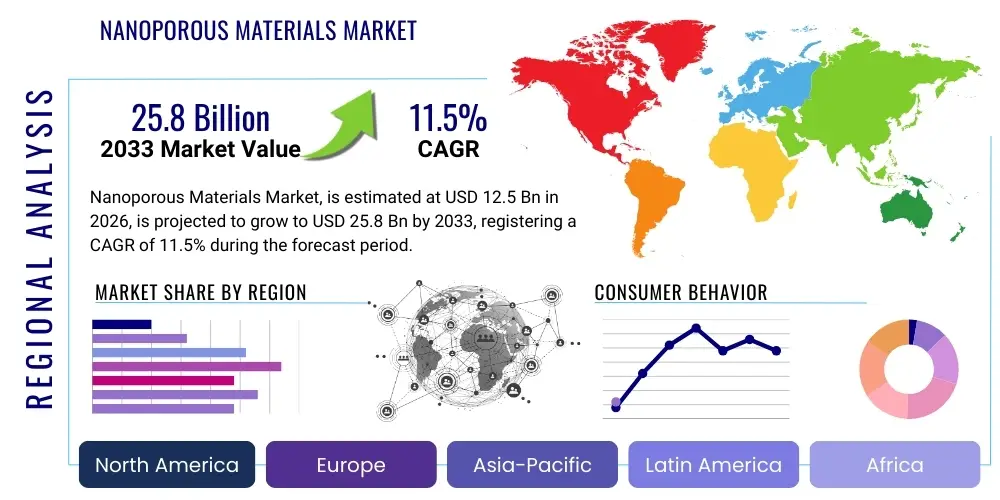

Nanoporous Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437537 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Nanoporous Materials Market Size

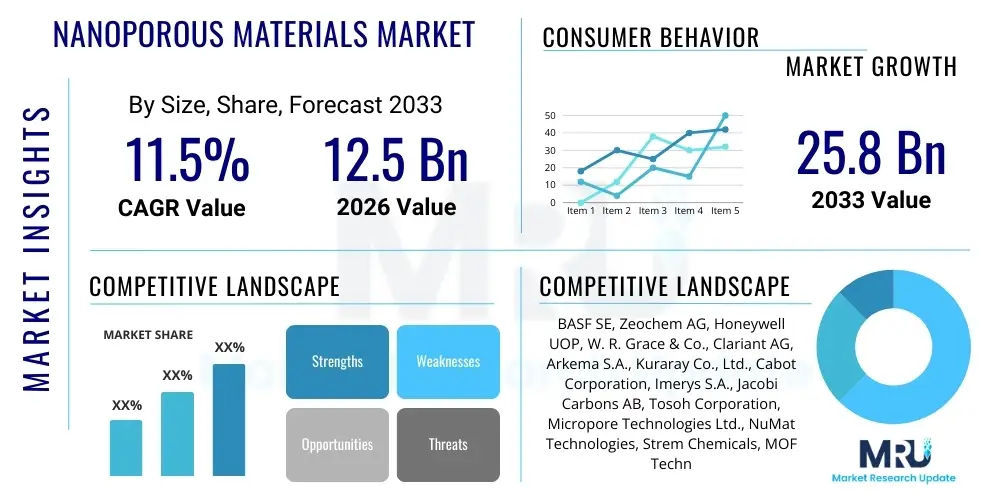

The Nanoporous Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $12.5 Billion in 2026 and is projected to reach $25.8 Billion by the end of the forecast period in 2033.

Nanoporous Materials Market introduction

The Nanoporous Materials Market encompasses a diverse range of substances characterized by highly ordered structures containing pores, cavities, or channels with dimensions typically less than 100 nanometers. These materials, which include activated carbon, zeolites, porous silica, metal-organic frameworks (MOFs), and porous polymers, derive their exceptional functional properties from their extraordinarily high surface area-to-volume ratio and tunable pore geometry. This unique structural composition makes them indispensable in applications requiring highly selective molecular separation, efficient adsorption, storage of gases, and high-performance catalysis. The primary objective behind the commercialization of these advanced materials is to enhance efficiency and sustainability across various industrial processes, notably in environmental purification and energy storage systems.

Major applications driving the demand for nanoporous materials span environmental remediation, energy, chemicals, and biomedicine. In the energy sector, they are crucial for advanced battery technologies, supercapacitors, and particularly for hydrogen and natural gas storage, where maximizing storage density is paramount. Furthermore, the chemical industry heavily relies on these materials as superior heterogeneous catalysts, offering enhanced reaction kinetics and selectivity compared to conventional bulk materials. The development of advanced synthetic methods, such as template-assisted synthesis and solvothermal processes, allows manufacturers to precisely control pore size distribution and surface functionality, thereby catering to highly specialized end-user requirements.

The core benefits offered by nanoporous materials—including enhanced selectivity, rapid mass transfer kinetics, and robust thermal stability—are key driving factors for market expansion. The escalating global focus on carbon capture and sequestration (CCS) technologies provides a substantial impetus, as MOFs and certain zeolites are highly effective at capturing CO2 directly from industrial sources. Concurrently, increasing governmental regulations concerning water and air quality necessitate the adoption of sophisticated filtration and purification media, further solidifying the market's growth trajectory. Continuous research and development activities aimed at lowering production costs and scaling up manufacturing processes for novel materials like MOFs and covalent organic frameworks (COFs) are expected to accelerate their integration into mainstream industrial applications.

Nanoporous Materials Market Executive Summary

The Nanoporous Materials Market is entering a period of robust expansion, primarily fueled by advancements in material science and increasing industrial requirements for sustainable and efficient separation technologies. Key business trends indicate a significant pivot toward advanced synthetic materials, particularly Metal-Organic Frameworks (MOFs) and Covalent Organic Frameworks (COFs), which offer superior tunability and performance compared to traditional materials like activated carbon. Strategic collaborations between academic institutions and industrial giants are accelerating the translation of laboratory-scale innovations into commercial production. Furthermore, companies are investing heavily in continuous flow synthesis techniques to improve yield consistency and reduce the high operational costs traditionally associated with high-purity nanoporous material manufacturing.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, largely due to rapid industrialization, high investments in renewable energy infrastructure, and stringent environmental policies implemented across nations like China, Japan, and South Korea. North America and Europe maintain leading positions in terms of revenue, driven by established petrochemical and pharmaceutical sectors, high adoption rates of advanced filtration technologies, and substantial R&D expenditure directed towards carbon capture and hydrogen storage solutions. Government funding programs in these regions, specifically targeting sustainable materials and climate technology, are providing essential financial incentives that accelerate market penetration for next-generation nanoporous products.

Segment trends reveal that the Activated Carbon segment continues to hold the largest market share by volume due to its cost-effectiveness and mature supply chain, although high-value segments like Zeolites and MOFs are demonstrating the highest growth rates (CAGR) based on revenue. Application-wise, the Catalysis and Adsorption/Separation segments dominate the market. The pharmaceutical segment, leveraging nanoporous materials for controlled drug delivery systems and enhanced diagnostics, is also emerging as a high-potential area. The growing imperative for energy efficiency is particularly boosting the use of porous ceramics and silica for thermal insulation and energy harvesting applications, indicating a diversified revenue stream across the materials landscape.

AI Impact Analysis on Nanoporous Materials Market

Common user questions regarding AI's influence on the Nanoporous Materials Market frequently center on the efficiency of material discovery, optimization of synthesis parameters, and predictive modeling of material performance. Users are keen to understand how AI can overcome the significant hurdle of long and expensive trial-and-error processes typically required to discover new MOFs or highly selective zeolites. Specific concerns revolve around AI's capability to predict adsorption isotherms, catalytic activity, and stability under harsh industrial conditions, thereby accelerating commercialization timelines. The core theme is leveraging machine learning (ML) and generative AI (GAI) to transition from empirical research to data-driven material design, ensuring that synthesized materials perfectly match specific application requirements, such as CO2 capture selectivity at fluctuating temperatures or high-pressure gas storage capacity.

AI, particularly through machine learning algorithms and deep learning, is fundamentally transforming the discovery and optimization phases of nanoporous materials. By analyzing vast databases of crystal structures, synthesis recipes, and performance data, AI models can rapidly identify high-potential candidates, dramatically reducing the time required for initial screening. This capability is critical for complex materials like MOFs, where the chemical space of possible structures is virtually limitless. Furthermore, AI tools are being implemented in smart manufacturing environments to monitor and adjust critical synthesis parameters (temperature, pressure, pH) in real-time, ensuring batch-to-batch consistency and high purity, which is essential for high-end applications like drug delivery and ultra-purification.

The adoption of AI-driven simulations is also extending the life cycle and predictive maintenance protocols for nanoporous material-based industrial systems (e.g., PSA units). Predictive models can forecast material degradation, fouling rates, and performance decline under various operational loads, allowing operators to schedule regeneration or replacement proactively, thus minimizing downtime and maximizing operational efficiency. This shift towards AI-enhanced process management represents a major leap in maximizing the economic viability of utilizing expensive, high-performance nanoporous adsorbents in large-scale industrial settings.

- AI accelerates the virtual screening of millions of potential nanoporous structures (e.g., MOFs, Zeolites) for targeted properties.

- Machine learning algorithms optimize complex synthesis parameters to achieve higher yields and consistent pore size distributions.

- Predictive modeling enhances the understanding of material stability and performance under extreme operational conditions (high temperature, pressure).

- AI facilitates automated design and optimization of adsorption and separation processes, improving energy efficiency in industrial gas separation units.

- Generative AI is used to propose novel hybrid nanoporous compositions with tailored surface functionalities.

DRO & Impact Forces Of Nanoporous Materials Market

The Nanoporous Materials Market is primarily propelled by the stringent global environmental regulations mandating efficient pollution control and the accelerating demand for advanced energy storage solutions, particularly for electric vehicles and renewable energy integration. Key drivers include the inherent ability of these materials to provide superior selectivity and surface area, making them crucial for enhancing catalytic efficiency and enabling cost-effective gas separation, such as natural gas purification and air separation units. Restraints largely center on the high synthesis cost and scalability challenges, especially for novel, highly crystalline materials like MOFs and COFs, which currently lack robust, large-volume industrial manufacturing protocols. Opportunities exist prominently in biomedical fields, utilizing mesoporous silica nanoparticles (MSNs) for targeted drug delivery, and in emerging climate technologies, such as direct air capture (DAC).

Impact forces acting on the market are multifaceted, encompassing technological innovation, regulatory mandates, and supply chain complexity. Technological advancements in fabrication techniques, particularly electrospinning and 3D printing of structured adsorbents, are enhancing material performance and geometric stability, thereby minimizing pressure drop in industrial reactors. The environmental impact force is substantial; as nations commit to net-zero targets, the need for materials capable of highly efficient carbon capture and wastewater treatment intensifies market pressure. However, the reliance on specialized raw materials and complex purification steps constitutes a major restraining force, often limiting widespread adoption in cost-sensitive industrial segments.

The long-term market outlook is defined by the balance between technological breakthroughs in synthesis and the effective management of industrial scaling constraints. Successful commercialization hinges on reducing the energy intensity and chemical usage in the production process (e.g., solvent recycling in MOF synthesis). Market growth will be further amplified by the opportunity presented by membrane separation technology, where nanoporous materials are integrated into thin films to create high-flux, high-selectivity membranes for critical applications like desalination and molecular sieving, positioning them as an indispensable component of future resource management and industrial processing infrastructure.

Segmentation Analysis

The Nanoporous Materials Market is comprehensively segmented based on material type, structure, application, and end-use industry. Analyzing these segments provides a clear delineation of market trends, revealing that while traditional materials like activated carbon retain volume leadership due to cost efficiency in bulk applications (water filtration), the highest revenue growth is concentrated in advanced synthetic materials offering exceptional performance characteristics. The segmentation by structure, differentiating between materials based on pore size (microporous, mesoporous, macroporous), is critical as it directly dictates the material's suitability for specific molecular dimensions, linking structure to function across all major end-use sectors. Geographic analysis further segments the market by identifying regional dominance in specific application areas, such as North America's strength in advanced catalysts and APAC's high consumption in environmental remediation and battery materials.

Key strategic shifts within segmentation involve the movement towards hierarchical porous materials, which combine multiple pore sizes (micro and meso) to optimize both adsorption capacity and mass transfer rates simultaneously. This hybrid approach caters to complex industrial streams where fast kinetics are essential. Furthermore, the application segmentation highlights the growing convergence of nanoporous material usage across distinct fields; for example, MOFs initially designed for gas storage are now being repurposed for biomedical imaging and sensing, blurring traditional application boundaries and opening new revenue streams. Understanding the precise requirements of each end-use industry—from petrochemical cracking to drug delivery formulation—is essential for accurate market forecasting and strategic product development targeting high-margin niches.

- By Material Type: Activated Carbon, Zeolites, Porous Silica, Metal-Organic Frameworks (MOFs), Porous Alumina, Carbon Nanotubes, Others (Porous Polymers, COFs, Aerogels).

- By Structure: Microporous Materials (<2 nm), Mesoporous Materials (2 nm – 50 nm), Macroporous Materials (>50 nm), Hierarchical Porous Materials.

- By Application: Catalysis, Separation & Adsorption (Gas Separation, Liquid Separation, Humidity Control), Energy Storage & Generation (Batteries, Supercapacitors, Fuel Cells), Drug Delivery & Biomedical, Insulation, Sensors, Others.

- By End-Use Industry: Chemical & Petrochemical, Energy (Oil & Gas, Power Generation), Environmental (Water Treatment, Air Purification), Pharmaceutical & Biomedical, Automotive, Manufacturing & Industrial.

Value Chain Analysis For Nanoporous Materials Market

The value chain for nanoporous materials is complex, starting with the synthesis of specialized precursors and culminating in highly customized end-products utilized in sophisticated industrial systems. Upstream analysis involves the sourcing and purification of raw materials, such as inorganic salts, organic linkers (for MOFs), and silica/alumina precursors (for zeolites and porous silica). The synthesis phase is the most critical and high-value adding step, involving advanced chemical engineering to precisely control pore formation, crystallization, and surface functionalization. Due to the high sensitivity of these processes, quality control and intellectual property protection around synthesis methodologies are paramount in the upstream segment. Key challenges in this phase include high energy consumption and the necessity of high-purity solvents.

The midstream segment involves processing, functionalization, and formulation. This includes shaping the raw powder materials into usable forms, such as pellets, beads, monoliths, or thin films, depending on the application (e.g., monolithic catalysts for flow reactors or beads for PSA units). Direct distribution channels involve manufacturers selling high-volume, standard products (like bulk activated carbon) directly to large industrial consumers (e.g., municipal water treatment facilities or petrochemical complexes). Indirect distribution relies heavily on specialized chemical distributors and regional agents, particularly for advanced materials (MOFs, specialized zeolites) that require specific technical support or integration assistance for smaller, specialized end-users in the pharmaceutical or sensor markets.

Downstream analysis focuses on integration into end-user systems. For instance, in gas separation, the nanoporous material is integrated into pressure swing adsorption (PSA) units or membrane modules. In drug delivery, they are encapsulated into biocompatible formulations. The success of the downstream segment is highly dependent on effective collaboration between the material producer and the system integrator. This ensures that the material meets operational stability, regeneration efficiency, and longevity requirements within the demanding industrial environment. The trend towards customized, application-specific formulations is driving the need for closer technical support across the distribution network.

Nanoporous Materials Market Potential Customers

Potential customers for nanoporous materials are highly diversified across capital-intensive and research-driven sectors that require efficiency gains in separation, catalysis, or energy management. The largest volume consumers are generally found in the chemical and petrochemical industries, where materials like zeolites and activated carbon are routinely purchased for cracking, isomerization, bulk gas drying, and impurity removal processes. These buyers prioritize operational stability, regeneration cost, and throughput capacity, demanding materials that can withstand high temperatures and pressures over extended operational cycles. Large chemical corporations often purchase these materials directly from major manufacturers under long-term supply contracts.

Another significant customer segment includes environmental services companies and government agencies focused on infrastructure development, specifically in water and wastewater treatment, and air quality control. These customers rely on nanoporous adsorbents for the removal of contaminants, heavy metals, and volatile organic compounds (VOCs). Their purchasing decisions are heavily influenced by regulatory compliance requirements and the total cost of ownership (TCO) of the filtration or adsorption system. The pharmaceutical and biomedical sectors represent high-value, albeit lower volume, customers. These buyers (e.g., drug formulation laboratories and medical device manufacturers) procure specialized mesoporous silica and biocompatible MOFs for controlled release mechanisms, imaging contrast agents, and medical diagnostics, emphasizing biocompatibility, purity, and highly controlled pore geometry.

The burgeoning energy sector, including battery manufacturers, fuel cell developers, and natural gas producers, constitutes a rapidly growing customer base. Companies in this domain require high-capacity, thermally stable materials for hydrogen storage, CO2 capture from flue gas, and advanced electrode components. These customers are highly sensitive to material energy density and cycle life performance. Due to the novelty of materials like MOFs in energy applications, procurement often begins with R&D collaborations or pilot project agreements before transitioning into large-scale commercial contracts, indicating a strategic, long-term customer relationship model.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion |

| Market Forecast in 2033 | $25.8 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Zeochem AG, Honeywell UOP, W. R. Grace & Co., Clariant AG, Arkema S.A., Kuraray Co., Ltd., Cabot Corporation, Imerys S.A., Jacobi Carbons AB, Tosoh Corporation, Micropore Technologies Ltd., NuMat Technologies, Strem Chemicals, MOF Technologies, NanoResearch Elements, Porous Materials Inc., Evonik Industries AG, Nippon Chemical Industrial Co., Ltd., Materion Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nanoporous Materials Market Key Technology Landscape

The technological landscape of the Nanoporous Materials Market is characterized by intense innovation across synthesis, characterization, and application development. Key synthesis technologies include hydrothermal/solvothermal methods (dominant for zeolites and MOFs), template-assisted synthesis (critical for achieving uniform mesoporosity in silica and carbon), and chemical vapor deposition (CVD) for producing ordered carbon nanotubes and porous thin films. Recent technological progress has focused heavily on continuous flow synthesis, which aims to replace traditional batch reactors with scalable, energy-efficient systems that enable high-volume production of advanced materials like MOFs while ensuring batch consistency, a historical bottleneck for commercialization.

A crucial technological area is functionalization, where surface chemistry is precisely engineered to enhance material selectivity. This involves grafting specific chemical groups onto the pore walls, which is essential for targeted applications such as highly selective CO2 capture in the presence of water vapor, or optimizing the loading and release profile in drug delivery systems. The convergence of nanotechnology and materials science has also led to the rise of hierarchical porosity design, utilizing technologies like dual-templating or post-synthetic modification to create structures that optimize both fast diffusion (via macropores) and high adsorption capacity (via micropores), thereby maximizing overall material performance in dynamic industrial environments.

Furthermore, advanced characterization techniques are indispensable for quality control and R&D. Technologies such as high-resolution transmission electron microscopy (HRTEM), advanced gas adsorption isotherms (using specialized equipment like BET analyzers), and small-angle X-ray scattering (SAXS) provide the necessary insights into pore size distribution, crystallinity, and structural integrity. The integration of 3D printing and additive manufacturing is an emerging technology, allowing researchers to fabricate custom-designed, geometrically optimized monolithic structures for reactor beds and separation columns, significantly improving contact efficiency and minimizing pressure drops compared to traditional packed beds of powdered materials.

Regional Highlights

Geographically, the Nanoporous Materials Market exhibits dynamic growth patterns influenced by regional industrial maturity, regulatory frameworks, and investment in sustainable technologies. North America, particularly the United States, commands a significant market share, driven by a robust petrochemical industry that demands high volumes of zeolites and catalysts, and substantial government and private sector investment into emerging fields like hydrogen technology and carbon capture utilization and storage (CCUS). The region's technological leadership ensures a steady adoption rate for novel materials, especially high-performance MOFs originating from major research universities and specialized startups. Strict environmental standards for vehicle emissions and industrial wastewater further solidify the market for advanced adsorption media.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is underpinned by extensive infrastructure development, booming manufacturing sectors (electronics, automotive), and critical investments in addressing severe environmental challenges, particularly in China and India. The APAC region is a major consumer of activated carbon for large-scale water purification projects and is quickly becoming a manufacturing hub for energy storage components, driving demand for porous carbon and silica materials used in batteries and supercapacitors. Government initiatives supporting cleaner production technologies and subsidized renewable energy projects provide significant impetus for the adoption of efficient separation and catalytic materials.

Europe holds a mature market position, characterized by stringent chemical regulations (REACH) and an aggressive push towards circular economy models and climate neutrality. European consumption is strong in high-value, niche applications such as pharmaceutical production, specialized chemical synthesis, and advanced thermal insulation materials. The region demonstrates strong demand for environmentally friendly materials, prioritizing high-efficiency zeolites for catalytic converters in the automotive sector and innovative MOFs for small-scale, decentralized environmental monitoring and purification systems. Research collaboration across EU member states ensures continuous innovation in scalable, sustainable synthesis protocols, maintaining Europe's competitive edge in quality and performance.

- North America: Dominance in catalysis and advanced energy applications; high R&D spending on CCUS and hydrogen storage; strong presence of major petrochemical and automotive industries.

- Asia Pacific (APAC): Highest growth rate fueled by industrial expansion; heavy investment in water treatment and pollution control; major manufacturing base for battery components (e.g., porous carbons).

- Europe: Focus on high-value applications, strict environmental compliance (Euro 7 standards); leadership in specialized chemical synthesis and sustainable material development (MOFs for adsorption cooling).

- Latin America (LATAM): Emerging market driven by oil and gas processing needs; increasing adoption of water treatment solutions in response to urbanization and resource scarcity.

- Middle East & Africa (MEA): Growth tied to diversification efforts away from traditional oil economy; significant investment in large-scale desalination projects (requiring porous membranes) and petrochemical complex expansions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nanoporous Materials Market.- BASF SE

- Zeochem AG

- Honeywell UOP

- W. R. Grace & Co.

- Clariant AG

- Arkema S.A.

- Kuraray Co., Ltd.

- Cabot Corporation

- Imerys S.A.

- Jacobi Carbons AB

- Tosoh Corporation

- Micropore Technologies Ltd.

- NuMat Technologies

- Strem Chemicals

- MOF Technologies

- NanoResearch Elements

- Porous Materials Inc.

- Evonik Industries AG

- Nippon Chemical Industrial Co., Ltd.

- Materion Corporation

Frequently Asked Questions

Analyze common user questions about the Nanoporous Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Zeolites and MOFs, and why is MOF adoption increasing?

Zeolites are crystalline aluminosilicates with rigid, inorganic frameworks, offering high thermal stability and robust acidity for catalysis and ion exchange. Metal-Organic Frameworks (MOFs) are hybrid materials composed of metal nodes and organic linkers. MOFs offer significantly greater tunability in pore size, surface area, and functionality, allowing them to be engineered for extremely selective applications like highly targeted gas separation (e.g., CO2 capture) and drug delivery, driving their rapid adoption.

How do nanoporous materials contribute to the transition to sustainable energy?

Nanoporous materials are critical for enhancing sustainable energy systems by enabling efficient gas storage, particularly for hydrogen and natural gas in vehicles (adsorbent-based storage systems). They are also used as electrode components in high-performance supercapacitors and batteries to increase energy density and charge/discharge rates, and as high-selectivity membranes for more efficient production of pure hydrogen or biofuel components.

What are the main constraints hindering the large-scale commercialization of advanced nanoporous materials like MOFs?

The primary constraints include the high manufacturing cost associated with pure precursor materials and complex synthesis methods (often requiring expensive organic solvents), and difficulties in scaling up production from laboratory batches to industrial quantities while maintaining structural integrity, pore uniformity, and material stability under industrial operating conditions.

Which application segment represents the fastest growth opportunity in the Nanoporous Materials Market?

The fastest growth opportunity lies within the Carbon Capture, Utilization, and Storage (CCUS) application segment, driven by global climate mandates. Nanoporous materials, especially specialized MOFs and functionalized porous polymers, demonstrate superior efficiency and lower energy penalties for capturing CO2 directly from industrial flue gases or the atmosphere compared to traditional amine scrubbing technologies.

In which structural category are most R&D efforts focused currently, and what are their advantages?

Current R&D is heavily concentrated on Hierarchical Porous Materials, which contain a tailored combination of micropores, mesopores, and macropores. The advantage is that macropores facilitate rapid mass transport, while micropores provide high adsorption capacity, resulting in materials that exhibit both high efficiency and fast kinetics, essential for high-throughput industrial processes such as high-speed chromatography and catalytic flow reactions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager