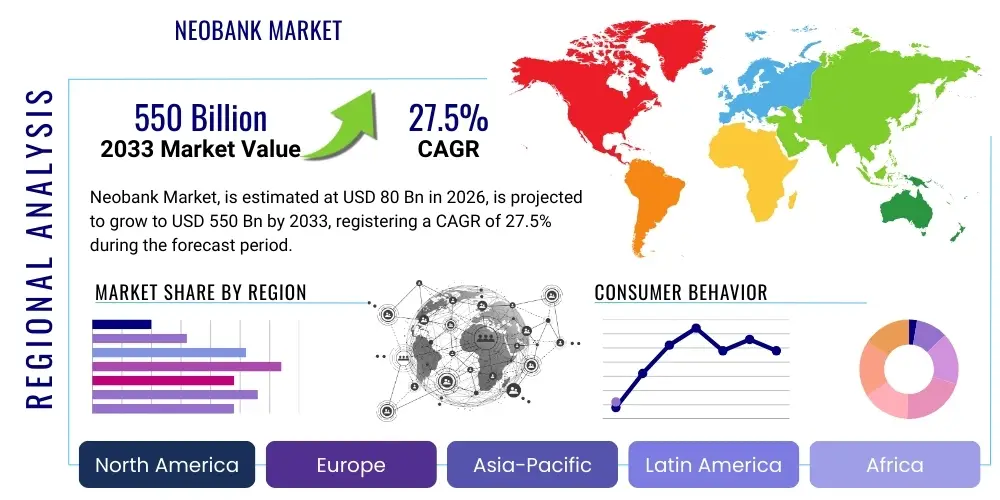

Neobank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437660 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Neobank Market Size

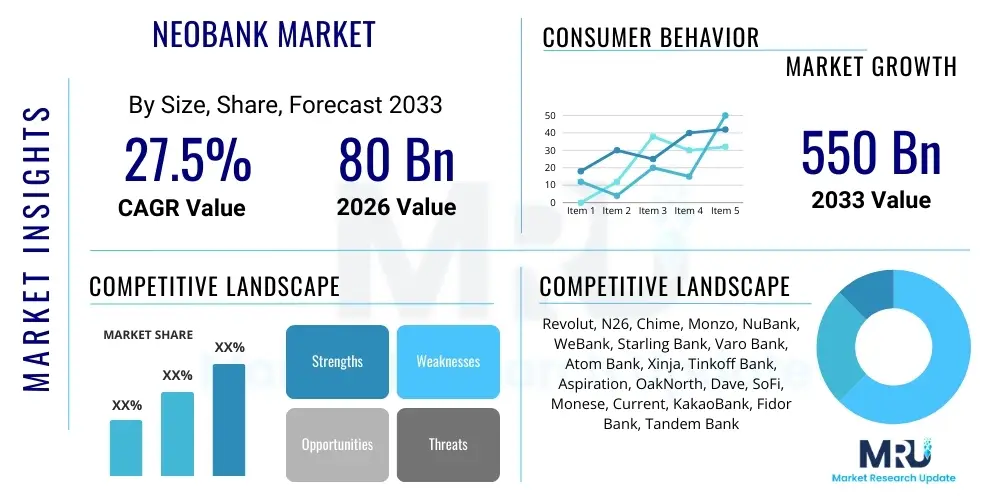

The Neobank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 27.5% between 2026 and 2033. The market is estimated at USD 80 Billion in 2026 and is projected to reach USD 550 Billion by the end of the forecast period in 2033.

Neobank Market introduction

The Neobank Market encompasses fully digital financial institutions that operate exclusively online, often without physical branch networks. These entities leverage sophisticated technology, including cloud computing, advanced data analytics, and Artificial Intelligence (AI), to deliver seamless, cost-effective, and highly personalized banking services. Unlike traditional banks, neobanks typically offer streamlined processes for account opening, instant payment processing, and comprehensive financial management tools directly accessible via mobile applications, catering predominantly to digitally native customer segments seeking efficiency and transparency in their financial lives. The core product offerings often revolve around transactional accounts, savings pots, cross-border payment services, and targeted lending solutions.

Major applications of neobanks span across retail banking, SME lending, and wealth management, providing customers with essential services such as debit cards, direct deposits, bill payments, and robust expense tracking. The inherent benefits derived from utilizing neobanks include significantly lower operational costs, translating into lower fees for consumers, and superior user experience (UX) driven by rapid innovation cycles and mobile-first strategies. Furthermore, neobanks excel in providing detailed, real-time insights into spending habits, enabling better financial planning for their users. The flexibility and scalability offered by their digital infrastructure allow them to adapt quickly to changing market demands and regulatory environments, offering a competitive edge over legacy institutions.

The principal driving factors accelerating the Neobank market expansion include the rapid global proliferation of smartphones and high-speed internet connectivity, increased consumer trust in digital financial services, and favorable regulatory frameworks in several key geographies (like the EU and parts of Asia) encouraging financial innovation through open banking initiatives. Additionally, the growing dissatisfaction among younger demographics with the cumbersome processes and outdated technology employed by traditional banks is pushing significant consumer migration towards digital alternatives. The global shift toward cashless economies, particularly amplified by recent global health crises, has cemented digital banking as the preferred mode of financial interaction for billions worldwide, fueling substantial investment and competition within the neobanking ecosystem.

Neobank Market Executive Summary

The Neobank Market is characterized by intense competition and dynamic technological adoption, driving significant business trends focused on diversification beyond basic payment accounts into high-yield savings products, investment platforms, and embedded finance solutions. Key business strategies currently revolve around expanding licensing capabilities to become full-service banks, rather than relying solely on partnerships with established chartered banks. Furthermore, strategic mergers and acquisitions are increasing as established players seek to acquire niche technologies or expand their geographical footprints rapidly, consolidating market share among top-tier digital disruptors. Operational efficiency remains a central metric, heavily influenced by leveraging cloud architecture to maintain lower Customer Acquisition Costs (CAC) compared to traditional banking models, thereby sustaining the aggressive pricing models neobanks typically employ.

Regionally, the market exhibits highly varied maturity levels; North America and Europe currently dominate the market in terms of valuation and adoption, largely due to high levels of digital literacy, established regulatory sandbox environments, and substantial venture capital funding directed toward FinTech enterprises. Conversely, the Asia Pacific region, particularly countries like India and Southeast Asian nations, represents the highest growth potential, driven by vast underserved populations and rapid mobile penetration, positioning neobanks as critical agents of financial inclusion. Latin America is also experiencing explosive growth, benefiting from high inflation rates which make real-time, low-fee international transactions offered by neobanks particularly attractive. The Middle East and Africa (MEA) are witnessing nascent growth, spurred by government initiatives promoting digital economies, though regulatory hurdles and infrastructure limitations remain pertinent challenges.

Segmentation analysis reveals that the Retail segment continues to hold the largest market share, catering to the vast individual consumer base seeking daily banking convenience, though the Business segment, targeting Small and Medium-sized Enterprises (SMEs), is demonstrating the fastest Compound Annual Growth Rate (CAGR). SMEs benefit significantly from digital-first treasury management, simplified invoicing, and rapid access to working capital loans that traditional banks often fail to provide efficiently. Within technology, AI-driven automation and robust cybersecurity solutions are becoming indispensable features, shifting customer loyalty towards platforms that guarantee enhanced security and hyper-personalized financial advice, ensuring sustainable competitive differentiation in a crowded digital landscape.

AI Impact Analysis on Neobank Market

Common user questions regarding AI's impact on the Neobank market frequently center on how these technologies enhance security, personalize financial offerings, and automate traditionally manual banking processes. Users are keenly interested in the efficacy of AI in detecting sophisticated fraud patterns in real-time and the reliability of AI-powered chatbots and virtual assistants for instant customer support. Concerns often revolve around data privacy when algorithmic decision-making is involved in credit scoring, and whether AI can truly deliver unbiased, equitable financial advice. The consensus expectation is that AI will further reduce human intervention, leading to ultra-low operating costs and enabling neobanks to offer near-instantaneous financial services, fundamentally redefining the customer relationship from transactional to advisory.

- AI enhances personalized product offerings by analyzing spending habits, risk profiles, and saving goals to suggest optimized financial products, increasing customer engagement and lifetime value.

- Machine Learning (ML) algorithms drive superior fraud detection capabilities, identifying anomalous transactions and patterns far faster and more accurately than traditional rule-based systems, significantly minimizing financial losses.

- AI powers conversational interfaces (chatbots and voice assistants) that provide 24/7 automated customer service, resolving routine queries instantly and efficiently, thereby reducing call center operational expenditure.

- Advanced AI models are utilized for real-time credit scoring and underwriting, enabling neobanks to approve loans and credit lines rapidly and precisely, serving credit-thin files that are often overlooked by conventional banks.

- Regulatory Technology (RegTech) solutions leveraging AI automate compliance checks, Know Your Customer (KYC) processes, and Anti-Money Laundering (AML) monitoring, ensuring adherence to complex global financial regulations.

- Predictive analytics driven by AI allows neobanks to forecast market shifts, manage liquidity risk more effectively, and optimize their balance sheets in dynamic economic environments.

- AI facilitates robust cybersecurity measures, continuously monitoring network traffic and identifying potential vulnerabilities and threats before they can be exploited.

DRO & Impact Forces Of Neobank Market

The Neobank Market is powerfully shaped by several interconnected Drivers, Restraints, Opportunities, and broader Impact Forces. Primary drivers include the massive shift toward digital financial transactions globally, facilitated by ubiquitous mobile technology and increasing consumer appetite for frictionless banking experiences. The low overhead costs inherent to the digital model allow neobanks to offer better interest rates and minimal transaction fees, directly challenging the profitability structure of incumbent banks. Furthermore, global regulatory shifts promoting open banking and API standardization are significantly lowering the barriers to entry for new FinTech players, fostering a highly competitive and innovative ecosystem.

Conversely, significant restraints hinder growth, predominantly the complex and fragmented global regulatory environment, which necessitates considerable investment in compliance infrastructure, particularly concerning cross-border operations and data localization mandates. Consumer trust remains a critical factor; while growing, some users still harbor reservations about depositing large sums in institutions without physical presences, leading to persistent challenges in acquiring primary banking relationships. Furthermore, intense competition among hundreds of global neobanks, coupled with aggressive digital offerings launched by traditional banks (often called 'flanker brands'), exerts continuous pressure on profit margins and forces high marketing expenditure for customer acquisition.

The primary opportunities lie in leveraging financial inclusion initiatives in emerging markets, expanding into specialized niche segments such as Gen Z banking or fractional stock trading, and penetrating the lucrative Business-to-Business (B2B) FinTech space by offering specialized SME solutions. Furthermore, the development of integrated ecosystems, combining banking with insurance, wealth management, and loyalty programs, presents a massive opportunity for increasing customer stickiness and total revenue per user. The key impact forces dictating the market's trajectory include the accelerating pace of technological obsolescence, the constant threat of sophisticated cyberattacks requiring state-of-the-art security investments, and macroeconomic factors such as rising interest rates, which affect lending profitability and customer deposit behaviors, compelling neobanks to rapidly evolve their product portfolios to maintain relevance and sustainable growth.

Segmentation Analysis

The Neobank Market segmentation provides a detailed structural breakdown based on key differentiating factors such as the type of service provided, the nature of the end-user, and the technological deployment model. This analysis is crucial for understanding specific market dynamics, identifying high-growth segments, and tailoring competitive strategies to distinct customer needs across the global financial landscape. The market is fundamentally segmented to address diverse customer requirements, ranging from individual consumer needs for simplified payment solutions to complex business requirements for integrated treasury management and cross-border invoicing, defining the targeted strategies of market players.

- By Account Type:

- Retail Banking Accounts (Individual Consumers)

- Business Banking Accounts (SMEs and Corporations)

- By Service Type:

- Payments and Money Transfers

- Savings and Investments

- Lending and Credit Services

- Other Value-Added Services (e.g., Insurance, Budgeting Tools)

- By Deployment Model:

- Cloud-Based

- On-Premise (Less Common, primarily in hybrid models or highly regulated environments)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Neobank Market

The Neobank market value chain is structurally lean and relies heavily on digital integration and strategic partnerships, fundamentally differing from the complex, asset-heavy structure of traditional banking. The upstream activities primarily involve technology procurement and development, focusing on securing highly scalable and reliable cloud infrastructure (e.g., AWS, Azure, Google Cloud) and developing proprietary core banking platforms built on microservices architecture. Crucial upstream partners also include core banking software providers and advanced data analytics firms, which supply the foundational tools necessary for rapid product development and regulatory compliance. The focus in this stage is efficiency, scalability, and minimizing time-to-market for new features, ensuring the technology stack can handle exponential user growth without compromising security or speed.

The operational core of the value chain involves platform management, customer relationship management (CRM), and risk management. This stage is dominated by the sophisticated use of APIs (Application Programming Interfaces) which facilitate seamless integration with third-party providers for services such as KYC verification, AML screening, and specialized lending models. Distribution channels for neobanks are predominantly direct, relying heavily on mobile application downloads and direct website sign-ups, thus eliminating the need for expensive physical branches and associated staff. This direct-to-consumer model allows neobanks to gather proprietary user data instantly, feeding back into product improvement cycles, reinforcing their core competency of hyper-personalization.

Downstream activities center on customer retention and monetization, where indirect distribution often occurs through partnerships with employers for salary deposits or through integrated financial marketplaces that cross-sell non-banking services (like insurance or investment brokerage). The key to success downstream is maintaining high service quality and user trust, facilitated by real-time alerts, proactive security monitoring, and efficient, instant resolution of customer issues, often managed through AI-powered channels. The overall value chain emphasizes agility and low cost, allowing neobanks to pass savings onto consumers, which acts as their primary competitive advantage against legacy financial institutions that struggle to dismantle their incumbent cost structures and complex IT systems.

Neobank Market Potential Customers

Potential customers for the Neobank Market are highly diverse but predominantly coalesce around demographics that prioritize speed, digital literacy, and cost-efficiency in their financial dealings. The largest and most immediate segment consists of digitally native individuals, notably Millennials and Gen Z, who have grown up relying on smartphones for all daily tasks and expect their financial institutions to operate with the same level of seamlessness and instantaneity. These individuals often utilize neobanks as their primary or secondary banking service provider, drawn by features such as integrated budgeting tools, low-fee international transfers, and simplified investment options. This segment is characterized by a lower tolerance for bureaucracy and a higher willingness to switch providers based on user experience and perceived value.

A secondary, rapidly growing customer segment comprises Small and Medium-sized Enterprises (SMEs) that require modern, flexible financial tools tailored to their often-complex needs, particularly in cross-border trade and payroll management. Traditional banks often impose high fees, rigid credit approval processes, and cumbersome reporting requirements that impede the agility of SMEs. Neobanks, through specialized business accounts, integrated accounting software functionality, and rapid disbursement of business loans, offer a critical alternative that supports faster operational scaling and streamlined financial administration. These potential customers value efficiency, clear fee structures, and the ability to integrate banking operations directly into their existing enterprise resource planning (ERP) systems via modern APIs.

Furthermore, a crucial segment targeted by neobanks in emerging markets is the underbanked and unbanked population. In regions with low penetration of traditional banking services but high mobile usage, neobanks act as powerful agents of financial inclusion, providing individuals and micro-entrepreneurs with access to basic financial tools, digital payment systems, and secure mechanisms for saving and sending money. These customers might not meet the strict requirements of established banks but possess the necessary digital profile for neobanks. The adoption here is driven by necessity and the critical need for a secure, low-cost alternative to cash, making this segment vital for long-term volume growth and societal impact across emerging economies in APAC, LATAM, and Africa.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 80 Billion |

| Market Forecast in 2033 | USD 550 Billion |

| Growth Rate | 27.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Revolut, N26, Chime, Monzo, NuBank, WeBank, Starling Bank, Varo Bank, Atom Bank, Xinja, Tinkoff Bank, Aspiration, OakNorth, Dave, SoFi, Monese, Current, KakaoBank, Fidor Bank, Tandem Bank |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neobank Market Key Technology Landscape

The technological foundation of the Neobank market is intrinsically linked to scalability, efficiency, and real-time data processing, relying heavily on modern distributed computing architectures. Cloud computing platforms, often provided by hyperscalers, represent the single most important technological enabler, granting neobanks massive computational power and flexible storage solutions without the necessity of large upfront capital investment in proprietary hardware. This cloud-first approach facilitates rapid scaling of operations to meet fluctuating demand, allows for seamless deployment of updates and new features, and ensures high availability and disaster recovery capabilities, distinguishing their operational resilience from the often-brittle legacy systems of traditional banks. Furthermore, the reliance on secure cloud infrastructure underpins the low operational expenditure model that allows neobanks to maintain competitive pricing.

The widespread adoption of Application Programming Interfaces (APIs) is another critical technological pillar, enabling neobanks to integrate quickly and securely with third-party service providers, aligning perfectly with global Open Banking mandates. APIs facilitate the creation of complex financial ecosystems, allowing users to connect their accounts to budgeting tools, investment platforms, and e-commerce checkouts instantly. Microservices architecture, where applications are built as collections of loosely coupled services, allows development teams to innovate independently and deploy updates frequently, ensuring the user interface remains modern and functional. This architectural flexibility is crucial for maintaining the superior user experience (UX) that customers expect from digital-native financial services, allowing rapid iteration based on user feedback and market testing.

Beyond core infrastructure, advanced data technologies, including Artificial Intelligence (AI) and Machine Learning (ML), are paramount for competitive differentiation. These technologies are deeply embedded in operational processes, from automating rigorous compliance checks (RegTech) and enhancing cybersecurity to executing personalized marketing campaigns and optimizing capital allocation. Furthermore, the emerging role of Distributed Ledger Technology (DLT) or blockchain is beginning to impact cross-border payments, promising near-instantaneous and transparent transaction settlements, bypassing costly correspondent banking networks. The seamless integration of these cutting-edge technologies—Cloud, APIs, AI/ML, and DLT—defines the technological moat surrounding successful neobanks, driving enhanced security, efficiency, and a truly global operational capacity.

Regional Highlights

The regional analysis of the Neobank Market reveals significant disparities in market maturity, regulatory support, and consumer adoption rates across the globe. Europe currently stands as a leading region, primarily driven by the progressive implementation of the revised Payment Services Directive (PSD2), which mandated Open Banking and fostered a highly competitive environment. Countries like the UK and Germany host some of the world’s largest and most established neobanks, benefiting from high digital literacy and substantial early-stage venture capital. The European market focuses heavily on cross-border Eurozone services, seamless integrated mobile platforms, and sophisticated consumer budgeting tools, solidifying its position as the largest market by current transaction volume and user base. Regulatory clarity, although still complex regarding pan-European licensing, has largely enabled these players to scale rapidly.

North America, particularly the United States, represents a massive market opportunity, characterized by higher average customer transaction values and significant funding rounds. While regulatory fragmentation between state and federal level posed initial hurdles, dedicated FinTech charters and increasing state-level support for innovative banking models have accelerated growth. The US market emphasizes credit building, consumer lending, and highly integrated investment features, appealing to a consumer base accustomed to high levels of personalization. Conversely, the Asia Pacific (APAC) region is projected to register the fastest growth rate. This acceleration is spearheaded by populous nations such as India, Indonesia, and China, where mobile-first strategies effectively address large unbanked populations. APAC neobanks often integrate seamlessly into existing super-app ecosystems, leveraging high mobile payment adoption and government-backed digitization initiatives to bypass traditional banking infrastructure entirely.

Latin America (LATAM) is experiencing explosive momentum, fueled by high inflation and a strong need for reliable, low-fee alternatives to conventional banking, where large segments of the population are dissatisfied with existing services. Brazil and Mexico are primary hubs for neobanking activity, with local players achieving substantial scale and focusing on inclusive credit access and simplified investment products. Finally, the Middle East and Africa (MEA) present a nascent but high-potential market. Growth here is primarily driven by supportive government visions promoting digital economies (e.g., UAE, Saudi Arabia) and the imperative for financial inclusion across sub-Saharan Africa. Challenges persist regarding fragmented telecommunications infrastructure and varying regulatory maturity, necessitating bespoke solutions focused on basic digital accounts and mobile money integration, defining the long-term strategic focus for regional and international market participants.

- Europe: Leading market adoption, strong regulatory support (PSD2), dominated by players like N26 and Revolut, focused on pan-European services and integrated finance.

- North America (US): High transaction value market, growth accelerated by specific FinTech charters, focus on credit products, consumer lending, and robust investment platforms (e.g., Chime, Varo).

- Asia Pacific (APAC): Fastest growing region, driven by mobile penetration and financial inclusion in India, Indonesia, and Southeast Asia; often integrated into 'super-app' ecosystems (e.g., WeBank, KakaoBank).

- Latin America (LATAM): Explosive growth due to inflation and lack of trust in incumbent banks; strong focus on credit access and basic banking in high-density urban areas (e.g., NuBank).

- Middle East and Africa (MEA): Emerging market characterized by government digitization efforts and significant focus on basic mobile money and cross-border remittances; regulatory landscape is maturing rapidly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neobank Market.- Revolut

- N26

- Chime

- Monzo

- NuBank

- WeBank

- Starling Bank

- Varo Bank

- Atom Bank

- Xinja

- Tinkoff Bank

- Aspiration

- OakNorth

- Dave

- SoFi

- Monese

- Current

- KakaoBank

- Fidor Bank

- Tandem Bank

Frequently Asked Questions

Analyze common user questions about the Neobank market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary security advantages of neobanks compared to traditional banks?

Neobanks typically utilize advanced, cloud-native security protocols, including biometric authentication, real-time transaction monitoring powered by AI for fraud detection, and instant card freezing features within the mobile application. Their reliance on modern, updated technology stacks, rather than legacy core systems, often provides a superior defense against contemporary cyber threats and data breaches, ensuring enhanced fund security.

How do neobanks achieve profitability if they offer services at significantly lower fees?

Neobanks achieve profitability primarily through a significantly lower operational cost structure, avoiding the overheads associated with physical branch networks and large legacy IT systems. Revenue is generated through interchange fees on card transactions, premium subscription models for enhanced features, interest margin on lending (if licensed), and fees derived from high-value cross-selling of related financial products like insurance and investment services.

Are deposits held with neobanks protected by government insurance schemes?

Deposit protection depends heavily on the neobank's licensing model. Neobanks that hold a full banking license (e.g., Varo Bank, Starling Bank) are typically insured by the relevant national deposit guarantee scheme (such as FDIC in the US or FSCS in the UK). Neobanks operating through a partnership model usually pass customer funds through their licensed partner bank, ensuring the funds receive the same level of governmental protection.

What is the main driver behind the rapid expansion of neobanks in emerging markets?

The rapid expansion in emerging markets is fundamentally driven by high mobile penetration coupled with vast underserved populations lacking access to basic financial services from traditional banks. Neobanks provide essential financial inclusion, offering low-cost, easy-to-access digital accounts and payment rails that circumvent geographical and infrastructure barriers, supporting economic activity for the unbanked.

How is Open Banking impacting the competitive positioning of neobanks globally?

Open Banking, facilitated by regulations like PSD2, is highly favorable to neobanks as it mandates that incumbent banks share customer data (with permission) via APIs. This allows neobanks to offer superior aggregation services, integrating data from multiple financial sources to provide comprehensive budgeting tools and personalized advice, strengthening their competitive edge in data utilization and customized customer experience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager