Nasal Spray Vaccine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431345 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Nasal Spray Vaccine Market Size

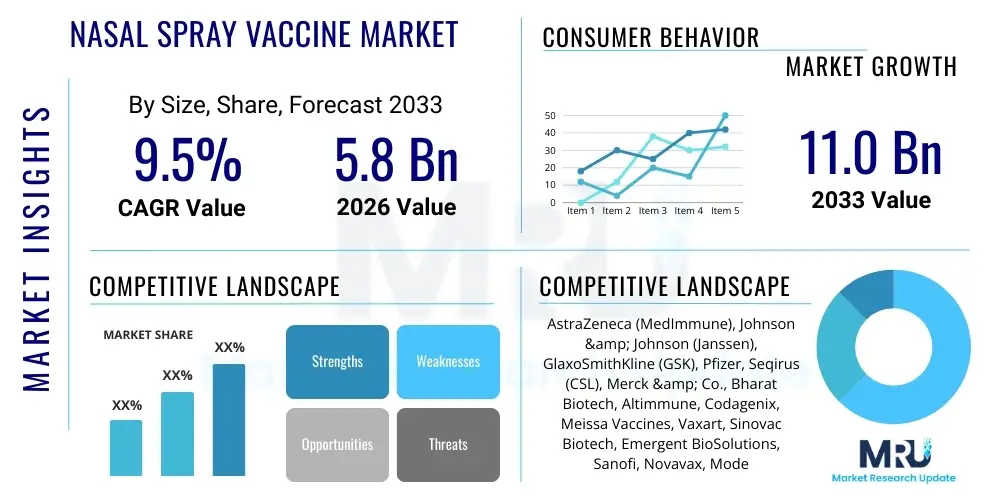

The Nasal Spray Vaccine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033.

Nasal Spray Vaccine Market introduction

The Nasal Spray Vaccine Market encompasses the development, production, and commercialization of vaccines administered through the nasal route, offering a non-invasive alternative to traditional injectable vaccines. These products are primarily designed to elicit mucosal immunity, which is crucial for preventing respiratory infections at the point of entry. Key products currently commercialized include influenza vaccines, with significant research focused on expanding applications to diseases like COVID-19, respiratory syncytial virus (RSV), and various infectious diseases where mucosal protection offers superior defense. The intrinsic appeal of needle-free delivery, particularly in pediatric and needle-phobic populations, significantly underpins the market's growth trajectory.

The mechanism of action for nasal spray vaccines involves delivering attenuated or inactivated pathogens, or specific antigens, directly onto the nasal mucosa. This direct delivery stimulates both local secretory IgA responses and systemic IgG responses, often providing a more comprehensive immune defense against airborne pathogens compared to systemic immunization alone. Major applications span seasonal immunization campaigns, rapid deployment during pandemics, and prophylactic use against endemic respiratory viruses. The ongoing innovation focuses on improving formulation stability, enhancing immunogenicity through advanced adjuvants, and optimizing delivery devices to ensure precise and consistent dosing.

Benefits driving market adoption include ease of administration, which facilitates mass vaccination programs without requiring specialized medical personnel, and improved patient compliance, especially in settings requiring booster doses. The primary driving factor remains the global imperative for enhanced pandemic preparedness, pushing research institutions and pharmaceutical companies to accelerate the development of next-generation mucosal vaccines that can block transmission effectively, not just severe disease. Furthermore, the rising prevalence of respiratory infections worldwide and supportive governmental immunization policies contribute substantially to market expansion.

Nasal Spray Vaccine Market Executive Summary

The Nasal Spray Vaccine Market is poised for substantial expansion, driven by strong business trends centered on prophylactic medicine and advanced drug delivery systems. Key business developments involve strategic partnerships between major pharmaceutical companies and biotechnology firms specializing in mucosal immunology to accelerate clinical trials for novel candidates targeting emerging threats. Furthermore, significant investment in manufacturing infrastructure capable of producing thermostable, single-dose nasal formulations is evident. The market is transitioning beyond established influenza products toward highly complex platforms utilizing viral vectors and protein subunits, seeking to address efficacy gaps observed in certain populations, particularly the elderly or immunocompromised.

Regional trends indicate North America and Europe currently dominate the market due to robust healthcare spending, high awareness of preventive health, and the presence of leading pharmaceutical innovators. However, the Asia Pacific region is anticipated to demonstrate the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is primarily attributed to rising immunization coverage goals set by governments in countries like China and India, increasing accessibility to cold chain logistics, and the high burden of respiratory diseases requiring effective public health interventions. Latin America and the Middle East and Africa are emerging markets, primarily focusing on vaccine procurement programs supported by global health organizations, emphasizing cost-effective and easy-to-administer options.

Segmentation trends highlight that the Live Attenuated Vaccine (LAV) type holds a significant share, especially for influenza, although subunit and vector-based vaccine segments are projected to grow faster, fueled by ongoing COVID-19 and RSV research. Application-wise, Infectious Diseases dominate, with a strong focus on respiratory viruses. The distribution channel analysis shows that Hospital Pharmacies and Government Stockpiles remain central, reflecting the public health nature of mass immunization campaigns. The future market structure will likely be characterized by rapid regulatory pathways for novel mucosal delivery platforms and a continued shift towards platforms offering cross-protection against viral variants.

AI Impact Analysis on Nasal Spray Vaccine Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Nasal Spray Vaccine market frequently revolve around how AI can expedite antigen selection, optimize formulation stability, and predict clinical success rates, particularly for novel mucosal delivery systems. Users are concerned about whether AI can overcome the inherent biological challenges of mucosal delivery, such as rapid clearance and enzymatic degradation, which often restrict vaccine potency. Key expectations center on AI's ability to analyze vast genomic and proteomic datasets to identify highly immunogenic, conserved epitopes suitable for intranasal presentation, especially for rapidly mutating viruses like influenza and SARS-CoV-2. Additionally, stakeholders inquire about AI-driven process optimization in manufacturing, aiming for faster scale-up and improved quality control of complex nasal spray devices and formulations.

- AI accelerates target identification by analyzing viral genomics to pinpoint conserved mucosal antigens suitable for broad-spectrum protection.

- Machine learning (ML) models optimize vaccine formulation stability by simulating interactions between adjuvants, excipients, and mucosal barriers.

- AI-driven clinical trial simulation predicts efficacy in diverse populations, reducing the cost and duration of preclinical development for intranasal candidates.

- Predictive analytics enhances personalized dosing strategies based on individual patient immunological profiles and environmental risk factors.

- AI systems improve manufacturing efficiency and quality control (QC) of nasal spray devices by monitoring particle size distribution and dose uniformity in real-time.

- Deep learning assists in discovering novel mucosal adjuvants that safely enhance local immune responses without causing excessive inflammation.

DRO & Impact Forces Of Nasal Spray Vaccine Market

The dynamics of the Nasal Spray Vaccine Market are highly influenced by a critical balance of drivers, restraints, and opportunities, collectively forming potent impact forces. Key drivers include the inherent advantage of needle-free administration, which drastically improves vaccination rates, especially in high-volume settings or among pediatric patients and those suffering from needle phobia (trypanophobia). Moreover, the ability of nasal vaccines to induce mucosal immunity at the primary infection site offers a distinct biological advantage over traditional injectable vaccines, promising better prevention of infection and transmission. The continuous global threat of respiratory pandemics and the subsequent prioritization of public health preparedness by major economies further solidify the demand for rapidly deployable and effective mucosal vaccines.

However, the market faces significant restraints. One major challenge is the perceived or actual lower efficacy of some existing nasal formulations compared to injectable counterparts, particularly in specific age groups or against certain strains, which creates regulatory and public trust hurdles. Furthermore, ensuring the stability and integrity of liquid nasal formulations, often requiring stringent cold chain management, remains complex, especially in developing regions. Another restraint is the regulatory complexity associated with mucosal delivery systems, as proving equivalent or superior immune response profiles requires specialized clinical endpoints and biomarkers that differ from systemic immunization standards, slowing down the commercialization path.

Opportunities for market expansion are substantial, primarily driven by research into next-generation vaccine platforms, including mRNA-based nasal sprays and novel viral vectors engineered for superior mucosal tropism. The increasing application scope beyond influenza to include highly prevalent diseases such as RSV, pertussis, and various bacterial pathogens, represents untapped market potential. The cumulative effect of these drivers and opportunities, coupled with the persistent impact forces of public health expenditure and biotechnological advancements, suggest a transformative period for the market where overcoming formulation challenges will unlock unprecedented growth, positioning nasal vaccines as a cornerstone of future respiratory immunization strategies.

Segmentation Analysis

The Nasal Spray Vaccine Market is segmented based on product type, application, distribution channel, and mechanism of action, allowing for detailed market assessment and strategic targeting. The product type segmentation differentiates between Live Attenuated Vaccines (LAV), which are currently dominant due to successful influenza products, and newer generations such as Subunit Vaccines, Inactivated Vaccines, and Viral Vector Vaccines, which promise improved safety profiles and broader application potential. The shift toward non-replicating or subunit formulations is driven by efforts to maximize cross-protective immunity and ensure applicability in immunocompromised patient groups.

In terms of application, the market is primarily segmented into Infectious Diseases, holding the largest share, and therapeutic applications where mucosal delivery is being investigated for immune modulation in areas like allergies or chronic inflammation. Within infectious diseases, influenza vaccination remains the primary driver, but the burgeoning pipeline targeting COVID-19, RSV, and emerging infectious diseases is reshaping the market landscape. The distribution channel segmentation, encompassing Hospital Pharmacies, Retail Pharmacies, and Government Stockpiles, reflects the mixed nature of vaccine consumption—balancing routine clinical prescription with large-scale public health procurement programs.

Understanding these segments is crucial for stakeholders to allocate resources effectively. The fastest-growing segments are projected to be Viral Vector and Subunit Vaccines, reflecting the industry's focus on high-efficacy, highly stable formulations. Geographically, while established markets offer high revenue stability, emerging markets in the Asia Pacific provide the highest growth opportunities due to massive target populations and expanding governmental focus on national immunization programs, requiring cost-effective and easy-to-administer needle-free solutions.

- By Product Type:

- Live Attenuated Vaccines (LAV)

- Inactivated Vaccines

- Subunit Vaccines

- Viral Vector Vaccines

- RNA/DNA Vaccines (Intranasal Delivery)

- By Application:

- Infectious Diseases (Influenza, COVID-19, RSV, Pertussis)

- Non-Infectious Diseases (Experimental/Therapeutic)

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Government/Public Health Agencies (Stockpiles)

Value Chain Analysis For Nasal Spray Vaccine Market

The value chain for the Nasal Spray Vaccine Market is complex, stretching from fundamental research and development (R&D) to final patient administration, requiring strict integration and quality control at every stage. The upstream segment involves intensive R&D activities, including antigen discovery, adjuvant selection (critical for mucosal effectiveness), and formulation development focused on stabilizing the vaccine within the nasal delivery medium. Key upstream players include specialized biotechnology firms, academic research centers, and suppliers of pharmaceutical-grade excipients and proprietary nasal spray devices. Challenges at this stage involve ensuring the scalability of novel delivery systems and securing intellectual property rights for new mucosal vaccine platforms.

The core midstream activities include large-scale manufacturing, purification, and sterile filling of the vaccine product, often requiring specialized biocontainment facilities, particularly for live attenuated or viral vector products. Downstream activities focus on packaging, logistics, and distribution. Given the often temperature-sensitive nature of vaccines, a robust cold chain network is essential for maintaining product viability until the point of use. The primary distribution channels are direct sales to government stockpiles for large-scale public health campaigns and sales through specialized pharmaceutical distributors to hospital and retail pharmacies for routine use.

The direct channel, characterized by sales to national governments or large procurement bodies, focuses heavily on contractual negotiations, volume pricing, and guaranteed supply, reflecting the public health priority of these products. The indirect channel, serving retail and hospital settings, relies more on marketing, prescription awareness, and integration into existing pharmacy supply chains. Successful market penetration depends on optimizing the delivery mechanism itself—the nasal spray device must be easy, reliable, and precise, representing a crucial intersection point between the pharmaceutical and medical device sectors within the value chain.

Nasal Spray Vaccine Market Potential Customers

Potential customers for the Nasal Spray Vaccine Market are highly diverse, spanning individual patients to large governmental organizations, categorized primarily by their purchasing power and intended use. The largest volume buyers are national governments and public health agencies, such as the Centers for Disease Control and Prevention (CDC) in the US, the European Medicines Agency (EMA) member states, and various bodies under the World Health Organization (WHO) framework. These entities procure vast quantities for seasonal immunization programs and pandemic preparedness stockpiling, emphasizing cost-effectiveness, proven efficacy in large populations, and ease of mass administration.

Healthcare providers, including pediatric clinics, general practitioners, and hospital systems, form another crucial customer segment. These providers specifically seek non-invasive options to improve patient compliance, especially in vulnerable populations such as children and adolescents, where needle aversion is common. Their purchasing decisions are often influenced by local regulatory guidelines, reimbursement policies, and clinical preference based on real-world efficacy data specific to their patient demographics.

Individual end-users and caregivers represent the final layer of customers, particularly in markets where nasal vaccines are readily available through retail pharmacy channels without immediate clinical intervention. These consumers prioritize convenience and comfort, often choosing nasal spray options for seasonal vaccines if they perceive the non-invasive nature as a significant benefit. Therefore, market messaging must target both institutional buyers focusing on population health benefits and individual users prioritizing ease of use and safety profiles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AstraZeneca (MedImmune), Johnson & Johnson (Janssen), GlaxoSmithKline (GSK), Pfizer, Seqirus (CSL), Merck & Co., Bharat Biotech, Altimmune, Codagenix, Meissa Vaccines, Vaxart, Sinovac Biotech, Emergent BioSolutions, Sanofi, Novavax, Moderna, Bavarian Nordic, CureVac, Takeda Pharmaceutical, CanSino Biologics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nasal Spray Vaccine Market Key Technology Landscape

The technological landscape of the Nasal Spray Vaccine Market is characterized by rapid innovation focused on optimizing delivery mechanisms and enhancing the immunogenicity of the vaccine payload at the mucosal surface. A primary technological challenge is ensuring the vaccine survives the harsh environment of the nasal cavity—including rapid mucociliary clearance and enzymatic degradation—to effectively interact with lymphoid tissues like the nasal-associated lymphoid tissue (NALT). Current research is heavily invested in developing advanced micro- and nanoparticles as delivery vehicles, designed to encapsulate antigens and release them slowly or target them specifically to dendritic cells, thereby significantly boosting the immune response.

Furthermore, significant technological advancements are centered on the nature of the vaccine platform itself. While traditional Live Attenuated Vaccines (LAVs) are prevalent, the emergence of viral vectors (e.g., adenoviruses) engineered to express specific antigens intranasally offers a highly potent alternative, exemplified by next-generation COVID-19 candidates. Another critical area is the development of stable, thermostable formulations, often achieved through lyophilization or spray-drying techniques, which bypass the stringent cold chain requirements, making these vaccines vastly more accessible in low and middle-income countries (LMICs) and improving global distribution efficiency.

The manufacturing technology for the nasal spray device is equally important. Precision dosing devices, including unit-dose sprayers and multi-dose applicators, utilize micro-pump technology to ensure consistent droplet size and optimal deposition within the nasal cavity, maximizing systemic absorption and local immune stimulation while minimizing vaccine wastage. Integrating these delivery systems with novel vaccine platforms, such as intranasal mRNA or DNA vaccines, which require specific formulation enhancers (e.g., lipid nanoparticles tailored for mucosal penetration), defines the cutting edge of current market technology and future commercial success.

Regional Highlights

- North America: North America, led by the United States, holds the largest market share primarily due to advanced R&D capabilities, high healthcare expenditure, and established infrastructure for mass immunization. The region benefits from early adoption of new vaccine technologies and substantial government investment in pandemic preparedness stockpiles. The presence of major pharmaceutical innovators and a well-defined regulatory pathway for flu vaccines contribute significantly to market stability and revenue generation. The focus here is increasingly shifting towards broad-spectrum, needle-free vaccines for influenza and novel intranasal candidates for COVID-19 and RSV, driven by consumer demand for convenience and superior protective efficacy against transmission.

- Europe: Europe represents a mature market characterized by robust public health systems and centralized procurement efforts, often coordinated through the European Union. Countries like the UK, Germany, and France are significant consumers of nasal spray influenza vaccines. Regulatory harmonization across the EU facilitates market access for approved products, but market growth can be slower than in North America due to differing national immunization preferences and varying reimbursement schedules. Strategic regional growth is being fueled by efforts to improve pediatric vaccination rates and a strong commitment to local manufacturing capacity for advanced biological products, including mucosal vaccines.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market during the forecast period. This accelerated expansion is fueled by massive populations in countries like China and India, the high burden of respiratory diseases, and rapidly developing healthcare infrastructure. Governmental initiatives to increase vaccination coverage, coupled with rising disposable incomes and awareness of preventive health, drive demand. Local pharmaceutical companies are aggressively developing indigenous nasal vaccine platforms, often focusing on cost-effective manufacturing processes to meet national needs, positioning APAC as a critical hub for high-volume, affordable nasal vaccine production and consumption.

- Latin America (LATAM): LATAM is an emerging market where demand is heavily influenced by governmental immunization programs supported by international organizations like the Pan American Health Organization (PAHO). Market penetration is tied to improving cold chain logistics and addressing public health challenges related to vaccine equity. While purchasing power per capita may be lower than in North America, the sheer need for accessible and easy-to-administer vaccines makes nasal spray formulations an attractive option for large-scale public health campaigns focused on infectious disease control, particularly in rural or hard-to-reach areas.

- Middle East and Africa (MEA): The MEA region is characterized by diverse healthcare landscapes. The Middle East, with its higher income economies (e.g., GCC nations), focuses on adopting premium, technologically advanced vaccines. Africa, however, presents significant logistical challenges but also immense need, driving interest in thermostable nasal vaccine formulations that require minimal cold chain infrastructure. Growth here is primarily dependent on international aid, global vaccine initiatives, and local capacity building for vaccine manufacturing and distribution across highly disparate operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nasal Spray Vaccine Market.- AstraZeneca (MedImmune)

- Johnson & Johnson (Janssen)

- GlaxoSmithKline (GSK)

- Pfizer

- Seqirus (CSL)

- Merck & Co.

- Bharat Biotech

- Altimmune

- Codagenix

- Meissa Vaccines

- Vaxart

- Sinovac Biotech

- Emergent BioSolutions

- Sanofi

- Novavax

- Moderna

- Bavarian Nordic

- CureVac

- Takeda Pharmaceutical

- CanSino Biologics

Frequently Asked Questions

Analyze common user questions about the Nasal Spray Vaccine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a nasal spray vaccine over an injectable vaccine?

The primary advantage is non-invasive, needle-free administration, which increases patient compliance, especially in children and individuals with needle phobia. Crucially, nasal vaccines elicit mucosal immunity at the entry site of respiratory pathogens, potentially blocking infection and transmission more effectively than systemic injectable vaccines.

Which diseases are primarily targeted by current nasal spray vaccines?

Currently, the market is dominated by prophylactic vaccines against seasonal influenza. However, extensive research and pipeline development are focused on expanding applications to highly prevalent infectious respiratory diseases, including COVID-19, Respiratory Syncytial Virus (RSV), and pertussis.

What are the main technical challenges restraining the growth of this market?

Key technical challenges include ensuring the stability of the vaccine formulation within the spray device, overcoming rapid mucociliary clearance in the nasal cavity, and achieving consistent, high-level efficacy across all age groups compared to established injectable alternatives. Cold chain requirements for liquid formulations also pose a logistical restraint.

How is Artificial Intelligence (AI) influencing the development of next-generation nasal vaccines?

AI is accelerating the development process by optimizing antigen selection to identify conserved, potent mucosal epitopes, predicting the stability of novel formulations, and simulating complex clinical trial outcomes. This significantly streamlines the path for new intranasal vaccine candidates toward regulatory approval.

Which region is expected to exhibit the fastest growth rate in the Nasal Spray Vaccine Market?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This growth is driven by rising governmental focus on massive national immunization programs, expanding access to healthcare infrastructure, and the high disease burden requiring accessible, high-volume vaccination solutions.

Are mRNA vaccines being developed for nasal administration?

Yes, significant research efforts are underway to adapt mRNA vaccine technology for intranasal delivery. This involves developing specialized lipid nanoparticle (LNP) formulations optimized for mucosal penetration and stability, aiming to combine the rapid development capabilities of mRNA with the localized immunity benefits of nasal delivery.

What is the role of adjuvants in nasal spray vaccine effectiveness?

Adjuvants are critical in nasal vaccines because the mucosal surface often requires stronger stimulation than systemic injection to trigger a robust immune response. Adjuvants enhance the local delivery and uptake of the antigen by immune cells in the nasal-associated lymphoid tissue (NALT), crucial for initiating both local secretory IgA and systemic IgG protection.

How do Government Stockpiles impact the distribution channel segmentation?

Government Stockpiles represent a highly centralized, high-volume distribution channel, essential for pandemic preparedness and mass seasonal campaigns. This channel often dictates pricing strategies and necessitates direct negotiation with manufacturers, contrasting with the retail and hospital pharmacy channels focused on individual prescriptions.

What distinguishes Subunit Nasal Vaccines from Live Attenuated Nasal Vaccines (LAVs)?

LAVs use a weakened, replicating form of the pathogen to induce immunity, often providing robust protection but carrying a small risk of reversion or mild symptoms. Subunit vaccines use only specific purified protein components, offering a higher safety profile and applicability in immunocompromised individuals, though they often require stronger adjuvants for comparable efficacy.

What is meant by the "Impact Forces" in market analysis?

Impact Forces refer to the cumulative, large-scale macroeconomic and technological factors that fundamentally shape market trajectory. For nasal spray vaccines, these forces include sustained global health security prioritization, evolving regulatory standards for mucosal immunity proof, and irreversible technological advancements in drug delivery and formulation science.

Is there a commercial nasal spray vaccine available for COVID-19?

While numerous candidates have reached advanced clinical stages globally, regulatory approvals and widespread commercial availability vary significantly by region. Several countries, particularly in Asia, have approved or conditionally authorized intranasal COVID-19 vaccines, utilizing platforms like viral vectors or inactivated virus technology, demonstrating the viability of the delivery route.

What is the significance of the shift towards thermostable formulations?

The shift toward thermostable formulations, often lyophilized (freeze-dried), is critical for market access in regions lacking reliable cold chain infrastructure. This technological advance reduces logistical costs and complexity, thereby improving distribution efficiency and global vaccine equity, particularly across Africa and rural Asia.

How does the value chain distinguish between upstream and downstream activities?

Upstream activities focus on early-stage innovation: R&D, antigen discovery, formulation science, and device prototyping. Downstream activities involve commercialization, focusing on large-scale manufacturing (filling, packaging), logistics (cold chain management), distribution, and marketing to end-users or governmental buyers.

Do nasal spray vaccines offer long-term immunity?

The duration of immunity varies significantly by vaccine type and target pathogen. While some nasal LAVs can offer several seasons of protection, the longevity of mucosal immunity is a major focus of ongoing research. Researchers are working to engineer formulations that induce more durable memory T-cell and B-cell responses in mucosal tissues.

What role does the pharmaceutical supply chain play in market competitiveness?

A robust and resilient pharmaceutical supply chain is essential for competitive advantage, particularly concerning the timely supply of bulk antigen, specialized adjuvants, and proprietary delivery devices. Companies with vertically integrated manufacturing and established cold chain logistics networks are better positioned to meet high seasonal and pandemic demand surges efficiently.

How do regulatory bodies approach the approval of nasal spray vaccines compared to injectables?

Regulatory bodies demand distinct clinical evidence for nasal vaccines, specifically requiring data on the induction of mucosal IgA antibodies, in addition to systemic IgG responses. Demonstration of protection against infection and transmission (not just severe disease) often requires specialized trial endpoints, making the approval process potentially more complex than that for established injectable formulations.

What emerging technology is most likely to disrupt the nasal spray vaccine market?

The integration of nanotechnology and AI-driven design is highly disruptive. Nanoparticle encapsulation technologies designed specifically to overcome mucosal barriers, combined with AI used for predicting ideal deposition patterns and dosage, promise to create highly efficacious, stable, and easily administered next-generation vaccines.

What is the market relevance of the pediatric population in this segment?

The pediatric population is highly relevant as they are primary recipients of current nasal spray influenza vaccines due to the non-invasive nature and high prevalence of needle phobia in this group. Market expansion in this demographic is a core driver, particularly with new vaccines targeting childhood diseases like RSV.

How is the concept of cross-protection relevant to nasal vaccine development?

Cross-protection is highly relevant, especially for viruses like influenza that mutate frequently. Nasal delivery aims to target conserved epitopes across different strains, potentially yielding a "universal" mucosal immune response that offers broader protection against variants, a critical unmet need in current respiratory vaccinology.

What market segment is expected to see the fastest growth in terms of product type?

Viral Vector and RNA/DNA-based intranasal vaccines are projected to experience the fastest growth. These platforms offer flexibility, rapid development capabilities, and the potential for stronger immune induction compared to traditional formulations, attracting substantial R&D funding following recent successful proof-of-concept studies.

How significant is the impact of needle phobia on market adoption rates?

Needle phobia (trypanophobia) is a significant psychological barrier to vaccination globally. The availability of nasal spray alternatives directly addresses this restraint, leading to higher acceptance and coverage rates, particularly in school-based vaccination programs and annual seasonal campaigns.

What is the distinction between direct and indirect distribution channels for these products?

Direct distribution typically involves manufacturers selling large volumes directly to government agencies for public health stockpiling. Indirect distribution involves sales through wholesale distributors to retail pharmacies, clinics, and hospitals, relying on traditional commercial supply chains and prescription mechanisms.

Why is formulation stability a persistent restraint for nasal vaccines?

Liquid formulations exposed to temperature fluctuations can degrade, compromising vaccine efficacy. The components needed for mucosal delivery (like specialized adjuvants or viral vectors) are often inherently less stable than traditional injectable formulations, necessitating advanced engineering solutions like lyophilization or improved packaging.

What is the long-term opportunity for nasal vaccines in therapeutic applications?

The long-term therapeutic opportunity lies in leveraging the mucosal immune system for controlled immune modulation, potentially addressing chronic conditions such as severe allergies, autoimmune diseases, or even certain cancers, by using the nasal route to induce specific tolerance or localized immune activation.

What are the implications of developing highly effective nasal vaccines for global transmission rates?

Highly effective nasal vaccines that block transmission at the mucosal surface could fundamentally alter pandemic control strategies. By preventing mild or asymptomatic infection and viral shedding, they could significantly reduce the basic reproductive number (R0) of respiratory viruses, potentially halting community spread more effectively than current systemic vaccines focused on preventing severe disease.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager