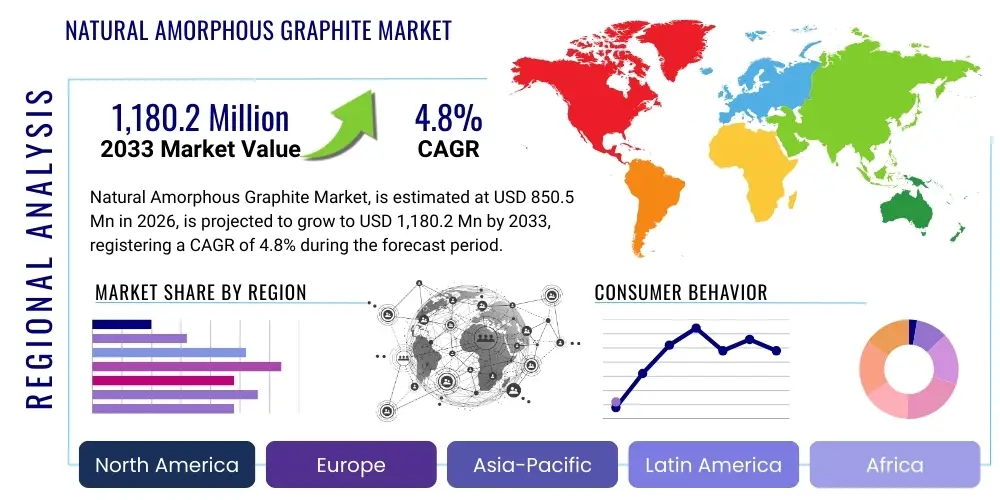

Natural Amorphous Graphite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432577 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Natural Amorphous Graphite Market Size

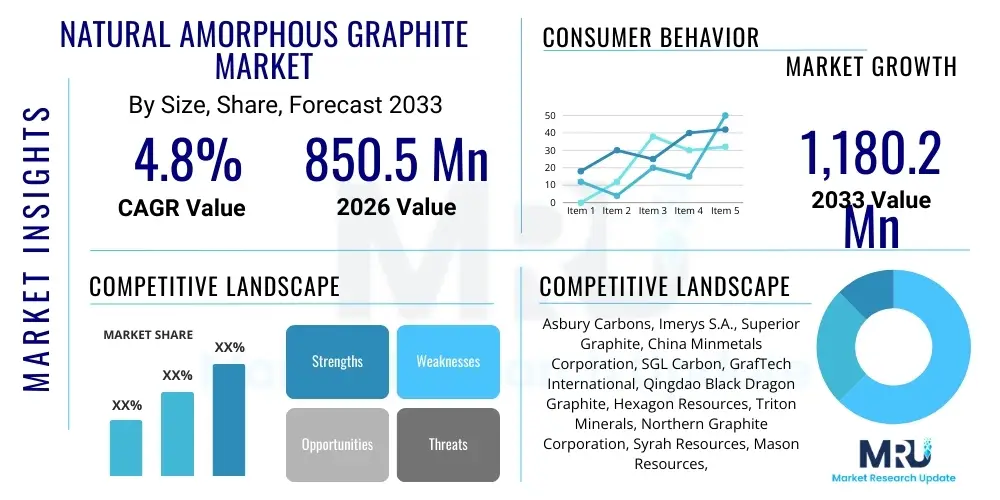

The Natural Amorphous Graphite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $850.5 Million in 2026 and is projected to reach $1,180.2 Million by the end of the forecast period in 2033.

Natural Amorphous Graphite Market introduction

Natural Amorphous Graphite is a high-carbon mineral characterized by its fine, microcrystalline structure, distinguishing it from flake and vein graphite varieties. While the term "amorphous" suggests a lack of crystal structure, it technically refers to its extremely fine particle size, which makes individual crystals undetectable under standard optical microscopy. This high purity and fine particle size make amorphous graphite essential in numerous industrial applications, particularly where consistent performance and high carbon content are paramount. Key applications span metallurgy, refractories, friction materials, and coatings, serving as a cost-effective alternative to higher-grade synthetic graphite in specific use cases.

The market expansion is fundamentally driven by robust demand from the global steel and automotive industries, where amorphous graphite is crucial for manufacturing fire-resistant materials and specialized brake linings. Its excellent thermal stability, electrical conductivity, and lubricating properties ensure its sustained utilization in demanding industrial environments. Furthermore, the increasing focus on energy efficiency and lightweighting in manufacturing processes fuels the adoption of advanced refractory linings and conductive coatings that rely heavily on the unique attributes of this material.

Major benefits of utilizing natural amorphous graphite include its affordability relative to other graphite forms, its high carbon purity, and its reliable performance as a reducing agent or lubricant. The driving factors for market growth involve infrastructure development globally, particularly in emerging economies, which necessitates extensive steel production. Additionally, the nascent, yet growing, demand from the lithium-ion battery sector—specifically for anode materials in certain performance segments—is beginning to shape future market dynamics, positioning amorphous graphite as a versatile and indispensable industrial mineral.

Natural Amorphous Graphite Market Executive Summary

The Natural Amorphous Graphite Market is poised for stable expansion, underpinned by sustained demand across key industrial sectors, notably refractories, foundries, and the braking industry. Business trends indicate a focus on process optimization and enhanced purification techniques to meet the increasingly stringent specifications required by high-tech applications, particularly in Europe and North America. Consolidation among smaller mining operations and strategic alliances aimed at securing consistent supply chains are defining characteristics of the current market landscape. Furthermore, manufacturers are exploring innovative composite materials that leverage amorphous graphite’s properties to enhance product lifecycle and performance efficiency, driving value growth over volume growth in mature segments.

Regionally, the Asia Pacific (APAC) region dominates the production and consumption of natural amorphous graphite, primarily due to the massive scale of industrial activity, steel production, and refractory manufacturing in countries like China and India. The rapid urbanization and infrastructure investment across APAC are powerful engines for demand. While APAC remains the cornerstone, regulatory shifts concerning environmental compliance in major producing nations are creating market volatility and prompting end-users in Europe and North America to diversify sourcing strategies, often looking towards African and Latin American suppliers to mitigate risks associated with over-reliance on single geographic sources.

Segment trends highlight the dominance of the refractory application segment, which utilizes amorphous graphite for crucibles, ladles, and continuous casting processes owing to its high resistance to heat and chemical inertness. Concurrently, the friction material segment, crucial for vehicle brakes and clutches, demonstrates steady growth, driven by global automotive production volumes. The smaller, yet strategically significant, segment encompassing specialty lubricants and conductive coatings is experiencing higher growth rates, reflecting technological advancements and the adoption of amorphous graphite in niche, high-value industrial applications that demand specific electrical or thermal management characteristics.

AI Impact Analysis on Natural Amorphous Graphite Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Natural Amorphous Graphite Market frequently revolve around how AI can optimize mining efficiency, predict global supply chain disruptions, and accelerate materials discovery for enhanced industrial performance. Users are keen to understand if AI-driven predictive maintenance can reduce downtime in refractory applications that utilize amorphous graphite, or if machine learning algorithms can refine the quality control processes, especially concerning carbon purity and particle size distribution. The central expectation is that AI will primarily serve as a tool for operational efficiency and demand forecasting, rather than directly influencing the material’s physical properties or replacing its core applications, given its status as a fundamental industrial mineral.

AI is expected to significantly enhance the operational facets of the amorphous graphite supply chain, from geological exploration and resource modeling to automated quality assurance in processing plants. Machine learning models can analyze vast datasets concerning mineral composition and processing parameters, allowing producers to achieve higher yields and consistent product quality, thereby reducing waste and operational costs. This analytical capability is crucial for amorphous graphite, where minor variations in particle size or ash content can drastically affect its performance in specialized applications like battery components or highly demanding refractory linings. The integration of digital twins and AI-powered simulation tools will also aid end-users in optimizing the formulation of graphite composites, leading to better material utilization.

While AI is unlikely to replace natural amorphous graphite itself, its influence on demand predictability and efficiency will subtly reshape market competitiveness. Companies utilizing AI for demand forecasting will be better positioned to manage inventory and respond swiftly to cyclical changes in the steel and automotive industries. Furthermore, the integration of AI in advanced robotic sorting systems at the mine site can improve beneficiation processes, potentially leading to higher recovery rates of quality graphite, mitigating some of the supply constraints faced by the industry. This technological adoption will differentiate leading players focused on sustainability and efficiency.

- AI optimizes geological modeling and exploration for new amorphous graphite reserves.

- Predictive analytics enhance supply chain resilience by forecasting regional demand fluctuations in steel and automotive sectors.

- Machine learning algorithms improve processing efficiency, purity levels, and yield rates in beneficiation plants.

- AI-driven quality control systems ensure precise particle size distribution necessary for advanced refractory and friction materials.

- Automation facilitated by AI reduces operational costs and enhances worker safety in challenging mining environments.

- Digital twins accelerate the development and testing of graphite-containing composite materials for enhanced performance.

DRO & Impact Forces Of Natural Amorphous Graphite Market

The Natural Amorphous Graphite Market is strongly influenced by a combination of robust growth drivers (D), significant constraints (R), emerging opportunities (O), and potent impact forces, all shaping its trajectory through the forecast period. The primary driver remains the indispensable role of amorphous graphite in the global refractory industry, intrinsically linked to the expansion of steel and basic materials production, particularly in rapidly industrializing regions. Simultaneously, restraints such as stringent environmental regulations related to mining and processing, coupled with the variability in quality and availability from primary source regions, present challenges to stable supply chains. Opportunities emerge from the exploration of amorphous graphite’s potential as a more affordable carbon source in specific battery chemistries and the growth of friction materials in the expanding electric vehicle (EV) sector, where noise reduction and thermal management are critical performance metrics.

The core impact forces affecting the market include the price volatility of competing carbon materials, primarily synthetic graphite and other carbonaceous fillers, which influence purchasing decisions among cost-sensitive end-users. Geopolitical stability in major producing countries, notably China and Mexico, acts as a continuous force determining global supply levels and pricing. Furthermore, technological advancements in material science, leading to the development of higher-performance substitutes or novel processing techniques that change end-user specifications, consistently exert pressure on the established market dynamics. The shift towards sustainable mining practices and ethical sourcing is also becoming a non-negotiable impact force, driven by consumer and regulatory pressure, forcing producers to invest in cleaner extraction methods.

Specific market forces are currently driving modernization efforts within the industry. The increasing demand for higher-purity amorphous graphite, even in traditional segments like refractories, reflects a pursuit of enhanced product longevity and performance, demanding greater investment in post-processing purification technologies. Conversely, the market is restrained by the finite nature of high-quality deposits and the high capital expenditure required for opening new mines and processing facilities that comply with modern environmental standards. Navigating these drivers and restraints requires strategic foresight from major market participants, balancing cost-effectiveness with compliance and quality assurance to maintain competitive positioning.

Segmentation Analysis

The Natural Amorphous Graphite Market is segmented primarily based on end-use application, purity level, and geographical region. Segmentation by application provides critical insights into the primary demand drivers, with refractories consistently representing the largest share due to the material's essential role in lining furnaces and crucibles in the steel and glass industries. Purity level segmentation is crucial as it dictates the suitability of the material for specialized, high-value applications versus standard industrial usage, with 80% to 90% carbon content being the most common category for bulk consumption.

Further segmentation reveals distinct market dynamics within smaller, specialized segments. The lubricants and pencils segments, while smaller in volume, often command higher pricing due to the stringent particle size and purity requirements. The differentiation across these segments allows market players to tailor their production capabilities and marketing efforts, focusing either on high-volume, cost-competitive supply for refractories or low-volume, high-margin specialty products. Understanding these granular segmentations is vital for effective market penetration and long-term investment planning.

- By Application:

- Refractories

- Foundries and Casting

- Friction Materials (Brake Linings and Clutches)

- Coatings and Paints

- Lubricants

- Pencils and Electrodes

- Others (Chemicals, Batteries)

- By Purity Level:

- 80% to 90% Carbon Content

- 90% to 95% Carbon Content

- Above 95% Carbon Content

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Natural Amorphous Graphite Market

The value chain for natural amorphous graphite is complex, starting with geological exploration and culminating in the incorporation of the refined material into high-performance industrial products. The upstream segment involves mining and initial beneficiation, predominantly concentrated in countries like China, Mexico, and South Korea, where high-quality amorphous deposits are abundant. Key activities at this stage include extraction, crushing, grinding, and flotation to achieve the initial concentration. The cost of mining and adherence to regulatory standards heavily influence the price of the raw material entering the chain.

The midstream section focuses on crucial processing activities, including purification (acid leaching or thermal treatment) to achieve the required carbon content, followed by meticulous sizing and packaging. This stage adds significant value, transforming bulk raw graphite into industrial-grade material suitable for specialized applications like friction compounds or high-end refractories. Distribution channels typically involve large international traders and distributors who possess the logistical networks and regulatory knowledge to transport bulk minerals across continents, facilitating indirect sales to numerous smaller manufacturing end-users globally.

The downstream segment encompasses the end-product manufacturers—refractory producers, brake pad manufacturers, lubricant formulators, and specialized chemical companies—who are the direct customers. Direct distribution often occurs for very large volume contracts between mining conglomerates and major steel producers. Indirect distribution, leveraging specialized regional agents, is more common for supplying niche applications and SMEs. The competitive advantage in the downstream segment often relies on the stability of supply, material consistency, and technical support provided by the graphite supplier, ensuring optimal incorporation of the amorphous graphite into the final product formulation.

Natural Amorphous Graphite Market Potential Customers

The potential customers for natural amorphous graphite are highly diversified but predominantly concentrated within heavy industrial and manufacturing sectors that rely on materials with superior thermal, electrical, and lubricating properties. The largest segment of buyers consists of refractory manufacturers, who purchase vast quantities of medium-purity graphite for use in crucibles, fire bricks, and furnace linings critical for steel, cement, and non-ferrous metal production. These end-users demand high consistency in carbon content and low ash residue to ensure material longevity under extreme heat and chemical exposure.

Another major buying group includes manufacturers of friction materials, specifically companies producing automotive brake pads, clutch facings, and train braking systems. In this segment, amorphous graphite serves as a vital component to manage heat dissipation, wear resistance, and noise reduction. The increasing complexity of modern braking systems and the growth of the global automotive fleet ensure sustained demand from this consumer base. Furthermore, the specialized chemical and paint industries utilize fine-grained amorphous graphite for conductive coatings, anti-corrosive paints, and as a component in certain chemical processes requiring stable carbon sources.

Emerging segments of buyers include research institutions and specialty chemical producers exploring novel uses in energy storage, focusing on developing cost-effective anode materials for specific segments of the battery market where high purity is less critical than cost and availability. Lubricant producers also form a consistent customer base, utilizing amorphous graphite's inherent slipperiness in industrial greases, oils, and dry film lubricants, often for heavy machinery and extreme temperature environments where conventional petroleum-based lubricants fail.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850.5 Million |

| Market Forecast in 2033 | $1,180.2 Million |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asbury Carbons, Imerys S.A., Superior Graphite, China Minmetals Corporation, SGL Carbon, GrafTech International, Qingdao Black Dragon Graphite, Hexagon Resources, Triton Minerals, Northern Graphite Corporation, Syrah Resources, Mason Resources, Focus Graphite, Graphite India Ltd., Tokai Carbon, Shaanxi Xinghua Graphite Co., Ltd., Tirupati Graphite, R.K. Graphite, BTR New Energy Materials, Nanjing Kairuifeng Advanced Carbon Material Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Amorphous Graphite Market Key Technology Landscape

The technology landscape in the natural amorphous graphite market is dominated by advancements in mining efficiency, purification processes, and particle engineering. Traditional extraction techniques are being supplemented by automation and enhanced sensor-based sorting (SBS) technologies, which significantly improve the selectivity of ore recovery and reduce waste, leading to higher overall yield from existing deposits. In terms of processing, the focus remains heavily on achieving higher carbon purity levels economically, utilizing advanced acid leaching techniques and specialized thermal purification reactors that can handle the fine particle size of amorphous graphite without excessive material loss. These purification technologies are critical for meeting the increasingly demanding specifications of friction materials and specialty coating applications.

Particle engineering represents a growing area of technological innovation. Techniques such as micronization and spheronization, typically associated with high-end flake graphite, are being adapted for amorphous graphite to tailor its morphology for specific niche applications, such as certain battery anode formulations or highly specialized lubricant blends. Achieving consistent, tight particle size distribution (PSD) is paramount for performance in refractories and friction materials, leading to the adoption of sophisticated air classifiers and grinding mills. This technological refinement allows suppliers to move amorphous graphite into market segments previously dominated by higher-cost carbon materials, enhancing its competitive value proposition.

Furthermore, sustainable and environmentally friendly processing technologies are gaining traction, driven by regulatory pressure and corporate social responsibility goals. Innovations in closed-loop water usage, reduced reliance on harsh chemical reagents in purification, and improved tailings management are essential technological trends. These advancements not only ensure compliance but also offer a competitive edge by reducing operational environmental footprints. The application of sophisticated analytical tools, including X-ray diffraction and scanning electron microscopy, forms the technological backbone for quality control, ensuring that every batch of natural amorphous graphite adheres precisely to the required industrial specifications before entering the complex supply chain.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the Natural Amorphous Graphite Market, driven primarily by China, which is both the largest producer and consumer globally. The massive scale of the Chinese steel and cement industries necessitates huge volumes of refractory materials, cementing graphite's core application. India and Southeast Asian nations, fueled by rapid industrialization and urbanization, also exhibit substantial growth. Regional growth is characterized by high volume consumption but increasingly challenged by environmental regulatory crackdowns, particularly concerning particulate emissions from processing, which necessitates technological upgrades among local producers.

- North America: The North American market is characterized by mature industrial demand and a focus on high-quality, specialized applications. Demand is stable in the friction materials segment (automotive and heavy transport) and in high-performance refractory linings used in advanced manufacturing. While domestic production is limited, the region relies heavily on imports from Mexico and other global suppliers. Key trends include the stringent material specifications required by automotive OEMs and a growing emphasis on reliable, non-China-sourced supply chains, favoring suppliers with robust ethical sourcing policies.

- Europe: Europe represents a highly advanced market with sophisticated demand across specialized industrial sectors, particularly automotive, aerospace, and high-temperature manufacturing. The European market focuses heavily on material certification, sustainability, and quality assurance. Amorphous graphite is crucial for producing high-end friction components that meet strict EU safety standards and high-performance refractories in specialized alloy manufacturing. Regulatory frameworks promoting clean industrial practices are influencing a shift towards higher-purity grades and processed material, even for traditional bulk applications.

- Latin America: Latin America is significant primarily as a production hub, particularly Mexico, which holds substantial, high-quality amorphous graphite deposits. Market dynamics in this region are tied to global commodity prices and export volumes. Domestic consumption is generally smaller, driven mainly by regional mining operations and localized manufacturing. The growth potential lies in further investment in processing infrastructure to move beyond raw material export and capture higher value within the global supply chain, leveraging proximity to the North American market.

- Middle East & Africa (MEA): The MEA region is currently a smaller consumer base, dominated by infrastructure development projects and growth in local steel production (especially in the Gulf Cooperation Council countries). Consumption is tied to refractory demand supporting these industrial expansions. Africa holds promising, though often underdeveloped, graphite reserves. Market expansion will depend heavily on geopolitical stability and the realization of major industrial projects that require large-scale importation of refractory and construction materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Amorphous Graphite Market.- Asbury Carbons

- Imerys S.A.

- Superior Graphite

- China Minmetals Corporation

- SGL Carbon

- GrafTech International

- Qingdao Black Dragon Graphite

- Hexagon Resources

- Triton Minerals

- Northern Graphite Corporation

- Syrah Resources

- Mason Resources

- Focus Graphite

- Graphite India Ltd.

- Tokai Carbon

- Shaanxi Xinghua Graphite Co., Ltd.

- Tirupati Graphite

- R.K. Graphite

- BTR New Energy Materials

- Nanjing Kairuifeng Advanced Carbon Material Co.

Frequently Asked Questions

Analyze common user questions about the Natural Amorphous Graphite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between amorphous and flake graphite?

Amorphous graphite, defined by its extremely fine particle size and microcrystalline structure, is generally lower in purity and cost-effective for industrial applications like refractories and friction materials. Flake graphite has a distinct crystalline structure, higher purity, and is primarily used in high-end applications like expandable graphite and lithium-ion battery anodes.

Which application segment holds the largest share in the amorphous graphite market?

The refractory segment consistently holds the largest market share. Amorphous graphite is essential for lining furnaces, crucibles, and ladles in the steel, cement, and glass manufacturing industries due to its high thermal resistance and chemical stability.

How is the Natural Amorphous Graphite supply chain affected by geopolitical factors?

The supply chain is highly centralized, with a few countries dominating production (notably China and Mexico). Geopolitical instability or regulatory changes in these regions can lead to significant supply bottlenecks and price volatility globally, driving consumers to seek diversified, resilient sourcing strategies.

Can amorphous graphite be used as a material for lithium-ion batteries?

While high-purity spherical flake graphite is the standard for anodes, amorphous graphite is being explored as a cost-effective alternative or blending material in certain lower-performance battery segments or specific coating applications due to its carbon content and relative abundance.

What technological advancements are driving the quality improvement of amorphous graphite?

Key technological advancements include enhanced sensor-based sorting (SBS) in mining, refined acid leaching and thermal purification processes to boost carbon purity, and specialized particle engineering techniques to achieve precise particle size distribution required for high-performance applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager