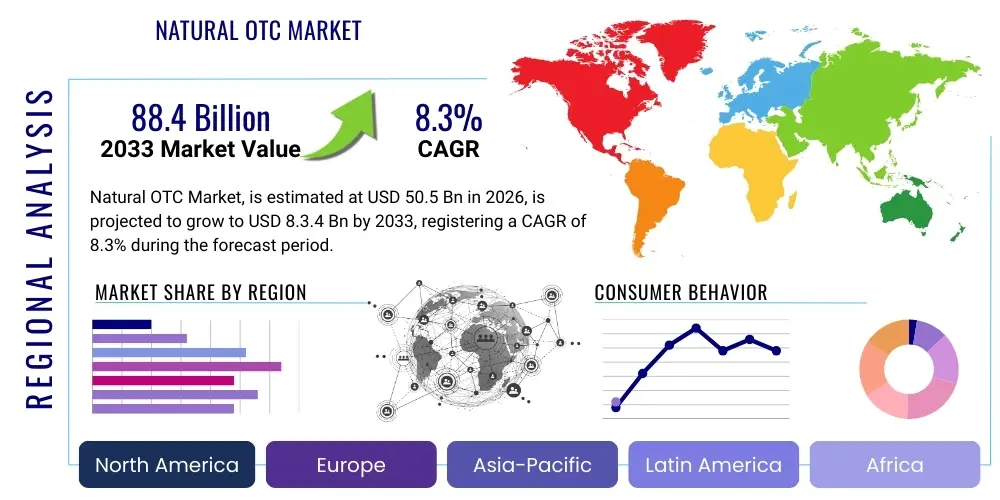

Natural OTC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437888 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Natural OTC Market Size

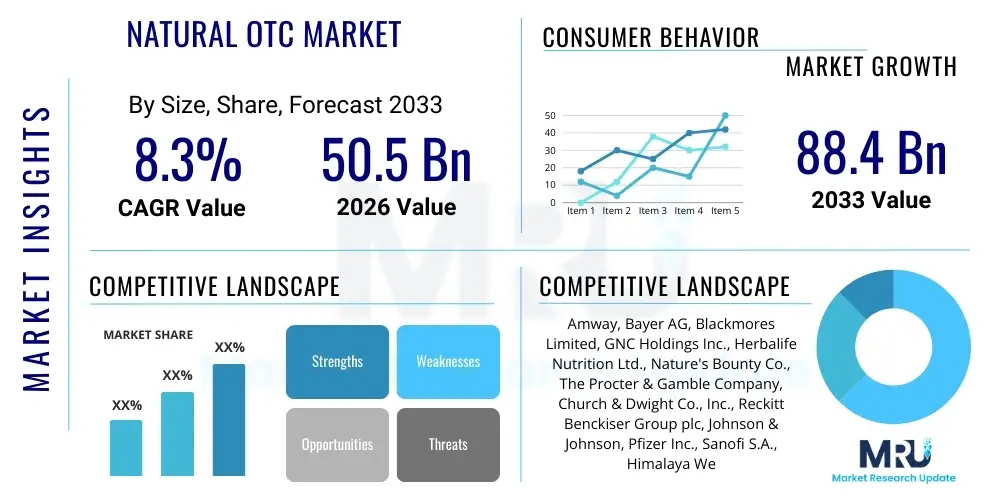

The Natural OTC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% between 2026 and 2033. The market is estimated at USD 50.5 Billion in 2026 and is projected to reach USD 88.4 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by increasing consumer preference for preventive healthcare and natural remedies over synthetic pharmaceuticals, particularly in developed economies where health consciousness is high. The rising prevalence of chronic lifestyle diseases and the demand for over-the-counter solutions derived from botanical, mineral, or natural sources are key accelerators driving this valuation increase across all major geographical regions, including North America and Asia Pacific.

Natural OTC Market introduction

The Natural Over-The-Counter (OTC) market encompasses a wide array of non-prescription products formulated using naturally derived ingredients, including vitamins, minerals, herbal supplements, homeopathic medicines, and natural topical preparations. These products are utilized by consumers for self-treatment of minor ailments, immune support, digestive health, and overall wellness maintenance. The primary growth drivers for this market segment include enhanced public awareness regarding the potential side effects associated with synthetic drugs, a paradigm shift towards holistic health management, and greater accessibility of these natural products through diversified retail channels such as pharmacies, health food stores, and e-commerce platforms. The Natural OTC market is characterized by stringent regulatory scrutiny, especially concerning standardization and claims validation, ensuring product safety and efficacy remain paramount concerns for both manufacturers and regulatory bodies globally.

Major applications for Natural OTC products span diverse therapeutic areas. Digestive health supplements, such as probiotics and natural fiber products, represent a significant segment, driven by modern dietary habits and stress-related digestive issues. Furthermore, the immense demand for immune support products, particularly exacerbated by recent global health crises, has propelled the sales of vitamin C, zinc, and elderberry formulations. Pain management and sleep aids, utilizing natural compounds like curcumin, magnesium, and melatonin, also constitute substantial application areas. These products offer consumers alternatives perceived as safer for long-term use compared to conventional OTC medications, supporting the trend of proactive and personalized health management, which is a key growth determinant.

The benefits associated with the Natural OTC market extend beyond individual health outcomes to macroeconomic impacts, fostering innovation in ethnobotany and sustainable sourcing practices. Manufacturers are increasingly focusing on clean label formulations, ensuring transparency regarding ingredient origin and processing methods, which resonates strongly with environmentally conscious consumers. Driving factors include favorable demographic shifts, such as aging populations seeking non-invasive and gentle health solutions, and increasing disposable income, allowing consumers to prioritize premium natural wellness products. Regulatory changes that streamline the approval processes for recognized traditional medicines also provide a conducive environment for market proliferation, solidifying the market's trajectory towards sustained expansion across established and emerging economies.

Natural OTC Market Executive Summary

The Natural OTC market is exhibiting strong business trends characterized by significant mergers and acquisitions activity aimed at consolidating niche botanical expertise and expanding distribution networks into high-growth geographies, particularly in Asia Pacific. Key players are increasingly investing in clinical trials and third-party certifications to substantiate health claims, thereby building consumer trust and differentiating their premium offerings from generic supplements. Regional trends indicate North America maintaining market dominance due to high health expenditure and entrenched consumer acceptance of dietary supplements, while the Asia Pacific region, led by China and India, is registering the highest growth rate, propelled by increasing urbanization, rising health literacy, and the strong cultural acceptance of traditional natural medicine systems. Segment trends highlight that the Vitamins and Dietary Supplements category holds the largest market share, though the Herbal Remedies segment is experiencing rapid expansion due to its perceived authenticity and suitability for chronic conditions. E-commerce remains the fastest-growing distribution channel, providing unparalleled access to specialized natural products for a global consumer base, fundamentally redefining retail strategy in this sector.

AI Impact Analysis on Natural OTC Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Natural OTC market center predominantly on three areas: personalized natural supplement recommendations, optimization of supply chain transparency for natural ingredients, and accelerated R&D for novel botanical compounds. Consumers and industry stakeholders are keen to understand how AI-driven diagnostics and recommendation engines can tailor supplement regimes based on individual genetic data, microbiome analysis, or lifestyle factors, shifting the market from mass-produced products to highly customized natural health solutions. There is also significant interest in using AI, particularly machine learning and computer vision, to verify the authenticity and quality of raw natural materials, addressing long-standing concerns regarding adulteration and mislabeling. Furthermore, users anticipate AI will revolutionize drug discovery by rapidly analyzing vast pharmacological datasets to identify synergistic combinations of natural ingredients for enhanced efficacy, thereby cutting down the time and cost associated with product development in the botanical space.

- AI-driven Personalization: Customization of natural supplement dosages and formulations based on individual biomarker data, optimizing treatment efficacy.

- Supply Chain Transparency: Implementation of AI and blockchain solutions to trace natural ingredients from source to shelf, ensuring ethical sourcing and authenticity verification.

- Accelerated R&D: Utilizing machine learning algorithms to screen natural compound libraries, identify bioactive molecules, and predict efficacy for specific health indications, drastically reducing development cycles.

- Manufacturing Optimization: AI-powered quality control systems enhancing the consistency and potency of herbal extracts and final product batches.

- Consumer Education and Engagement: Deploying AI chatbots and virtual assistants to provide accurate information about natural remedies, improving health literacy and product selection.

DRO & Impact Forces Of Natural OTC Market

The Natural OTC market is shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities. Key drivers include the global shift towards preventive healthcare and the consumer distrust of synthetic pharmaceuticals, coupled with extensive marketing campaigns promoting holistic wellness lifestyles. This foundational demand is amplified by the widespread adoption of digital platforms that facilitate detailed product information sharing and direct-to-consumer sales, increasing market penetration dramatically. However, the market faces significant restraints, notably the regulatory complexity and fragmentation across different geographical jurisdictions, which necessitates costly and time-consuming compliance efforts. Furthermore, the challenge of maintaining standardization and efficacy across naturally sourced ingredients, which are inherently subject to biological variability, presents a major technical hurdle that impacts scalability and consumer confidence.

Opportunities within the Natural OTC sector are substantial, primarily focusing on technological integration and addressing unmet needs in chronic care. The development of advanced encapsulation and delivery systems, such as liposomal technology, enhances the bioavailability of natural compounds, improving therapeutic outcomes and justifying premium pricing. Expansion into new therapeutic areas, particularly mental health and cognitive function, using adaptogens and nootropics derived from natural sources, offers significant growth avenues. The market impact forces suggest that the influence of social media health influencers and digital marketing will continue to grow exponentially, driving adoption rates faster than traditional advertising methods. Conversely, the continuous scrutiny from consumer advocacy groups and regulatory bodies regarding misleading health claims acts as a persistent negative force, compelling companies toward greater scientific rigor and transparency.

The balance of these forces creates a dynamic environment where innovation in formulation and ethical sourcing is crucial for competitive advantage. Companies that successfully navigate the regulatory landscape by securing clinical evidence for their natural products are poised for market leadership. The major impact force is the evolving definition of "natural" among consumers and regulators; as consumers become more educated, they demand evidence-based natural solutions rather than traditional remedies alone. This elevated expectation necessitates continuous investment in scientific validation, transforming the market from purely traditional to one that marries botanical science with modern pharmaceutical rigor. Successfully managing these internal and external pressures determines long-term viability and market share gain across all product categories.

Segmentation Analysis

The Natural OTC market is comprehensively segmented based on product type, formulation, therapeutic area, and distribution channel, providing granular insights into consumer behavior and market dynamics. Analyzing these segments reveals varying growth trajectories and consumer preferences, allowing market participants to strategically tailor product development and marketing efforts. The product segmentation, covering dietary supplements, herbal remedies, and natural cosmetics, reflects the breadth of natural solutions utilized for self-care. Geographic segmentation is critical, highlighting the differing regulatory landscapes and cultural acceptance levels of natural products across North America, Europe, and the rapidly expanding Asia Pacific region, which exhibits high demand for traditional Chinese and Ayurvedic medicine derivatives.

- By Product Type:

- Dietary Supplements (Vitamins, Minerals, Amino Acids, Probiotics)

- Herbal/Botanical Extracts

- Traditional/Ayurvedic Medicines

- Homeopathic Products

- Natural Functional Foods and Beverages

- By Formulation:

- Tablets and Capsules

- Powders

- Liquids and Gels

- Gummies and Chewables (High Growth)

- By Therapeutic Area:

- Immune Health and Wellness

- Digestive Health

- Pain Management

- Cardiovascular Health

- Weight Management

- Cognitive and Mental Health

- By Distribution Channel:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail (E-commerce)

- Specialty Health Food Stores

Value Chain Analysis For Natural OTC Market

The value chain for the Natural OTC market begins with the upstream segment, focusing heavily on the ethical sourcing and extraction of raw natural materials, including medicinal plants, specific minerals, and fermentation bases for probiotics. Critical activities at this stage involve ensuring biodiversity preservation, implementing sustainable farming practices, and adhering to strict quality control for standardization of active ingredient concentration. Suppliers of high-quality, certified organic, and non-GMO botanical extracts hold significant bargaining power, as product efficacy is directly tied to the raw material quality. The complexity of sourcing globally dispersed natural resources necessitates sophisticated logistics and quality assurance protocols to minimize contamination and ensure consistency before the manufacturing stage.

The midstream process involves formulation, manufacturing, and packaging, where advanced technology plays a crucial role in preserving the potency and bioavailability of sensitive natural ingredients. Manufacturers must adhere to Good Manufacturing Practices (GMP) and often seek multiple international certifications (e.g., USDA Organic, NSF) to demonstrate product integrity. The choice between direct and indirect distribution significantly impacts the value addition and final consumer pricing. Direct channels, primarily e-commerce, allow brands to retain higher margins and capture immediate consumer feedback. Conversely, indirect channels involving wholesalers and large pharmacy chains offer necessary scale and accessibility, especially for mature markets where physical retail presence is vital for consumer confidence and purchase volume.

The downstream segment focuses on marketing, sales, and end-user engagement. Distribution channels are highly diversified, ranging from traditional retail outlets like pharmacies and grocery stores to increasingly dominant online platforms. Digital marketing, informed by consumer health trends and search queries, is critical for educating potential customers about the benefits and appropriate use of natural products. The involvement of healthcare practitioners, such as naturopaths and functional medicine doctors, acts as a crucial influence in certain segments, driving professional recommendations. Effective supply chain management, minimizing stockouts and ensuring timely replenishment across vast retail networks, is the final critical element determining market efficiency and customer satisfaction in this competitive environment.

Natural OTC Market Potential Customers

The primary customer base for the Natural OTC market is diverse but centers around individuals actively engaged in preventive healthcare, categorized often as 'Wellness Seekers' and 'Health-Conscious Consumers.' This demographic typically spans ages 35 to 65, possessing higher disposable incomes and a propensity to invest in supplements and non-pharmaceutical alternatives to maintain vitality and manage age-related conditions proactively. A significant subset includes individuals disillusioned with conventional medicine for minor or chronic non-life-threatening ailments, seeking gentler, holistic solutions with fewer perceived side effects. Furthermore, parents seeking natural remedies for their children’s minor illnesses, preferring ingredients without artificial additives, constitute a rapidly expanding potential customer segment globally.

Another crucial segment comprises patients managing chronic conditions (e.g., joint pain, digestive issues, sleep disorders) who utilize natural products as adjunctive or complementary therapies, often recommended by integrated healthcare practitioners. These customers prioritize efficacy, requiring products backed by clinical data or strong traditional evidence. The purchasing decision is heavily influenced by transparent labeling, brand reputation, and the perceived sustainability or ethical sourcing of ingredients. Retail strategies must therefore be tailored to reach these segmented buyer personas, focusing educational content through specialized health portals and reputable e-commerce platforms, reinforcing trust and scientific validation as key purchase motivators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 50.5 Billion |

| Market Forecast in 2033 | USD 88.4 Billion |

| Growth Rate | 8.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amway, Bayer AG, Blackmores Limited, GNC Holdings Inc., Herbalife Nutrition Ltd., Nature's Bounty Co., The Procter & Gamble Company, Church & Dwight Co., Inc., Reckitt Benckiser Group plc, Johnson & Johnson, Pfizer Inc., Sanofi S.A., Himalaya Wellness Company, MegaFood, and Nordic Naturals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Natural OTC Market Key Technology Landscape

The Natural OTC market is rapidly adopting advanced technological solutions to overcome inherent challenges related to ingredient stability, bioavailability, and standardization. A key area of innovation is in extraction and purification techniques. Modern manufacturers are moving beyond traditional solvent extraction methods to utilize Supercritical Fluid Extraction (SFE) and Ultrasonic-Assisted Extraction (UAE). SFE, employing compressed carbon dioxide, ensures the extraction of active compounds without residual toxic solvents, yielding purer, highly concentrated botanical extracts crucial for premium OTC products. UAE reduces extraction time and energy consumption while enhancing the yield of heat-sensitive compounds, thereby maintaining the therapeutic integrity of the final formulation. These high-tech extraction processes are foundational to meeting the increasingly rigorous quality and efficacy standards demanded by both regulatory bodies and educated consumers.

Furthermore, significant technological advances are observed in delivery systems designed to maximize the absorption and effect of natural ingredients within the human body. Novel technologies like liposomal encapsulation are transforming the market by protecting active ingredients (such as curcumin or certain vitamins) from degradation in the digestive tract, ensuring higher systemic bioavailability. Nanotechnology is also being explored to create nano-emulsions that improve the solubility and absorption rates of poorly soluble natural compounds. These controlled release mechanisms allow for precise dosing and targeted action, elevating the therapeutic performance of Natural OTC products to levels comparable to or exceeding synthetic alternatives. Investment in these complex formulation technologies is a critical differentiator for companies seeking to establish market leadership in evidence-based natural health solutions.

Beyond formulation and delivery, digital technologies are playing an increasing role in the quality assurance and consumer engagement aspects of the Natural OTC market. The integration of blockchain technology is emerging as a powerful tool for supply chain transparency, allowing consumers to trace the origin and processing history of botanical ingredients, thereby verifying claims of sustainability and purity. Additionally, advanced analytical techniques such as High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry are standard practice for rigorous quantitative and qualitative analysis, ensuring batch consistency and freedom from contaminants. This blend of pharmaceutical-grade analytics and transparent digital tracking ensures that the Natural OTC sector evolves from a loosely regulated supplement industry to a standardized, technologically sophisticated healthcare segment, capable of generating high-trust consumer relationships.

Regional Highlights

- North America: This region maintains the largest market share, driven by a well-established supplement culture, high consumer spending on health and wellness, and extensive research and development in natural ingredients. The U.S. market is characterized by strong regulatory oversight (FDA guidelines) and high uptake of personalized nutrition and targeted dietary supplements, particularly in areas like sports nutrition and cognitive support.

- Europe: Europe is a mature market focusing heavily on regulation, quality standards, and the integration of traditional herbal medicines into primary care. Germany and France lead in the consumption of phytomedicines, benefitting from established traditions and consumer trust in pharmacy-led health advice. Regulatory harmony remains a challenge, but the demand for organic and sustainably sourced natural products is exceptionally high.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid growth is underpinned by the massive populations of China and India, where Traditional Chinese Medicine (TCM) and Ayurveda are deeply embedded in healthcare systems. Rising disposable incomes, increasing awareness of western health trends, and government support for traditional medicine integration are key growth catalysts in this region.

- Latin America: Growth is primarily fueled by improving economic conditions and greater access to global health trends. Brazil and Mexico are emerging as key markets, demonstrating increasing adoption of natural products for general wellness and immune support, although market fragmentation and variable regulatory environments pose barriers.

- Middle East and Africa (MEA): This region is characterized by nascent market development but strong potential, particularly in the UAE and Saudi Arabia, driven by high healthcare expenditure and exposure to international wellness trends. The focus often lies on natural products that align with local cultural and religious practices, with imports forming a significant portion of the supply chain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Natural OTC Market.- Amway

- Bayer AG

- Blackmores Limited

- GNC Holdings Inc.

- Herbalife Nutrition Ltd.

- Nature's Bounty Co.

- The Procter & Gamble Company

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group plc

- Johnson & Johnson

- Pfizer Inc.

- Sanofi S.A.

- Himalaya Wellness Company

- MegaFood

- Nordic Naturals

- Pharmavite LLC

- Nutraceutical International Corporation

- Swisse Wellness PTY Ltd.

- Unilever PLC

- GlaxoSmithKline plc

Frequently Asked Questions

Analyze common user questions about the Natural OTC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth trend in the Natural OTC market?

The primary driver is the pervasive consumer shift toward preventive health measures, coupled with increasing skepticism regarding the long-term safety of synthetic drugs. Enhanced consumer awareness regarding holistic wellness and the expanding accessibility of natural products via e-commerce platforms are accelerating this growth trend globally.

Which product segment dominates the Natural OTC Market?

The Dietary Supplements segment, specifically encompassing vitamins, minerals, and probiotics, currently holds the largest market share. This dominance is due to the widespread acceptance of supplements for addressing common nutritional gaps and supporting immune function across all age groups.

How does stringent regulation impact the Natural OTC market?

Stringent, often fragmented, regulation across global jurisdictions acts as a major restraint, increasing compliance costs and time-to-market. However, regulation also enforces higher quality and standardization (GMP), which ultimately builds greater consumer trust and validates product claims, benefiting credible manufacturers.

What role does technology play in enhancing Natural OTC product efficacy?

Technology is crucial for enhancing efficacy through advanced extraction methods like Supercritical Fluid Extraction (SFE) and novel delivery systems such as liposomal encapsulation. These innovations significantly increase the purity, stability, and bioavailability of active natural compounds, improving therapeutic outcomes.

Which geographical region offers the highest growth potential for Natural OTC products?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly growing economies, rising health literacy, and the strong cultural acceptance and modernization of traditional medicines like Ayurveda and Traditional Chinese Medicine (TCM).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager