Natural and Synthetic Menthol Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440239 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Natural and Synthetic Menthol Market Size

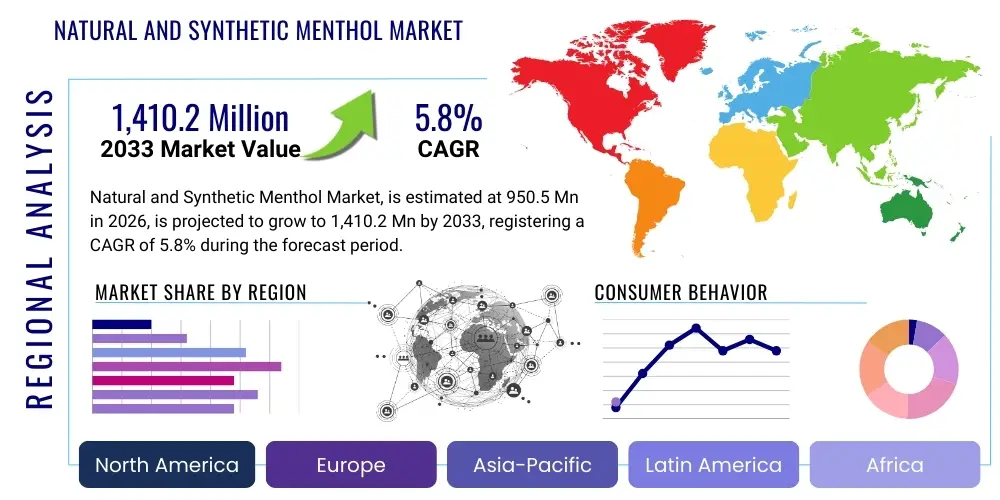

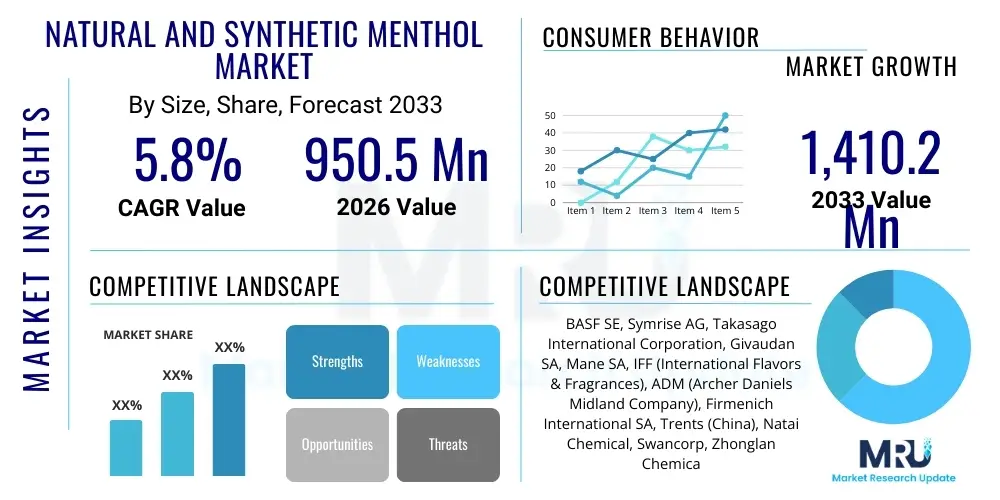

The Natural and Synthetic Menthol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 950.5 Million in 2026 and is projected to reach USD 1,410.2 Million by the end of the forecast period in 2033.

Natural and Synthetic Menthol Market introduction

The Natural and Synthetic Menthol Market encompasses the production, distribution, and utilization of L-menthol, a cyclic terpene alcohol known for its distinctive cooling sensation, refreshing aroma, and analgesic properties. Menthol is a critical ingredient across numerous sectors, ranging from consumer goods like oral hygiene products and confectionery to specialized pharmaceutical and therapeutic applications. Natural menthol is primarily sourced from the oil of the cornmint plant (Mentha arvensis), requiring extensive agricultural processes and subsequent distillation, which inherently links its supply and price volatility to climatic conditions and crop yields. This natural variant is highly valued for its perceived purity and complex aromatic profile, although its sustainability and cost effectiveness often pose challenges for large-scale industrial buyers.

Conversely, synthetic menthol, predominantly manufactured through chemical processes such as the hydrogenation of thymol or utilizing proprietary synthesis routes developed by major chemical producers, offers higher supply stability and often a more competitive price point compared to its natural counterpart. Major applications of both forms include flavorings in chewing gums and candies, active ingredients in cough suppressants and topical pain relievers, and as a cooling additive in tobacco products (where regulations permit). The inherent benefits of menthol, specifically its ability to activate cold-sensitive receptors (TRPM8) in the skin and mucous membranes, drive its pervasive use. Key driving factors propelling market expansion include rising consumer awareness regarding functional ingredients, escalating demand for sophisticated flavor profiles in foods and beverages, and the continuous growth of the pharmaceutical and personal care industries, particularly in emerging economies characterized by improving healthcare infrastructures and increased disposable incomes.

The market dynamic is highly influenced by the interplay between the two main types. While natural menthol commands a premium and is favored in the premium food and cosmetic segments due to consumer preference for natural labeling, synthetic menthol dominates high-volume industrial uses where cost optimization and reliable, large-scale supply are paramount. Technological advancements in synthetic production, aiming for high optical purity (L-menthol content), are blurring the quality distinction, intensifying competition. Furthermore, regulatory shifts, particularly concerning menthol’s use in flavored tobacco products across North America and Europe, necessitate continuous strategic adaptation by manufacturers to diversify their application portfolio into alternative growth areas such as Vicks vaporubs, sports medicine, and therapeutic dermal patches, thus ensuring sustained market relevance despite regulatory headwinds.

Natural and Synthetic Menthol Market Executive Summary

The Natural and Synthetic Menthol Market is poised for robust expansion driven by sustained demand from the pharmaceutical and oral care sectors, coupled with innovation in flavor technology. Business trends indicate a strategic move towards hybrid sourcing models, where manufacturers leverage the stable pricing of synthetic alternatives while maintaining a natural portfolio to cater to specific consumer segments demanding organic or naturally derived ingredients. The ongoing push for high purity L-menthol, regardless of origin, is dictating investment in advanced separation and synthesis technologies. Furthermore, corporate sustainability initiatives are increasingly scrutinizing the environmental footprint of menthol production, favoring suppliers who can demonstrate responsible sourcing and efficient chemical processing, leading to consolidation among vertically integrated players who control both the supply chain and end-product formulation expertise. Diversification into non-traditional applications like functional foods and aromatherapy diffusers represents a key business opportunity for established players seeking to mitigate risk associated with volatile raw material costs and tightening regulatory oversight in traditional segments.

Regional trends highlight the Asia Pacific (APAC) region, led by China and India, as the primary growth engine, fueled by rapid urbanization, massive population bases, and soaring demand for personal care and pharmaceutical products. APAC not only serves as a major consumption hub but also dominates the global supply chain for natural menthol (China being a primary producer of cornmint oil) and is rapidly increasing its capacity for synthetic production. North America and Europe, while characterized by slower growth rates due to stringent regulations on flavored tobacco products, maintain strong market value driven by sophisticated pharmaceutical research and development and high consumer spending on premium wellness and oral care products. Regulatory divergence across major regions, particularly the bans on menthol cigarettes in various jurisdictions, mandates tailored regional strategies, pushing companies to reallocate resources toward therapeutic and non-tobacco flavor applications, thus structurally shifting the consumption pattern towards the healthcare and cosmetics segments.

Segmentation trends reveal that the Synthetic Menthol segment, categorized by its production method, is expected to maintain market share dominance due to its cost effectiveness and reliable supply chain, particularly essential for industrial-scale use in consumer packaged goods (CPG). However, the Natural Menthol segment is forecast to register a higher CAGR, reflecting the robust global trend favoring 'clean label' products and natural ingredients in high-value segments like high-end cosmetics and organic confectionery. In terms of application, the Oral Care & Hygiene segment (toothpaste, mouthwash) remains the largest consumer, benefiting from global efforts to improve dental health standards. Crucially, the pharmaceutical segment (cough drops, analgesics) is exhibiting the fastest growth trajectory, driven by an aging global population and increased prevalence of respiratory illnesses. Innovation within product formulation focuses on microencapsulation techniques to control menthol release, enhance stability, and improve the user experience across all key application areas, ensuring sustained market relevance through functional enhancement.

AI Impact Analysis on Natural and Synthetic Menthol Market

User questions regarding AI's impact on the Natural and Synthetic Menthol Market frequently center on supply chain efficiency, optimization of chemical synthesis pathways, and predictive modeling for volatile raw material pricing, specifically cornmint oil. Key themes emerging from user inquiries include the potential for AI-driven process control to minimize waste and increase yield in synthetic production (e.g., maximizing the L-menthol enantiomer ratio), and the use of machine learning algorithms to forecast demand fluctuations influenced by regulatory changes or seasonal health trends. Users also express interest in how AI can accelerate the discovery and testing of novel, sustainable cooling agents that might serve as partial substitutes for traditional menthol, and how computational chemistry models can simulate molecular interactions to enhance product efficacy and stability in complex formulations like pharmaceutical gels or extended-release flavors. The consensus expectation is that AI will primarily serve as an optimization tool, addressing the dual challenges of cost efficiency in synthetic production and mitigating supply risk in natural sourcing.

- AI-driven optimization of synthetic chemical processes, including real-time parameter adjustments to maximize the yield and purity of L-menthol enantiomers, leading to reduced production costs and enhanced consistency.

- Predictive supply chain analytics utilizing machine learning to forecast natural menthol (cornmint) crop yields based on weather patterns, climate data, and geopolitical factors, improving purchasing strategies and hedging against price volatility.

- Development of advanced computational chemistry and molecular modeling techniques to design novel menthol derivatives or natural cooling compounds with tailored sensory profiles and improved stability in final product formulations.

- Implementation of AI for quality control in manufacturing, using image recognition and spectral analysis to quickly detect impurities or inconsistencies in both natural extracts and synthetic batches, ensuring compliance with strict pharmaceutical standards.

- Enhanced demand forecasting models integrated with regulatory databases, enabling manufacturers to proactively adjust production volumes and application portfolios in anticipation of new flavor bans (e.g., in tobacco or vaping products) in key international markets.

DRO & Impact Forces Of Natural and Synthetic Menthol Market

The trajectory of the Natural and Synthetic Menthol Market is defined by a complex interaction of driving forces, inherent restraints, and compelling strategic opportunities, all subject to impactful external forces. A primary driver is the pervasive and increasing adoption of menthol in consumer healthcare products, specifically topical analgesics, cough and cold remedies, and specialized sports recovery products, catalyzed by an aging global population and rising awareness about self-medication for minor ailments. Additionally, the flavor and fragrance industry's continuous innovation, seeking to integrate appealing cooling sensations into novel food products, beverages, and personal care items, further stimulates demand. These drivers are bolstered by technological advancements in microencapsulation, which improve menthol’s stability, bioavailability, and controlled release in complex matrixes, broadening its functional utility beyond traditional applications. Furthermore, the stable and cost-effective supply offered by synthetic production methods provides a resilient foundation for industrial growth, particularly in price-sensitive markets.

Despite strong drivers, the market faces significant restraints, most notably the escalating regulatory crackdown on mentholated tobacco products, particularly in North America and Europe, which traditionally represented a substantial volume segment for synthetic menthol producers. This regulatory pressure necessitates costly and strategic pivots. Another key restraint is the high price volatility and supply risk associated with natural menthol derived from cornmint oil, which is vulnerable to adverse weather conditions, pests, and agrarian geopolitical policies, leading to unpredictable spikes in raw material costs. Moreover, the production of high-purity L-menthol, whether through natural extraction or synthetic resolution, remains a technologically demanding process, and the existence of optically inactive isomers (DL-menthol) in cheaper synthetic routes can diminish product quality for specialized applications, creating a bottleneck for high-specification requirements in pharmaceuticals.

Strategic opportunities within this market primarily revolve around the accelerated development of pharmaceutical and cosmeceutical applications, leveraging menthol’s proven analgesic and anti-inflammatory properties for advanced dermal treatments and therapeutic preparations. The growing consumer preference for 'natural' or 'nature-identical' ingredients presents a lucrative opportunity for producers of high-quality, sustainably sourced natural menthol and for synthetic producers capable of marketing their product as pharmacopoeia-grade and highly pure. Furthermore, geographical expansion into rapidly industrializing regions of Latin America and Southeast Asia, where penetration of modern oral care and pharmaceutical products is accelerating, offers fertile ground for volume growth. The immediate impact forces shaping the competitive landscape include intellectual property disputes concerning novel synthetic pathways, environmental scrutiny regarding chemical waste from synthetic plants, and fluctuating input costs such as crude oil derivatives and agricultural chemicals, which directly influence the profitability and competitive positioning of both natural and synthetic producers across the value chain, compelling continuous cost management and technological investment to maintain a competitive edge.

Segmentation Analysis

The Natural and Synthetic Menthol Market is primarily segmented based on Origin, Application, and Purity Grade, reflecting the diverse industrial requirements and consumer preferences across the global marketplace. Segmentation by Origin (Natural vs. Synthetic) is critical as it dictates pricing structures, supply chain reliability, and market access in segments sensitive to 'clean label' requirements. While the volume dominance belongs to synthetic production due to its industrial scalability, the value segment is often driven by premium-priced natural extracts. The Application segmentation is highly illustrative of consumption patterns, with Oral Care, Pharmaceuticals, and Flavor & Fragrance being the most significant revenue generators. Analyzing these segments helps stakeholders understand where future innovation and regulatory impacts are likely to be concentrated. Purity Grade segmentation (e.g., Pharmacopoeia Grade, FCC Grade) is essential, especially for pharmaceutical and high-end cosmetic uses, where strict adherence to chirality and purity is non-negotiable, directly influencing the manufacturing complexity and final cost of the ingredient.

- By Origin:

- Natural Menthol (Derived primarily from Mentha arvensis)

- Synthetic Menthol (Chemically synthesized, typically via thymol or m-cresol pathways)

- By Application:

- Oral Care & Hygiene (Toothpaste, Mouthwash, Dental Floss)

- Pharmaceuticals (Cough drops, Topical Analgesics, Vapor Rubs, Medicated Inhalers)

- Confectionery & Food Products (Chewing Gum, Candies, Beverages, Baked Goods)

- Flavor & Fragrance (Perfumery, Soaps, Shampoos, Personal Care Products)

- Tobacco & Vaping Products (Menthol Cigarettes, E-liquids - Subject to severe regulatory restrictions)

- Others (Aromatherapy, Cleaning Agents, Pesticides)

- By Purity Grade:

- Pharmacopoeia Grade (High Purity L-Menthol for Pharmaceuticals)

- Food Grade (FCC, suitable for consumption)

- Technical Grade (Industrial applications)

Value Chain Analysis For Natural and Synthetic Menthol Market

The value chain for menthol is bifurcated, reflecting the distinct nature of its two origins. For natural menthol (upstream analysis), the chain begins with specialized agriculture—the cultivation of cornmint (Mentha arvensis), predominantly in China and India. This upstream stage is characterized by high seasonality, labor intensity, and susceptibility to environmental fluctuations. Following harvest, crude menthol oil is extracted via steam distillation. Key players at this stage are farmers and primary processors/distillers who handle purification and crystallization to achieve crude menthol crystals. The subsequent midstream activities involve global traders and specialized refineries who further purify, grade, and sometimes reprocess the natural crystals to meet specific pharmaceutical or food safety standards. Distribution channels, both direct and indirect, rely on a network of global ingredient distributors, specialized flavor houses, and bulk chemical suppliers who manage logistics, quality assurance, and compliance with regional regulations.

The synthetic menthol value chain is fundamentally different, starting with the petrochemical industry, where raw materials like thymol, p-menthane, or m-cresol are derived (upstream analysis). The core activity is complex chemical synthesis, typically involving hydrogenation, cyclization, and asymmetric synthesis to produce L-menthol. Major chemical companies dominate this capital-intensive manufacturing stage, characterized by high barriers to entry due to proprietary catalyst technology and necessary investments in large-scale reactors and separation equipment. The competitive advantage here lies in maximizing the stereoselective yield of the desired L-menthol isomer. Distribution (direct and indirect) largely mirrors the natural supply chain, utilizing established channels to deliver high-volume batches to large industrial consumers such as multinational CPG companies. Direct sales are common for major volume contracts, while indirect channels serve smaller formulators and regional cosmetic producers.

The downstream analysis reveals that the final consumers are diverse industries, with flavoring and fragrance houses, pharmaceutical formulation companies, and consumer goods manufacturers acting as the primary buyers. These entities integrate menthol into their final product matrices—be it a toothpaste, a cough suppressant, or a premium fragrance. The shift towards product customization, particularly the demand for encapsulated or sustained-release menthol forms, has introduced an additional layer of complexity in the midstream and downstream stages, requiring specialized formulation expertise. Regulatory compliance acts as a critical bottleneck throughout the chain, influencing procurement decisions and manufacturing practices. For instance, the strict quality requirements for Pharmacopoeia Grade menthol enforce a high level of transparency and documentation, directly impacting the profitability and market access for suppliers in both the natural and synthetic segments.

Natural and Synthetic Menthol Market Potential Customers

Potential customers for natural and synthetic menthol are overwhelmingly concentrated within the fast-moving consumer goods (FMCG) and healthcare sectors, utilizing menthol's sensory and functional attributes. The largest buying groups include multinational oral care companies that incorporate menthol for its refreshing taste and perceived antibacterial properties in toothpastes, mouthwashes, and oral sprays. Pharmaceutical companies represent another critical customer base, relying on menthol as a non-prescription active ingredient for its local anesthetic and counterirritant effects in topical pain relievers, dermal patches, and cough suppressants. These pharmaceutical buyers demand stringent purity levels (Pharmacopoeia Grade) and require reliable, audited supply chains, often favoring established synthetic producers for supply security and quality consistency.

Furthermore, the confectionery and food industries, particularly manufacturers of chewing gum, hard candies, and specialty beverages, constitute a significant portion of the customer landscape, utilizing menthol primarily for flavoring and the distinctive cooling sensation it provides. In this segment, cost-efficiency often drives the preference toward high-quality synthetic menthol, although premium or organic confectionery brands may opt for natural sources to align with consumer trends favoring clean labeling. Lastly, the flavor and fragrance houses act as intermediaries, purchasing large volumes of menthol to formulate proprietary cooling blends and aromatic bases before selling these specialized ingredients to cosmetic, tobacco, and personal care manufacturers. Understanding the varied purity requirements and purchasing cycles of these distinct end-user categories is crucial for market stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950.5 Million |

| Market Forecast in 2033 | USD 1,410.2 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Symrise AG, Takasago International Corporation, Givaudan SA, Mane SA, IFF (International Flavors & Fragrances), ADM (Archer Daniels Midland Company), Firmenich International SA, Trents (China), Natai Chemical, Swancorp, Zhonglan Chemical, Skyrun Industrial, Menthol Chemical, Hangzhou Grass. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural and Synthetic Menthol Market Key Technology Landscape

The technological landscape in the menthol market is characterized by sophisticated chemical engineering aimed at achieving high enantiomeric purity, particularly for the L-menthol isomer, which provides the desired cooling sensation. In the synthetic sector, the dominant technology revolves around asymmetric synthesis, pioneered by companies like Takasago and others. This technology involves using chiral catalysts, often based on ruthenium or rhodium, to guide the reaction towards the production of L-menthol from precursors such as thymol or m-cresol, bypassing the need for extensive separation of unwanted isomers. Continuous process improvement focuses on developing more robust, cost-effective, and environmentally benign catalytic systems to increase yield and reduce waste streams. Furthermore, advanced separation techniques, including crystallization methods and simulated moving bed chromatography (SMBC), are crucial for resolving racemic mixtures when asymmetric synthesis is not employed or requires further refinement, ensuring the final product meets the stringent pharmacopoeia standards.

For natural menthol, the key technologies center on agricultural biotech and enhanced extraction/purification methods. Biotechnology is being applied to develop high-yield cornmint cultivars that are more resistant to pests and diseases, ensuring a more stable and higher-quality source of crude menthol oil. In the processing stage, technological innovation involves optimizing steam distillation and fractional crystallization processes to efficiently separate L-menthol from the crude oil, which contains various other terpenes. Advanced distillation techniques help reduce energy consumption and improve the retention of desirable co-aromatics often valued in natural extracts. Furthermore, the industry is increasingly adopting supercritical fluid extraction (SFE) as a gentler, solvent-free method to produce highly pure, concentrated natural extracts, particularly appealing to the organic and premium food markets, although this remains a higher-cost process compared to conventional steam distillation.

Across both segments, a significant area of technological focus is encapsulation and delivery systems. Microencapsulation technology, utilizing materials like cyclodextrins or specialized polymers, is essential for protecting menthol from volatility, enhancing its stability in liquid or humid formulations, and, crucially, enabling a controlled or prolonged release of the cooling sensation. This technology is highly valued in chewing gums, sustained-release cough lozenges, and advanced cosmetic preparations where a long-lasting sensory effect is desired. The adoption of process analytical technology (PAT) tools, including in-line spectroscopy and automated monitoring systems, is also crucial across the manufacturing cycle. These digital technologies ensure consistent quality, reduce batch variability, and facilitate rapid process adjustments, significantly boosting operational efficiency and adherence to regulatory standards, positioning technology as a primary competitive differentiator in this mature yet highly technical market.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant force in the global menthol market, characterized by its dual role as the world's primary production base (especially natural menthol from China and India) and the fastest-growing consumption market. The substantial growth is fueled by massive populations, rising incomes, and expanding domestic pharmaceutical and personal care industries. India, in particular, is a significant consumer of menthol in both Ayurvedic preparations and modern medicine. Regulatory environments are generally less restrictive regarding flavoring additives compared to Western nations, allowing for high-volume consumption in food and confectionery.

- North America: North America represents a mature, high-value market, driven primarily by its advanced pharmaceutical sector and strong consumer spending on premium oral care and wellness products. Although volumes are pressured by strict FDA and state-level regulations targeting mentholated tobacco and vaping products, the demand for menthol in topical analgesics, cold remedies, and high-purity pharmaceutical applications remains exceptionally strong, commanding premium pricing. Key players focus on innovation in therapeutic delivery systems and stringent quality compliance.

- Europe: Similar to North America, Europe is a high-value market where stringent regulations, particularly the EU Tobacco Products Directive (TPD) effectively banning menthol cigarettes, have significantly reshaped consumption patterns. Market growth is now overwhelmingly concentrated in the pharmaceutical (e.g., Vicks products, throat lozenges) and the sophisticated fine fragrance and cosmetic segments. European consumers place a high emphasis on natural sourcing and sustainability, driving demand for traceable, sustainably produced natural menthol and high-grade synthetic alternatives that adhere to REACH regulations.

- Latin America (LATAM): LATAM is an emerging high-growth region, benefiting from improved economic conditions and increasing modernization of its healthcare and CPG sectors. Countries like Brazil and Mexico are witnessing expanding markets for modern oral hygiene products and basic pharmaceuticals, where menthol is a core ingredient. Supply chains are often reliant on imports from Asian or European producers, making logistics efficiency and local distribution networks crucial for market penetration.

- Middle East and Africa (MEA): The MEA region presents varied growth opportunities. The Gulf Cooperation Council (GCC) countries drive demand in the premium personal care and fragrance segments due to high disposable income, while emerging economies in Africa focus more on basic pharmaceutical needs and functional foods. Regulatory frameworks are evolving, and the market generally favors competitively priced synthetic menthol for industrial applications, focusing on stability and shelf life suitable for warmer climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural and Synthetic Menthol Market.- BASF SE

- Symrise AG

- Takasago International Corporation

- Givaudan SA

- International Flavors & Fragrances (IFF)

- Mane SA

- Archer Daniels Midland Company (ADM)

- Firmenich International SA

- Trents (China) Co., Ltd.

- Natai Chemical Co., Ltd.

- Swancorp

- Zhonglan Chemical (Group) Co., Ltd.

- Skyrun Industrial Co., Ltd.

- Penta International

- Menthol Chemical Industries Ltd.

- Hubei Huarong Chemical Co., Ltd.

- Robertet Group

- Sensient Technologies Corporation

- Haarmann & Reimer (now part of Symrise)

- Privi Organics India Limited

Frequently Asked Questions

Analyze common user questions about the Natural and Synthetic Menthol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between natural and synthetic menthol in terms of market impact?

Natural menthol, derived from cornmint, offers a complex, natural profile but is supply-constrained and price-volatile; it is preferred in premium 'clean label' segments. Synthetic menthol offers highly stable, cost-effective supply, dominating high-volume industrial and most pharmaceutical applications where purity and consistency are paramount.

How is the regulatory environment currently affecting the menthol market growth?

Stringent regulations and outright bans on mentholated tobacco products in major markets (North America, Europe) are significantly restraining volume growth in that traditional segment. However, this pressure is forcing manufacturers to successfully pivot and focus resources on expansion within the high-growth pharmaceutical and sophisticated oral care sectors.

Which application segment is demonstrating the highest growth rate for menthol?

The Pharmaceutical segment, including topical analgesics, cough suppressants, and therapeutic patches, is exhibiting the highest projected growth rate. This is fueled by global demographic trends, particularly an aging population, and increased consumer demand for self-medication products utilizing menthol's proven analgesic properties.

What are the key technological advancements influencing menthol production efficiency?

Key advancements include asymmetric synthesis using advanced chiral catalysts to maximize the yield of pure L-menthol in synthetic production, and microencapsulation technologies designed to improve menthol stability, control release rate, and prolong the cooling sensation in various consumer product matrices.

Which geographic region holds the largest market share for menthol and why?

The Asia Pacific (APAC) region currently holds the largest market share, driven by its status as the leading global producer of natural menthol (China, India) and its immense, rapidly growing consumer base which necessitates high volumes of menthol for expanding oral care, food, and domestic pharmaceutical industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager