Natamycin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437894 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Natamycin Market Size

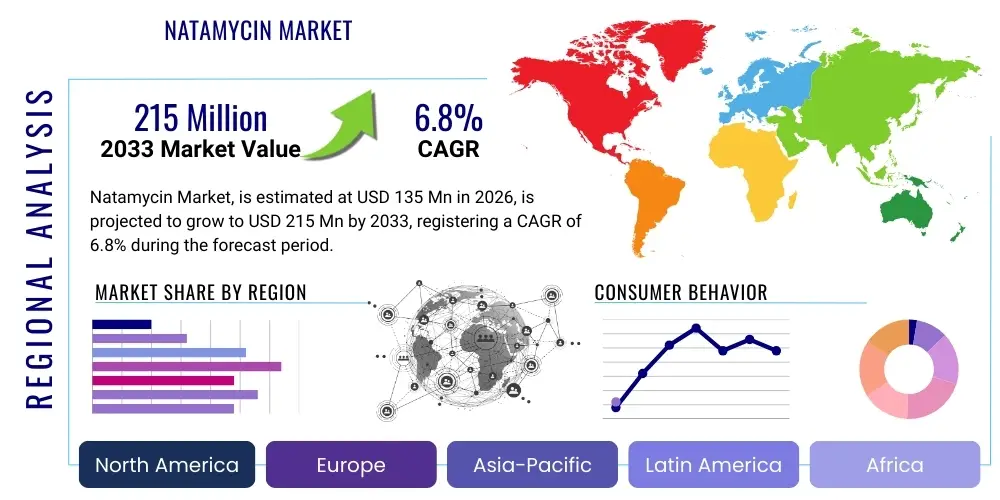

The Natamycin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $135 million in 2026 and is projected to reach $215 million by the end of the forecast period in 2033.

Natamycin Market introduction

The Natamycin Market centers on the production and distribution of Natamycin (Pimaricin), a potent, broad-spectrum antifungal agent derived from the bacterium Streptomyces natalensis. Recognized globally as a natural preservative (E235 in Europe), Natamycin is primarily utilized in the food and beverage industry to prevent spoilage caused by molds and yeasts, thereby extending the shelf life of various perishable products. Its efficacy at low concentrations and minimal impact on the flavor or appearance of food makes it a preferred alternative to synthetic preservatives.

The product is widely applied across crucial food segments, including dairy products (especially cheese and yogurt), processed meats, beverages, and baked goods. Its primary function is surface treatment, often applied through spraying or dipping solutions, particularly for hard and semi-hard cheeses where mold growth poses significant challenges. The increasing consumer preference for clean-label products, which feature natural, recognizable ingredients and fewer synthetic additives, is the fundamental driving force fueling the robust expansion of the Natamycin sector across developed and emerging economies.

Beyond its dominant role in food preservation, Natamycin exhibits growing potential in niche applications such as ophthalmology (treating fungal keratitis) and cosmetics. The market growth trajectory is further supported by stringent global regulations aimed at reducing food waste and increasing food safety standards. Technological advancements in fermentation processes and purification techniques are continuously improving production efficiency and the cost-effectiveness of high-ppurity Natamycin, ensuring its competitive position against other antimicrobial agents in the global marketplace.

Natamycin Market Executive Summary

The Natamycin market is characterized by strong growth, primarily fueled by shifting consumer paradigms favoring natural food preservatives and stringent food safety legislation globally. Key business trends include aggressive capacity expansion by major manufacturers, particularly in the Asia Pacific region, and strategic mergers and acquisitions focused on securing proprietary fermentation technologies. The market observes significant investment in research and development to optimize production yields and explore novel delivery systems, such as microencapsulation, which enhance Natamycin’s stability and controlled release in complex food matrices. Competitive dynamics are influenced by the balance between high-quality, pharmaceutical-grade Natamycin producers and commodity-grade suppliers catering to bulk food preservation needs.

Regionally, North America and Europe currently represent the largest consumption bases due to established regulatory acceptance (FDA and EFSA approval) and high penetration rates in the dairy sector. However, the Asia Pacific region is forecast to exhibit the highest CAGR during the projected period, driven by rapid urbanization, increasing demand for packaged and processed foods, and improving cold chain infrastructure in countries like China and India. Regulatory harmonization and increased awareness regarding the benefits of natural preservatives among regional food processors are accelerating adoption across APAC, making it the central hub for future manufacturing investment and consumption expansion.

Segmentation analysis reveals that the dairy application segment maintains market dominance, specifically within cheese preservation, owing to the high value and vulnerability of these products to mold contamination. In terms of product form, powdered Natamycin holds the largest market share due to its superior stability, ease of transport, and flexibility in formulation (dissolving into dipping solutions or incorporating into coating materials). However, the liquid Natamycin segment, utilized mainly for surface spraying, is expected to see accelerated growth as ready-to-use formulations gain traction among small- to medium-sized food processors seeking operational simplicity and guaranteed dosing accuracy.

AI Impact Analysis on Natamycin Market

User queries regarding AI's influence on the Natamycin market typically revolve around optimizing complex biological production processes, ensuring quality control, and predicting market demand. Users frequently ask how Artificial Intelligence (AI) and Machine Learning (ML) can improve the efficiency of microbial fermentation, which is central to Natamycin production, and whether AI can assist in compliance and regulatory monitoring across diverse jurisdictions. The core expectation is that AI will enhance yield, reduce batch-to-batch variability, and lower production costs, thereby stabilizing the supply chain for this sensitive biological additive. Furthermore, there is considerable interest in AI's capability to screen for new, efficient strains of Streptomyces natalensis and to model the interaction of Natamycin with various food components to predict optimal application doses.

The integration of sophisticated AI algorithms into the Natamycin production landscape is already transforming manufacturing protocols. By analyzing vast datasets generated during the fermentation stage—including pH levels, temperature, dissolved oxygen, and nutrient feed rates—ML models can predict optimal intervention points, leading to significant increases in Natamycin output per batch and a reduction in wasted resources. This predictive analytics capability moves the production process from reactive adjustments to proactive, optimized bioprocessing. Moreover, in quality assurance, AI-driven image recognition and spectroscopic analysis can swiftly identify contaminants or inconsistencies in the final purified product, ensuring that regulatory purity standards are consistently met before commercial distribution.

Beyond production, AI plays a pivotal role in market strategy and logistics. Advanced ML models are being deployed to forecast demand variations based on seasonal food consumption patterns, regional regulatory changes, and competitive pricing dynamics, allowing suppliers to optimize inventory management and reduce the risk of stockouts or spoilage. This enhanced visibility and predictive capacity are crucial for a global market dealing with a sensitive, naturally derived chemical. In the long term, AI-assisted research platforms may accelerate the discovery of new antimicrobial compounds or novel applications for Natamycin beyond traditional food preservation, such as exploring its efficacy against antibiotic-resistant pathogens in clinical settings or developing new sustained-release drug delivery formulations.

- Optimization of Fermentation Yields: AI/ML models analyze bioprocess parameters (temperature, pH, nutrient input) to maximize Streptomyces natalensis output and Natamycin concentration.

- Enhanced Quality Control (QC): AI-driven spectroscopy and hyperspectral imaging detect impurities and ensure consistent product potency, streamlining batch release.

- Predictive Maintenance and Supply Chain: ML algorithms forecast equipment failures and predict regional demand fluctuations, stabilizing global Natamycin supply and logistics.

- Strain Improvement and Genetic Engineering: AI assists in screening high-producing microbial strains and optimizing genetic pathways for enhanced biosynthesis efficiency.

- New Application Discovery: Data mining and AI correlation platforms explore potential therapeutic or cosmetic uses for Natamycin, broadening its market scope beyond food.

DRO & Impact Forces Of Natamycin Market

The Natamycin market is fundamentally shaped by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively exert significant Impact Forces (IF) on its growth trajectory. The primary driver is the accelerating global shift toward natural and clean-label ingredients, driven by heightened consumer awareness regarding the potential adverse effects of synthetic preservatives. This preference positions Natamycin, a natural antimicrobial derived from fermentation, as a highly desirable replacement for chemicals like sorbates and benzoates. Concurrently, increasing global urbanization and the resultant expansion of the packaged food industry, coupled with mounting concerns over food waste, mandate effective preservation solutions, further boosting Natamycin demand.

Conversely, the market faces significant restraints, including stringent regulatory hurdles, particularly concerning maximum permissible usage levels and application scope, which can vary drastically between countries and economic blocs. Natamycin production relies on complex biological fermentation, making it susceptible to high initial investment costs and operational complexities, leading to price volatility compared to simpler chemical preservatives. Furthermore, a limited public understanding and occasional misclassification of Natamycin as a non-natural preservative in certain consumer segments pose communication challenges for market expansion, requiring continuous educational efforts by manufacturers and regulatory bodies.

Opportunities for growth are abundant, primarily revolving around the expansion of Natamycin's application portfolio into emerging sectors such as pharmaceuticals (specifically ophthalmology and dermatology), animal feed preservation, and advanced cosmetics, where its antimicrobial properties are highly valued. Technological advancements in encapsulation and synergistic formulations (combining Natamycin with other natural antimicrobials) offer the chance to enhance efficacy in challenging food environments and reduce overall dosage requirements. These impact forces—consumer demand acting as a consistent pull, regulatory complexity creating friction, and technological innovation providing necessary leverage—will define the competitive landscape and market penetration rates over the forecast period.

- Drivers: Growing consumer preference for natural, clean-label food preservatives; rising global food safety standards and waste reduction efforts; demonstrated efficacy against a wide range of molds and yeasts.

- Restraints: High production costs associated with complex microbial fermentation; varied and often strict regulatory approvals across different global markets; potential price competition from cheaper, synthetic alternatives.

- Opportunities: Expansion into high-value pharmaceutical and cosmetic applications; advancements in delivery systems (e.g., encapsulation) to improve stability and performance; market penetration into emerging economies with developing processed food sectors.

- Impact Forces: Strong regulatory oversight (medium to high impact); accelerating technological innovation (high impact); shifting consumer health trends (very high impact).

Segmentation Analysis

The Natamycin market is comprehensively segmented based on its application, form, and purity level, reflecting the diverse requirements of the end-user industries. This segmentation is crucial for understanding market dynamics, allowing manufacturers to tailor their production, formulation, and marketing strategies to specific industry needs. The efficacy of Natamycin across different matrices—from high-moisture dairy to dry ingredients—necessitates specialized product formats and concentration levels, directly impacting pricing and competitive positioning across segments. The application segment remains the most influential factor, defining volume demand and geographical distribution patterns, closely followed by the product form, which dictates ease of use and formulation stability.

The dominance of the dairy segment is uncontested, primarily driven by its use in cheese preservation, a critical necessity for maintaining product quality during aging, storage, and distribution. However, the non-food segments, especially pharmaceutical-grade Natamycin, although smaller in volume, command significantly higher price premiums due to the rigorous purification and quality assurance standards required for medical applications. The differentiation based on purity level—food-grade versus pharmaceutical-grade—is vital for regulatory compliance and market access, creating distinct value chains and competitive arenas within the broader market structure.

Further analysis of segmentation reveals emerging trends, such as the increasing utilization of Natamycin in processed meat and beverage applications, often mandated by shelf-life extensions required by modern retail supply chains. The ongoing research into synergistic formulations, where Natamycin is combined with other GRAS (Generally Recognized as Safe) ingredients, represents a crucial technological segmentation, aiming to broaden its applicability while optimizing antimicrobial performance under varying environmental conditions. These segments provide critical pathways for sustained market growth beyond traditional cheese preservation.

- By Application:

- Dairy Products (Cheese, Yogurt, Cream)

- Meat and Poultry

- Beverages (Fruit Juices, Wine, Soft Drinks)

- Baked Goods and Confectionery

- Pharmaceutical/Medical (Ophthalmic solutions)

- Others (Animal Feed, Cosmetics)

- By Form:

- Powder (Pure and Blended)

- Liquid (Suspensions, Concentrates)

- By Purity Level:

- Food Grade

- Pharmaceutical Grade (High Purity)

Value Chain Analysis For Natamycin Market

The Natamycin market value chain is intricate, beginning with specialized upstream microbial fermentation and culminating in highly regulated downstream food and pharmaceutical applications. The upstream segment involves sourcing raw materials, primarily specialized fermentation media (sugars, nitrogen sources, mineral salts), and cultivating high-yield strains of Streptomyces natalensis. This stage is capital-intensive and requires significant technical expertise in bioprocessing, purification, and crystallization to ensure the production of Natamycin that meets stringent food or pharmaceutical standards. The technical barrier to entry at the production stage is high, concentrating manufacturing capacity among a few specialized global companies.

Midstream activities focus on formulating the bulk Natamycin into commercially viable products, such as standardized powders or ready-to-use liquid suspensions, often blended with carrier agents (e.g., salts or starches) to enhance stability and ease of application. Distribution channels are highly specialized, often requiring cold chain or carefully controlled environments due to the product's sensitivity to light, pH, and temperature, particularly for the liquid and high-purity pharmaceutical formats. Direct distribution is common for large industrial buyers (e.g., major cheese producers) where technical support and customized dosing recommendations are required, establishing strong producer-client relationships.

Downstream market dynamics are characterized by strict quality assurance requirements from end-users, predominantly large-scale food processors and pharmaceutical companies. Indirect distribution utilizes specialized food ingredient distributors who manage inventory, local regulatory compliance checks, and logistical support for smaller buyers. Potential customers prioritize suppliers who offer robust documentation, regulatory compliance certificates (e.g., ISO, kosher, halal, non-GMO), and consistent product quality. The integration of technical service (application consultancy) into the sales process is a crucial differentiator, ensuring optimal use and compliance within the diverse production environments of end-user industries.

Natamycin Market Potential Customers

The primary consumers of Natamycin are highly regulated entities within the food processing, pharmaceutical, and specialized chemical industries that require effective, natural antimicrobial solutions to guarantee product safety and extend shelf life. The largest consumer base resides in the dairy sector, encompassing manufacturers of cheese (both surface-ripened and brined varieties), yogurt, and fermented milk products, where mold inhibition is paramount to product quality and inventory control. These companies seek Natamycin to comply with internal quality standards and external regulatory mandates regarding microbial load.

Another significant group includes major multinational and regional producers of packaged foods, particularly those specializing in processed meats (e.g., sausages, ham coatings), fruit juices, and wine, where Natamycin acts as a crucial barrier against yeast and mold spoilage, particularly during long-distance transportation and storage in diverse climatic conditions. The demand from these sectors is directly tied to global trade volumes and consumer demand for consistently high-quality, long-shelf-life products.

The fastest-growing segment of potential customers includes pharmaceutical and clinical end-users, notably compounding pharmacies and specialized drug manufacturers focused on ophthalmological solutions (like eye drops for fungal infections) and topical dermatological preparations. These buyers require ultra-high purity, certified-grade Natamycin, prioritizing product quality, stability, and rigorous testing protocols over cost-effectiveness, thereby driving the demand for specialized, premium Natamycin grades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $135 million |

| Market Forecast in 2033 | $215 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM, Danisco (DuPont), Hande Bio-Tech, Foodchem International, Delvitis, Zhejiang Silver Elephant Bioengineering, Shandong Zhongke-Lu'an, VGP Biotechs, Nanjing Jianle, Kemin Industries, Lallemand, Biocon, Novozymes, Chr. Hansen, TCI Chemicals, Siveele B.V., Guangxi Biokey, Shanghai Richfield, Fuso Chemical, C.J. CheilJedang. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natamycin Market Key Technology Landscape

The Natamycin market's technological landscape is primarily defined by continuous advancements in microbial fermentation, purification processes, and formulation science, all aimed at enhancing production efficiency, reducing costs, and improving product performance under diverse operational conditions. The core technology remains submerged fermentation, utilizing specialized bioreactors where high-yielding strains of Streptomyces natalensis are cultivated. Modern production facilities are increasingly incorporating advanced control systems, often leveraging AI and sensor technology, to monitor and precisely adjust parameters like oxygen transfer rate, agitation speed, and nutrient feed, which are critical determinants of Natamycin yield and quality consistency across large-scale batches.

A significant technological focus is placed on enhancing downstream processing, specifically the complex purification and recovery stages. Natamycin, being a polyene macrolide, requires careful handling due to its sensitivity to pH and light. Key innovations here include optimized extraction techniques using specific solvents, advanced membrane filtration systems (ultrafiltration and nanofiltration) for removing impurities, and highly controlled crystallization processes to achieve pharmaceutical-grade purity (typically >95%). Manufacturers are investing heavily in continuous purification systems that replace traditional batch processing, promising substantial reductions in energy consumption and labor while improving throughput rates.

Furthermore, formulation technology plays a critical role in market differentiation. The development of advanced delivery systems, particularly encapsulation techniques (such as liposomal or microencapsulation using biodegradable polymers), is a pivotal innovation. Encapsulation protects Natamycin from detrimental environmental factors present in food matrices (like acidity or high salt content) and ensures a sustained, controlled release over time, significantly enhancing its efficacy, especially in challenging applications like brines and low-pH beverages. Research into synergistic combinations with other natural preservatives (like bacteriocins or organic acids) represents another technological frontier, enabling manufacturers to offer broad-spectrum protection while meeting clean-label requirements.

Regional Highlights

The global Natamycin market exhibits distinct regional dynamics driven by local regulatory environments, consumer dietary habits, and the maturity of the processed food industry.

- North America: A mature and high-value market, primarily driven by the large-scale production of cheese (Cheddar, Monterey Jack) and strict regulations promoting food safety. The US FDA approval solidifies its position. The region demonstrates high technological adoption in dairy processing and a strong consumer focus on natural ingredients, creating consistent demand for food-grade Natamycin, and is also a significant consumer of pharmaceutical-grade Natamycin.

- Europe: Dominant in terms of application breadth, largely due to EFSA’s long-standing acceptance of Natamycin (E235) across numerous product categories, particularly traditional cheese varieties (e.g., Gouda, Edam) and dry sausages. European markets are characterized by stringent quality controls and a highly organized supply chain, emphasizing natural preservation solutions to adhere to clean-label campaigns.

- Asia Pacific (APAC): The fastest-growing region, powered by rapid economic development, changing lifestyles, and subsequent surge in packaged food consumption (ready meals, processed snacks, dairy alternatives). Countries like China, India, and Southeast Asian nations are increasing Natamycin adoption as their local food industries modernize and strive for longer shelf lives and export compliance, presenting lucrative opportunities for market penetration and establishing new manufacturing hubs.

- Latin America: Characterized by moderate, steady growth, driven by expansion in the regional dairy and meat processing sectors, particularly in Brazil and Argentina. Demand is often correlated with economic stability and investment in modern cold chain logistics, which necessitates reliable antimicrobial preservation for perishable goods destined for both domestic consumption and export markets.

- Middle East and Africa (MEA): Currently represents a smaller but expanding market segment. Growth is propelled by increasing regulatory standards, foreign investment in food production capabilities, and rising consumer awareness of food quality and spoilage prevention, particularly in the Gulf Cooperation Council (GCC) countries where imported food items dominate the retail landscape, requiring extended shelf life.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natamycin Market.- DSM

- Danisco (DuPont)

- Hande Bio-Tech

- Foodchem International

- Delvitis

- Zhejiang Silver Elephant Bioengineering

- Shandong Zhongke-Lu'an

- VGP Biotechs

- Nanjing Jianle

- Kemin Industries

- Lallemand

- Biocon

- Novozymes

- Chr. Hansen

- TCI Chemicals

- Siveele B.V.

- Guangxi Biokey

- Shanghai Richfield

- Fuso Chemical

- C.J. CheilJedang

Frequently Asked Questions

Analyze common user questions about the Natamycin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Natamycin and why is it considered a clean-label ingredient?

Natamycin (E235) is a naturally occurring antifungal compound produced via fermentation of the bacterium Streptomyces natalensis. It is considered clean-label because it is a bio-derived, natural preservative widely accepted as a superior alternative to synthetic chemical preservatives (like sorbates or benzoates) in the food industry.

In which applications is Natamycin most commonly used globally?

Globally, Natamycin is most extensively used in the dairy industry, specifically for the surface treatment of hard and semi-hard cheeses to inhibit mold and yeast growth, significantly extending the product's shelf life and maintaining quality during storage and distribution.

Is there a difference in purity between food-grade and pharmaceutical-grade Natamycin?

Yes, pharmaceutical-grade Natamycin requires significantly higher purity (often >95%) and must meet rigorous pharmacopeial standards (USP/EP) for therapeutic uses, such as treating fungal keratitis, whereas food-grade Natamycin standards focus more on functional efficacy and compliance with food additive regulations (e.g., FDA, EFSA).

What regulatory constraints affect the Natamycin market growth?

Market growth is constrained by variations in regulatory approvals across regions regarding maximum permissible dosage levels and the specific food categories where its use is permitted. Achieving regulatory consensus and simplifying the approval process across diverse national boundaries remain persistent challenges.

How do technology and innovation impact the cost-effectiveness of Natamycin?

Technological advancements in high-yield microbial strain optimization, advanced continuous purification techniques (like membrane filtration), and sophisticated process control systems are driving down the operational costs associated with complex fermentation, thereby improving the overall cost-effectiveness and competitiveness of Natamycin.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager