Nanocrystalline Ribbons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435760 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Nanocrystalline Ribbons Market Size

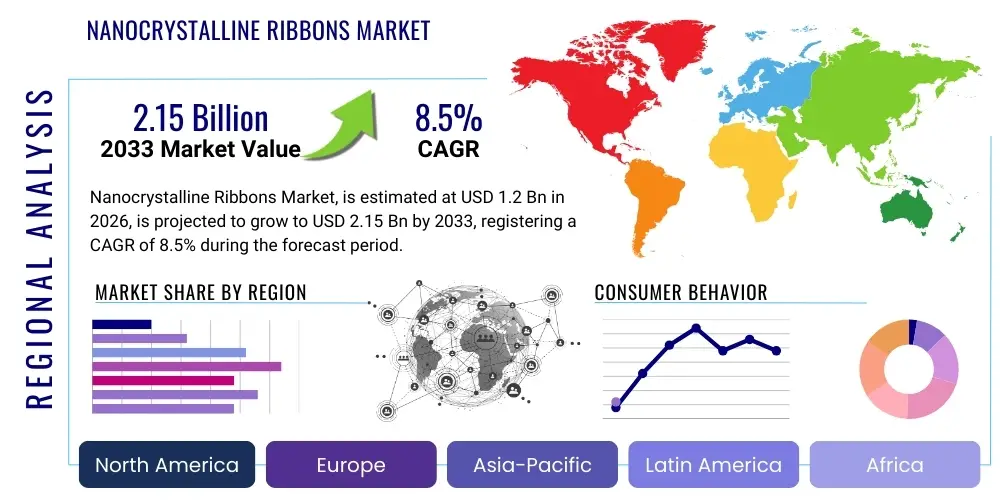

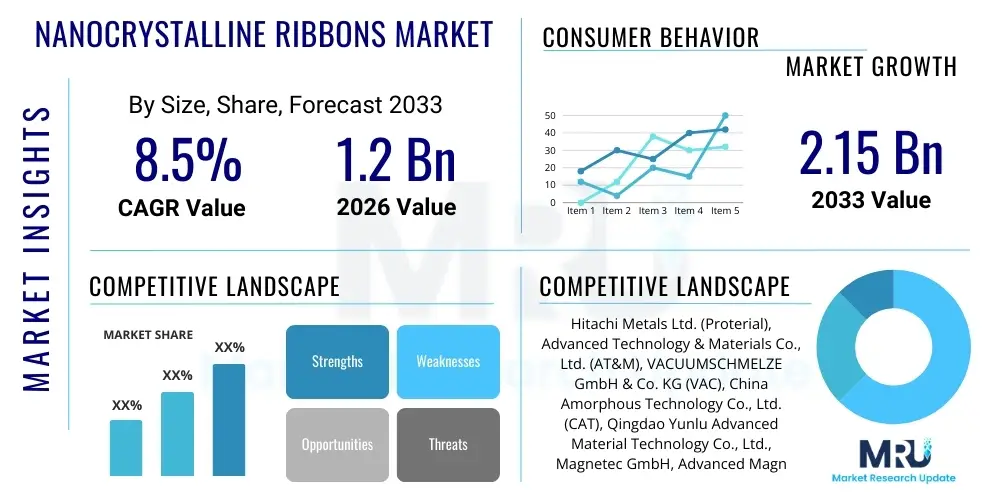

The Nanocrystalline Ribbons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.15 Billion by the end of the forecast period in 2033.

Nanocrystalline Ribbons Market introduction

Nanocrystalline ribbons represent an advanced class of soft magnetic materials characterized by their exceptionally fine grain structure, typically measuring less than 100 nanometers. These materials are fabricated primarily through rapid solidification techniques, such as melt spinning, which yield amorphous metallic ribbons that are subsequently annealed to achieve a highly refined nanocrystalline structure. This unique microstructural configuration imparts superior magnetic properties, including high saturation magnetic induction, extremely low core losses, and high permeability, particularly at high frequencies. Unlike conventional silicon steels or ferrites, nanocrystalline alloys, predominantly based on iron (Fe), silicon (Si), boron (B), and trace elements like niobium (Nb) and copper (Cu), offer unparalleled energy efficiency, making them critical components in modern electrical and electronic systems.

The primary applications of nanocrystalline ribbons span across numerous high-reliability sectors requiring optimal magnetic performance and minimal energy dissipation. They are extensively utilized in power electronics, including the manufacturing of high-frequency transformers, common mode chokes, inductive components for switching power supplies, and magnetic shielding solutions. A significant driver for market adoption is the global push toward energy conservation, particularly in electric vehicles (EVs), renewable energy infrastructure (solar inverters), and high-efficiency power distribution systems. Their ability to operate efficiently under elevated temperatures and high frequencies gives them a distinct advantage over amorphous metals and traditional soft magnetic alloys, positioning them as essential materials for technological advancement in power management.

The core benefits derived from integrating nanocrystalline ribbons include significant reduction in size and weight of electronic devices due to higher power density capabilities, coupled with enhanced operational longevity and reduced heat generation. Driving factors propelling this market include stringent regulatory standards mandating energy efficiency in electronic devices, rapid expansion of the electric vehicle market requiring high-performance magnetic components for charging and drive systems, and the increasing complexity of data centers demanding highly efficient power supplies. Furthermore, ongoing research focused on reducing material costs and optimizing annealing processes continues to broaden the accessibility and applicability of these sophisticated magnetic materials across various industrial and consumer electronics domains.

Nanocrystalline Ribbons Market Executive Summary

The Nanocrystalline Ribbons Market is entering a period of robust expansion, driven primarily by fundamental shifts in global energy and power electronics industries. Business trends highlight a strong industry focus on optimizing manufacturing scalability, particularly through continuous melt-spinning techniques, and developing proprietary alloy compositions that further enhance high-frequency performance and thermal stability. Leading market players are strategically investing in vertical integration to control raw material sourcing and subsequent annealing processes, ensuring consistent quality required for critical applications like automotive traction systems and high-end consumer electronics. The shift from traditional amorphous metals to nanocrystalline variants is accelerating due to the latter's superior saturation flux density and lower hysteresis losses, thereby offering substantial performance upgrades in compact systems.

Regional trends indicate that the Asia Pacific (APAC) region, spearheaded by China, Japan, and South Korea, maintains dominance in both production and consumption, primarily due to the concentration of major electronics manufacturing, electric vehicle production, and renewable energy installation hubs. Europe and North America, while having established manufacturing bases, are experiencing high demand driven by stringent energy efficiency regulations (e.g., EU Ecodesign directives) and significant investment in smart grid infrastructure and electric mobility. These regions focus intensely on premium, highly customized nanocrystalline components for specialized industrial and aerospace applications, often demanding materials with specific coercivity and permeability characteristics that align with extreme operational environments.

Segment trends confirm that the application segment is dominated by high-frequency transformers and inductors, reflecting the pervasive need for efficient power conversion across all sectors. Material segmentation shows that Fe-based nanocrystalline ribbons constitute the largest market share owing to their balance of performance and cost-effectiveness, although Co-based ribbons are crucial in niche applications requiring high-temperature stability or specific magnetic responses. The end-use segments demonstrate accelerating growth in the automotive sector, attributed to the proliferation of battery electric vehicles (BEVs) and hybrid electric vehicles (HEVs) which rely heavily on these components for on-board chargers, DC-DC converters, and motor control electronics. This diversification across high-growth end-uses ensures the market's sustained stability and resilience against cyclical fluctuations in any single industrial sector.

AI Impact Analysis on Nanocrystalline Ribbons Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Nanocrystalline Ribbons Market frequently center on themes of material discovery, manufacturing optimization, and predictive performance modeling. Users are keen to understand how AI-driven algorithms can accelerate the identification of novel alloy compositions that might yield even better magnetic properties or reduce reliance on expensive rare earth elements. Furthermore, a substantial number of inquiries relate to leveraging AI and Machine Learning (ML) to refine the highly sensitive annealing process—the critical step that transforms amorphous ribbons into their nanocrystalline state—to minimize defects, maximize consistency, and optimize energy usage during production. The collective user expectation is that AI will move the market beyond incremental improvements toward radical material innovation and significantly enhanced production yields, directly impacting cost and quality.

The implementation of AI/ML models is fundamentally transforming the R&D pipeline within the nanocrystalline materials sector. Predictive simulations based on machine learning can analyze vast datasets of material parameters, processing conditions, and resulting magnetic performance to suggest optimized formulations that human researchers might overlook. This drastically reduces the time and cost associated with traditional trial-and-error experimentation. Furthermore, in manufacturing, AI-powered quality control systems, utilizing advanced sensor fusion and image recognition, monitor the melt-spinning process in real-time. These systems can immediately detect anomalies in ribbon thickness, surface texture, or cooling rate, adjusting process parameters dynamically to maintain the tight tolerances required for high-performance magnetic cores, thereby increasing material yield and reducing waste.

The impact extends to the operational efficiency and customization capabilities of nanocrystalline ribbon suppliers. AI tools are being deployed for demand forecasting across various demanding sectors like automotive and aerospace, allowing manufacturers to optimize inventory and production schedules for highly specialized products. Moreover, deep learning algorithms are used in component design simulation, where engineers can input specific application requirements (e.g., frequency range, temperature profile, required saturation flux) and the AI rapidly generates optimal core geometries and material specifications utilizing nanocrystalline alloys. This capability allows for unprecedented customization and faster time-to-market for high-density power solutions, solidifying AI's role as a technological enabler for market growth.

- AI accelerates the discovery and optimization of novel nanocrystalline alloy compositions.

- Machine learning models enhance process control during melt spinning and subsequent annealing, ensuring material uniformity.

- Predictive maintenance driven by AI minimizes equipment downtime and optimizes energy consumption in production facilities.

- AI-based simulation tools allow for rapid design optimization of magnetic components (e.g., transformers, inductors) using nanocrystalline cores.

- Data analytics driven by AI improves supply chain resilience and accurate demand forecasting across key end-use sectors.

DRO & Impact Forces Of Nanocrystalline Ribbons Market

The Nanocrystalline Ribbons Market is influenced by a dynamic interplay of factors that both accelerate adoption and pose inherent challenges to sustained growth. Key drivers include the global energy efficiency mandates, particularly those affecting power supplies, consumer electronics, and renewable energy systems, which favor the ultra-low core losses inherent in nanocrystalline materials. The unprecedented growth in the Electric Vehicle (EV) industry acts as a powerful catalyst, as EVs require compact, efficient, and reliable magnetic components for on-board charging systems and power conversion units that manage battery energy. These strong demand drivers are amplified by the trend towards miniaturization in electronics, where nanocrystalline materials facilitate higher power densities in smaller physical footprints, addressing the constraints of modern device design.

However, the market faces significant restraints primarily centered around manufacturing complexity and cost. The melt-spinning process requires high precision and capital expenditure, leading to higher initial material costs compared to conventional soft magnetic materials like ferrites or traditional amorphous metals. Furthermore, the specialized annealing process necessary to induce the nanocrystalline structure is highly sensitive to temperature and time, contributing to production complexities and potentially limiting scalability for extremely high-volume, low-cost applications. Another limiting factor is the relative lack of awareness and standardized design guidelines in some traditional engineering sectors, hindering rapid displacement of established magnetic materials where cost is prioritized over peak performance.

Despite these restraints, substantial opportunities exist, particularly in the development of flexible electronics and advanced sensor technologies, where the unique physical and magnetic properties of nanocrystalline ribbons can be leveraged. The expansion of 5G infrastructure and associated telecommunication equipment demands high-frequency, low-loss magnetic components, creating a substantial new avenue for growth. The core impact force shaping the market trajectory is the increasing societal and regulatory pressure for decarbonization and energy system optimization. This pressure compels manufacturers and engineers across the electrical spectrum to adopt the most efficient magnetic materials available, thereby positioning nanocrystalline ribbons as a foundational technology for future energy systems, ensuring that performance and efficiency considerations increasingly outweigh initial cost concerns in high-value applications.

Segmentation Analysis

The Nanocrystalline Ribbons Market is comprehensively segmented based on material composition, application, and end-use industry, providing a granular view of market dynamics and adoption patterns. Analyzing these segments helps stakeholders understand which areas exhibit the highest growth potential and where technological innovation is most concentrated. The material segmentation, differentiating between Fe-based and Co-based ribbons, is crucial as Fe-based materials dominate due to their cost-effectiveness and high saturation induction, while Co-based ribbons cater to niche applications demanding superior thermal stability and lower magnetostriction. The application segmentation, spanning transformers, chokes, and sensors, illustrates the broad functional utility across various electronic systems, with power conversion applications remaining the dominant revenue stream.

The largest growth driver within segmentation is the end-use industry, specifically the automotive sector. This segment includes electric vehicles (BEVs, PHEVs) and autonomous systems, where the ribbons are essential for high-performance DC-DC converters, electric motor power control units, and robust noise suppression chokes. The necessity for these vehicles to manage high power levels efficiently while maintaining lightweight characteristics makes nanocrystalline ribbons indispensable. Furthermore, the industrial segment, which includes solar inverters, welding machines, and uninterruptible power supplies (UPS), is steadily expanding due to the global shift toward cleaner energy sources and the modernization of industrial power infrastructure, all of which require highly efficient and reliable magnetic components.

Understanding the interplay between these segments is vital for strategic planning. For instance, the demand for compact, high-frequency inductors (Application segment) directly translates into increased consumption by the Consumer Electronics (End-Use segment) and Automotive (End-Use segment) sectors. Future market opportunities are also heavily reliant on advancements in processing technology (Material segment), particularly efforts to further reduce core losses at extremely high operating frequencies, a requirement driven by emerging technologies like Gallium Nitride (GaN) and Silicon Carbide (SiC) based power semiconductors. This ongoing technological push ensures that nanocrystalline ribbons remain at the forefront of power electronic material science.

- Material Type

- Fe-based Nanocrystalline Ribbons (Dominant market share due to cost efficiency and high saturation)

- Co-based Nanocrystalline Ribbons (Used for specialized applications requiring zero magnetostriction or high temperature stability)

- Application

- High-Frequency Transformers and Inductors (Primary application in power conversion)

- Common Mode Chokes and Filters (Essential for noise suppression and electromagnetic compatibility)

- Magnetic Sensors and Cores

- Magnetic Shielding (Used in sensitive environments)

- End-Use Industry

- Automotive (Electric Vehicles, On-board Chargers, Traction Systems)

- Industrial (Solar Inverters, Welding Equipment, UPS Systems)

- Consumer Electronics (Adapters, Power Supplies, Chargers)

- Telecommunications (5G Base Stations, Data Centers)

- Aerospace and Defense (High-reliability power systems)

Value Chain Analysis For Nanocrystalline Ribbons Market

The value chain for the Nanocrystalline Ribbons Market begins with the upstream procurement of raw materials, primarily high-purity iron, silicon, boron, and trace alloying elements like niobium and copper. This stage is crucial as the purity and precise composition of these raw materials directly dictate the final magnetic properties and crystalline structure of the ribbon. Suppliers in this segment, often large metallurgical firms, must meet rigorous standards. Manufacturing follows, encompassing the highly specialized processes of alloy melting, rapid solidification via melt spinning to form the amorphous ribbon precursor, and the subsequent critical annealing step to induce the desired nanocrystalline structure. Efficiency and quality control during the manufacturing stage are paramount, as slight variations in cooling rate or annealing temperature can dramatically affect the ribbon’s performance, leading to the formation of specialized intellectual property regarding process optimization.

The midstream of the value chain involves the processing and conversion of the raw nanocrystalline ribbons into usable magnetic cores. This includes cutting, stacking, or winding the ribbon into toroidal, gap, or C-cores required for transformers and inductors. Component manufacturers and fabricators must possess precise winding and handling capabilities to prevent physical damage to the delicate ribbons, which could compromise their magnetic integrity. These fabricated cores are then supplied either directly to major Original Equipment Manufacturers (OEMs) or through specialized electronic component distributors. The distribution channel is often hybrid; direct sales dominate for high-volume automotive and industrial customers requiring technical collaboration, while indirect sales through technical distributors cater to smaller batch requirements and broader electronics markets.

The downstream segment involves the integration of these magnetic cores into final products across key end-use industries, such as electric vehicle powertrains, solar power inverters, and high-frequency communication devices. This stage requires extensive technical support and collaboration between the core manufacturer and the end-user to ensure optimal electromagnetic integration and performance within the final system. The direct channel facilitates rapid feedback loops essential for continuous product improvement and customization, particularly critical in the fast-evolving EV sector. The indirect distribution channel leverages the distributor's inventory and regional logistics network, ensuring broad market reach and timely delivery of standardized components, thus balancing specialized needs with widespread accessibility and forming a resilient and technically demanding value chain.

Nanocrystalline Ribbons Market Potential Customers

Potential customers for Nanocrystalline Ribbons are overwhelmingly concentrated in sectors characterized by a high demand for energy efficiency, high-frequency operation, and miniaturization of power components. The primary and fastest-growing customer segment is the automotive industry, specifically manufacturers of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs). These companies require robust, lightweight, and highly efficient magnetic components for on-board chargers (OBCs), DC-DC converters that step down high battery voltage, and filtering chokes within the motor drive systems. As the shift to high-voltage battery systems (800V) accelerates, the need for nanocrystalline materials capable of handling elevated power density without excessive thermal loss increases substantially, making these automotive OEMs critical long-term buyers.

The second major category of buyers is the industrial power electronics sector, including manufacturers of solar and wind power inverters, uninterruptible power supplies (UPS), and large industrial welding equipment. In solar applications, nanocrystalline cores significantly boost the efficiency and reliability of grid-tie inverters by minimizing switching losses at high frequencies, thereby maximizing energy harvest. Manufacturers focusing on industrial automation and robotics also utilize these ribbons for compact and precise power supplies essential for motor control and sensing applications. For these industrial customers, reliability and long operational lifespan are paramount, prioritizing the superior magnetic stability of nanocrystalline materials over cheaper, less robust alternatives.

A third significant customer segment includes manufacturers of sophisticated consumer electronics and telecommunication infrastructure. This involves producers of high-efficiency laptop chargers, compact power adapters, and most importantly, equipment for 5G base stations and data center power supplies. Data centers consume vast amounts of electricity, driving continuous innovation toward highly efficient power conversion modules, making them persistent and high-volume consumers of nanocrystalline materials for power inductors and filtering chokes. In essence, any buyer whose product performance is fundamentally constrained by energy loss, size, or weight in power conversion stages represents a high-potential customer for nanocrystalline ribbon technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.15 Billion |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals Ltd. (Proterial), Advanced Technology & Materials Co., Ltd. (AT&M), VACUUMSCHMELZE GmbH & Co. KG (VAC), China Amorphous Technology Co., Ltd. (CAT), Qingdao Yunlu Advanced Material Technology Co., Ltd., Magnetec GmbH, Advanced Magnetic Materials Technology Co., Ltd. (AMM), Foshan Huaxin Industrial Co., Ltd., Chengdu Galaxy Magnet Co., Ltd., MK Magnetics, Inc., Toshiba Materials Co., Ltd., TDK Corporation, Fuji Electric Co., Ltd., Bomatec AG, Changzhou Powerway Advanced Material Co., Ltd., Metglas Inc., JFE Steel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nanocrystalline Ribbons Market Key Technology Landscape

The technological landscape of the Nanocrystalline Ribbons Market is defined by continuous advancements in rapid solidification processes, primarily melt spinning, and subsequent thermal treatments. Melt spinning involves rapidly cooling molten metallic alloys at rates exceeding 105 Kelvin per second, resulting in a thin, continuous ribbon with an amorphous, non-crystalline structure. This highly specialized process requires precise control over nozzle geometry, melt delivery, and copper wheel speed to ensure uniform ribbon thickness and composition, critical factors for subsequent magnetic performance. Recent technological innovations focus on increasing the width of the produced ribbons and enhancing throughput speed, directly addressing scalability and cost reduction challenges inherent in the manufacturing process, moving the technology closer to widespread adoption in high-volume applications.

The core technological differentiator lies in the thermal annealing process, which transforms the initial amorphous structure into the final nanocrystalline state. This step is a carefully controlled heat treatment designed to promote the nucleation and growth of extremely fine crystallites (typically 5-30 nm) within the residual amorphous matrix. The addition of trace elements, such as Niobium (Nb) and Copper (Cu), plays a critical catalytic role, hindering the growth of coarse grains and ensuring a fine, homogeneous nanocrystalline structure, which is crucial for achieving low core loss and high permeability. Manufacturers utilize highly controlled atmosphere furnaces and precise temperature profiles to manage this transformation, with proprietary temperature-time curves often constituting valuable intellectual property.

Beyond the fundamental ribbon production, the technology landscape also includes advancements in core fabrication and integration. This involves specialized cutting and winding equipment designed to handle the brittle nature of the ribbons without inducing stress or deformation, which could degrade magnetic properties. Furthermore, the integration of nanocrystalline materials is increasingly intertwined with the adoption of wide-bandgap (WBG) semiconductors like Silicon Carbide (SiC) and Gallium Nitride (GaN). Since SiC and GaN operate at much higher frequencies than traditional silicon devices, they necessitate magnetic components with minimal high-frequency losses—a requirement perfectly met by the unique magnetic soft properties of nanocrystalline ribbons, solidifying their status as a complementary and necessary technology for next-generation power electronics.

Regional Highlights

Regional analysis reveals significant variation in the consumption and production of nanocrystalline ribbons, driven by localized industrial demands and regulatory environments. The Asia Pacific (APAC) region stands as the dominant market, both in manufacturing capability and end-use consumption. China, Japan, and South Korea are central to this dominance due to their massive production bases for consumer electronics, electric vehicles, and renewable energy components. China, in particular, benefits from strong governmental support for local materials science and advanced manufacturing, leading to substantial investment in large-scale production facilities. The demand here is driven by the rapid deployment of solar farms and the world's largest electric vehicle market, necessitating high volumes of efficient power components. Japan and South Korea focus on high-quality, high-reliability nanocrystalline cores used in sophisticated industrial machinery and premium automotive applications, contributing significantly to innovation in alloy technology.

Europe represents a highly mature market characterized by stringent energy efficiency standards and a strong focus on industrial automation and electric mobility. Regulations such as the EU Ecodesign directives heavily incentivize the adoption of high-efficiency materials like nanocrystalline ribbons in transformers and power supplies. Germany, France, and the UK are key consumers, driven by their established automotive manufacturing sectors and significant investments in smart grid technology. European companies are known for producing highly customized, high-performance nanocrystalline cores tailored for niche applications in aerospace and specialized industrial machinery, placing a high value on material performance over base cost.

North America, particularly the United States, is a rapidly accelerating market for nanocrystalline ribbons. Demand is fueled by massive investments in infrastructure modernization, expansion of data centers, and the growing domestic electric vehicle manufacturing capacity. The shift in regulatory focus toward grid reliability and energy independence mandates the use of highly efficient power conversion systems, boosting consumption in the industrial and telecommunications sectors. Manufacturers in this region often focus on developing advanced magnetic shielding applications and high-frequency components for specialized defense and aerospace use, leveraging their sophisticated research capabilities to push the material's performance limits. While production volume may be lower than in APAC, the value associated with high-performance, customized components remains exceptionally high, positioning North America as a vital innovation hub.

- Asia Pacific (APAC): Dominant market in terms of volume and production capacity, driven by high demand from EV manufacturing, solar energy deployment, and consumer electronics production in China and South Korea.

- Europe: Mature market with demand anchored by stringent energy efficiency regulations, industrial automation, and high-quality electric vehicle manufacturing, particularly in Germany and France.

- North America: Rapid growth driven by infrastructure investment, data center expansion, and increasing domestic EV production, with a focus on high-reliability applications and aerospace/defense technology.

- Latin America (LATAM): Emerging market potential linked to regional electrical grid modernization and gradual adoption of renewable energy projects, though currently relies heavily on imported components.

- Middle East and Africa (MEA): Growth primarily tied to energy infrastructure development, including oil and gas sector power management and localized renewable energy projects, exhibiting steady, focused adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nanocrystalline Ribbons Market.- Hitachi Metals Ltd. (Proterial)

- VACUUMSCHMELZE GmbH & Co. KG (VAC)

- Advanced Technology & Materials Co., Ltd. (AT&M)

- China Amorphous Technology Co., Ltd. (CAT)

- Qingdao Yunlu Advanced Material Technology Co., Ltd.

- Magnetec GmbH

- Advanced Magnetic Materials Technology Co., Ltd. (AMM)

- Foshan Huaxin Industrial Co., Ltd.

- Chengdu Galaxy Magnet Co., Ltd.

- MK Magnetics, Inc.

- Toshiba Materials Co., Ltd.

- TDK Corporation

- Fuji Electric Co., Ltd.

- Bomatec AG

- Changzhou Powerway Advanced Material Co., Ltd.

- Metglas Inc.

- JFE Steel Corporation

- Delta Electronics, Inc. (Component Division)

- Sumitomo Metal Mining Co., Ltd.

- Santoku Chemical Industries Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Nanocrystalline Ribbons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Nanocrystalline Ribbons over traditional magnetic materials?

Nanocrystalline ribbons offer significantly lower core losses and higher permeability compared to ferrites and traditional amorphous metals, particularly at high switching frequencies. This enables greater energy efficiency, higher power density, and reduced component size, crucial for modern power electronics in EVs and renewable energy systems.

How is the growth of the Electric Vehicle (EV) sector impacting the Nanocrystalline Ribbons Market?

The EV sector is the most substantial growth driver, necessitating high-performance magnetic components for on-board chargers, DC-DC converters, and motor inverters. Nanocrystalline materials are critical because they maintain efficiency under high power and temperature conditions, directly supporting the push for longer EV range and faster charging capabilities.

Which regions dominate the production and consumption of Nanocrystalline Ribbons?

The Asia Pacific (APAC) region, led by China, Japan, and South Korea, dominates both the production and consumption of nanocrystalline ribbons. This is primarily due to the concentration of global manufacturing for consumer electronics, electric vehicles, and solar energy infrastructure in these countries.

What are the key technical challenges facing manufacturers of Nanocrystalline Ribbons?

Key challenges include the high capital expenditure required for precise melt spinning equipment, the complexity and high cost of the controlled thermal annealing process, and the ongoing need to reduce material costs while maintaining superior magnetic performance and scalability for mass production.

In what applications are Fe-based and Co-based Nanocrystalline Ribbons typically used?

Fe-based ribbons are the market standard, used widely in high-frequency transformers and common mode chokes due to their high saturation induction and cost-effectiveness. Co-based ribbons are reserved for specialized applications demanding near-zero magnetostriction or operation in extreme temperature environments, such as high-precision sensors or aerospace components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Iron-Based Nanocrystalline Ribbons Market Size Report By Type (Vertical magnetic field annealing Type, Ordinary annealing, Transverse magnetic field annealing Type), By Application (High Frequency Transformers Cores, Current Transformer Cores, EMC Common Mode, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Cobalt Based Nanocrystalline Ribbons Market Statistics 2025 Analysis By Application (Distribution Transformer, Electric Machinery, Electronic Components), By Type (Broadband Ribbon Type, Narrow Ribbon Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager