Natural Flake Graphite Professional Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435041 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Natural Flake Graphite Professional Market Size

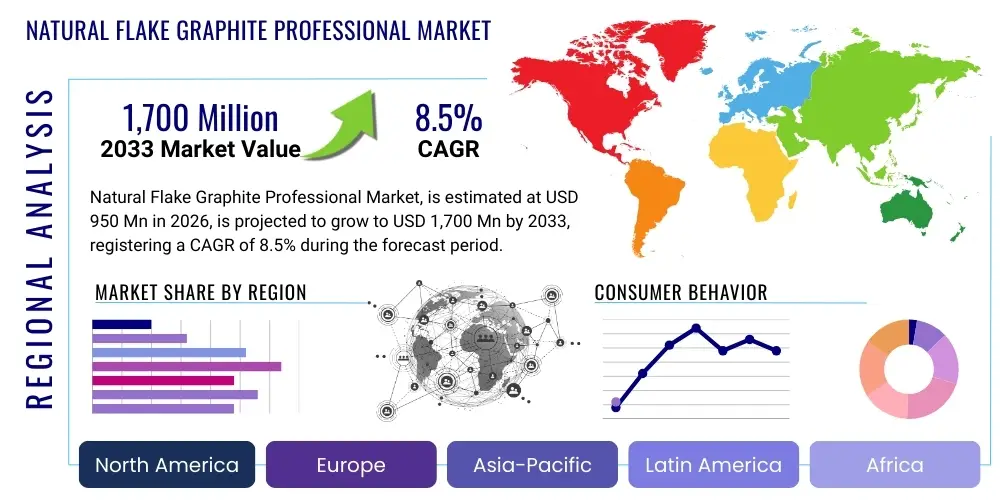

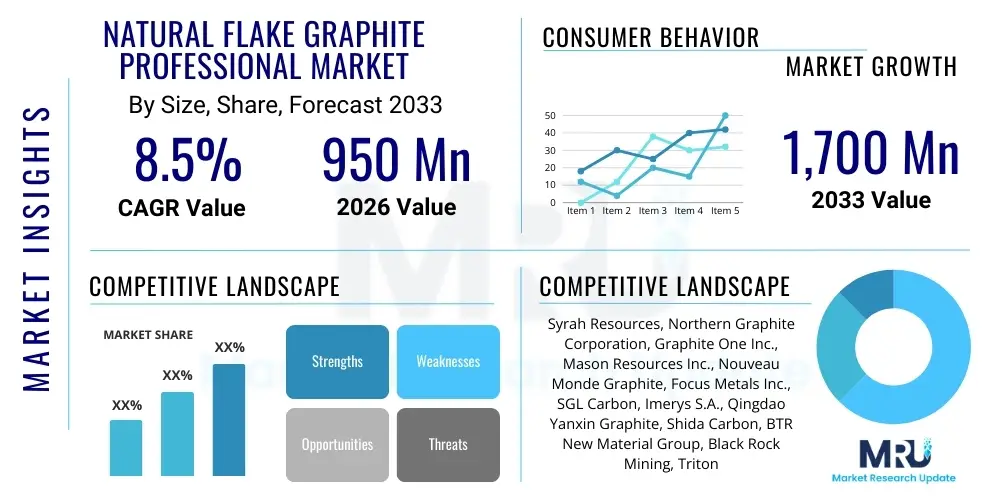

The Natural Flake Graphite Professional Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,700 million by the end of the forecast period in 2033.

Natural Flake Graphite Professional Market introduction

The Natural Flake Graphite Professional Market encompasses the mining, processing, and distribution of crystalline graphite characterized by its distinct layered structure. This mineral is considered a critical strategic raw material due to its irreplaceable properties, including high thermal and electrical conductivity, inherent lubricity, and chemical stability across a wide temperature range. Flake graphite is primarily categorized by flake size and carbon purity, determining its suitability for specialized applications, most notably the production of spherical purified graphite (SPG) essential for lithium-ion battery anodes.

Major applications driving market demand include energy storage systems, traditional refractory materials used in steel and metallurgy, and the production of expanded graphite for fire retardants and sealing solutions. The professional market segment focuses on high-grade, meticulously processed flake graphite tailored to stringent industrial specifications. The increasing global imperative for decarbonization and the subsequent rapid adoption of Electric Vehicles (EVs) and grid-scale energy storage solutions are the paramount driving factors accelerating market expansion and requiring substantial investment in both upstream mining capacity and downstream purification technologies.

The benefits associated with natural flake graphite include its relatively low cost compared to synthetic alternatives for high-volume applications, superior capacity retention in battery anodes, and its role as a fundamental component in enhancing thermal management and mechanical integrity across various industrial sectors. However, geopolitical concentration of processing capabilities and the energy-intensive nature of achieving battery-grade purity present ongoing strategic challenges that influence market dynamics and pricing structures for this crucial mineral.

Natural Flake Graphite Professional Market Executive Summary

The Natural Flake Graphite Professional Market is currently experiencing a transformative phase, driven overwhelmingly by the exponential growth in the global battery supply chain. Business trends indicate a massive pivot toward securing diversified and localized graphite sources, particularly in North America and Europe, to mitigate reliance on existing processing bottlenecks concentrated primarily in Asia Pacific (APAC). Key corporations are engaging in aggressive vertical integration strategies, moving from exploration and mining directly into purification and anode material manufacturing to stabilize supply and control quality parameters critical for high-performance battery production.

Regionally, APAC maintains its dominance, not solely in raw material consumption for refractories and traditional markets, but more significantly as the center for large-scale, cost-effective spherical graphite processing and anode fabrication. North America and Europe, however, are witnessing unprecedented government incentives and private capital influx aimed at establishing indigenous, environmentally compliant graphite projects, emphasizing resource security and establishing resilient supply chains for the burgeoning EV manufacturing base within these regions. This regional tension between established processing hubs and emerging secure supply chains defines the current investment landscape.

Segment trends confirm that the high-purity (99.95% C) battery-grade graphite segment is the fastest growing and most strategically important component of the market. While traditional refractory applications remain a significant volume driver, growth rates are modest compared to the energy sector. Furthermore, there is an increasing demand for specialized, smaller flake sizes required for optimized spheroidization and subsequent anode coating, pushing technological innovation in grinding and classification techniques across the industry.

AI Impact Analysis on Natural Flake Graphite Professional Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Natural Flake Graphite Professional Market frequently center on efficiency gains in mining operations, predictive modeling for material pricing volatility, and the optimization of energy-intensive purification processes. Users are concerned about how AI can mitigate environmental impact, particularly concerning waste reduction and energy consumption during thermal and chemical processing stages necessary to achieve battery-grade specifications. Furthermore, questions arise concerning AI’s capability to accelerate the discovery of new, viable graphite deposits and to analyze complex geological data sets to enhance resource extraction efficiency and reduce operational costs, thereby addressing key supply constraints.

- AI-driven optimization of flotation circuits enhances yield and purity rates in the beneficiation process, minimizing resource waste.

- Predictive maintenance analytics applied to mining equipment and processing machinery reduces downtime and operational expenditure significantly.

- Machine learning algorithms analyze market demand, inventory levels, and geopolitical factors to forecast future graphite pricing trends and assist in strategic procurement.

- AI supports advanced geological surveying and data analysis, accelerating the identification and delineation of high-quality flake graphite reserves.

- Simulation models powered by AI optimize thermal and chemical purification parameters, reducing energy consumption and improving the environmental footprint of processing facilities.

DRO & Impact Forces Of Natural Flake Graphite Professional Market

The dynamics of the Natural Flake Graphite Professional Market are governed by a complex interplay of strong external demand drivers, significant operational restraints, and compelling technological opportunities, all shaped by profound impact forces related to geopolitical and environmental policy. The principal driver is the non-negotiable requirement of graphite as the anode material in Li-ion batteries, where no readily available, commercially viable substitute exists that meets performance requirements at scale. This fundamental demand ensures market growth is inextricably linked to the trajectory of the global EV and renewable energy storage sectors. However, reliance on highly concentrated supply chains and high capital expenditure requirements for greenfield projects act as primary restraints, potentially throttling growth rates if processing capacity does not expand rapidly enough to meet battery demand projections.

Opportunities are emerging through the development of advanced graphite derivatives, such as purified microsphere graphite and coated graphite powders, tailored for next-generation solid-state and high-silicon anode batteries, promising enhanced energy density and cycle life. Furthermore, efforts to commercialize novel, environmentally sustainable purification technologies that reduce or eliminate hazardous chemical usage present a critical market opportunity for companies seeking premium positioning in Western markets focused on ethical sourcing and stringent ESG compliance. The ability of new players to innovate in processing efficiency will determine their market viability.

The predominant impact force influencing this market is regulatory pressure, particularly concerning critical minerals legislation introduced by major economic blocs (e.g., the U.S. Inflation Reduction Act). These policies strongly incentivize the development of localized, non-Chinese supply chains, effectively reshaping global trade flows and investment patterns toward domestic resource development and processing. Additionally, growing scrutiny of the environmental and social governance (ESG) performance of mining and processing operations exerts continuous pressure on market participants to adopt best practices, often increasing initial project costs but providing long-term strategic advantage.

Segmentation Analysis

The Natural Flake Graphite Professional Market is highly stratified, primarily categorized based on the material's purity level, which dictates the end-use application, and the size of the flakes, which affects processing requirements. Segmentation by Purity includes low-grade (70-85% C), intermediate-grade (85-95% C), and high-purity (99%+ C) graphite, with the high-purity segment dominating growth due to battery requirements. Segmentation by Application differentiates between high-volume, established uses like refractories and crucibles, and high-growth, technology-intensive applications such as Li-ion battery anodes, specialty lubricants, and expandable graphite.

- By Purity:

- Low Purity (Less than 85% Carbon)

- Medium Purity (85% to 95% Carbon)

- High Purity (Greater than 95% Carbon)

- Battery Grade (99.95% Carbon)

- By Flake Size:

- Coarse Flake (+80 mesh)

- Medium Flake (-80 to +100 mesh)

- Fine Flake (-100 mesh)

- By Application:

- Refractories

- Batteries (Anode Material)

- Lubricants and Friction Products

- Foundry and Casting

- Expanded Graphite (Fire retardants, Seals, Gaskets)

- Others (e.g., Fuel Cells, Graphene Production)

Value Chain Analysis For Natural Flake Graphite Professional Market

The value chain for natural flake graphite begins with the upstream segment, encompassing geological exploration, mining, and initial beneficiation (crushing, grinding, flotation) to produce concentrate, typically ranging from 90% to 97% carbon purity. Key activities at this stage include substantial capital investment in resource extraction infrastructure and the management of regulatory approvals and environmental impact assessments, which significantly influence the initial cost structure of the raw material. Geographical location, ore quality, and proximity to processing facilities dictate operational feasibility and competitiveness in this initial phase.

The midstream segment involves sophisticated thermal or chemical purification processes to achieve ultra-high purity levels, critically 99.95% C for battery applications, followed by crucial morphological modification steps such as micronization and spheroidization to create spherical purified graphite (SPG). Distribution channels for raw flake graphite are typically direct sales contracts between mining companies and large-scale industrial processors, or through specialized mineral traders who manage global logistics. The selection of purification technology, which directly impacts energy consumption and adherence to environmental standards, is a key determinant of competitive advantage in the midstream.

The downstream segment represents the ultimate consumption points, primarily dominated by manufacturers of Li-ion battery anodes, followed by refractory brick producers, and specialty chemical companies utilizing expanded graphite. Direct distribution channels are highly favored in the battery sector to ensure strict quality control and traceability, often involving long-term supply agreements. Indirect distribution, leveraging distributors or agents, is more common for smaller volume, specialized applications like lubricants or friction materials, allowing producers to access diverse, smaller end-users efficiently.

Natural Flake Graphite Professional Market Potential Customers

The primary and fastest-growing segment of potential customers for high-purity natural flake graphite consists of global Li-ion battery anode manufacturers, who require material processed to 99.95% purity and shaped into specific spherical geometries. These buyers operate on massive scales, demand rigorous consistency and quality assurance, and typically secure supply through multi-year off-take agreements to stabilize their input costs and production schedules. Their procurement decisions are heavily influenced by the graphite producer’s ability to guarantee ethical sourcing, environmental compliance, and long-term volume scalability necessary to support gigafactory expansion plans worldwide.

A second major customer category includes established heavy industry users, primarily refractory producers within the steel, cement, and glass manufacturing sectors. These customers require larger flake size and slightly lower purity (typically 90-95% C) for use in magnesia-carbon bricks, crucibles, and continuous casting components where thermal shock resistance and high temperature stability are paramount. Although volume growth here is steady rather than explosive, this segment provides essential base load demand and stability to the flake graphite market, often consuming a wider range of flake sizes compared to the battery sector.

Additionally, specialty chemical and advanced materials companies constitute a critical customer base, purchasing graphite for niche applications such as expandable graphite for fire seals and flame retardants, or for feedstock in the emerging graphene production market. These buyers value specialized technical specifications, including high expansion ratios or specific particle size distributions, often engaging in highly customized supply relationships with producers capable of advanced material functionalization and chemical surface treatment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,700 million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Syrah Resources, Northern Graphite Corporation, Graphite One Inc., Mason Resources Inc., Nouveau Monde Graphite, Focus Metals Inc., SGL Carbon, Imerys S.A., Qingdao Yanxin Graphite, Shida Carbon, BTR New Material Group, Black Rock Mining, Triton Minerals, AMG Advanced Metallurgical Group, Mineral Commodities Ltd., Leading Edge Materials, Aoyu Graphite Group, NextSource Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Flake Graphite Professional Market Key Technology Landscape

The core technological advancements in the Natural Flake Graphite Professional Market revolve around achieving ultra-high purity and modifying the particle morphology to meet the exacting standards of the Li-ion battery industry. The purification process is critical, involving either harsh acid leaching (hydrofluoric acid) or high-temperature thermal purification (>2,500°C) to remove mineral contaminants and achieve the necessary 99.95% carbon content. Current technological focus is increasingly shifting toward developing cleaner, less energy-intensive, and safer purification methods, such as innovative caustic roasting or electrochemical techniques, to align with tightening environmental regulations, particularly in Western jurisdictions seeking localized supply chains.

A second crucial area of innovation is spheroidization and micronization technology. Raw flake graphite must be ground and micronized, then processed through specialized equipment to reshape the flat flakes into near-perfect spherical particles, known as spherical purified graphite (SPG). This geometric transformation is essential as it optimizes the packing density of the anode material, which directly impacts the energy density and cycle life of the final battery cell. Companies are investing heavily in optimizing yield rates during spheroidization, a notoriously inefficient process that often results in significant material loss (fines).

Finally, surface coating technology represents a critical value-add step. SPG particles are typically coated with amorphous carbon derived from pitch or coal tar derivatives. This coating process, often done via chemical vapor deposition (CVD) or similar techniques, is vital for stabilizing the solid electrolyte interphase (SEI) layer formed on the anode during charge cycles. An optimal coating enhances the safety, efficiency, and longevity of the battery, representing a complex material science challenge where technological leadership translates directly into market share and premium pricing for high-performance anode materials.

Regional Highlights

The regional dynamics of the Natural Flake Graphite Professional Market are highly polarized, dominated by established demand centers versus emerging supply security initiatives. Asia Pacific (APAC), particularly China, controls the vast majority of global spherical graphite production and anode manufacturing capacity. China's dominance stems from decades of investment in downstream processing and its ability to refine graphite concentrate at massive scale and competitive cost, utilizing raw materials sourced globally, including from Africa and domestic mines. Consequently, APAC remains the largest consumer and value-addition hub, driving pricing and technological standards for battery-grade material.

North America and Europe are rapidly escalating their strategic efforts to establish resilient, local supply chains for battery minerals. These regions face an urgent need to onshore mining and purification capabilities to support their domestic EV manufacturing ambitions and comply with regional critical mineral mandates designed to reduce geopolitical supply risk. Governments are offering substantial financial incentives, streamlined permitting processes, and partnerships to attract investment into new graphite mining and processing facilities, particularly focusing on environmentally responsible operations (green graphite). This drive positions North America and Europe as the regions with the highest potential growth in terms of new, vertically integrated production capacity.

The Middle East and Africa (MEA) region, particularly Mozambique, Tanzania, and Madagascar, holds significant global flake graphite reserves and is crucial in the upstream mining segment. These regions supply large volumes of high-quality raw concentrate to the global market, primarily exported to processing hubs in APAC. While MEA is rich in resources, the focus is increasingly moving toward establishing local or regional beneficiation and potentially midstream processing capabilities to capture greater value from their mineral wealth, often through partnerships with international mining majors.

- Asia Pacific (APAC): Dominates global processing (spheroidization, purification) and consumption, driven by mass production of Li-ion batteries in China, South Korea, and Japan.

- North America: Focused on rapid resource security and developing domestic, environmentally compliant mining and purification facilities, supported by significant government initiatives (IRA).

- Europe: Driven by strict ESG standards and the need to localize the supply chain for its expanding network of gigafactories; emphasizing partnerships for secure, responsible sourcing.

- Africa (MEA): Key supplier of raw, high-quality flake graphite concentrate; strategic resource location with potential for increased local processing.

- Latin America: Emerging potential, particularly in countries like Brazil and Mexico, focusing on exploration and securing international investment for resource development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Flake Graphite Professional Market.- Syrah Resources

- Northern Graphite Corporation

- Graphite One Inc.

- Mason Resources Inc.

- Nouveau Monde Graphite

- Focus Metals Inc.

- SGL Carbon

- Imerys S.A.

- Qingdao Yanxin Graphite

- Shida Carbon

- BTR New Material Group

- Black Rock Mining

- Triton Minerals

- AMG Advanced Metallurgical Group

- Mineral Commodities Ltd.

- Leading Edge Materials

- Aoyu Graphite Group

- NextSource Materials

- Heilongjiang Lida Graphite Co., Ltd.

- Tokai Carbon Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Natural Flake Graphite Professional market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Natural Flake Graphite Market?

The exponential adoption of Electric Vehicles (EVs) and the corresponding growth in stationary Energy Storage Systems (ESS) are the primary drivers, as natural flake graphite is the indispensable anode material for most commercial lithium-ion batteries.

What is 'Battery Grade Graphite' and why is it essential?

Battery Grade Graphite refers to natural flake graphite purified to 99.95% carbon content and spherodized into micrometer-sized particles (SPG). This high purity and specific morphology are essential for maximizing battery energy density, efficiency, and cycle life.

How do geopolitical factors impact the global graphite supply chain?

Geopolitical factors, particularly the high concentration of midstream processing (spheroidization and purification) capabilities in China, create supply chain vulnerabilities. This risk drives Western economies to invest heavily in establishing diversified, localized, and environmentally secure graphite processing facilities.

What are the main alternatives to natural flake graphite in Li-ion battery anodes?

While silicon-based anodes show high theoretical capacity, they are typically blended with natural graphite due to swelling issues. Synthetic graphite is an alternative, but natural flake graphite is generally preferred due to its lower cost, higher crystallinity, and superior performance stability.

Which regions are leading in new graphite mining project development?

North America (Canada and the U.S.) and parts of Africa (Mozambique and Tanzania) are leading new mining project development, spurred by strategic initiatives aimed at securing critical mineral supply outside of existing concentrated processing centers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager