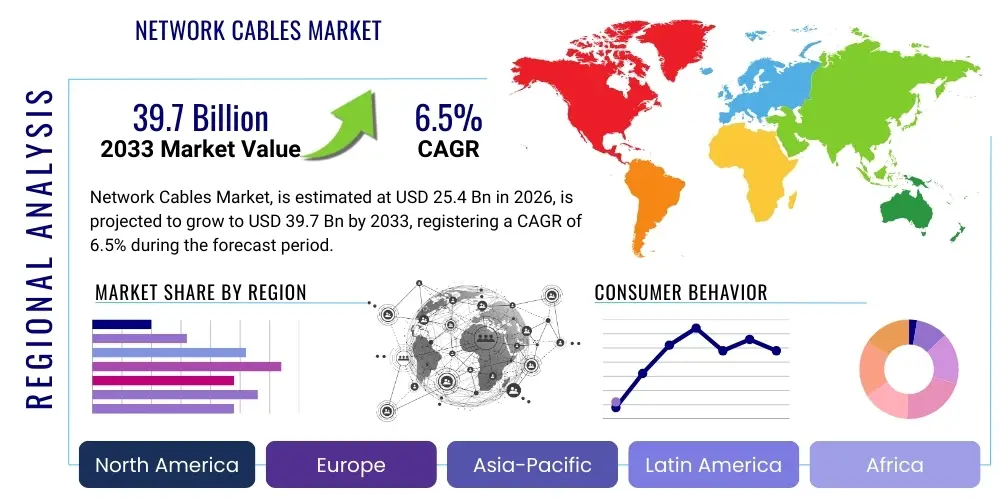

Network Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436444 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Network Cables Market Size

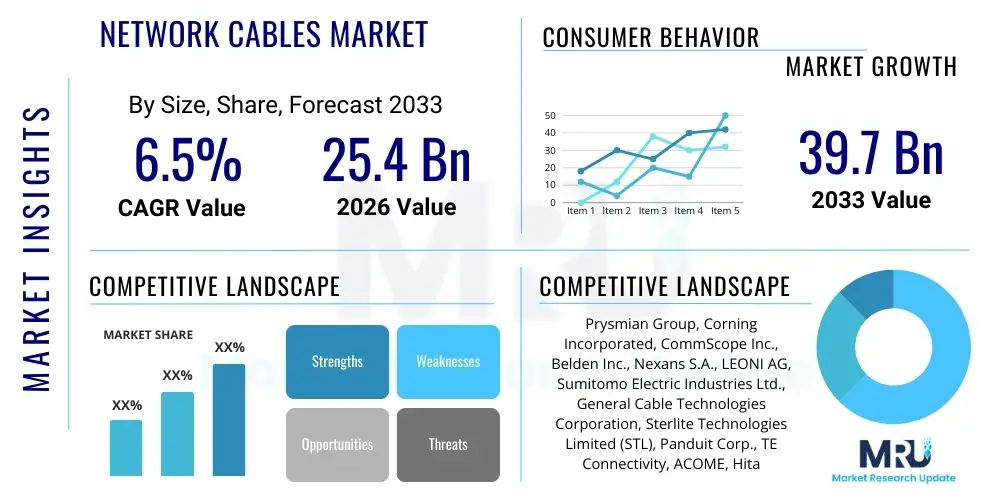

The Network Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 25.4 billion in 2026 and is projected to reach USD 39.7 billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the global surge in data traffic, the widespread deployment of 5G infrastructure, and the continuous growth of hyperscale and edge data centers. The transition from legacy copper infrastructure to high-performance fiber optic solutions in core networks remains a pivotal market dynamic, ensuring sustained revenue growth across all geographic regions.

The valuation reflects robust demand not only from traditional telecom operators but increasingly from enterprise sectors prioritizing digital transformation initiatives. Industrial automation, the rise of the Internet of Things (IoT), and the implementation of smart city projects necessitate high-bandwidth, reliable connectivity solutions, pushing the adoption curve for Cat 6a, Cat 8, and single-mode fiber cables. Furthermore, geopolitical focus on digital sovereignty and domestic infrastructure development acts as a significant catalyst, leading governments and private entities to invest heavily in resilient communication backbones.

Network Cables Market introduction

The Network Cables Market encompasses the design, manufacturing, and distribution of physical transmission media essential for connecting network devices, facilitating data exchange, and supporting the backbone of global digital infrastructure. Products range from traditional copper-based twisted pair cables (like Category 5e, 6, 7, and 8) used extensively in Local Area Networks (LANs) and Power over Ethernet (PoE) applications, to high-speed fiber optic cables (single-mode and multi-mode) dominating wide area networks (WANs), data centers, and long-haul telecommunications. These cables are critical conduits, ensuring low latency, high bandwidth, and robust performance across diverse networking environments, from small office setups to massive industrial complexes and international submarine cable systems.

Major applications of network cables include internal and external data center connectivity, telecommunications infrastructure (FTTH/FTTx), enterprise networking, and specialized industrial communication protocols (Industrial Ethernet). Key benefits derived from modern networking cables involve their ability to support vastly increased data transmission rates (up to 400 Gbps and beyond with advanced fiber solutions), enhanced signal integrity, and superior electromagnetic interference (EMI) resistance. The market is driven by several interconnected factors, primarily the exponentially growing demand for cloud services, video streaming, the deployment of 5G and subsequent 6G wireless technologies requiring dense backhaul networks, and the proliferation of connected devices globally which necessitate reliable wired connectivity endpoints.

Network Cables Market Executive Summary

The Network Cables Market is poised for dynamic growth, underpinned by significant technological shifts towards ultra-high-speed connectivity and network virtualization. Business trends indicate a strong prioritization of fiber optic infrastructure investments, particularly in the data center and long-haul segments, driven by the need to handle massive computational loads generated by AI, machine learning, and high-fidelity streaming services. There is a palpable trend towards consolidating network infrastructure using unified standards, such as Single Pair Ethernet (SPE) for industrial IoT applications, balancing performance requirements with installation ease and cost efficiency. The competitive landscape is characterized by innovation in cable shielding, jacket materials (for fire safety and environmental compliance), and miniaturization efforts to increase port density.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by extensive government-backed FTTH projects in China and India, coupled with rapid urbanization and the establishment of new manufacturing hubs requiring robust industrial networking. North America and Europe maintain dominance in high-end product adoption, particularly Cat 8 copper and advanced multi-fiber push-on (MPO) solutions, driven by the concentration of hyperscale data center operators and early adopters of 5G technology. Latin America and the Middle East & Africa (MEA) are emerging rapidly, showing steep increases in demand for fundamental network upgrades spurred by digital banking initiatives and governmental digitalization efforts.

Segmentation trends highlight the increasing market share of fiber optic cables, although copper solutions retain critical relevance in edge computing, access networks, and PoE applications where shorter distance, cost-effectiveness, and power delivery capabilities are paramount. Within the application segment, Data Centers are expected to maintain the highest CAGR due to continuous upgrade cycles and the implementation of higher-density cabling solutions necessary for spine-and-leaf architecture designs. Standardization bodies like TIA and ISO/IEC continue to influence procurement decisions, ensuring compliance and interoperability across the increasingly complex network environment.

AI Impact Analysis on Network Cables Market

Common user questions regarding AI's impact on the Network Cables Market revolve around the necessary infrastructure upgrades required to support AI computational loads, the role of AI in optimizing network management, and the projected increase in demand for specific cable types. Users frequently inquire if current network infrastructure is sufficient for training large language models (LLMs) and supporting complex machine learning (ML) workloads, often focusing on the required latency and bandwidth specifications. Based on this analysis, the key themes indicate that AI is primarily an accelerant for demand, necessitating massive upgrades to support high-throughput, low-latency communication between GPUs and high-performance computing clusters. While AI may optimize network routing and maintenance, its most profound market influence is driving the need for higher category copper (Cat 8) and advanced multi-fiber cable assemblies (400G and 800G connectivity) to mitigate bottlenecks within hyper-connected AI data centers.

The deployment of sophisticated AI systems requires unparalleled interconnectivity speeds. Training and inference processes demand that vast quantities of data be transferred instantaneously between servers, requiring ultra-low latency internal cabling solutions. This pressure significantly boosts the procurement of cutting-edge network cables, moving beyond traditional 10G and 40G standards towards 100G, 200G, 400G, and increasingly 800G connectivity solutions, primarily based on fiber optics. AI applications, particularly those related to real-time analytics and autonomous systems, cannot tolerate the bandwidth constraints or latency inherent in legacy networking infrastructure, thereby accelerating the replacement cycle for enterprise and cloud networks.

Furthermore, AI-driven network management tools are impacting the market by influencing product design. These tools rely on granular performance data, which, in turn, drives the development of ‘smarter’ cables incorporating sensors or advanced shielding to minimize crosstalk and ensure optimal signal quality necessary for AI-enhanced monitoring and predictive maintenance. This shift ensures that future network cables are not just passive conduits but integral components of intelligent infrastructure, capable of supporting the demanding communication requirements of the AI-driven digital economy.

- Accelerated demand for high-density, low-latency fiber optic cables (MPO/MTP).

- Increased procurement of Cat 8 and Cat 8.1 copper cables for high-speed switch-to-server connections over short distances.

- AI data center expansion mandates massive deployment of 400G and 800G network interconnects.

- Adoption of AI-optimized network performance tools influencing cable quality specifications and reducing tolerance for signal degradation.

- Promotion of sustainable cable manufacturing through AI-driven supply chain optimization and material selection.

DRO & Impact Forces Of Network Cables Market

The Network Cables Market dynamics are shaped by powerful Drivers, structural Restraints, and significant Opportunities, which collectively create the Impact Forces steering market growth. The primary driving force is the global exponential growth in data consumption, propelled by cloud computing, big data analytics, and the widespread implementation of 5G wireless networks, which necessitate dense, high-capacity wired backhaul infrastructure. Simultaneously, the proliferation of IoT devices across industrial and commercial sectors demands reliable, often ruggedized, network cabling capable of supporting Power over Ethernet (PoE) and industrial protocols over long lifecycles. These drivers ensure continuous investment in both new infrastructure and systematic upgrades of existing networks.

Key restraints include the high initial capital expenditure associated with deploying new high-speed fiber optic infrastructure, particularly in comparison to upgrading existing copper networks. Furthermore, the complexity of managing evolving standards (e.g., Cat 6a vs. Cat 8, single-mode vs. multi-mode fiber specifications) and skilled labor shortages for complex fiber installation and splicing pose significant friction points, potentially slowing down large-scale deployments in developing regions. Market volatility in raw material costs, specifically copper and polymer resins, also influences manufacturing stability and final product pricing, acting as a periodic restraint on margin expansion.

Opportunities for market expansion are substantial, primarily centered on the untapped potential of smart city development, which requires integrated cabling solutions for transportation, utilities, and surveillance systems. The emergence of Single Pair Ethernet (SPE) presents a robust opportunity to standardize connectivity in industrial automation and automotive applications, simplifying installation while meeting high reliability standards. Moreover, the increasing regulatory focus on fire safety and low-smoke halogen-free (LSHF) materials provides a niche for manufacturers developing innovative, compliant, and environmentally sustainable cable products. These collective forces underscore a transition towards performance-driven and specialized cabling solutions tailored for specific high-growth verticals like robotics, AI data centers, and remote health monitoring.

Segmentation Analysis

The Network Cables Market is highly segmented, reflecting the diverse application environments and technical requirements inherent in modern connectivity. Analyzing the market through segmentation allows stakeholders to understand specific demand profiles across different product types, standards, materials, and end-user industries. This detailed breakdown is crucial for targeted product development, strategic inventory management, and maximizing market penetration across varied technological landscapes. The primary segmentation dimensions include cable type (e.g., Copper vs. Fiber Optic), cable standard (e.g., Cat 6, Cat 7, Cat 8), application (e.g., Data Center, Industrial, Commercial), and geography.

The segmentation by cable type reveals the structural shift towards Fiber Optic solutions, driven by the insatiable need for bandwidth in core and metro networks, though Copper solutions maintain a dominant position in premise wiring, edge networking, and endpoints where PoE capability is essential. Standardization segmentation demonstrates that while older categories like Cat 5e are phasing out, intermediate standards like Cat 6A continue to dominate new commercial installations, balancing cost and performance. However, ultra-high-speed requirements in data centers are pushing Cat 8 adoption.

Furthermore, segmentation by application highlights distinct market behaviors. The Data Center segment focuses intensively on density, speed, and modularity, favoring high-performance MPO/MTP fiber assemblies. Conversely, the Industrial segment demands ruggedized cables with high mechanical integrity, resistance to environmental factors (temperature, vibration, chemicals), and specific protocol compatibility (e.g., PROFINET, EtherCAT), primarily utilizing robust Industrial Ethernet copper cables. Understanding these varying requirements is fundamental to supplying appropriate and compliant networking solutions efficiently.

- By Type:

- Copper Cables (Twisted Pair, Coaxial)

- Fiber Optic Cables (Single-mode, Multi-mode)

- Specialty Cables (Hybrid, Power over Fiber)

- By Standard:

- Category 5e (Cat 5e)

- Category 6 (Cat 6)

- Category 6a (Cat 6a)

- Category 7/7a (Cat 7)

- Category 8 (Cat 8)

- By Application:

- Data Center Connectivity

- Enterprise Networking (Commercial and Office Buildings)

- Industrial Communication (Industrial Ethernet, Factory Automation)

- Telecommunications (FTTH, Backhaul Networks)

- Residential/SOHO

- By End-User Industry:

- IT and Telecommunications

- Government and Defense

- Manufacturing and Automation

- Energy and Utilities

- Healthcare and Life Sciences

- By Geography:

- North America (U.S., Canada)

- Europe (Germany, U.K., France)

- Asia Pacific (China, Japan, India)

- Latin America (Brazil, Mexico)

- Middle East & Africa (UAE, South Africa)

Value Chain Analysis For Network Cables Market

The value chain for the Network Cables Market is extensive, starting from raw material sourcing and culminating in the complex installation and maintenance of integrated network systems. Upstream analysis focuses heavily on the procurement of critical materials, primarily high-purity copper, silica glass (for fiber preforms), and sophisticated polymer jackets (PVC, LSZH, polyethylene). Key upstream suppliers include raw material manufacturers and specialized chemical companies. The cost and quality of these raw materials significantly dictate the final product price and performance characteristics, making supply chain resilience and material hedging crucial strategic elements for cable manufacturers.

Midstream activities involve core manufacturing processes: copper wire drawing, insulation extrusion, twisting and stranding, jacketing, and rigorous testing for copper cables; and fiber drawing, preform manufacturing, buffering, coloring, and assembly for fiber optic cables. Manufacturers must invest heavily in precision machinery and quality control to meet stringent international standards (ISO/IEC, TIA). Distribution channels play a critical role; direct sales are common for large volume, customized orders (like submarine cables or hyperscale data center projects), allowing manufacturers to work closely with network architects. Conversely, standardized cables (Cat 6, patch cords) are predominantly sold through indirect channels, including electrical distributors, IT wholesale partners, and e-commerce platforms, maximizing regional reach and inventory accessibility.

Downstream activities are dominated by system integrators, professional installers, and IT infrastructure management companies who provide end-user services, including network design, installation, testing, and certification. The increasing technical complexity of modern networks—such as fiber splicing for dense wave division multiplexing (DWDM) and certifying Cat 8 installations—means the expertise of downstream service providers is vital to the perceived quality and functionality of the cable infrastructure. This strong dependence on certified downstream partners ensures that specialized knowledge remains a bottleneck and a critical component of customer value delivery across the market.

Network Cables Market Potential Customers

The potential customer base for the Network Cables Market is broad and diversified, extending across every sector reliant on digital communication and data processing. The primary high-volume end-users are large Telecommunication Service Providers (Telcos), who continuously invest in expanding and upgrading their core network infrastructure, including FTTH deployments, 5G backhaul networks, and international submarine cable systems. These buyers prioritize high performance, extreme durability, and extensive standardization compliance due to the long operational lifespan required for their infrastructure investments. Furthermore, Hyperscale Data Center Operators (e.g., Google, Amazon, Microsoft, Meta) represent a critical customer segment, demanding enormous volumes of high-density, ultra-low-latency fiber optic assemblies necessary for interconnecting thousands of servers within massive facilities.

Another rapidly expanding customer cluster includes large Enterprise clients across finance, education, and healthcare, undertaking comprehensive digital transformation projects. These customers are driving demand for structured cabling solutions (Cat 6A and Cat 7) within commercial buildings, supporting high-speed corporate LANs, and enabling advanced applications like video conferencing and sophisticated surveillance systems utilizing Power over Ethernet (PoE). Beyond the commercial sector, Government and Defense agencies constitute a consistent customer segment, prioritizing secure, highly resilient, and often custom-designed network cables that adhere to strict safety and security protocols, frequently requiring specialized ruggedized and shielded products for mission-critical applications.

The emerging segments include Industrial Automation and IoT ecosystem builders. Manufacturers implementing Industry 4.0 initiatives require robust, environmentally protected Industrial Ethernet cables (compliant with TIA 1005 standards) to connect robotics, sensors, and PLCs on factory floors. Similarly, smart city infrastructure projects—spanning transportation management, smart grids, and public security systems—demand specialized outdoor and underground cables capable of enduring harsh environmental conditions while ensuring uninterrupted data flow and power delivery. Successful vendors must tailor their offerings to meet the unique performance, safety, and longevity requirements of each specific end-user category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.4 Billion |

| Market Forecast in 2033 | USD 39.7 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Corning Incorporated, CommScope Inc., Belden Inc., Nexans S.A., LEONI AG, Sumitomo Electric Industries Ltd., General Cable Technologies Corporation, Sterlite Technologies Limited (STL), Panduit Corp., TE Connectivity, ACOME, Hitachi Cable, LS Cable & System Ltd., Furukawa Electric Co. Ltd., Wirewerks, Siemon, Fiberhome, Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Network Cables Market Key Technology Landscape

The technology landscape of the Network Cables Market is characterized by continuous innovation aimed at increasing bandwidth density, reducing latency, and enhancing signal integrity across demanding environments. A core technological trend involves the relentless push for faster fiber optic capabilities, moving beyond 100G and 200G to widespread deployment of 400G and 800G connectivity, particularly within data center ecosystems. This transition relies heavily on Multi-Fiber Push-On (MPO) and Multi-fiber Termination Push-on (MTP) connectors, which allow for high-density termination and rapid deployment of parallel optics. Furthermore, advancements in fiber material science, such as bend-insensitive fiber (BIF), are critical for making installations easier in congested spaces and reducing signal loss caused by tight bending radii.

On the copper side, the focus remains on maximizing data rates over existing infrastructure while supporting higher Power over Ethernet (PoE) requirements. The maturation of Category 8 (Cat 8) cabling technology allows for 40 Gigabit Ethernet (40GBASE-T) over short distances (up to 30 meters), specifically addressing the server-to-switch links within small and medium data centers. Concurrently, Single Pair Ethernet (SPE) technology is gaining traction. SPE significantly reduces cable weight and complexity by using only one pair of copper wires, making it ideal for the rapidly growing Industrial IoT (IIoT) and automotive Ethernet markets where space and weight constraints are paramount, thus opening up new application domains that were previously inefficient for traditional four-pair Ethernet.

Another significant technological advancement centers around cable safety and sustainability. The increasing adoption of Low Smoke Zero Halogen (LSZH) or Low Smoke Halogen-Free (LSHF) jacketing materials is a direct response to stringent fire safety regulations, particularly in European and dense urban markets. These materials emit minimal corrosive or toxic smoke when burned, protecting both equipment and occupants. Furthermore, the development of Active Optical Cables (AOCs) and Direct Attach Copper (DAC) cables, which integrate active components directly into the cable assembly, provides performance enhancement and simplified connectivity solutions for high-speed interconnections, bridging the gap between passive copper and complex fiber links in specific short-reach, high-bandwidth applications.

Regional Highlights

The global Network Cables Market exhibits pronounced regional variations driven by differing levels of digital maturity, infrastructure spending patterns, and regulatory environments. North America, characterized by the highest concentration of hyperscale data centers, cloud service providers, and early adopters of 5G technology, continues to be a dominant market in terms of value, largely driven by demand for cutting-edge high-speed fiber optic solutions (400G and above) and advanced Cat 8 copper cabling. Investment in edge computing infrastructure and ongoing expansion of suburban fiber-to-the-home (FTTH) networks ensure sustained demand, focusing on premium, high-performance, and standardized products compliant with stringent TIA standards.

Asia Pacific (APAC) is projected to be the fastest-growing region, contributing the largest volume share to the market. This robust growth is fueled by massive government investments in digitalization and telecommunications infrastructure, notably in countries like China, India, and Southeast Asian nations executing ambitious FTTH rollout plans and large-scale smart city projects. APAC is also a major global manufacturing hub for electronic goods and automotive parts, leading to soaring demand for reliable Industrial Ethernet cables to support sophisticated factory automation (Industry 4.0). Cost-competitiveness and scalable manufacturing capabilities define the competitive environment in this region.

Europe represents a mature yet highly regulated market, with growth driven by strict implementation of data protection laws (GDPR) necessitating secure data center growth, and a strong regulatory push towards sustainable infrastructure. Demand is high for LSZH/LSHF compliant cables for installation in public buildings and commercial spaces. Furthermore, European focus on industrial automation and automotive connectivity is rapidly accelerating the adoption of Single Pair Ethernet (SPE) technology. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, experiencing high growth rates as digital transformation accelerates, particularly in sectors like finance, telecommunications, and oil & gas, leading to large-scale procurement of basic to mid-range copper and fiber infrastructure for foundational network builds.

- North America: Leading market for hyperscale data center connectivity and early adoption of 400G/800G fiber and Cat 8 copper; focused on network resilience and low latency.

- Asia Pacific (APAC): Fastest growing region; massive volume demand driven by national FTTH rollouts, urbanization, and intense factory automation (Industry 4.0).

- Europe: High demand for environmental and safety compliant products (LSZH); strong adoption of Single Pair Ethernet for industrial and automotive applications.

- Latin America (LATAM): Growth spurred by increased internet penetration and investment in foundational infrastructure for financial services and public sector digitalization.

- Middle East & Africa (MEA): Significant projects in smart city development (e.g., NEOM in Saudi Arabia) and expansion of fiber optic submarine cables connecting continents, driving high-performance cable demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Network Cables Market.- Prysmian Group

- Corning Incorporated

- CommScope Inc.

- Belden Inc.

- Nexans S.A.

- LEONI AG

- Sumitomo Electric Industries Ltd.

- General Cable Technologies Corporation (A Prysmian Group Company)

- Sterlite Technologies Limited (STL)

- Panduit Corp.

- TE Connectivity

- ACOME

- Hitachi Cable

- LS Cable & System Ltd.

- Furukawa Electric Co. Ltd.

- Wirewerks

- Siemon

- Fiberhome

- Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC)

- TFC Telecom

Frequently Asked Questions

Analyze common user questions about the Network Cables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced fiber optic network cables?

The primary driver is the exponential growth of data traffic, specifically the requirement for ultra-high bandwidth and minimal latency needed to support hyperscale cloud computing, AI infrastructure, 5G backhaul networks, and high-resolution video streaming services.

How does the Category 8 (Cat 8) standard differ in market application compared to Cat 6a?

Cat 8 is designed specifically for short-distance, high-speed connectivity (up to 30 meters) within data centers, supporting 25GBASE-T or 40GBASE-T Ethernet. Cat 6a, however, remains the standard choice for longer horizontal cable runs (up to 100 meters) within commercial buildings, supporting 10 Gigabit Ethernet (10GBASE-T).

What is Single Pair Ethernet (SPE) and which industries are adopting it rapidly?

Single Pair Ethernet (SPE) uses only one pair of copper wires for power and data transmission, significantly reducing cable size and weight. It is being rapidly adopted by the Industrial IoT (IIoT), factory automation, and automotive industries for connecting edge devices, sensors, and cameras where high reliability and space efficiency are critical.

What are Low Smoke Zero Halogen (LSZH) cables and why are they important?

LSZH cables utilize jacketing materials that emit minimal smoke and zero toxic halogen gases when exposed to fire. They are crucial for fire safety compliance in densely populated areas like public transportation, commercial offices, and data centers, reducing the risk of respiratory harm and equipment corrosion during a fire event.

Which geographical region exhibits the fastest growth rate in the Network Cables Market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, primarily driven by massive infrastructure investments in 5G deployment, extensive Fiber-to-the-Home (FTTH) initiatives, rapid urbanization, and significant expansion of the manufacturing and automation sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager