Neonatal and Infantcare Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433298 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Neonatal and Infantcare Products Market Size

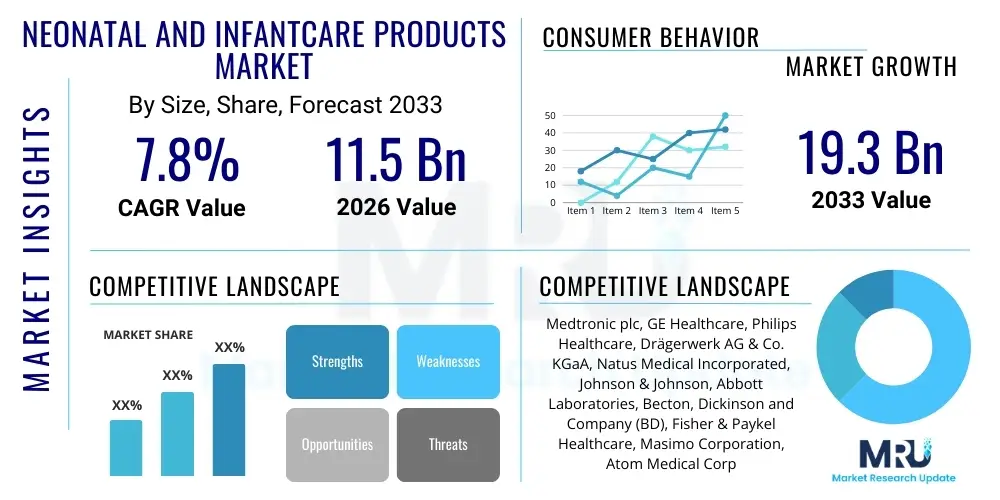

The Neonatal and Infantcare Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 19.3 Billion by the end of the forecast period in 2033.

Neonatal and Infantcare Products Market introduction

The Neonatal and Infantcare Products Market encompasses a vast array of specialized medical devices, consumables, and technological solutions designed for the health, monitoring, and well-being of newborns, particularly those requiring intensive care (NICU patients) and infants up to two years of age. Key product categories range from respiratory support and temperature management systems to advanced monitoring devices, phototherapy equipment, and specialized feeding systems. This market addresses critical needs arising from increasing rates of preterm births globally, complications during delivery, and the growing emphasis on reducing infant mortality rates, making technological innovation a central pillar of growth.

Major applications of these products include life support in Neonatal Intensive Care Units (NICUs), continuous vital sign monitoring, non-invasive diagnostic procedures, and safe infant transport. Benefits derived from advanced neonatal care products include improved survival rates for premature infants, reduced incidence of hospital-acquired infections, enhanced developmental outcomes, and streamlined clinical workflow for healthcare providers. The demand is heavily influenced by infrastructural improvements in developing economies, increasing healthcare expenditure, and governmental policies supporting maternal and child health.

Driving factors sustaining market momentum include the continuous introduction of miniaturized and portable devices that enable seamless monitoring both within the hospital and in home-care settings. Furthermore, rising disposable incomes in emerging economies are shifting consumer preferences toward high-quality, branded infant care products. The market's resilience is also tied to the inherent biological need for specialized care immediately following birth, particularly as medical science allows for the viability of increasingly premature infants, thereby escalating the demand for sophisticated life-support systems.

Neonatal and Infantcare Products Market Executive Summary

The Neonatal and Infantcare Products Market is characterized by robust growth, driven by technological integration and shifting demographic trends. Key business trends include the strong consolidation of product lines by major multinational corporations focusing on integrated care platforms, and a significant venture capital inflow into start-ups developing smart monitoring and wearable technologies for infants. There is an increasing demand for disposable medical consumables to enhance infection control standards, alongside a growing preference for non-invasive monitoring solutions that minimize discomfort for newborns. The convergence of IoT and medical devices is paving the way for advanced predictive diagnostics, making real-time data accessibility a competitive necessity for manufacturers.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by substantial improvements in healthcare infrastructure, increasing birth rates, and government initiatives aimed at improving neonatal health outcomes, particularly in countries like China and India. North America and Europe currently hold the largest market shares due to high healthcare spending, early adoption of advanced medical technologies, and the presence of established regulatory frameworks that promote high-quality device standards. However, cost containment pressures and stringent approval processes in mature markets necessitate continuous innovation to justify premium pricing.

Segmentation trends highlight the dominance of monitoring and screening devices, reflecting the critical importance of continuous vital sign surveillance for at-risk infants. Within consumables, diapers and wipes remain the largest revenue generators, though specialized infant formula for preterm babies is witnessing rapid expansion. The distribution landscape is evolving rapidly, with e-commerce platforms gaining traction for consumer-grade infant care products, while hospital procurement and direct sales remain paramount for specialized medical equipment, necessitating sophisticated logistics and supply chain management tailored to the sensitive nature of these products.

AI Impact Analysis on Neonatal and Infantcare Products Market

Analysis of common user questions reveals significant interest regarding AI's role in improving diagnostic accuracy, personalizing treatment protocols, and enhancing remote monitoring capabilities for newborns. Users frequently inquire about how AI algorithms can predict severe health events, such as sepsis or respiratory distress, earlier than traditional methods, thereby reducing critical intervention times. Concerns often center on the security and privacy of sensitive infant health data, the clinical validation required for AI-driven diagnostic tools, and the training necessary for NICU staff to effectively utilize these sophisticated platforms. Users also express strong expectations regarding the integration of AI into wearable devices for seamless, non-intrusive monitoring both inside the hospital and once the infant is transitioned home.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming neonatal care from reactive treatment to proactive prediction. AI algorithms are being trained on vast datasets of physiological parameters—such as heart rate variability, oxygen saturation, and respiratory patterns—collected from continuous monitoring devices. This enables the identification of subtle, complex patterns indicative of early-stage deterioration that might be missed by human observation or simpler alarms. For instance, AI is proving instrumental in developing predictive models for necrotizing enterocolitis (NEC) and neonatal sepsis, conditions where early detection drastically improves prognosis, representing a major leap forward in critical infant care.

Furthermore, AI is streamlining clinical workflow and personalizing care. In terms of market implications, AI-driven software is becoming a critical value-add for hardware manufacturers, moving the market away from standalone devices toward integrated smart systems. This technological pivot necessitates substantial investments in data infrastructure and cybersecurity to maintain compliance with health regulations like HIPAA and GDPR, given the sensitive nature of infant data. As AI tools become more ubiquitous, they will not only enhance the efficacy of existing products but also drive the development of entirely new classes of diagnostic and therapeutic neonatal solutions.

- AI enhances early detection of critical conditions (sepsis, NEC, respiratory failure) through predictive analytics.

- Machine Learning optimizes ventilator settings and drug dosages based on individual infant response data.

- AI-powered image analysis supports accurate reading of neonatal radiographs and ultrasounds, reducing physician workload.

- Natural Language Processing (NLP) improves clinical documentation and data extraction from Electronic Health Records (EHRs) for research.

- Wearable sensors integrated with AI provide continuous, non-invasive remote monitoring and anomaly detection for home care.

DRO & Impact Forces Of Neonatal and Infantcare Products Market

The market dynamics are shaped by a powerful interplay of clinical needs, technological progress, regulatory requirements, and consumer demand. The primary drivers include the escalating global prevalence of preterm births, which directly increases the requirement for advanced, high-acuity neonatal equipment, and the rapid expansion of NICU facilities globally, especially in emerging economies seeking to adhere to international infant mortality standards. Simultaneously, continuous technological miniaturization and the development of non-invasive monitoring techniques, offering improved comfort and accuracy, fuel product adoption. Governments and NGOs worldwide are increasingly investing in initiatives to reduce infant mortality, further stimulating procurement cycles within healthcare systems.

Restraints, however, pose significant hurdles, most notably the high initial procurement and maintenance costs associated with specialized neonatal equipment, limiting access in low-resource settings. Stringent regulatory approval processes in key markets (FDA, EMA) often delay the launch of innovative products, increasing development expenses and time-to-market. Furthermore, a critical shortage of highly skilled neonatologists and specialized NICU nurses in certain regions challenges the effective deployment and utilization of sophisticated monitoring and life-support systems, restraining market expansion in areas lacking adequate human capital.

Opportunities for growth are abundant, particularly in the development of portable and connected care solutions that facilitate telemedicine consultations for remote or rural populations, expanding the reach of specialized care beyond urban centers. The market can capitalize on the development of affordable, durable alternatives for low- and middle-income countries (LMICs). The growing emphasis on preventative care and developmental tracking post-discharge creates new avenues for consumer-focused, smart infant monitoring products, blending medical-grade technology with ease-of-use for parents. These impact forces—clinical imperative, cost constraints, and technological potential—collectively define the competitive landscape and strategic direction for stakeholders.

Segmentation Analysis

The Neonatal and Infantcare Products Market is meticulously segmented based on product type, end-user, and distribution channel, reflecting the diversity of clinical and consumer requirements. The segmentation ensures that tailored solutions address the varying needs of NICUs (high-acuity devices) versus parental home use (convenience and monitoring). Product categorization highlights the distinction between critical care life support, such as ventilators and incubators, and high-volume consumables like diapers and feeding tubes, which drives different supply chain strategies and competitive environments. End-user classification is crucial for marketing specialized equipment, predominantly targeting hospitals and dedicated pediatric clinics, while consumer products focus on retail and e-commerce channels.

- By Product Type:

- Neonatal Equipment

- Incubators and Warmers

- Neonatal Monitoring Devices (Pulse Oximeters, ECG Monitors)

- Respiratory Assistance and Support Systems (Ventilators, CPAP Devices)

- Phototherapy Equipment

- Neonatal Imaging Systems (Ultrasound, X-ray)

- Infant Consumables and Disposables

- Diapers and Wipes

- Feeding Tubes and Devices

- Incontinence Products

- Specialized Neonatal Catheters

- Neonatal Care Software and IT Systems

- By Application:

- Infant Care and Monitoring

- Infection Control and Hygiene

- Nutritional Support and Feeding

- Surgical and Critical Care

- By End User:

- Hospitals (NICU, Pediatric Wards)

- Maternity Centers

- Specialized Pediatric Clinics

- Home Care Settings

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- E-commerce Platforms

- Direct Sales (for capital equipment)

Value Chain Analysis For Neonatal and Infantcare Products Market

The value chain for neonatal and infantcare products is highly complex, beginning with the meticulous sourcing of medical-grade raw materials, which must meet exceptionally high standards for biocompatibility and safety, especially for products that come into direct contact with fragile skin or internal systems. Upstream analysis involves specialized chemical and plastics manufacturing for devices and disposables, often requiring cleanroom production environments and rigorous quality control protocols. Innovation at this stage, particularly in sensor technology and advanced material science for non-toxic and hypoallergenic components, dictates product differentiation and manufacturing costs.

The core manufacturing stage involves precision engineering for capital equipment (like incubators and ventilators) and high-volume, automated production for consumables (like specialized diapers and feeding sets). The integration of software and hardware, particularly for smart monitoring devices, adds layers of complexity, requiring expertise in embedded systems and data security. Regulatory compliance is paramount throughout the production process; companies must secure approvals from bodies like the FDA or CE Mark before products can enter distribution, representing a significant barrier to entry.

Downstream analysis focuses heavily on efficient distribution. Specialized medical equipment usually employs a direct sales model or relies on certified distributors who can provide technical support, installation, and ongoing maintenance to hospitals and NICUs. Conversely, high-volume consumer products utilize robust indirect channels, leveraging third-party logistics, wholesale distributors, retail chains (pharmacies and supermarkets), and increasingly, global e-commerce platforms. The choice of distribution channel depends on the product's complexity, cost, and end-user, with a continuous trend toward omnichannel strategies to maximize market penetration and ensure timely delivery, which is crucial in critical care settings. Effective supply chain management is vital to mitigate risks associated with stockouts of essential, often single-use, products.

Neonatal and Infantcare Products Market Potential Customers

Potential customers for neonatal and infantcare products span both the institutional healthcare sector and individual consumer markets, each demanding distinct product attributes and distribution methods. The primary institutional buyers are Neonatal Intensive Care Units (NICUs) and specialized pediatric hospitals. These entities require high-capital equipment such as advanced life support systems, precise patient monitoring devices, and sophisticated diagnostic tools. Their purchasing decisions are driven by clinical efficacy, regulatory compliance, durability, integration capabilities with existing hospital IT infrastructure, and total cost of ownership, making procurement cycles lengthy and evidence-based.

Secondary institutional customers include public and private maternity centers, general hospitals with dedicated labor and delivery wards, and government health ministries or procurement agencies focusing on large-scale maternal and child health programs, particularly in developing nations. These customers often prioritize cost-effectiveness and ease of maintenance for reliable, standard-of-care equipment, such as basic infant warmers and phototherapy units. The relationship management with these professional customers relies heavily on clinical data, service contracts, and training provided by the manufacturer.

The consumer segment represents the largest volume market for non-medical consumables and smart home-monitoring devices. This includes parents and guardians of newborns, caregivers, and extended family members who purchase items like diapers, specialized formula, feeding bottles, baby monitors, and hygiene products. Purchases are heavily influenced by brand reputation, safety certifications, price sensitivity, convenience (found predominantly through retail and e-commerce), and recommendations from pediatricians. This segment is characterized by rapid adoption of new, tech-enabled products designed for convenience and peace of mind.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 19.3 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic plc, GE Healthcare, Philips Healthcare, Drägerwerk AG & Co. KGaA, Natus Medical Incorporated, Johnson & Johnson, Abbott Laboratories, Becton, Dickinson and Company (BD), Fisher & Paykel Healthcare, Masimo Corporation, Atom Medical Corporation, F. Hoffmann-La Roche Ltd, Terumo Corporation, Vygon S.A., Getinge AB, Cook Medical, Nonin Medical, Dorel Juvenile, Kimberly-Clark Corporation, Procter & Gamble. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neonatal and Infantcare Products Market Key Technology Landscape

The technological landscape of the Neonatal and Infantcare Products Market is rapidly advancing, moving towards non-invasive, data-intensive, and highly integrated solutions. A significant trend is the proliferation of Internet of Things (IoT) connectivity, where essential monitoring devices—such as pulse oximeters, temperature sensors, and apnea monitors—are networked. This connectivity enables seamless, real-time data transmission to central nursing stations and Electronic Health Records (EHRs), enhancing continuous surveillance and improving response times in critical situations. Furthermore, the focus on miniaturization allows for the development of portable devices that facilitate safe infant transport and enhance the feasibility of high-quality monitoring in home care settings post-discharge.

Non-invasive monitoring technology is crucial, driving innovation in areas like continuous non-invasive blood pressure measurement (CNIBP) and advanced transcutaneous bilirubinometers, reducing the need for painful or stressful blood draws. Materials science plays an equally important role, leading to the development of bio-compatible sensors and flexible, skin-friendly materials for neonatal interfaces that prevent injury or irritation to the fragile skin of premature infants. This technological evolution supports the clinical goal of providing 'minimal handling' care, which is vital for the neurodevelopmental outcomes of vulnerable newborns.

In infant care specifically, advancements are centered around 'smart' products. This includes AI-integrated baby monitors capable of interpreting sound and movement patterns to distinguish between normal sleep and distress signals, and smart feeding systems that track nutritional intake precisely. Biometric clothing and smart mattresses are also emerging, embedding sensors to monitor vital signs without traditional cables and electrodes, positioning the market for a fusion of clinical monitoring accuracy with consumer ease-of-use. These technological shifts necessitate manufacturers to invest heavily in software development, data analytics, and robust cybersecurity protocols to protect sensitive patient data.

Regional Highlights

The global neonatal and infantcare market exhibits distinct regional dynamics driven by healthcare expenditure, birth demographics, and regulatory environments. North America, led by the United States and Canada, remains a dominant force, characterized by high adoption rates of cutting-edge technology, significant R&D investment, and established reimbursement policies that favor advanced, high-cost medical devices. This region frequently serves as the launchpad for AI-integrated monitoring systems and advanced life support platforms.

Europe represents a mature market with high clinical standards and robust demand, particularly in Western countries like Germany, the UK, and France. Growth here is supported by well-structured national health services and a strong emphasis on evidence-based medicine, though market access can be challenging due to rigorous medical device regulations (MDR). There is increasing pressure for manufacturers to demonstrate long-term cost-effectiveness and clinical superiority.

Asia Pacific (APAC) is the engine for future market expansion, projected to show the highest CAGR. This growth is directly linked to massive populations, improving healthcare access, increasing disposable incomes, and governments implementing comprehensive plans to upgrade public health infrastructure, particularly NICU capabilities in high-birth-rate nations like India and China. Latin America and the Middle East & Africa (MEA) are emerging, focusing primarily on affordable, durable, and essential care equipment, driven by rising awareness of infant mortality prevention and expanding medical tourism.

- North America: Market leader in technology adoption; strong presence of key players; high healthcare spending on specialized NICU equipment and premium consumer products.

- Europe: Characterized by strict regulatory adherence (EU MDR); strong focus on non-invasive and reusable devices; high penetration of advanced neonatal ventilators and incubators.

- Asia Pacific (APAC): Fastest growing region due to improving medical infrastructure, large birth cohorts, and increased government investment in maternal and infant health programs.

- Latin America (LATAM): Emerging market driven by privatization of healthcare services and increasing demand for mid-range, essential neonatal equipment.

- Middle East & Africa (MEA): Growth centered in the Gulf Cooperation Council (GCC) countries due to high medical tourism rates and expansion of modern hospitals; reliance on imported, high-quality medical devices.

- Key Countries: US (R&D hub), China (manufacturing and large consumer base), India (infrastructure development), Germany (quality manufacturing), Brazil (largest LATAM market).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neonatal and Infantcare Products Market.- Medtronic plc

- GE Healthcare

- Philips Healthcare

- Drägerwerk AG & Co. KGaA

- Natus Medical Incorporated

- Johnson & Johnson

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- Fisher & Paykel Healthcare

- Masimo Corporation

- Atom Medical Corporation

- F. Hoffmann-La Roche Ltd

- Terumo Corporation

- Vygon S.A.

- Getinge AB

- Cook Medical

- Nonin Medical

- Dorel Juvenile

- Kimberly-Clark Corporation

- Procter & Gamble

Frequently Asked Questions

Analyze common user questions about the Neonatal and Infantcare Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for smart neonatal monitoring devices?

Demand is primarily driven by the need for continuous, non-invasive monitoring of premature infants, reducing clinical burden, and integrating real-time data into predictive AI models. Smart devices enhance early detection of critical events like respiratory distress and sepsis, improving infant outcomes and offering peace of mind to parents in home care settings.

How is the growth of the Neonatal Intensive Care Unit (NICU) infrastructure affecting the market?

The expansion and modernization of NICU infrastructure globally, particularly in developing economies, directly boosts the sales of high-capital neonatal equipment, including incubators, ventilators, and specialized phototherapy units. Increased investment ensures higher standards of care, driving institutional procurement cycles for advanced medical technology.

What are the primary regulatory challenges faced by manufacturers in this market?

Manufacturers face significant hurdles, including stringent safety and efficacy requirements imposed by regulatory bodies (e.g., FDA and EU MDR). Compliance necessitates rigorous clinical trials, extensive documentation, and protracted approval timelines, particularly for high-risk life support and monitoring devices, leading to increased development costs.

Which product segment is expected to show the highest revenue growth during the forecast period?

The monitoring and screening devices segment, especially those incorporating wireless and AI technologies, is projected to exhibit the highest revenue growth. This acceleration is fueled by the transition toward data-driven, continuous surveillance solutions required for effective management of increasingly vulnerable, premature infant populations globally.

What is the competitive landscape regarding infant consumables like diapers and wipes?

The consumables segment is highly competitive and volume-driven, dominated by large consumer goods corporations such as Procter & Gamble and Kimberly-Clark. Competition centers on material innovation (hypoallergenic, sustainable), price points, and aggressive retail distribution strategies, with e-commerce significantly reshaping consumer access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager