Neodymium Iron Boron Magnet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434685 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Neodymium Iron Boron Magnet Market Size

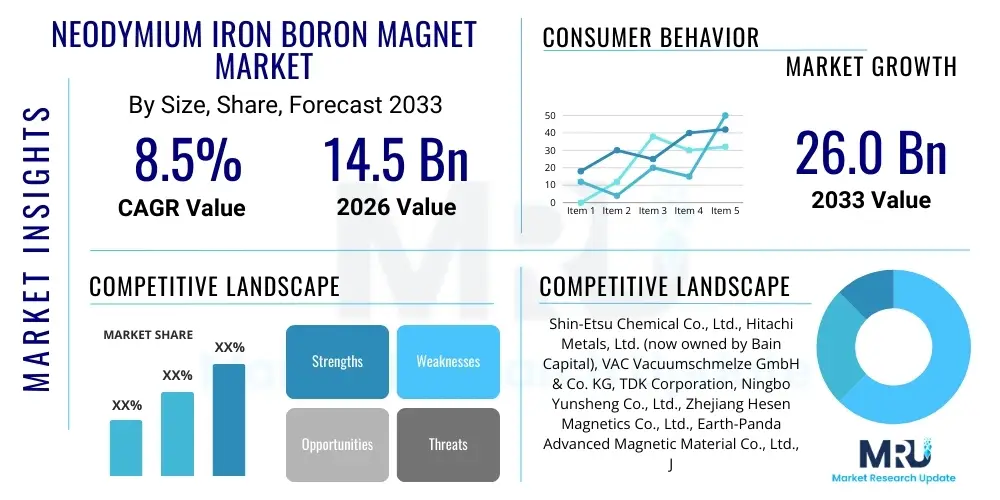

The Neodymium Iron Boron Magnet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 26.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global transition toward electrification, particularly within the automotive and renewable energy sectors, where these magnets are indispensable components for high-efficiency motors and generators. The increasing demand for compact, lightweight, and powerful magnetic materials across industrial and consumer electronics applications further cements this growth trajectory, reflecting the critical role NdFeB magnets play in modern technological infrastructure.

Neodymium Iron Boron Magnet Market introduction

Neodymium Iron Boron (NdFeB) magnets are the strongest type of permanent magnets commercially available, categorized as rare-earth magnets. These materials are characterized by their exceptional magnetic properties, including high remanence (Br), high coercivity (Hc), and high maximum energy product ((BH)max), making them superior to traditional ferrite or aluminum-nickel-cobalt (Alnico) magnets. The composition primarily includes neodymium, iron, and boron, often supplemented by small additions of heavy rare earth elements like dysprosium (Dy) or terbium (Tb) to enhance thermal stability and corrosion resistance, which are crucial for high-temperature and demanding applications like electric vehicle traction motors and wind turbine generators. Their unparalleled strength-to-weight ratio allows for the miniaturization of electronic devices and the construction of highly efficient machinery, directly addressing the modern market requirements for reduced size and improved performance.

The principal applications of NdFeB magnets span several high-growth industries. In the automotive sector, they are vital for electric vehicle (EV) traction motors, power steering systems, anti-lock braking systems (ABS), and various miniature sensors and actuators. Within the energy production landscape, they are essential in Direct Drive (DD) wind turbines, where their high magnetic energy density enables the generation of substantial power output efficiently. Furthermore, these magnets are integral to consumer electronics, forming the core components of hard disk drives (HDDs), headphones, smartphones, and speakers, driving demand based on the rapid advancement and proliferation of these devices globally. The inherent benefits, such as superior magnetic performance, reduced system weight, and increased energy efficiency, make them irreplaceable in numerous high-performance applications, reinforcing their market importance.

Key driving factors propelling the market growth include stringent government regulations mandating energy efficiency and the global commitment to decarbonization, which fuels massive investments in electric mobility and renewable energy infrastructure, particularly offshore wind farms. The continued innovation in magnet manufacturing, such as grain boundary diffusion techniques aimed at reducing the reliance on expensive and supply-constrained heavy rare earth elements, also acts as a significant market driver. Despite supply chain vulnerabilities associated with rare earth element extraction and processing, the continuous push for high-performance applications ensures sustained demand for these critical magnetic materials. The strategic importance of NdFeB magnets for technological superiority has positioned them at the center of geopolitical and industrial competition worldwide.

Neodymium Iron Boron Magnet Market Executive Summary

The Neodymium Iron Boron Magnet Market is experiencing robust expansion, fundamentally underpinned by transformative shifts in global industrial infrastructure, primarily the surging adoption of electric vehicles (EVs) and significant growth in large-scale renewable energy generation, specifically wind power. Geographically, the market dominance remains centralized in the Asia Pacific region, driven by China's comprehensive control over the rare earth supply chain and its massive capacity for magnet production and downstream manufacturing. Key business trends indicate a strong focus among leading manufacturers on securing raw material supply through vertical integration or long-term agreements, while simultaneously investing heavily in R&D to improve intrinsic coercivity without proportional increases in dysprosium usage, thereby mitigating cost and supply risks associated with heavy rare earth elements (HREEs). The transition from conventional internal combustion engines (ICE) to hybrid and battery electric vehicles represents the single most impactful demand driver, ensuring continuous high volume requirements for high-performance, heat-resistant sintered NdFeB magnets.

Segment trends highlight the sintered magnet category as the dominant market segment by value, due to its application in high-power scenarios like wind turbines and EV motors, where exceptional magnetic performance at high temperatures is non-negotiable. Conversely, bonded NdFeB magnets are showing healthy growth in the miniaturization segment, including sensor technology, small motors, and consumer electronics, benefiting from complex shape formation capabilities and lower manufacturing costs, albeit with lower magnetic strength. Regionally, while Asia Pacific leads in supply and demand, North America and Europe are rapidly increasing their domestic manufacturing capabilities and consumption rates, fueled by ambitious regional goals for EV production and establishing localized sustainable supply chains. These Western regions are focusing intensely on magnet recycling technologies (e.g., Hydrogen Decrepitation) and alternative processing methods to reduce reliance on Asian material processing, signifying a crucial strategic shift toward resilience.

Overall, the market is characterized by high technological intensity, cyclical commodity pricing based on rare earth element availability, and a strategic competitive landscape where intellectual property rights related to magnet manufacturing patents play a pivotal role. The primary strategic imperative for market participants is balancing the need for superior magnetic performance against the cost and volatility of raw materials, ensuring that next-generation magnets offer both improved efficiency and enhanced supply chain resilience. Future growth will be significantly shaped by the maturation of recycling technologies, advancements in fully non-dysprosium NdFeB compositions, and the sustained expansion of the global electric fleet and smart infrastructure investments, leading to a consistently upward trajectory for the entire NdFeB magnet value chain.

AI Impact Analysis on Neodymium Iron Boron Magnet Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Neodymium Iron Boron Magnet Market primarily revolve around three strategic areas: enhancing raw material efficiency, optimizing complex manufacturing processes, and accelerating the discovery of novel magnet compositions. Users frequently ask how AI and machine learning (ML) algorithms can predict the stability and performance of low-Dysprosium or Dysprosium-free magnet formulations, thereby reducing reliance on costly and geopolitically sensitive heavy rare earth elements (HREEs). There is also significant interest in leveraging AI for supply chain resilience, specifically using predictive analytics to forecast rare earth pricing volatility and optimize inventory management, mitigating the risk of sudden supply disruptions. Furthermore, manufacturers are keenly exploring AI's potential in optimizing energy consumption during the sintering and heat treatment processes, which are notoriously energy-intensive, seeking to lower production costs and improve yield consistency across complex, high-volume batches of magnets.

The integration of AI and ML is poised to revolutionize the R&D phase of magnet materials. Traditional material science research relies on extensive empirical experimentation, which is time-consuming and expensive. AI models, conversely, can analyze vast datasets of material properties, crystalline structures, and processing parameters to rapidly screen and predict the characteristics of millions of theoretical compositions, drastically shortening the development cycle for next-generation magnets that are more sustainable, heat-resistant, and powerful. This capability is paramount for addressing the ever-increasing performance requirements of advanced applications like aerospace actuators and extreme-temperature EV components. By enabling the rapid validation of high-performing, resource-efficient alternatives, AI acts as a catalyst for innovation, potentially disrupting the current dependence on specific rare earth element ratios and conventional manufacturing optimization techniques.

In the manufacturing environment, AI-driven process control systems are being deployed to manage the intricate sintering process. Sintering involves precise control over temperature, pressure, and time, where small deviations can significantly impact the final magnetic properties. Machine learning algorithms analyze real-time sensor data from the furnace, identifying subtle correlations between input parameters and final quality metrics (such as coercivity and energy product). This allows for dynamic adjustments to the process, ensuring higher uniformity, reducing scrap rates, and maximizing throughput, leading to superior quality control and operational efficiency. The application of AI therefore transitions magnet manufacturing from an art, relying on operator experience, to a science, grounded in data-driven precision, which is essential for meeting the stringent quality demands of critical sectors like automotive safety and wind energy reliability.

- AI-driven material informatics accelerates the discovery of HREE-reduced or HREE-free magnet compositions.

- Predictive maintenance analytics optimize sintering furnaces and grinding equipment, minimizing downtime and energy usage.

- Machine learning algorithms enhance supply chain resilience by accurately forecasting rare earth commodity price fluctuations and supply constraints.

- AI optimizes manufacturing parameters (temperature, pressure, atmosphere) during the complex powder metallurgical process for consistent magnetic quality.

- Computer vision systems are deployed for automated, high-speed inspection and defect detection in finished magnet blocks and components.

- AI models assist in designing optimal magnetic circuits and motor geometries, maximizing efficiency based on specific NdFeB properties.

DRO & Impact Forces Of Neodymium Iron Boron Magnet Market

The dynamics of the Neodymium Iron Boron Magnet market are shaped by a complex interplay of robust demand drivers rooted in global sustainability initiatives, significant structural restraints concerning resource security and material pricing, and substantial technological opportunities focused on circular economy principles and advanced processing. The primary driver is the pervasive requirement for energy efficiency across all industrial and consumer domains, making high-performance NdFeB magnets essential for achieving net-zero emission targets. Restraints predominantly center on the volatile supply and geographically concentrated processing of rare earth elements, particularly the dependence on China for both mining and refining capabilities, which introduces geopolitical risk and price instability. Opportunities lie in innovative solutions such as large-scale magnet recycling (urban mining) and the development of alternative, resource-independent magnetic materials, alongside the technological enhancement of coercivity with reduced heavy rare earth content, directly addressing the core challenges of sustainability and security.

Market Drivers are powerfully aligned with macro-economic and regulatory trends. The exponential growth of the Electric Vehicle industry—including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs)—creates an unprecedented need for NdFeB magnets in traction motors, which offer the highest power density required for vehicle performance and range. Concurrently, the global push for renewable energy, especially large-scale onshore and offshore wind farms, relies heavily on high-torque, permanent magnet synchronous generators (PMSGs) utilizing tonnes of NdFeB magnets per unit, cementing their status as a critical enabling technology for the energy transition. This dual-market demand, supported by favorable subsidies and carbon reduction goals, provides a solid and sustained growth foundation for the magnet sector, insulating it somewhat from typical economic downturns as the transition is viewed as a long-term, strategic global investment.

However, the market faces significant structural Restraints. The most critical constraint is the highly specialized and capital-intensive nature of rare earth processing, which is globally dominated by a few players, creating a tight and non-fungible supply structure. Furthermore, the necessary presence of heavy rare earth elements (like Dy) in high-temperature applications mandates higher material costs and increases exposure to supply disruptions. Environmental concerns associated with rare earth mining and processing, which generate substantial volumes of toxic byproducts, also impose regulatory and social constraints on the establishment of new mining and refining operations outside of current centers. These challenges necessitate high levels of capital investment in robust, environmentally compliant processing facilities and force manufacturers to constantly hedge against volatile commodity pricing, which directly impacts the profitability and final cost of the finished magnets.

Opportunities for market expansion and resilience are primarily centered on technological innovation and supply chain diversification. The advancement of grain boundary diffusion (GBD) technology allows for the targeted application of HREEs only to the surface of the magnetic grains, significantly reducing the overall dysprosium required while maintaining high coercivity. Furthermore, the development of end-of-life recycling infrastructure for magnets, extracting rare earths from discarded electronics (e-waste), presents a viable long-term opportunity to establish a circular economy and lessen dependence on primary mining. The strategic imperative for North American and European governments to localize rare earth processing and magnet manufacturing through joint ventures and policy support also provides substantial investment opportunities aimed at creating resilient, geographically diverse supply networks, thereby mitigating geopolitical risks and ensuring consistent access to critical materials for domestic industries.

Segmentation Analysis

The Neodymium Iron Boron Magnet Market is comprehensively segmented based on product type, manufacturing process, end-use application, and geographical region, offering granular insights into the varied market dynamics and demand profiles. The fundamental segmentation focuses on the distinction between Sintered NdFeB magnets and Bonded NdFeB magnets, representing two vastly different processing methods that determine the final magnetic performance and permissible operating environment. Sintered magnets, produced via powder metallurgy and subsequent high-temperature treatment, dominate the market in terms of magnetic strength and high-temperature capability, commanding premium prices and serving high-power applications like automotive traction and wind turbines. Bonded magnets, conversely, are manufactured by mixing NdFeB powder with a polymer binder, allowing for the creation of intricate shapes with high dimensional accuracy, suitable for smaller, lower-power components.

Further segmentation is critical across the highly diverse application landscape. The end-use sectors are broadly categorized into Automotive, Electronics (including Consumer and Industrial), Medical Devices, and Energy (Wind Turbines, Power Generation). The Automotive segment, particularly driven by the Electric Vehicle revolution, is expected to exhibit the fastest growth, followed closely by the Energy sector, which is scaling up wind power capacity globally. Understanding these segment dynamics is vital for market players, as the technical specifications (e.g., thermal stability, required coercivity, and maximum energy product) vary significantly between a small motor in a hard disk drive (bonded magnet requirement) and a large generator in an offshore wind turbine (high-grade sintered magnet requirement). This variation dictates the necessary capital expenditure in specific manufacturing technologies and the raw material input strategy, particularly concerning heavy rare earth element utilization.

The strategic segmentation also involves analyzing market penetration based on material composition—specifically, high-coercivity magnets (containing HREEs like Dy) versus lower-coercivity, standard magnets (often HREE-free). As manufacturers strive for performance gains and cost reduction, the segment focusing on grain boundary diffused magnets is gaining significant traction, bridging the gap between high performance and resource efficiency. The competitive structure relies heavily on segment specialization; for example, Japanese companies often lead in proprietary high-performance, heat-resistant sintered technology for automotive use, while Chinese manufacturers dominate the volume production across most segments, including standard sintered and bonded varieties. Overall, segmentation analysis provides a roadmap for targeted investment, revealing where the highest value creation and steepest growth curves are anticipated over the forecast period.

- By Product Type:

- Sintered NdFeB Magnets (Dominant in High-Performance Applications)

- Bonded NdFeB Magnets (Used for Intricate Shapes and Miniaturization)

- By Application:

- Electric Vehicles (Traction Motors, Actuators)

- Wind Power Generation (Direct Drive Turbines)

- Consumer Electronics (HDD, Speakers, Headphones)

- Industrial Motors and Actuators

- Medical Devices (MRI Equipment, Pumps)

- By Grade/Composition:

- High-Grade/High-Coercivity (Containing Dysprosium/Terbium)

- Standard/Low-Coercivity (HREE-reduced or HREE-free)

- By Region:

- Asia Pacific (APAC)

- North America

- Europe

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Neodymium Iron Boron Magnet Market

The Neodymium Iron Boron magnet value chain is highly complex, characterized by critical chokepoints in the upstream segment and intense integration in the downstream assembly and distribution processes. Upstream analysis begins with the mining and extraction of rare earth ores (Bastnäsite and Monazite), primarily concentrated in China, followed by highly specialized and environmentally challenging separation and refining processes to produce high-purity rare earth oxides, such as Neodymium, Praseodymium, Dysprosium, and Terbium oxides. This refining stage is energy-intensive and critical, as the purity of the oxides directly dictates the final magnetic performance. The intermediate stage involves metallization, converting the oxides into rare earth metals or alloys (NdFeB alloys), which are then used as the primary input for magnet manufacturing. The consolidation of rare earth mining, refining, and alloy production within China provides significant geopolitical leverage and cost advantages to Asian magnet producers.

The core manufacturing stage involves converting the NdFeB alloy into finished magnets, primarily through powder metallurgy for sintered magnets or injection/compression molding for bonded magnets. This stage requires significant intellectual property, specifically related to optimal particle size control, sintering parameters, and surface treatments to enhance corrosion resistance. Distribution channels are varied: direct sales dominate high-value segments where custom specifications are crucial, such as selling specialized magnets directly to major automotive Tier 1 suppliers or wind turbine manufacturers (Original Equipment Manufacturers - OEMs). Indirect distribution involves specialized magnet distributors and trading houses that cater to smaller industrial users and consumer electronics assembly lines. The direct channel ensures better quality control and long-term partnerships, whereas the indirect channel maximizes market reach and facilitates volume sales across fragmented industrial applications.

Downstream activities involve integrating the finished magnets into various end products. Key downstream industries include the assembly of permanent magnet synchronous motors (PMSMs) for electric vehicles, the construction of massive direct drive generators for wind turbines, and the production of small actuators and sensors for consumer electronics. The performance of these high-value end products is intrinsically linked to the quality and consistency of the embedded NdFeB magnets, making stringent quality assurance mandatory throughout the supply chain. Successful downstream integration requires close collaboration between magnet manufacturers and OEMs to optimize magnetic circuit designs, ensuring that the magnet properties are fully leveraged to maximize system efficiency, thereby reinforcing the high strategic value of vertical integration or deep collaborative partnerships between raw material providers, magnet fabricators, and end-product assemblers.

Neodymium Iron Boron Magnet Market Potential Customers

Potential customers for Neodymium Iron Boron magnets span a vast array of high-technology sectors requiring exceptional power density, precision, and efficiency. The primary target customer groups are large-scale Original Equipment Manufacturers (OEMs) and Tier 1 suppliers within the mobility and energy sectors. Automotive manufacturers, focused on developing electric vehicle platforms (including BEVs, PHEVs, and specialized high-performance motors), constitute the fastest-growing and most crucial customer segment. These buyers prioritize magnets with high operating temperature stability and high coercivity, often necessitating the use of heavy rare earth elements, and they demand strict adherence to quality and high-volume consistency, as motor failure can result in costly recalls and safety hazards. Contracts with these automotive clients are typically multi-year, high-volume agreements, making them strategically vital for magnet producers.

The second major customer group is the Wind Energy sector, comprising turbine manufacturers that utilize NdFeB magnets in permanent magnet synchronous generators (PMSGs). Offshore wind turbines, in particular, require extremely large, high-grade sintered magnets to maximize electricity generation efficiency and minimize maintenance requirements in harsh environments. These customers require materials with exceptional corrosion resistance and longevity, making magnet producers specializing in large-scale, customized magnetic assemblies the preferred suppliers. Additionally, the Industrial Automation segment, including manufacturers of robotics, factory automation equipment, and high-precision machinery, represents a stable and diversified customer base, purchasing magnets for servomotors, linear actuators, and specialized magnetic separation equipment that requires precise and powerful magnetic fields.

A third significant customer segment includes manufacturers in the Consumer Electronics and Medical Devices industries. Electronics companies utilize bonded NdFeB magnets for miniaturized applications like smartphone speakers, headphones, vibration motors, and computer peripherals due to the magnets' high strength in small form factors. Medical device manufacturers, particularly those producing MRI machines, advanced surgical robotics, and specialized fluid pumps, require magnets that meet stringent biocompatibility and quality standards. These customers value dimensional accuracy, reliability, and custom magnetic characteristics, often relying on global distributors to source their specialized magnet requirements, making these segments important for bonded magnet manufacturers and general-purpose magnet suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 26.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co., Ltd., Hitachi Metals, Ltd. (now owned by Bain Capital), VAC Vacuumschmelze GmbH & Co. KG, TDK Corporation, Ningbo Yunsheng Co., Ltd., Zhejiang Hesen Magnetics Co., Ltd., Earth-Panda Advanced Magnetic Material Co., Ltd., Jingcheng New Energy Technology Co., Ltd., China Rare Earth Holdings Limited, Arnold Magnetic Technologies, Daido Steel Co., Ltd., Niron Magnetics, Bunting Magnetics Co., Electron Energy Corporation, Neo Performance Materials Inc., Lynas Rare Earths Ltd., Adams Magnetic Products Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neodymium Iron Boron Magnet Market Key Technology Landscape

The technological landscape of the Neodymium Iron Boron magnet market is characterized by intense efforts to enhance performance while simultaneously addressing the scarcity and cost volatility of critical raw materials, primarily Dysprosium (Dy). The core technological innovation lies in optimizing the microstructural engineering of the magnetic material. A crucial technology is Grain Boundary Diffusion (GBD), often referred to as Hot Pressing or Die Upsetting. GBD involves diffusing heavy rare earth elements (HREEs) like Dy or Tb only into the surface layers of the sintered NdFeB grains, forming a highly coercive shell. This process significantly improves the intrinsic coercivity (resistance to demagnetization) at high operating temperatures, which is critical for EV motors, while dramatically reducing the overall amount of HREEs required compared to conventional methods where Dy is uniformly mixed throughout the alloy. This optimization delivers high-performance magnets that are more cost-effective and resource-efficient.

Another major technological advancement focuses on the development of next-generation manufacturing processes and entirely new compositions. Additive Manufacturing (3D Printing) of bonded magnets is emerging, allowing for the rapid prototyping and production of complex geometric shapes with minimal material waste, opening new design possibilities for miniaturized components and specialized sensor applications. Furthermore, extensive research is dedicated to creating high-performance, Dysprosium-free NdFeB magnets. This involves using alternative elements such as Cerium or Lanthanum, coupled with advanced processing techniques, although achieving the same thermal stability as Dy-containing magnets remains a significant technical challenge for extreme-temperature applications. Companies are leveraging computational material science and AI to rapidly screen and validate these novel, resource-independent compositions.

Recycling technology, specifically Hydrogen Decrepitation (HD) and subsequent processing, constitutes a pivotal technology for future market stability and sustainability. HD allows for the efficient and selective extraction of rare earth metals from scrap magnets (both manufacturing waste and end-of-life products) without the need for traditional, complex chemical separation. This urban mining approach promises to create a localized, circular supply chain, reducing global dependency on primary rare earth mining and lowering the overall environmental footprint of magnet production. The successful scale-up and commercial viability of these recycling technologies are viewed as fundamental to the long-term strategic resilience of the magnet supply chain in North America and Europe, representing a significant area of technological investment and governmental support.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region in the global NdFeB magnet market, primarily due to China's comprehensive control over the entire rare earth supply chain, from mining and refining to alloy production and magnet fabrication. China not only serves as the largest supplier but also as the largest consumer, driven by its massive domestic electric vehicle industry, extensive consumer electronics manufacturing base, and enormous wind power capacity expansion plans, making it the epicenter of global magnetic material trade and technology.

- North America: The North American market is characterized by robust demand fueled by domestic electric vehicle production targets and significant governmental initiatives aimed at securing a localized, resilient supply chain for critical minerals. While raw material processing is currently limited, substantial investments are being directed towards establishing rare earth separation facilities and developing advanced magnet manufacturing capabilities, focusing heavily on technology innovation, recycling, and high-performance military applications.

- Europe: Europe represents a high-value consumption hub, driven by stringent decarbonization policies and ambitious goals for renewable energy deployment, particularly offshore wind and the rapidly expanding European EV battery and vehicle manufacturing ecosystem. The focus is on specialized, high-coercivity magnets essential for premium automotive brands and large-scale generators, coupled with strategic public-private partnerships aiming to reduce reliance on non-European supply sources through advanced recycling and innovative magnet processing.

- Latin America, Middle East, and Africa (LAMEA): These regions currently represent nascent but rapidly growing markets, primarily driven by industrial motor needs, localized consumer electronics assembly, and increasing infrastructure development projects. Growth in the Middle East is also linked to diversification away from fossil fuels, spurring early investments in solar and wind projects, which are expected to drive localized demand for NdFeB magnets in the latter half of the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neodymium Iron Boron Magnet Market.- Shin-Etsu Chemical Co., Ltd.

- Hitachi Metals, Ltd. (now owned by Bain Capital)

- VAC Vacuumschmelze GmbH & Co. KG

- TDK Corporation

- Ningbo Yunsheng Co., Ltd.

- Zhejiang Hesen Magnetics Co., Ltd.

- Earth-Panda Advanced Magnetic Material Co., Ltd.

- Jingcheng New Energy Technology Co., Ltd.

- China Rare Earth Holdings Limited

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Niron Magnetics

- Bunting Magnetics Co.

- Electron Energy Corporation

- Neo Performance Materials Inc.

- Lynas Rare Earths Ltd.

- Adams Magnetic Products Co.

- Sichuan Galaxy Magnets Co., Ltd.

- Jiangxi Golden Century Rare Earth Co., Ltd.

- Beijing Zhong Ke San Huan Hi-Tech Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Neodymium Iron Boron Magnet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the Neodymium Iron Boron Magnet Market growth?

The primary driving factor is the global transition to electrification, specifically the rapid expansion of the Electric Vehicle (EV) industry and the increasing deployment of high-efficiency Permanent Magnet Synchronous Generators (PMSGs) in wind turbines, both requiring superior magnetic performance.

How does the volatile supply of rare earth elements impact magnet manufacturers?

The volatile supply, heavily concentrated in specific regions, creates significant price fluctuations and supply chain risks, forcing manufacturers to invest in vertical integration, inventory hedging, and R&D focused on reducing or eliminating dependency on expensive heavy rare earth elements like Dysprosium.

What is the technological significance of Grain Boundary Diffusion (GBD) in magnet production?

GBD is a crucial technological process that allows magnet manufacturers to apply heavy rare earth elements (HREEs) only to the grain boundaries, enhancing the magnet's thermal stability and coercivity at high temperatures while significantly minimizing the overall HREE content required, improving cost efficiency.

Which magnet type, Sintered or Bonded, holds the largest market share by value?

Sintered NdFeB magnets hold the largest market share by value due to their superior magnetic strength and thermal resistance, making them indispensable for high-power, high-stakes applications such as EV motors and large-scale wind turbine generators.

How is AI expected to influence the future development of NdFeB magnets?

AI is expected to accelerate materials discovery by analyzing composition data to design novel, resource-efficient magnet formulations (e.g., Dysprosium-free) and optimize the complex sintering and manufacturing parameters for improved yield and quality consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager