Natural Latex Pacifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436696 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Natural Latex Pacifier Market Size

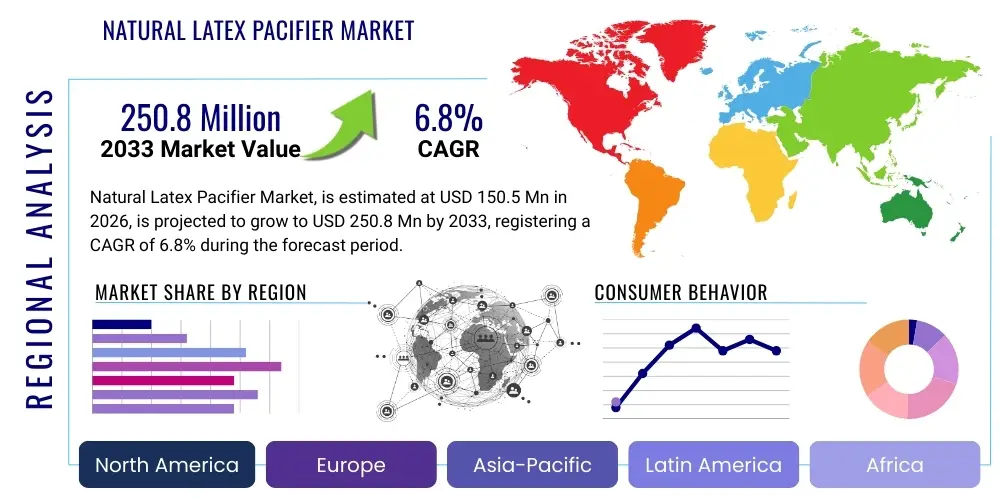

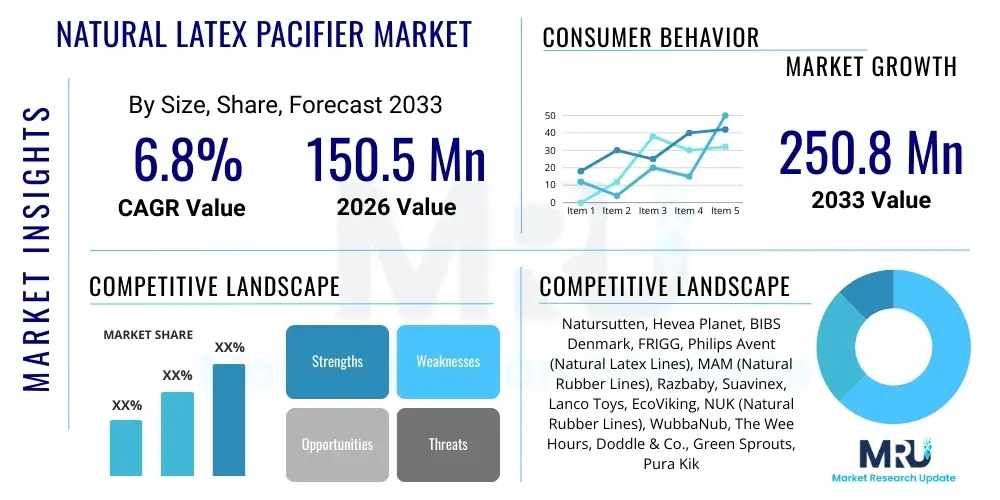

The Natural Latex Pacifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 150.5 Million in 2026 and is projected to reach USD 250.8 Million by the end of the forecast period in 2033.

Natural Latex Pacifier Market introduction

The Natural Latex Pacifier Market encompasses the manufacturing, distribution, and sale of pacifiers made primarily from natural rubber latex, derived from the Hevea brasiliensis tree. This product segment caters specifically to consumers seeking eco-friendly, sustainable, and naturally sourced alternatives to synthetic materials like silicone or plastic, particularly in infant care products. These pacifiers are renowned for their softness, elasticity, and biodegradability, appealing strongly to parents prioritizing organic and hypoallergenic options for their children. The core application is soothing infants, aiding in the development of suckling reflexes, and providing comfort during sleep or distress periods, differentiating them in a competitive global baby care landscape.

Product descriptions typically highlight the material's inherent properties, such as being free from chemical softeners, BPA, PVC, and phthalates, which are increasingly scrutinized by consumer safety advocates and regulatory bodies. Major applications center around newborns and toddlers up to three years old, serving critical functions related to infant well-being and parental convenience. The primary benefit driving adoption is the perceived natural safety and environmental responsibility associated with natural rubber, coupled with the durability and unique tactile feel that many infants prefer over stiffer synthetic options. The material's ability to resist tearing and withstand sterilization processes further enhances its market viability and perceived value.

Driving factors propelling market growth include the rising global awareness regarding plastic hazards and the increasing consumer preference for bio-based products across all sectors, extending strongly into premium baby goods. Demographic trends, such as increasing birth rates in emerging economies and higher disposable incomes in developed regions allowing for premium product purchasing, also contribute significantly. Furthermore, rigorous marketing emphasizing sustainability and pediatrician endorsements concerning orthodontic shape and design validation are crucial in shaping purchasing decisions, positioning natural latex pacifiers as a superior, health-conscious choice over conventional counterparts.

Natural Latex Pacifier Market Executive Summary

The Natural Latex Pacifier Market is experiencing robust growth driven by profound shifts in consumer priorities towards health, wellness, and environmental stewardship, translating into strong business trends favoring sustainable manufacturing practices. Key business trends include the diversification of product designs—focusing on orthodontic, cherry, and symmetrical nipple shapes—and enhanced packaging that emphasizes biodegradable and recyclable materials. Companies are increasingly investing in ethical sourcing of natural latex and obtaining certifications (such as GOTS or Oeko-Tex) to validate their sustainability claims, which serves as a powerful competitive differentiator in a market highly sensitive to parental trust and safety assurances. Strategic mergers and acquisitions are observed as larger baby product conglomerates look to integrate specialized natural brands to capture the niche eco-conscious consumer base.

Regionally, North America and Europe dominate the market due to high consumer awareness, stringent regulatory standards favoring non-toxic materials, and the presence of sophisticated distribution channels including specialized organic baby stores and high-end e-commerce platforms. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market, propelled by rapid urbanization, rising middle-class disposable income, and increasing adoption of Western baby care standards and premium products. Latin America and MEA show nascent growth, highly dependent on targeted educational campaigns regarding the benefits of natural materials over conventional plastics, focusing on allergen safety and sustainable alternatives.

Segment trends indicate that the market is bifurcating along product type and age group lines. The orthodontic shape segment holds a significant market share, driven by recommendations from dental professionals for minimizing alignment issues, although the classic cherry shape remains popular for newborn comfort. The 0-6 months age group accounts for the largest revenue share, reflecting the peak usage period for pacification. The most significant trend within distribution is the exponential growth of online retail channels, which offer unparalleled access to niche, international, and specialized natural pacifier brands, bypassing traditional mass retail bottlenecks and connecting directly with health-focused parents globally. Pricing elasticity remains low in the premium segment, indicating strong brand loyalty among eco-conscious consumers willing to pay a premium for certified safety and natural composition.

AI Impact Analysis on Natural Latex Pacifier Market

Common user questions regarding AI's impact on the Natural Latex Pacifier Market typically revolve around enhancing supply chain transparency, improving raw material quality prediction, optimizing personalized marketing, and ensuring product safety tracking. Users are highly interested in how AI can verify the authenticity and ethical sourcing of natural latex from plantations (Is the latex truly sustainably sourced? Can AI prevent adulteration?). Another major theme is the use of computer vision and machine learning for quality control in manufacturing—specifically, identifying micro-defects or inconsistencies in the nipple and shield molding process that are invisible to the human eye, thereby enhancing overall safety standards. Furthermore, consumers anticipate AI-driven personalization, expecting targeted product recommendations based on their infants’ specific developmental stages, sucking patterns (analyzed via smart pacifiers), and known sensitivities or allergies.

The integration of Artificial Intelligence (AI) primarily influences the back-end operations and consumer interaction strategies within the natural latex pacifier sector. AI algorithms are crucial for demand forecasting, particularly sensitive given the fluctuating supply chain dynamics of natural rubber which are heavily reliant on climate and geopolitical stability. Predictive maintenance of manufacturing machinery, optimizing molding and curing times specific to latex properties, minimizes waste and maintains the natural integrity of the material. This enhanced efficiency directly supports the sustainability claims fundamental to the product’s market appeal, ensuring that premium pricing is justified by superior process control and reduced environmental footprint.

On the consumer front, AI is revolutionizing personalized engagement. Brands leverage AI-powered analytics to understand evolving parental sentiments regarding natural ingredients, sustainability certifications, and design preferences. Chatbots and virtual assistants provide immediate, accurate information regarding latex sourcing, allergen potential, and sterilization best practices—critical trust builders for parents navigating complex safety concerns. While AI does not directly alter the final product material, its application across sourcing, manufacturing quality assurance, inventory management, and hyper-personalized digital communication reinforces the value proposition of natural latex pacifiers in a highly competitive and digitally influenced consumer goods market, mitigating risks and building consumer confidence.

- AI optimizes predictive quality control in latex processing, reducing material variability.

- Machine learning algorithms enhance supply chain transparency and verify sustainable sourcing claims.

- AI drives hyper-personalized marketing targeting eco-conscious parents based on purchase history and demographics.

- Demand forecasting using AI models reduces inventory waste, aligning with brand sustainability goals.

- Computer vision systems enable high-precision defect detection during the pacifier molding process.

- Chatbots provide instant customer support regarding product safety, cleaning, and allergen information.

- AI analytics monitor social media trends and parental concerns, rapidly informing product development and crisis management.

DRO & Impact Forces Of Natural Latex Pacifier Market

The dynamics of the Natural Latex Pacifier Market are shaped by a powerful interplay of Driving forces (D), Restraints (R), Opportunities (O), and associated Impact Forces. Key drivers include the overwhelming global shift toward organic and natural baby products, consumer willingness to pay a premium for non-toxic alternatives, and increasing concerns over synthetic chemicals in conventional plastic pacifiers. However, the market faces significant restraints, primarily the risk of latex allergies, which necessitate careful labeling and consumer education, and the inherent volatility of natural rubber prices influenced by agricultural cycles and global commodity markets. Opportunities lie in geographical expansion into untapped emerging markets and developing innovative hybrid products that combine natural latex with biodegradable plastics for specialized components, alongside leveraging digital platforms for direct-to-consumer (D2C) sales to enhance brand storytelling around sustainability.

The most immediate and high-impact driving force remains the regulatory push and consumer demand for BPA-free and phthalate-free products. This movement effectively mandates a shift away from traditional plastics, positioning natural latex as a favorable compliance solution. The restraining impact of latex allergy concerns requires significant investment in hypoallergenic research and clear communication strategies to differentiate natural rubber from synthesized allergens, ensuring that perceived risks do not undermine the overall market potential. Furthermore, the operational challenge of sterilizing natural latex—which can degrade faster than silicone under certain sterilization methods—requires manufacturers to provide explicit care instructions, managing consumer expectations regarding product lifespan.

The primary opportunity impact force is the potential for strategic market entry in Asia Pacific and Latin America, where growing economies are adopting high-standard Western infant care products, presenting robust future revenue streams. External impact forces, such as climate change affecting rubber plantation yield and geopolitical instability affecting supply routes, necessitate robust risk mitigation strategies, including hedging commodity prices and diversifying sourcing locations. Overall, the market momentum is strongly positive, largely driven by fundamental consumer values concerning infant health and environmental responsibility, provided manufacturers successfully navigate the challenges associated with natural material variability and allergy management through stringent quality control and transparent communication.

Segmentation Analysis

The Natural Latex Pacifier Market is comprehensively segmented across several critical axes: Product Type, Age Group, and Distribution Channel, reflecting diverse consumer preferences and purchasing behaviors within the global baby care sector. Understanding these segments is vital for targeted marketing and product development strategies, ensuring that products meet specific needs, ranging from orthodontic correction requirements to age-appropriate size specifications and preferred retail access points. The detailed analysis of segment dynamics reveals that premiumization trends are most pronounced in the orthodontic segment and among the 0-6 months age group, signifying a parent's willingness to invest early in specialized, high-quality, natural comfort items.

Segmentation by Product Type typically includes orthodontic, symmetrical/flat, and anatomical/cherry shapes. Orthodontic pacifiers are designed to minimize pressure on the developing palate and gums, commanding higher prices due to perceived developmental benefits. Segmentation by Age Group targets specific infant developmental stages, usually classified as 0-6 months, 6-18 months, and 18+ months, where material hardness, nipple size, and shield size are adjusted for safety and effectiveness. The 0-6 month category remains the largest volume driver, reflecting the period of most intensive pacifier usage before weaning typically begins.

Segmentation by Distribution Channel includes offline channels (supermarkets/hypermarkets, specialized baby stores, pharmacies) and online channels (e-commerce platforms and brand websites). The shift towards online retail is accelerating, offering brands an opportunity for direct consumer engagement and efficient inventory management, particularly valuable for niche, premium products like natural latex pacifiers. Offline channels, however, continue to be important for immediate purchase and impulse buying, especially pharmacies which benefit from perceived professional endorsement. Strategic focus must balance the high-growth, high-margin potential of online sales with the volume stability offered by established physical retail partnerships.

- By Product Type:

- Orthodontic Shape

- Symmetrical/Flat Shape

- Anatomical/Cherry Shape

- By Age Group:

- 0-6 Months

- 6-18 Months

- 18+ Months

- By Distribution Channel:

- Offline Retail

- Supermarkets and Hypermarkets

- Specialized Baby Stores

- Pharmacies and Drug Stores

- Online Retail

- E-commerce Platforms

- Brand Websites

- By Material Grade:

- Standard Natural Latex

- Hypoallergenic/Treated Latex

Value Chain Analysis For Natural Latex Pacifier Market

The value chain for the Natural Latex Pacifier Market begins with the upstream sourcing of raw materials, primarily natural rubber latex harvested from plantations, predominantly in Southeast Asia (Thailand, Indonesia, Malaysia). This stage is critical as the quality and sustainability certifications of the raw latex directly influence the final product’s market positioning and premium pricing. Upstream analysis focuses on ensuring ethical harvesting practices, minimizing chemical treatments during coagulation, and obtaining relevant environmental certifications, often involving long-term contracts with specialized rubber cooperatives to maintain a consistent supply of high-grade, food-contact compliant material. Suppliers must also manage price volatility risks inherent to agricultural commodities.

The middle segment involves manufacturing and production, including the molding, curing, and assembly of the pacifier components (nipple, shield, and ring). Manufacturing processes require precision engineering specialized for handling the elasticity and sensitivity of natural latex, ensuring orthodontic conformity and durability. Quality control is paramount at this stage, focusing on ensuring the pacifiers meet stringent international safety standards (e.g., EN 1400, ASTM F963) and are free of nitrosamines, heavy metals, and residual chemicals. Efficient operations and minimized waste are critical to maintaining the product’s ecological promise and optimizing manufacturing costs.

The downstream analysis focuses on market distribution and sales, covering both direct and indirect channels. Indirect distribution involves selling through distributors, wholesalers, large specialized baby retailers (e.g., Buy Buy Baby, Mothercare), and major general retail chains (Target, Walmart). Direct distribution, increasingly vital for premium natural brands, utilizes proprietary e-commerce platforms and subscription services, enabling greater control over branding, pricing, and customer relationship management. The marketing strategy at the downstream end heavily relies on conveying the natural, non-toxic, and sustainable attributes of the product directly to parents through digital content, parenting blogs, and social media influencers, ensuring high brand visibility and consumer education regarding usage and disposal.

Natural Latex Pacifier Market Potential Customers

Potential customers for the Natural Latex Pacifier Market are predominantly discerning parents and caregivers globally, spanning demographic segments but united by a shared emphasis on health, safety, and environmental responsibility in their infant care choices. The core buyer persona is often characterized as the ‘Eco-Conscious Millennial Parent’ who is well-educated, digitally native, and actively researches product provenance and material safety before purchase. These buyers view pacifiers not merely as convenience items but as extensions of their holistic parenting philosophy, prioritizing natural, non-toxic materials even if it means incurring a higher cost compared to mass-produced synthetic alternatives. Purchasing decisions are heavily influenced by sustainability certifications, transparent sourcing information, and endorsements from pediatricians or trusted parenting communities.

Geographically, key end-users are concentrated in regions with high levels of environmental awareness and disposable income, particularly North America (U.S., Canada) and Western Europe (Germany, UK, Scandinavia). These regions feature established markets for organic and ethical consumer goods, making the transition to natural latex pacifiers a natural extension of existing purchasing habits (e.g., organic food, eco-friendly diapers). Furthermore, professional entities such as pediatric clinics, specialized childcare facilities, and maternity hospitals also represent B2B customers, particularly those committed to maintaining an entirely natural or allergy-sensitive environment for infants, purchasing in bulk for institutional use while adhering to strict hygiene protocols.

The purchasing cycle for these natural products is often triggered during the pre-birth preparation phase or immediately following birth, driven by concerns over early exposure to plastics and chemicals. Secondary customer segments include gift-givers and grandparents who are keen to provide the safest, highest-quality items for new family members. Effective engagement requires focusing on content marketing that addresses common parental anxieties regarding allergies, material degradation, and optimal orthodontic development. Brand loyalty is high once established, provided the product delivers on its promises of durability, natural comfort, and sustainable origin, making retention strategies centered on subscription models and bundled offerings highly effective.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150.5 Million |

| Market Forecast in 2033 | USD 250.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Natursutten, Hevea Planet, BIBS Denmark, FRIGG, Philips Avent (Natural Latex Lines), MAM (Natural Rubber Lines), Razbaby, Suavinex, Lanco Toys, EcoViking, NUK (Natural Rubber Lines), WubbaNub, The Wee Hours, Doddle & Co., Green Sprouts, Pura Kiki, Becker’s Baby, O’Mickey, Rubber-Cal, Elodie Details |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural Latex Pacifier Market Key Technology Landscape

The technological landscape in the Natural Latex Pacifier Market centers less on radically new materials and more on advanced processing techniques and precise manufacturing to enhance the intrinsic qualities of natural rubber while mitigating its drawbacks, such as potential allergen content and susceptibility to rapid degradation. A critical technological focus is the optimization of the vulcanization and curing processes. This involves utilizing precise temperature and pressure controls during molding to achieve optimal elasticity and strength without relying on chemical accelerators that could introduce toxins. Advanced processing aims to stabilize the latex structure, making the pacifier more resistant to heat sterilization and prolonged use, thereby improving product longevity and safety compliance.

Another significant technological advancement involves minimizing nitrosamines and volatile organic compounds (VOCs) that can naturally occur or be introduced during standard latex manufacturing. Manufacturers employ specialized leaching technologies—intensive washing and extraction methods post-curing—to rigorously remove potential contaminants and residual proteins, a process crucial for developing truly hypoallergenic natural latex products that appeal to sensitive consumer segments. Furthermore, sophisticated 3D scanning and computer-aided design (CAD) are increasingly used to perfect orthodontic shapes based on pediatric data, ensuring the pacifiers meet exact geometrical standards required for dental health and regulatory approval, offering superior anatomical correctness compared to traditional molding methods.

Beyond material processing, technology extends into quality assurance and traceability. Non-contact measurement systems, often incorporating sensor technology and AI-driven computer vision, monitor the production line for dimensional accuracy and surface integrity at high speeds, ensuring zero-defect output. Additionally, blockchain technology is being explored by leading brands to provide transparent, verifiable records of the natural latex sourcing, from the plantation tap to the final packaged product. This technological transparency is vital for validating premium, ethical, and sustainable claims to the AEO-driven consumer who values detailed product information, differentiating high-quality natural latex from lower-grade alternatives in the crowded infant product sector.

Regional Highlights

North America: North America, particularly the United States, represents a mature yet dynamic market for natural latex pacifiers, characterized by high consumer awareness regarding health and sustainability, coupled with strong purchasing power. The region’s growth is driven by influential parental consumer groups who actively seek out organic and ethically sourced products, often prioritizing third-party certifications (e.g., GOTS, USDA Organic) even for infant accessories. The stringent regulatory environment concerning BPA, phthalates, and lead reinforces the demand for inherently natural, non-toxic alternatives. Market penetration is high, with established distribution through specialized organic baby boutiques, high-end department stores, and robust e-commerce platforms, making product accessibility widespread. The competitive landscape is intense, favoring brands that invest heavily in transparent marketing and detailed material provenance storytelling.

Europe: Europe stands as a pivotal market, often setting global trends in natural and eco-friendly infant care, supported by strong regulatory frameworks (such as the EU Toy Safety Directive and related standards like EN 1400) which necessitate high safety compliance. Scandinavian countries, in particular, show exceptional affinity for minimalist, natural designs, fueling the success of brands like BIBS and Hevea. Demand is high across Germany, the UK, and Nordic nations, fueled by government initiatives promoting sustainability and well-developed consumer education systems regarding chemical exposure risks in childhood. The market is highly segmented by design (orthodontic vs. cherry) and material certification, with a strong preference for domestically sourced or EU-certified rubber products whenever possible. E-commerce is crucial for accessing smaller, specialized natural brands from across the continent.

Asia Pacific (APAC): APAC is projected to be the fastest-growing region, presenting vast market opportunities due to rapidly increasing disposable incomes, high birth rates, and a pronounced shift towards premium, Western-style infant products, particularly in urban centers of China, South Korea, and India. While traditional preference often favored cost-effectiveness, the new generation of educated, affluent parents is willing to pay significant premiums for perceived safety and quality guarantees associated with natural materials, driven partly by widespread media coverage of safety scares related to mass-produced plastics. Market entry often requires strong local partnerships and significant investment in consumer education to distinguish natural latex from conventional rubber and manage cultural perceptions regarding hygiene and product lifespan. The regulatory environment is evolving, but international safety standards remain key selling points.

Latin America and Middle East & Africa (MEA): These regions currently hold smaller market shares but offer long-term growth potential. Growth in Latin America is concentrated in economically stable countries like Brazil and Mexico, driven by increasing awareness and the expanding presence of international retail chains that stock premium imported baby goods. The primary challenge is the affordability gap compared to conventional pacifiers, necessitating targeted marketing that emphasizes the long-term health value. In MEA, growth is gradual, focused primarily on high-income urban populations in the GCC countries (UAE, Saudi Arabia). Consumers here often prioritize globally recognized luxury brands and safety certifications, relying heavily on specialized pharmacies and high-end retail malls for product acquisition. Educational initiatives linking natural latex to superior infant health outcomes are essential for widespread adoption.

- North America: Dominant market share, driven by strong eco-conscious consumer base and stringent non-toxic material regulations (BPA-free focus).

- Europe: High market maturity, leading global trends in design and sustainability; strong demand in Scandinavia and Germany supported by comprehensive safety standards.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising disposable income, urbanization, and shift towards premium imported safety products in China and India.

- Latin America: Emerging market with growth potential concentrated in major economies, focusing on value-added health benefits to overcome price sensitivity.

- Middle East and Africa (MEA): Niche luxury segment adoption, primarily in GCC nations, relying on international brands and high visibility in specialized retail.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural Latex Pacifier Market.- Natursutten

- Hevea Planet

- BIBS Denmark

- FRIGG

- Philips Avent (Natural Latex Lines)

- MAM (Natural Rubber Lines)

- Razbaby

- Suavinex

- Lanco Toys

- EcoViking

- NUK (Natural Rubber Lines)

- WubbaNub

- The Wee Hours

- Doddle & Co.

- Green Sprouts

- Pura Kiki

- Becker’s Baby

- O’Mickey

- Rubber-Cal

- Elodie Details

Frequently Asked Questions

Analyze common user questions about the Natural Latex Pacifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of choosing natural latex over silicone for pacifiers?

Natural latex, derived from the rubber tree, offers superior softness, elasticity, and a tactile feel often preferred by infants, closely mimicking natural skin contact. It is also biodegradable and generally preferred by eco-conscious parents for its non-synthetic, renewable origin, unlike petroleum-derived silicone.

Are natural latex pacifiers safe for infants regarding potential allergens?

While pure natural rubber latex contains proteins that can cause allergic reactions in susceptible individuals, reputable manufacturers utilize specialized leaching processes to significantly reduce these proteins. It is crucial to monitor infants for sensitivity, but for most children, natural latex pacifiers are safe and non-toxic, free of common synthetic allergens like BPA and PVC.

How often should a natural latex pacifier be replaced due to material degradation?

Natural latex is an organic material and degrades faster than silicone, especially when exposed to heat, UV light, or frequent sterilization. Manufacturers typically recommend replacing natural latex pacifiers every 4 to 8 weeks, or immediately at the first signs of stickiness, swelling, discoloration, or tearing, ensuring continued hygiene and safety.

Which geographical regions are leading the demand for premium natural latex pacifiers?

North America and Europe, particularly Scandinavia and Germany, currently lead the market in demand and market maturity. This is due to high parental awareness, strong consumer focus on non-toxic, sustainable products, and high disposable incomes supporting the purchase of premium, certified organic infant care items.

What technological advancements are impacting the quality control of natural latex pacifiers?

Advanced technologies include AI-driven computer vision systems for high-precision defect detection during molding, and sophisticated leaching and curing processes designed to rigorously minimize nitrosamines and volatile organic compounds (VOCs). These process innovations enhance product safety, durability, and compliance with strict international infant care standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager