Natural Ingredient Insect Repellent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434069 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Natural Ingredient Insect Repellent Market Size

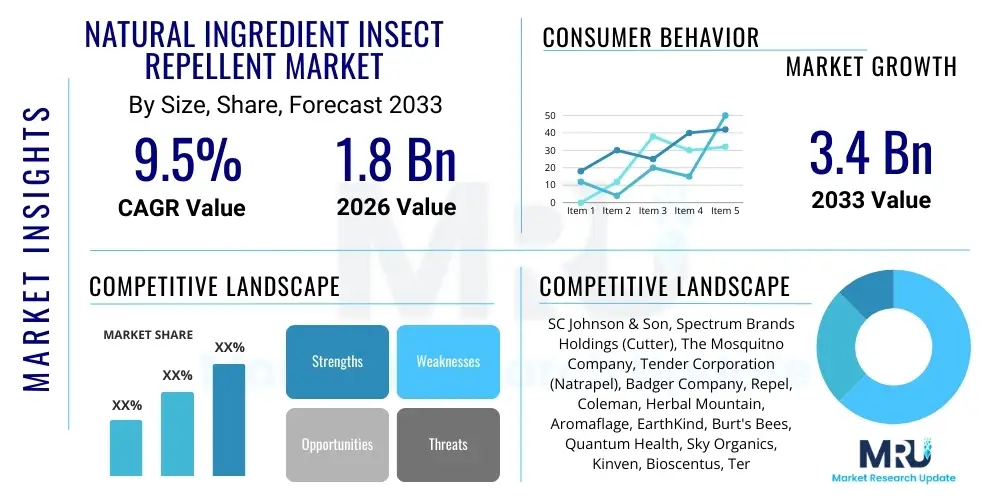

The Natural Ingredient Insect Repellent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Natural Ingredient Insect Repellent Market introduction

The Natural Ingredient Insect Repellent Market encompasses products designed to deter biting insects, such as mosquitoes, ticks, and fleas, utilizing active ingredients derived solely from plant extracts and essential oils, rather than synthetic chemicals like DEET (N,N-Diethyl-meta-toluamide) or picaridin. These products leverage compounds like citronella, lemon eucalyptus oil (OLE), peppermint, geraniol, and lavender to provide protection, catering primarily to consumers seeking non-toxic, eco-friendly, and skin-safe alternatives. The shift towards natural formulations is deeply rooted in widespread consumer aversion to the potential health risks associated with long-term exposure to conventional chemical repellents, especially concerning sensitive populations such as children and pregnant women. Furthermore, the perceived environmental friendliness of plant-based solutions contributes significantly to their growing appeal across global markets.

Major applications of natural insect repellents span across consumer and commercial sectors, including personal protection for outdoor recreation, travel, gardening, and routine residential use, particularly in regions prone to vector-borne diseases. These repellents are available in diverse formats, including aerosols, lotions, creams, wipes, and wearable patches, providing convenience and versatility for various consumer needs and preferences. The primary benefit driving adoption is the reduced toxicity profile, which aligns with the broader global wellness and clean label trends. Consumers are increasingly prioritizing ingredients that are sustainably sourced, biodegradable, and free from harsh synthetic additives, making natural formulations the preferred choice in households conscious of both personal health and ecological impact. This demand is further amplified by rising global temperatures and expanding geographical reach of vectors like the Aedes mosquito.

The market’s substantial growth is primarily driven by the escalating global incidence of vector-borne illnesses, notably Zika virus, Dengue fever, Malaria, and Lyme disease, which mandates robust preventative measures. This health crisis acts as a potent catalyst, compelling consumers to adopt effective insect protection. Simultaneously, strong regulatory pressures are encouraging the development and certification of safer, nature-derived alternatives. Manufacturers are heavily investing in research and development to enhance the efficacy and duration of natural repellents, often employing advanced microencapsulation technologies to overcome traditional limitations related to rapid evaporation and shorter protection times. These technological advancements, combined with aggressive marketing highlighting sustainability and health benefits, solidify the trajectory of the Natural Ingredient Insect Repellent Market.

Natural Ingredient Insect Repellent Market Executive Summary

The Natural Ingredient Insect Repellent Market demonstrates robust expansion, characterized by a fundamental shift in consumer behavior away from petrochemical-based protection towards sustainable, plant-derived solutions. Business trends are dominated by strategic mergers, acquisitions, and collaborations focused on securing reliable essential oil supply chains and integrating advanced formulation techniques to improve product performance metrics such as residual efficacy and sensory appeal. Key players are aggressively diversifying product portfolios to include specialized formulations catering to specific demographics, such as products optimized for infants, outdoor athletes, and highly sensitive skin types, utilizing ingredients that meet stringent organic and non-GMO certifications. Furthermore, packaging innovation, emphasizing biodegradable or recycled materials, is becoming a crucial competitive differentiator, aligning with overarching corporate social responsibility objectives and consumer eco-consciousness.

Regionally, North America and Europe currently represent the largest markets, underpinned by high consumer purchasing power, stringent regulatory environments that favor natural ingredients, and deeply entrenched wellness movements. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by dense populations, high susceptibility to endemic tropical diseases, rapidly expanding middle-class consumption, and increasing accessibility to high-quality international natural product brands. Governments in regions like Latin America and Southeast Asia are also playing a vital role, often subsidizing or promoting natural repellents as part of national public health campaigns aimed at controlling mosquito populations and mitigating disease outbreaks. The convergence of climate change effects leading to wider vector distribution further solidifies the need for effective regional preventative strategies, driving market penetration.

In terms of segmentation trends, the Lemon Eucalyptus Oil (OLE/PMD) ingredient segment is experiencing rapid adoption due to its classification by regulatory bodies like the U.S. CDC (Centers for Disease Control and Prevention) as an effective alternative to DEET, offering comparable protection levels. The retail segment remains dominant in distribution, but the E-commerce channel is demonstrating exponential growth, driven by convenience, broad product comparison capabilities, and the ease of accessing specialty brands that might not be available in traditional brick-and-mortar stores. The spray format continues to lead due to ease of application and coverage, but innovative wearable formats, such as repellent bracelets and clip-ons, are gaining traction, particularly among parents seeking passive, hands-free protection for children. This multi-faceted growth across ingredient types and distribution channels underscores the market's maturity and adaptability to diverse consumer requirements.

AI Impact Analysis on Natural Ingredient Insect Repellent Market

User queries regarding the impact of Artificial Intelligence (AI) on the Natural Ingredient Insect Repellent Market commonly revolve around improving ingredient discovery, optimizing formulation stability, predicting pest migration patterns, and enhancing personalized consumer recommendations. Users are keen to understand how AI can reduce the time and cost associated with identifying novel, potent botanical compounds that exhibit superior repellent activity and safety profiles compared to current standard essential oils. A core concern is the application of machine learning (ML) models to analyze complex interaction matrices between active ingredients and carrier formulations to ensure maximum residual efficacy while maintaining high levels of skin compatibility and minimizing sensory drawbacks like strong odor or stickiness. Furthermore, there is significant interest in how predictive AI models, leveraging climate data and geographic information systems (GIS), can inform manufacturing and inventory decisions by forecasting regional insect outbreak severity and timing, optimizing supply chain efficiency.

- AI-driven identification of novel, high-efficacy botanical extracts through rapid screening of genomic and biochemical databases.

- Machine learning optimization of repellent formulations for improved stability, sustained release mechanisms, and reduced skin irritation potential.

- Predictive modeling using AI and climate data to forecast regional vector activity and disease risk, aiding targeted marketing and supply chain logistics.

- Automation of quality control processes (QC) for essential oils, ensuring ingredient consistency and purity before formulation.

- Personalized digital marketing and product recommendations based on individual user travel history, local endemic risk factors, and skin type analysis.

- Enhanced regulatory compliance tracking using Natural Language Processing (NLP) to monitor and categorize global essential oil safety standards and restrictions.

DRO & Impact Forces Of Natural Ingredient Insect Repellent Market

The Natural Ingredient Insect Repellent Market is powerfully shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the critical Impact Forces determining market trajectory. The primary driver remains the pervasive global demand for safe, non-toxic alternatives to synthetic repellents, driven by mounting scientific evidence highlighting potential endocrine disruption and neurotoxicity associated with chemical counterparts. This consumer-led health preference is strongly reinforced by the undeniable increase in vector-borne disease transmission rates globally, which transforms insect repellent from a discretionary seasonal product into an essential public health tool, accelerating adoption rates across all socioeconomic strata. Furthermore, technological innovation in microencapsulation and nanotechnology is successfully addressing efficacy limitations, shifting the perception of natural repellents from niche products to viable, effective substitutes.

Conversely, significant restraints challenge rapid market expansion. The cost of manufacturing natural repellents is inherently higher than synthetic versions due to the intensive sourcing, extraction, and purification processes required for essential oils, alongside the volatile pricing and supply chain unpredictability of key botanicals like citronella and lemongrass. Perhaps the most prominent functional restraint is the relatively short duration of efficacy inherent to many plant-based active ingredients, which necessitates frequent reapplication, often frustrating users accustomed to the long-lasting protection of high-concentration DEET products. Regulatory hurdles, although sometimes supportive, can also restrain growth, as varying global standards regarding acceptable concentrations and testing methodologies for new botanical actives create complexity for international manufacturers seeking uniform product launches.

Despite these challenges, substantial opportunities exist, particularly in leveraging sustainable sourcing and Fair Trade practices to appeal to conscious consumers, thereby differentiating premium brands. Expansion into developing economies, where access to affordable, high-performing natural repellents is critical for public health, presents a massive untapped market. Moreover, innovation is focused on product diversification, moving beyond skin application to include textile treatments, ambient diffusers, and specialized pet care formulations. The collective impact forces show a market poised for accelerated growth, where the overwhelming driver of consumer preference for safety and sustainability, coupled with technological solutions mitigating performance gaps, overrides the restraints related to cost and efficacy duration, ensuring long-term market vitality.

Segmentation Analysis

The Natural Ingredient Insect Repellent Market is highly fragmented and segmented based on Product Type, Ingredient Type, Distribution Channel, and End-User, reflecting the diverse applications and consumer preferences within this health and wellness category. Segmentation allows manufacturers to precisely target specific consumer pain points, whether they relate to application method convenience, required efficacy duration, ingredient sensitivity, or purchasing location preference. For instance, the distinction between active ingredient types is crucial, as efficacy levels and sensory profiles (odor, feel) vary significantly, allowing consumers to choose formulations specifically optimized for protection against mosquitoes (e.g., OLE) versus ticks (e.g., Geraniol). Understanding these segment nuances is vital for strategic market entry and product positioning, particularly for brands aiming for premiumization based on ingredient origin and sustainable certifications.

The ongoing trend of personalization is intensifying the complexity within segmentation, driving demand for innovative product formats. While sprays remain the largest segment due to their widespread acceptance and ease of coverage, lotions and creams are gaining popularity among consumers prioritizing skin moisturizing benefits alongside protection, particularly in dry climates or for sensitive skin. Furthermore, the segmentation by distribution channel highlights the critical role of E-commerce, which facilitates consumer access to highly specialized or niche natural brands often overlooked by conventional mass retail. The ability to filter and compare products based on specific natural ingredients, such as vegan or PETA-certified formulations, further drives consumer migration towards online purchasing platforms, fundamentally altering traditional retail dynamics and requiring robust omnichannel strategies from market leaders.

- Product Type:

- Spray

- Lotion/Cream

- Wipes

- Oil-based formulations

- Wearables (Patches, Bracelets)

- Ingredient Type:

- Lemon Eucalyptus Oil (OLE/PMD)

- Citronella

- Peppermint

- Geraniol

- Lavender

- Catnip Oil

- Other Essential Oils (Clove, Rosemary, Soybean)

- Distribution Channel:

- Retail Stores (Mass Merchandisers, Grocery Stores, Convenience Stores)

- Pharmacies and Drug Stores

- Online/E-commerce

- Specialty Stores

- End-User:

- Residential (General Household Use)

- Commercial (Hotels, Resorts, Outdoor Cafés)

- Industrial/Military

Value Chain Analysis For Natural Ingredient Insect Repellent Market

The value chain for the Natural Ingredient Insect Repellent Market is complex, beginning with the highly fragmented upstream segment centered on the cultivation and extraction of botanical raw materials, primarily essential oils. Upstream activities involve agricultural processes, often executed by smallholder farmers or specialized botanical cultivation companies, followed by rigorous extraction (e.g., steam distillation, cold pressing) and purification to produce high-grade active ingredients. The quality and purity of these natural raw materials are paramount, significantly influencing the final product's efficacy and market compliance, necessitating robust quality control protocols and often leading to sourcing dependencies on specific geographic regions known for optimal botanical yields. Price volatility in this upstream segment directly impacts the manufacturing costs downstream, making secure, long-term sourcing contracts a critical strategic priority for major manufacturers.

The midstream phase involves formulation and manufacturing, where active essential oils are blended with inert carriers (solvents, emulsifiers, stabilizers) to create the final product format (spray, lotion, etc.). This stage requires substantial R&D investment, particularly in advanced techniques like microencapsulation to improve longevity and stability. Packaging and branding are also integral midstream activities, focusing heavily on sustainability (recyclable or biodegradable materials) and clear labeling that communicates natural origin and efficacy claims to the discerning consumer. Regulatory compliance testing for safety and efficacy occurs rigorously at this stage, ensuring adherence to standards set by bodies such as the EPA in the US or ECHA in Europe, which adds layers of complexity and cost to the manufacturing process.

The downstream segment focuses on distribution and sales, utilizing both direct and indirect channels to reach end-users. Indirect distribution, dominated by retail stores (pharmacies, mass merchants, grocery chains), relies on established wholesaler networks and robust shelf presence, driven by high consumer foot traffic and immediate accessibility. Direct channels, primarily through branded E-commerce platforms and specialized health and wellness retailers, allow for greater margin control, direct consumer engagement, and the efficient distribution of niche or premium products. The final stage involves marketing and consumer education, crucial for natural repellents due to historical skepticism regarding efficacy compared to synthetic alternatives; successful companies focus on scientific evidence and transparent ingredient lists to build consumer trust and drive repeat purchases.

Natural Ingredient Insect Repellent Market Potential Customers

The primary potential customers and end-users of Natural Ingredient Insect Repellents are individuals and households prioritizing personal health, safety, and environmental stewardship. This demographic includes health-conscious parents seeking non-DEET alternatives for infants and children, pregnant women, and individuals with sensitive skin or allergies who experience adverse reactions to synthetic chemicals. These buyers are typically willing to pay a premium for certified organic, hypoallergenic, or clean-label formulations. They are heavily influenced by pediatrician recommendations, online reviews, and endorsements from natural health and wellness communities, making digital content marketing and ingredient transparency crucial tools for engaging this core segment.

A second significant customer base comprises outdoor enthusiasts, travelers to endemic disease areas, and recreational users such as campers, hikers, and gardeners. While this group demands high efficacy, they also appreciate the portability and non-toxic profile, especially when spending extended periods outdoors. For this segment, the application format (e.g., durable spray bottles, quick-application wipes, or long-lasting wearables) is a key decision factor, and purchasing often occurs through sporting goods stores, specialized travel retailers, and online adventure-focused platforms. The threat of localized disease outbreaks, such as Lyme disease in temperate zones or Dengue fever in tropical destinations, directly correlates with increased purchasing frequency within this high-value segment.

Finally, institutional and commercial customers represent a rapidly growing B2B segment. This includes hospitality venues (eco-resorts, outdoor restaurants), educational facilities (summer camps, preschools), and government/military organizations that have shifted their procurement policies toward environmentally safer or low-toxicity products to meet regulatory mandates and enhance employee/guest safety. These buyers purchase in bulk, prioritizing cost-effectiveness alongside official efficacy certification. Commercial landscaping companies and organic farmers also use natural repellents as part of integrated pest management (IPM) strategies, seeking non-pesticidal solutions that adhere to strict ecological guidelines. This B2B market is driven by compliance, volume efficiency, and demonstrated environmental responsibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SC Johnson & Son, Spectrum Brands Holdings (Cutter), The Mosquitno Company, Tender Corporation (Natrapel), Badger Company, Repel, Coleman, Herbal Mountain, Aromaflage, EarthKind, Burt's Bees, Quantum Health, Sky Organics, Kinven, Bioscentus, Terramera, Ecosmart, Murphy's Naturals, California Baby, Avon (Skin So Soft) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Ingredient Insect Repellent Market Key Technology Landscape

The technological landscape of the Natural Ingredient Insect Repellent Market is characterized by intense research focused on overcoming the inherent limitations of essential oils, namely volatility and short residual effect. The core technological advancements revolve around formulation chemistry, utilizing novel delivery systems to prolong the active period of plant-derived compounds. The most prominent technology is microencapsulation, where tiny polymer shells encapsulate the active oil molecules. This technique protects the essential oils from rapid evaporation caused by heat or air exposure, facilitating a slow, sustained release of the repellent compound over several hours, thereby achieving efficacy comparable to synthetic alternatives without compromising the natural ingredient profile. This sustained-release mechanism is critical for products marketed towards high-end outdoor activities and travel.

Another crucial technological development involves nanotechnology and nano-emulsions, which enhance the stability and physical characteristics of the final product. By reducing the particle size of essential oils into the nano range, manufacturers can improve the product’s sensory profile, resulting in lighter, non-greasy formulations that are more appealing to the consumer. Nano-emulsions also boost the bioavailability and skin adherence of the active ingredients, which translates into more uniform protection and better compliance with reapplication schedules. Furthermore, advanced extraction techniques, such as supercritical fluid extraction (SFE), are becoming more prevalent upstream. SFE allows for the purification of botanicals at lower temperatures, preserving the integrity and potency of temperature-sensitive active compounds like monoterpenoids and sesquiterpenes, which are central to insect deterrence.

The integration of biotechnology is also impacting the market, particularly in the development of nature-identical compounds. For instance, manufacturers are exploring biosynthetic pathways to produce high-purity P-menthane-3,8-diol (PMD)—the active component of Lemon Eucalyptus Oil—in controlled laboratory environments. This process mitigates reliance on climate-sensitive agricultural sourcing and helps standardize product concentration and efficacy, addressing major supply chain and quality control restraints. Moreover, innovative application technologies, such as smart fabric integration and wearable devices embedded with slow-release matrices, are moving natural repellents beyond traditional sprays and lotions, providing convenient, passive protection solutions that resonate strongly with modern, tech-savvy consumers and contribute to the market's differentiation and expansion into specialty consumer goods.

Regional Highlights

The Natural Ingredient Insect Repellent Market exhibits significant regional disparities in adoption rates, regulatory acceptance, and market maturity, driven largely by local climate conditions, consumer health trends, and prevalence of vector-borne diseases. North America, particularly the United States, represents a dominant segment, fueled by a powerful clean-label movement, high disposable income enabling premium purchases, and strong awareness campaigns regarding tick-borne illnesses (Lyme disease) and mosquito-borne threats (West Nile Virus). This region benefits from established distribution channels and robust regulatory frameworks (like EPA approval for plant-based ingredients), which provide consumer assurance regarding product claims and safety. Manufacturers heavily focus on R&D for effective alternatives to DEET, driven by consumer willingness to pay more for proven, certified natural protection.

Europe closely follows, characterized by strict environmental regulations and high consumer sensitivity to chemicals, especially in countries like Germany and the Nordic region. The European market prioritizes sustainable sourcing, biodegradable packaging, and organic certifications (e.g., COSMOS standard). The proximity of certain regions in Southern Europe to high-risk vector zones further accelerates demand. Market penetration strategies in Europe often emphasize the eco-friendliness and dermatological safety of the products. However, regulatory heterogeneity across individual EU member states regarding specific essential oil maximum concentrations can pose a compliance challenge for manufacturers operating regionally.

Asia Pacific (APAC) is forecast to be the fastest-growing region over the forecast period. This rapid expansion is underpinned by the highest burden of tropical diseases (Dengue, Malaria, Japanese Encephalitis), dense populations, and rising urbanization which often creates favorable breeding grounds for vectors. While the market historically relied on traditional methods, rising disposable incomes and exposure to global wellness trends are driving a rapid transition toward branded, scientifically validated natural repellents. Countries like India, China, and Southeast Asian nations present immense opportunities, although strategies must account for price sensitivity and the need for locally relevant product formats and ingredient preferences. The Middle East and Africa (MEA) and Latin America (LATAM) also show promising growth, particularly in areas heavily affected by Zika and Malaria, where government and non-governmental organizations (NGOs) procurement drives substantial volume demand for affordable, effective natural protection solutions.

- North America (Dominant Region): High adoption rates driven by strong consumer interest in non-toxic living and established regulatory paths for botanical actives like OLE; focus on Lyme disease prevention products.

- Europe (High Sustainability Focus): Market growth sustained by stringent chemical safety regulations and strong demand for certified organic and eco-friendly products; emphasis on dermatological testing.

- Asia Pacific (Fastest Growth): Rapid market expansion due to high prevalence of vector-borne diseases, large population base, and increasing urbanization; focus on affordable and high-efficacy formats.

- Latin America (Critical Need): Demand driven by public health initiatives countering Zika, Dengue, and Chikungunya outbreaks; significant reliance on governmental and NGO procurement.

- Middle East and Africa (Emerging Market): Growth tied to tourism, climate change effects, and investment in public health infrastructure to combat endemic tropical diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Ingredient Insect Repellent Market.- SC Johnson & Son

- Spectrum Brands Holdings (Cutter)

- The Mosquitno Company

- Tender Corporation (Natrapel)

- Badger Company

- Repel

- Coleman

- Herbal Mountain

- Aromaflage

- EarthKind

- Burt's Bees

- Quantum Health

- Sky Organics

- Kinven

- Bioscentus

- Terramera

- Ecosmart

- Murphy's Naturals

- California Baby

- Avon (Skin So Soft)

Frequently Asked Questions

Analyze common user questions about the Natural Ingredient Insect Repellent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most effective natural ingredient alternative to DEET?

The ingredient scientifically proven to offer efficacy comparable to low-concentration DEET is P-menthane-3,8-diol (PMD), which is the active compound found in high concentrations in Oil of Lemon Eucalyptus (OLE). Regulatory bodies, including the U.S. CDC, recommend OLE formulations for effective protection against mosquitoes and ticks, making it the current industry standard for high-performance natural repellents.

How is the efficacy duration of natural insect repellents being improved?

Efficacy duration, traditionally a major limitation, is being significantly improved through advanced formulation technologies. Key methods include microencapsulation, which involves coating essential oils in protective polymer shells to ensure slow, sustained release over several hours, and the use of nanotechnology to create highly stable nano-emulsions that adhere better to the skin surface, preventing rapid evaporation.

Are natural insect repellents safe for infants and children?

Natural insect repellents are generally preferred for children due to the avoidance of synthetic neurotoxins; however, regulatory caution is advised regarding essential oils for infants under two months old. Repellents containing OLE (Lemon Eucalyptus Oil) are typically not recommended for children under three years. Parents should look for specific formulations marketed and tested for sensitive skin or pediatrician-approved blends like those utilizing citronella or low-concentration peppermint for optimal safety.

What are the primary factors driving the growth of the Natural Ingredient Insect Repellent Market?

The market growth is primarily driven by three interconnected factors: the escalating global threat of vector-borne diseases (e.g., Dengue, Zika), increasing consumer health consciousness leading to the rejection of synthetic chemicals (Clean Label movement), and continuous technological advancements in formulation that successfully address the historical performance gaps of natural ingredients, resulting in highly effective and marketable products.

How does the volatile supply chain of essential oils affect market pricing and availability?

The reliance on agricultural sourcing for essential oils introduces significant supply chain volatility, as yield and quality are highly dependent on climate conditions and geopolitical stability in key growing regions (e.g., Asia for Citronella). This volatility leads to unpredictable raw material costs, which manufacturers often pass on to consumers, resulting in higher retail prices compared to synthetics and potential shortages during periods of high vector activity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager