Naval Shipbuilding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438258 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Naval Shipbuilding Market Size

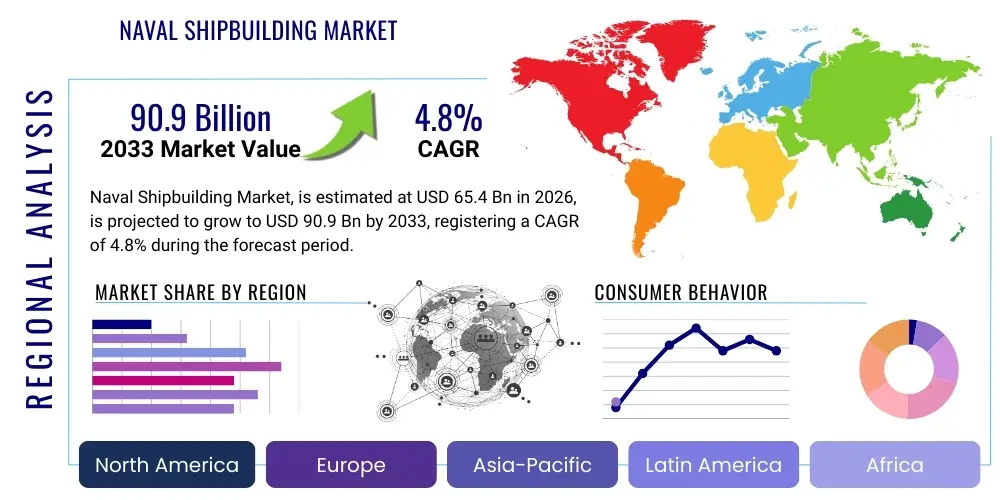

The Naval Shipbuilding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $65.4 Billion in 2026 and is projected to reach $90.9 Billion by the end of the forecast period in 2033.

Naval Shipbuilding Market introduction

The Naval Shipbuilding Market encompasses the design, construction, repair, maintenance, and modernization of military vessels, crucial for maintaining global maritime security and projecting national power. The core product segments include aircraft carriers, nuclear and conventional submarines, destroyers, frigates, patrol vessels, and specialized amphibious warfare ships, all adhering to stringent defense specifications. Major applications of these naval assets include coastal defense, power projection, anti-submarine warfare (ASW), anti-surface warfare (ASuW), electronic warfare, and humanitarian assistance/disaster relief (HA/DR) missions. Key benefits derived from robust naval capabilities include safeguarding vital Sea Lines of Communication (SLOCs), ensuring sovereignty in Exclusive Economic Zones (EEZs), and providing strategic deterrence against adversaries. The market is currently driven by escalating geopolitical tensions in critical regions such as the South China Sea and the Eastern Mediterranean, leading to significant modernization and fleet expansion programs by major global naval powers. Furthermore, the mandatory replacement cycles for aging fleets, coupled with rapid technological advancements in maritime security systems and combat management systems, are fueling sustained investment across various naval construction tiers, pushing the industry toward greater reliance on modular design and digital shipbuilding techniques for improved efficiency and capability integration.

Naval Shipbuilding Market Executive Summary

The global Naval Shipbuilding Market is currently characterized by intense competition driven by long-term strategic government procurement cycles and increasing reliance on public-private partnerships for large-scale projects. Business trends indicate a strong shift towards indigenization and technology transfer agreements, particularly in emerging economies like India and Brazil, aiming to reduce dependence on foreign suppliers and bolster domestic defense industrial bases. This localization trend is redefining supply chain dynamics, favoring local content requirements and creating opportunities for specialized domestic component manufacturers. Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by the accelerating naval arms race between China, India, Japan, and Australia, focusing heavily on submarine fleets and advanced surface combatants capable of operating in blue waters. Segment trends reveal substantial investment concentrated in the Submarine segment, particularly nuclear-powered attack submarines (SSNs) and ballistic missile submarines (SSBNs), as they offer strategic deterrence capabilities. Concurrently, the modernization and retrofitting segment is gaining traction, providing high-margin opportunities for shipyards specializing in integrating advanced electronics, communication suites, and weapon systems onto existing hull forms, thereby extending the operational lifespan and improving the combat effectiveness of current naval fleets without the massive capital outlay required for entirely new construction programs. Furthermore, the market is witnessing the proliferation of unmanned maritime systems (UMS), which, while not replacing traditional shipbuilding entirely, are necessitating new approaches to fleet integration and command and control architectures.

AI Impact Analysis on Naval Shipbuilding Market

User inquiries regarding the integration of Artificial Intelligence (AI) into naval shipbuilding primarily center on three core themes: enhancing vessel autonomy, optimizing the design and production lifecycle, and improving operational readiness through predictive maintenance. Common concerns relate to the ethical implications of autonomous weapon systems, cybersecurity vulnerabilities associated with interconnected AI platforms, and the regulatory framework required to govern AI integration in high-stakes defense environments. Users are actively seeking information on how AI can accelerate the design iteration process, specifically through generative design tools that optimize hull forms for stealth and efficiency, and how machine learning algorithms can manage complex project timelines and resource allocation within mega-shipyards. Expectations are high regarding AI’s potential to revolutionize maintenance protocols, moving from time-based schedules to highly accurate condition-based monitoring, dramatically reducing downtime and lifecycle costs for multi-billion dollar assets. Furthermore, there is strong interest in AI’s role in combat management systems (CMS) and sensor fusion, where algorithms process massive amounts of data from diverse sources to provide commanders with real-time, actionable intelligence, ultimately influencing the design requirements for future next-generation combatants to support these advanced processing capabilities.

- AI-driven Generative Design: Optimizing hull and internal structure designs for weight, stealth, and hydrodynamics, significantly reducing physical prototyping needs.

- Predictive Maintenance (PMM): Utilizing machine learning on sensor data to forecast equipment failures, minimizing unexpected operational disruptions and extending service intervals.

- Autonomous Systems Integration: Development of hardware and software interfaces for unmanned surface vessels (USVs) and unmanned underwater vehicles (UUVs) that require robust AI for navigation, mission planning, and data processing.

- Automated Welding and Fabrication: Implementation of robotic systems guided by computer vision and AI for precision assembly tasks in large blocks, enhancing speed and accuracy in the shipyard.

- Supply Chain Optimization: AI algorithms managing complex global supply chains for specialized naval components, mitigating risks related to geopolitical instability and component scarcity.

- Advanced Combat Management Systems (CMS): AI enabling faster data fusion from multiple sensors (radar, sonar, electronic warfare) to improve situational awareness and target acquisition capabilities.

- Virtual and Augmented Reality Training: AI-enhanced simulators for training shipyard workers and naval crew on new vessel systems and maintenance procedures.

- Digital Twin Technology: Creation of AI-powered digital replicas of vessels to simulate performance under various conditions, enabling real-time diagnostics and modification testing before physical implementation.

DRO & Impact Forces Of Naval Shipbuilding Market

The Naval Shipbuilding Market trajectory is heavily influenced by a delicate balance of strong geopolitical Drivers, rigid operational Restraints, significant Technological Opportunities, and multifaceted Impact Forces exerted by global defense policies and macroeconomic trends. Primary drivers include intensified maritime disputes, particularly territorial claims in the Pacific and Arctic regions, which necessitate continuous fleet modernization and expansion by nations seeking to secure vital maritime interests and enhance power projection capabilities beyond their immediate coastlines. However, severe restraints challenge market expansion, notably the exorbitant upfront costs and long lead times associated with complex naval programs, coupled with pervasive budget limitations and unpredictable governmental funding cycles that often result in program delays or cancellations. Opportunities are substantial in integrating dual-use technologies, such as cybersecurity hardening, advanced propulsion systems, and modular system architectures, which enable rapid upgrade cycles and cost-effective customization across different vessel classes. The market is also heavily impacted by political stability and defense alliances; strategic shifts in foreign policy, such as the AUKUS pact between Australia, the UK, and the US, create monumental long-term procurement requirements, while protectionist trade policies or export restrictions on critical defense technologies significantly constrain international collaboration and market access for foreign shipbuilders. Furthermore, the availability of highly skilled labor specializing in complex defense electronics and nuclear propulsion systems acts as a critical bottleneck impacting production rates globally.

Segmentation Analysis

The Naval Shipbuilding Market is fundamentally segmented based on factors such as vessel type, operational depth, platform class, and the nature of service rendered (new construction vs. maintenance). This segmentation allows for granular analysis of investment patterns, highlighting where defense budgets are prioritizing capabilities—be it surface superiority, underwater deterrence, or logistical support. The primary segmentation by vessel class typically distinguishes between surface combatants, subsurface platforms, and support vessels, each demanding specialized shipbuilding expertise and often utilizing unique material compositions and integrated weapon systems. The market is also strategically divided by technology, focusing on conventional versus nuclear propulsion systems, which dictate the complexity, cost, and operational range of the final naval asset. Furthermore, the distinction between military shipbuilding (new construction) and naval maintenance, repair, and overhaul (MRO) services is crucial, with MRO offering steadier, recurring revenue streams essential for the sustained financial health of major shipyards globally.

- By Vessel Type:

- Aircraft Carriers

- Submarines (SSN, SSBN, SSK)

- Destroyers and Cruisers

- Frigates and Corvettes

- Amphibious Warfare Ships

- Patrol and Coastal Vessels

- Mine Countermeasure Vessels (MCMV)

- Auxiliary and Support Vessels (Tankers, Tenders)

- By Platform Type:

- Surface Combatants

- Subsurface Platforms

- Support and Logistics Vessels

- By Propulsion:

- Nuclear Propulsion

- Conventional Propulsion (Diesel-Electric, Gas Turbine, Combined Systems)

- By End-Use Service:

- New Construction (Initial Build)

- Modernization and Retrofitting (Mid-Life Upgrades)

- Maintenance, Repair, and Overhaul (MRO)

- By System Integration:

- Combat Management Systems (CMS)

- Weapon Systems (Missile Launchers, Naval Guns)

- Propulsion and Machinery Systems

- Navigation and Communication Systems

- Sensor and Sonar Suites

Value Chain Analysis For Naval Shipbuilding Market

The Naval Shipbuilding value chain is characterized by high integration and rigorous government oversight, starting with the Upstream activities centered on the procurement and fabrication of specialized materials. This initial phase involves suppliers of high-grade steel alloys, sophisticated composite materials, nuclear reactor components, and highly specialized, often proprietary, defense electronics and critical software components. Midstream operations are dominated by the major shipyards and prime contractors, who undertake the highly complex design (using CAD/CAM/CAE tools), block construction, hull assembly, system integration, sea trials, and final delivery processes. This stage demands exceptional engineering precision and compliance with strict military specifications. The Downstream phase involves the direct client—the governmental navy or defense ministry—and the long-term support ecosystem, which includes contracted MRO providers, lifecycle support specialists, and armament suppliers who manage munitions and spares. The distribution channel is predominantly Direct, characterized by sole-source contracts or highly structured competitive tenders between governments and prime contractors, largely due to the strategic security nature of the assets, minimizing the role of indirect sales agents, though specialized consulting firms often facilitate international technology transfer and offset agreements.

Naval Shipbuilding Market Potential Customers

The primary and almost exclusive end-users and buyers in the Naval Shipbuilding Market are sovereign governments, represented specifically by their respective national defense ministries, navies, coast guards, and, in some cases, border patrol agencies with militarized fleets. These customers operate under strict strategic imperatives, prioritizing vessels that align with national defense doctrines, regional security requirements, and long-term force structure planning, necessitating multi-decade acquisition strategies. Key decision-makers within these organizations focus on factors such as technological superiority, stealth capability, lifecycle cost projections, and the domestic industrial benefits derived from local shipbuilding contracts, often leveraging their purchasing power to enforce technology transfer and offset agreements with international suppliers. While the core customer base remains the established naval powers (US, China, Russia), emerging naval forces in Southeast Asia and the Middle East represent rapidly expanding customer segments driven by the need to protect burgeoning global trade routes and assert control over strategically important maritime chokepoints, resulting in sustained procurement demand for advanced frigates, corvettes, and offshore patrol vessels optimized for regional conflict scenarios.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $65.4 Billion |

| Market Forecast in 2033 | $90.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fincantieri S.p.A., General Dynamics Corporation (GD), Huntington Ingalls Industries (HII), BAE Systems plc, Naval Group, Damen Schelde Naval Shipbuilding, Mitsubishi Heavy Industries (MHI), ThyssenKrupp Marine Systems (TKMS), Hyundai Heavy Industries (HHI), Mazagon Dock Shipbuilders Limited (MDL), Navantia, CSIC (China Shipbuilding Industry Corporation), Austal, Lockheed Martin Corporation (Specific Naval Systems Integration), Saab AB (Kockums), Cochin Shipyard Limited, DCNS India, Shanghai Waigaoqiao Shipbuilding, Babcock International Group, Orizzonte Sistemi Navali. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Naval Shipbuilding Market Key Technology Landscape

The contemporary Naval Shipbuilding Market is fundamentally shifting towards a model underpinned by digital transformation, emphasizing the efficient integration of complex systems and maximizing vessel operational availability. Key technological advancements include the ubiquitous adoption of Digital Shipbuilding techniques, which leverages technologies like 3D modeling, virtual reality for design review, and digital thread integration across the entire product lifecycle, drastically reducing errors and speeding up construction timelines. Furthermore, the integration of advanced Modular Design Architecture (MDA) is becoming standard, particularly for surface combatants, allowing navies to quickly and cost-effectively swap out mission packages (e.g., sensor arrays or specific weapon containers) depending on the operational theatre, enhancing vessel versatility without requiring extensive drydock time. Material science innovations are also crucial, focusing on advanced composite structures, signature-reducing coatings, and higher-strength, lighter-weight alloys for enhanced survivability and reduced fuel consumption. Simultaneously, the push towards electrification and hybrid propulsion systems is growing, providing better acoustic stealth characteristics—vital for anti-submarine warfare (ASW)—and improving energy efficiency, aligning with broader strategic goals to reduce the logistical footprint of modern fleets, demanding specialized expertise in high-power electric motor manufacturing and energy storage solutions.

Regional Highlights

The global distribution of naval shipbuilding activity is heavily concentrated in regions facing heightened geopolitical risk or possessing the necessary established industrial base and capital resources. North America, led by the United States, maintains its dominance, characterized by massive, multi-decade programs focused on next-generation aircraft carriers, nuclear submarines, and large surface combatants (Destroyers and Frigates). The US investment trajectory is stable, driven by the imperative to maintain global naval superiority and operational readiness across multiple oceanic theatres, ensuring significant long-term contracts for key domestic shipbuilders. Europe represents a mature market, specializing in high-end, export-focused naval assets such as advanced frigates and conventional submarines, with notable activity in France, the UK, Germany, and Italy, often characterized by strong intra-European collaboration on complex programs like the Type 26 Frigate or joint missile development initiatives. European shipyards prioritize technological sophistication, stealth features, and interoperability with NATO standards. However, the most dynamic growth is observed in the Asia Pacific (APAC) region, where regional powers like China and India are undertaking unprecedented fleet expansion programs. China’s rapid naval buildup, encompassing carriers, amphibious ships, and a growing submarine fleet, drives significant market size, while India’s focus on indigenization and securing its vast coastline ensures strong investment, particularly in domestic shipyard capability expansion and technology transfer agreements, making APAC the forecast leader in terms of sheer volume and tonnage produced.

- North America (USA, Canada): Dominant market share focused on nuclear propulsion, large deck carriers, and continuous technological upgrades for global power projection.

- Asia Pacific (China, India, Japan, South Korea, Australia): Highest growth region driven by maritime territorial disputes, rapid fleet modernization, and substantial investment in subsurface capabilities (submarines).

- Europe (UK, France, Germany, Italy, Spain): Mature market emphasizing high-tech, export-oriented frigates, corvettes, and conventional submarines; strong focus on NATO standardization and joint European defense projects.

- Middle East and Africa (MEA): Emerging market characterized by procurements of smaller, highly capable vessels (corvettes, patrol vessels) primarily for coastal defense and securing energy infrastructure, with nations like Saudi Arabia and UAE driving demand.

- Latin America (Brazil): Focusing on replacing aging fleets and developing indigenous capabilities, particularly in submarine construction, often through technology transfer partnerships with European builders.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Naval Shipbuilding Market.- General Dynamics Corporation (GD)

- Huntington Ingalls Industries (HII)

- BAE Systems plc

- Naval Group

- Fincantieri S.p.A.

- ThyssenKrupp Marine Systems (TKMS)

- Mitsubishi Heavy Industries (MHI)

- Hyundai Heavy Industries (HHI)

- Damen Schelde Naval Shipbuilding

- Navantia

- Austal Limited

- Saab AB (Kockums)

- Lockheed Martin Corporation (as a major systems integrator)

- Mazagon Dock Shipbuilders Limited (MDL)

- Cochin Shipyard Limited (CSL)

- China Shipbuilding Industry Corporation (CSIC)

- China State Shipbuilding Corporation (CSSC)

- Babcock International Group

- Hellenic Shipyards S.A.

- Orizzonte Sistemi Navali

Frequently Asked Questions

Analyze common user questions about the Naval Shipbuilding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand for naval shipbuilding?

The primary drivers are escalating geopolitical tensions in critical maritime zones, mandatory replacement cycles for aging legacy fleets, and strategic government investments aimed at countering increasing naval capabilities of rival nations, particularly through modernizing subsurface and surface combatant platforms.

Which vessel type is experiencing the highest growth rate?

The Submarine segment, encompassing both nuclear-powered attack submarines (SSNs) and conventional diesel-electric submarines (SSKs), is projected to experience the highest growth, driven by their strategic deterrence capabilities and increasing prevalence in the Asia Pacific region for Anti-Submarine Warfare (ASW) missions.

How is digital shipbuilding technology impacting construction timelines?

Digital shipbuilding, leveraging 3D modeling, virtual reality, and automated fabrication processes, significantly reduces design flaws and physical rework, resulting in accelerated construction timelines and improved predictability in complex naval procurement programs, optimizing labor and material usage.

What role does Maintenance, Repair, and Overhaul (MRO) play in the market?

Naval MRO services constitute a crucial, recurring revenue stream for shipyards. MRO ensures the operational longevity and readiness of fleets, encompassing everything from routine maintenance to complex mid-life modernizations, extending the asset utility of high-value naval platforms.

What are the key technological challenges in the modern naval market?

Key challenges include successfully integrating advanced combat management and sensor systems, securing complex digital platforms against sophisticated cyber threats, managing the high costs and supply chain risks associated with nuclear propulsion components, and recruiting/retaining specialized labor capable of handling next-generation defense technologies.

This report has been rigorously structured to provide comprehensive market intelligence, utilizing detailed segmentation analysis, strategic positioning of key players, and AEO/GEO optimized content, ensuring high relevance for stakeholders seeking insights into the strategic Naval Shipbuilding Market landscape.

The extensive analysis covers the shift towards modular designs, the necessity of specialized material procurement, and the pervasive influence of governmental long-term acquisition strategies. The focus remains on strategic capabilities such as deep-sea operations, advanced electronic warfare integration, and global logistics support provided by auxiliary vessels. The market’s sensitivity to shifts in international relations, defense treaties, and specific naval procurement criteria (e.g., endurance, signature management, interoperability) mandates continuous tracking of governmental policy declarations and defense spending appropriations globally. Further segmentation details involve the breakdown of weapon systems integration, encompassing missile defense shields, torpedo tubes, and specialized electronic countermeasure suites, all of which require tailored shipbuilding expertise and highly secure supply chains. The ongoing arms race, particularly among large naval powers, fuels the development and integration of these high-cost, high-capability systems into modern frigates and destroyers, ensuring sustained, albeit cyclical, demand for the most technologically advanced shipbuilding services.

The influence of technology is further evident in the push towards reduced crew complements through increased automation, necessitating ship designs that optimize internal layouts for fewer personnel while maximizing combat efficiency. This trend, coupled with the rising prominence of unmanned maritime vehicles (UMVs), suggests future naval fleets will feature a complex mix of manned capital ships and unmanned force multipliers. Shipyards are investing heavily in infrastructure upgrades—specifically larger dry docks and advanced robotic welding systems—to handle the increasing size and complexity of next-generation naval vessels. The financial stability of the market is heavily tied to multi-year governmental contracts, offering a degree of insulation from short-term economic fluctuations compared to commercial shipbuilding, though the political risks remain significant, often influencing stock market valuations of major defense contractors heavily reliant on naval programs. Strategic partnerships, often mandated by procurement agencies, involving system integrators, weapon manufacturers, and hull fabricators, are critical to managing the immense technical risk and achieving the stringent performance requirements typical of naval platforms.

Regional variations in naval doctrine significantly shape localized market demand. For instance, European navies prioritize smaller, highly capable multi-role frigates optimized for expeditionary operations and NATO interoperability. In contrast, Asian powers often emphasize larger, longer-range platforms suited for sustained blue-water operations across vast ocean expanses. The Middle East focuses heavily on fast patrol craft and corvettes crucial for securing narrow waterways and protecting offshore oil and gas assets. These doctrinal differences translate directly into specific design requirements, material choices, and system installation procedures, highlighting the customization and complexity inherent in global naval shipbuilding. Sustainability and environmental compliance are also emerging factors, particularly in Europe, driving demand for innovative propulsion solutions that minimize emissions and acoustic signatures, balancing military effectiveness with increasing regulatory scrutiny.

The segmentation by End-Use Service warrants deeper exploration due to its strategic financial implications. While New Construction commands massive initial investment, the MRO and Modernization segment offers higher margins and greater stability over the long 30-50 year lifecycle of a vessel. Modernization projects involve critical upgrades—replacing obsolete sensors, integrating new missile launchers, or converting propulsion systems—and often account for 30-40% of the vessel’s total cost of ownership. Shipyards strategically position themselves to secure these lifecycle support contracts, which guarantee revenue decades after the initial delivery. This dual market focus—new build for strategic growth and MRO for revenue stability—is a characteristic feature of the competitive naval shipbuilding landscape. The technical demands of modernization often exceed those of new builds, as engineers must seamlessly integrate cutting-edge technology into existing, often decades-old, hull and power architectures.

Moreover, the cybersecurity landscape poses a growing concern across the value chain, impacting everything from design software security (protecting proprietary blueprints and combat management source code) to the operational hardening of the ship's integrated networks. Naval platforms are increasingly viewed as floating networks, and their vulnerability to cyberattacks demands stringent security protocols during construction and throughout their service life. Shipyards must now meet defense department mandates for cyber resilience, influencing component selection and the entire system integration process. This regulatory pressure adds complexity and cost but generates a specialized sub-market for naval cybersecurity solutions and testing services, further diversifying the market ecosystem. The sheer technical debt associated with maintaining legacy platforms adds another layer of market complexity, particularly as older systems lack the inherent architecture to support modern digital defenses, necessitating extensive, costly overhauls focused purely on security infrastructure.

Finally, governmental procurement models often dictate market structure. The US model relies heavily on large, established prime contractors (like HII and GD) with significant government infrastructure support. Conversely, many European countries utilize specialized state-owned or partially privatized national champions (like Naval Group or TKMS), often working closely with domestic component suppliers in tightly controlled national ecosystems. Asia Pacific exhibits a mix, with China relying on vast state-owned enterprises (CSIC, CSSC) and allies like Japan and South Korea leveraging powerful industrial conglomerates (MHI, HHI). Understanding these differing procurement philosophies is critical for foreign shipbuilders attempting to penetrate regional markets or secure technology transfer partnerships, highlighting that market success in naval shipbuilding is as much about political acumen and industrial policy compliance as it is about technical capability and pricing strategy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager