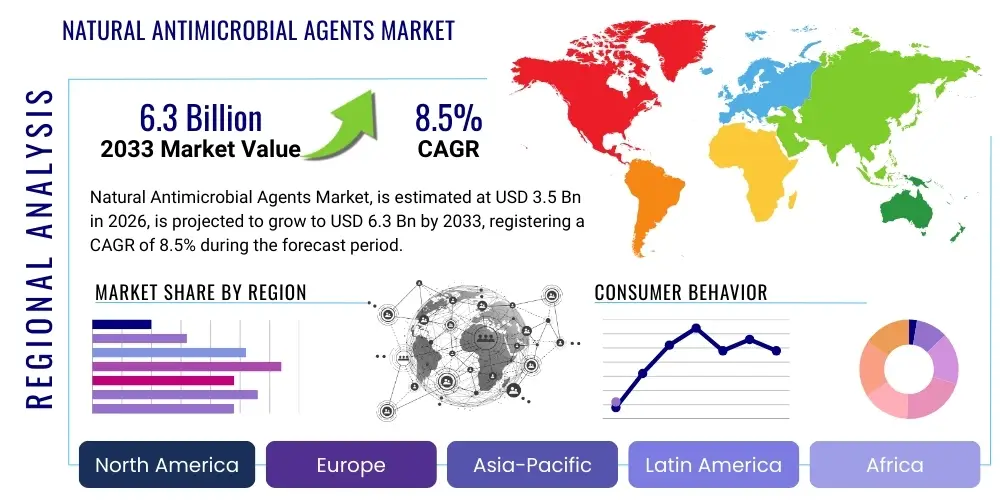

Natural Antimicrobial Agents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435991 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Natural Antimicrobial Agents Market Size

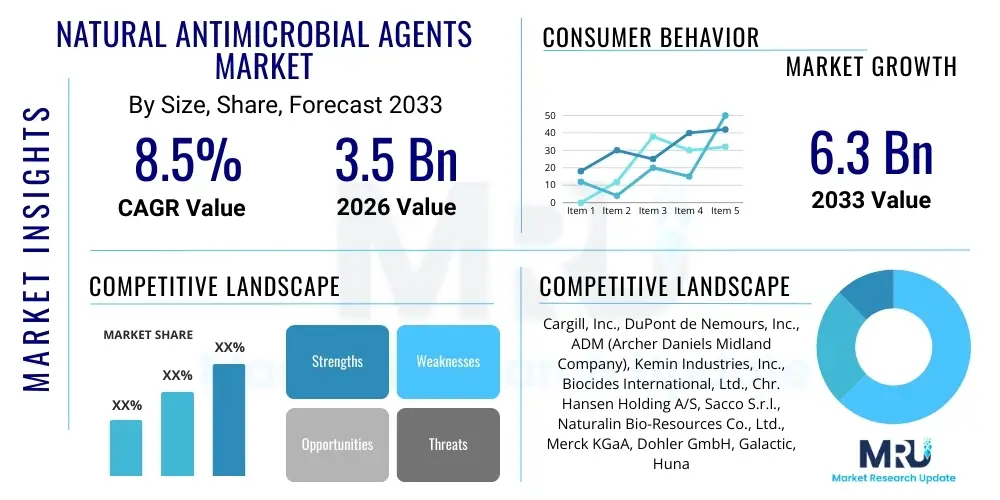

The Natural Antimicrobial Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 6.3 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by escalating consumer demand for natural, clean-label products across the food and beverage, personal care, and pharmaceutical industries, replacing synthetic preservatives viewed with increasing skepticism.

Natural Antimicrobial Agents Market introduction

The Natural Antimicrobial Agents Market encompasses substances derived from natural sources, such as plants, animals, and microorganisms, utilized to inhibit the growth of bacteria, fungi, and other harmful pathogens. These agents, including essential oils, organic acids, bacteriocins, and specific enzyme formulations, are highly valued for their ability to extend product shelf life and ensure consumer safety without relying on synthetic chemicals. The primary product offerings are diverse, ranging from rosemary extracts used in processed meats to nisin utilized in dairy products, reflecting a broad application landscape.

Major applications of these natural compounds span critical sectors, most notably the food and beverage industry, where they serve as effective preservatives, addressing concerns related to foodborne illnesses and spoilage. Beyond food preservation, they are increasingly integrated into pharmaceutical formulations, offering complementary therapeutic benefits, and into the personal care sector, replacing parabens and formaldehyde-releasing agents to meet the rising demand for 'free-from' cosmetic labels. The inherent bio-compatibility and perceived safety of these agents position them as superior alternatives in consumer products.

The market expansion is significantly accelerated by stringent global regulatory frameworks, particularly those pertaining to food safety and transparency in ingredient labeling, alongside a powerful consumer preference shift toward sustainable and naturally sourced ingredients. Key driving factors include advancements in extraction technologies, which enhance the purity and efficacy of these natural compounds, and continuous research into novel sources, such as marine and extremophile microorganisms, offering superior antimicrobial profiles.

Natural Antimicrobial Agents Market Executive Summary

The Natural Antimicrobial Agents Market demonstrates robust growth, fundamentally steered by prevailing business trends emphasizing clean-label formulation and sustainable sourcing. Strategic shifts among key manufacturers focus on vertical integration, ensuring a reliable supply of high-quality raw materials, such as specific botanicals or fermented extracts, and investing heavily in efficacy testing to validate their agents against common pathogens, thereby building trust with industrial end-users. Mergers and acquisitions are frequent, primarily targeting specialized ingredient producers to consolidate intellectual property and expand application reach, particularly into the high-growth nutraceutical space.

Regionally, North America and Europe currently dominate the market, largely due to established regulatory support for natural preservatives and high consumer awareness regarding product ingredients. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid growth in APAC is fueled by expanding middle-class populations, increased urbanization leading to higher demand for packaged and processed foods, and the growing adoption of Western standards of food safety and quality control across emerging economies like China and India. Local sourcing advantages also contribute to competitive pricing in these markets.

Segmentation trends indicate a strong preference for plant-derived agents, such as essential oils and flavonoids, driven by their sensory appeal and diverse functionality, including antioxidant properties. Application-wise, the Food & Beverage segment maintains its dominant share, particularly within dairy, meat, and bakery subsegments, as manufacturers strive to extend shelf life while maintaining ingredient deck simplicity. Furthermore, the bacteriocins segment, derived from microbial fermentation (e.g., nisin), is witnessing accelerated adoption due to its high efficacy against Gram-positive bacteria and acceptance in core food preservation applications, signifying a shift towards highly targeted biological solutions.

AI Impact Analysis on Natural Antimicrobial Agents Market

User queries regarding the impact of Artificial Intelligence (AI) on the Natural Antimicrobial Agents Market primarily revolve around how AI can accelerate the discovery of novel compounds, optimize production efficiency, and enhance the predictability of agent efficacy against evolving microbial resistance. Users are keenly interested in predictive analytics capabilities—specifically, whether machine learning models can accurately screen vast databases of natural compounds (e.g., plant metabolomes, microbial genomes) to identify new agents with superior efficacy and low toxicity profiles, thereby drastically reducing the time and cost associated with traditional laboratory screening methods. Furthermore, there is significant focus on AI's role in optimizing fermentation processes for microbial-derived agents like bacteriocins, ensuring maximum yield and purity under controlled, data-driven conditions, and in monitoring real-time effectiveness in complex industrial environments.

The integration of AI and machine learning algorithms is transforming the research and development pipeline for natural antimicrobials. AI-powered platforms can sift through chemical structure data and biological activity records to predict effective agent-pathogen interactions, dramatically narrowing down the candidates for in-vitro testing. This computational approach allows market players to quickly respond to emerging health threats and consumer demands for specialized natural preservatives. Moreover, AI is critical for optimizing the manufacturing environment. By analyzing sensor data from bioreactors and extraction units, AI models can fine-tune parameters such as temperature, pH, and nutrient concentration, leading to increased yields of high-purity natural active ingredients, thereby lowering production costs and improving market accessibility for these premium ingredients.

The use of AI extends into post-production quality assurance and supply chain management. Predictive maintenance models minimize downtime in complex extraction facilities, while advanced logistics algorithms ensure the stability and potency of heat-sensitive natural extracts during transport. Overall, AI is viewed by market participants as a necessary tool to overcome the long discovery cycles and variable efficacy inherent in natural compounds, enabling the industry to deliver consistent, high-performance, and cost-effective natural antimicrobial solutions at scale, thereby securing their competitive advantage against synthetic alternatives.

- AI accelerates novel compound discovery through high-throughput virtual screening of phytochemistry libraries.

- Machine learning algorithms predict efficacy and toxicity profiles of natural extracts, optimizing R&D expenditure.

- Predictive modeling enhances precision fermentation processes for high-yield production of bacteriocins and enzymes.

- AI analyzes real-time pathogen resistance data to guide targeted formulation adjustments for specific applications.

- Automated quality control systems ensure batch consistency and potency of complex natural antimicrobial blends.

- Supply chain optimization using AI minimizes waste and maintains cold chain integrity for sensitive botanical agents.

DRO & Impact Forces Of Natural Antimicrobial Agents Market

The dynamics of the Natural Antimicrobial Agents Market are significantly shaped by a confluence of driving factors (D), regulatory constraints (R), abundant opportunities (O), and potent external impact forces. Key drivers include overwhelming consumer demand for clean-label ingredients, pushing manufacturers across food, cosmetics, and pharmaceuticals to replace synthetic preservatives; escalating concerns over antibiotic resistance, promoting research into natural alternatives for therapeutic and animal health applications; and regulatory incentives, particularly in developed regions, favoring transparent, naturally derived ingredients. These factors collectively create a positive market momentum, mandating industrial adoption of bio-based preservation systems to align with public health and wellness trends.

However, the market faces considerable restraints that challenge widespread adoption. The primary restraint is the inherently variable efficacy and stability of natural agents, often influenced by environmental factors such as pH, temperature, and matrix composition, which complicate their integration into complex food or cosmetic systems. Furthermore, the higher cost of extraction, purification, and standardization of natural compounds compared to cheaper, mass-produced synthetic counterparts poses a significant financial barrier, particularly for smaller manufacturers. Regulatory hurdles also exist, as proving the safety and consistent efficacy of new, complex natural extracts often requires extensive and costly clinical or application-specific trials, slowing time-to-market.

Opportunities within this market are extensive and geographically widespread. The most prominent opportunity lies in exploring and commercializing novel sources, such as marine microorganisms, waste streams from agricultural processing (extracting beneficial compounds from peels or seeds), and innovative encapsulation techniques designed to enhance the stability, controlled release, and targeted action of existing agents. Moreover, the burgeoning trend in functional foods and personalized nutrition provides a high-growth niche for natural agents that offer dual benefits, such as antimicrobial activity coupled with strong antioxidant or anti-inflammatory properties, creating premium product differentiation and justifying higher pricing structures.

The major impact forces influencing the market are technological advancements in molecular biology and extraction techniques, which are constantly lowering the cost and increasing the purity of natural extracts, making them more competitive. Changing global trade policies and increased scrutiny on sustainable sourcing practices exert pressure on supply chains to demonstrate environmental responsibility, favoring suppliers of ethically sourced natural materials. Lastly, the pervasive influence of social media and immediate consumer information access means that adverse publicity regarding synthetic chemicals can trigger rapid, large-scale shifts in consumer purchasing behavior, acting as a powerful external force accelerating the transition towards validated natural solutions.

Segmentation Analysis

The Natural Antimicrobial Agents Market is comprehensively segmented based on source, product type, application, and function, reflecting the diversity and complexity of the compounds utilized across various industries. This granular segmentation allows market stakeholders to identify specific high-growth niches, ranging from botanically derived ingredients for clean-label cosmetics to complex microbial metabolites targeting specific pathogenic strains in clinical nutrition. Understanding these segments is critical for strategic product development, investment prioritization, and market penetration, as regulatory acceptance and consumer adoption rates vary significantly across different agent types and end-use applications.

The dominant segment by source remains plant-derived agents, appreciated for their broad-spectrum activity and sensory attributes, while the rapidly growing microbial segment, specifically bacteriocins, is gaining traction due to its high potency in regulated food applications. Application segmentation confirms the primacy of the Food & Beverage sector, although the Pharmaceutical and Personal Care segments show promising future growth driven by innovation in novel delivery systems. Functional segmentation highlights the market's evolution from simple preservation to advanced benefits like shelf-life extension and active label simplification, catering directly to current consumer preferences for minimal, effective ingredients.

- By Source:

- Plant-Derived (Essential Oils, Extracts, Polyphenols)

- Animal-Derived (Lactoferrin, Lysozyme)

- Microbial-Derived (Bacteriocins, Natamycin)

- By Product Type:

- Organic Acids (Lactic Acid, Acetic Acid, Citric Acid)

- Essential Oils (Oregano, Thyme, Rosemary, Clove)

- Bacteriocins (Nisin, Pediosin)

- Enzymes (Lysozyme, Glucose Oxidase)

- Others (Flavonoids, Polyphenols)

- By Application:

- Food & Beverages (Meat & Poultry, Dairy, Bakery & Confectionery, Beverages)

- Pharmaceuticals

- Personal Care & Cosmetics

- Animal Feed

- Nutraceuticals

- By Function:

- Preservatives

- Clean Label Ingredients

- Shelf-Life Extension Agents

- Inhibitors of Pathogen Growth

Value Chain Analysis For Natural Antimicrobial Agents Market

The value chain for the Natural Antimicrobial Agents Market begins with upstream activities focused on sourcing and cultivation, which is highly specialized due to the natural origin of the agents. This stage involves sustainable cultivation or harvesting of botanical sources, meticulous selection of microbial strains, and specialized fermentation or animal-derived ingredient processing. Quality control at the sourcing stage is paramount, as the concentration and profile of the active antimicrobial compounds are heavily dependent on environmental factors, genetic variance, and raw material handling. Key upstream participants include specialized agricultural producers, biotechnology firms specializing in microbial strain development, and contract research organizations (CROs) focusing on natural product isolation.

The subsequent core stage involves extraction, purification, and formulation. This is the most technically demanding segment, utilizing advanced techniques such as supercritical fluid extraction (SFE), microwave-assisted extraction (MAE), or proprietary fermentation and down-streaming processing to achieve high purity and concentration of the active agent. Companies here invest heavily in intellectual property protecting their unique processes, as efficacy and stability are directly linked to purity levels. After purification, agents are formulated—often encapsulated or blended with carriers—to ensure stability, enhance bioavailability, and facilitate easy integration into complex industrial matrices like high-moisture foods or oil-in-water emulsions used in cosmetics. The formulation stage addresses the inherent limitations of natural compounds, preparing them for industrial scale application.

Downstream distribution channels are critical, bridging manufacturers with diverse end-use industries. Distribution involves both direct sales, especially to large food processors or pharmaceutical companies requiring highly specialized or custom formulations, and indirect channels relying on specialized ingredient distributors. These distributors often provide technical support and regulatory guidance specific to regional requirements, which is essential for natural products facing varying global acceptance standards. The final consumer in the food, cosmetic, or health sector determines market pull, emphasizing the critical role of transparent labeling and consumer education regarding the benefits of these natural alternatives over synthetic options.

Natural Antimicrobial Agents Market Potential Customers

The potential customer base for natural antimicrobial agents is diverse and spans multiple regulated industries where pathogen control and shelf-life extension are critical determinants of product safety and market success. The largest segment of potential customers resides within the Food & Beverage industry, including large multinational food manufacturers, specialized dairy producers, meat and poultry processors, and industrial bakeries. These entities increasingly seek natural preservation solutions to meet strict retailer clean-label mandates while ensuring compliance with stringent food safety regulations designed to minimize spoilage and prevent foodborne outbreaks, making them heavy volume buyers.

Another significant customer segment is the Personal Care and Cosmetics industry. Manufacturers of skin care, hair care, and color cosmetics are actively replacing traditional synthetic preservatives (like parabens and formaldehydes) due to rising consumer scrutiny regarding potential long-term health effects. These companies require antimicrobial agents that are effective at low concentrations, non-irritating, and compatible with complex cosmetic formulations, prioritizing botanically derived ingredients or stabilized essential oil blends that often provide secondary sensory benefits.

Furthermore, the Pharmaceutical and Animal Feed sectors represent high-value potential customers. Pharmaceutical companies utilize natural antimicrobials in non-sterile preparations to prevent microbial contamination, and, increasingly, as adjunct therapies to combat drug-resistant infections, focusing on highly purified, documented extracts. The Animal Feed industry uses these agents (often organic acids and specific botanical extracts) as alternatives to antibiotic growth promoters, driven by regulatory pressures to reduce routine antibiotic use in livestock, making efficacy against veterinary pathogens a key purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill, Inc., DuPont de Nemours, Inc., ADM (Archer Daniels Midland Company), Kemin Industries, Inc., Biocides International, Ltd., Chr. Hansen Holding A/S, Sacco S.r.l., Naturalin Bio-Resources Co., Ltd., Merck KGaA, Dohler GmbH, Galactic, Hunan Nutramax Inc., Delavau LLC, DSM Nutritional Products, Arboris, LLC, Corbion N.V., Naturex (Givaudan), Danisco (Iff), Symrise AG, Shanghai Jianyin Food Additive Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Antimicrobial Agents Market Key Technology Landscape

The technological landscape of the Natural Antimicrobial Agents Market is dynamic, centered on enhancing the yield, purity, stability, and functional delivery of these complex compounds. Core technologies include advanced extraction methods designed to maximize the recovery of active ingredients while minimizing solvent use and thermal degradation. Techniques such as Supercritical Fluid Extraction (SFE) using CO2 are gaining prominence as they provide high selectivity and purity, producing clean extracts without residual solvents, directly supporting the clean-label trend. Membrane filtration and chromatography are also essential downstream technologies employed for high-purity separation and fractionation of complex mixtures, particularly crucial for isolating specific bacteriocins or enzymes from fermentation broths.

A critical area of innovation is stabilization and delivery technology. Natural antimicrobials, particularly essential oils and certain proteins, are often volatile, susceptible to heat, and prone to rapid degradation when exposed to light or oxygen. Encapsulation technologies, including nano-encapsulation, liposomal delivery systems, and spray-drying with protective matrices (e.g., modified starch or proteins), are widely used to protect the active ingredient, control its release rate, and ensure its stability throughout processing and storage. These technologies allow manufacturers to overcome formulation challenges, enabling the integration of sensitive agents into challenging environments like high-fat or high-water activity products without compromising efficacy.

Furthermore, biotechnology, specifically metabolic engineering and targeted fermentation, is revolutionizing the production of microbial-derived agents. Genetic modifications of bacteria or yeast strains are being utilized to optimize the biosynthesis pathways of potent bacteriocins or organic acids, leading to significantly higher yields and lower production costs compared to wild-type strains. Parallel advancements in genomic screening and bioinformatics are accelerating the identification of novel antimicrobial peptides and enzymes from underutilized sources, providing a constant influx of highly effective agents ready for industrial scaling and future commercialization.

Regional Highlights

North America represents a mature and dominant market for natural antimicrobial agents, characterized by high consumer expenditure on premium, health-oriented products and stringent food safety regulations enforced by bodies like the FDA. The market here is driven primarily by the clean-label movement, where major food and beverage corporations are reformulating popular products to remove synthetic preservatives. The U.S. and Canada show particularly high adoption rates for plant extracts, such as rosemary and green tea extracts, in packaged foods and dietary supplements. Furthermore, the region is a hotbed for technological innovation, with numerous biotechnology startups focusing on developing novel microbial-derived agents, underpinned by substantial venture capital investment in food tech and ingredient science.

Europe maintains the second-largest market share, largely propelled by the comprehensive regulatory framework established by the European Food Safety Authority (EFSA), which often sets the global standard for ingredient approval and usage limits. European consumers are highly sensitized to environmental and health implications, leading to significant demand for certified organic and sustainably sourced natural agents. Countries like Germany, France, and the UK exhibit robust demand in the personal care sector, necessitating high-purity, hypoallergenic natural preservatives to comply with strict cosmetic directives. The region is seeing strong growth in organic acids and fermentation-based products as manufacturers leverage existing dairy and fermentation expertise.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is attributable to several factors: rapid economic development, changing dietary habits towards packaged convenience foods, and growing foreign investment in the region's food processing infrastructure, which necessitates advanced preservation solutions. While cost sensitivity remains a factor, increasing urbanization and rising awareness of food safety standards in key markets like China, India, and Japan are driving demand for certified natural agents, particularly in meat processing and ready-to-eat meals. Local producers are heavily focused on leveraging indigenous botanical sources and traditional preservation methods adapted with modern technology.

Latin America (LATAM) shows emerging market potential, driven primarily by the growth of the processed food sector in Brazil and Mexico. The region’s abundance of unique biodiversity offers rich potential for novel, locally sourced botanical antimicrobial extracts. However, market adoption is often constrained by economic volatility and complex, fragmented regulatory environments that can slow the approval process for new natural ingredients. Current market focus is on cost-effective, high-volume agents like organic acids for meat and poultry applications, aiming to minimize spoilage losses within challenging climate conditions.

The Middle East and Africa (MEA) market is characterized by moderate but steady growth. Demand is concentrated in highly urbanized centers (e.g., UAE, Saudi Arabia, South Africa) where imported food standards require long shelf stability and robust preservation. The climate challenges in parts of MEA amplify the need for effective antimicrobial solutions, particularly in the dairy and beverage sectors. Future growth will be linked to regulatory harmonization and successful technology transfer that allows local sourcing and production of complex natural ingredients, reducing reliance on expensive imports.

- North America: Dominant market share; driven by clean-label mandates and high R&D investment in microbial agents; strong adoption in processed foods and nutraceuticals.

- Europe: High regulatory compliance standards (EFSA); strong demand for sustainable and organic certified ingredients; leading in personal care and fermentation-based preservatives.

- Asia Pacific (APAC): Highest projected CAGR; fueled by urbanization, improved cold chain logistics, and rapid adoption of processed foods in China and India; focus on indigenous botanical exploitation.

- Latin America (LATAM): Emerging potential; driven by Brazilian and Mexican food processing sectors; challenges due to economic volatility and reliance on cost-effective, basic natural acids.

- Middle East and Africa (MEA): Growth tied to urbanization and climate control needs; reliance on imports; increasing standardization needed for broader market penetration.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Antimicrobial Agents Market.- Cargill, Inc.

- DuPont de Nemours, Inc.

- ADM (Archer Daniels Midland Company)

- Kemin Industries, Inc.

- Biocides International, Ltd.

- Chr. Hansen Holding A/S

- Sacco S.r.l.

- Naturalin Bio-Resources Co., Ltd.

- Merck KGaA

- Dohler GmbH

- Galactic

- Hunan Nutramax Inc.

- Delavau LLC

- DSM Nutritional Products

- Arboris, LLC

- Corbion N.V.

- Naturex (Givaudan)

- Danisco (Iff)

- Symrise AG

- Shanghai Jianyin Food Additive Co., Ltd.

- Niacet Corporation

- Bio-Vet, Inc.

Frequently Asked Questions

Analyze common user questions about the Natural Antimicrobial Agents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Natural Antimicrobial Agents Market?

The central factor is the global consumer shift towards clean-label products and the consequent industry imperative to replace synthetic preservatives (e.g., parabens, artificial nitrites) with natural alternatives that offer effective preservation without compromising product safety perception.

How do Natural Antimicrobial Agents overcome challenges related to their stability and efficacy?

Stability and efficacy challenges are largely addressed through advanced technological solutions, specifically microencapsulation and liposomal delivery systems, which protect the active compounds from heat, oxidation, and pH variations, ensuring their targeted release and consistent performance in complex industrial formulations.

Which product type segment holds the largest share in the Natural Antimicrobial Agents Market?

Currently, the Essential Oils and Organic Acids segments collectively dominate the market share due to their proven broad-spectrum activity, cost-effectiveness at scale, and widespread regulatory approval across food, feed, and cosmetic applications worldwide.

What role does biotechnology play in the commercialization of natural antimicrobials?

Biotechnology is vital, specifically in microbial fermentation and metabolic engineering. It enables the high-yield, cost-effective industrial production of complex agents like bacteriocins (e.g., Nisin) and certain enzymes, providing highly potent alternatives to traditionally extracted botanical compounds.

Which geographic region is expected to show the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), driven by increasing disposable incomes, rapid expansion of the organized food processing sector, and growing public health awareness regarding food safety and packaged product quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager