh, filtered air into the dwelling, typically from the loft space or directly from outside, slightly pressurizing the internal environment to force stale, moisture-laden air out through existing natural leakage paths, thereby effectively controlling condensation and mold growth.

Major applications for MVHR and PIV systems span across the entire building sector, critically focusing on energy-efficient residential properties, both new builds designed to meet stringent passive house standards and retrofitted structures seeking IAQ improvements and mold remediation. The commercial sector also utilizes MVHR extensively in highly insulated offices, schools, hospitals, and retail environments where consistent air exchange and energy efficiency are mandatory for occupant comfort and operational cost reduction. The inherent benefit of these systems lies in their ability to deliver continuous fresh air without the substantial heat loss associated with traditional trickle vents or opening windows, addressing the 'sick building syndrome' prevalent in modern, airtight constructions.

Driving factors for sustained market growth include increasingly stringent global building codes mandating higher levels of energy performance and IAQ standards, particularly across Europe and North America. Regulatory frameworks promoting Net-Zero or near-zero energy building standards make MVHR almost essential for compliance, given its high heat recovery efficiency. Furthermore, heightened public awareness regarding the adverse health effects of indoor pollutants, allergens, and airborne pathogens, exacerbated by the global focus on respiratory health, has accelerated the adoption of filtration-equipped ventilation systems. The ongoing trend toward urbanization and smaller, highly insulated dwellings further underscores the necessity for controlled, efficient ventilation solutions.

MVHR and PIV Market Executive Summary

The global MVHR and PIV market demonstrates robust expansion, driven primarily by favorable legislative mandates focusing on sustainable building practices and mandatory reductions in residential carbon footprints. Business trends indicate a strong pivot towards decentralized MVHR units, especially suitable for apartment blocks and smaller retrofits, offering ease of installation and reduced ducting complexity, alongside the integration of smart controls allowing homeowners to manage ventilation based on occupancy and real-time IAQ readings. Competitive dynamics are characterized by vertical integration, with key players investing in sensor technology and filter media development to enhance product differentiation. Investment is also flowing into PIV technology for the vast retrofit market, particularly in older housing stocks experiencing chronic condensation issues where full MVHR installation is cost-prohibitive, making PIV a pragmatic, cost-effective solution.

Regional trends highlight Europe as the undisputed market leader, catalyzed by the Energy Performance of Buildings Directive (EPBD) and the widespread adoption of Passivhaus standards in countries like Germany and the UK, creating a deeply entrenched demand structure for high-efficiency ventilation. North America is accelerating its adoption, particularly in high-performance homes in colder climates where heat retention is crucial, supported by local incentive programs. Asia Pacific, while currently smaller, is projected to exhibit the highest growth rate, fueled by rapid urbanization, increasing concerns over outdoor air pollution infiltrating homes, and the subsequent demand for high-efficiency particulate air (HEPA) filtration capabilities integrated into MVHR systems across densely populated urban centers in China and Japan. These regional disparities dictate product specialization, with Europe favoring highly efficient centralized MVHR and APAC showing strong demand for localized, filtered solutions.

Segment trends reveal that the Residential application segment, particularly the Retrofit sub-segment, dominates the overall market volume for PIV systems, focusing on moisture control in existing buildings. However, the New Build segment is the primary consumer of high-specification, centralized MVHR systems, driven by strict regulatory adherence to energy efficiency targets. Technology-wise, centralized MVHR holds the highest market value, but decentralized MVHR is gaining significant momentum due to its applicability in smaller, multi-unit dwellings. The integration of advanced control mechanisms, such as humidity sensors, volatile organic compound (VOC) detection, and CO2 monitoring, into both MVHR and PIV systems is transforming them from simple ventilation devices into comprehensive, intelligent IAQ management platforms.

AI Impact Analysis on MVHR and PIV Market

User queries regarding AI's influence on the MVHR and PIV market frequently center around optimizing system efficiency, predicting maintenance needs, and achieving truly autonomous IAQ management. Common concerns involve whether AI can dynamically adjust fan speeds and heat recovery levels based on predictive modeling of internal and external conditions, rather than relying solely on current sensor data. Users are also keen to understand how machine learning algorithms can interpret complex data sets—including weather forecasts, building thermal inertia, and occupancy schedules—to preemptively adjust ventilation settings, thereby maximizing both energy savings and occupant comfort. Furthermore, the role of AI in fault detection, diagnostics, and minimizing downtime is a critical topic, ensuring the longevity and reliable operation of these sophisticated systems.

AI integration is fundamentally transforming MVHR and PIV systems by moving them from reactive controls to predictive, adaptive management platforms. Machine learning algorithms analyze historical usage patterns, external weather data, and real-time sensor feedback (CO2, VOC, humidity) to create sophisticated operational profiles. This allows the system to anticipate ventilation demands before indoor air quality deteriorates or before unnecessary energy expenditure occurs, for instance, learning the typical morning peak usage and pre-conditioning the air slightly ahead of time. This optimization capability results in significant energy savings beyond the standard heat recovery function, enhancing the overall value proposition for both commercial and high-end residential installations.

Moreover, AI supports predictive maintenance, shifting the servicing model from scheduled checks to condition-based monitoring. By analyzing fan motor current signatures, heat exchanger performance data, and filter pressure drop curves, AI can identify subtle deviations that signal impending component failure or necessary filter replacement. This proactive approach ensures that systems operate at peak efficiency consistently and minimizes costly emergency repairs. For manufacturers, AI-driven data insights provide valuable feedback loops for product development, informing future designs regarding real-world performance bottlenecks and user interaction preferences, ultimately accelerating the development of next-generation ventilation technologies focused on hyper-efficiency and minimal user intervention.

- AI enables predictive maintenance by analyzing operational anomalies, minimizing downtime and servicing costs.

- Machine learning algorithms optimize fan speeds and heat recovery based on learned occupancy and weather patterns, maximizing energy efficiency.

- Integration allows for autonomous IAQ management, dynamically responding to CO2, VOC, and humidity peaks without user input.

- AI facilitates deep data analytics for manufacturers, driving product innovation focused on real-world performance optimization.

- Smart systems use external data (e.g., local air quality indices) to modulate incoming air filtration levels automatically.

DRO & Impact Forces Of MVHR and PIV Market

The market for MVHR and PIV systems is powerfully influenced by a triad of drivers, restraints, and opportunities, collectively shaped by regulatory frameworks and evolving societal demands for health and sustainability. Key drivers are primarily legislative, centering on mandates for improved building envelope performance and carbon reduction targets, making controlled ventilation essential rather than optional. Restraints largely involve initial high capital costs associated with MVHR installation, especially in retrofits requiring extensive ductwork, alongside a persistent gap in installer expertise and consumer understanding of the technologies' long-term benefits. Opportunities abound in the burgeoning smart home integration market, the urgent need for IAQ solutions post-pandemic, and the development of cost-effective, decentralized systems that cater to smaller, older properties.

The primary drivers bolstering market growth include stringent governmental regulations like the European Union's push towards Near Zero Energy Buildings (NZEB) and similar initiatives in North America aimed at reducing building energy use. These mandates necessitate airtight construction, which inherently requires mechanical ventilation to prevent moisture build-up and poor air quality. Furthermore, heightened environmental consciousness and rising energy prices make the heat recovery capabilities of MVHR extremely attractive, providing a clear Return on Investment (ROI) over the lifespan of the building. The measurable impact of these drivers is the normalization of MVHR in new residential and commercial construction across developed markets, transforming it from a niche product into a standard building component, ensuring consistent demand growth.

Conversely, significant restraints hinder wider market penetration. The complexity and relatively high upfront investment required for centralized MVHR systems often deter average homeowners, particularly in price-sensitive retrofit projects where PIV may be chosen as a cheaper compromise. The installation quality is also a major concern; poorly installed or commissioned MVHR systems can lead to noise complaints or failure to meet expected efficiency targets, eroding consumer confidence. Another restraint is the lack of standardized regulatory oversight in some emerging markets, where cheap, inefficient alternatives can flood the market, confusing consumers. Addressing these restraints requires focused training programs for installers and clear government subsidies to offset initial purchase costs.

Market opportunities are expansive, primarily driven by technological innovation and shifting health priorities. The trend toward developing high-efficiency, filter-integrated PIV systems capable of handling pollutants beyond moisture positions PIV for stronger growth in urban retrofit markets. For MVHR, the convergence with IoT (Internet of Things) and AI provides opportunities for premium, feature-rich products that offer seamless integration with other smart building systems, providing personalized climate control and advanced IAQ monitoring. The increasing adoption of decentralized MVHR systems also opens up new avenues in multi-story residential buildings and apartments where centralized ducting is impractical, offering scalable solutions that bypass traditional installation constraints and capitalize on the efficiency benefits of MVHR technology in previously underserved market segments.

Segmentation Analysis

The MVHR and PIV market is comprehensively segmented based on technology type, application sector, and geographic region, reflecting the diverse needs of the building industry regarding energy efficiency, installation constraints, and scale. Segmentation by product type clearly differentiates between the complex, high-efficiency centralized MVHR systems required for large properties and new builds, the simpler, more localized decentralized MVHR units gaining traction in apartments, and the cost-effective, pressurization-based PIV systems largely used for moisture control in existing homes. Understanding these distinct segments is crucial for manufacturers to tailor their marketing and product development efforts, addressing specific pain points such as installation cost versus heat recovery performance.

Within the application spectrum, the market is broadly divided into Residential and Commercial segments. The Residential segment is further broken down into New Build, which demands peak efficiency MVHR systems to meet Passive House or equivalent standards, and Retrofit, which often favors PIV or decentralized MVHR due to installation limitations and cost sensitivity. The Commercial sector, encompassing healthcare, educational institutions, and offices, mandates highly reliable, high-volume MVHR systems often integrated with sophisticated Building Management Systems (BMS) to handle varying occupancy loads and comply with strict health and safety codes related to air changes per hour. The performance criteria, expected lifespan, and filtration requirements differ significantly between these application segments, driving product specialization and dictating major revenue streams.

Geographic segmentation remains a pivotal factor, with Europe dominating due to pioneering regulatory frameworks and high energy costs, leading to sophisticated market maturity. North America follows, exhibiting strong growth spurred by local energy efficiency standards and a focus on resilience in construction. Asia Pacific is emerging rapidly, driven by urbanization and critical public health concerns related to air pollution, which necessitate high-level filtration capabilities within ventilation units, shifting the focus towards enhanced air purification alongside heat recovery. This geographical diversity underscores the need for regionalized product strategies, adapting to local climate conditions (humidity, temperature extremes) and construction methodologies.

- Product Type:

- MVHR Systems:

- Centralized MVHR

- Decentralized MVHR (Single Room Heat Recovery)

- PIV Systems:

- Loft-Mounted PIV

- Wall-Mounted PIV (For homes without loft space)

- MVHR Systems:

- Application:

- Residential:

- New Build

- Retrofit/Renovation

- Commercial:

- Office Buildings and Retail

- Healthcare Facilities (Hospitals and Clinics)

- Educational Institutions (Schools and Universities)

- Industrial/Manufacturing (Cleanrooms and controlled environments)

- Residential:

- Filter Technology (Integrated Components):

- G3/G4 Filters (Basic Dust and Pollen)

- F7/ePM2.5 Filters (Fine Particulate Matter)

- HEPA Filters (High-Efficiency Particulate Air)

- Control Mechanism:

- Standard Manual Controls

- Humidity & CO2 Sensor-Based Controls

- Smart & IoT-Enabled Systems

- Region:

- North America (US, Canada, Mexico)

- Europe (UK, Germany, France, Nordics)

- Asia Pacific (China, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA)

Value Chain Analysis For MVHR and PIV Market

The value chain for the MVHR and PIV market begins with upstream activities focused on the sourcing of critical components, predominantly heat exchangers (plate, rotary, counterflow), specialized fan motors (often EC motor technology for efficiency), electronic controls, and high-performance filter media. Manufacturers rely heavily on a stable supply chain for energy-efficient components, where innovation in material science—such as anti-bacterial coatings for heat exchangers or improved filter longevity—can provide a significant competitive advantage. Upstream analysis also includes the intellectual property development related to fan design and system housing acoustics, aiming to deliver quiet operation, which is a major consumer requirement. Strategic partnerships with motor and sensor technology providers are vital for maintaining the technical leadership required in this energy-critical sector.

The core manufacturing stage involves assembly, quality assurance, and product customization to meet regional standards (e.g., specific airflow rates or mandatory labeling). Downstream analysis focuses intensely on effective distribution channels and installation expertise. Due to the technical complexity of MVHR, especially centralized systems, distribution heavily relies on specialized wholesalers and HVAC distributors who can provide technical support and stock necessary ducting components and accessories. Direct distribution is common for high-volume commercial projects, ensuring precise specification control and system integration with BMS platforms.

The distribution channel structure is multi-faceted. Direct channels are utilized for large commercial or institutional contracts, involving direct engagement between the manufacturer and the project developer or mechanical contractor. Indirect channels dominate the residential and small commercial sectors, relying on a robust network of authorized distributors, plumbing and heating wholesalers, and specialized ventilation retailers. Crucially, the final installation and commissioning services, often provided by certified independent installers, form a significant part of the value chain, as system performance is highly dependent on correct duct design, balancing, and calibration. This emphasis on correct installation highlights the necessity for manufacturers to invest heavily in training and certification programs for their installer base to maintain brand reputation and performance claims, ultimately ensuring end-user satisfaction and proper product functioning.

MVHR and PIV Market Potential Customers

Potential customers for MVHR and PIV systems are highly diverse, spanning from individual homeowners focused on improving internal air quality and reducing heating bills to large-scale property developers required to comply with stringent green building regulations. Primary end-users fall into three major categories: Residential New Build Developers, who are volume buyers driven by energy efficiency compliance; Residential Homeowners (Retrofit Market), driven by issues such as condensation, mold, and health concerns; and Commercial Building Operators, motivated by occupational health standards, energy savings, and the need to maintain optimal working or healing environments. Each customer segment prioritizes different product attributes, with developers focusing on cost and ease of installation, and commercial operators demanding reliability and integration capabilities.

Residential buyers in the new build sector, particularly those constructing high-specification or Passivhaus standard homes, view MVHR as an essential investment to achieve design objectives. For the vast retrofit market, PIV is often the preferred, accessible solution, particularly targeting owners of aging housing stock struggling with ventilation issues compounded by insulation upgrades. These buyers are typically focused on simplicity, low operational noise, and immediate remediation of visible mold or moisture problems. The buying decision in the retrofit market is heavily influenced by energy auditors, local government schemes offering subsidies, and recommendations from builders specializing in damp proofing or energy efficiency upgrades.

The commercial sector represents high-value customers requiring industrial-grade solutions. Key buyers include Facilities Managers (FMs) and Chief Operating Officers (COOs) of large office complexes, healthcare networks, and educational campuses. In healthcare, for example, MVHR systems must often meet specialized filtration standards (e.g., ISO 8 cleanroom standards in specific areas) and provide redundant operation, emphasizing reliability over initial cost. Education and office environments prioritize low noise, high CO2 control capabilities to enhance productivity, and long-term maintenance contracts. These sophisticated buyers rely heavily on Mechanical, Electrical, and Plumbing (MEP) consulting engineers to specify systems that integrate seamlessly with central Building Management Systems and comply with strict air change rates required for high-density occupancy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 Billion |

| Market Forecast in 2033 | USD 2.80 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zehnder Group, Vent-Axia, Nuaire Ltd, Mitsubishi Electric Corporation, Daikin Industries Ltd, Titon Plc, Airflow Developments Ltd, Volution Group Plc, Swegon Group AB, Systemair AB, Panasonic Corporation, Carrier Global Corporation, EnviroVent Ltd, Semco LLC, Genvex A/S, S&P Soler & Palau Ventilation Group, Brink Climate Systems, Lossnay, Johnson Controls International Plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

MVHR and PIV Market Key Technology Landscape

The technological landscape of the MVHR and PIV market is rapidly advancing, moving far beyond basic air exchange mechanisms to incorporate highly efficient, smart, and integrated solutions. Core technological innovation revolves around maximizing heat recovery efficiency, driven by advancements in heat exchanger design, such as high-performance counterflow plate exchangers which achieve up to 90% thermal efficiency, or enthalpy exchangers that also recover latent heat (moisture), crucial for maintaining optimal humidity levels in extremely dry or humid climates. Furthermore, the mandatory adoption of Electronically Commutated (EC) motor technology has revolutionized fan performance, providing significant energy savings through precise, variable-speed control that consumes dramatically less power than older AC alternatives, directly contributing to compliance with stringent energy consumption standards.

A major focus of current R&D is the integration of sophisticated sensor technology and Internet of Things (IoT) connectivity. Modern systems are equipped with highly accurate CO2, relative humidity, and VOC sensors that modulate system operation in real-time, ensuring optimal indoor air quality (IAQ) on demand, rather than running continuously at fixed speeds. IoT connectivity enables remote monitoring, data logging, and seamless integration with smart home ecosystems and Building Management Systems (BMS). This capability is fundamental for both residential users seeking convenience and commercial operators requiring centralized control and data analytics for energy reporting and fault diagnosis.

The evolution of filtration technology represents another critical technological differentiator. As concerns over both outdoor air pollution (PM2.5) and indoor health hazards persist, manufacturers are integrating higher-grade filtration stages, often F7 or even HEPA filters, into MVHR systems to capture fine particulate matter, viruses, and allergens. This requires careful redesign of the unit architecture to manage the increased pressure drop associated with dense filters without significantly increasing fan power consumption or acoustic output. The goal is to deliver clean, conditioned, and energy-efficient fresh air, positioning the MVHR unit as a comprehensive air treatment device rather than merely a ventilation system, thereby addressing growing consumer demand for health-focused home technology and enhancing market differentiation.

Regional Highlights

- Europe: Market Dominance and Regulatory Leadership

Europe holds the largest market share, predominantly driven by proactive governmental policies and a high energy cost environment that makes heat recovery financially compelling. The implementation of the Energy Performance of Buildings Directive (EPBD) and the widespread acceptance of energy standards like Passivhaus across countries such as Germany, the UK, and the Nordic region have made high-efficiency MVHR systems standard in new construction. The UK represents a particularly strong market for PIV systems, addressing the massive requirement for condensation control in older, social, and private housing stock undergoing retrofit insulation. Regulations demanding minimum ventilation rates and specific heat recovery efficiencies ensure that European manufacturers continuously innovate, leading the market in product quality, controls sophistication, and acoustic performance. The market here is highly mature and intensely competitive, characterized by long-term framework agreements with major housebuilders and a well-established network of specialized HVAC distribution channels.

Germany and the Nordics lead in the adoption of centralized, highly efficient MVHR systems, often integrated with ground source heat pumps or solar thermal systems to create holistic, low-energy building solutions. France and the Benelux countries also show robust growth, increasingly mandating mechanical ventilation in refurbishment projects. This regional strength is cemented by strong consumer awareness regarding both energy efficiency and indoor air quality (IAQ), supported by robust governmental subsidy schemes that incentivize the replacement of outdated ventilation units. The focus in Europe remains on achieving the highest thermal efficiency possible while minimizing the specific fan power (SFP), a measure of how much energy is used to move air through the system, ensuring optimal energy performance in adherence to rigorous European Union energy labels and standards.

Furthermore, the European market is segmented by strong national preferences; for instance, the dominance of PIV in specific retrofit markets like the UK contrasts with the near-universal adoption of high-efficiency MVHR in German new builds. This reflects the different approaches taken to solve the common problem of airtight construction coupled with the need for continuous, controlled air movement. The continued growth across the continent is assured by the sustained pressure on property owners and developers to reduce carbon emissions and meet stringent building fabric performance targets, making ventilation not just a comfort feature but a critical compliance component.

- North America: Accelerating Adoption and Climate Resilience Focus

North America is a rapidly expanding market, especially in regions with extreme weather conditions where heat or cooling retention is critical. The US and Canada are seeing increased adoption, driven by regional building codes such as those set by ASHRAE (American Society of Heating, Refrigerating and Air-Conditioning Engineers) and programs like Energy Star, which promote energy-efficient housing. MVHR systems are particularly popular in colder US states and throughout Canada where energy recovery ventilators (ERVs), which recover both sensible heat and latent heat (moisture), are highly valued for balancing humidity levels during harsh winters without over-drying indoor air, a critical factor for comfort and building envelope preservation.

Growth in the US is segmented, with high penetration in high-performance building niches and a growing presence in mainstream residential construction, particularly in states adopting stricter energy codes like California and New York. The market is also heavily influenced by the commercial sector, where large office buildings and institutional facilities require robust, scalable MVHR systems to manage high occupancy loads and meet LEED certification standards. The North American market emphasizes durability, ease of maintenance, and compatibility with proprietary building automation systems (BAS). The increasing consumer focus on wildfire smoke infiltration in western states is also driving demand for high-grade filtration solutions integrated into MVHR systems, augmenting the overall value proposition of superior air quality control.

The shift towards prefabricated and modular construction methods in North America further favors the standardized, compact nature of modern ventilation units, simplifying installation timelines and reducing on-site complexity. While PIV systems have less market presence compared to Europe, they are gradually entering the market, finding use in smaller, single-family homes undergoing insulation upgrades where ductwork installation for centralized MVHR is complex. The general trend is moving towards higher-capacity, high-efficiency centralized MVHR systems for new, larger homes and commercial projects, leveraging advanced controls and integration capabilities to compete effectively with traditional HVAC equipment.

- Asia Pacific (APAC): Future Growth Engine Focused on Air Quality

The APAC region is projected to be the fastest-growing market, propelled by rapid urbanization, massive infrastructural development, and escalating public awareness regarding pervasive outdoor air pollution (smog, PM2.5). In countries like China, Japan, and South Korea, where outdoor air quality is a significant health hazard, the ability of MVHR systems to deliver highly filtered, fresh air while retaining conditioned temperature is a key driver. Here, the priority often shifts slightly from pure energy recovery to aggressive air purification, necessitating the integration of specialized high-efficiency particulate air (HEPA) and activated carbon filters into standard MVHR units.

Japan is a mature sub-market within APAC, known for demanding high quality, silent operation, and compact decentralized MVHR solutions suitable for small urban dwellings. Conversely, the high volume of new construction in metropolitan areas of China and India presents enormous potential for large-scale centralized MVHR installation in commercial towers and large residential complexes. The emerging middle class in these regions is increasingly willing to invest in premium home technology that directly contributes to health and wellness, driving the adoption of smart, sensor-controlled MVHR systems that monitor and report IAQ levels directly to mobile applications.

The major challenges in APAC include variable construction standards, intense price competition from local manufacturers offering simpler solutions, and the need for systems resilient to high humidity and monsoon climates. Opportunities are concentrated in luxury residential developments and international commercial projects that adhere to western environmental standards. The focus on sustainable building practices and government initiatives aimed at mitigating urban air pollution will be the core long-term catalysts for MVHR adoption across Southeast Asia, cementing the region's position as a critical market for global manufacturers seeking high-growth volume opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the MVHR and PIV Market.- Zehnder Group AG

- Vent-Axia Ltd

- Nuaire Ltd

- Mitsubishi Electric Corporation

- Daikin Industries Ltd

- Titon Plc

- Airflow Developments Ltd

- Volution Group Plc

- Swegon Group AB

- Systemair AB

- Panasonic Corporation

- Carrier Global Corporation

- EnviroVent Ltd

- Semco LLC

- Genvex A/S

- S&P Soler & Palau Ventilation Group

- Brink Climate Systems B.V.

- Lossnay (Mitsubishi Electric brand)

- Johnson Controls International Plc

- Reznor HVAC (A brand of AmbiRad)

Frequently Asked Questions

Analyze common user questions about the MVHR and PIV market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference in operation between MVHR and PIV systems?

MVHR (Mechanical Ventilation with Heat Recovery) is a balanced, two-way system that extracts stale air and supplies fresh air simultaneously, recovering heat energy between the two airstreams. PIV (Positive Input Ventilation) is an unbalanced system that gently introduces fresh air, slightly pressurizing the dwelling and forcing stale air out through natural gaps and leakage paths, primarily used for moisture control.

Which factors are driving the MVHR market growth?

Market growth is driven primarily by increasingly strict global building regulations mandating high energy efficiency and airtight construction (e.g., NZEB standards), rising energy costs making heat recovery economically viable, and heightened consumer awareness regarding the health benefits of maintaining superior Indoor Air Quality (IAQ).

Is MVHR or PIV more suitable for retrofit projects in older homes?

PIV is often more suitable for retrofitting existing homes, particularly older properties, due to its significantly lower installation cost, minimal requirement for ductwork, and effectiveness in mitigating chronic condensation and mold issues common in poorly ventilated, insulated buildings. MVHR, while superior in efficiency, is typically reserved for full renovations or new builds.

How is AI impacting the energy efficiency of modern MVHR systems?

AI impacts efficiency by enabling predictive operation. Machine learning algorithms analyze occupancy patterns, weather forecasts, and real-time IAQ sensor data to dynamically adjust fan speeds and heat recovery levels. This optimizes performance by ensuring the system runs only at the necessary minimum power, significantly reducing overall energy consumption beyond standard heat recovery.

What role do filter specifications play in MVHR unit selection?

Filter specifications are crucial for ensuring high Indoor Air Quality (IAQ). Modern MVHR systems often require F7 (ePM2.5) or HEPA filters to effectively capture fine particulate matter and allergens, especially in urban environments. Selecting the correct filter class is vital for health benefits but must be balanced against the slight increase in pressure drop and corresponding fan energy use.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- MVHR and PIV Market Statistics 2025 Analysis By Application (Residential, Non-residential), By Type (MVHR, PIV), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- MVHR and PIV Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (MVHR, PIV), By Application (Residential, Non-residential), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager