Neon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436126 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Neon Market Size

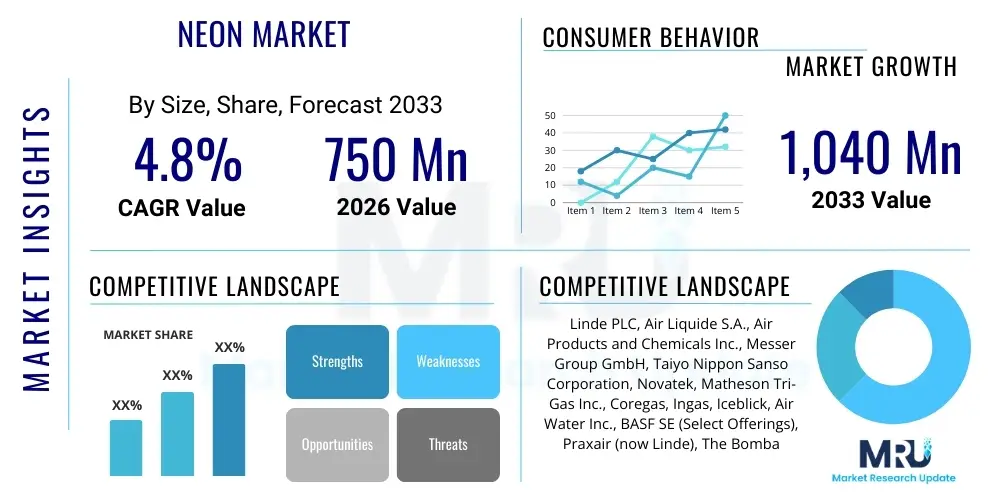

The Neon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. This critical industrial gas market is estimated at $750 Million in 2026 and is strategically projected to reach $1,040 Million by the end of the forecast period in 2033, driven primarily by relentless expansion within the semiconductor manufacturing sector and continuous advancements in specialized laser technology. The valuation reflects the high unit cost and critical nature of high-purity neon required for advanced lithography processes, where purity levels directly impact chip yield and performance. Furthermore, the inherent scarcity and complex production logistics associated with neon, primarily sourced as a byproduct of cryogenic air separation, contribute significantly to its elevated market pricing and specialized market dynamics, cementing its status as a strategic commodity within the global technology supply chain.

The consistent growth trajectory is further supported by the increasing global capacity for display panel manufacturing, particularly advanced Organic Light-Emitting Diode (OLED) and Liquid Crystal Display (LCD) screens, which utilize neon in various production stages. While neon’s traditional use in decorative and specialized lighting persists, the predominant revenue generation now originates from high-tech industrial applications. Market stability is currently influenced by ongoing efforts to diversify supply chains following geopolitical disruptions, which have highlighted the vulnerability of relying on concentrated sources for this vital element. Investment in advanced recycling and purification technologies is becoming paramount for major industrial gas providers to mitigate future supply shocks and ensure stable pricing mechanisms across crucial end-user industries.

Neon Market introduction

The Neon Market encompasses the production, purification, distribution, and application of neon, an inert, colorless noble gas (Ne) found in trace amounts in the atmosphere. Neon is not manufactured directly but is obtained as a secondary product during the large-scale cryogenic distillation of air, a process designed primarily for extracting high volumes of nitrogen and oxygen. Its unique properties, including low chemical reactivity and distinct spectroscopic emission characteristics, make it indispensable for highly specific industrial applications. Major applications span sophisticated excimer lasers used in DUV (Deep Ultraviolet) photolithography for semiconductor fabrication, high-voltage indicators, plasma tubes, specialized aerospace illumination systems, and, traditionally, in vibrant neon signage.

The primary benefits driving the demand for high-purity neon stem from its inert nature, which prevents unwanted chemical reactions during sensitive processes like semiconductor etching and deposition. The market is fundamentally segmented by purity grade, with ultra-high purity (UHP) neon demanding the highest premium due to its critical role in advanced manufacturing processes that require absolute process integrity. Driving factors include the global race for smaller, faster electronic chips, requiring continuous innovation in lithography techniques that rely heavily on neon-based excimer lasers. Additionally, the proliferation of digital displays and specialized scientific instrumentation contributes substantially to sustained market expansion, making neon a fundamental enabling material for modern high technology.

Neon Market Executive Summary

The Neon Market Executive Summary underscores a period of strategic realignment, characterized by intensified efforts to secure resilient supply chains and significant investment in gas recovery and purification infrastructure, largely in response to the acute supply disruptions experienced in recent years. Business trends indicate a shift towards long-term supply contracts and regionalized sourcing strategies, particularly among major semiconductor and industrial gas companies seeking to buffer against geopolitical volatility. Furthermore, technological innovation focuses heavily on enhancing the efficiency of neon recycling from spent excimer laser mixtures, thereby reducing reliance on atmospheric extraction. Key companies are also exploring alternative noble gas mixtures and production methods, although neon remains irreplaceable in specific lithography steps, solidifying its market indispensability.

Regionally, the Asia Pacific (APAC) continues to dominate both in terms of consumption and processing capacity, driven overwhelmingly by the sheer scale of semiconductor fabrication (fabs) and display manufacturing facilities located in countries like South Korea, Taiwan, China, and Japan. North America and Europe, while having lower consumption volumes, are pivotal centers for research, technology development, and high-purity gas equipment manufacturing. Segment trends clearly show the Electronics sector maintaining its position as the largest and most value-intensive segment, primarily fueled by capital expenditures in the memory and logic chip fabrication industries. Growth in the general illumination and display segment is steady but significantly outpaced by the high-growth trajectory and stringent purity demands of the photolithography application, which dictates pricing and purity standards across the entire market.

AI Impact Analysis on Neon Market

Common user questions regarding AI's impact on the Neon Market predominantly center on improving operational efficiency in the highly capital-intensive cryogenic separation and gas purification processes, and enhancing supply chain predictability for this scarce resource. Users frequently inquire about how AI models can optimize the energy consumption of large-scale Air Separation Units (ASUs), predict fluctuations in raw atmospheric gas composition, and forecast long-term demand from cyclical semiconductor fabrication cycles. Furthermore, significant concern exists around leveraging machine learning to detect impurities in ultra-high-purity neon streams in real-time, thereby ensuring product quality that meets the rigorous standards of DUV lithography. The consensus among users is that AI will primarily serve as a critical tool for operational excellence, supply resilience, and cost reduction in managing this high-value, high-risk commodity.

The application of Artificial Intelligence within the Neon market value chain is poised to deliver transformative improvements, moving beyond traditional statistical process control to predictive analytics and autonomous optimization. AI algorithms can analyze complex sensor data from ASUs, optimizing flow rates, temperatures, and pressures to maximize the yield of trace noble gases like neon while minimizing the massive energy footprint associated with cryogenic processes. This predictive maintenance capability extends to sophisticated purification equipment, drastically reducing downtime and ensuring the consistent production of required purity grades, which is essential for end-users like TSMC, Samsung, and Intel. The net effect of AI integration is expected to stabilize supply, enhance quality control, and mitigate the steep operational costs inherent in atmospheric gas extraction.

Moreover, AI-driven supply chain platforms are crucial for managing the volatile global distribution of neon. By integrating real-time geopolitical data, manufacturing output forecasts, and inventory levels, AI can simulate various risk scenarios, providing distributors with optimal logistics routes and storage strategies. This enhanced visibility and predictive capacity are vital for mitigating the impact of unexpected regional shutdowns or transportation bottlenecks, as neon often requires specialized, high-pressure handling. The integration of AI tools, therefore, is not merely an optional upgrade but a necessary evolution for maintaining competitive advantage and ensuring operational continuity in this geopolitically sensitive commodity market.

- Enhanced predictive maintenance of cryogenic Air Separation Units (ASUs) to maximize neon yield.

- Real-time optimization of energy consumption in distillation columns, reducing operational expenditure.

- Advanced quality control systems utilizing machine learning for instantaneous impurity detection in UHP neon.

- Improved demand forecasting models integrating semiconductor fab utilization rates and economic indicators.

- AI-driven supply chain risk modeling and logistics optimization to stabilize global distribution.

- Automated process control in gas recycling and purification facilities, boosting recovery efficiency.

DRO & Impact Forces Of Neon Market

The dynamics of the Neon Market are heavily shaped by a confluence of powerful drivers (D), persistent restraints (R), and strategic opportunities (O), collectively acting as critical impact forces (IF). The primary driver is the accelerating global investment in semiconductor technology, particularly the transition to sub-7nm node fabrication, which necessitates advanced DUV photolithography and, consequently, ultra-high-purity neon. This demand is intrinsically linked to the expanding adoption of 5G, AI hardware, high-performance computing, and automotive electronics. The market faces significant restraints, chiefly the high dependency on a limited number of production hubs, which exposes the supply chain to severe geopolitical risk and price volatility, as evidenced by recent market dislocations. Furthermore, the inherently high energy intensity and capital cost of cryogenic air separation present persistent operational barriers for scaling production quickly.

Significant opportunities are emerging through technological advancements aimed at supply resilience. These include pioneering new techniques for neon isotope separation and the development of highly efficient closed-loop recycling systems specifically designed for excimer lasers, which could drastically reduce the reliance on virgin atmospheric extraction. Another key opportunity lies in exploring new high-tech applications, such as specialized research in plasma physics and emerging quantum computing technologies, which often require unique noble gas environments. These forces collectively dictate market expansion, pricing mechanisms, and investment strategies, compelling major industrial gas suppliers to prioritize supply diversification and efficiency enhancement across their global operations.

The impact forces also include regulatory pressures related to industrial safety and environmental sustainability. While neon itself is inert, the cryogenic processes used for its extraction are major energy consumers, placing pressure on manufacturers to adopt greener production methods, potentially leveraging renewable energy sources for their ASUs. The market’s overall resilience depends on the speed at which the industry can implement advanced recovery technologies and establish globally diversified sourcing agreements, moving away from past dependencies that threatened critical manufacturing supply lines worldwide. The balancing act between meeting stringent purity requirements and mitigating operational risks defines the competitive landscape.

- Drivers: Exponential growth in the semiconductor industry and demand for advanced photolithography; increasing sophistication of display panel manufacturing (OLED, microLED); rising global demand for specialized scientific lasers.

- Restraints: Extreme supply chain fragility due to concentrated primary production capacity; high capital expenditure and energy consumption required for cryogenic air separation; price volatility linked to geopolitical instability; inherently low atmospheric concentration and high extraction cost.

- Opportunities: Development and deployment of highly efficient closed-loop neon recycling technology; diversification of sourcing capabilities into new geographic regions; exploration of novel applications in quantum technology and high-energy physics research; strategic partnerships between gas suppliers and chip manufacturers to guarantee long-term supply.

- Impact Forces: Geopolitical tensions influencing noble gas trade; stringent UHP requirements from leading chip foundries; rapid technological obsolescence driving consistent demand for smaller lithography nodes.

Segmentation Analysis

The Neon Market segmentation provides a granular view of demand distribution and value generation across various purity levels, application areas, and end-user verticals, which is critical for strategic resource allocation and pricing strategies. The market is primarily segmented based on Purity Grade, which dictates suitability for high-stakes applications; Application, reflecting how the gas is utilized (e.g., etching, illumination, cooling); and End-Use Industry, specifying the ultimate consuming sector. The delineation of segments underscores the massive value differential between commodity-grade neon used in lighting and ultra-high purity (UHP) neon essential for cutting-edge semiconductor lithography, the latter commanding significantly higher prices due to the intense purification processes involved and the critical nature of its function.

Analysis reveals that the Electronics segment, specifically the photolithography application within semiconductor manufacturing, remains the dominant revenue generator, consistently requiring the highest volumes of the purest neon available globally. This segment's growth trajectory is intrinsically tied to global semiconductor investment cycles. Conversely, the Traditional Lighting and Signage segment, while historically important, exhibits slower growth due to competition from more energy-efficient LED and other solid-state lighting solutions, although specialized uses persist in high-performance indicator lamps and research environments requiring specific spectral emissions.

Understanding these segments allows market participants to tailor their investment in purification technology and distribution logistics. For instance, focusing on UHP neon production necessitates rigorous quality control and specialized, leak-proof containment and transportation systems, vastly different from those required for lower-purity industrial uses. The ongoing shift toward advanced manufacturing processes ensures that segments requiring the highest purity grades will continue to experience above-average growth rates throughout the forecast period, emphasizing the need for robust supply chain management tailored to high-tech end-users.

- By Purity Grade:

- Standard Purity Neon (Industrial/Lighting Grade)

- High Purity Neon (HP, 99.99%)

- Ultra-High Purity Neon (UHP, 99.999% and above, critical for lithography)

- By Application:

- Excimer Lasers (Photolithography, Material Processing)

- Lighting and Signage (Traditional Neon Tubes, Indicator Lamps)

- Display Technologies (Plasma Displays, specialized buffer gases)

- Aerospace and Defense (Specialized Cooling and Environmental Systems)

- Healthcare and Research (Scientific Instrumentation, Cryogenic Applications)

- By End-Use Industry:

- Electronics and Semiconductors (Dominant Segment)

- Industrial and Manufacturing

- Chemical and Petrochemical

- Aerospace and Automotive

Value Chain Analysis For Neon Market

The Value Chain for the Neon Market is characterized by highly complex, energy-intensive upstream processes, meticulous midstream purification, and a highly specialized, concentrated downstream distribution network. Upstream analysis focuses predominantly on the initial extraction phase, which occurs as a minor byproduct of large-scale cryogenic Air Separation Units (ASUs). This step is inherently inefficient for neon specifically, as its atmospheric concentration is only 18 parts per million (ppm), meaning massive volumes of air must be processed. Key upstream providers are large industrial gas conglomerates that own and operate the global network of ASUs. The concentration of these units in certain regions historically created significant supply bottlenecks, emphasizing the critical relationship between base industrial gas production (oxygen, nitrogen) and noble gas sourcing.

The midstream process involves advanced multi-stage purification and separation, transforming the crude neon mixture into the UHP required by semiconductor fabs. This stage is technologically demanding and capital-intensive, involving catalytic conversion, adsorption, and additional cryogenic distillation cycles. Direct and indirect distribution channels then move the purified gas to end-users. Direct channels typically involve long-term, high-volume contracts between major gas suppliers and tier-one semiconductor foundries, often involving dedicated fleets of high-pressure tube trailers or specialized ISO tanks. Indirect distribution involves smaller distributors and regional resellers serving diverse industrial and research needs, requiring extensive logistical support tailored to hazardous, pressurized gas transportation.

Downstream analysis centers on the integration of neon into highly specific end-user equipment, particularly excimer lasers for DUV lithography. This requires close collaboration between the gas supplier, the laser equipment manufacturer (e.g., ASML), and the semiconductor fab to ensure flawless gas quality and delivery integrity. The value chain is heavily weighted toward high-technology applications, where gas quality is paramount, and failure due to impurities can lead to multi-million dollar production losses. Therefore, reliability, purity certification, and just-in-time delivery for high-volume consumers are the principal determinants of value creation and competitive advantage within the downstream segment.

Neon Market Potential Customers

The potential customer base for the Neon Market is concentrated within sectors demanding ultra-high purity inert gases for critical manufacturing processes, reflecting a heavy reliance on technology fabrication and specialized industrial operations. The primary buyers are large-scale global semiconductor manufacturers, or "fabs," who utilize neon almost exclusively in their photolithography operations. These customers operate continuously and require vast, consistent supplies of UHP neon to power the excimer lasers essential for etching minute features onto silicon wafers. Their procurement strategies often involve multi-year contracts and rigorous supplier qualification processes due to the direct impact of gas quality on product yield and overall manufacturing cost.

Beyond semiconductors, significant purchasers include major manufacturers of flat panel displays (LCD and OLED), particularly those specializing in plasma display technology where neon serves as a key component in the gas mixture. Laser system integrators and original equipment manufacturers (OEMs) specializing in DUV and specialized material processing lasers also represent a substantial customer segment, purchasing neon in various purities for system operation and maintenance. Additionally, governmental research laboratories, aerospace contractors, and specialized lighting manufacturers constitute a steady, albeit smaller, segment of the potential customer pool, valuing neon for its unique spectral and inert properties in niche applications like specialized indicator lights and high-performance testing environments.

The demand characteristics of these potential customers are diverse; while semiconductor fabs prioritize absolute purity and volume stability, research institutions often seek smaller volumes but might require specialized isotopic compositions or unique delivery mechanisms. The market is structured to cater to these varying needs, but the sheer financial weight and technical stringency imposed by the top-tier semiconductor customers effectively define the market’s pricing floor and quality ceiling. Therefore, industrial gas suppliers strategically align their capacity and logistics to primarily serve the high-volume, high-value demands emanating from the global microelectronics industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,040 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde PLC, Air Liquide S.A., Air Products and Chemicals Inc., Messer Group GmbH, Taiyo Nippon Sanso Corporation, Novatek, Matheson Tri-Gas Inc., Coregas, Ingas, Iceblick, Air Water Inc., BASF SE (Select Offerings), Praxair (now Linde), The Bombay Oxygen Corporation Ltd., Hangzhou Hangyang Co. Ltd., Yingde Gases Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neon Market Key Technology Landscape

The Neon Market's technology landscape is defined by continuous innovation across three critical areas: high-efficiency cryogenic separation, ultra-high purification, and robust gas recycling systems tailored for excimer laser applications. The fundamental technology, cryogenic air separation, relies on complex distillation columns operating at extremely low temperatures to sequentially separate atmospheric components. Recent advancements focus on optimizing the cold box design and integrating highly efficient heat exchangers and proprietary column packing materials to enhance the recovery yield of trace noble gases like neon and xenon, thereby lowering the substantial energy inputs required for extraction. The competitive edge lies in maximizing recovery rates from the low-concentration crude neon stream generated as a byproduct of oxygen and nitrogen production.

For midstream processing, the technology landscape is centered on achieving the demanding Ultra-High Purity (UHP) levels required by the semiconductor industry (often 99.999% purity). This involves advanced gas scrubbing technologies, sophisticated getters, and specialized catalytic converters to remove trace impurities such as hydrogen, carbon monoxide, and various hydrocarbons that could severely damage sensitive laser optics and semiconductor substrates. Technological progress in this area is characterized by the development of highly selective adsorption materials and continuous, real-time laser-based analytical monitoring systems, ensuring zero contamination throughout the purification and storage phases, a non-negotiable requirement for DUV photolithography.

Perhaps the most strategically vital technological focus is the development and deployment of closed-loop recycling and recovery systems for excimer lasers. Lasers used in semiconductor fabs consume neon rapidly, and the spent gas, while contaminated, still contains valuable neon. Modern recovery technologies employ highly specialized cryogenic condensation and proprietary membrane separation techniques to efficiently recover and re-purify the laser exhaust gas on-site or at centralized facilities. The success of these recycling technologies directly impacts supply chain resilience and reduces the market's dependence on primary atmospheric extraction, offering a long-term solution to scarcity and price volatility. Investment in these advanced recycling units is a defining characteristic of major technology roadmaps for industrial gas providers.

Regional Highlights

The regional analysis of the Neon Market reveals a pronounced imbalance between primary production capacity and consumption demand, heavily favoring the Asia Pacific region in terms of overall market influence and consumption volume. North America and Europe possess significant technological expertise in gas handling and laser manufacturing but rely heavily on global supply chains for the raw material. The market structure mandates focused attention on key regional dynamics to ensure stable global supply and mitigate concentration risks, particularly given the historical supply dependence on Eastern European sources for crude neon concentrates.

Asia Pacific (APAC) stands as the undisputed center of global neon consumption, driven by the massive concentration of semiconductor fabrication facilities (fabs) and leading flat panel display manufacturers. Countries such as Taiwan, South Korea, China, and Japan are the largest end-users, requiring vast, consistent quantities of UHP neon for their continuous manufacturing cycles. China, in particular, is rapidly investing in its own domestic cryogenic separation and purification infrastructure to achieve self-sufficiency in noble gas supply, transforming its role from a primary consumer to an increasingly significant processor. This regional intensity dictates global price stability and strategic investment in regional distribution networks.

North America and Europe represent crucial markets for technology and high-value applications. North America is a hub for excimer laser innovation and key technology development for gas purification and handling. Consumption here is driven by advanced R&D, aerospace, and high-specification manufacturing, often involving specialized high-purity contracts. European consumption is robust, supported by strong industrial gas companies and advanced manufacturing bases, focusing heavily on strategic long-term supply agreements and leveraging their expertise in large-scale ASU operation and logistics to manage the intricate distribution of this volatile commodity across the continent.

- Asia Pacific (APAC): Dominates global demand due to high concentration of semiconductor foundries and display panel manufacturing. Key consumer markets include Taiwan, South Korea, China, and Japan. Experiences rapid expansion in domestic purification capacity to enhance self-reliance.

- North America: Crucial market for technology innovation, laser manufacturing, and specialized R&D. Demand is high for UHP grades used in military, aerospace, and advanced research facilities. Focuses on securing diversified and resilient supply contracts.

- Europe: Strong base for industrial gas production and logistics management. Significant consumer in industrial manufacturing and automotive electronics. High emphasis on sustainable and energy-efficient extraction processes.

- Middle East & Africa (MEA): Emerging market, primarily reliant on imports for specialized industrial applications, with limited indigenous production capacity for noble gases. Growth is linked to infrastructure development and petrochemical expansion requiring specialized gases.

- Latin America: Smallest regional market for high-ppurity neon, with demand concentrated in research and basic industrial sectors. Dependent almost entirely on imports from global suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neon Market. These entities control the majority of the global cryogenic separation capacity, purification technologies, and specialized distribution logistics essential for ultra-high purity gas delivery.- Linde PLC

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Novatek

- Matheson Tri-Gas Inc.

- Coregas

- Ingas

- Iceblick

- Air Water Inc.

- BASF SE (Select Offerings)

- Praxair (now part of Linde)

- The Bombay Oxygen Corporation Ltd.

- Hangzhou Hangyang Co. Ltd.

- Yingde Gases Group

- Nippon Sanso Holdings Corporation

- GTS Global Technical Services

- Suzhou Jinhong Gas Co., Ltd.

- Wujiang Xinglu Air Separation Plant Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Neon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of demand for ultra-high purity (UHP) neon?

The primary driver for UHP neon demand is the global semiconductor industry, specifically the requirement for excimer lasers used in Deep Ultraviolet (DUV) photolithography, which is essential for manufacturing advanced memory and logic chips at critical process nodes (sub-7nm).

Why is neon supply highly vulnerable to geopolitical risk and price volatility?

Neon is a byproduct of cryogenic air separation, and historically, a significant portion of global crude neon purification capacity was concentrated in a limited number of specialized facilities in specific geopolitical regions, making the supply chain sensitive to regional conflicts and logistical disruptions.

How is the industrial gas industry mitigating neon supply risks?

The industry is mitigating risks through rigorous supply chain diversification, increasing investment in decentralized global purification facilities, and rapidly deploying advanced closed-loop recycling and recovery technologies within major semiconductor fabrication plants to reduce reliance on primary extraction.

Which purity grade of neon commands the highest market premium?

Ultra-High Purity (UHP) neon, typically defined as 99.999% purity and above, commands the highest premium due to the rigorous, multi-stage purification processes required and its critical, non-negotiable role in preventing contamination during sensitive semiconductor lithography.

What role does Asia Pacific play in the global Neon Market?

Asia Pacific (APAC) is the dominant consuming region globally, hosting the majority of the world's semiconductor foundries and display panel manufacturers. This region drives the largest volume demand and dictates the highest quality standards for neon supply worldwide.

Is neon still widely used in traditional lighting applications?

While neon retains a niche market in traditional signage and specialized high-voltage indicator lamps due to its unique glow characteristics, the revenue share from industrial lighting has decreased relative to high-tech applications like excimer lasers, which are the main revenue generators.

How does the Neon Market relate to other noble gases?

Neon, like Krypton and Xenon, is extracted from air using similar cryogenic processes. While they are often produced together, neon’s application in lithography is unique, differentiating its demand profile and making its supply constraints often more acute than those affecting other noble gases.

What technological advancements are crucial for future market growth?

The most crucial technological advancements involve breakthroughs in high-efficiency closed-loop neon recycling systems for excimer lasers and AI-driven optimization of the cryogenic air separation process to maximize trace gas yield while minimizing overall energy consumption.

What is the typical shelf life of high-purity neon, and why is container integrity vital?

Neon itself is stable, but its "shelf life" is entirely dependent on the integrity of the containment vessel. Container integrity is vital because even minute leaks or contamination ingress can render UHP neon unusable for sensitive applications like lithography, incurring high material loss.

Who are the primary end-users in the industrial segment outside of electronics?

Outside of the electronics sector, primary end-users include the aerospace industry for specialized environmental controls, high-energy physics laboratories requiring inert environments, and manufacturers of advanced scientific and medical lasers.

How does the high cost of production impact market entry barriers?

The high capital expenditure required to establish and operate large-scale, high-efficiency cryogenic Air Separation Units (ASUs) and subsequent UHP purification facilities creates substantial entry barriers, consolidating the market among a few major industrial gas providers.

Are there substitutes for neon in excimer lasers?

While alternative laser technologies exist for certain material processing applications, for the specific sub-wavelength etching capabilities required by Deep Ultraviolet (DUV) photolithography in advanced node semiconductor manufacturing, ultra-high purity neon remains currently irreplaceable.

What is the projected Compound Annual Growth Rate (CAGR) for the Neon Market?

The Neon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033, reflecting stable, high-value demand driven by persistent expansion in the global semiconductor fabrication capacity.

What is the significance of the crude neon extraction process?

Crude neon extraction is critical because neon is obtained as a minor byproduct of oxygen and nitrogen production in large ASUs. The efficiency of the primary gas production dictates the availability of the crude neon stream, establishing the upper limit for global supply capacity.

How does AI contribute to neon quality control?

AI systems contribute to quality control by analyzing massive streams of spectroscopic data in real-time during the purification process, instantly identifying and reacting to trace impurities to ensure that the UHP neon meets the stringent specifications required by lithography tools.

What are the key differences between HP and UHP neon grades?

High Purity (HP) neon is suitable for general industrial and lighting applications, whereas Ultra-High Purity (UHP) neon undergoes additional, intense purification stages, resulting in significantly lower impurity levels (often parts per billion), making it mandatory for sensitive semiconductor processes.

Which geographical region is investing heavily in domestic neon production capacity?

China is investing heavily in expanding its domestic cryogenic air separation and noble gas purification infrastructure to reduce its reliance on international supply chains and enhance its self-sufficiency in meeting the demands of its rapidly growing domestic electronics manufacturing base.

What are the environmental considerations in neon production?

The primary environmental consideration is the massive energy consumption of the cryogenic air separation process. Manufacturers are increasingly focused on optimizing ASU efficiency and exploring renewable energy sources to power these facilities to lower their operational carbon footprint.

How do long-term supply agreements affect market stability?

Long-term supply agreements, typically established between major gas suppliers and semiconductor foundries, enhance market stability by guaranteeing consistent supply volumes and mitigating acute price fluctuations, which is crucial for customers with high-volume, continuous operational needs.

What defines the downstream segment of the neon value chain?

The downstream segment is defined by the integration of the purified neon gas into specialized end-user applications, primarily high-precision equipment like excimer lasers and scientific instrumentation, requiring rigorous technical support and delivery protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Neon Gas Market Size Report By Type (Low-purity Product, High-purity Product, Ultra-high Purity Product), By Application (Neon Lamp, Medical Field, Refrigerant, Laser, Other Application), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- High-purity Neon Gas Market Statistics 2025 Analysis By Application (Neon Lamp, Laser), By Type (99.5%~99.9%, 99.9%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- High Purity Neon Gas (Ne) Market Statistics 2025 Analysis By Application (Electronics, Semiconductor), By Type ( 99.9%, 99.9%~99.99%, 99.99%~99.999%), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Neon Gas Market Statistics 2025 Analysis By Application (Neon Lamp, Medical Field, Refrigerant, Laser), By Type (Low-purity Product, High-purity Product, Ultra-high Purity Product), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Acupuncture Lasers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Yttrium Aluminum Garnet (Yag) Laser, Semiconductor Source, Helium Neon Light Source, Carbon Source, Others), By Application (Hospital, Beauty Clinic, Clinic, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager