Nanoimprint Lithography Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435724 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Nanoimprint Lithography Equipment Market Size

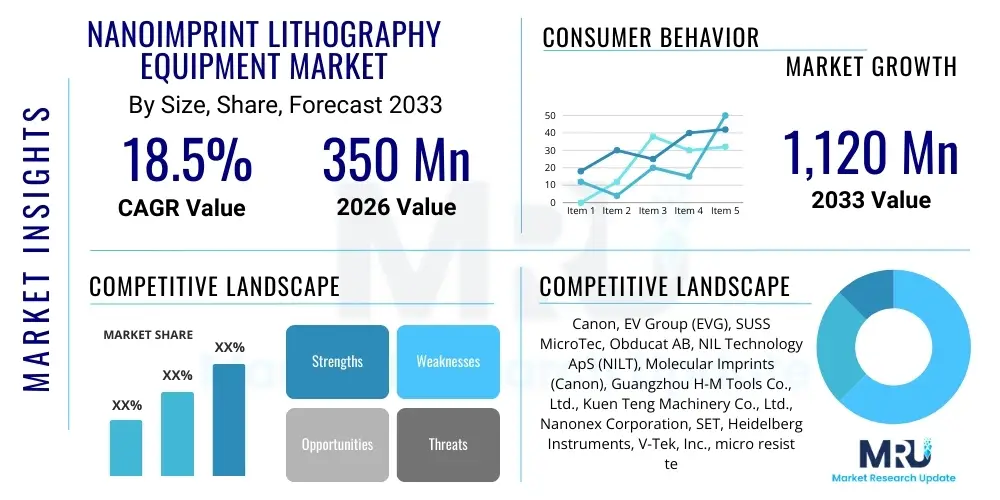

The Nanoimprint Lithography Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 1,120 Million by the end of the forecast period in 2033.

Nanoimprint Lithography Equipment Market introduction

The Nanoimprint Lithography (NIL) Equipment Market encompasses advanced manufacturing systems designed for replicating nanoscale patterns onto substrate materials. NIL is a promising alternative to traditional photolithography, particularly for high-volume, low-cost patterning of features below 50 nm. These equipment pieces utilize mechanical deformation of a resist layer using a rigid or flexible mold (stamp) under controlled temperature and pressure conditions, allowing for extremely high-resolution replication with reduced complexity and energy consumption compared to deep ultraviolet (DUV) lithography. The core technology provides inherent advantages in critical dimensions (CD) control and pattern transfer fidelity, crucial for next-generation devices.

Key products within this market include systems categorized by their curing mechanism, such as Ultraviolet Nanoimprint Lithography (UV-NIL) systems, which use UV light to cure the resist, and Thermal Nanoimprint Lithography (T-NIL) systems, which rely on elevated temperatures to soften the resist material before stamping. Major applications span high-density semiconductor device fabrication, advanced displays (OLED, microLED), specialized micro-electro-mechanical systems (MEMS), and optical components like diffractive optical elements (DOEs) and waveguides. The adoption is driven by the necessity for precise, cost-effective nanoscale manufacturing in areas where traditional lithography methods face complexity or cost limitations, particularly concerning high aspect ratio features and non-conventional geometries.

The primary benefits of adopting NIL equipment include significant cost reduction per wafer, high throughput potential, ability to define complex 3D structures, and energy efficiency. Driving factors include the persistent demand for miniaturization in consumer electronics, the proliferation of photonics and augmented reality (AR) devices requiring sophisticated optical elements, and the ongoing shift towards advanced packaging technologies (e.g., heterogeneous integration) in the semiconductor sector. Furthermore, the inherent simplicity of the pattern transfer mechanism positions NIL as a scalable solution for emerging applications such as bio-sensing platforms and anti-reflective coatings.

Nanoimprint Lithography Equipment Market Executive Summary

The Nanoimprint Lithography (NIL) Equipment Market is experiencing robust growth fueled by technological advancements that enhance resolution and throughput, positioning NIL as a disruptive force in nanoscale manufacturing, particularly below the 20 nm node. Business trends highlight strategic collaborations between equipment manufacturers and materials suppliers to optimize resist performance and stamp longevity, accelerating industrial adoption beyond research labs into mass production environments, especially within specialized semiconductor foundry services and the photonics industry. Regional trends indicate that the Asia Pacific (APAC) region dominates market share due to the concentration of major semiconductor fabrication facilities (fabs), display panel manufacturers, and a high volume of consumer electronics production, while North America and Europe focus heavily on R&D and specialized high-precision applications like aerospace sensors and advanced medical devices. Segment trends reveal that the UV-NIL segment maintains leadership due to its applicability in high-resolution, low-temperature processing crucial for display manufacturing and compound semiconductor patterning, while the semiconductor application segment commands the largest revenue share, driven by the increasing integration of NIL processes for patterning spacer layers, molds for etching, and forming contact holes in memory devices.

Market expansion is significantly driven by the increasing penetration of 3D sensing technology, which relies heavily on NIL for fabricating microlens arrays and diffractive optics, leading to substantial investments in high-throughput cluster tools capable of 300 mm wafer processing. The competitive landscape is moderately consolidated, with key players focusing on offering fully automated systems integrated with inspection and defect control modules, addressing long-standing concerns regarding stamp alignment and contamination. Furthermore, the market is seeing a growing emphasis on Soft-NIL techniques, particularly relevant for flexible electronics and roll-to-roll processing, catering to the burgeoning demand for bendable displays and wearable technology. These integrated segment and regional dynamics underscore a market transitioning from niche application to an essential complementary technology in the advanced microfabrication ecosystem.

The future outlook for NIL equipment involves overcoming challenges related to defect density control at production scale and ensuring the long-term economic viability against conventional deep ultraviolet lithography tools. However, the compelling cost-of-ownership advantages, especially in non-critical layers or applications requiring highly structured surfaces, continue to attract investment. The focus remains on standardization of processes, particularly the harmonization of resist chemistry and stamp manufacturing tolerances, which will be vital for broader industrial adoption across diverse end-use sectors including automotive lighting and specialized bio-chips, reinforcing the market’s projected double-digit CAGR through 2033.

AI Impact Analysis on Nanoimprint Lithography Equipment Market

Users frequently inquire about how Artificial Intelligence (AI) can mitigate the persistent challenges of defect control, process variability, and throughput optimization inherent in Nanoimprint Lithography (NIL). Key themes revolve around AI's ability to enhance real-time metrology, predict stamp wear and tear, and automate alignment procedures, which are traditionally bottlenecks in high-volume NIL manufacturing. Concerns often focus on the data requirements necessary to train robust AI models for complex nanoscale patterning processes. Expectations center on AI-driven systems providing predictive maintenance for critical components like stamp holders and chucks, significantly improving the yield rates currently achievable. Furthermore, users anticipate that AI will facilitate optimal process parameter tuning (pressure, temperature, exposure time) based on wafer characteristics and environmental conditions, transforming NIL from a highly specialized, manual process into a highly reliable and autonomous fabrication technique, ultimately lowering the cost of ownership and accelerating NIL adoption in commercial fabs.

- AI enhances real-time defect inspection and classification using computer vision algorithms, drastically improving yield.

- Predictive maintenance schedules for stamps and modules are optimized by AI analysis of usage patterns and material stress data.

- Automated alignment corrections utilize machine learning to compensate for environmental drift and substrate irregularities instantly.

- AI-driven process optimization dynamically tunes imprinting parameters (e.g., pressure profiles) based on layer stack and resist properties.

- Simulation and modeling capabilities are accelerated, allowing faster design iterations for complex NIL stamps and resists.

DRO & Impact Forces Of Nanoimprint Lithography Equipment Market

The Nanoimprint Lithography (NIL) Equipment Market is fundamentally shaped by a confluence of technological drivers, structural restraints, and strategic opportunities, creating a complex array of impact forces. The primary drivers include the escalating need for cost-effective manufacturing of high-resolution structures below 50 nm, particularly for advanced optical components used in AR/VR headsets and 3D sensing modules. NIL’s inherent ability to replicate complex 3D geometries with high fidelity, coupled with its lower capital expenditure compared to cutting-edge DUV or EUV tools, makes it highly attractive for specialized foundry operations. However, significant restraints impede widespread adoption, notably the persistent challenges related to defect density control—specifically trapped air bubbles, particulate contamination, and pattern damage during stamp separation. These defects severely impact production yield, particularly for critical layers in leading-edge semiconductor chips, necessitating rigorous process monitoring and cleanroom standards.

Opportunities for market expansion lie predominantly in emerging application areas, such as the fabrication of complex grating structures for photonics integrated circuits (PICs), large-area patterning for flexible displays, and specialized bio-medical devices requiring highly structured surfaces (e.g., microfluidics). The development of next-generation stamp materials (e.g., low-adhesion coatings, high-durability quartz) and specialized imprint resists that allow for faster release cycles and reduced sticking are key areas leveraging these opportunities. Strategic impact forces include the fierce competition from established photolithography technologies, which continue to extend their capabilities through complex techniques like multi-patterning, though at increasingly prohibitive costs. Furthermore, geopolitical shifts influencing global semiconductor supply chains are encouraging regional investments in specialized fabrication capabilities, often favoring cost-effective solutions like NIL for specific device architectures.

The long-term impact forces hinge on achieving complete process standardization and scalability. If equipment manufacturers can successfully integrate advanced metrology and automated defect management into their tools, addressing current yield concerns, NIL is poised to capture a substantial share of the non-critical patterning market, particularly in high-growth areas like memory and advanced packaging. Conversely, failure to standardize materials and processes could relegate NIL primarily to niche optical and display applications, restraining its potential in mainstream semiconductor manufacturing. Government funding for nanomanufacturing research in regions like APAC and Europe acts as a significant positive impact force, accelerating technology maturation and pilot production studies.

Segmentation Analysis

The Nanoimprint Lithography Equipment market is segmented based on critical technical and commercial attributes, providing a granular view of market dynamics. Primary segmentation revolves around the core technology employed, reflecting distinct curing and pattern transfer mechanisms that cater to different substrate materials and process requirements. Further segmentation based on application reveals the end-use sectors driving current and future demand, with semiconductor and advanced optical devices dominating investment. Understanding these segments is crucial as different application areas require highly specialized NIL tool configurations, ranging from high-pressure thermal systems to low-contact force UV-curing apparatus. This segmented structure allows manufacturers to tailor equipment specifications—such as wafer size compatibility, alignment accuracy, and throughput—to meet the exacting standards of specific end-user environments, ensuring optimal cost-of-ownership and performance.

The market structure is highly dependent on the intersection of technology and application. For instance, high-volume manufacturing of diffraction gratings for augmented reality (AR) lenses typically requires UV-NIL due to its high resolution and low process temperature, whereas research institutions experimenting with novel polymer structures often utilize Thermal NIL for its material versatility. Geographically, segmentation highlights the dominance of Asia Pacific due to its established infrastructure for mass production of consumer electronics, contrasted with the innovation-driven smaller-scale adoption in North America and Europe focused on medical and defense-related applications. This multifaceted segmentation approach helps in strategic planning, identifying high-growth pockets, and allocating R&D resources effectively towards the most demanding market needs.

- Technology:

- UV-Nanoimprint Lithography (UV-NIL)

- Thermal-Nanoimprint Lithography (T-NIL)

- Soft-Nanoimprint Lithography (S-NIL)

- Application:

- Semiconductor Devices

- Display Technology (OLED, MicroLED)

- MEMS/NEMS Fabrication

- Optical Components and Photonics (DOEs, Waveguides)

- Healthcare and Biotechnology (Microfluidics)

- Other Applications (Security features, Storage media)

- End-User:

- Consumer Electronics Manufacturers

- Semiconductor Foundries and IDMs

- R&D Institutes and Academia

- Aerospace and Defense

- Automotive Industry

- Wafer Size:

- Less than 4-inch

- 6-inch to 8-inch

- 12-inch (300mm)

Value Chain Analysis For Nanoimprint Lithography Equipment Market

The value chain for the Nanoimprint Lithography Equipment Market is characterized by highly specialized expertise required at both the upstream material sourcing stage and the downstream integration phase. Upstream analysis involves suppliers of critical raw materials, most importantly high-precision quartz or silicon for stamp fabrication, specialized polymers for resists, and advanced mechanical components like high-accuracy stages, pneumatic systems, and high-power UV light sources. The quality and availability of these materials directly impact the resolution and repeatability of the final NIL process. Key upstream activities include the design and manufacturing of the master stamp, which is a highly technical and capital-intensive process often undertaken by specialized service providers or the equipment manufacturers themselves, ensuring the foundational quality of the imprinting process.

Midstream activities are dominated by the core equipment manufacturers, such as Canon, EV Group, and SUSS MicroTec, who are responsible for the complex integration of mechanical, optical, and software components into robust, automated NIL systems. These manufacturers focus heavily on improving alignment accuracy, throughput, and defect management features within the equipment. Downstream analysis encompasses the end-users—primarily semiconductor foundries, specialized photonics companies, and display manufacturers—who utilize the NIL equipment for mass production. Their feedback on yield rates, equipment uptime, and process stability is crucial for ongoing product refinement. The distribution channel is predominantly direct, given the high capital cost, complexity, and customization required for NIL tools, necessitating direct sales engagement, installation, maintenance, and expert technical support from the manufacturer to the end-user fabrication site.

The flow within the value chain is also influenced by indirect distribution methods through strategic partnerships and regional agents, particularly in emerging markets where equipment manufacturers leverage local expertise for sales and after-sales service. Direct distribution is crucial for large Integrated Device Manufacturers (IDMs) and Tier 1 foundries requiring bespoke solutions, ensuring tighter quality control and direct communication regarding proprietary processes. Indirect channels, while less common for high-end systems, facilitate market entry for smaller, regional research centers or specialized component manufacturers. Overall efficiency hinges on tight collaboration between stamp designers, resist chemists, and equipment engineers to ensure that the entire stack—material, mold, and machine—works harmoniously to achieve high yield at production scale.

Nanoimprint Lithography Equipment Market Potential Customers

Potential customers for Nanoimprint Lithography (NIL) equipment are highly specialized entities operating at the forefront of miniaturization and advanced material engineering, requiring precision patterning capabilities that surpass the economic or technical feasibility of traditional lithography. The primary consumer base consists of large Integrated Device Manufacturers (IDMs) and specialized semiconductor foundries that utilize NIL for manufacturing non-critical but highly structured layers, such as grating layers in DRAM/NAND flash memory, or for patterning hard mask molds in advanced packaging technologies like fan-out wafer-level packaging (FOWLP). These customers are driven by the need to lower manufacturing costs per die and achieve high-aspect-ratio features not easily replicated by standard patterning techniques, making NIL a key enabling technology for cost-sensitive, high-volume applications.

A secondary, yet rapidly growing, customer segment includes manufacturers of advanced optical components, particularly those focused on the burgeoning markets for Augmented Reality (AR), Virtual Reality (VR), and 3D sensing solutions (LiDAR). Companies producing diffractive optical elements (DOEs), waveguides, and microlens arrays are critical buyers, as NIL offers unparalleled precision and cost-efficiency in replicating these complex, nanoscale optical structures across large areas. Furthermore, high-tech display panel producers, particularly those experimenting with microLED or specialized OLED structures, represent significant potential, leveraging NIL’s ability to define fine-pitch patterns necessary for high-resolution displays. This diversification across electronics and photonics highlights the versatility and expanding relevance of NIL technology beyond core semiconductor fabrication.

Additionally, research institutions, academic labs, and governmental defense agencies constitute a stable base of customers, albeit focused on lower volume, high-variability systems. These organizations procure NIL equipment for fundamental research into advanced materials, novel device prototypes (e.g., bio-sensors, flexible electronics, metamaterials), and microfluidic platforms. For these customers, the flexibility and high resolution achievable by NIL, often coupled with smaller wafer sizes, are the primary purchasing criteria. The potential buyer landscape is therefore characterized by entities prioritizing high fidelity, cost control, and the capability to fabricate complex, three-dimensional nanoscale geometries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 1,120 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Canon, EV Group (EVG), SUSS MicroTec, Obducat AB, NIL Technology ApS (NILT), Molecular Imprints (Canon), Guangzhou H-M Tools Co., Ltd., Kuen Teng Machinery Co., Ltd., Nanonex Corporation, SET, Heidelberg Instruments, V-Tek, Inc., micro resist technology GmbH, IMS CHIPS, Planartech, Advanced Nanoimprint Technology (ANI), LitePlast, Eikonix, Nanoscribe, Hitachi High-Tech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nanoimprint Lithography Equipment Market Key Technology Landscape

The technology landscape of the Nanoimprint Lithography (NIL) Equipment market is characterized by several distinct modalities, each optimized for specific applications and substrate types. The dominant technology is UV-Nanoimprint Lithography (UV-NIL), where a low-viscosity, UV-curable liquid resist is patterned and then hardened using UV exposure. This technique is favored for its ability to operate at room temperature and low pressure, minimizing thermal expansion issues and substrate damage, making it ideal for large-area patterning on delicate materials like display substrates or complex optical stacks. Technological advancements in UV-NIL focus heavily on increasing pattern uniformity across 300mm wafers, improving residual layer thickness control (RLT), and integrating advanced prism-based alignment systems to achieve high overlay accuracy, crucial for multilayer device fabrication.

Thermal-Nanoimprint Lithography (T-NIL) represents the traditional and more robust form of NIL, relying on heating the substrate and a thermoplastic resist above its glass transition temperature before applying pressure with the mold. While T-NIL offers high fidelity and material compatibility (often used with thick polymer layers), its limitations include longer cycle times due to necessary heating and cooling steps, and potential issues with thermal expansion, which restrict its use in some high-precision, high-throughput environments. Research and development in T-NIL currently focuses on flash heating techniques and low-thermal-mass chucks to dramatically reduce the processing time, making it more competitive for certain semiconductor packaging applications requiring high aspect ratios and thick resists. Furthermore, Soft-Nanoimprint Lithography (S-NIL), which utilizes soft, flexible stamps (e.g., PDMS), is gaining traction for patterning curved surfaces or for roll-to-roll (R2R) processing on flexible substrates, opening avenues in flexible electronics and bio-technology where conformal contact is paramount.

Beyond the core imprinting mechanisms, the technological maturity of NIL equipment is increasingly defined by ancillary systems. Advanced equipment now integrates sophisticated metrology modules (e.g., Atomic Force Microscopy and Scanning Electron Microscopy integration) for in-situ process control and automated defect detection systems that leverage AI and machine vision to classify and minimize yield-impacting issues like bubble formation or particle contamination. Furthermore, sophisticated demolding mechanisms, including specialized coatings and precise stage control, are essential technical differentiators, directly addressing the critical challenge of stamp separation without damaging the delicate imprinted features or the stamp itself. The overall trend is towards hybrid systems that combine NIL with existing lithography techniques (e.g., stepper technology integration) to leverage the strengths of each process for optimal cost and performance.

Regional Highlights

Regional dynamics play a crucial role in shaping the Nanoimprint Lithography Equipment Market, driven by the varying geographical concentrations of semiconductor fabrication, display manufacturing, and governmental R&D initiatives.

- Asia Pacific (APAC): APAC is the dominant market leader, primarily driven by mass production facilities located in South Korea, Taiwan, China, and Japan. This region houses the majority of the world's leading semiconductor foundries (TSMC, Samsung, SK Hynix) and major display panel manufacturers (LG Display, BOE). The high volume of consumer electronics manufacturing necessitates cost-effective, high-throughput patterning solutions, leading to aggressive adoption of NIL, particularly UV-NIL, for display backplanes, advanced memory components, and next-generation packaging. Government support for indigenous nanomanufacturing capabilities further accelerates equipment investment and local technological refinement.

- North America: North America represents a significant hub for technological innovation and specialized, high-value NIL applications. The market is characterized by strong investment from high-tech defense contractors, aerospace industries, and specialized photonic device manufacturers focusing on augmented reality and sensor technology. While volume production is lower than in APAC, the demand for cutting-edge resolution and bespoke process solutions for compound semiconductors and bio-medical devices is strong. Key growth is concentrated around major research universities and leading semiconductor equipment suppliers based in the U.S.

- Europe: Europe maintains a strong presence, particularly in research and development (R&D) and niche high-precision manufacturing, supported by institutions like the Fraunhofer Society and IMEC. Countries like Germany and Sweden host critical players (e.g., SUSS MicroTec, Obducat AB) that drive innovation in T-NIL and specialized optical applications, including diffractive optics for automotive lighting and security features. The European market focuses on technological leadership in equipment manufacturing and the integration of NIL into pilot lines for micro- and nano-optical components.

- Latin America, Middle East, and Africa (LAMEA): This collective region currently holds the smallest market share, with demand primarily confined to academic research centers and governmental science initiatives. Market penetration is expected to increase gradually as local governments invest in localized semiconductor assembly or advanced materials research, slowly driving the need for entry-level and research-grade NIL equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nanoimprint Lithography Equipment Market.- Canon

- EV Group (EVG)

- SUSS MicroTec

- Obducat AB

- NIL Technology ApS (NILT)

- Molecular Imprints (acquired by Canon)

- Guangzhou H-M Tools Co., Ltd.

- Kuen Teng Machinery Co., Ltd.

- Nanonex Corporation

- SET

- Heidelberg Instruments

- V-Tek, Inc.

- micro resist technology GmbH

- IMS CHIPS

- Planartech

- Advanced Nanoimprint Technology (ANI)

- LitePlast

- Eikonix

- Nanoscribe

- Hitachi High-Tech

Frequently Asked Questions

Analyze common user questions about the Nanoimprint Lithography Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Nanoimprint Lithography (NIL) over traditional photolithography?

NIL offers significantly lower capital expenditure and operational costs compared to advanced DUV or EUV photolithography. It provides high-resolution patterning capability down to below 10 nm, high fidelity in replicating complex 3D structures, and superior throughput potential for specific, non-critical applications like optical elements and specialized memory layers.

What is the most significant technical challenge limiting the mass adoption of NIL equipment in semiconductor manufacturing?

The primary limiting factor is the control of defect density and uniformity, particularly particulate contamination and trapped air bubbles, which severely impact production yield on large-area wafers (300mm). Ensuring perfect overlay accuracy and extending stamp durability under continuous operation also remain critical technical hurdles.

Which type of Nanoimprint Lithography (NIL) technology is leading the market and why?

UV-Nanoimprint Lithography (UV-NIL) is currently leading the market due to its compatibility with high-throughput manufacturing, ability to operate at room temperature and low pressure (minimizing thermal distortion), and its suitability for patterning sensitive materials used in display technology and advanced optical devices.

How is the growth of Augmented Reality (AR) technology influencing the demand for NIL equipment?

AR technology is a major driver, as it relies on precise nanoscale optical components such as diffractive optical elements (DOEs) and waveguides for image projection. NIL equipment is uniquely suited to fabricate these complex, high-precision structures cost-effectively and at the required volumes, directly fueling demand in the optical application segment.

Which geographic region is expected to demonstrate the highest growth rate for NIL equipment through 2033?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, driven by sustained massive investments in new semiconductor fabrication capacity, the expansion of advanced display production (MicroLED), and the rapid adoption of NIL in high-volume consumer electronics manufacturing hubs across East Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager