NAND Flash Memory Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440468 | Date : Jan, 2026 | Pages : 241 | Region : Global | Publisher : MRU

NAND Flash Memory Market Size

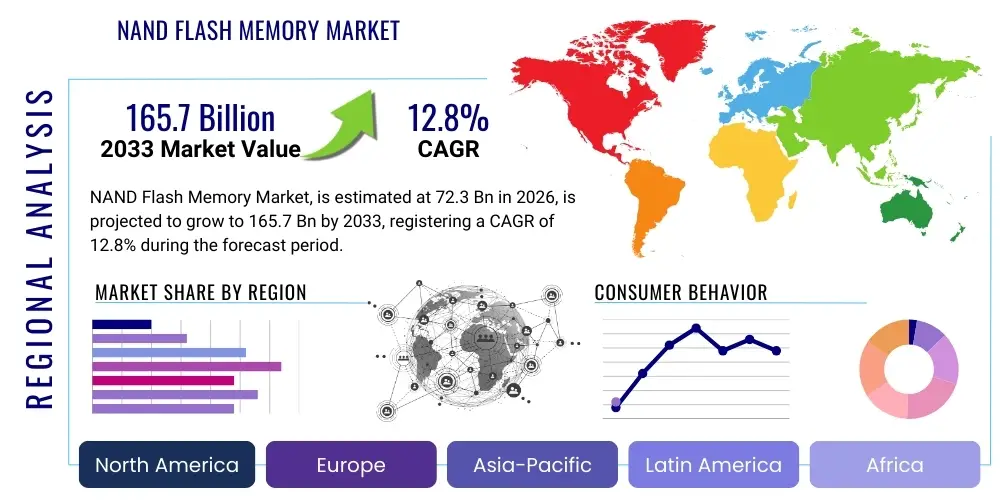

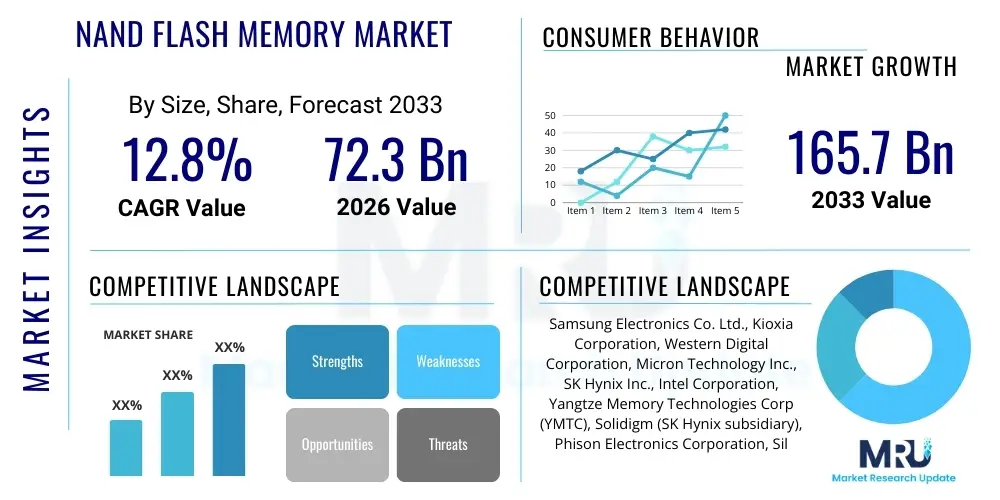

The NAND Flash Memory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at USD 72.3 Billion in 2026 and is projected to reach USD 165.7 Billion by the end of the forecast period in 2033.

NAND Flash Memory Market introduction

The NAND Flash Memory market is a cornerstone of the modern digital economy, providing essential non-volatile storage solutions across a vast spectrum of applications. Originating as a robust alternative to NOR flash for mass storage, NAND flash technology has evolved significantly, particularly with the advent of 3D stacking, enabling unprecedented densities and performance improvements. Its ability to retain data without power, combined with high speed, compact form factor, and increasing cost-effectiveness, has cemented its position as the preferred storage medium for everything from consumer devices to enterprise-grade infrastructure. The market's growth is fundamentally driven by the exponential increase in data generation and consumption globally, fueled by digital transformation initiatives, the proliferation of connected devices, and the pervasive integration of advanced technologies.

NAND flash memory operates by storing data in floating gate or charge trap cells, which can hold multiple bits of information depending on the cell type (SLC, MLC, TLC, QLC, PLC). This technological versatility allows for a tailored approach to various application requirements, balancing performance, endurance, and cost. Major applications span across solid-state drives (SSDs) for client and enterprise computing, internal storage for smartphones, tablets, and other portable devices, as well as crucial roles in automotive systems, industrial automation, and cloud data centers. The benefits of NAND flash memory include its non-volatility, excellent read and write speeds, low power consumption, high shock resistance, and small physical footprint, making it ideal for compact and portable electronics as well as high-performance storage solutions.

The primary driving factors for the NAND Flash Memory market encompass the relentless growth of data volumes generated by cloud computing, artificial intelligence (AI), machine learning (ML), 5G wireless technology, and the Internet of Things (IoT). The increasing adoption of SSDs in enterprise servers and personal computers, the continuous evolution of smartphone technology demanding higher storage capacities, and the rising sophistication of infotainment and autonomous driving systems in the automotive sector are further propelling market expansion. These factors collectively create a robust demand landscape, fostering continuous innovation in NAND flash architecture, controller technology, and manufacturing processes to meet ever-growing storage needs.

NAND Flash Memory Market Executive Summary

The NAND Flash Memory market is characterized by dynamic business trends, marked by continuous innovation in 3D NAND technology and a fluctuating supply-demand equilibrium that often impacts pricing and profitability. Major industry players are heavily investing in research and development to push the boundaries of layer stacking, increase bits per cell (e.g., QLC and PLC NAND), and enhance controller technologies to improve endurance and performance. Consolidation activities among manufacturers and strategic partnerships are prevalent as companies seek to optimize production efficiencies, secure supply chains, and expand market reach. The transition from planar 2D NAND to vertical 3D NAND architectures remains a critical trend, driving higher capacities and lower costs per bit, which in turn fuels adoption across new and existing applications. Furthermore, the market exhibits cyclical patterns influenced by global economic conditions, technological transitions, and capital expenditure decisions of leading semiconductor firms, making strategic forecasting and agile supply chain management paramount.

Regionally, the Asia Pacific (APAC) stands as the undisputed powerhouse for the NAND Flash Memory market, primarily due to its dominant position in semiconductor manufacturing and a massive consumer electronics production base. Countries like South Korea, Japan, China, and Taiwan host the largest NAND flash fabrication plants and serve as major hubs for OEM assembly, creating a robust demand ecosystem. North America and Europe follow, with significant demand stemming from data center expansion, enterprise storage solutions, automotive electronics, and the development of AI and cloud computing infrastructures. The growth in these regions is driven by strong technological adoption rates and substantial investments in digital transformation. Emerging economies in Latin America, the Middle East, and Africa are also showing accelerating growth, fueled by increasing internet penetration, smartphone adoption, and developing digital economies, presenting new opportunities for market expansion as digital infrastructure matures.

Segmentation trends within the NAND Flash Memory market highlight specific areas of intense growth and technological focus. The enterprise SSD segment is experiencing robust expansion, driven by the escalating demands of cloud computing, big data analytics, and artificial intelligence workloads that require high-performance, low-latency, and reliable storage. Similarly, the automotive sector is witnessing a surge in demand for high-end NAND solutions to support advanced driver-assistance systems (ADAS), in-vehicle infotainment, and autonomous driving capabilities, necessitating industrial-grade endurance and reliability. From a technology perspective, Quad-Level Cell (QLC) NAND is gaining traction due to its higher density and lower cost per bit, making it attractive for bulk storage applications, while advancements in controller technology and NVMe interface are critical for unlocking the full performance potential of modern NAND flash. These segment-specific trends underscore the diverse and evolving requirements of end-users, pushing manufacturers to innovate across the entire product portfolio.

AI Impact Analysis on NAND Flash Memory Market

Common user questions regarding AI's impact on the NAND Flash Memory market often revolve around how AI's insatiable data demands will translate into increased storage needs, whether existing NAND architectures are sufficient for AI workloads, and the potential for AI to drive innovation in memory technology itself. Users frequently inquire about the specific types of NAND that AI applications favor (e.g., enterprise SSDs, high-endurance, high-speed), the implications for pricing and supply, and the long-term effects on market growth and competitive landscapes. There is also considerable interest in understanding the role of NAND at the edge for AI inferencing and the power efficiency requirements for large-scale AI data centers. Overall, the overarching theme is how AI will not only consume more storage but also shape the technological trajectory of NAND flash memory to meet its unique performance, capacity, and latency demands.

- Increased Demand for High-Capacity Storage: AI models, especially deep learning networks, require massive datasets for training and inference. This directly translates to an exponential increase in the demand for high-capacity NAND flash memory, particularly in data centers and cloud environments.

- Emphasis on High-Performance Enterprise SSDs: AI workloads, especially for real-time analytics and complex model training, necessitate fast data access. This drives demand for enterprise-grade SSDs that offer superior read/write speeds, low latency, and high endurance compared to client-grade alternatives.

- Emergence of Edge AI Storage Requirements: With the rise of edge computing, AI inferencing is increasingly performed closer to data sources. This creates a need for robust, compact, and energy-efficient NAND storage solutions for edge devices, IoT gateways, and industrial applications.

- Driving Innovation in NAND Architectures and Controllers: AI's demands push for advancements in NAND technology, including higher layers in 3D NAND, more efficient multi-level cell technologies (e.g., PLC), and sophisticated controllers optimized for AI-specific data patterns and I/O operations to minimize bottlenecks.

- Impact on Data Center and Cloud Infrastructure: AI's integration into cloud services and enterprise data centers necessitates significant upgrades to storage infrastructure, with NAND flash becoming a critical component for accelerating data pipelines and reducing overall computational latency.

- Potential for Specialized Memory Solutions: While current NAND serves AI well, the future might see hybrid memory architectures or even new memory types influenced by AI's unique computational and data access patterns, potentially integrating processing capabilities closer to storage.

- Energy Efficiency Concerns: The energy consumption of large-scale AI training and inference facilities makes power-efficient NAND solutions more attractive, driving research into lower-power memory controllers and designs.

DRO & Impact Forces Of NAND Flash Memory Market

The NAND Flash Memory market is influenced by a powerful combination of drivers, restraints, and opportunities that collectively shape its trajectory and competitive landscape. Key drivers include the relentless proliferation of data across all sectors, spurred by the expansion of cloud computing, the widespread adoption of AI and machine learning, and the continuous growth of the Internet of Things (IoT) ecosystem. Furthermore, the increasing demand for high-performance and reliable storage in automotive electronics, particularly for advanced driver-assistance systems (ADAS) and autonomous vehicles, alongside the pervasive demand for higher storage capacities in smartphones and enterprise SSDs, significantly propels market expansion. These macro trends create an insatiable need for non-volatile, high-density, and fast storage solutions, making NAND flash an indispensable technology for modern digital infrastructure.

Conversely, the market faces several significant restraints, notably the inherent price volatility of NAND flash memory, which is subject to cyclical supply-demand imbalances, impacting manufacturers' profitability and market stability. The extreme complexity and capital-intensive nature of manufacturing advanced 3D NAND flash, coupled with the susceptibility to supply chain disruptions (e.g., natural disasters, geopolitical tensions, or material shortages), pose substantial challenges. Moreover, the increasing competition from alternative memory technologies, such as emerging non-volatile memories (e.g., MRAM, ReRAM, PCM) and traditional DRAM for certain high-speed applications, can limit NAND flash's market share in specific niches. The continuous drive to increase bits per cell (e.g., from TLC to QLC and PLC) also presents endurance and performance trade-offs that must be carefully managed to maintain reliability standards across diverse applications, serving as a technical restraint to rapid adoption in all scenarios.

Despite these challenges, numerous opportunities exist to foster sustained growth in the NAND Flash Memory market. The expansion into untapped and emerging markets, particularly in developing economies witnessing digital transformation and increasing internet penetration, offers substantial growth potential. Advancements in packaging technologies and the development of higher density NAND solutions (e.g., more layers in 3D NAND) continue to push the boundaries of storage capacity and cost efficiency, opening doors for new applications and market segments. The growing need for specialized, robust storage in industrial IoT, edge computing, and specialized AI hardware further presents lucrative avenues for innovation and market penetration. Additionally, the development of intelligent NAND controllers and software-defined storage solutions capable of optimizing performance and endurance for specific workloads represents a key opportunity to enhance the value proposition of NAND flash memory in a data-intensive world.

Segmentation Analysis

The NAND Flash Memory market is comprehensively segmented across various dimensions to provide a granular understanding of its structure, dynamics, and growth opportunities. These segmentation analyses enable market participants to identify key trends, target specific customer needs, and strategize effectively. Understanding the market through the lens of type, application, and end-user provides crucial insights into technological preferences, demand drivers, and competitive landscapes within each sub-segment. The ongoing technological evolution in NAND flash memory, such as the transition from 2D to 3D NAND and the adoption of different multi-level cell technologies, significantly influences the composition and growth rates of these segments. Each segment presents unique performance, cost, and endurance requirements, dictating product development and market positioning strategies for manufacturers.

- By Type:

- 2D NAND: Planar structure, typically limited in density scaling, still used in some legacy or low-cost applications.

- 3D NAND: Vertical stacking of memory cells, enabling significantly higher densities, improved performance, and lower cost per bit.

- SLC (Single-Level Cell): Stores 1 bit per cell, offering highest endurance and performance, but lowest density and highest cost.

- MLC (Multi-Level Cell): Stores 2 bits per cell, balancing endurance, performance, and cost, commonly used in client SSDs.

- TLC (Triple-Level Cell): Stores 3 bits per cell, offering higher density and lower cost than MLC, widely adopted in consumer electronics and mainstream SSDs.

- QLC (Quad-Level Cell): Stores 4 bits per cell, providing the highest density and lowest cost per bit, suitable for bulk data storage and read-intensive applications.

- PLC (Penta-Level Cell): Stores 5 bits per cell, an emerging technology aiming for even higher densities, though with trade-offs in endurance and read/write speeds.

- By Application:

- SSDs (Solid-State Drives): High-performance storage replacements for HDDs.

- Client SSD: Used in personal computers, laptops, and workstations, emphasizing speed and everyday performance.

- Enterprise SSD: Designed for data centers, servers, and cloud environments, prioritizing endurance, reliability, and consistent performance under heavy workloads.

- Smartphones: Primary storage for mobile devices, dictating app performance and media capacity.

- Tablets: Internal storage for portable computing devices, similar to smartphones but often with slightly different performance profiles.

- Memory Cards (SD cards, MicroSD cards): Removable storage for cameras, drones, mobile devices, and embedded systems.

- USB Flash Drives: Portable data storage devices for convenient file transfer and backup.

- Automotive: Crucial for infotainment, navigation, ADAS, and autonomous driving systems, requiring high reliability and wide temperature range operation.

- Industrial: Used in factory automation, surveillance, and rugged computing, demanding extreme durability and long-term support.

- Other Consumer Electronics (Cameras, Gaming Consoles): Storage for digital cameras, camcorders, gaming consoles, smart TVs, and set-top boxes.

- By End-User:

- Consumer Electronics: Includes smartphones, tablets, laptops, digital cameras, and other personal devices.

- Enterprise (Data Centers, Cloud): Cloud service providers, large enterprises, and hyper-scalers leveraging NAND for server storage and data analytics.

- Automotive: Car manufacturers and tier-1 suppliers integrating NAND into vehicle systems.

- Industrial: Manufacturers of industrial PCs, automation equipment, and specialized machinery.

- Telecommunications: Equipment for 5G base stations, networking devices, and communication infrastructure.

Value Chain Analysis For NAND Flash Memory Market

The value chain for the NAND Flash Memory market is a complex ecosystem involving multiple stages, from raw material sourcing to end-user consumption, each contributing significantly to the final product's cost and value. The upstream segment of the value chain is dominated by highly specialized industries, including suppliers of critical raw materials such as silicon wafers, rare earth elements, and various chemicals essential for semiconductor manufacturing. Alongside these, equipment manufacturers play a crucial role, providing advanced machinery for lithography, etching, deposition, and inspection processes that are indispensable for fabricating intricate NAND flash structures. These upstream providers require substantial R&D investments and possess highly specialized intellectual property, making them critical bottlenecks or enablers for innovation and production capacity.

Moving downstream, the value chain encompasses NAND flash die manufacturers (fabs) which convert silicon wafers into individual NAND flash chips. These chips are then typically assembled into various forms by module makers, such as solid-state drives (SSDs), memory cards (SD, microSD), and embedded multi-media cards (eMMC) or Universal Flash Storage (UFS) modules. These module makers often integrate proprietary controllers and firmware to optimize performance, endurance, and compatibility for specific applications. The final stage involves Original Equipment Manufacturers (OEMs), who incorporate these NAND-based storage solutions into their end products, ranging from smartphones, laptops, and enterprise servers to automotive systems and industrial equipment. This downstream integration is where the value of raw NAND flash is transformed into functional, marketable products for end-users.

Distribution channels for NAND Flash Memory products are diverse, encompassing both direct and indirect models. Direct distribution typically involves major NAND manufacturers selling directly to large OEMs or hyperscale cloud providers, particularly for high-volume orders of raw NAND dies or enterprise SSDs. This allows for direct negotiation, customized solutions, and closer collaboration on product development and supply chain management. Indirect channels, on the other hand, involve a network of distributors, wholesalers, and retailers who procure NAND flash products from manufacturers or module makers and then supply them to smaller OEMs, system integrators, or directly to consumers. E-commerce platforms also play an increasingly vital role in reaching a broad customer base, especially for consumer-grade SSDs and memory cards. The choice of distribution channel often depends on the product type, target market, and volume requirements, with a hybrid approach being common to maximize market penetration and efficiency.

NAND Flash Memory Market Potential Customers

The potential customers for NAND Flash Memory are incredibly diverse, spanning across nearly every sector of the modern digital economy due to the universal need for data storage. At the forefront are major Original Equipment Manufacturers (OEMs) in the consumer electronics segment, including global giants like Apple, Samsung, Huawei, Dell, HP, and Lenovo, who integrate vast quantities of NAND flash into their smartphones, tablets, laptops, and other devices. These OEMs are driven by consumer demand for higher storage capacities, faster performance, and sleek device form factors. The enterprise sector, comprising cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, along with large corporations operating their own data centers, represents another critical customer segment. These entities require high-end, reliable enterprise SSDs to manage massive data workloads, support virtualization, and power AI/ML applications, emphasizing endurance, consistent performance, and scalability.

Beyond traditional computing, the automotive industry has emerged as a rapidly growing segment of potential customers. Manufacturers like Tesla, BMW, Mercedes-Benz, and a multitude of Tier-1 suppliers increasingly rely on high-endurance, automotive-grade NAND flash memory to power advanced driver-assistance systems (ADAS), in-vehicle infotainment systems, navigation, and eventually autonomous driving platforms. These applications demand extreme reliability, wide operating temperature ranges, and long product lifecycles. Furthermore, the industrial sector, encompassing manufacturers of industrial PCs, factory automation equipment, surveillance systems, and specialized machinery, also represents a significant customer base. These users prioritize ruggedness, extended temperature support, and consistent long-term availability, often requiring customized NAND solutions tailored to harsh operating environments. The proliferation of IoT devices across smart cities, healthcare, and smart homes also broadens the customer base, as each connected device generates and processes data requiring local or edge storage solutions.

System integrators and value-added resellers (VARs) also serve as indirect, yet critical, customers, purchasing NAND flash products to build customized solutions for their clients across various industries. Additionally, even individual consumers are direct purchasers of NAND flash in the form of standalone SSDs for PC upgrades, USB flash drives, and memory cards for cameras and other devices. The demand from the telecommunications sector is also expanding, driven by the rollout of 5G infrastructure, which requires high-performance, non-volatile storage for network functions virtualization (NFV), edge computing nodes, and base station equipment. This broad spectrum of end-users and buyers, each with unique requirements regarding capacity, performance, endurance, and cost, underscores the pervasive influence of NAND flash memory and its central role in modern technological landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 72.3 Billion |

| Market Forecast in 2033 | USD 165.7 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics Co. Ltd., Kioxia Corporation, Western Digital Corporation, Micron Technology Inc., SK Hynix Inc., Intel Corporation, Yangtze Memory Technologies Corp (YMTC), Solidigm (SK Hynix subsidiary), Phison Electronics Corporation, Silicon Motion Technology Corporation, Marvell Technology Inc., Microchip Technology Inc., Realtek Semiconductor Corporation, GigaDevice Semiconductor Inc., Longsys Electronics Co. Ltd., Toshiba Memory Corporation, SanDisk (Western Digital subsidiary), Crucial (Micron subsidiary), SK hynix system ic, Macronix International Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

NAND Flash Memory Market Key Technology Landscape

The NAND Flash Memory market is at the forefront of semiconductor innovation, constantly pushing the boundaries of density, performance, and cost-efficiency through advancements in its core technology landscape. A pivotal development has been the widespread adoption and continuous evolution of 3D NAND technology, which involves vertically stacking layers of memory cells to overcome the scaling limitations of traditional 2D planar NAND. Manufacturers are relentlessly increasing the number of active layers (e.g., 100+ to 200+ layers), enabling higher capacities within the same or smaller footprint, significantly reducing the cost per gigabyte. This architectural shift is complemented by advancements in multi-level cell technologies, transitioning from SLC and MLC to more dense TLC and QLC NAND, with Penta-Level Cell (PLC) NAND on the horizon, each storing more bits per cell but requiring more sophisticated error correction and wear-leveling algorithms.

Beyond the memory array itself, the controller technology plays an equally critical role in optimizing NAND flash performance and longevity. Modern NAND controllers feature advanced error correction codes (ECC) such as LDPC (Low-Density Parity Check) to manage the increased error rates inherent in higher-density multi-level cell NAND. They also incorporate sophisticated wear-leveling algorithms, garbage collection, and caching mechanisms to maximize endurance and maintain consistent performance throughout the lifespan of the device. The transition to high-speed interfaces like NVMe (Non-Volatile Memory Express) has revolutionized SSD performance, dramatically reducing latency and increasing bandwidth compared to older SATA interfaces, making NAND flash suitable for high-demand applications like enterprise data centers, AI/ML workloads, and real-time analytics.

Furthermore, packaging technologies and integration methods are continuously evolving to meet diverse application requirements. This includes compact BGA (Ball Grid Array) packages for mobile and embedded applications (UFS, eMMC), and M.2 or U.2 form factors for client and enterprise SSDs. Emerging memory technologies, while not directly NAND flash, are also part of the broader memory landscape and influence NAND's trajectory. Technologies like CXL (Compute Express Link)-attached memory are explored to bridge the gap between CPU and storage, potentially creating new roles for NAND in hybrid memory systems. Research into next-generation non-volatile memories such as MRAM, ReRAM, and PCM continues, though NAND flash remains dominant for mass storage due to its unparalleled cost-effectiveness and mature ecosystem. These ongoing technological developments ensure NAND flash remains a dynamic and indispensable component in the digital age.

Regional Highlights

- North America: This region is a significant market for NAND Flash Memory, driven by its robust ecosystem of data centers, cloud computing infrastructure, and enterprise IT spending. The presence of major technology giants, extensive research and development activities in AI and machine learning, and the high adoption rate of advanced computing solutions contribute to strong demand for high-performance enterprise SSDs and specialized storage solutions.

- Europe: Europe represents a mature market with growing demand from the automotive sector for ADAS and infotainment systems, industrial automation, and expanding data center investments. The focus on digital transformation, IoT initiatives, and stringent data privacy regulations also influences the demand for secure and reliable NAND flash storage.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for NAND Flash Memory, primarily due to its dominance in semiconductor manufacturing, a massive consumer electronics production base (smartphones, laptops), and rapid expansion of data centers and cloud services, especially in China, South Korea, Japan, and Taiwan. The region also benefits from increasing disposable incomes and widespread adoption of mobile and connected devices.

- Latin America: This region is experiencing steady growth, fueled by increasing internet penetration, smartphone adoption, and developing digital infrastructure projects. While smaller in market size compared to APAC or North America, its potential for digital transformation across various industries presents emerging opportunities for NAND flash demand.

- Middle East and Africa (MEA): The MEA region is characterized by nascent but rapidly expanding digital economies, significant investments in smart city projects, and growing mobile connectivity. These factors contribute to an increasing demand for data storage solutions, making it an attractive, albeit smaller, growth market for NAND flash memory.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the NAND Flash Memory Market.- Samsung Electronics Co. Ltd.

- Kioxia Corporation

- Western Digital Corporation

- Micron Technology Inc.

- SK Hynix Inc.

- Intel Corporation

- Yangtze Memory Technologies Corp (YMTC)

- Solidigm (SK Hynix subsidiary)

- Phison Electronics Corporation

- Silicon Motion Technology Corporation

- Marvell Technology Inc.

- Microchip Technology Inc.

- Realtek Semiconductor Corporation

- GigaDevice Semiconductor Inc.

- Longsys Electronics Co. Ltd.

- Toshiba Memory Corporation

- SanDisk (Western Digital subsidiary)

- Crucial (Micron subsidiary)

- SK hynix system ic

- Macronix International Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the NAND Flash Memory market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is NAND Flash Memory and how does it differ from DRAM?

NAND Flash is a type of non-volatile storage that retains data even without power, used for mass storage in SSDs, smartphones, and memory cards. DRAM (Dynamic Random Access Memory) is volatile, requiring constant power to retain data, and is used for faster, temporary working memory in computers.

What are the primary applications driving the growth of the NAND Flash Memory market?

The market's growth is primarily driven by the increasing adoption of Solid-State Drives (SSDs) in client and enterprise computing, the rising demand for higher storage capacities in smartphones and other consumer electronics, and the expansion of cloud computing, AI, and automotive electronics.

What is 3D NAND and why is it important?

3D NAND is a technology that stacks memory cells vertically in multiple layers, significantly increasing storage density and overcoming the scaling limitations of older 2D planar NAND. This allows for higher capacities, improved performance, and lower cost per bit, making it crucial for modern storage solutions.

How do QLC and TLC NAND differ, and what are their typical uses?

TLC (Triple-Level Cell) NAND stores 3 bits per cell, offering a balance of capacity, performance, and cost, commonly found in mainstream SSDs and consumer devices. QLC (Quad-Level Cell) NAND stores 4 bits per cell, providing even higher density and lower cost per bit, making it ideal for bulk storage, read-intensive applications, and large data archives.

What impact does Artificial Intelligence (AI) have on the NAND Flash Memory market?

AI significantly boosts demand for NAND Flash Memory by requiring vast amounts of high-performance, low-latency storage for training large datasets and facilitating inference. This drives the need for enterprise-grade SSDs and propels innovation in NAND architectures and controllers to meet AI-specific workload demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Nand Flash Memory Market Size Report By Type (SLC (One-Bit Per Cell), MLC (Two-Bit Per Cell), TLC (Three-Bit Per Cell), QLC (Quad Level Cell)), By Application (Smartphone, SSD, Memory Card, Tablet, Other Applications), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Flash Memory Market Size Report By Type (NAND Flash Memory (Universal Serial Bus (USB) drives, Hard Disk Drives (HDDs), Solid State Drives (SDDs)), NOR Flash Memory), By Application (Tablets and PC, Smartphones, Handheld media player devices, solid state drives (SSD), Others (DSC Digital Still Camera)), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Nand Flash Memory Market Size Report By Type (SLC NAND, MLC NAND, TLC NAND, QLC NAND), By Application (Smartphone, SSD, Memory Card, Tablet, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- NAND Flash Memory and DRAM Market Statistics 2025 Analysis By Application (Smartphone, PC, SSD, Digital TV), By Type (NAND Flash Memory, DRAM), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- NAND Flash Memory Market Statistics 2025 Analysis By Application (PC, SSD, Consumer Electronics), By Type (TLC NAND, MLC NAND, SLC NAND, QLC NAND), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager