Myocardial Infarction Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435778 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Myocardial Infarction Treatment Market Size

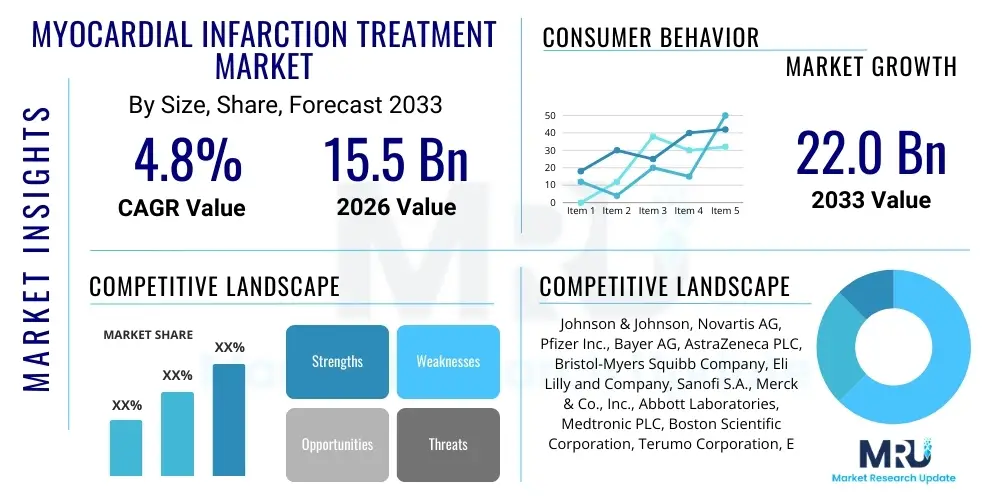

The Myocardial Infarction Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 22.0 Billion by the end of the forecast period in 2033.

Myocardial Infarction Treatment Market introduction

The Myocardial Infarction (MI), commonly known as a heart attack, treatment market encompasses a comprehensive range of pharmaceutical agents, medical devices, and sophisticated surgical procedures designed to manage, treat, and prevent acute coronary syndrome events. This market is fundamentally driven by the rising global burden of cardiovascular diseases (CVDs), particularly in aging populations across developed and rapidly developing economies. Key therapeutic categories include antiplatelet drugs, anticoagulants, beta-blockers, ACE inhibitors, and lipid-lowering agents, which form the pharmacological backbone of MI management. Furthermore, interventional cardiology procedures, such as percutaneous coronary intervention (PCI) utilizing stents (BMS, DES), and coronary artery bypass grafting (CABG), represent significant revenue streams within the device and procedural segments of the market. The critical objective of these treatments is timely reperfusion, minimizing myocardial damage, and improving long-term patient outcomes, thereby sustaining the market’s robust growth trajectory.

The product description spans across several critical domains tailored for acute and chronic MI treatment protocols. Pharmaceutical solutions focus heavily on immediate stabilization and secondary prevention, with innovations continuously emerging in highly efficacious antiplatelet agents (P2Y12 inhibitors) and novel anticoagulants offering improved bleeding profiles. On the device front, technological advancements in biodegradable stents and robotic-assisted surgical systems are redefining interventional standards, enhancing procedural safety, and reducing recovery times. Major applications of these technologies include emergency medical settings, cath labs, intensive care units (ICUs), and long-term outpatient care for chronic secondary prevention. The integrated nature of diagnostics, intervention, and pharmaceutical therapy ensures a holistic market ecosystem responding dynamically to clinical guidelines and patient needs, emphasizing early detection and rapid therapeutic deployment.

The core benefits driving this market are centered on reducing mortality rates associated with MI and significantly improving the quality of life for survivors. Effective treatment regimens diminish the risk of complications such as heart failure, arrhythmias, and subsequent MI events. Driving factors include exponential growth in diagnostic capabilities, enabling faster triage and treatment initiation; increasing awareness regarding heart health; sustained investments in cardiovascular research and development, particularly targeting personalized medicine approaches; and favorable reimbursement policies in major markets such as North America and Western Europe. However, global disparities in access to advanced care and the high costs associated with proprietary drug formulations and sophisticated interventional devices pose persistent challenges that the industry is actively working to mitigate through biosimilars and value-based care models, ensuring continuous market evolution.

Myocardial Infarction Treatment Market Executive Summary

The Myocardial Infarction Treatment Market is characterized by intense innovation in both pharmacological and interventional domains, projecting sustained high-single-digit growth through 2033. Business trends are dominated by strategic collaborations between pharmaceutical giants and medtech companies, focused on developing integrated solutions that combine diagnostics with tailored therapeutic delivery, specifically leveraging drug-eluting technologies and advanced imaging modalities. The trend towards personalized antiplatelet therapy based on genetic profiling is gaining traction, promising reduced adverse event rates and optimized treatment efficacy. Furthermore, the market is witnessing increased emphasis on secondary prevention strategies, fostering growth in maintenance drug therapies and remote patient monitoring solutions. Regulatory fast tracks for breakthrough devices designed for acute MI management are accelerating time-to-market, contributing significantly to the competitive landscape and driving capital expenditure towards specialized cardiovascular units globally.

Regional trends indicate North America maintaining its dominance due to advanced healthcare infrastructure, high awareness levels, robust reimbursement frameworks, and the early adoption of premium-priced novel therapies like PCSK9 inhibitors and advanced bioresorbable scaffolds. Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by the staggering increase in MI incidence linked to lifestyle changes, expanding healthcare access in countries like China and India, and significant government initiatives aimed at modernizing cardiovascular care facilities. Europe remains a key contributor, balancing established generic drug use with the swift uptake of innovative devices, driven largely by standardized European clinical guidelines and centralized procurement strategies. Investment focus is shifting towards developing nations where unmet needs for timely reperfusion therapies are highest, presenting substantial opportunities for affordable diagnostic tools and essential drug formulations, thus balancing high-value innovation with accessibility imperatives across the global market.

Segment trends reveal that the pharmaceutical segment, particularly antiplatelet agents and anticoagulants, continues to hold the largest market share, driven by lifelong secondary prevention requirements. However, the device segment is expected to exhibit a higher CAGR, primarily propelled by the widespread acceptance and continuous refinement of drug-eluting stents (DES) and the potential introduction of fully bioresorbable scaffolds with proven long-term safety profiles. Among end-users, hospitals remain the primary service providers due to the necessity of specialized equipment (cath labs) and multidisciplinary teams required for acute MI intervention. There is a growing trend towards specialized cardiac centers and ambulatory surgical centers (ASCs) handling less acute follow-up procedures, leading to a fractional shift in demand distribution. The procedure type segmentation shows that PCI dominates interventional approaches, reflecting its minimally invasive nature and demonstrated effectiveness in emergency settings, overshadowing more traditional CABG procedures except in complex, multi-vessel disease scenarios.

AI Impact Analysis on Myocardial Infarction Treatment Market

User queries regarding the impact of Artificial Intelligence (AI) in Myocardial Infarction Treatment predominantly center on its potential for early and precise diagnosis, optimization of therapeutic decisions, and personalized risk stratification following an acute event. Users are keenly interested in how machine learning algorithms can analyze vast datasets—including ECGs, imaging (MRI, CT), electronic health records (EHRs), and genetic markers—to predict cardiac events years in advance or, acutely, to rapidly identify the extent of myocardial damage in the critical window post-infarction. Common concerns revolve around the integration challenges of AI systems into existing hospital IT infrastructures, regulatory approval pathways for AI-driven diagnostic tools, and the ensuring of data privacy while utilizing large-scale patient data for algorithm training. Expectations are high for AI to revolutionize drug discovery (identifying novel targets), automate routine diagnostic tasks, and significantly improve resource allocation within emergency departments, reducing critical time-to-treatment intervals (door-to-balloon time), which is paramount for MI survival.

The integration of AI is anticipated to substantially transform the continuum of MI care, moving from reactive treatment to proactive, predictive intervention. Specifically, deep learning models are showing significant promise in analyzing complex electrocardiogram patterns, often detecting subtle indicators of ischemia or impending MI that might be overlooked by human interpretation, leading to improved diagnostic accuracy in diverse clinical settings. Furthermore, AI is crucial in optimizing dosage for high-risk medications, such as potent antiplatelets and anticoagulants, by factoring in real-time patient parameters, co-morbidities, and genetic polymorphisms (pharmacogenomics), thereby minimizing life-threatening bleeding risks while maximizing therapeutic benefit. This analytical capability extends to monitoring patients post-discharge, where AI-powered wearables and remote platforms analyze biometric data for early detection of secondary complications, allowing clinicians to intervene remotely before a full-blown relapse occurs, ultimately driving greater efficiency and improved long-term patient survival metrics.

The economic impact is expected to be profound, generating efficiencies through automated workflow management in cath labs and ICUs, potentially reducing labor costs associated with repetitive image analysis and data entry. Startups focusing on AI-based cardiac imaging segmentation and functional assessment are attracting significant venture capital, validating the commercial viability of these technologies. However, the high initial capital investment required for specialized AI hardware and the need for skilled clinicians trained in interpreting AI outputs remain short-term barriers. Successful implementation necessitates robust validation of AI algorithms across diverse patient demographics to ensure equitable clinical benefit and avoid algorithmic bias, a critical ethical consideration driving current research protocols within the field of cardiovascular AI applications.

- AI enhances MI risk stratification using EHR and genetic data.

- Machine learning accelerates novel drug target identification for MI treatment.

- AI algorithms improve ECG interpretation and imaging analysis accuracy for acute diagnosis.

- Optimization of personalized antiplatelet and anticoagulant dosing reduces adverse events.

- Predictive analytics minimizes time-to-treatment (door-to-balloon time) in emergency settings.

- Automated cardiac functional assessment streamlines post-MI rehabilitation planning.

DRO & Impact Forces Of Myocardial Infarction Treatment Market

The Myocardial Infarction Treatment Market is propelled by significant demographic and technological drivers, balanced by inherent market restraints and substantial untapped opportunities, collectively shaping the direction of growth. A primary driver is the continually increasing global prevalence of risk factors such as hypertension, diabetes, obesity, and sedentary lifestyles, which directly contribute to the higher incidence of atherosclerotic disease and subsequent MI events across all demographics. Furthermore, the demographic shift towards an older population globally is a major contributing factor, as MI incidence rises steeply with age, ensuring a steadily expanding patient pool requiring primary and secondary intervention throughout the forecast period. The rapid pace of innovation in minimally invasive procedures, particularly in interventional cardiology devices like advanced bioresorbable stents and intravascular imaging (IVUS/OCT), enhances clinical outcomes and drives product premiumization, fueling market value growth. The continuous refinement of treatment guidelines by major cardiology societies (e.g., ESC, ACC/AHA) emphasizes early, aggressive treatment, translating directly into higher demand for diagnostics and advanced therapeutic agents.

Despite these strong drivers, the market faces notable restraints. The high cost associated with innovative proprietary drugs (e.g., novel anticoagulants, PCSK9 inhibitors) and sophisticated interventional devices limits their accessibility, particularly in low- and middle-income countries, fostering disparity in patient care. Regulatory hurdles and the lengthy process required for clinical trials of new cardiovascular drugs and devices impose significant time and financial burdens on market entrants. Furthermore, patent expiry of blockbuster drugs leads to increased availability of low-cost generic alternatives, applying downward pressure on overall market revenues in the pharmaceutical segment, requiring continuous innovation to maintain profitability. The issue of patient non-adherence to long-term secondary prevention drug regimens, which is critical for preventing recurrent MI, also limits the effectiveness of prescribed treatments and poses a persistent challenge to maximizing public health outcomes.

Opportunities within the MI treatment landscape are vast, centered primarily on the expansion into emerging markets where healthcare spending is rapidly increasing and the cardiovascular disease burden is rising sharply, creating fertile ground for market penetration by multinational corporations. The development of advanced cell-based and regenerative therapies aimed at repairing damaged myocardial tissue post-infarction represents a highly lucrative long-term opportunity that could fundamentally shift treatment paradigms away from purely symptomatic management. Furthermore, the shift towards predictive and personalized medicine, utilizing advanced biomarkers and genetic profiling to tailor antiplatelet and anti-thrombotic therapy, promises higher efficacy and safety profiles, attracting premium pricing. Technological integration, particularly leveraging telecardiology and remote monitoring devices for post-MI care, expands the reach of high-quality follow-up services, addressing geographic limitations and enhancing patient adherence, thereby generating significant new revenue streams for digital health providers collaborating within the cardiovascular ecosystem. These powerful forces—Drivers, Restraints, and Opportunities—create complex impact forces requiring strategic navigation for sustained success and market leadership.

Segmentation Analysis

The Myocardial Infarction Treatment Market is comprehensively segmented based on three primary categories: Treatment Type, End-User, and Application, each reflecting distinct aspects of the therapeutic ecosystem. Analyzing these segments provides a granular view of revenue distribution, growth hotspots, and competitive dynamics. The Treatment Type segment, encompassing pharmaceuticals and devices, dictates the clinical pathway taken for MI management, with pharmaceuticals addressing immediate and chronic biochemical needs, while devices are essential for mechanical reperfusion and structural support. End-User segmentation, focusing primarily on hospitals and specialized cardiac centers, reflects the infrastructural requirements necessary for delivering acute care, considering that MI is an emergency condition requiring specialized facilities. Application segmentation delineates between ST-segment elevation myocardial infarction (STEMI) and non-ST-segment elevation myocardial infarction (NSTEMI), recognizing the difference in urgency and procedural requirements for each type, influencing product uptake across various settings.

Within the Treatment Type, the pharmaceutical segment is sub-segmented into various drug classes, including beta-blockers, ACE inhibitors, antiplatelet agents (aspirin, P2Y12 inhibitors), anticoagulants (heparin, DOACs), and lipid-lowering agents (statins, PCSK9 inhibitors). Antiplatelet agents, crucial for preventing thrombus formation, represent the largest and most competitive sub-segment. The devices segment is primarily driven by coronary stents (DES, BMS), catheters, and angioplasty balloons, with DES technology innovations continually pushing the boundaries of effectiveness and safety. The continuous innovation within drug development, particularly in secondary prevention, ensures steady growth in the pharmaceutical segment, while technological miniaturization and integration in devices enhance procedural success rates and drive higher procedural volumes globally.

Geographic segmentation is also critical, illustrating varying adoption rates influenced by regulatory environments, economic development, and disease prevalence patterns across key regions like North America, Europe, APAC, Latin America, and MEA. North America consistently adopts cutting-edge, high-cost therapies rapidly, securing its dominant market position. Conversely, APAC's segment growth is volumetric, driven by increasing patient numbers and expanding access to essential, often generic, drug therapies. Strategic segment investment is focused on developing next-generation anti-thrombotic agents that minimize bleeding risks and developing smart, connected interventional devices that reduce the necessity for highly specialized surgical skills, thereby democratizing access to complex MI treatments across geographically diverse markets and ultimately maximizing the potential for patient recovery.

- By Treatment Type:

- Pharmaceuticals

- Antiplatelet Agents (Aspirin, P2Y12 Inhibitors)

- Anticoagulants (Heparins, DOACs)

- Beta-Blockers and ACE Inhibitors

- Lipid-Lowering Agents (Statins, PCSK9 Inhibitors)

- Medical Devices

- Coronary Stents (Drug-Eluting Stents, Bare-Metal Stents)

- Catheters

- Angioplasty Balloons

- Intravascular Imaging Devices (IVUS, OCT)

- Pharmaceuticals

- By Application:

- ST-Segment Elevation Myocardial Infarction (STEMI)

- Non-ST-Segment Elevation Myocardial Infarction (NSTEMI)

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Specialized Cardiac Centers

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Myocardial Infarction Treatment Market

The Value Chain for the Myocardial Infarction Treatment Market begins with rigorous upstream activities involving raw material procurement, specialized API (Active Pharmaceutical Ingredient) synthesis, and the sourcing of complex medical-grade materials such as advanced polymers, metals (e.g., cobalt-chromium for stents), and high-purity chemicals necessary for drug formulation. Research and Development (R&D) forms the most critical upstream component, requiring massive investments from pharmaceutical and medical device manufacturers to discover novel molecular entities, conduct lengthy clinical trials, and gain regulatory approvals. This R&D intensive phase ensures the continued introduction of higher efficacy, lower toxicity drugs and safer, more biocompatible interventional devices. Patent protection at this stage is vital for securing competitive advantages and recouping the substantial investment required for complex therapeutic development, particularly concerning innovative stent coatings and specialized delivery systems.

Midstream activities encompass the manufacturing, formulation, and quality control processes. For pharmaceuticals, this includes large-scale GMP (Good Manufacturing Practice) production, sterile filling, and packaging. For devices, specialized high-precision manufacturing processes, sterilization, and assembly are required, often adhering to ISO 13485 standards. Distribution channel dynamics are multifaceted, encompassing both direct and indirect routes. Direct distribution is often utilized for high-value, sophisticated devices (like complex stent systems) where technical sales support and specialized training for interventional cardiologists are necessary. Indirect channels, relying on wholesalers, distributors, and logistics providers, are predominantly used for high-volume, lower-cost pharmaceuticals and generic drug formulations. Effective cold chain logistics are paramount for biological agents and certain sensitive drug classes to maintain product integrity throughout the distribution network, ensuring patient safety and efficacy.

Downstream analysis focuses on the final delivery and end-user consumption. Hospitals, being the primary setting for acute MI care, act as major buyers, driven by specialized procurement contracts and GPO (Group Purchasing Organization) agreements. Specialized cardiac centers and ambulatory settings consume treatments for follow-up and chronic management. The entire value chain is heavily influenced by regulatory oversight (FDA, EMA), health technology assessments (HTA), and complex reimbursement mechanisms that determine the commercial success and adoption rate of new therapies. Successful market players optimize their value chain by minimizing supply chain disruptions, strategically locating manufacturing sites closer to key markets to reduce logistical costs, and investing heavily in physician education and post-market surveillance to demonstrate the real-world safety and efficacy of their products, completing the cycle of value generation from concept to clinical outcome.

Myocardial Infarction Treatment Market Potential Customers

The primary customers and end-users of Myocardial Infarction treatment products are healthcare institutions characterized by their capability to manage acute cardiac events and provide subsequent long-term care. Hospitals, particularly those with comprehensive cardiac care units and equipped cath labs, represent the largest potential customer segment. These institutions require high volumes of antiplatelet and anticoagulant drugs, alongside advanced interventional devices such as drug-eluting stents and complex catheter systems, necessary for immediate revascularization procedures. Purchasing decisions in this segment are often centralized and influenced heavily by cost-effectiveness, clinical evidence, inclusion in formulary lists, and the availability of sophisticated supporting technology and trained personnel, making institutional sales a critical focus for manufacturers.

Specialized Cardiac Centers and standalone Cardiology Clinics constitute another significant customer base. While hospitals manage the initial acute phase (STEMI/NSTEMI), these centers often handle elective PCI procedures for stable angina and, crucially, manage the long-term secondary prevention of MI survivors. They are consistent consumers of maintenance pharmaceuticals (beta-blockers, statins) and sophisticated diagnostic tools used for risk assessment and monitoring. Their purchasing decisions emphasize ease of use, integration with patient management systems, and demonstrated superiority in improving long-term patient outcomes, often relying on direct relationships with pharmaceutical representatives and medical device trainers to ensure proficiency with new therapeutic modalities and diagnostic tools available in the market.

Finally, Ambulatory Surgical Centers (ASCs) and Governmental Healthcare Agencies (e.g., Veteran Affairs, National Health Service) also represent important customer segments. ASCs may handle some follow-up procedures or diagnostics but are less involved in acute MI management. Governmental agencies, conversely, are massive volume purchasers, particularly of generic essential medicines, driven by the mandate to provide cost-effective public healthcare. The growing trend of home-based monitoring and telemedicine also introduces the patient as an indirect consumer of devices, particularly wearables and remote diagnostics, although the prescribing physician and the underlying health system remain the direct purchasing entities responsible for initiating and funding the treatment regimen, highlighting the complex network of buyers involved in the Myocardial Infarction Treatment Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 22.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Novartis AG, Pfizer Inc., Bayer AG, AstraZeneca PLC, Bristol-Myers Squibb Company, Eli Lilly and Company, Sanofi S.A., Merck & Co., Inc., Abbott Laboratories, Medtronic PLC, Boston Scientific Corporation, Terumo Corporation, Edwards Lifesciences, Teleflex Incorporated, Siemens Healthineers, General Electric Healthcare, Baxter International, Daiichi Sankyo Company, Novo Nordisk A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Myocardial Infarction Treatment Market Key Technology Landscape

The technology landscape for the Myocardial Infarction Treatment Market is characterized by continuous evolution across three main technological pillars: advanced pharmacological delivery systems, sophisticated interventional devices, and integrating digital health platforms. In pharmacology, key technological advancements include the development of proprietary extended-release formulations for secondary prevention drugs, enhancing patient adherence and reducing dosing frequency. Furthermore, the technology surrounding gene-based therapies and mRNA technology is emerging, offering the potential to induce endogenous repair mechanisms in damaged myocardial tissue, marking a highly disruptive technological shift from traditional symptom management to regenerative treatment modalities. The focused investment in developing anti-thrombotic agents with improved safety profiles, utilizing novel chemical structures to selectively target coagulation factors while minimizing systemic bleeding risk, underscores the sustained technological rivalry in the pharmaceutical space.

Within the medical device sector, technological leadership is maintained by advancements in coronary stent technology. The transition from bare-metal stents (BMS) to first-, second-, and now third-generation Drug-Eluting Stents (DES) has dramatically reduced restenosis rates. Current innovation focuses on bioresorbable scaffolds (BRS) technology, designed to provide temporary structural support before dissolving completely, leaving behind a healed, native coronary artery, thus reducing the risk of late thrombosis associated with permanent metallic implants. Complementary technologies, such as advanced intravascular imaging (e.g., Optical Coherence Tomography (OCT) and Intravascular Ultrasound (IVUS)), allow interventional cardiologists to precisely size and place stents, optimizing procedural outcomes and reducing complications. Robotics and precision navigation systems are also entering the cath lab, promising higher accuracy and reduced radiation exposure for both patients and clinical staff.

Digital health and connectivity technologies form the third, rapidly expanding pillar. Telecardiology platforms leverage sophisticated algorithms and machine learning to analyze large volumes of patient data (ECGs, blood pressure, oxygen saturation) collected via wearable devices and implantable monitors, enabling proactive management of chronic conditions post-MI. These platforms facilitate remote patient management, adherence tracking, and rapid intervention during early signs of deterioration. Furthermore, the utilization of sophisticated Electronic Health Record (EHR) integration tools powered by AI allows healthcare providers to implement evidence-based guidelines automatically, streamlining care pathways and ensuring consistent, high-quality treatment delivery, thereby leveraging technology not just for treatment but for systemic improvement in operational efficiency and population health management following an acute myocardial infarction event.

Regional Highlights

- North America (United States, Canada): This region dominates the global Myocardial Infarction Treatment Market, driven by high per capita healthcare spending, rapid adoption of innovative, premium-priced medical devices (especially latest-generation DES and advanced catheters), and the presence of major industry players and leading research institutions. Robust reimbursement policies, particularly in the US, encourage the uptake of novel pharmaceutical agents like PCSK9 inhibitors and sophisticated personalized antiplatelet regimens. The mature regulatory environment and extensive patient data infrastructure further facilitate clinical trials and market entry for specialized MI therapeutics.

- Europe (Germany, UK, France, Italy, Spain): Europe represents the second-largest market, characterized by standardized clinical guidelines (ESC) that promote consistent care protocols across member states. While utilization of generics is high due to nationalized healthcare systems focusing on cost-effectiveness, countries like Germany and the UK are rapid adopters of high-tech interventional procedures and diagnostic imaging technologies. The market is propelled by a high incidence of cardiovascular disease, countered by increasing pressure from HTA bodies to demonstrate value-based outcomes for new drug and device approvals.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to exhibit the fastest growth CAGR, primarily due to the vast, untapped patient population experiencing a surging incidence of MI linked to rapid urbanization and lifestyle changes. While Japan and South Korea demonstrate high technology adoption mirroring Western markets, growth in China and India is volumetric, driven by expanding government initiatives to improve infrastructure, increase insurance coverage, and subsidize essential medicines. This region offers immense opportunities for manufacturers of affordable, high-quality generic drugs and essential medical devices, addressing the substantial unmet need for timely and effective cardiac care.

- Latin America (LATAM) (Brazil, Mexico): The LATAM market exhibits fragmented growth, with urban centers adopting advanced treatments while rural areas face access challenges. Brazil and Mexico are key markets, driven by private healthcare investment and a rising middle class demanding quality cardiovascular care. However, market growth is constrained by fluctuating economic conditions, complex regulatory landscapes, and dependence on imported medical devices, necessitating localized manufacturing or strong distributor partnerships for successful market penetration.

- Middle East and Africa (MEA): Growth in the MEA market is largely concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia), where high healthcare expenditure, sophisticated infrastructure, and high prevalence of metabolic disorders (diabetes, obesity) drive demand for specialized MI treatment, including advanced procedures and premium drugs. The African sub-region, conversely, presents major challenges related to low healthcare infrastructure maturity and limited access, focusing predominantly on essential, cost-effective pharmaceutical interventions provided through public health programs and international aid initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Myocardial Infarction Treatment Market.- Johnson & Johnson

- Novartis AG

- Pfizer Inc.

- Bayer AG

- AstraZeneca PLC

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Sanofi S.A.

- Merck & Co., Inc.

- Abbott Laboratories

- Medtronic PLC

- Boston Scientific Corporation

- Terumo Corporation

- Edwards Lifesciences

- Teleflex Incorporated

- Siemens Healthineers

- General Electric Healthcare

- Baxter International

- Daiichi Sankyo Company

- Novo Nordisk A/S

Frequently Asked Questions

Analyze common user questions about the Myocardial Infarction Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers fueling the growth of the Myocardial Infarction Treatment Market?

The market growth is primarily driven by the escalating global prevalence of cardiovascular risk factors (diabetes, obesity, hypertension), the demographic shift towards an aging population, and continuous technological advancements in interventional cardiology devices and personalized pharmaceutical therapies designed for improved patient outcomes.

How is Artificial Intelligence (AI) influencing the diagnosis and management of MI?

AI is critically impacting MI care by enabling highly accurate, early risk stratification using predictive analytics, optimizing personalized drug dosing (especially antiplatelets), and automating the interpretation of complex cardiac imaging and ECG data, thereby significantly reducing critical time-to-treatment intervals (door-to-balloon time).

Which segment holds the largest share in the Myocardial Infarction Treatment Market by Treatment Type?

The pharmaceutical segment, particularly antiplatelet agents (P2Y12 inhibitors) and lipid-lowering drugs (statins), holds the largest market share due to the necessity of immediate stabilization protocols and lifelong secondary prevention regimens required by post-MI patients globally.

What are the main regional growth hotspots anticipated during the forecast period?

While North America maintains market dominance due to high investment and technology adoption, the Asia Pacific (APAC) region, driven by expanding healthcare infrastructure and a massive increase in disease incidence in countries like China and India, is projected to register the highest Compound Annual Growth Rate (CAGR) through 2033.

What are the key technological innovations expected to disrupt the device segment?

Key disruptions stem from the further development and commercialization of bioresorbable scaffolds (BRS) designed to eliminate long-term complications associated with permanent metallic stents, alongside the increased integration of intravascular imaging (OCT/IVUS) and precision robotic-assisted systems for optimizing procedural success in percutaneous coronary intervention (PCI).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager