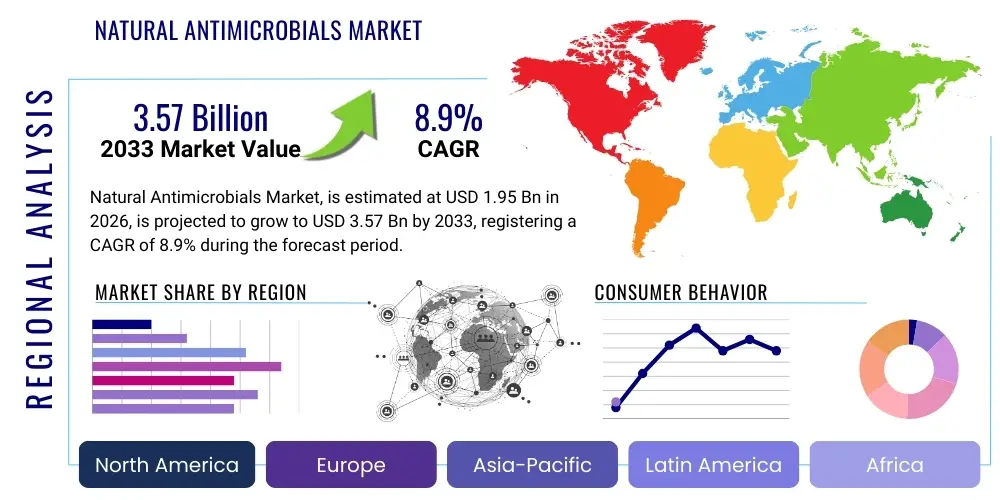

Natural Antimicrobials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438047 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Natural Antimicrobials Market Size

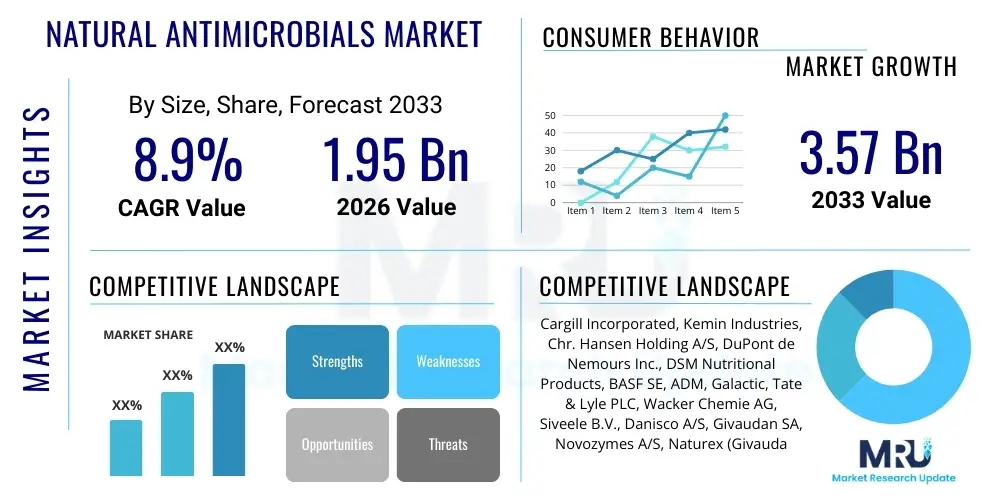

The Natural Antimicrobials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 1.95 Billion in 2026 and is projected to reach USD 3.57 Billion by the end of the forecast period in 2033.

Natural Antimicrobials Market introduction

Natural antimicrobials, derived from plant extracts, microbial sources, animals, or minerals, represent a critical segment of the preservation industry, offering alternatives to synthetic chemical preservatives. These substances, including essential oils, organic acids, bacteriocins, and enzymes, are gaining traction due to increasing consumer demand for clean-label products and heightened awareness regarding the potential health risks associated with artificial additives. The core function of these natural agents is to inhibit the growth of pathogenic and spoilage microorganisms in various matrices, thereby extending shelf life and ensuring product safety across diverse sectors.

The product description encompasses a wide array of bioactive compounds. For instance, plant-derived antimicrobials utilize compounds like polyphenols, terpenes, and flavonoids, which exhibit broad-spectrum antimicrobial activity. Major applications span food and beverages, pharmaceuticals, personal care, and animal feed. In the food industry, they are essential for preserving meat products, dairy, and ready-to-eat meals. The pharmaceutical sector uses them in topical preparations and drug formulations where natural components are preferred to maintain stability and prevent contamination during storage and use.

The principal benefits driving the market include their perceived safety, biodegradability, and the ability to fulfill stringent regulatory requirements, particularly in Europe and North America where clean labeling is a dominant trend. The primary driving factors involve the global shift towards organic food consumption, continuous research and development yielding highly effective natural agents, and mounting pressure from regulatory bodies to reduce the use of synthetic ingredients deemed harmful or unnecessary. Furthermore, the rise of antibiotic resistance in clinical settings is spurring interest in natural alternatives for therapeutic and preventive applications in human and animal health.

Natural Antimicrobials Market Executive Summary

The Natural Antimicrobials Market is characterized by robust growth, fueled predominantly by shifts in consumer preferences toward organic and minimally processed goods, and reinforced by continuous innovation in extraction and encapsulation technologies that enhance the efficacy and stability of natural compounds. Business trends indicate a strong focus on strategic mergers and acquisitions among established chemical companies and specialized biotech firms, aiming to consolidate expertise in natural product chemistry and expand product portfolios tailored for the high-growth food safety and preservation sector. Moreover, the demand for natural ingredients capable of replacing traditional preservatives like parabens and sulfites is creating lucrative opportunities for startups specializing in novel botanical extracts and fermentation-derived antimicrobials.

Segment trends highlight the dominance of the food and beverage sector, especially the meat and poultry segment, which requires highly potent, yet non-toxic, preservation solutions to mitigate risks associated with bacterial contamination such as Salmonella and Listeria. Within the product type segmentation, essential oils and organic acids maintain significant market shares, though bacteriocins derived from probiotic bacteria are experiencing the fastest growth rate due to their targeted effectiveness and suitability for fermented foods. Regional trends show that North America and Europe currently lead the market in terms of revenue, driven by mature regulatory frameworks promoting natural products and high disposable income supporting premium, clean-label purchases. However, the Asia Pacific region, particularly emerging economies like China and India, is poised for explosive growth as industrialization of the food processing sector accelerates and awareness regarding food safety improves significantly.

AI Impact Analysis on Natural Antimicrobials Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Natural Antimicrobials Market frequently revolve around optimizing discovery processes, improving strain development, and ensuring quality control. Key themes analyzed suggest users are concerned with how AI can drastically reduce the time and cost associated with screening thousands of natural compounds from terrestrial and marine sources for novel antimicrobial activity. They also inquire about the application of machine learning (ML) models to predict the efficacy, safety profile, and stability of new natural compounds under various industrial conditions, particularly food processing temperatures. Furthermore, there is significant interest in using predictive analytics to tailor antimicrobial formulations for specific food matrices, overcoming traditional challenges such as flavor masking and degradation during storage, thereby accelerating the pipeline from discovery to commercial deployment in sectors like food preservation and drug development.

- AI-driven high-throughput screening accelerates the identification of novel antimicrobial peptides and phytochemicals from vast genomic and chemical libraries.

- Machine learning algorithms optimize fermentation processes for bacteriocin production, improving yield and purity of microbial-derived antimicrobials.

- Predictive modeling assists in formulating stable natural antimicrobial blends that maintain efficacy under specific pH, temperature, and moisture conditions in food manufacturing.

- AI enhances supply chain traceability for botanical sources, ensuring the authenticity and quality of raw materials used in natural antimicrobial production.

- Deep learning models facilitate personalized medicine applications by identifying natural agents effective against specific drug-resistant bacterial strains in clinical settings.

DRO & Impact Forces Of Natural Antimicrobials Market

The market for natural antimicrobials is fundamentally shaped by compelling drivers rooted in consumer health concerns and regulatory mandates, countered by significant restraints primarily linked to cost and functional limitations, yet offering considerable opportunities through technological advancements and expansion into new applications. The collective influence of these forces determines market direction and penetration depth. The primary driving force remains the increasing global resistance to conventional synthetic antibiotics and preservatives, pushing both consumers and industries toward safer, nature-derived alternatives. However, the functional hurdle of natural antimicrobials, specifically their often lower efficacy, volatility, and interaction with food components, acts as a primary restraint that manufacturers must continuously overcome through formulation science.

Drivers: The dominant market driver is the pervasive "clean label" movement, where consumers actively seek products free from artificial additives, coloring agents, and synthetic preservatives. This trend places direct commercial pressure on food, cosmetic, and pharmaceutical manufacturers to reformulate their products utilizing natural compounds. Concurrently, escalating health consciousness among the populace regarding the long-term effects of synthetic food additives strengthens the demand base. Regulatory support, particularly the tightened restrictions on several synthetic food additives by agencies such as the FDA and EFSA, further mandates the transition to natural preservation systems. Furthermore, rising livestock production globally increases the demand for natural feed antimicrobials to enhance animal health and replace growth-promoting antibiotics.

Restraints: Despite strong demand, the market faces key constraints, predominantly centering on the higher production costs associated with extracting and purifying high-concentration natural compounds compared to synthesizing chemical alternatives. Natural antimicrobials often suffer from intrinsic limitations such as flavor impact, which can alter the sensory profile of the final product, and lower stability, as they are susceptible to degradation by heat, light, and pH variations encountered during processing and storage. This requires expensive encapsulation or stabilization technologies, which adds complexity and cost to manufacturing. Variability in the efficacy and supply chain inconsistencies of botanical sources also pose challenges, necessitating standardization efforts across the industry.

Opportunities: Significant market opportunities lie in the development of synergistic blends of natural antimicrobials—combinations that exhibit enhanced efficacy at lower concentrations, thereby mitigating cost and flavor issues. The rapid growth of functional foods and beverages, along with ready-to-eat meals, presents high-volume application areas for advanced natural preservation systems. Furthermore, exploring novel sources, particularly marine organisms and extremeophile microorganisms, promises the discovery of new, potent antimicrobial peptides and enzymes with unique properties that can overcome current functional limitations. Investment in sophisticated microencapsulation and nano-delivery systems represents a key pathway to improve bioavailability, stability, and controlled release of existing natural compounds, substantially expanding their application scope in demanding industries.

Segmentation Analysis

The Natural Antimicrobials Market is analyzed across various critical dimensions, segmented by product type, source, application, and form, providing a comprehensive view of consumption patterns and growth dynamics across different industrial verticals. The segmentation reveals that organic acids, due to their established efficacy and cost-effectiveness, dominate the product landscape, widely used across food preservation, especially in dairy and meat. However, essential oils, derived from highly aromatic botanicals such as oregano, thyme, and rosemary, are rapidly gaining share, driven by their dual benefits of preservation and flavor enhancement in processed foods and cosmetics, positioning them as a high-growth segment.

When examined by source, the plant-derived segment holds the largest share, leveraging the vast biodiversity of botanicals and the availability of established extraction techniques. Microbial sources, including bacteria and fungi that produce bacteriocins and protective cultures, constitute the fastest-growing segment, benefiting from advancements in fermentation technology and a greater understanding of gut health and food safety. The segmentation by application clearly shows the food and beverage industry as the primary consumer, driven by continuous demands for safer, longer-lasting products, though the pharmaceutical and personal care industries are substantially increasing their utilization rates to cater to the sensitive consumer base preferring natural ingredients in health and cosmetic products.

Geographically, North America and Europe dictate the current market structure due to their stringent regulatory environments and high consumer acceptance of premium, naturally preserved goods. The detailed segmentation by form (liquid, powder, and encapsulated) highlights the increasing preference for powder and encapsulated forms, particularly in large-scale food manufacturing, as these forms offer better stability, easier integration into dry mixes, and controlled release mechanisms critical for maintaining effectiveness throughout a product's shelf life. This granular segmentation is essential for market participants to tailor their innovation and marketing strategies effectively to address specific niche requirements.

- By Product Type:

- Organic Acids (Lactic Acid, Acetic Acid, Citric Acid, Propionic Acid)

- Essential Oils (Oregano, Rosemary, Thyme, Clove, Citrus Extracts)

- Bacteriocins (Nisin, Natamycin)

- Plant Extracts (Herbal Extracts, Spice Extracts)

- Enzymes (Lysozyme, Lactoferrin)

- By Source:

- Plant-derived

- Animal-derived

- Microbial-derived

- Mineral-derived

- By Application:

- Food & Beverages (Meat & Poultry, Seafood, Dairy, Bakery, Beverages, Confectionery)

- Pharmaceuticals

- Personal Care & Cosmetics

- Animal Feed

- Other Industrial Applications

- By Form:

- Liquid

- Powder

- Encapsulated

Value Chain Analysis For Natural Antimicrobials Market

The value chain for the Natural Antimicrobials Market initiates with the upstream activities of raw material sourcing, followed by complex extraction and processing, leading finally to downstream distribution and end-user application. Upstream analysis involves the sustainable procurement of source materials, which include medicinal plants, agricultural waste streams, specialized microbial cultures, and animal by-products. The challenge at this stage is ensuring consistent quality, standardization of active compound concentration, and ethical sourcing practices. Research institutions and specialized botanical suppliers play a crucial role, dedicating resources to improving cultivation techniques (for plants) or optimizing fermentation protocols (for microbial strains) to maximize the yield of the desired antimicrobial agents.

Processing and manufacturing constitute the core value-addition stage. This involves advanced purification techniques, such as supercritical fluid extraction (SFE) or chromatography, to isolate highly potent antimicrobial fractions while minimizing unwanted compounds like those that affect flavor. This stage also includes specialized formulation, particularly micro- and nano-encapsulation, which is vital for enhancing stability and controlled release, thereby improving the functional performance of the natural agents in harsh environments. Manufacturers must invest heavily in quality assurance testing to meet stringent food safety and pharmaceutical standards before product release. The complexity of these processes often results in higher manufacturing costs compared to synthetic alternatives.

The downstream activities involve distribution and market penetration. Distribution channels are bifurcated into direct sales, typically used for large-volume industrial clients (e.g., major food processors or pharmaceutical companies) who require technical support and customized blends, and indirect channels, which utilize specialized ingredient distributors and brokers to reach smaller and medium-sized enterprises (SMEs). Success in downstream distribution relies heavily on effective technical marketing and providing application-specific data demonstrating efficacy and compliance. The end-users, encompassing food processors, cosmetic formulators, and pharmaceutical companies, integrate these ingredients into their final products, validating the entire value chain through consumer acceptance and product safety.

Natural Antimicrobials Market Potential Customers

The primary customers for the Natural Antimicrobials Market are large-scale industrial buyers within the fast-moving consumer goods (FMCG) and healthcare sectors who require preservation solutions that align with modern consumer expectations for safety and natural origin. The largest segment of potential customers includes meat and poultry processors, dairy manufacturers, and producers of chilled ready-to-eat meals. These industries face immense pressure to prevent microbial spoilage and pathogenic outbreaks while eliminating synthetic additives like nitrates and nitrites, making natural bacteriocins (e.g., nisin) and plant extracts highly desirable alternatives.

Another crucial customer group is the personal care and cosmetics industry, particularly manufacturers of organic and luxury cosmetic lines. These companies utilize natural antimicrobials, such as certain essential oils or fermented extracts, to preserve water-based formulations (creams, lotions, shampoos) against yeast and mold contamination, replacing traditional preservatives like parabens and formaldehyde releasers, which are increasingly scrutinized by consumer advocacy groups. For these buyers, the non-toxicity and branding advantage derived from natural ingredients are as important as the functional preservation capability.

Furthermore, the animal feed industry and specialty pharmaceutical manufacturers represent growing segments. Animal feed producers use natural organic acids and specific herbal extracts to improve gut health and reduce reliance on growth-promoting antibiotics in livestock farming, a major global initiative. Pharmaceutical customers, especially those focused on botanical drug development and natural supplements, require high-purity, standardized natural antimicrobials for topical preparations, oral hygiene products, and excipients in drug manufacturing, prioritizing reliability and regulatory compliance above all else when selecting suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.95 Billion |

| Market Forecast in 2033 | USD 3.57 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cargill Incorporated, Kemin Industries, Chr. Hansen Holding A/S, DuPont de Nemours Inc., DSM Nutritional Products, BASF SE, ADM, Galactic, Tate & Lyle PLC, Wacker Chemie AG, Siveele B.V., Danisco A/S, Givaudan SA, Novozymes A/S, Naturex (Givaudan), Ajinomoto Co. Inc., D & L Industries, Inc., Laiwu Taihe Biochemistry Co. Ltd., Amano Enzyme Inc., Bioseutica B.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Antimicrobials Market Key Technology Landscape

The technological landscape of the Natural Antimicrobials Market is characterized by a strong emphasis on improving the extraction efficiency, stability, and delivery mechanisms of naturally derived bioactive compounds. Advanced separation techniques, such as Supercritical Fluid Extraction (SFE) using CO2, are critical as they allow for the isolation of volatile essential oils and heat-sensitive plant extracts at lower temperatures, preserving their potency and natural structure without the use of harsh organic solvents. Membrane filtration technologies, including ultrafiltration and nanofiltration, are also widely employed for the purification and concentration of microbial-derived antimicrobials, such as bacteriocins, ensuring high purity levels required for food and pharmaceutical applications.

A pivotal technological trend is the proliferation of encapsulation and delivery systems aimed at overcoming the functional limitations inherent to many natural agents. Microencapsulation, utilizing materials like alginate, cyclodextrins, or liposomes, shields sensitive antimicrobials from degradation caused by heat, light, and oxidation during processing. Nano-delivery systems take this a step further, offering enhanced bioavailability and controlled release kinetics directly at the site of microbial contamination, which is particularly beneficial in complex food matrices or targeted drug delivery. These advancements allow manufacturers to achieve the necessary antimicrobial effect with lower concentrations, thereby reducing cost and mitigating potential negative sensory impacts.

Furthermore, genetic engineering and synthetic biology are playing an increasingly important role, particularly in optimizing the production of bacteriocins and other antimicrobial peptides. Researchers are using precision fermentation and engineered microbial strains to significantly boost the yield and purity of specific natural antimicrobials in a controlled, scalable manner, offering a reliable alternative to variable botanical sourcing. Alongside production technologies, sophisticated detection systems utilizing biosensors and molecular profiling are being integrated into the quality control process, ensuring the standardized efficacy and consistent composition of every batch of natural antimicrobial ingredients before they are supplied to end-users.

Regional Highlights

The global consumption and production patterns of natural antimicrobials exhibit significant regional variability, driven by differing regulatory standards, consumer income levels, and local sourcing capabilities. North America, encompassing the United States and Canada, holds a dominant market share due to its advanced food processing industry, high consumer spending on organic and clean-label products, and stringent governmental oversight regarding synthetic food additives. The region is characterized by high adoption rates of encapsulated essential oils and bacteriocins in meat and dairy preservation, necessitating constant innovation in delivery systems to comply with the region's focus on food safety.

Europe represents another cornerstone of the market, driven by powerful regulatory initiatives like the EU’s Farm to Fork Strategy and a deep-seated cultural preference for traditional, natural preservation methods. Countries such as Germany, the UK, and France show significant penetration of organic acids and plant-derived antimicrobials in bakery, beverage, and cosmetic formulations. European manufacturers often focus on developing highly sustainable and certified organic sources, aligning their products with strong environmental and ethical consumer concerns.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, largely fueled by rapid industrialization of food processing, burgeoning middle-class populations with rising disposable income, and increasing awareness of foodborne illnesses. Major markets like China, India, and Japan are investing heavily in food infrastructure, creating massive demand for effective preservation solutions, particularly for shelf-stable goods. While local traditional preservation methods are common, there is a swift adoption of globally recognized microbial and plant-derived antimicrobials to meet increasing export standards and address urban food safety concerns. Latin America and the Middle East & Africa (MEA) are emerging regions, where growth is driven by increasing meat production and the need for cost-effective, easily accessible natural preservation methods in warm climates.

- North America: Market leader; driven by clean-label mandates, high consumer awareness, and extensive use of bacteriocins and plant extracts in meat and packaged foods.

- Europe: High adoption rate; supported by strict environmental regulations, strong emphasis on organic certification, and preference for organic acids and certified herbal extracts in cosmetics and food.

- Asia Pacific (APAC): Highest CAGR; accelerated by rapid industrialization of food processing, improving cold chain logistics, and growing consumer focus on non-synthetic food ingredients, particularly in China and India.

- Latin America: Growth driven by expanding meat export industries and increasing demand for natural preservatives in beverage and fruit processing.

- Middle East & Africa (MEA): Emerging market; increasing urbanization and investments in local food security necessitate the use of stable, high-performance natural preservation techniques.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Antimicrobials Market.- Cargill Incorporated

- Kemin Industries

- Chr. Hansen Holding A/S

- DuPont de Nemours Inc. (Now IFF)

- DSM Nutritional Products

- BASF SE

- Archer Daniels Midland (ADM)

- Galactic

- Tate & Lyle PLC

- Wacker Chemie AG

- Siveele B.V.

- Danisco A/S

- Givaudan SA (Naturex)

- Novozymes A/S

- Amano Enzyme Inc.

- Ajinomoto Co. Inc.

- D & L Industries, Inc.

- Laiwu Taihe Biochemistry Co. Ltd.

- Bioseutica B.V.

- Corbion N.V.

- Handary SA

- Lallemand Inc.

- Solvay S.A.

- Sensient Technologies Corporation

Frequently Asked Questions

Analyze common user questions about the Natural Antimicrobials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary growth drivers for the Natural Antimicrobials Market?

The market is primarily driven by rising consumer demand for clean-label products, increasing regulatory scrutiny on synthetic additives, and the urgent need for effective alternatives due to widespread antimicrobial resistance in clinical and food settings.

Which application segment holds the largest share in the Natural Antimicrobials Market?

The Food and Beverages application segment dominates the market share, largely due to the necessity for extending the shelf life of highly perishable goods, such as meat, dairy, and ready-to-eat meals, while adhering to natural ingredient labeling standards.

How does encapsulation technology benefit natural antimicrobials?

Encapsulation technologies, including micro and nano systems, significantly enhance the market viability of natural antimicrobials by protecting volatile compounds from thermal degradation, masking undesirable flavors, and providing controlled release for sustained efficacy during processing and storage.

Which product type is projected to exhibit the highest growth rate?

Bacteriocins, which are potent antimicrobial peptides derived from microbial fermentation (e.g., nisin, natamycin), are expected to show the highest CAGR due to their high efficacy against foodborne pathogens and their established acceptance as natural food preservatives.

What are the main challenges restraining the adoption of natural antimicrobials?

Key restraints include the higher cost of production and purification compared to synthetic options, functional limitations such as volatility and instability under processing conditions, and the potential negative impact on the sensory profile (flavor/odor) of the final product.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager