Nanosecond Fiber Lasers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432558 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Nanosecond Fiber Lasers Market Size

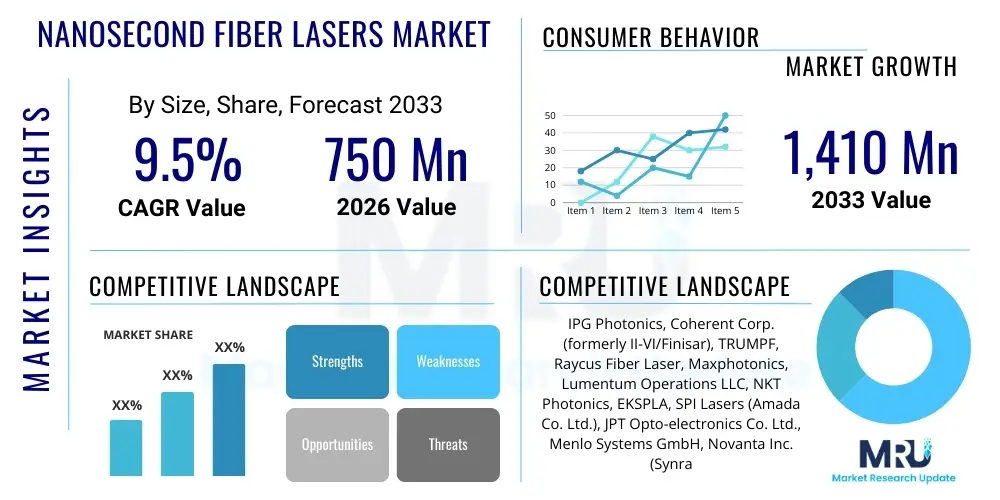

The Nanosecond Fiber Lasers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,410 Million by the end of the forecast period in 2033.

Nanosecond Fiber Lasers Market introduction

Nanosecond fiber lasers represent a specialized segment within the pulsed laser industry, defined by their ability to generate optical pulses with durations typically ranging from one nanosecond (10-9 seconds) up to several hundred nanoseconds. These high peak power pulses, coupled with the inherent stability and efficiency of fiber laser architecture, make them indispensable across a wide spectrum of industrial and scientific applications. The foundational principle involves utilizing rare-earth-doped optical fibers as the gain medium, pumped by high-power laser diodes, often employing Q-switching or Master Oscillator Power Amplifier (MOPA) configurations to achieve the desired pulse characteristics. Unlike continuous wave (CW) lasers, the pulsed nature of nanosecond lasers allows for precise energy delivery with minimal thermal effect on the surrounding material, a critical feature in fine material processing. The efficiency gains realized through the fiber format, coupled with the rugged, all-fiber construction, provide superior immunity to vibration and thermal drift compared to legacy solid-state lasers, ensuring consistent performance in demanding 24/7 manufacturing environments.

The product description highlights ruggedness, compactness, and exceptional beam quality (M2 near 1), features derived from the inherent waveguide structure of the optical fiber. Major applications span material micro-processing, including deep engraving, ablation, fine cutting of thin metals, and high-speed marking of various substrates such as plastics, ceramics, and advanced composite materials used in aerospace. Furthermore, they are extensively used in Light Detection and Ranging (LiDAR) systems for mapping and autonomous navigation, specialized medical device manufacturing (especially surgical tools and precision component joining), and scientific research requiring high energy density pulses for excitation or measurement purposes. The key benefit propelling market expansion is their superior wall-plug efficiency, extended reliability, and significantly reduced maintenance requirements compared to traditional solid-state lasers, translating directly into lower operational costs, enhanced industrial throughput, and faster amortization of the initial capital investment across the manufacturing lifecycle. This combination of technical superiority and economic viability positions nanosecond fiber lasers as the preferred industrial tool across numerous high-tech fabrication sectors.

Driving factors are primarily rooted in the increasing demand for high-precision manufacturing processes across the automotive and electronics industries, particularly the fabrication of consumer electronics components, next-generation display technologies (e.g., OLED/MicroLED), and crucial components for electric vehicle battery packs, such as foil cutting and cleaning. The pervasive trend towards miniaturization in electronic devices necessitates tools capable of ultra-fine detailing, precise material removal, and controlled ablation without damaging underlying layers, capabilities which nanosecond fiber lasers effectively deliver through precise pulse energy control. Additionally, the rapid global rollout of advanced LiDAR systems for autonomous vehicles and high-resolution surveying and mapping services is contributing significantly to the demand for compact, robust pulsed laser sources operating at eye-safe wavelengths (1.5 µm). Continuous innovation in high-power semiconductor pump diode technology further enhances the peak power capabilities, pulse repetition frequency (PRF), and overall energy efficiency of these laser systems, making them increasingly competitive against alternative laser technologies, including some lower-end picosecond systems, by bridging the performance gap at a lower cost point.

Nanosecond Fiber Lasers Market Executive Summary

The Nanosecond Fiber Lasers Market is currently characterized by robust business trends focusing heavily on vertical integration, application-specific customization, and aggressive diversification of product power outputs and spectral wavelengths. Leading global manufacturers are strategically consolidating their supply chains, particularly regarding the sourcing and in-house production of high-performance pump diodes and specialized rare-earth-doped fibers. This vertical approach ensures greater control over product quality, minimizes supply vulnerabilities, and accelerates time-to-market for new, higher-specification models. A critical trend involves the refinement of flexible MOPA (Master Oscillator Power Amplifier) architectures, which enable end-users to precisely tune operational parameters—such as pulse repetition rate, pulse width, and energy profile—independently. This flexibility allows for optimized material interaction across dissimilar substrates, a crucial capability for modern hybrid manufacturing processes. Furthermore, the integration of advanced diagnostic sensors and sophisticated control software is moving nanosecond systems toward 'smart tooling,' facilitating real-time monitoring, AI-driven process correction, and simplified integration into complex, digitally-managed manufacturing workflows (Industry 4.0 environments). This competitive environment drives continuous cost optimization and technical capability enhancement.

From a geographical perspective, regional trends unequivocally demonstrate that Asia Pacific (APAC) remains the powerhouse of the Nanosecond Fiber Lasers Market, holding the dominant market share fueled by unparalleled investment in high-volume, high-technology manufacturing. Nations such as China, leveraging massive internal demand and a highly developed industrial infrastructure, act as both the largest production base and the most significant consumer market, driving scale economies. North America and Europe, while growing at a slightly slower volume rate compared to APAC, exhibit extremely high demand for high-specification, niche application lasers. Growth in these regions is underpinned by rigorous quality requirements in advanced sectors like aerospace, defense (where reliability and ruggedization are mandatory), and high-end medical device manufacturing. Furthermore, governmental initiatives promoting industrial automation, carbon emission reduction, and technological sovereignty are stimulating significant capital expenditure on modern fiber laser technology, pushing Western markets toward specialized, high-margin product segments.

Analysis of segment trends reveals a sustained momentum in the Material Processing application segment, which continues to account for the largest revenue share, specifically driven by marking, deep engraving, and micro-ablation tasks crucial for electronic component fabrication. Within the power output segment, while the mid-power range (50W to 100W) offers the optimal blend of cost and speed for general industrial applications, the high-power segment (exceeding 100W, sometimes reaching multi-kilowatt pulsed systems) is recording the highest compound annual growth rate (CAGR). This surge is driven by demanding, high-throughput applications such as surface texturing of solar cells, complex metal cleaning (e.g., preparation for brazing or welding), and structural material processing in automotive manufacturing. Technology-wise, there is a clear migration from simple Q-switched systems toward the more versatile MOPA configuration, as manufacturers recognize the long-term benefits of enhanced process control, which directly translates into higher yields and reduced scrap rates across diverse materials, solidifying the MOPA architecture's dominance in advanced industrial settings.

AI Impact Analysis on Nanosecond Fiber Lasers Market

Common user questions regarding AI's impact on the Nanosecond Fiber Lasers Market center around how artificial intelligence and machine learning (ML) algorithms can be practically implemented to optimize complex laser process parameters, enhance instantaneous quality assurance, and seamlessly integrate laser systems into broader, interconnected smart factory (or Industry 5.0) ecosystems. Users are acutely interested in real-time defect detection during micro-processing, autonomous feedback loops that instantaneously adjust pulse energy and repetition rates based on thermal or acoustic feedback from the material, and the deployment of predictive maintenance models (e.g., utilizing Regression or Classification ML models) to forecast and mitigate component degradation, thereby maximizing uptime. The key themes driving user inquiry focus on eliminating empirical trial-and-error in process setup, achieving unprecedented levels of precision repeatability, and maximizing yield rates, especially when processing sensitive or high-value components. Expectations are particularly high for AI to move laser operation from fixed, pre-defined parameters to truly adaptive and self-correcting settings, thereby significantly lowering the dependency on highly specialized human operators and accelerating process validation cycles in R&D environments.

- AI-driven optimization of laser parameters: Machine learning models (e.g., Reinforcement Learning) analyze real-time sensor data (such as spectral analysis of plasma plume, acoustic emissions, and pyrometry data) to autonomously adjust critical parameters, including focus position, pulse overlap, pulse width, and power, ensuring optimal material interaction and consistent quality across dynamic operating conditions.

- Predictive maintenance and diagnostics: Advanced statistical and ML models (like ARIMA or Long Short-Term Memory networks) are used to analyze operational metadata (e.g., diode current, temperature profiles, spectral shifts) to accurately forecast potential component failures, particularly degradation of pump diodes or optical elements, initiating preventative service actions well before critical failure occurs.

- Enhanced quality control and inspection: Deep learning models, specifically Convolutional Neural Networks (CNNs), are deployed on high-speed imagery captured during or immediately after laser processing to rapidly identify microscopic defects, subsurface flaws, or inconsistencies in surface texture, automating quality assurance steps at speeds and accuracies unattainable by human visual inspection.

- Adaptive manufacturing systems: AI orchestrators facilitate the integration of nanosecond fiber lasers into flexible robotic work cells, allowing the laser system to communicate and automatically adjust its operation profile in response to variations in input material batches, jig misalignment, or environmental factors (e.g., ambient temperature or humidity fluctuations).

- Process simulation and digital twins: AI leverages vast datasets of historical laser-material interaction results to create highly accurate virtual models (digital twins) of the laser processing line, significantly accelerating R&D cycles, allowing manufacturers to simulate complex processing strategies and validate new materials without costly physical prototyping.

- Improved beam steering and tracking: AI algorithms enhance the control signals for high-speed galvanometer mirrors and fast steering mirrors, optimizing trajectory planning and reducing path errors, which is crucial for maintaining edge quality and precision in high-speed, 3D complex laser marking and deep ablation tasks.

- Automated recipe generation: ML algorithms analyze material properties and desired outcome specifications (e.g., ablation depth, surface roughness) to automatically generate optimal laser processing "recipes," drastically reducing the setup time required when transitioning between different materials or application types.

- Energy footprint optimization: AI monitors and manages the laser system's power consumption based on real-time workload, optimizing pump diode usage and cooling system operation to minimize energy usage without compromising beam stability or output power, aligning with sustainability goals.

DRO & Impact Forces Of Nanosecond Fiber Lasers Market

The core drivers sustaining the upward trajectory of the Nanosecond Fiber Lasers Market are firmly rooted in the twin demands for high-volume miniaturization and process efficiency across critical industrial sectors. The imperative to fabricate smaller, more complex components in the electronics industry—ranging from flexible circuits to intricate sensor components—requires tools that offer high peak power for swift material removal combined with excellent beam quality for micron-level precision. Nanosecond fiber lasers fulfill this requirement effectively, providing superior processing quality compared to mechanical alternatives or less controlled laser sources. Furthermore, the undeniable total cost of ownership (TCO) advantage—stemming from reduced power consumption, extended pump diode lifetime, and virtually no requirement for optical alignment or mirror cleaning—makes fiber lasers an economically compelling replacement for older, less reliable solid-state lasers in industrial settings demanding 24/7 operation. This high degree of reliability is paramount in automated production lines where unscheduled downtime carries substantial financial penalties.

Despite these powerful drivers, market expansion is constrained by several factors. The initial acquisition cost of advanced, high-power nanosecond fiber laser systems, particularly those incorporating MOPA architecture and integrated scanning optics, remains a significant barrier to entry for smaller job shops or manufacturers operating on tighter capital budgets, despite the long-term operational savings. A more direct technological restraint is the intense and increasing competition posed by Ultra-Short Pulse (USP) lasers, specifically picosecond and femtosecond systems. While nanosecond lasers are highly efficient for ablation, they inherently cause a heat-affected zone (HAZ) due to the relatively long pulse duration. In applications demanding absolutely pristine, damage-free cold ablation—such as high-end medical device machining or advanced semiconductor processing—USP lasers are mandated, restricting the ultimate market ceiling for nanosecond technology in the highest-precision segments. Overcoming this requires continuous technological innovation to shorten nanosecond pulse widths and improve thermal management.

Significant opportunities are materializing across several emerging high-growth sectors. The massive global investment in Electric Vehicle (EV) battery manufacturing and infrastructure presents a crucial growth vector, where nanosecond lasers are essential for high-speed, large-area cleaning, foil preparation, and precise welding of battery components, leveraging their speed and power capabilities. The continuous evolution of 3D sensing and navigation technologies, particularly in advanced, next-generation automotive and drone-based LiDAR systems, requires compact, powerful, and eye-safe nanosecond fiber lasers (often operating at 1550 nm), creating a dedicated, high-margin niche. Additionally, the development of high-power nanosecond lasers capable of reaching kilowatt levels average power is opening up new possibilities in surface engineering, including laser texturing for friction reduction and large-area paint stripping in aerospace maintenance, applications traditionally dominated by bulkier or less efficient laser technologies. Strategic geographical expansion into rapidly industrializing regions and customized solutions addressing localized manufacturing needs further enhance opportunity capture.

- Drivers:

- Increasing integration of laser technology in high-volume micro-processing for semiconductor and electronics manufacturing, driven by miniaturization trends.

- Demonstrated superior reliability, extended operational lifetime, and markedly lower total cost of ownership (TCO) compared to alternative laser technologies.

- Accelerated adoption in complex 3D sensing and advanced military/civilian LiDAR systems for enhanced autonomy and mapping capabilities.

- Ongoing fundamental technological advancements resulting in higher energy efficiency, greater pulse flexibility (MOPA systems), and higher peak power outputs.

- Mandates for high-speed, non-contact, and contamination-free processing in critical industries such as medical device manufacturing and aerospace component traceability.

- Restraints:

- High initial capital investment required for state-of-the-art nanosecond fiber laser systems, challenging smaller businesses.

- Technological competition from picosecond and femtosecond lasers, which offer superior "cold ablation" results in ultra-high precision, heat-sensitive applications.

- Market vulnerability to global economic downturns affecting capital expenditure budgets in major industrial sectors, especially automotive and heavy machinery.

- Requirement for a highly specialized technical workforce capable of advanced system integration, programming, and sophisticated maintenance procedures.

- Opportunities:

- Explosive market growth potential derived from the scaling of global Electric Vehicle (EV) battery manufacturing and associated processing needs.

- Expansion into new spectral ranges (Green and UV nanosecond lasers) to address unique processing requirements for specialized materials such as glass and specific polymers.

- Development of portable, robust, and sealed nanosecond laser units for deployment in field diagnostics, remote sensing, and challenging industrial environments.

- Niche market expansion in additive manufacturing processes, such as laser powder bed fusion (L-PBF) support structure removal and surface conditioning.

- Impact Forces:

- Technology Innovation: Rapid development in components (pump diodes, fiber Bragg gratings) constantly shifts the performance curve.

- Industry 4.0 Integration: Pressure to integrate laser systems into interconnected, smart factory environments.

- Regulatory Compliance: Strict safety standards (e.g., laser safety class) and environmental regulations influence product design and implementation.

- Geopolitical Shifts: Trade policies and technological independence initiatives influence sourcing decisions and regional manufacturing capabilities, particularly between major economic blocks.

Segmentation Analysis

The Nanosecond Fiber Lasers Market segmentation is pivotal for understanding demand structure and strategic positioning, primarily divided across operational type, power output range, and application domain. Segmentation by Type differentiates between Q-switched (QS) lasers and MOPA (Master Oscillator Power Amplifier) configurations. Q-switched systems are characterized by simplicity and robustness, generating high-peak-power pulses (often tens of kilowatts) at relatively lower repetition rates, making them cost-effective for fundamental applications like permanent surface marking and deep, high-energy engraving on robust metals. Conversely, MOPA systems represent the technological vanguard, offering vastly superior flexibility; they decouple pulse duration (which can be tailored from 2 ns up to 500 ns) from the repetition rate (up to several MHz), allowing for tailored energy delivery. This feature is crucial for delicate processes such as black marking on anodized aluminum or achieving fine contrast on plastics without incurring excessive thermal damage, driving their rapid adoption in high-tech, sensitive manufacturing.

Power output is a crucial delineator of application suitability and market value. The low-power segment (typically under 20W) serves delicate applications requiring minimal material interaction, such as surface color change or thin film scribing, where fine detail and low heat input are prioritized over speed. The medium-power segment (20W to 100W) represents the industrial workhorse, providing the optimal blend of processing speed and cost for general marking, surface cleaning, and light ablation across a wide array of materials; this segment holds the largest volume share. The high-power segment (above 100W, extending to several hundred watts average power) is the fastest growing in terms of value, addressing high-throughput, demanding industrial needs such as deep drilling, large-area rust or residue removal, and specialized surface texturing processes required in solar panel and automotive component manufacturing, leveraging the increased speed that higher average power enables.

Application segmentation reveals the true breadth of market usage. Material Processing is the foundational segment, encompassing all facets of manufacturing, including micromachining, cutting, welding, and cleaning, absorbing the majority of laser sales volume. However, the non-material processing segments, particularly LiDAR and Sensing (driven by autonomous vehicle research and development), and Medical (focused on surgical precision and ophthalmology), exhibit disproportionately high growth rates and typically demand more specialized, high-reliability laser modules, often operating in eye-safe spectral regions (1.5µm). The convergence of high-power nanosecond systems with automation and vision systems further creates sub-segments focused purely on complex 3D structuring, demanding high-performance scanning optics and sophisticated software integration. Strategic investment is heavily skewed towards MOPA systems in the 50W-150W range, as this combination offers the broadest utility and highest potential return across multiple high-growth end-user industries.

- By Type:

- Q-Switched Nanosecond Fiber Lasers

- MOPA (Master Oscillator Power Amplifier) Nanosecond Fiber Lasers

- By Power Output:

- Low Power (Under 20W)

- Medium Power (20W – 100W)

- High Power (Above 100W)

- By Application:

- Material Processing (Marking, Engraving, Ablation, Micro-machining)

- LiDAR and Sensing

- Medical (Ophthalmology, Surgery)

- Scientific Research

- Defense and Aerospace

- By End-User Industry:

- Electronics and Semiconductors

- Automotive (Including EV Battery Manufacturing)

- Jewelry and Watchmaking

- Packaging and Printing

- Tool and Die Manufacturing

Value Chain Analysis For Nanosecond Fiber Lasers Market

The Nanosecond Fiber Lasers Market value chain is initiated by the sophisticated upstream activities dominated by component manufacturers. These specialized suppliers provide high-cost, high-performance inputs, including high-brightness, highly reliable semiconductor pump diodes (typically 915 nm or 976 nm), which are paramount to system efficiency and lifetime. Other critical components include specialized rare-earth-doped fibers (such as Ytterbium-doped for 1µm output), robust fiber Bragg gratings (FBGs) used as integrated mirrors, and high-power handling passive components like combiners and isolators. Vertical integration is a prevalent competitive strategy where major laser manufacturers (e.g., IPG Photonics, Coherent) invest heavily in pump diode production capabilities to ensure supply stability, control quality, and optimize cost structures, often setting them apart from smaller competitors reliant on external component sourcing. The quality and spectral stability of these upstream inputs directly determine the performance, size, and ultimate market cost of the final nanosecond laser module, making supplier relationships critical.

The central phase involves the complex integration and manufacturing process conducted by the core laser engine producers. This involves meticulous fiber splicing, precise thermal management system integration, and the development of proprietary control electronics and firmware necessary to manage the MOPA or Q-switched pulse generation processes. Once the fiber laser engine is manufactured, tested, and certified, it moves downstream to system integrators and Original Equipment Manufacturers (OEMs). These downstream players specialize in combining the laser source with application-specific hardware—such as high-speed galvanometer scanners, complex F-Theta lenses, automated material handling systems (robotics), and certified safety enclosures—to create turnkey laser workstations ready for deployment in end-user factories. The system integration phase adds significant value by tailoring a standard laser module into a functional manufacturing solution optimized for tasks like 3D engraving, high-speed marking, or remote welding, requiring deep expertise in optics, mechanical engineering, and software development.

Distribution strategy is multi-tiered and highly dependent on the target customer size and geographical location. For large multinational corporations (MNCs) and high-volume OEMs, major laser manufacturers typically engage in direct sales and support, offering customized solutions and comprehensive service contracts, fostering long-term relationships and capturing high-margin service revenue. For reaching the fragmented Small and Medium Enterprise (SME) market, indirect channels are employed through regional distributors and value-added resellers (VARs). These partners provide local market access, immediate technical support, application testing, and customized integration tailored to regional industrial standards. Post-sale activities, including maintenance, spare parts supply, system upgrades, and professional training for operators and engineers, form an increasingly lucrative revenue stream for manufacturers, reinforcing customer loyalty and extending the operational life of the installed laser base. The service component ensures long-term engagement throughout the laser system's 10-15 year lifecycle.

Nanosecond Fiber Lasers Market Potential Customers

The principal customer base for nanosecond fiber lasers resides within sectors requiring unparalleled precision, consistency, and high throughput in non-contact material modification. The Electronics and Semiconductor industries are paramount end-users, where these lasers are critical for processes such as precise cutting of flexible printed circuits (FPCs), highly accurate marking of semiconductor packages for traceability (using low-damage parameters), laser trimming of resistors, and the delicate repair or modification of display technologies (OLED/LCD). The demanding nature of miniaturization and the necessity for zero-contamination processing make the fiber laser’s high beam quality and stability indispensable. Furthermore, Tier 1 suppliers in the data communication and telecommunications sector are major consumers, utilizing nanosecond lasers for precise wire stripping and connector fabrication where thermal damage must be rigorously avoided.

The rapidly evolving Automotive and Electric Vehicle (EV) manufacturing sectors represent the strongest current growth segment. EV battery production requires nanosecond lasers for several key processes: high-speed, clean removal of electrode coatings (cleaning tabs prior to welding), precise cutting of battery foils, and permanent, high-contrast marking of battery casings for critical thermal management and serialization purposes. In the broader automotive industry, nanosecond systems are essential for marking powertrain components, ensuring engine block traceability, and processing high-performance engineering plastics used in vehicle interiors. The robust, factory-ready design of fiber lasers makes them perfectly suited for the continuous, high-duty cycle demands of automotive assembly lines globally, providing a definitive competitive edge over less reliable laser alternatives.

Beyond these industrial giants, the medical device sector provides a highly specialized and growing customer segment. Companies manufacturing surgical tools, coronary stents, catheters, and various implants rely on nanosecond lasers for micro-drilling, precision welding of dissimilar materials, and sterile, permanent marking compliant with regulatory requirements (e.g., UDI). The ability to deliver precise energy doses with controlled thermal output is essential to maintain material integrity and biocompatibility. Additionally, defense organizations and aerospace contractors are significant end-users, requiring ruggedized systems for parts marking, material verification, coating removal, and deployment in highly sensitive targeting and ranging applications (LiDAR), where operational reliability in extreme environments is a non-negotiable factor for system deployment and operational readiness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,410 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IPG Photonics, Coherent Corp. (formerly II-VI/Finisar), TRUMPF, Raycus Fiber Laser, Maxphotonics, Lumentum Operations LLC, NKT Photonics, EKSPLA, SPI Lasers (Amada Co. Ltd.), JPT Opto-electronics Co. Ltd., Menlo Systems GmbH, Novanta Inc. (Synrad), Laser Quantum (Novanta), Apollo Instruments Inc., Fianium (Newport Corporation), Keopsys, Onefive GmbH, Quantel Laser (Lumibird Group), Amplitude Laser Group, Toptica Photonics AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nanosecond Fiber Lasers Market Key Technology Landscape

The technological core of the Nanosecond Fiber Lasers Market is defined by the symbiotic relationship between high-performance optical fibers and advanced semiconductor pumping technology. At the foundational level, the use of rare-earth-doped silica fibers, specifically Ytterbium (Yb) for 1030-1080 nm output or Erbium/Thulium (Er/Tm) for eye-safe 1.5 µm/2.0 µm output, dictates the laser's fundamental wavelength and power scaling potential. The continuous refinement of large mode area (LMA) fibers is critical, as LMA designs allow for higher power handling by mitigating deleterious non-linear effects, such as stimulated Brillouin scattering (SBS) and stimulated Raman scattering (SRS), while preserving the single-mode beam quality (M2 close to 1) required for fine focusing and high-precision processing. This continuous push in fiber design ensures that nanosecond systems can increase their peak and average power without sacrificing the necessary beam coherence and focusability essential for industrial micro-machining applications.

A central competitive battlefield in the technological landscape is the optimization of the Master Oscillator Power Amplifier (MOPA) architecture. MOPA systems utilize a highly stable, low-power seed source (often a DFB laser diode) to generate the initial, precise pulse shape, which is then amplified through successive stages of high-gain fiber. The technological advantage lies in the sophisticated electronic control unit that drives the seed source, allowing complete and independent control over pulse duration (ranging typically from 4 ns to 200 ns) and pulse repetition rate (up to several MHz). This flexibility allows manufacturers to offer application-specific processing profiles—for instance, long pulses at low repetition rates for deep material melting, or short, fast pulses for minimized thermal effects on sensitive polymers. The complexity and performance stability of the control electronics, including proprietary software for automated pulse shaping and power stabilization, are key differentiators between market leaders and general suppliers.

Thermal management is an increasingly critical technological factor, especially as average power levels climb towards the multi-hundred-watt range. Waste heat, primarily generated by inefficient conversion in the pump diodes and absorption in the fiber, must be efficiently dissipated to prevent wavelength drift, component stress, and beam quality degradation. State-of-the-art systems incorporate sophisticated, closed-loop liquid cooling systems with precise temperature control algorithms to stabilize the temperature of the pump diode arrays and the gain fiber spool. Furthermore, the integration of advanced diagnostic and sensing capabilities—such as embedded pyrometers, spectrum analyzers, and power meters—allows the laser system to monitor its own health and performance in real-time. This level of self-diagnosis supports AI-driven predictive maintenance and ensures that the laser output remains rigorously stable across extended operational periods and fluctuating environmental temperatures, which is a non-negotiable requirement for high-reliability applications in defense and high-volume industrial production.

A significant technological vector involves moving beyond the fundamental infrared (IR) wavelength. Techniques such as frequency doubling (SHG) using non-linear crystals generate Green nanosecond pulses (around 532 nm), which are vital for processing materials transparent to IR light, such as glass, certain ceramics, and specialized plastics. Further frequency tripling (THG) yields Ultraviolet (UV) nanosecond pulses (around 355 nm), highly prized for applications like cutting transparent, thin-film displays, micro-drilling highly sensitive electronic components, and advanced scientific material studies, capitalizing on the material's high UV absorption. While these wavelength-converted systems add complexity and cost—requiring precise temperature control of non-linear crystals and careful management of free-space optics—they substantially broaden the addressable market by enabling precision processes that cannot be achieved with standard IR lasers, solidifying their high-value, niche market position.

Integration technology, driven by Industry 4.0 paradigms, is another defining element. Modern nanosecond fiber lasers are not standalone tools but interconnected nodes within automated manufacturing networks. They must feature robust, high-speed communication interfaces (e.g., EtherCAT, Profinet, or OPC UA) and be compatible with sophisticated external control systems, including vision systems and robotic manipulators. The laser's internal firmware and proprietary control software must facilitate rapid parameter changes (pulse-on-demand), highly accurate synchronization with scanning systems (e.g., galvos capable of processing millions of points per second), and seamless data logging for quality assurance. The trend is toward monolithic, sealed systems with embedded controllers, which minimize external complexities and enhance robustness against industrial contaminants, ensuring long-term operational consistency even in harsh factory environments where dust, humidity, and vibration are prevalent challenges to optical systems.

Finally, the evolution of component ruggedization and miniaturization continues to push the boundaries of applicability. Fiber Bragg Gratings (FBGs) are crucial in the monolithic architecture, serving as highly selective, non-degrading mirrors integrated directly into the fiber core, replacing bulky, alignment-sensitive free-space mirrors. Advances in pump diode packaging—achieving higher brightness and better thermal management in smaller footprints—directly translate into more compact and lighter laser modules. This focus on Size, Weight, and Power (SWaP) optimization is particularly relevant for mobile applications, such as drone-based LiDAR systems and handheld cleaning/marking units, broadening the market beyond stationary industrial machine tools. The technological landscape is thus characterized by continuous refinement of core optical components, sophisticated electronic control, and integration focused on maximizing both performance metrics and operational reliability across the vast spectrum of high-demand industrial and defense applications.

To further enhance processing flexibility and speed, advancements in beam shaping and beam delivery systems coupled with nanosecond lasers are essential. Techniques such as diffractive optical elements (DOEs) and specialized beam homogenizers are increasingly employed to transform the laser's fundamental Gaussian beam profile into top-hat, square, or line-shaped energy distributions. This customization allows for uniform energy delivery over a defined area, critical for large-area surface texturing, precise coating removal, or efficient ablation across wide substrates without hot spots. This optical complexity is managed through sophisticated software control that dynamically selects or adjusts the beam profile based on the material recipe, moving beyond the simple focused spot approach. The use of advanced acousto-optic modulators (AOMs) and electro-optic modulators (EOMs) within MOPA systems further refines pulse control, allowing for fast, high-contrast modulation of the laser output, critical for precise cutting and high-speed marking where rapid switching is necessary.

The development of specialized fiber compositions addresses material challenges. For instance, the use of polarization-maintaining (PM) fibers throughout the laser cavity and delivery path is crucial for certain high-precision applications, especially those involving frequency conversion (SHG/THG), where maintaining the linear polarization state of the light is necessary for efficient conversion and predictable material interaction. While more expensive, PM fiber systems offer superior stability in applications sensitive to beam quality variation. Additionally, there is continuous research into alternative dopants and cladding materials to push the operational limits of fiber lasers further into the mid-infrared (MIR) spectrum, extending their utility into specialized areas like plastics welding (e.g., 2µm Thulium-doped systems) or specific defense countermeasures, although Ytterbium-based 1µm systems remain the industrial standard due to cost and performance benefits.

Finally, the security and intellectual property surrounding the core fiber laser design—particularly the proprietary pumping schemes, fiber designs, and specialized coating processes—remain highly guarded assets for market leaders. Patents related to non-linear suppression, power coupling efficiency, and thermal mitigation techniques represent significant barriers to entry for new competitors. The market leaders continuously invest a substantial portion of revenue into R&D to maintain this technological edge, ensuring that their products meet or exceed the rigorous demands for stability, beam quality, and lifetime required by demanding industrial sectors like aerospace and high-end semiconductor fabrication, thereby cementing the current structure of the competitive landscape based on technological sophistication rather than merely price point.

Regional Highlights

- Asia Pacific (APAC): APAC is the global epicenter of nanosecond fiber laser consumption and manufacturing, driven overwhelmingly by the colossal electronics, semiconductor, and automotive production bases in China, Japan, South Korea, and Taiwan. China specifically dominates the volume consumption of industrial lasers due to massive domestic manufacturing output and competitive pricing from local suppliers. The region's rapid investment in 5G infrastructure, OLED display manufacturing, and Electric Vehicle (EV) battery Gigafactories mandates high-speed, high-precision laser processing tools, ensuring that APAC sustains the highest growth rate globally throughout the forecast period. The competitive landscape here is intensely price-sensitive, balancing cost with necessary technological specifications, particularly in the high-volume marking segment.

- North America: This region is characterized by high demand for specialized, high-value nanosecond fiber laser systems, particularly within the aerospace, defense, advanced medical device, and R&D sectors. Adoption is driven by the necessity for strict traceability, high-quality marking standards, and sophisticated material verification processes. The presence of leading technology companies focused on autonomous vehicle development also makes North America a core market for advanced LiDAR applications, demanding robust, high-performance pulsed fiber lasers for mapping and sensor technology. Investment is weighted toward systems offering reliability and compliance with stringent operational standards (e.g., ITAR regulations for defense applications).

- Europe: Europe is a mature market focusing heavily on industrial automation (Industry 4.0 initiatives) and high-quality manufacturing standards, especially in Germany (automotive, machinery) and Switzerland (medical devices, watchmaking). The demand here centers on highly reliable, energy-efficient systems that integrate seamlessly into complex robotic work cells. Regulatory emphasis on safety, environmental efficiency, and precision engineering further drives the adoption of closed, highly precise laser processing units, bolstering the market for European manufacturers who emphasize customized solutions and deep technical support. The market prioritizes technological sophistication and long-term service agreements over initial low cost.

- Latin America (LATAM): While smaller than the major industrial hubs, LATAM presents steady growth opportunities, primarily concentrated in large manufacturing economies like Brazil and Mexico. Demand is largely focused on industrial marking, packaging, and basic material processing applications tied to local automotive assembly plants, consumer goods production, and the expanding local electronics assembly sector. Market expansion is dependent on increasing foreign direct investment in manufacturing and the replacement of older solid-state lasers with more modern, cost-effective fiber laser technology, often relying on global distributors and VARs for localized technical support and installation services.

- Middle East and Africa (MEA): This region is the smallest market segment, characterized by niche demand in oil and gas infrastructure maintenance, defense (especially aerial and naval surveillance), and emerging medical sectors, particularly in the UAE and Saudi Arabia. Growth is often project-based, linked to large-scale industrial diversification and infrastructure initiatives aimed at reducing reliance on oil revenues. Adoption rates are lower due to fragmented industrial bases and reliance on imported, fully integrated laser systems, but potential exists in specialized maintenance applications requiring non-destructive testing and high-power cleaning solutions for pipeline and asset integrity management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nanosecond Fiber Lasers Market.- IPG Photonics

- Coherent Corp. (formerly II-VI/Finisar)

- TRUMPF

- Raycus Fiber Laser

- Maxphotonics

- Lumentum Operations LLC

- NKT Photonics

- EKSPLA

- SPI Lasers (Amada Co. Ltd.)

- JPT Opto-electronics Co. Ltd.

- Menlo Systems GmbH

- Novanta Inc. (Synrad)

- Laser Quantum (Novanta)

- Apollo Instruments Inc.

- Fianium (Newport Corporation)

- Keopsys

- Onefive GmbH

- Quantel Laser (Lumibird Group)

- Amplitude Laser Group

- Toptica Photonics AG

Frequently Asked Questions

Analyze common user questions about the Nanosecond Fiber Lasers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes nanosecond fiber lasers from picosecond or femtosecond lasers?

Nanosecond lasers operate with pulse durations in the 1 to 100+ nanosecond range, resulting in higher average power and highly efficient material removal through melting and vaporization (thermal ablation). Ultra-short pulse (USP) lasers, conversely, operate in the picosecond/femtosecond range, achieving "cold ablation" with minimal heat-affected zones, ideal for highly delicate, zero-damage processing, but typically at a much higher system cost and lower throughput speed for bulk removal.

Which industries are driving the primary demand for MOPA nanosecond fiber lasers?

The primary demand drivers are the consumer electronics, semiconductor, and automotive sectors, particularly the Electric Vehicle (EV) battery manufacturing industry. MOPA architecture provides unparalleled flexibility in controlling pulse characteristics, which is essential for precise layer removal, high-contrast marking on plastics and metals, and highly controlled surface preparation tasks that demand application-specific pulse tuning.

How is the integration of AI influencing the operational efficiency of nanosecond laser systems?

AI integration is fundamentally shifting laser operation from manual calibration to autonomous process optimization. AI and machine learning algorithms utilize real-time sensor data to continuously adjust laser parameters, ensuring consistent material processing quality, minimizing defects, and facilitating predictive maintenance to maximize system uptime in high-volume, automated manufacturing environments.

What is the total cost of ownership (TCO) advantage of fiber lasers compared to conventional solid-state lasers?

Nanosecond fiber lasers offer a significantly lower TCO due to their inherent efficiency (lower electricity consumption), higher reliability, and virtually maintenance-free operational design. Unlike traditional solid-state lasers requiring frequent lamp replacement, mirror realignment, or expensive cooling solutions, fiber lasers often require only minor filter cleaning over long operational lifespans, drastically reducing recurrent operational expenses and downtime.

What role do nanosecond fiber lasers play in advanced sensing technologies like LiDAR?

Nanosecond fiber lasers are crucial components in robust, long-range LiDAR systems used in autonomous vehicles and aerial mapping. Their ability to deliver high-peak-power, high-energy pulses with excellent beam quality enables effective remote sensing over vast distances, particularly utilizing eye-safe wavelengths around 1.5µm, providing the speed and accuracy necessary for real-time 3D environmental mapping and obstacle detection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager