Network Cable Tester Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432588 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Network Cable Tester Market Size

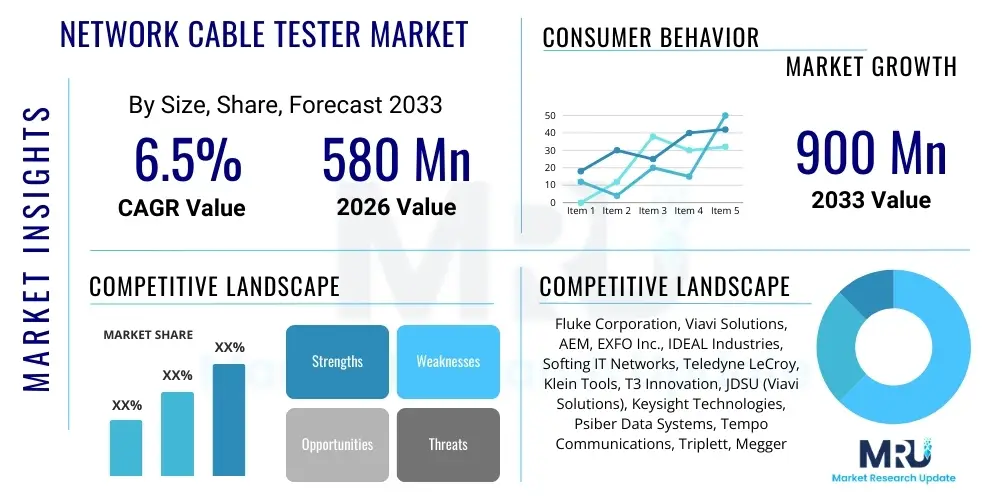

The Network Cable Tester Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $900 Million by the end of the forecast period in 2033.

Network Cable Tester Market introduction

The Network Cable Tester Market encompasses devices crucial for verifying the integrity, performance, and compliance of network cabling infrastructure, spanning copper and fiber optic media. These tools range from basic continuity and wire-map checkers to sophisticated certification testers capable of high-frequency performance measurement, ensuring reliable data transmission rates required by modern standards like 10GBASE-T, 40G Ethernet, and beyond. The rapid global expansion of data centers, the rollout of 5G networks, and the proliferation of Internet of Things (IoT) devices necessitate robust and reliable physical layer infrastructure, directly driving the demand for advanced testing equipment that can diagnose complex faults, including crosstalk, attenuation, and return loss, ensuring stringent operational uptime and performance guarantees.

Major applications of network cable testers include installation verification in commercial buildings, troubleshooting existing enterprise networks, certifying structured cabling systems, and performing routine maintenance checks in industrial settings and telecommunications infrastructure. The key benefits derived from using these specialized instruments include reduced network downtime due to preemptive fault detection, compliance with international industry standards (such as TIA/EIA and ISO/IEC), enhanced efficiency for installation teams, and ultimately, verification of capital investment in high-performance cabling. The driving factors sustaining market growth are intrinsically linked to technological shifts, specifically the transition to higher bandwidth requirements, the increasing adoption of Power over Ethernet (PoE) technologies, and the rising complexity of network architectures requiring multi-functional diagnostic capabilities.

Network Cable Tester Market Executive Summary

The Network Cable Tester Market is currently witnessing a significant business trend characterized by the convergence of testing functionalities into single, portable units, integrating features like network discovery, advanced troubleshooting, and fiber optic inspection alongside traditional copper testing capabilities. This evolution addresses the needs of technicians who manage increasingly heterogeneous networks. Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to massive investments in digital infrastructure, including smart cities projects, new data center construction in emerging economies like India and Southeast Asia, and aggressive 5G deployment schedules. North America and Europe, while mature, maintain strong market shares driven by continuous upgrades of existing enterprise networks and stringent regulatory compliance requirements mandating periodic system certifications.

Segment trends reveal a pronounced shift towards sophisticated certification and qualification testers, displacing the demand for basic continuity models, particularly in professional installation environments where performance guarantees are contractual obligations. Furthermore, the rising integration of Power over Ethernet (PoE) functionality, which simplifies device deployment but complicates electrical load testing, has spurred the rapid development of specialized PoE testers capable of measuring voltage, current, and delivered power up to the latest IEEE 802.3bt standards (PoE++ or 4PPoE). The enterprise and telecommunications segments remain the largest end-users, but the industrial sector, driven by Industrial IoT (IIoT) applications requiring ruggedized and precise field testing instruments, is projected to demonstrate above-average growth throughout the forecast period.

AI Impact Analysis on Network Cable Tester Market

Common user questions regarding AI's impact on the Network Cable Tester Market center around predictive maintenance, automation of complex diagnostic processes, and reducing the reliance on highly skilled human technicians for initial fault localization. Users frequently ask if AI can analyze cable test results in real-time to forecast potential degradation before it causes failure, and how AI might standardize troubleshooting protocols across diverse enterprise environments. Key themes emerging are the expectation that AI integration will shift the testing paradigm from reactive fault finding to proactive network assurance, minimizing operational expenditure and maximizing infrastructure lifespan by identifying subtle performance anomalies that standard tools might miss.

The integration of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize the network testing workflow. AI/ML capabilities are leveraged to process vast datasets generated during certification sweeps, identifying correlations between environmental factors (temperature, humidity), testing parameters, and cable failure rates, thus enabling the creation of highly accurate predictive models for infrastructure health. Furthermore, AI facilitates enhanced Answer Engine Optimization (AEO) by automatically classifying and tagging fault reports, making historical diagnostic data instantly searchable and actionable. This strategic integration enhances the utility of high-end testers, transitioning them into smart diagnostic platforms rather than mere measurement devices, thereby improving overall network reliability and optimizing testing efficiency in large-scale deployments like Hyperscale data centers.

- AI-driven Predictive Failure Analysis: Algorithms analyze historical test data to forecast cable degradation and suggest proactive maintenance schedules, reducing catastrophic failures.

- Automated Fault Classification: AI systems automatically categorize complex wiring and performance errors (e.g., subtle intermittent faults) based on pattern recognition, accelerating diagnostics.

- Optimized Test Protocol Generation: AI determines the minimum required tests for compliance based on network topology, reducing time spent on unnecessary measurements.

- Enhanced Data Aggregation and Reporting: Automated summarization and visualization of complex certification results, tailored for compliance reporting and easy consumption by non-technical stakeholders.

- Remote Diagnostics and Self-Healing Network Integration: AI tools enable high-end testers to interface with Network Management Systems (NMS) for automated initiation of testing or verification procedures post-change management.

DRO & Impact Forces Of Network Cable Tester Market

The dynamics of the Network Cable Tester Market are shaped by a complex interplay of driving forces related to technological advancements and infrastructure development, constraints related to cost and complexity, and substantial opportunities arising from emerging industrial and communication standards. The primary driver is the pervasive need for high-speed, reliable connectivity, particularly the global upgrade cycle mandated by the transition from Gigabit Ethernet to 10 Gigabit and 40 Gigabit Ethernet standards, requiring higher precision certification tools. Conversely, the market faces restraints such as the significant initial capital expenditure required for high-end certification testers and the ongoing complexity of keeping field technicians trained on rapidly evolving testing standards and equipment interfaces. Strategic opportunities are abundant in specialized sectors, particularly the burgeoning Industrial Ethernet market and the increasing demand for specialized testers that can simultaneously verify both data performance and PoE functionality in smart building ecosystems.

The key impact forces influencing vendor strategies include the rapid pace of standardization bodies (e.g., IEEE, TIA) which forces manufacturers to continually update hardware and software to remain compliant, and the competitive pressure to offer integrated, user-friendly solutions that bridge the gap between basic troubleshooting and comprehensive certification. The demand for ruggedized testers optimized for harsh environments (industrial, outdoor telco installations) also acts as a significant market driver. Furthermore, the reliance on distributors and calibration services forms a crucial external impact force, as the accuracy and lifespan of certification equipment depend heavily on consistent, professional maintenance and local accessibility of support infrastructure. Addressing these impact forces requires vendors to focus on modular designs, software upgradability, and expanded service contracts to mitigate the restraint imposed by high replacement costs.

Drivers:

- Accelerated deployment of hyperscale and enterprise data centers globally, mandating certified high-performance cabling (Category 6A, 7, 8).

- The widespread global rollout of 5G infrastructure requiring robust fiber and copper backhaul testing capabilities.

- Increasing adoption of high-power Power over Ethernet (PoE++) solutions, demanding testers capable of verifying DC resistance balance and power delivery integrity.

- Strict regulatory and contractual requirements in enterprise and healthcare sectors mandating proof of installation compliance (Level III/IV certification).

Restraints:

- High initial cost and calibration frequency associated with professional-grade certification testers, limiting adoption by smaller installation firms.

- Complexity in training technicians on sophisticated multi-functional testers and interpreting the vast amounts of generated data.

- Market saturation in the basic continuity and verification tester segment, leading to price erosion in lower-end products.

- Challenges related to achieving global consistency in testing standards and measurement methodologies across different geographical regions.

Opportunities:

- Development of cloud-integrated testing solutions offering real-time data analysis, remote collaboration, and seamless reporting generation.

- Growth in the specialized Industrial Ethernet testing segment (e.g., Profinet, EtherNet/IP) which requires ruggedized and highly deterministic testing tools.

- Expansion into the automotive and aerospace industries requiring precision testing for complex in-vehicle network architectures (e.g., Automotive Ethernet).

- Modular expansion capabilities allowing existing testers to integrate future testing requirements (e.g., new fiber standards or specialized industrial protocols) via software or hardware add-ons.

Segmentation Analysis

The Network Cable Tester Market is predominantly segmented based on the product type, the medium of testing (copper or fiber), the application or end-user industry, and the level of functionality offered (verification, qualification, or certification). Product type segmentation is critical as it defines the capability level and target audience, ranging from basic tools that confirm connectivity and wiring schemes (verification testers) to advanced instruments that measure transmission characteristics against industry standards (certification testers). The market is highly differentiated by the testing media, as the optical fiber segment requires highly specialized Optical Time Domain Reflectometers (OTDRs) and power meters, separate from copper-based solutions that rely on Time Domain Reflectometry (TDR) and frequency-based analysis.

The application segmentation highlights the dominant role of the telecommunications and enterprise network installation sectors, which account for the largest demand volume, driven by large-scale infrastructure projects and corporate network upgrades. However, the market structure is increasingly influenced by end-user complexity; data center operators demand the highest performance and integrated solutions for complex MPO/MTP fiber arrays, while residential installers typically require cost-effective, easy-to-use verification tools. Understanding these layered segmentations is vital for vendors to tailor product portfolios, ensuring that feature sets, pricing, and distribution strategies align with the specific technical requirements and budget constraints of distinct customer cohorts, thus maximizing market penetration and addressing niche high-growth areas.

- By Product Type:

- Verification Testers (Basic continuity, wire map)

- Qualification Testers (Bandwidth capability estimation, troubleshooting)

- Certification Testers (High-end, standards-compliant measurement, guaranteed performance)

- Optical Time Domain Reflectometers (OTDRs) and Fiber Testers

- Coax Cable Testers

- By Cable Type/Media:

- Copper Cable Testers (Twisted Pair: Cat 5e, 6, 6A, 7, 8)

- Fiber Optic Cable Testers (Single-mode, Multi-mode)

- By Application:

- Enterprise Networks (LAN/WAN troubleshooting and installation)

- Telecommunications and Service Providers (OSP and backhaul infrastructure)

- Data Centers (High-density infrastructure testing)

- Industrial Networks (IIoT, Process Automation)

- Residential/Home Network Installation

- By Testing Capability:

- Power over Ethernet (PoE) Testing

- TDR/TCL Measurement

- Frequency-based Performance Measurement

- By End-User:

- Network Installers and Contractors

- IT Departments and Network Administrators

- Field Engineers and Technicians

- Government and Defense Agencies

Value Chain Analysis For Network Cable Tester Market

The value chain for the Network Cable Tester Market starts with upstream activities focused on the procurement of highly specialized electronic components, including sophisticated signal processing chips, high-frequency oscillators, precision calibration modules, and ruggedized casings. Manufacturing involves complex calibration processes and quality assurance protocols, as the core value proposition of these devices is the certified accuracy of their measurements. Key manufacturers often maintain significant R&D investments to keep pace with evolving IEEE and TIA standards, ensuring their products meet the stringent requirements for certifying new cable categories (e.g., Cat 8) or advanced fiber connectivity (e.g., MPO/MTP). The manufacturing stage culminates in final assembly and rigorous, traceable factory calibration, which is essential for maintaining the tool’s accreditation.

Downstream activities are dominated by distribution and after-sales support. Distribution channels are typically hybrid, involving direct sales teams for large enterprise clients and hyperscale data center operators, complemented by a robust network of specialized technical distributors and value-added resellers (VARs) who handle sales to smaller contractors and regional installers. These indirect channels often provide localized technical support and initial training. A critical component of the downstream value chain is the recurrent revenue generated by mandatory calibration, repair, and certification services, ensuring the long-term accuracy and usability of expensive equipment. Effective utilization of digital platforms for software updates, reporting, and knowledge base access enhances customer stickiness and reinforces the overall value proposition, distinguishing leading vendors in a competitive landscape.

Network Cable Tester Market Potential Customers

The primary customers and end-users of network cable testers span diverse industries where reliable data transmission is paramount to operational success. The largest buying segment consists of professional network installation contractors and cabling integrators who utilize certification testers to validate new infrastructure deployments, providing contractual performance guarantees to their clients. Enterprise IT departments, particularly those managing large campus networks, are also crucial customers, relying on qualification and verification testers for ongoing troubleshooting and maintenance activities to minimize internal downtime and manage routine cable adds, moves, and changes.

Beyond traditional corporate environments, significant purchasing power resides in specialized sectors. Telecommunications providers (Telcos) require extensive OTDRs and high-end copper testers for outside plant (OSP) management, backbone installations, and last-mile connectivity verification. Data center operators, managing highly dense and complex fiber arrays, demand the most advanced MPO testing and reporting capabilities. Furthermore, the burgeoning industrial sector, including manufacturing plants and energy utilities, increasingly requires ruggedized testers capable of verifying Industrial Ethernet (such as Profinet) integrity in harsh operating conditions, representing a high-growth segment for specialized product offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $900 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fluke Corporation, Viavi Solutions, AEM, EXFO Inc., IDEAL Industries, Softing IT Networks, Teledyne LeCroy, Klein Tools, T3 Innovation, JDSU (Viavi Solutions), Keysight Technologies, Psiber Data Systems, Tempo Communications, Triplett, Megger |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Network Cable Tester Market Key Technology Landscape

The core technology landscape of the Network Cable Tester Market is defined by the sophisticated methods used to measure physical layer performance and locate faults accurately. Time Domain Reflectometry (TDR) remains fundamental for copper cable fault localization, sending a pulse down the cable and analyzing the reflected signal to identify impedance mismatches caused by opens, shorts, or split pairs. High-end certification testers utilize advanced frequency domain analysis to measure critical parameters such as Near-End Crosstalk (NEXT), Far-End Crosstalk (FEXT), and attenuation across the entire frequency spectrum (up to 2 GHz for Cat 8 certification), ensuring the cable can support the specified data rate without excessive errors. The trend is moving towards faster, more accurate measurements with standardized automated pass/fail reporting.

In the fiber optic segment, Optical Time Domain Reflectometers (OTDRs) are the dominant technology, functioning similarly to TDR but using light pulses to characterize optical links, measure loss, and locate faults like breaks or poor splices. The shift to MPO/MTP multi-fiber connectors in data centers necessitates specialized MPO testing modules and automated reporting tools to manage the complexity of high-fiber-count installations. Furthermore, Power over Ethernet (PoE) testing has become integral, requiring embedded technology to simulate active loads, measure delivered voltage and current under varying conditions, and verify compliance with IEEE 802.3 standards (up to 90W). Connectivity enhancements, such as integrated Wi-Fi and cloud synchronization, facilitate seamless data transfer from the field unit to centralized reporting software, significantly enhancing workflow efficiency and enabling Generative Engine Optimization (GEO) through structured report generation.

Regional Highlights

The global Network Cable Tester Market exhibits significant regional variation driven by infrastructure maturity, regulatory environments, and the pace of digital transformation.

- North America (NA): Characterized by a high density of corporate headquarters and hyperscale data centers, leading to strong demand for top-tier certification testers and fiber optic test equipment. Strict adherence to TIA standards and a rapid adoption rate of advanced technologies like Cat 8 and high-power PoE drive continuous market growth. The region boasts major market players and benefits from extensive research and development activities focused on network security and performance diagnostics.

- Europe: This region is defined by highly specific, often national, regulatory frameworks (e.g., in Germany and the UK) and strong emphasis on the refurbishment and upgrade of existing industrial and enterprise infrastructure. Demand is substantial for qualification testers used in legacy systems and certification tools required for meeting stringent ISO/IEC standards. The growth of Industrial Ethernet in the manufacturing sector (Industry 4.0) makes specialized ruggedized testing solutions a key growth area.

- Asia Pacific (APAC): Represents the fastest-growing region, fueled by massive government investments in digital infrastructure, rapid urbanization, and the aggressive build-out of 5G networks and accompanying data centers, particularly in China, India, and Southeast Asia. The market here is characterized by high volume demand for both basic verification tools and high-end OTDRs necessary for laying extensive new fiber backbones and access networks. Cost-competitiveness is a significant factor in vendor success within this diverse region.

- Latin America (LATAM): Growth is primarily concentrated in major urban centers and supported by steady infrastructure modernization projects. The market faces challenges related to economic volatility but shows consistent demand for mid-range qualification tools as enterprises prioritize network stability and efficiency improvements over immediate high-speed certification mandates. Brazil and Mexico are the primary regional revenue generators.

- Middle East and Africa (MEA): Marked by large-scale, strategic infrastructure development projects (e.g., smart cities in the Gulf Cooperation Council countries) driving demand for new installations of certified fiber and copper systems. Africa sees increasing investments in telecom infrastructure, driving the need for robust, durable field testers for remote deployment and maintenance. Security concerns and reliance on imported technology shape the procurement processes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Network Cable Tester Market.- Fluke Corporation (Fluke Networks)

- Viavi Solutions (formerly JDSU)

- AEM (Advanced Equipment Manufacturing)

- EXFO Inc.

- IDEAL Industries, Inc.

- Softing IT Networks GmbH

- Teledyne LeCroy

- Keysight Technologies, Inc.

- Klein Tools, Inc.

- T3 Innovation

- Psiber Data Systems Inc.

- Tempo Communications Inc.

- Triplett Test Equipment and Tools

- Megger Group Limited

- NetAlly (A business unit of TTI)

- Anritsu Corporation

- GAO Tek Inc.

- TREND Networks

- Shenzhen NOYAFA Electronic Co., Ltd.

- B&B Electronics Mfg. Co. (Advantech)

Frequently Asked Questions

Analyze common user questions about the Network Cable Tester market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a verification, qualification, and certification cable tester?

Verification testers confirm basic connectivity and wiring continuity. Qualification testers determine if an existing cabling link can support specific network speeds (e.g., 1 Gbps). Certification testers provide detailed, standards-compliant measurement against industry specifications (TIA/ISO), offering a legal guarantee of performance required for contractual installations.

How is the growth of Power over Ethernet (PoE) impacting tester technology?

The widespread adoption of high-power PoE (up to 90W) necessitates specialized testers capable of verifying DC resistance balance, measuring power draw, and simulating loading conditions to ensure the cable can transmit both data and required power efficiently without degrading data signal quality, making multi-function PoE testing a mandatory feature.

What technological advancements are driving the demand for high-end fiber optic testers?

The shift to higher-density fiber arrays, particularly MPO/MTP connectors used in data centers, drives demand for advanced OTDRs and dedicated MPO testing solutions that simplify high-fiber-count measurement, automate loss calculation, and integrate end-face inspection to ensure infrastructure reliability for 40G and 100G networks.

Which geographical region shows the strongest growth potential for cable testers?

The Asia Pacific (APAC) region exhibits the strongest growth potential due to aggressive investment in new digital infrastructure, including extensive 5G network rollouts and the construction of numerous hyperscale data centers, fueling demand across all categories of testing equipment from basic to highly specialized certification tools.

How does AI contribute to improving network cable testing efficiency?

AI integration allows for predictive maintenance by analyzing historic test data to forecast component degradation, automates complex fault classification, and optimizes test plans, enabling field technicians to diagnose problems faster and transition network maintenance from reactive repair to proactive network assurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager