Nafion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431402 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Nafion Market Size

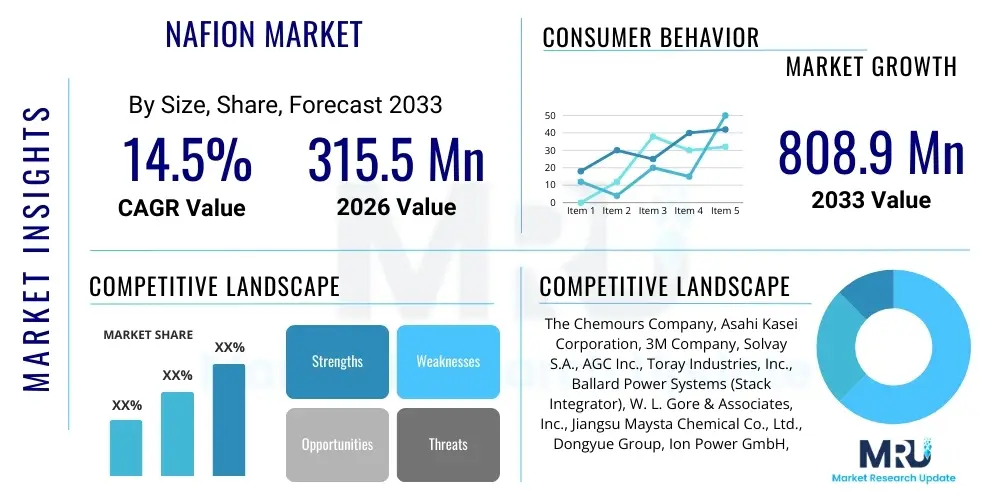

The Nafion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at $315.5 Million in 2026 and is projected to reach $808.9 Million by the end of the forecast period in 2033.

Nafion Market introduction

The Nafion market centers on high-performance perfluorosulfonic acid (PFSA) copolymer membranes and dispersions, predominantly used as solid electrolytes in electrochemical applications. Nafion, originally developed by DuPont and now produced by The Chemours Company, is distinguished by its exceptional thermal stability, high proton conductivity, and chemical resistance, particularly in harsh acidic and oxidative environments. These attributes make it the gold standard for Proton Exchange Membrane (PEM) technology, which is critical for the burgeoning hydrogen economy. The fundamental product offers unparalleled efficiency in converting chemical energy to electrical energy, positioning it centrally within global decarbonization strategies.

Major applications of Nafion membranes span critical industrial and energy sectors, including fuel cells (both vehicular and stationary), water electrolyzers for green hydrogen production, and the chlor-alkali industry for caustic soda and chlorine generation. In fuel cells, Nafion acts as the electrolyte, selectively transporting protons while blocking electron flow, thereby enabling efficient power generation. Its utilization in electrolyzers is paramount to achieving high-efficiency water splitting, which is a key process for sustainable energy storage. Furthermore, smaller applications, such as specialized sensors, chemical synthesis, and humidity control systems, also leverage Nafion’s unique ion-exchange properties, contributing to market diversity.

The market growth is fundamentally driven by the global pivot toward sustainable energy solutions and regulatory mandates supporting reduced carbon emissions. Governments worldwide are heavily investing in hydrogen infrastructure, particularly green hydrogen derived from renewable sources, where PEM electrolyzers utilizing Nafion are essential. The benefits of using Nafion include enhanced operational longevity, high power density, and improved stack efficiency compared to alternative membrane technologies. However, the high manufacturing cost and the need for rigorous quality control during membrane fabrication remain central challenges that the industry is actively addressing through innovation in material science and scalable production techniques.

Nafion Market Executive Summary

The Nafion market is experiencing robust expansion, primarily fueled by unprecedented global investments in the hydrogen value chain and the accelerated adoption of fuel cell electric vehicles (FCEVs). Key business trends include aggressive research and development focused on reducing membrane thickness to lower material costs and improve efficiency, alongside strategic partnerships between membrane manufacturers and automotive or energy integrators to secure long-term supply agreements. The volatility in raw material costs, specifically fluoropolymers, coupled with increasing environmental scrutiny regarding PFAS substances, necessitates sophisticated supply chain management and the development of alternative, lower-cost catalyst-coated membranes (CCMs) that optimize Nafion usage.

Regional trends indicate that Asia Pacific (APAC), particularly China, Japan, and South Korea, maintains dominance in terms of demand for Nafion, largely due to extensive governmental support for FCEV deployment and mass production capabilities for PEM electrolyzers aimed at large-scale hydrogen hubs. Europe is also emerging as a major growth engine, driven by the ambitious European Green Deal and specific targets for green hydrogen generation by 2030, which directly translates into increased demand for high-performance ionomers like Nafion for large-scale electrolysis projects. North America, influenced by policies such as the Inflation Reduction Act (IRA), is seeing substantial investment in domestic PEM manufacturing and hydrogen infrastructure buildout, reinforcing its position as a critical innovation and application hub.

Segment trends reveal that the Application segment dominated by Fuel Cells, particularly within heavy-duty transport and material handling equipment, is the highest revenue generator, emphasizing the material’s reliability under rigorous operating conditions. However, the Water Electrolysis sub-segment is poised to record the highest Compound Annual Growth Rate (CAGR) over the forecast period, reflecting the exponential scaling required for green hydrogen production. By form, the Membrane segment holds the largest share due to its direct utility in electrochemical stacks, though the Dispersion segment is increasingly critical for developing advanced catalyst layers and specialized coatings in CCM manufacturing, ensuring sustained technological evolution across all end-use sectors.

AI Impact Analysis on Nafion Market

User queries regarding AI's impact on the Nafion market often revolve around three core themes: optimizing material synthesis, enhancing stack performance prediction, and automating quality control in manufacturing. Users are keen to understand how artificial intelligence and machine learning (ML) algorithms can accelerate the discovery of next-generation ionomers, potentially reducing reliance on costly and complex perfluorinated structures, or how AI can precisely model the complex phenomena of membrane degradation and humidification levels within fuel cell and electrolyzer stacks under varying load conditions. Furthermore, there is significant interest in leveraging predictive maintenance and operational analytics facilitated by AI to extend the lifespan of stacks, thereby mitigating one of the major commercial hurdles associated with high-cost Nafion components.

AI’s initial impact is most visible in computational materials science, where machine learning models are used to rapidly screen thousands of potential polymer structures, predicting proton conductivity, mechanical strength, and chemical stability without extensive, costly laboratory experiments. This computational acceleration significantly reduces the time-to-market for improved Nafion variants or competitive PFSA alternatives. In the manufacturing sector, AI-powered image recognition and sensor fusion are being deployed to monitor the thin film casting process of Nafion membranes, ensuring uniformity and identifying micro-defects instantaneously, thereby drastically improving yield rates and ensuring the stringent quality required for high-performance applications.

Looking forward, AI integration will revolutionize system-level optimization. Real-time data gathered from operational PEM stacks (monitoring temperature, pressure, current density, and humidity) can be fed into AI models to dynamically adjust operating parameters, preventing localized drying or flooding of the membrane—conditions that accelerate degradation. This predictive optimization enhances energy efficiency, prolongs the lifespan of Nafion membranes within the stack, and ultimately improves the economic viability of both FCEVs and large-scale electrolyzers. The synergy between high-performance materials like Nafion and advanced AI analytics will be instrumental in achieving cost parity with conventional energy technologies.

- AI accelerates new ionomer discovery via computational screening, optimizing molecular structure and stability.

- Machine learning algorithms predict membrane degradation and failure points, enabling proactive maintenance strategies.

- AI-driven sensor data fusion optimizes stack operating parameters (humidity and temperature) for peak Nafion performance.

- Automated visual inspection systems utilizing AI enhance quality control during Nafion membrane fabrication, reducing manufacturing defects.

- Predictive modeling shortens R&D cycles for improved Catalyst Coated Membrane (CCM) designs utilizing Nafion dispersion.

DRO & Impact Forces Of Nafion Market

The Nafion market dynamics are shaped by strong governmental and industrial commitment to the hydrogen economy (Driver), the inherently high cost and durability concerns of the membrane material (Restraint), and the expansive potential in green hydrogen production via PEM electrolyzers (Opportunity). These factors interact to create intense competitive pressure (Impact Force). The primary driver is the accelerating global decarbonization trend, making Nafion indispensable in zero-emission FCEVs and high-efficiency water splitting. Concurrently, the necessity for robust, long-lasting, and cost-effective membranes pushes research toward thin-film structures and novel PFSA alternatives. The market's future trajectory is heavily dependent on regulatory support and technological breakthroughs that address the current cost-per-kilowatt hour challenge.

Key drivers include substantial regulatory support, such as tax credits and subsidies for fuel cell technology adoption and hydrogen infrastructure buildout across major economies. The automotive sector's shift towards FCEVs, particularly in heavy-duty commercial transport (trucking and buses), offers a massive scaling opportunity, demanding consistently high volumes of Nafion membranes. Furthermore, the inherent advantages of PEM technology—compact design, rapid response time, and high current density operation—over competing technologies like alkaline electrolysis, solidify Nafion’s dominant position in high-growth, technically demanding segments, especially in variable renewable energy integration scenarios.

However, the restraints are significant. The high cost of Nafion, intrinsically linked to the complex, resource-intensive polymerization process and the high price of fluorinated precursors, presents a major barrier to widespread commercial adoption, particularly against cheaper, albeit less efficient, alternatives. Moreover, membrane durability and susceptibility to degradation from contaminants (like carbon monoxide or sulfur compounds) or thermal cycling stress remain persistent technical challenges that restrict the lifespan and thus the total cost of ownership for PEM systems. Addressing these restraints necessitates continuous innovation, including the incorporation of inorganic fillers or structural reinforcements to enhance mechanical integrity and chemical resilience. Opportunities lie mainly in large-scale hydrogen generation and storage, and specialized niche markets such as medical devices and redox flow batteries, which increasingly utilize Nafion’s ion-exchange capabilities.

Segmentation Analysis

The Nafion market segmentation provides a granular view of demand distribution across various forms, end-user industries, and critical applications. Understanding these segments is vital for manufacturers to prioritize investment in capacity expansion and R&D tailored to specific sector needs, such as the stringent automotive durability requirements versus the high throughput demands of industrial chlor-alkali production. The market is primarily segmented by Form (Membrane, Dispersion, Resin), Application (Fuel Cells, Water Electrolysis, Chlor-alkali, Others), and End-Use Industry (Automotive, Chemical Processing, Energy, Others). The diversity in applications underscores the material's versatility as a high-performance ionomer.

The Form segment analysis reveals that pre-formed Nafion Membranes, which are directly integrated into electrochemical stacks, constitute the largest revenue share. These membranes are categorized by their thickness and equivalent weight (EW), which dictates their proton conductivity and mechanical properties. Conversely, Nafion Dispersion, which is a key ingredient in creating catalyst-coated membranes (CCMs) by binding catalyst particles to the membrane surface, is the fastest-growing form segment. Innovations in dispersion technology are central to enhancing the efficiency and reducing the platinum loading required in PEM stacks, directly impacting overall system cost.

The Application segment is clearly dominated by electrochemical energy conversion, where Fuel Cells (specifically PEMFCs) hold significant market value, driven by mobility applications. However, the rapidly scaling sector is Water Electrolysis, specifically PEM electrolyzers, which are essential for producing green hydrogen. The demand here is driven by national green energy mandates. Chemical Processing, dominated by the chlor-alkali sector, remains a stable, mature, and essential user of Nafion's chemical resistance properties, particularly in demanding industrial environments where traditional membranes fail. Strategic focus areas for the forecast period revolve around maximizing production capacity for membranes optimized for high-current density electrolysis.

- By Form:

- Membrane (Dominant revenue share, categorized by thickness and EW)

- Dispersion (Fastest growth, critical for CCM manufacturing)

- Resin (Used in specialized coatings and lab applications)

- By Application:

- Fuel Cells (PEMFCs, DMFCs - High Value)

- Water Electrolysis (PEM Electrolyzers - Highest Growth CAGR)

- Chlor-alkali Industry (Stable industrial application)

- Others (Sensors, Batteries, Humidifiers)

- By End-Use Industry:

- Automotive & Transportation (FCEVs, Buses, Trucks)

- Chemical Processing (Chlorine/Caustic soda production)

- Energy & Power Generation (Stationary Power, Grid Storage)

- Research & Development (Academic and Industrial Labs)

Value Chain Analysis For Nafion Market

The Nafion market value chain is characterized by high barriers to entry, controlled by a few specialized upstream chemical manufacturers possessing proprietary fluoropolymer technology, and culminates in sophisticated, high-precision downstream integration into complex electrochemical systems. Upstream analysis focuses heavily on the production of tetrafluoroethylene (TFE) and specialized perfluorinated vinyl ether monomers, which are the foundational chemical components required for synthesizing the PFSA copolymer. The supply of these precursors is concentrated and highly sensitive to regulatory changes concerning fluorochemicals (PFAS), making precursor sourcing a critical vulnerability and determining factor for the final product cost. Effective upstream control is paramount for maintaining product purity and consistency, vital for Nafion's performance metrics.

Midstream activities involve the complex polymerization process, casting the ionomer solution into membranes of precise thickness, and drying/annealing processes, which are technologically guarded secrets of core manufacturers. Distribution channels are typically specialized, involving both direct and indirect sales models. Direct distribution is common for large-volume customers, such as major automotive OEMs or large-scale hydrogen project developers, who require customized membrane specifications and long-term supply assurance. Indirect channels involve authorized distributors and specialized solution providers who integrate Nafion components into smaller-scale systems, such as laboratory equipment or specialized chemical reactors, providing technical support and localized inventory management across various geographical markets.

Downstream analysis highlights the role of system integrators and Catalyst Coated Membrane (CCM) manufacturers. These players take the raw Nafion membrane and optimize its interface with catalysts (like platinum) to create the core component of the fuel cell or electrolyzer stack. The ultimate end-users are vehicle manufacturers (like Hyundai or Toyota), industrial chemical plants (for chlor-alkali), and utility companies implementing power-to-gas solutions. The highest value addition occurs at the midstream (proprietary membrane manufacturing) and the downstream (CCM coating and stack integration), where technological know-how translates directly into system efficiency and longevity. Success in the downstream market hinges on establishing robust quality assurance procedures and providing extensive after-sales support relating to stack operation and maintenance.

Nafion Market Potential Customers

The primary potential customers and end-users of Nafion products are large industrial conglomerates and technology developers deeply entrenched in the sustainable energy transition. These include Original Equipment Manufacturers (OEMs) of Fuel Cell Electric Vehicles (FCEVs) and heavy-duty transportation solutions, who prioritize high power density and extended operational life for their mobility applications. Additionally, utility-scale energy companies and independent power producers (IPPs) investing in green hydrogen infrastructure constitute a massive and rapidly expanding customer base, particularly those building centralized hydrogen hubs using high-capacity PEM electrolyzers, requiring bulk quantities of high-quality Nafion membranes.

A second crucial customer segment is the global chemical processing industry, specifically companies involved in the production of chlorine, caustic soda, and other electrochemical commodities. These customers are long-term, stable purchasers of Nafion, valuing its superior chemical stability and ion selectivity, which minimizes energy consumption and environmental impact compared to older diaphragm or mercury cell technologies. Furthermore, advanced manufacturing companies producing niche products, such as specialized gas sensors, medical diagnostic devices, and portable power systems (e.g., small direct methanol fuel cells), represent specialized customers requiring tailored Nafion dispersion solutions for thin-film applications and micro-scale devices.

The purchasing decisions of these end-users are heavily influenced by performance metrics like Equivalent Weight (EW), membrane thickness, mechanical strength, and, critically, the total system cost of ownership (TCO). For large-scale industrial buyers, consistency of supply and the ability of the manufacturer to scale production capacity to meet multi-megawatt project demands are paramount. Research institutions and government laboratories also constitute a steady customer base, acquiring Nafion products for experimental testing, development of next-generation ionomers, and advancing fundamental research in electrochemistry, acting as early adopters for new Nafion formulations and composite structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $315.5 Million |

| Market Forecast in 2033 | $808.9 Million |

| Growth Rate | 14.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Chemours Company, Asahi Kasei Corporation, 3M Company, Solvay S.A., AGC Inc., Toray Industries, Inc., Ballard Power Systems (Stack Integrator), W. L. Gore & Associates, Inc., Jiangsu Maysta Chemical Co., Ltd., Dongyue Group, Ion Power GmbH, FuelCell Energy, Inc., Plug Power Inc., Kolon Industries, Co., Ltd., Pajarito Powder, LLC, BASF SE. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nafion Market Key Technology Landscape

The Nafion market’s technological landscape is defined by continuous innovation aimed at optimizing the membrane's structure to simultaneously reduce cost, enhance proton conductivity, and improve mechanical durability. The core technology remains the Perfluorosulfonic Acid (PFSA) ionomer, characterized by a perfluorinated backbone for chemical resistance and sulfonic acid side chains for proton transport. Current R&D efforts are heavily focused on developing thinner membranes (e.g., less than 20 micrometers) to minimize ohmic resistance and material usage, crucial for high-power density applications. This thinning process necessitates advanced reinforcement technologies, often involving embedding inert materials (like PTFE or inorganic oxides) within the Nafion matrix to prevent pinhole formation and membrane swelling, which are common failure modes in thin films.

A secondary, but rapidly advancing, technological area is the integration of Nafion Dispersion technology into Catalyst Coated Membranes (CCMs). The industry is moving away from traditional five-layer Membrane Electrode Assemblies (MEAs) toward three-layer CCMs where the Nafion dispersion acts as the ionomer binder within the catalyst layer. The technology challenge here involves optimizing the dispersion’s mixing and deposition process to ensure an ideal triple-phase boundary (gas, catalyst, ionomer) for efficient electrochemical reactions, minimizing platinum loading without sacrificing performance. Techniques like ultrasonic spraying, decal transfer, and ink-jet printing are being refined to ensure ultra-uniform and low-cost catalyst layer application, which is a major determinant of system efficiency.

Furthermore, technology development is also concentrating on addressing the sensitivity of Nafion to dehydration and high temperatures. Research is exploring composite membranes (e.g., Nafion hybridized with high-temperature polymers or phosphoric acid) to extend the operating temperature range beyond 80°C, which is essential for improving thermodynamic efficiency and simplifying thermal management systems in automotive and industrial stacks. The development of specialized conditioning and pre-treatment methods for Nafion membranes before stack assembly is also a key technological focus, aiming to ensure immediate and stable performance upon deployment, particularly in harsh or intermittent operational cycles characteristic of renewable energy integration.

Regional Highlights

Regional dynamics play a crucial role in shaping the Nafion market, driven by varying levels of government commitment to FCEV deployment, hydrogen economy targets, and existing chemical infrastructure. Asia Pacific (APAC) currently holds the dominant market share, characterized by aggressive technological adoption and substantial manufacturing scale-up, particularly in countries aiming to lead the global FCEV race. Europe is the second-largest market and represents the highest growth potential for PEM electrolyzers, primarily driven by the "Green Hydrogen" mandates under the European Green Deal, necessitating massive inputs of high-performance ionomers like Nafion to achieve ambitious decarbonization goals by the end of the forecast period.

North America is emerging strongly, bolstered by favorable policy frameworks, including incentives for domestic manufacturing and hydrogen infrastructure development. The region's growth is characterized by significant R&D activity aimed at improving membrane cost efficiency and durability for grid-scale energy storage solutions. Latin America, the Middle East, and Africa (MEA) currently hold smaller market shares but are projected to see increasing adoption, particularly in the Middle East, where large-scale, low-cost solar-powered green hydrogen projects are being initiated, relying heavily on PEM technology for efficient water splitting.

Specific regional market nuances include Japan's focus on commercializing FCEVs and establishing a hydrogen society, which creates steady demand for mobility-grade Nafion. Germany and the Scandinavian countries are spearheading PEM electrolysis for industrial and power generation applications, focusing on robust, large-format membranes. Meanwhile, the U.S. market is prioritizing the development of robust supply chains for fluorochemicals to mitigate dependency on international suppliers, driven by national energy security concerns, influencing investment in domestic Nafion production capacity and advanced fabrication technologies.

- Asia Pacific (APAC): Market leader by volume; driven by China, Japan, and South Korea’s FCEV adoption and electronics manufacturing.

- Europe: Highest growth rate forecast; propelled by Green Hydrogen targets (e.g., H2 Roadmap, European Green Deal) and strong demand for industrial electrolyzers.

- North America: Focus on supply chain security and R&D; growth stimulated by the Inflation Reduction Act (IRA) and heavy-duty transport fuel cell deployment.

- Middle East & Africa (MEA): Emerging market for large-scale green hydrogen projects (e.g., NEOM in Saudi Arabia) utilizing PEM electrolysis technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nafion Market.- The Chemours Company (Primary manufacturer and brand owner of Nafion PFSA materials)

- Asahi Kasei Corporation

- 3M Company

- Solvay S.A.

- AGC Inc.

- Toray Industries, Inc.

- Ballard Power Systems (Major user and stack integrator)

- W. L. Gore & Associates, Inc.

- Dongyue Group Co., Ltd.

- Jiangsu Maysta Chemical Co., Ltd.

- Ion Power GmbH

- FuelCell Energy, Inc.

- Plug Power Inc.

- Kolon Industries, Co., Ltd.

- Pajarito Powder, LLC (Focus on catalyst components)

- BASF SE (Chemical supplier and application developer)

- Johnson Matthey (Catalyst layer technology)

- Freudenberg Performance Materials

- Giner Inc.

- Honeywell International Inc.

Frequently Asked Questions

Analyze common user questions about the Nafion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current exponential growth in Nafion demand?

The exponential growth is primarily driven by the global transition to the hydrogen economy, specifically the rapidly increasing deployment of high-efficiency Proton Exchange Membrane (PEM) electrolyzers for scalable green hydrogen production. Nafion's superior proton conductivity and durability make it indispensable in these critical energy applications, supported by significant government subsidies and decarbonization mandates worldwide, especially across Europe and Asia Pacific.

How does the high cost of Nafion material impact the commercial viability of fuel cells?

The high initial cost of Nafion, stemming from complex fluoropolymer synthesis and purification processes, historically increases the overall cost of the Membrane Electrode Assembly (MEA), presenting a barrier to cost parity with traditional power sources. However, manufacturers are mitigating this through innovations like thinner membranes (reducing material use) and advanced catalyst coating techniques (using Nafion dispersion) that enhance efficiency and extend lifespan, thereby lowering the total cost of ownership (TCO) over the operating life of the fuel cell or electrolyzer stack.

What are the main segments of the Nafion market by application and which is the fastest growing?

The main application segments are Fuel Cells (for automotive and stationary power), Water Electrolysis (for hydrogen production), and the Chlor-alkali Industry. While Fuel Cells currently hold the largest revenue share, the Water Electrolysis segment, specifically the demand for membranes in PEM electrolyzers, is projected to be the fastest-growing application segment due to substantial global investments in large-scale industrial green hydrogen projects required to meet 2030 climate targets.

What is the role of Equivalent Weight (EW) in determining Nafion membrane performance?

Equivalent Weight (EW) is a critical performance metric defined as the mass of dry polymer containing one mole of sulfonic acid groups. A lower EW indicates a higher concentration of acid sites, leading to increased proton conductivity and swelling, which is generally desirable for higher power density at lower operating temperatures. Conversely, a higher EW offers better mechanical stability and reduced swelling, often preferred for higher temperature or specialized applications where mechanical robustness is paramount over maximum conductivity.

How are manufacturers addressing the durability challenges of Nafion membranes under intense operational stress?

Manufacturers are addressing durability through several technological advancements: 1. Mechanical Reinforcement: Incorporating PTFE or inert inorganic fillers (like SiO2) to enhance mechanical strength and resist pinholing under cyclic stress. 2. Chemical Stabilization: Developing composite membranes that scavenge free radicals, reducing chemical degradation. 3. System Optimization: Utilizing AI and sophisticated sensors to manage humidity and temperature fluctuations dynamically, preventing conditions that lead to accelerated membrane degradation, thus extending stack operational life significantly.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager