Myocardial Infarction Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432888 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Myocardial Infarction Therapeutics Market Size

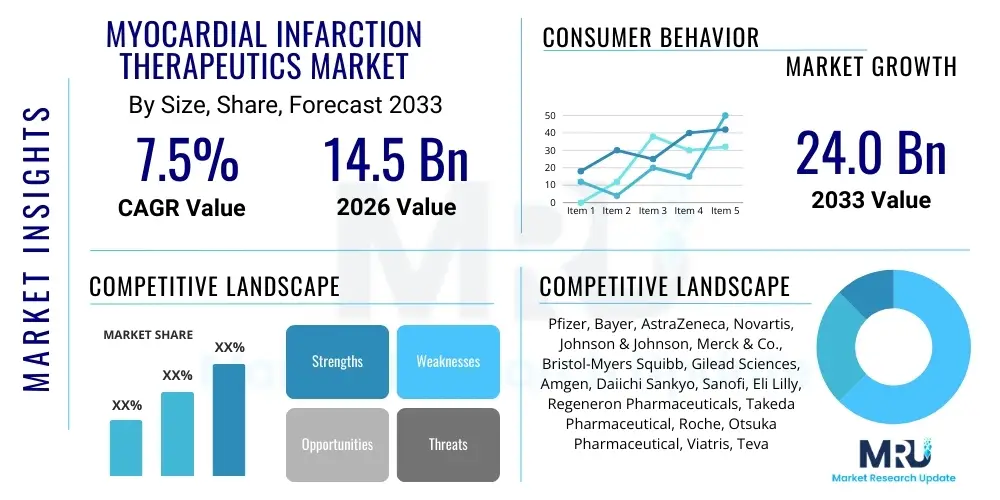

The Myocardial Infarction Therapeutics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $24.0 Billion by the end of the forecast period in 2033.

Myocardial Infarction Therapeutics Market introduction

The Myocardial Infarction (MI) Therapeutics Market encompasses a broad range of pharmaceutical agents and advanced interventional devices designed for the acute management, secondary prevention, and rehabilitation of patients who have suffered a heart attack, commonly known as a myocardial infarction. This therapeutic landscape includes critical pharmacological interventions such as antiplatelet agents, anticoagulants, beta-blockers, ACE inhibitors, and statins, which are essential for limiting infarct size, managing symptoms, and significantly reducing the risk of recurrence and associated mortality. The core objective of these treatments is rapid reperfusion—restoring blood flow to the ischemic myocardium—and stabilizing the patient’s condition through effective reduction of cardiac workload and atherosclerotic progression.

Major applications of MI therapeutics span the entire patient journey, beginning with emergency response in the ambulance or emergency department, followed by intensive care unit management, and extending into long-term ambulatory care for chronic disease management. Key benefits driving market growth include substantial reductions in cardiovascular mortality rates, improved quality of life post-MI, and decreased hospitalization frequency due to better control over underlying risk factors. The development of novel P2Y12 inhibitors and more effective anti-inflammatory agents represents significant product innovation aimed at addressing limitations associated with existing treatment protocols, particularly bleeding risks and drug resistance.

Driving factors sustaining robust market expansion are primarily the increasing global prevalence of cardiovascular diseases, largely attributed to aging populations, sedentary lifestyles, and rising rates of obesity, hypertension, and diabetes. Furthermore, enhanced public awareness and rapid advancements in diagnostic technologies, enabling quicker and more accurate diagnosis of MI (especially NSTEMI), translate into a higher adoption rate for sophisticated therapeutic regimes. Government initiatives and regulatory pathways encouraging the development of generics and biosimilars in established therapeutic classes are simultaneously enhancing accessibility and affordability across various economic regions, further solidifying the market’s growth trajectory.

Myocardial Infarction Therapeutics Market Executive Summary

The Myocardial Infarction Therapeutics Market exhibits strong business trends characterized by intense competition in the generic segment and high innovation in targeted therapies, particularly those focusing on inflammation and myocardial repair post-ischemic injury. Strategic collaborations between large pharmaceutical corporations and emerging biotech firms specializing in regenerative medicine and novel delivery systems are defining the competitive landscape. Investment continues to pivot towards phase III clinical trials for next-generation antiplatelet therapies and sophisticated anticoagulants that promise reduced adverse effects while maintaining high efficacy. Furthermore, the integration of personalized medicine approaches, leveraging pharmacogenomics to tailor drug selection and dosing based on individual genetic profiles, represents a crucial technological shift influencing business models.

Regional trends indicate that North America and Europe currently dominate the market share, driven by high healthcare expenditure, sophisticated infrastructure, and rapid uptake of premium branded drugs. However, the Asia Pacific region, particularly China and India, is projected to record the highest growth rates due to a massive, underserved patient pool, improving healthcare access, and the rising penetration of medical insurance. Emerging markets are also witnessing a significant shift from relying solely on low-cost generics to incorporating advanced combination therapies, prompted by improving clinical guidelines and the increasing influence of international cardiology societies on local medical practices.

Segment trends highlight the dominance of the antiplatelet agents segment, which remains the cornerstone of post-MI treatment. Within this segment, novel oral anticoagulants (NOACs) are steadily displacing traditional therapies like warfarin due to their superior safety profiles and ease of administration. Technological advancements in cardiac biomarker diagnostics, enabling precise identification of the severity and type of MI (STEMI vs. NSTEMI), are accelerating the tailored deployment of specific therapeutic classes. The trend towards early invasive strategies, coupled with advancements in medical devices like drug-eluting stents, reinforces the demand for co-administered high-potency pharmaceuticals, linking device segments closely with the therapeutics market growth.

AI Impact Analysis on Myocardial Infarction Therapeutics Market

Users frequently inquire about AI's role in optimizing treatment protocols, predicting patient risk stratification, and accelerating drug discovery processes specifically tailored for post-MI recovery. Key themes revolve around whether AI can reliably personalize antiplatelet and anticoagulant dosing to minimize bleeding risks, a major concern for clinicians. Expectations are high regarding AI's ability to analyze complex EKG, imaging (MRI/CT), and genetic data to identify patients most likely to benefit from aggressive or novel therapies, thereby improving therapeutic efficacy and reducing unnecessary healthcare costs associated with adverse events. Furthermore, there is strong interest in using machine learning algorithms to identify novel therapeutic targets, particularly those related to inflammatory pathways crucial in chronic heart failure development post-MI.

- AI-driven precision dosing models enhance the therapeutic window for high-risk medications, such as P2Y12 inhibitors and anticoagulants, minimizing bleeding complications while maximizing anti-ischemic effects.

- Machine learning algorithms significantly improve risk stratification by analyzing multimodal patient data (genomics, clinical history, imaging), allowing for proactive intervention and personalized secondary prevention strategies.

- AI accelerates the identification of novel drug targets and validation of lead compounds, drastically shortening the R&D cycle for anti-fibrotic and regenerative therapies aimed at minimizing cardiac remodeling post-MI.

- Natural Language Processing (NLP) tools extract actionable insights from vast pools of electronic health records (EHRs) and clinical trial data, informing real-world effectiveness of specific MI therapeutic regimes across diverse patient populations.

- Artificial Intelligence assists in optimizing clinical trial design for new MI drugs by selecting highly specific patient cohorts, thereby increasing the probability of trial success and speeding up regulatory approvals.

DRO & Impact Forces Of Myocardial Infarction Therapeutics Market

The Myocardial Infarction Therapeutics Market is propelled by increasing cardiovascular disease prevalence and significant advancements in pharmacological efficacy, while simultaneously being constrained by high development costs for novel biologics and stringent regulatory approval pathways. Opportunities arise primarily from the expanding application of precision medicine, particularly pharmacogenomic testing for antiplatelet responsiveness, and the untapped potential in developing nations with rapidly growing elderly populations. The overarching impact forces—including technological innovation, regulatory environment, and competitive intensity—determine the pace of market diffusion and accessibility of premium therapeutic options.

Drivers: The dominant driver is the alarming rise in global lifestyle-related diseases (diabetes, obesity) directly contributing to atherosclerosis and subsequent MI incidence. Enhanced diagnostic capabilities, especially high-sensitivity troponin assays, allow for earlier intervention, increasing the adoption volume of acute phase drugs. Furthermore, compelling clinical evidence demonstrating the long-term survival benefit of aggressive therapeutic regimens post-MI fuels demand. Government and insurance bodies increasingly mandate coverage for standard-of-care treatments, ensuring broad market access.

Restraints: Significant restraints include the high cost associated with advanced branded therapeutics, limiting adoption in low- and middle-income countries. Concerns over potential side effects, such as major bleeding events associated with potent antiplatelets and anticoagulants, necessitate cautious prescribing and monitoring, thereby complicating widespread use. Additionally, the impending patent expiration of several blockbuster drugs poses a threat to revenue streams for major pharmaceutical companies, shifting focus towards high-risk, high-reward novel target identification.

Opportunities: Key opportunities lie in the development of therapies targeting novel non-thrombotic mechanisms, such as inflammation and cardiac regeneration, which represent unmet needs in chronic heart failure prevention post-MI. The growing penetration of specialized cardiovascular clinics and the increasing utilization of digital health platforms for patient monitoring and adherence management offer new avenues for market penetration. Expanding market presence in emerging economies through strategic partnerships and localized manufacturing presents substantial untapped commercial potential.

Impact Forces: The impact forces are defined by the rapid rate of technological substitution, where novel antiplatelets quickly supersede older generations, and the influence of powerful regulatory bodies (FDA, EMA) dictating clinical guidelines and treatment standards. The threat of generic erosion is high, necessitating constant R&D investment to maintain competitive advantage. The bargaining power of large healthcare providers and payers (insurance companies) significantly dictates drug pricing and formulary inclusion, putting downward pressure on net sales prices, making competitive pricing and value demonstration critical strategic levers.

Segmentation Analysis

The Myocardial Infarction Therapeutics Market is intricately segmented based on therapeutic class, type of MI, route of administration, and distribution channel, reflecting the complexity of clinical management required for this acute condition. Therapeutic segmentation is crucial as treatment strategies are often guided by clinical guidelines and vary significantly depending on the patient's presentation and co-morbidities. Understanding these segments helps pharmaceutical manufacturers tailor their research and marketing efforts towards areas with the highest unmet clinical needs and commercial potential, such as novel agents targeting resistant patient populations or those with high bleeding risk.

The differentiation between STEMI (ST-segment elevation myocardial infarction) and NSTEMI (non-ST-segment elevation myocardial infarction) is paramount in segmenting the market, as STEMI typically necessitates immediate reperfusion therapy (primary PCI or thrombolysis) followed by aggressive medical management, while NSTEMI often follows a different, often delayed, invasive strategy. This distinction impacts the choice and timing of acute phase drugs, especially thrombolytics and certain high-intensity antiplatelet agents. Distribution channels also play a critical role, with hospital pharmacies dominating the acute care segment due to the immediate requirement for high-cost, specialized injectable drugs necessary during the initial stabilization phase.

The growth within specific therapeutic classes, such as P2Y12 inhibitors, is being driven by the continuous introduction of superior molecules (e.g., ticagrelor and prasugrel) offering faster onset of action and more predictable pharmacodynamic profiles compared to older generations (clopidogrel). Furthermore, the shift towards preventive medicine bolsters the statins and ACE inhibitor segments, as these agents form the backbone of long-term secondary prevention aimed at minimizing future cardiovascular events. The interplay between these segments is dynamic, often resulting in combination therapies, which are increasingly becoming the standard of care, driving value growth rather than just volume expansion across the market.

- By Therapeutic Class:

- Antiplatelet Agents (e.g., Aspirin, P2Y12 Inhibitors)

- Anticoagulants (e.g., Heparins, NOACs)

- Beta-Blockers

- Angiotensin-Converting Enzyme (ACE) Inhibitors and Angiotensin II Receptor Blockers (ARBs)

- Lipid-Lowering Agents (e.g., Statins, PCSK9 Inhibitors)

- Thrombolytic Agents

- Others (e.g., Glycoprotein IIb/IIIa Inhibitors)

- By Type of MI:

- ST-segment Elevation Myocardial Infarction (STEMI)

- Non-ST-segment Elevation Myocardial Infarction (NSTEMI)

- By Route of Administration:

- Oral

- Injectable/Intravenous

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Myocardial Infarction Therapeutics Market

The value chain for Myocardial Infarction Therapeutics begins with upstream analysis encompassing pharmaceutical research and development (R&D), focusing heavily on identifying and validating novel molecular targets, often requiring complex clinical trials spanning multiple geographies. The manufacturing phase involves the synthesis of active pharmaceutical ingredients (APIs), stringent quality control, and the formulation into final dosage forms (tablets, injectables). High regulatory oversight characterizes this upstream segment, driving up initial capital investment and necessitating robust intellectual property protection through patents. Outsourcing of API manufacturing to specialized Contract Manufacturing Organizations (CMOs) is common practice to manage costs and scalability, particularly for generic segments.

The midstream elements focus on distribution, involving logistics, warehousing, and inventory management. Due to the critical, time-sensitive nature of acute MI treatment, ensuring an uninterrupted supply chain for essential drugs like thrombolytics and potent anticoagulants is paramount. Distribution channels are bifurcated: direct channels involve large pharmaceutical companies selling directly to major hospital networks or national health systems (especially for injectable, acute treatments), ensuring immediate access in emergency settings. Indirect channels involve wholesalers and distributors facilitating the flow of chronic management drugs (e.g., statins, oral antiplatelets) to retail and online pharmacies, catering primarily to the secondary prevention phase.

Downstream analysis centers on end-users, primarily hospitals (Emergency Departments, Cardiac Catheterization Labs, and ICUs) and individual patients. The utilization of these therapeutics is heavily influenced by physician prescribing habits, adherence to standardized clinical guidelines (e.g., those from the ACC/AHA or ESC), and payer reimbursement policies. Effective market penetration requires intensive medical education and marketing targeted at cardiologists and emergency medicine physicians. The final value captured involves successful patient outcomes, leading to sustained demand for long-term maintenance therapies, making patient adherence support and monitoring (often facilitated through digital health solutions) a critical component of the downstream value delivery.

Myocardial Infarction Therapeutics Market Potential Customers

Potential customers and end-users of Myocardial Infarction Therapeutics are multifaceted, encompassing the immediate healthcare facilities responsible for acute treatment and the long-term prescribers managing chronic cardiac risk. Acute care hospitals, including specialized cardiac centers and large tertiary care institutions equipped with catheterization labs, represent the primary purchasers of high-value, time-critical therapeutics like thrombolytics, specialized antiplatelets, and parenteral anticoagulants. These institutions require immediate, reliable supply due to the life-saving nature of these drugs and their critical role in reperfusion strategies.

Beyond the hospital setting, retail pharmacies and large pharmacy chains serve as essential distribution points for the vast majority of long-term maintenance medications required for secondary prevention post-MI, such as oral antiplatelet agents, beta-blockers, ACE inhibitors, and statins. These entities cater directly to the millions of patients managing chronic cardiac conditions, making formulary inclusion and advantageous pricing structures crucial for market success. Government procurement agencies and national health services (e.g., the NHS in the UK or centralized purchasing bodies in countries with universal healthcare) also act as major buyers, dictating pricing and volume through large-scale tendering processes.

Ultimately, the final consumers are the patients themselves, whose demand is mediated entirely through cardiologists, general practitioners, and primary care physicians who initiate and manage the therapeutic regimens. Pharmaceutical manufacturers often target Key Opinion Leaders (KOLs) and large cardiology groups to influence prescribing behavior, emphasizing superior clinical outcomes, improved safety profiles, and enhanced patient compliance of their products. Furthermore, payers and insurance providers are indirect but powerful customers, as their coverage decisions fundamentally determine the accessibility and affordability of both branded and generic MI therapeutics across the patient population.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $24.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pfizer, Bayer, AstraZeneca, Novartis, Johnson & Johnson, Merck & Co., Bristol-Myers Squibb, Gilead Sciences, Amgen, Daiichi Sankyo, Sanofi, Eli Lilly, Regeneron Pharmaceuticals, Takeda Pharmaceutical, Roche, Otsuka Pharmaceutical, Viatris, Teva Pharmaceutical Industries, Sandoz (Novartis Group), Mylan (Viatris). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Myocardial Infarction Therapeutics Market Key Technology Landscape

The technological landscape driving the Myocardial Infarction Therapeutics market is defined by the evolution of pharmacotherapy and the integration of sophisticated diagnostics and monitoring tools. In pharmacotherapy, the focus is shifting from broad-spectrum antithrombotic agents to highly targeted therapies that mitigate specific risks. This includes the development of novel P2Y12 inhibitors with rapid onset and offset kinetics, offering better control during interventional procedures, and the introduction of factor Xa inhibitors within the NOAC class, which present lower risk of major bleeding compared to legacy agents like warfarin. Furthermore, significant research is dedicated to developing therapeutics that target inflammatory pathways (e.g., IL-1β inhibitors) post-MI, moving beyond simple antithrombotic action to address chronic cardiac remodeling and subsequent heart failure.

Beyond traditional drug development, significant technological advancements are seen in drug delivery systems and personalized medicine. Encapsulation technologies and biodegradable polymer matrices are being explored to achieve localized and sustained release of therapeutic agents directly to the damaged myocardium, maximizing local drug concentration while minimizing systemic exposure and side effects. Genetic profiling, particularly pharmacogenomic testing for CYP2C19 polymorphisms, is becoming a standard technology to predict individual responsiveness to prodrug antiplatelets like clopidogrel, thereby enabling clinicians to select the most efficacious therapy upfront and reduce treatment failure rates in high-risk patients.

In the adjacent medical technology space, advancements in diagnostic imaging (e.g., cardiac MRI for detailed infarct size assessment) and remote patient monitoring devices are crucial enablers. Wearable technology and digital health platforms allow for continuous monitoring of vital signs and cardiac rhythms, facilitating earlier detection of complications and improving medication adherence. The application of sophisticated bioinformatics and AI tools to analyze these vast datasets supports the development of predictive models, optimizing the timing and duration of therapeutic intervention, ultimately enhancing the overall efficacy and safety profile of MI treatment regimens globally.

Regional Highlights

Regional dynamics significantly influence the Myocardial Infarction Therapeutics Market, driven by variances in disease prevalence, healthcare infrastructure, regulatory environments, and reimbursement policies. North America, specifically the United States, commands the largest market share. This dominance is attributed to high patient awareness, sophisticated healthcare infrastructure ensuring rapid access to complex treatment protocols (like primary PCI), high expenditure on advanced branded pharmaceuticals, and the rapid adoption of precision medicine techniques, including genetic testing for personalized therapy selection. The presence of major pharmaceutical innovators and robust R&D spending further solidifies this region's leadership. However, increasing cost containment pressures from federal and private payers remain a major factor influencing market strategy.

Europe represents the second-largest market, characterized by strong national healthcare systems and adherence to stringent clinical guidelines set by organizations like the European Society of Cardiology (ESC). Western European countries (Germany, France, UK) show high adoption of premium therapeutics, but price negotiation and reference pricing models often constrain the maximum revenue potential compared to the US market. Eastern Europe offers significant growth opportunities as healthcare spending increases and infrastructure improves, facilitating the shift from older, cheaper generics to modern, efficacious branded and biosimilar products. Regulatory harmonization across the European Union streamlines market entry for newly approved drugs.

The Asia Pacific (APAC) region is poised for the fastest growth throughout the forecast period. This rapid expansion is fueled by demographic trends, including the enormous and growing geriatric population, coupled with increasing disposable incomes and substantial improvements in healthcare access and insurance coverage in large economies such as China and India. While generic drugs currently hold a dominant share, the shift towards branded and patent-protected novel agents is accelerating, particularly in urban centers. Strategic manufacturing alliances and local R&D initiatives, supported by favorable government policies, are making APAC a vital future hub for both consumption and production of MI therapeutics. Latin America and the Middle East & Africa (MEA) present emerging opportunities, though market penetration is often hindered by economic instability and variable public health investment, requiring localized strategies focusing on essential medicines and affordability.

- North America: Market leader due to high healthcare spending, immediate adoption of premium therapies, and established reimbursement mechanisms. Strong focus on R&D for novel anti-inflammatory and regenerative treatments post-MI.

- Europe: Second largest market; driven by universal healthcare coverage and adherence to advanced ESC guidelines. Generic penetration is strong, necessitating robust value demonstration for branded products.

- Asia Pacific (APAC): Highest projected CAGR; fueled by urbanization, rising incidence of lifestyle diseases, improving healthcare infrastructure, and vast untapped patient pools in China and India.

- Latin America (LATAM): Emerging market with increasing penetration of branded generics and biosimilars, focused on improving access in key economies like Brazil and Mexico.

- Middle East & Africa (MEA): Growth constrained by variable healthcare access, but opportunities exist in wealthy Gulf Cooperation Council (GCC) countries adopting high-standard clinical care and importing specialized therapeutics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Myocardial Infarction Therapeutics Market.- Pfizer Inc.

- Bayer AG

- AstraZeneca PLC

- Novartis AG

- Johnson & Johnson

- Merck & Co., Inc.

- Bristol-Myers Squibb Company

- Gilead Sciences, Inc.

- Amgen Inc.

- Daiichi Sankyo Company, Limited

- Sanofi S.A.

- Eli Lilly and Company

- Regeneron Pharmaceuticals, Inc.

- Takeda Pharmaceutical Company Limited

- Roche Holding AG

- Otsuka Pharmaceutical Co., Ltd.

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis Group)

- Mylan (Viatris)

Frequently Asked Questions

Analyze common user questions about the Myocardial Infarction Therapeutics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of growth in the Myocardial Infarction Therapeutics Market?

The market is primarily driven by the escalating global prevalence of cardiovascular diseases linked to aging populations and lifestyle factors such as obesity and diabetes. Additionally, advancements in diagnostic technologies and the resulting earlier detection of myocardial infarction (MI) necessitate immediate and sustained pharmaceutical intervention, propelling demand for acute and chronic therapeutic agents.

Which therapeutic class holds the largest market share in MI treatment?

The Antiplatelet Agents segment, including both aspirin and novel P2Y12 inhibitors (like ticagrelor and prasugrel), consistently holds the largest share. These drugs are fundamental to preventing secondary ischemic events and are universally recommended as the standard of care following an acute MI event or intervention, securing their dominance in both acute and long-term care settings.

How does personalized medicine influence the selection of MI therapeutics?

Personalized medicine, especially pharmacogenomics, significantly impacts treatment selection by analyzing individual genetic variations (e.g., CYP2C19 status) to predict efficacy and safety profiles for antiplatelet drugs. This allows clinicians to tailor the dosage and specific drug choice, optimizing treatment effectiveness while simultaneously minimizing life-threatening adverse reactions such as major bleeding.

What major constraints limit the growth of the Myocardial Infarction Therapeutics Market?

Key constraints include the high development costs associated with bringing novel biologics and advanced targeted therapies to market. Furthermore, regulatory scrutiny regarding the safety profiles of potent antithrombotic agents, specifically concerns related to increased bleeding risk, necessitates intensive monitoring and limits their maximum market potential, particularly in diverse patient groups.

Which region is expected to show the fastest growth rate for MI therapeutics?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth is attributable to massive demographic shifts, improving healthcare infrastructure, increasing health expenditure, and the subsequent broadening of access to advanced cardiovascular care and therapeutic drugs in economies such as China and India.

The extensive analysis of the Myocardial Infarction Therapeutics market underscores a robust landscape characterized by high levels of innovation focused on improving patient safety and efficacy, particularly through precision medicine approaches. The confluence of rising global disease burden and technological advancements in diagnostics and drug delivery ensures sustained market expansion well into the future. Strategic imperatives for market participants include navigating complex regulatory environments, managing the threat of generic competition, and actively pursuing opportunities in non-thrombotic targets such as inflammation and myocardial regeneration to address long-term unmet clinical needs post-infarction.

Continuous investment in advanced clinical trials that focus on diverse patient populations, including those with comorbidities like chronic kidney disease and diabetes, is essential to broaden the applicability of current and pipeline therapeutics. Furthermore, leveraging digital health solutions for improved patient monitoring and adherence will be pivotal in translating clinical trial success into real-world effectiveness, particularly in secondary prevention settings. The integration of artificial intelligence in analyzing patient data for risk stratification and personalized treatment optimization is rapidly moving from a theoretical concept to a clinical reality, setting the stage for highly tailored and efficient MI management protocols.

In summary, while established pharmacological classes remain the foundation of MI treatment, future growth will be dominated by sophisticated combination therapies, highly selective agents that minimize side effects, and novel regenerative approaches aimed at reducing cardiac remodeling. The market remains highly attractive, driven by undeniable demographic trends and compelling clinical necessity, offering significant opportunities for companies that can demonstrate superior value, robust evidence, and operational agility in navigating the global pharmaceutical landscape. Focus must remain on addressing the critical trade-off between antithrombotic efficacy and bleeding risk—a challenge that continues to spur innovative drug development globally.

The ongoing refinement of clinical guidelines, frequently updated by leading professional organizations such as the American College of Cardiology (ACC) and the European Society of Cardiology (ESC), exerts significant influence on market uptake. These guidelines standardize treatment protocols, often favoring newer, evidence-based agents over older generations, thereby creating continuous demand for innovative products. Companies that successfully achieve recommendation status in these global guidelines gain immediate credibility and substantial market access across developed regions, underlining the importance of rigorous Phase III clinical data generation and transparent reporting on patient-centric outcomes beyond simple survival rates, such as quality of life and complication incidence.

From a regulatory perspective, market entry, particularly in the biologics space targeting cardiac repair, remains complex and capital-intensive. Regulatory bodies are increasingly focused on real-world evidence (RWE) to supplement traditional randomized controlled trials (RCTs), particularly for long-term safety monitoring. Manufacturers must therefore establish robust post-marketing surveillance systems capable of collecting and analyzing RWE effectively. This trend favors larger entities with established infrastructure and data analytics capabilities, presenting potential barriers to entry for smaller biotech firms without strong strategic partnerships.

The commercial success of pipeline therapeutics, such as those targeting inflammation (e.g., NLRP3 inflammasome inhibitors), hinges not only on clinical superiority but also on effective payer negotiations to secure favorable reimbursement status. As healthcare systems globally grapple with rising costs, manufacturers must clearly articulate the long-term economic benefits—such as reduced hospital readmissions and minimized progression to chronic heart failure—to justify premium pricing. This strategic shift towards value-based healthcare models necessitates a robust understanding of health economics and outcomes research (HEOR) to demonstrate compelling total cost-of-care reduction to payers, solidifying the commercial viability of next-generation MI therapeutics.

The role of generics and biosimilars is expected to intensify, particularly as key patents for established antiplatelets and statins expire, providing significant cost savings for healthcare systems. While this may negatively impact the immediate revenue of originator companies, it simultaneously expands market volume by improving accessibility in price-sensitive regions. The response of originator companies involves shifting R&D focus toward combination fixed-dose therapies and specialized formulations that offer enhanced compliance or delivery mechanisms, securing niche market protection even after patent loss for the original API. This dynamic competition fosters both innovation and affordability within the broader MI therapeutics ecosystem.

Furthermore, technology enabling remote diagnosis and pre-hospital intervention, such as advanced ambulance telemetry and rapid point-of-care testing, is indirectly boosting the MI therapeutics market. Faster diagnosis leads to quicker administration of time-critical drugs like thrombolytics, maximizing their efficacy and patient outcome. This integrated approach, linking early detection with immediate pharmacological management, ensures that the acute phase segment of the market remains critical and high-value, driven by the imperative to save myocardial tissue and patient lives within the golden hour following symptom onset. This interconnectedness highlights the systemic nature of market growth, dependent not just on the quality of the drug but the efficiency of the entire care pathway.

In terms of future innovation, research into stem cell therapy and gene therapy targeting damaged cardiac muscle holds significant promise, although these technologies are currently in early clinical phases and face substantial hurdles regarding large-scale manufacturing and long-term safety data. Should these regenerative approaches prove successful, they would fundamentally transform the MI treatment paradigm, shifting the focus from damage limitation to complete tissue restoration. While pharmaceutical drugs will remain essential for preventing further thrombotic events, these advanced biological therapies represent the ultimate frontier in reversing the permanent damage caused by myocardial infarction. The successful commercialization of these technologies would create premium sub-segments within the overall therapeutics market, demanding specialized infrastructure and highly trained clinical personnel for administration.

The global disparity in access to high-quality MI care remains a prominent ethical and commercial challenge. In many low- and middle-income countries (LMICs), access to essential MI drugs, including generic statins, aspirin, and basic reperfusion therapies, is severely limited. Market growth in these regions is primarily dependent on international aid programs, government subsidies, and tiered pricing strategies implemented by pharmaceutical companies to ensure affordability. Addressing this disparity represents a major social responsibility, but also a substantial long-term volume opportunity for companies willing to adapt their business models to meet local economic constraints and public health needs. Successfully penetrating these emerging markets requires nuanced understanding of local regulatory requirements, distribution networks, and prevailing patient compliance challenges.

Finally, the growing awareness and diagnosis of Type 2 myocardial infarction (MI Type 2), which is typically due to oxygen supply/demand imbalance rather than plaque rupture, is creating a demand for therapeutics tailored to this specific pathophysiology. While traditional antithrombotics are less effective in Type 2 MI, therapies focusing on blood pressure control, heart rate reduction (beta-blockers), and managing underlying systemic illnesses (e.g., sepsis, severe anemia) become paramount. This clinical refinement in MI classification is leading to the development and targeted marketing of existing drugs for these specific indications, broadening the scope of the MI therapeutics market beyond the classic Type 1 atherosclerotic event. This indicates a maturing market where therapeutic strategies are becoming increasingly customized based on etiological factors.

The strategic deployment of manufacturing capabilities is also evolving, with a noticeable trend toward regionalizing production to mitigate supply chain vulnerabilities exposed during recent global disruptions. Establishing manufacturing footprints closer to major consumer markets, such as in Europe and APAC, helps reduce lead times, ensures compliance with local drug quality standards, and often facilitates faster regulatory approval processes. For high-volume generic drugs, robust production facilities in India and China continue to dominate due to cost efficiencies, but strategic redundancy and diversification of API sources are critical risk management strategies for all major market players in the MI therapeutics sector.

The intersection of cardiovascular therapeutics with digital health is creating new market ecosystems. Beyond simple adherence monitoring, advanced digital tools are enabling real-time detection of potential adverse drug reactions, particularly bleeding events, allowing for immediate therapeutic adjustment. Telecardiology consultations, supported by AI interpretation of cardiac data, extend specialist care to remote areas, ensuring that complex post-MI management protocols are maintained consistently, regardless of geographical location. Companies integrating their therapeutic offerings with proprietary digital support systems gain a competitive edge by demonstrating improved patient outcomes and enhanced compliance rates, offering a holistic value proposition to healthcare providers and payers.

Furthermore, the focus on preventative cardiology has indirectly stimulated the market for MI therapeutics. Aggressive management of risk factors—hyperlipidemia, hypertension, and diabetes—through medications like statins and ACE inhibitors is part of the long-term MI treatment plan, preventing recurrence. The increasing use of combination pills (Fixed-Dose Combinations or FDCs) that consolidate multiple MI-related therapeutic classes into a single tablet simplifies complex dosing regimens, significantly boosting patient adherence, particularly in elderly populations. These FDCs represent a major commercial strategy aimed at sustaining revenue growth for off-patent drugs through convenience and improved outcomes.

The ethical considerations surrounding patient consent, data privacy in personalized medicine, and equitable access to costly novel therapies are increasingly influencing regulatory and public perception. Pharmaceutical companies must adopt robust governance frameworks to manage the sensitive genetic and health data utilized in personalized MI therapy selection. Demonstrating ethical pricing models, particularly in emerging markets, is becoming a non-negotiable component of corporate social responsibility, impacting brand reputation and long-term market acceptance. The industry must balance the necessity of innovation with the public health imperative of ensuring broad and equitable access to life-saving treatments for myocardial infarction patients globally.

In conclusion, the Myocardial Infarction Therapeutics Market is highly dynamic, driven by a continuous cycle of pharmacological refinement, technological integration, and increasing global burden of cardiac disease. Success in this sector requires not only R&D excellence in developing superior drug candidates but also strategic mastery in market access, pricing negotiation, and integrating digital solutions to optimize the entire continuum of care, from acute intervention to long-term secondary prevention, ensuring sustained growth towards the projected $24.0 Billion valuation by 2033.

Finally, the market is characterized by highly consolidated R&D spending, predominantly concentrated among the top 15 global pharmaceutical firms. These firms possess the extensive resources necessary to navigate the high costs and inherent risks associated with late-stage cardiovascular clinical trials. The strategic imperative for these leaders involves minimizing development risk through predictive modeling and biomarker validation early in the process. For smaller biotech players, successful market entry is often contingent upon developing niche, breakthrough therapies—such as specialized anti-fibrotic agents or gene therapies—and subsequently partnering with large pharmas for global scale-up, distribution, and commercialization, underscoring the collaborative nature of innovation in this critical therapeutic domain.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager