Mycelium Leather Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434544 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Mycelium Leather Market Size

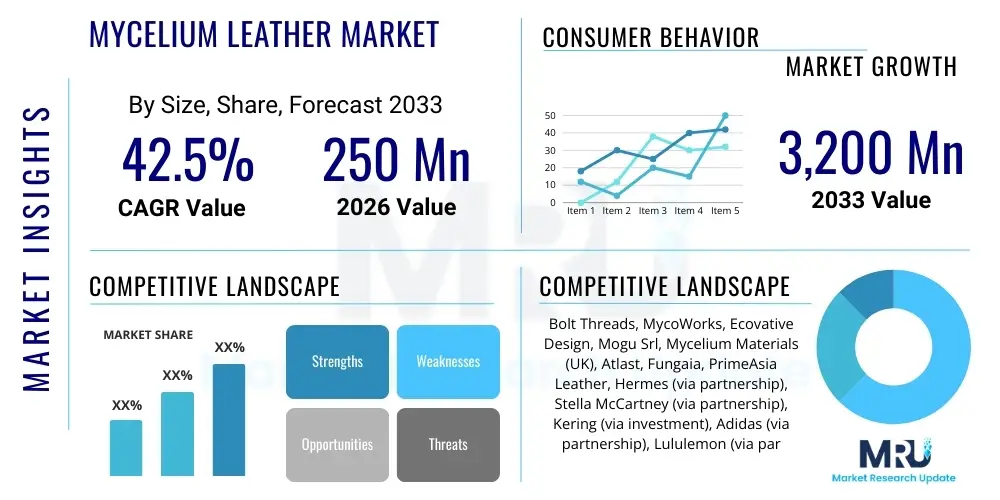

The Mycelium Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 42.5% between 2026 and 2033. The market is estimated at $250 Million USD in 2026 and is projected to reach $3,200 Million USD by the end of the forecast period in 2033.

Mycelium Leather Market introduction

The Mycelium Leather Market is centered on the production and commercialization of bio-based materials derived from the root structure of fungi, known as mycelium. This innovative material serves as a sustainable, cruelty-free, and biodegradable alternative to traditional animal hides and petroleum-based synthetic leathers (PU/PVC). The product boasts significant functional attributes, including durability, flexibility, and a comparable aesthetic quality to high-end animal leather, positioning it as a disruptive force in the luxury, fashion, and automotive industries. Market participants are heavily focused on scaling production methodologies to reduce costs and meet the surging demand driven by global environmental mandates and consumer preference shifts toward ethical sourcing.

Major applications of mycelium leather span across consumer goods, including high-end fashion accessories such as handbags, wallets, and belts, as well as performance footwear, where its lightweight and breathable nature is advantageous. Furthermore, the material is rapidly penetrating the automotive interior market, providing sustainable upholstery options for electric and luxury vehicle manufacturers committed to achieving net-zero supply chains. The primary benefits driving its adoption include superior sustainability metrics—requiring significantly less water, land, and energy compared to livestock farming—and its inherent ability to decompose naturally at the end of its lifecycle, addressing the pervasive issue of textile waste.

Key driving factors propelling this market include the escalating scrutiny over the environmental impact of traditional leather production, including methane emissions and chemical tanning processes. Regulatory pressures in Europe and North America emphasizing circular economy principles also accelerate adoption. Moreover, significant venture capital investments into biotech and materials science startups specializing in fungal fermentation have enhanced technological readiness and production capacity, moving mycelium leather from laboratory novelty to commercial viability, thus ensuring robust market expansion throughout the forecast period.

Mycelium Leather Market Executive Summary

The Mycelium Leather Market is characterized by rapid technological advancements and high strategic investment activity, positioning it for exponential growth over the next decade. Business trends indicate a strong move toward strategic partnerships between mycelium producers and established luxury fashion houses and multinational corporations, aimed at validating material quality and ensuring supply chain consistency. Key players are aggressively seeking patents related to feedstock optimization, fermentation processes, and post-processing treatments (like natural dyeing and finishing) to establish market dominance and proprietary material characteristics, driving competition primarily on sustainability claims and aesthetic performance rather than just price.

Regionally, Europe, particularly countries with strong environmental policies and established luxury goods industries such as Italy and France, currently dominates the market in terms of early adoption and high-value applications. North America follows closely, fueled by substantial biotechnology funding and a robust consumer base prioritizing ethical fashion and corporate social responsibility (CSR) initiatives. The Asia Pacific region is anticipated to demonstrate the highest growth rate, driven by the expanding manufacturing base in textiles, rising disposable income, and increasing awareness regarding vegan alternatives in densely populated markets like China and India.

Segmentation trends reveal that the Fashion & Apparel segment holds the largest market share due to the immediate suitability of mycelium for small leather goods and accessories, offering high margins and visibility for sustainable branding. However, the Footwear and Automotive segments are projected to exhibit the fastest growth, underpinned by the high volume requirements and rigorous material specifications in these sectors. Furthermore, the market for ‘Pure Mycelium’ based materials, which utilize fermentation optimized for strength and texture without synthetic backing, is gaining traction over ‘Mycelium Composite’ materials, reflecting the market’s push toward complete biodegradability and maximum sustainability impact.

AI Impact Analysis on Mycelium Leather Market

User inquiries regarding AI's impact on the Mycelium Leather Market predominantly center on three core themes: optimization of biomanufacturing processes, supply chain efficiency, and novel material discovery. Users frequently ask how AI can accelerate the fermentation cycle, reduce batch variation, and predict the optimal environmental conditions (temperature, pH, nutrient mix) for high-quality mycelium growth. A significant concern revolves around using AI-driven robotics and sensor technology to automate the labor-intensive harvesting and processing stages, thereby reducing costs and increasing scalability to compete with traditional materials. Furthermore, there is substantial user interest in how machine learning algorithms can analyze vast biological datasets to identify superior fungal strains or combinations thereof, leading to new materials with enhanced tensile strength, water resistance, or specific textures tailored for specialized applications like performance sports gear or industrial protective wear.

The integration of AI, particularly predictive analytics and machine vision, is crucial for transitioning mycelium leather production from small batch lab operations to industrial-scale biomanufacturing. AI systems are deployed to monitor bioreactor health in real-time, analyzing hundreds of data points relating to gas exchange, metabolic activity, and substrate consumption. This level of granular control minimizes contamination risks, optimizes resource utilization (like reducing unused nutrient media), and ensures consistent material thickness and homogeneity across massive surface areas, which is vital for automotive and upholstery applications requiring large, defect-free sheets. The predictability offered by AI directly addresses one of the primary historical constraints of biomaterials: the lack of standardized quality output.

Beyond the production floor, AI significantly enhances the market's efficiency in demand forecasting and supply chain management. Machine learning models analyze consumer trends, social media sentiment, and ethical purchasing patterns to predict which product types (e.g., thickness, finish, color) will experience peak demand in specific fashion cycles, guiding production schedules proactively. This strategic forecasting minimizes inventory waste and optimizes logistics, ensuring that high-value, perishable bio-materials are utilized efficiently. Ultimately, AI acts as a multiplier for sustainability, not only optimizing the biological process but also creating a leaner, more responsive, and economically viable supply chain for mycelium-based products globally.

- AI-Driven Bioreactor Optimization: Utilizes predictive modeling to manage temperature, humidity, and nutrient levels for maximum mycelium yield and consistent material quality.

- Accelerated Strain Discovery: Machine learning algorithms analyze fungal genomic data to identify novel species or genetic modifications enhancing material properties like durability and texture.

- Automated Quality Control (QC): Computer vision systems inspect material sheets post-harvesting for defects, ensuring high-standard uniformity required by luxury and automotive industries.

- Supply Chain and Demand Forecasting: Predictive analytics optimize inventory levels, forecast consumer adoption rates, and streamline logistics for time-sensitive, sustainable materials.

- Enhanced Material Performance Simulation: AI models simulate how new mycelium compositions will perform under stress, abrasion, and moisture exposure, reducing physical prototyping cycles.

DRO & Impact Forces Of Mycelium Leather Market

The trajectory of the Mycelium Leather Market is governed by a dynamic interplay of potent drivers, stringent restraints, and expansive opportunities, all converging to shape the competitive landscape. The primary drivers revolve around global sustainability imperatives and consumer behavioral shifts, while the main restraints include challenges related to manufacturing scalability and cost parity with established synthetic options. Opportunities are abundant, rooted in product diversification and technological breakthroughs, creating significant impact forces that are redefining traditional material hierarchies. The successful mitigation of initial production costs and scaling hurdles will determine the rate at which mycelium leather transitions from a niche luxury product to a mainstream material across multiple industrial applications, representing a critical pivot point for market evolution.

Impact forces dictate the market's receptivity and integration speed. Economic forces strongly influence adoption, as the current high production cost of mycelium leather necessitates premium pricing, limiting penetration into mid-market segments. Sociocultural forces, however, strongly favor mycelium, driven by the global rise of veganism, conscious consumerism, and the preference for verifiable cruelty-free products. Technological impact forces are overwhelmingly positive, with continuous innovation in bioreactor design, substrate optimization, and genetic engineering rapidly addressing historical limitations in material performance and scalability. Regulatory forces, particularly EU directives regarding microplastics and carbon footprint mandates, serve as powerful external drivers pushing industries toward bio-based, biodegradable alternatives like mycelium.

The market’s inherent structural dynamics show that the high environmental cost of traditional leather and plastic-based synthetics acts as a perpetual structural driver for alternatives. Restraints such as long product development cycles required for regulatory approvals, particularly in high-stakes industries like automotive and aircraft interiors, slow initial market penetration. Despite these hurdles, the opportunity to establish completely closed-loop, circular economies—where mycelium leather waste can be composted and potentially even re-integrated as feedstock—presents an unparalleled competitive advantage, fueling massive investment and strategic maneuvering among market leaders aiming to capture the future of sustainable material science and secure intellectual property rights over novel strain development.

- Drivers (D)

- Growing Global Demand for Sustainable and Vegan Alternatives to Animal Leather.

- Favorable Environmental Policies and Regulations Promoting Bio-based, Biodegradable Materials.

- Significant Investments in Biotechnology and Mycelium Research by Venture Capital and Corporate R&D.

- Increasing Consumer Awareness and Acceptance of Cruelty-Free and Circular Economy Products.

- Superior Performance Characteristics (e.g., breathability, lightweight nature) in certain high-end applications like footwear.

- Restraints (R)

- High Manufacturing Cost and Lack of Scale Compared to Established Synthetic and Animal Leathers.

- Challenges in Achieving Material Consistency and Durability for Mass-Market High-Stress Applications.

- Limited Established Supply Chain Infrastructure and Reliance on Specialized Bioreactor Technology.

- Need for Extensive Research and Development to Enhance Resistance to UV Degradation and Abrasion.

- Intellectual Property Disputes and Complexity in Securing Proprietary Fungal Strains and Processes.

- Opportunities (O)

- Expansion into High-Volume Markets such as Automotive Interiors, Mass-Market Footwear, and General Upholstery.

- Developing Second and Third-Generation Materials with Enhanced Functionality (e.g., self-healing properties, embedded sensors).

- Strategic Partnerships with Global Brands to Validate Commercial Viability and Increase Consumer Exposure.

- Creation of Vertical Integration Models, Controlling Everything from Fungal Culture to Final Finishing.

- Exploiting Emerging Markets in Asia Pacific with Rapidly Growing Ethical Consumer Segments.

Segmentation Analysis

The Mycelium Leather Market is meticulously segmented based on application, raw material source, and end-user vertical, reflecting the diverse uses and rapidly evolving production techniques within this nascent industry. Analysis of these segments is crucial for understanding current revenue streams and identifying future high-growth pockets. The Application segment dominates analytical focus, illustrating the material's versatility across fashion, footwear, and automotive sectors, each possessing unique material specifications and volume demands. The differentiation between various fungal species (raw material) and production methods further highlights the technological diversity and strategic positioning adopted by different market players, who tailor their mycelium strain selection to specific performance requirements such as tensile strength for straps or softness for apparel.

Current market dynamics show that the Application segments, particularly luxury fashion and high-end footwear, currently command premium pricing and act as vital brand validators, despite lower overall volume consumption compared to industrial sectors. Manufacturers are strategically targeting these high-visibility segments first to build material credibility and secure necessary capital for scaling. Meanwhile, the segmentation by End-Use Industry indicates a future shift, projecting that the Automotive and Home Furnishings sectors, demanding large, standardized sheets and robust material specifications, will drive the majority of volume growth post-2028 as production efficiencies improve and pricing becomes more competitive against legacy materials.

Furthermore, segmentation based on Product Type—specifically separating pure mycelium sheets from mycelium composites (blended with natural fibers or bio-based polymers)—is critical for assessing the true sustainability profile of the market offerings. Pure mycelium products align perfectly with stringent circular economy goals but often present higher production costs, while composites offer faster scalability and cost reduction at the expense of complete biodegradability. Strategic market players are investing heavily in pure mycelium technologies to secure long-term sustainability leadership and regulatory compliance, positioning this sub-segment as the definitive long-term growth driver, despite current composite materials filling immediate mass-market voids.

- By Application

- Footwear (Sneakers, Boots, Dress Shoes)

- Fashion Accessories (Handbags, Wallets, Belts, Jewelry)

- Apparel (Jackets, Trousers, Skirts)

- Automotive Interiors (Seat Upholstery, Dashboards, Trims)

- Home Furnishings (Furniture Upholstery, Decorative Items)

- By Product Type

- Pure Mycelium Leather (100% Mycelium-derived Material)

- Mycelium Composite Leather (Blended with bio-based polymers or natural fibers)

- By Raw Material

- Ganoderma Lucidum (Known for thickness and durability)

- Pleurotus Ostreatus (Oyster Mushroom, common for fast growth)

- Other Fungal Species (e.g., strains optimized for specific textures or growth rates)

- By Distribution Channel

- Direct Sales (B2B, Manufacturer to Brand)

- Indirect Sales (Distributors, Agents, Online B2B Platforms)

Value Chain Analysis For Mycelium Leather Market

The value chain of the Mycelium Leather Market is distinct from traditional leather production, relying heavily on biotechnological expertise rather than agriculture or chemical processing. The chain begins upstream with substrate preparation and fungal strain cultivation—a crucial step involving proprietary knowledge regarding nutrient media composition and bioreactor management. Effective upstream analysis focuses on securing scalable, sustainable, and cost-effective feedstock (often agricultural waste like corn cobs or sawdust) and maintaining highly optimized, non-contaminated fungal cultures, which directly impacts the quality and yield of the final bio-material sheet. Efficiency in this initial stage is vital, as feedstock costs and cultivation time significantly influence overall production economics.

Midstream activities encompass the actual growth phase, where the mycelium structure is fermented into thick mats, followed by harvesting and initial processing (dehydration, stabilization). This is the most technology-intensive phase, requiring specialized bioreactors (often proprietary vertical farming setups or large trays) and precise environmental controls. Downstream analysis focuses on post-processing, which includes tanning, dyeing, texturizing, and finishing treatments required to meet industry standards for abrasion, colorfastness, and feel. Unlike animal leather, which uses hazardous chromium tanning, mycelium typically undergoes gentler, bio-compatible treatments. Integration of these finishing technologies is key to differentiating products and meeting the stringent aesthetic demands of luxury buyers.

Distribution channels are currently dominated by Direct Sales (B2B), as the material is often customized for specific brand partners (e.g., luxury handbags requiring a specific tensile strength or finish). This direct model allows for strict quality control and enables close collaboration between the materials producer and the end-user brand during the design and validation phases. Indirect channels, through specialized materials distributors focusing on sustainable textiles, are slowly emerging to service smaller brands or enter new geographical territories. The complexity and novelty of the material necessitate educational sales efforts, making strong, direct relationships essential for initial market penetration and scaling, especially in automotive sectors where material certification requires extensive direct interaction.

Mycelium Leather Market Potential Customers

Potential customers for mycelium leather span a wide range of industries unified by a critical need for high-performance, verifiable sustainable materials that align with circular economy principles and ethical consumer expectations. The primary tier of customers comprises global luxury fashion houses that are under intense public and investor pressure to divest from materials associated with environmental harm or animal cruelty. These buyers prioritize premium aesthetics, brand storytelling potential, and the ability to claim high levels of biodegradability or bio-content in their product lines, making mycelium an ideal component for limited edition or core sustainable collections.

The secondary, high-volume customer segment includes multinational footwear manufacturers, particularly those focusing on athletic and performance gear. These buyers are attracted to mycelium leather’s potential for breathability, lightweight construction, and consistent large-sheet production capabilities necessary for efficient cutting and assembly. Furthermore, the automotive sector represents a rapidly emerging and lucrative customer base, consisting primarily of electric vehicle (EV) manufacturers and high-end luxury car brands. These companies seek certified non-animal, low-carbon footprint materials for interior upholstery to meet stringent sustainability goals and satisfy the ethical preferences of their technologically savvy customer base, demanding materials that are durable enough to last the vehicle’s lifetime.

Tertiary customers include manufacturers of high-end home furnishings and upholstery, seeking innovative, durable, and naturally derived materials for furniture and wall coverings, as well as specialized producers of small leather goods (wallets, tech cases) who require flexible materials in moderate volumes. In all segments, the purchasing decision is heavily influenced by the ability of the mycelium supplier to provide certified environmental impact data (life cycle assessment), ensure supply consistency, and collaborate on achieving specific material specifications tailored to their unique product lines, moving the customer relationship beyond transactional purchases toward long-term strategic material sourcing partnerships.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million USD |

| Market Forecast in 2033 | $3,200 Million USD |

| Growth Rate | 42.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bolt Threads, MycoWorks, Ecovative Design, Mogu Srl, Mycelium Materials (UK), Atlast, Fungaia, PrimeAsia Leather, Hermes (via partnership), Stella McCartney (via partnership), Kering (via investment), Adidas (via partnership), Lululemon (via partnership), General Motors (via research), Forager, BioFabbrica, Meati Foods (Focusing on food, but related IP), Nature’s Myco, Mushroom Leather Company, Biovatech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Mycelium Leather Market Key Technology Landscape

The technology landscape for the Mycelium Leather Market is dominated by advances in solid-state and submerged fermentation biomanufacturing techniques. Solid-state fermentation involves growing the fungal mycelium on a solid, nutrient-rich substrate in controlled environmental conditions, allowing the organism to form a dense, interconnected mat that mirrors the structure of leather dermis. Key technological focus areas in this domain include optimizing substrate formulation—often utilizing proprietary mixes of agricultural waste products—and designing scalable growth chambers (bioreactors) that ensure consistent moisture, gas exchange, and temperature, which are critical variables determining the final material’s structural integrity and thickness uniformity, essential for achieving industrial standards and repeatability.

Submerged fermentation, while less common for full leather sheets, is employed for producing specific fungal biomass components or for rapid prototyping, relying on liquid nutrient media and large vats similar to brewing or pharmaceutical fermentation. A critical technological battleground lies in post-processing. Innovations in bio-tanning (using natural, non-toxic cross-linking agents instead of chromium) and non-chemical finishing treatments are crucial for maintaining the material's biodegradability while achieving high performance metrics, such as water resistance, UV stability, and abrasion resistance. Leading companies are heavily investing in proprietary surface modification technologies, including bio-based coatings and physical texturing methods, to emulate the look and feel of specific luxury animal leathers without compromising the sustainability promise.

Furthermore, genetic engineering and synthetic biology are becoming increasingly important. Researchers are utilizing CRISPR technology and other gene editing tools to modify fungal strains (e.g., Ganoderma species) to accelerate growth cycles, produce mycelial structures with enhanced natural self-assembly capabilities, or even secrete natural pigments, reducing the need for external chemical dyes. The deployment of AI and IoT sensors within bioreactors to manage environmental controls and predict batch failure rates constitutes a foundational technology layer, enabling the efficient scale-up from pilot plant production to multinational industrial output, ensuring that technology scalability is addressed concurrently with material innovation.

Regional Highlights

The global Mycelium Leather Market exhibits significant regional disparities in terms of technological maturity, regulatory support, and consumer adoption rates, largely driven by environmental policies and established fashion hubs. Europe currently leads the market in both consumption value and technological standardization, primarily driven by the stringent sustainability targets set by the European Union, which aggressively push industries toward biodegradable and non-toxic materials. Countries like Italy and France, holding the historical core of global luxury fashion, are rapidly integrating mycelium leather into high-visibility product lines, validating the material’s premium status and aesthetic quality. The strong consumer base in Northern Europe, deeply committed to ethical purchasing, further sustains this high-value market segment. European manufacturers benefit from significant public and private funding directed toward circular economy innovation.

North America is positioned as the primary hub for technological innovation and venture capital investment in the mycelium space. The United States, with its robust biotechnology sector centered around California and Massachusetts, houses many of the pioneering companies responsible for breakthroughs in bioreactor design and fungal strain optimization. Market growth in this region is propelled by massive corporate partnerships—particularly with large athletic wear companies and innovative automotive manufacturers—seeking to publicize their commitment to reduced carbon footprints and animal welfare. The regional focus often leans toward achieving mass-market scalability and performance durability, ensuring the material can compete directly with durable synthetic leathers used in demanding applications.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period, driven by dual factors: the presence of major global manufacturing centers (China, Vietnam, India) and a rapidly expanding middle class adopting Western consumer trends, including ethical fashion. While APAC manufacturing currently presents opportunities for cost-efficient scaling, the primary growth driver will shift toward domestic consumption as environmental awareness and disposable incomes increase in large economies like China and South Korea. Government initiatives promoting domestic biotechnology and sustainable materials, coupled with local textile and footwear conglomerates seeking competitive advantages through sustainability claims, will catalyze exponential growth, particularly in the mid-market and mainstream footwear segments. Latin America and the Middle East and Africa (MEA) remain emerging markets, where adoption is currently concentrated in luxury imports and small-scale pilot projects, dependent on infrastructure improvements and increased consumer awareness regarding bio-materials.

- Europe: Dominant market in high-value luxury application; strong regulatory environment supporting biodegradability; early adoption by major fashion houses (France, Italy). Focus on material aesthetics and premium positioning.

- North America: Leader in R&D and venture capital funding; critical mass production scaling; strong penetration in athletic footwear and automotive sectors (USA, Canada). Focus on durability and industrial scalability.

- Asia Pacific (APAC): Highest projected CAGR due to expanding middle class, increasing environmental awareness, and large-scale manufacturing capabilities (China, South Korea, India). Focus on cost optimization and mainstream adoption.

- Latin America (LATAM): Nascent market, primarily driven by imported high-end sustainable goods; potential for domestic agricultural waste utilization as feedstock; limited local production currently.

- Middle East and Africa (MEA): Growth tied to diversification strategies away from oil dependency; small, yet highly conscious luxury consumer base; limited infrastructure for advanced biomanufacturing currently, but high potential for future governmental investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Mycelium Leather Market. These companies are actively engaged in proprietary fungal strain development, scaling bioreactor technology, and securing high-profile commercial partnerships to solidify their position in the rapidly growing bio-materials sector. Their strategies often involve deep vertical integration, from biotech IP management to post-processing finishes, ensuring quality control and performance customization for industrial clients.- Bolt Threads

- MycoWorks

- Ecovative Design

- Mogu Srl

- Mycelium Materials (UK)

- Atlast

- Fungaia

- PrimeAsia Leather (Exploring alternatives)

- Hermes (Strategic partner/investor)

- Stella McCartney (Key early adopter)

- Kering (Investment in biotech)

- Adidas (Product development partner)

- Lululemon (Material procurement partner)

- General Motors (R&D focus for interiors)

- Forager

- BioFabbrica

- Meati Foods (Related IP/biomass production expertise)

- Nature’s Myco

- Mushroom Leather Company

- Biovatech

- Biomaterial Systems

- Geltor (Relevant fermentation expertise)

- Modern Synthesis (Related material science)

- Saga Industries

Frequently Asked Questions

Analyze common user questions about the Mycelium Leather market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Mycelium Leather and how is it produced sustainably?

Mycelium leather is a bio-material derived from the root structure of fungi, grown through a controlled process called solid-state fermentation. It is produced by feeding fungal cultures agricultural waste feedstock in vertical farms or bioreactors. This process requires significantly less water, land, and energy compared to traditional animal leather, and the resulting material is inherently biodegradable, making it a highly sustainable alternative to both animal hides and petroleum-based synthetics.

How does the cost and scalability of Mycelium Leather compare to traditional materials?

Currently, the production cost of mycelium leather is higher than traditional animal leather or PU synthetics due to the intensive R&D required and the need for specialized bioreactor infrastructure and proprietary cultivation techniques. However, as technologies like AI optimization and scaled biomanufacturing mature, the cost is projected to decrease significantly during the forecast period (2026-2033). Scalability is rapidly improving through large strategic investments aimed at building industrial-sized production facilities.

Which industries are the primary users of Mycelium Leather?

The primary markets currently utilizing mycelium leather include the Luxury Fashion industry (handbags, small goods) and the High-End Footwear sector, which value its ethical profile and premium aesthetic. The Automotive sector is rapidly emerging as a critical high-volume end-user, seeking sustainable upholstery options for electric vehicles and complying with global initiatives to de-carbonize vehicle interiors and supply chains.

Is Mycelium Leather fully biodegradable, and what is its expected durability?

Pure mycelium leather (not composite materials relying heavily on synthetic backings) is designed to be fully biodegradable or compostable, representing a true circular material solution. In terms of durability, continuous technological advancements in proprietary bio-tanning and post-processing finishing treatments are rapidly improving its performance, making it comparable to, and in some metrics superior to, conventional leathers in terms of abrasion, flexibility, and water resistance, meeting commercial standards for high-wear products.

Who are the leading companies driving innovation in Mycelium Leather technology?

Leading innovators include specialized biotech companies such as MycoWorks and Bolt Threads, which hold significant intellectual property related to fungal strain selection, bioreactor design, and finishing treatments. These companies are driving the shift from laboratory-scale production to industrial output, often collaborating directly with major global brands like Adidas, Hermes, and Kering to validate material performance and accelerate commercial adoption across various high-visibility consumer goods segments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager