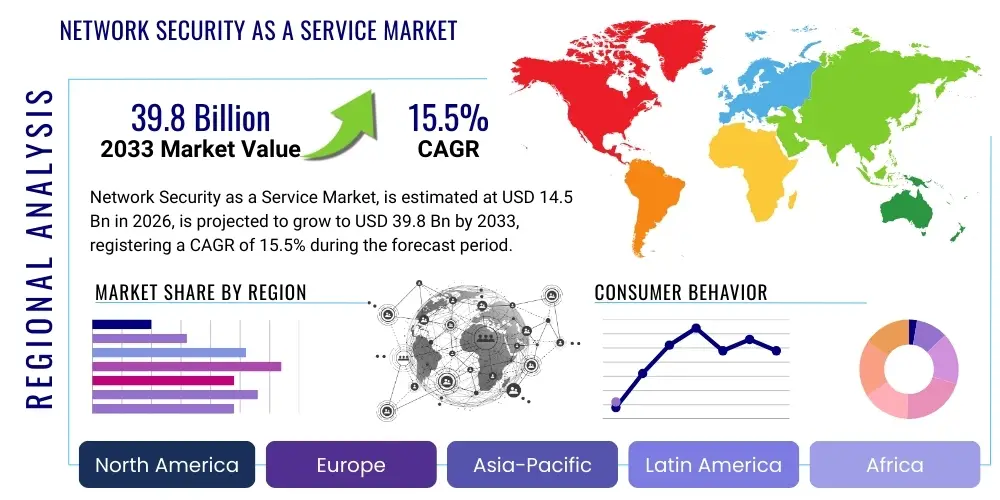

Network Security as a Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431342 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Network Security as a Service Market Size

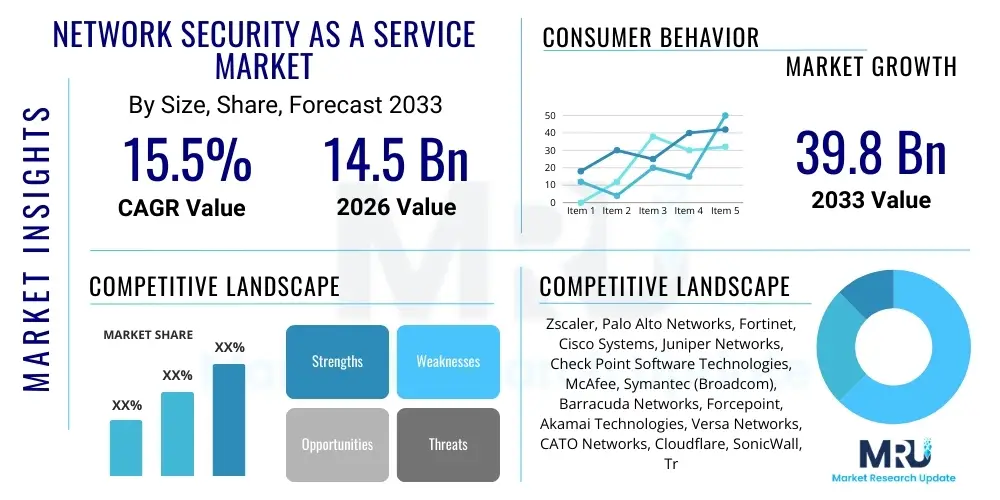

The Network Security as a Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 39.8 Billion by the end of the forecast period in 2033.

Network Security as a Service Market introduction

The Network Security as a Service (NSaaS) market encompasses a cloud-delivered model for providing essential network security functions, thereby enabling organizations to defend their distributed infrastructure, remote workforce, and multi-cloud environments effectively. NSaaS is fundamentally shifting the security paradigm away from traditional perimeter-based hardware appliances towards a flexible, scalable, and consumption-based security architecture, often bundled under the Secure Access Service Edge (SASE) framework. Key product offerings include Firewall-as-a-Service (FWaaS), Intrusion Detection and Prevention Systems (IDS/IPS), Security Web Gateways (SWG), and Unified Threat Management (UTM) solutions, all managed and delivered from the cloud.

Major applications of NSaaS span across securing hybrid cloud environments, enabling zero-trust network access (ZTNA) for remote employees, ensuring regulatory compliance across geographically dispersed operations, and providing integrated data loss prevention (DLP) across various endpoints and applications. The inherent scalability and reduced capital expenditure (CapEx) associated with NSaaS deployments are significant benefits, allowing businesses of all sizes, particularly Small and Medium-sized Enterprises (SMEs), to access enterprise-grade security tools previously unattainable due to high cost and complexity. This democratization of advanced security capabilities is crucial in the current threat landscape, characterized by sophisticated ransomware attacks and persistent state-sponsored cyber espionage.

The primary driving factors propelling the NSaaS market include the rapid acceleration of digital transformation initiatives, the persistent global shift toward hybrid work models, and the exponential growth in the number of interconnected devices (IoT). Furthermore, organizations are grappling with increasingly fragmented network architectures resulting from multi-cloud adoption and the proliferation of Software-as-a-Service (SaaS) applications. NSaaS provides a centralized policy enforcement point and simplified management, directly addressing the operational complexity and security gaps inherent in these modern, dynamic IT environments, making it an indispensable component of contemporary enterprise infrastructure strategy.

Network Security as a Service Market Executive Summary

The Network Security as a Service market is characterized by robust growth fueled by the convergence of networking and security functions, primarily through the adoption of the SASE architecture. Business trends indicate a significant consolidation among established security vendors and network providers, aiming to offer integrated, single-vendor solutions that simplify procurement and deployment for end-users. Enterprise investment is heavily skewed towards solutions that promise seamless integration with existing cloud platforms (AWS, Azure, GCP) and offer superior application performance alongside stringent security controls. The demand for advanced features such as AI-driven threat intelligence and automated policy orchestration is escalating, pushing vendors towards continuous innovation in platform intelligence and responsiveness, transforming security from a static defense layer into a dynamic, adaptive service.

Regionally, North America maintains market dominance, attributed to high security spending, early adoption of cloud technologies, and the presence of major technology hubs and regulatory mandates requiring robust data protection measures. Europe is witnessing accelerated adoption, driven predominantly by stringent data sovereignty and privacy regulations, such as the General Data Protection Regulation (GDPR), which necessitates highly granular security controls and logging capabilities delivered via the cloud. The Asia Pacific (APAC) region is emerging as the fastest-growing market, spurred by aggressive digitalization across sectors like BFSI and IT & Telecom, coupled with increasing awareness of cyber risks among emerging economies, leading to substantial governmental and private sector investments in resilient, cloud-based infrastructure security.

In terms of segmentation trends, the Firewall-as-a-Service (FWaaS) and Secure Web Gateway (SWG) segments are experiencing particularly high momentum, driven by the immediate need to secure remote internet access and enforce corporate policies across dispersed employee populations. Among end-users, the Banking, Financial Services, and Insurance (BFSI) sector remains a critical consumer, requiring robust, real-time threat protection for sensitive transactional data and customer information. Furthermore, the hybrid deployment model (combining elements of private and public cloud security delivery) is gaining traction, offering organizations the necessary balance between centralized cloud management and compliance-driven control over sensitive data that must reside on-premises or within a dedicated private environment, reflecting a maturation in enterprise cloud strategy.

AI Impact Analysis on Network Security as a Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on NSaaS overwhelmingly revolve around three core themes: efficacy in zero-day threat detection, the potential for autonomous response capabilities, and concerns regarding managing the inevitable increase in complexity and false positives (alert fatigue). Users are keenly interested in how AI can move beyond signature-based detection to accurately identify novel threats and behavioral anomalies across vast, encrypted traffic volumes without compromising network speed. They seek assurance that AI integration will lead to smarter, more proactive security postures rather than simply generating more data for human analysts to sift through. This demand for actionable intelligence and automation is defining the next generation of NSaaS offerings, particularly in integrating AI/ML models into threat intelligence feeds and policy automation engines to deliver true adaptive security.

- AI significantly enhances real-time anomaly detection by analyzing baseline network traffic behavior to identify deviations indicative of malware or intrusion, moving beyond traditional signature matching.

- Machine Learning (ML) is utilized to automate security policy optimization, dynamically adjusting access controls and firewall rules based on context, risk scores, and observed user/device behavior.

- AI-driven orchestration platforms integrate threat intelligence from various sources, enabling rapid, autonomous incident response, such as quarantining compromised devices or rolling back unauthorized changes.

- It improves phishing and social engineering defense by analyzing email content, user behavior patterns, and network metadata to preemptively block malicious communication streams.

- AI reduces alert fatigue for security operations center (SOC) analysts by accurately prioritizing genuine threats and filtering out benign activities or low-fidelity alerts, enhancing operational efficiency.

- AI algorithms are crucial for encrypted traffic analysis (ETA), enabling the identification of malicious payloads within TLS/SSL tunnels without requiring decryption, thereby maintaining privacy and compliance.

- Predictive threat modeling, utilizing historical attack data and ML models, allows NSaaS providers to proactively reinforce network segments deemed most vulnerable to anticipated attack campaigns.

DRO & Impact Forces Of Network Security as a Service Market

The dynamics of the Network Security as a Service market are shaped by powerful drivers and significant constraints, tempered by substantial future opportunities. The relentless increase in sophisticated cyberattacks, coupled with the rapid adoption of cloud infrastructure (IaaS, PaaS, SaaS) and the necessity of securely supporting remote and hybrid workforces, are the primary drivers accelerating NSaaS adoption. Organizations recognize that legacy on-premises security stacks cannot adequately protect decentralized data and identities. Conversely, restraints primarily revolve around regulatory hurdles related to data residency and sovereignty in specific jurisdictions, the inherent complexity involved in migrating from established, proprietary security hardware to cloud-native platforms, and initial concerns regarding vendor lock-in when committing to a single cloud security provider for core functions. These forces create a compelling environment where demand outpaces resistance, positioning NSaaS as a critical infrastructural investment.

Impact forces currently governing the market heavily favor growth. The immediate impact force is the widespread adoption of SASE (Secure Access Service Edge), which is effectively merging the NSaaS sector with the SD-WAN market, creating a unified, powerful architectural standard. This convergence simplifies IT operations while dramatically improving security efficacy and network performance. Furthermore, compliance mandates, particularly those concerning privacy (e.g., CCPA, HIPAA, GDPR), act as continuous growth vectors, forcing enterprises to adopt highly auditable, centralized security policy enforcement mechanisms that NSaaS excels at delivering. The opportunity sphere is vast, focusing on extending cloud security to new frontiers like Operational Technology (OT) networks, integrating advanced 5G connectivity security, and embedding Zero Trust principles deep within micro-segmented network fabrics, thereby ensuring market expansion and long-term viability.

Despite the substantial momentum, cost pressures and technical skills gaps pose ongoing challenges. While NSaaS reduces CapEx, the total cost of ownership (TCO) for subscription-based OpEx models requires careful management, particularly for large enterprises consuming multiple services. The scarcity of cybersecurity professionals skilled in cloud security architectures and SASE deployment methodologies further acts as a restraint, compelling vendors to invest heavily in user-friendly, low-code management interfaces and automation tools. Successful vendors are those who can mitigate these friction points by offering clear TCO models and highly abstracted, intuitive management platforms, thus maximizing the positive impact of drivers while minimizing the negative effects of restraining factors.

Segmentation Analysis

The Network Security as a Service market is segmented across multiple dimensions to reflect the diverse needs and deployment strategies of modern enterprises. Key segmentation criteria include the type of component (defining the core security function delivered), the service model (reflecting how the service is consumed), the deployment type (public, private, or hybrid cloud), and the organizational size and end-user vertical. This detailed segmentation allows market players to tailor offerings, such as bundling advanced threat intelligence with FWaaS for large financial institutions or providing streamlined, cost-effective Secure Web Gateway solutions specifically optimized for small and medium businesses (SMEs) operating primarily on public cloud infrastructure. The increasing demand for comprehensive, unified platforms is blurring the lines between some component segments, favoring holistic SASE offerings over discrete, siloed security tools.

- By Component:

- Firewall-as-a-Service (FWaaS)

- Intrusion Detection and Prevention Systems (IDS/IPS)

- Security Web Gateway (SWG)

- Unified Threat Management (UTM)

- Anti-Malware and Antivirus

- Data Loss Prevention (DLP)

- Distributed Denial of Service (DDoS) Protection

- Zero Trust Network Access (ZTNA)

- Cloud Access Security Broker (CASB)

- By Service Model:

- Infrastructure as a Service (IaaS) Security

- Platform as a Service (PaaS) Security

- Software as a Service (SaaS) Security

- By Deployment Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-User Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecommunication

- Healthcare

- Government and Defense

- Retail and E-commerce

- Manufacturing

- Others (Education, Utilities)

Value Chain Analysis For Network Security as a Service Market

The NSaaS value chain begins with upstream activities focused on foundational research and development (R&D), where security vendors and hyperscale cloud providers innovate in areas like AI/ML algorithms for threat detection, distributed cloud architecture design, and integration of ZTNA protocols. Key upstream suppliers include specialized software firms providing encryption and authentication libraries, and hardware manufacturers contributing optimized servers and networking infrastructure for edge computing points of presence (PoPs). Effective upstream strategy minimizes latency and maximizes processing power for real-time security inspection, which is critical for successful NSaaS delivery. Investment in proprietary global backbone networks is also a defining upstream competitive advantage, ensuring highly reliable service delivery across geographies.

Midstream activities involve core service provisioning, including packaging the security functions (FWaaS, SWG, CASB) into scalable, multi-tenant cloud platforms, setting up regional data centers, and establishing robust security operations centers (SOCs) to monitor the platform and manage global threat intelligence feeds. This stage also includes key partnerships and integrations, particularly with SD-WAN vendors to facilitate SASE convergence, and with major identity providers (IdP) for centralized authentication and access management. The transition to a unified SASE platform necessitates seamless integration and orchestration capabilities, which constitute a significant part of the midstream value addition, ensuring that network and security policies are uniformly enforced.

Downstream analysis focuses on distribution channels and direct engagement with end-users. Direct sales channels are common for large enterprise contracts, providing tailored solutions and extensive post-sales technical support. However, the indirect distribution channel, primarily leveraging Managed Security Service Providers (MSSPs), Value-Added Resellers (VARs), and system integrators, accounts for a substantial portion of the market, particularly in reaching SMEs and facilitating complex multi-vendor deployments. MSSPs play a crucial role by packaging NSaaS solutions with ongoing monitoring, incident response, and compliance reporting services, offering customers a complete, outsourced security solution. The most successful vendors ensure their platforms are easily consumed and managed via channel partners, enhancing market reach and accelerating time-to-market for new service features.

Network Security as a Service Market Potential Customers

The potential customer base for Network Security as a Service solutions is exceptionally broad, spanning nearly every vertical that relies on internet connectivity, cloud services, and a distributed workforce. However, the most immediate and substantial buyers are typically organizations undergoing aggressive digital transformation, defined by high rates of SaaS adoption, multi-cloud infrastructure usage, and a large number of remote or mobile employees who require secure access regardless of location. These characteristics make financial institutions, high-tech manufacturing firms, and IT & Telecom providers prime candidates, as their operations mandate stringent regulatory compliance coupled with the need for high-speed, scalable global connectivity.

In the BFSI sector, NSaaS potential customers prioritize advanced threat prevention capabilities, including real-time DLP and robust application control, essential for protecting sensitive customer data and complying with industry-specific regulations like PCI DSS. For the Healthcare sector, potential customers are driven by the necessity of securing Electronic Health Records (EHR) and complying with mandates such as HIPAA, requiring secure remote access for clinicians and administrative staff. Furthermore, organizations that leverage extensive third-party contractor networks or engage in frequent mergers and acquisitions also represent significant potential customer pools, as NSaaS provides a rapid, uniform way to onboard and secure disparate network segments and external users under a centralized security policy.

Small and Medium-sized Enterprises (SMEs) constitute a massive, rapidly expanding cohort of potential customers. Traditionally, SMEs have struggled to deploy and manage complex, hardware-intensive security solutions due to budgetary and staffing constraints. NSaaS directly addresses this pain point by offering enterprise-grade security functionalities through affordable, subscription-based models requiring minimal internal maintenance. The simplicity of deployment and the immediate access to centralized threat intelligence offered by NSaaS enable SMEs to achieve a security posture that effectively counters modern sophisticated threats without the heavy capital investment associated with traditional security infrastructure, making cloud-delivered security indispensable for this growing segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 39.8 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zscaler, Palo Alto Networks, Fortinet, Cisco Systems, Juniper Networks, Check Point Software Technologies, McAfee, Symantec (Broadcom), Barracuda Networks, Forcepoint, Akamai Technologies, Versa Networks, CATO Networks, Cloudflare, SonicWall, Trend Micro, Microsoft, Google Cloud, AWS, IBM Security |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Network Security as a Service Market Key Technology Landscape

The technological core of the Network Security as a Service market is centered on providing distributed, policy-driven enforcement mechanisms that are highly scalable and performant. The single most transformative technology is Secure Access Service Edge (SASE), which integrates core network functions (SD-WAN) with essential security services (SWG, CASB, ZTNA, FWaaS) into a single, cloud-native platform. This architecture eliminates the traditional reliance on backhauling traffic to centralized data centers for security inspection, instead delivering security capabilities at the nearest point of presence (PoP) to the user or device. This shift is crucial for optimizing user experience in a cloud-first world, significantly reducing latency while ensuring a consistent, high level of security policy application across all edges of the network, whether corporate, branch office, or remote user location.

Another fundamental technological pillar is Zero Trust Network Access (ZTNA). ZTNA replaces outdated VPN technology by providing context-aware, least-privilege access based on continuous verification of the user, device posture, and the specific application being accessed, irrespective of the user's location. This move away from implicit trust to explicit verification for every connection is essential for protecting against lateral movement within a network, which is a common strategy utilized by ransomware and advanced persistent threats (APTs). Furthermore, advancements in Micro-segmentation technology, delivered virtually through the NSaaS platform, allow organizations to logically divide their networks into smaller, isolated zones, minimizing the potential blast radius of a security breach and ensuring that security policies are applied with surgical precision.

The integration of advanced threat intelligence platforms is also non-negotiable within the NSaaS landscape. Modern NSaaS solutions leverage large, globally distributed telemetry data sets and machine learning models to identify emerging attack patterns and dynamically update enforcement points worldwide in real time. Cloud Access Security Brokers (CASBs) remain critical components, specifically designed to mitigate risks associated with the usage of SaaS applications by enforcing corporate policies for cloud application access, detecting shadow IT usage, and preventing data leakage across sanctioned and unsanctioned cloud services. The confluence of these technologies—SASE, ZTNA, and AI-driven threat intelligence—defines the competitive edge and scalability of next-generation NSaaS platforms, moving security closer to the data and the user.

Regional Highlights

The global Network Security as a Service market exhibits diverse growth patterns influenced by regional regulatory environments, technological maturity, and the speed of cloud adoption. North America currently holds the largest market share, driven by a high concentration of sophisticated cyber threats, substantial enterprise IT spending budgets, and regulatory pressure in critical sectors like BFSI and Healthcare (HIPAA, SOX compliance). The region has been an early adopter of advanced security architectures, including SASE and Zero Trust models, fostering a highly competitive landscape with numerous key vendors headquartered in the U.S. and Canada. The mature cloud infrastructure and the necessity to secure massive remote workforces established since 2020 continue to ensure stable, high demand for managed cloud security services.

Europe represents the second-largest market and is characterized by a high impetus for growth, primarily mandated by the General Data Protection Regulation (GDPR) and various European Union directives concerning critical infrastructure protection. European organizations prioritize NSaaS solutions that offer strong data residency guarantees, highly detailed audit trails, and the ability to enforce differing security policies across diverse member states efficiently. Countries like Germany, the UK, and France are leading investment due to their strong manufacturing and financial sectors, which require robust cloud security and strict compliance with local data protection laws, favoring flexible hybrid deployment models that address specific national regulatory nuances.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by massive digital transformation initiatives across emerging economies like India, China, and Southeast Asia, coupled with increasing governmental efforts to modernize IT infrastructure and enhance cybersecurity defenses against regional threats. The market growth here is strongly supported by the increasing adoption of 5G networks and a shift towards cloud services among SMEs. However, regional market segmentation is complex due to varying economic development stages and unique regulatory environments, creating strong demand for vendor solutions that are highly adaptable and locally supported to navigate this fragmented landscape efficiently.

- North America: Dominant market share due to mature cloud infrastructure, high cyber spending, and early adoption of SASE and ZTNA architectures; stringent regulatory compliance in finance and health.

- Europe: Growth driven by GDPR compliance, strong focus on data sovereignty, and high adoption rates in countries with robust manufacturing and financial sectors (Germany, UK).

- Asia Pacific (APAC): Fastest-growing market segment; propelled by rapid digitalization, 5G deployment, and increasing cybersecurity awareness among governments and SMEs; key markets include China, Japan, and India.

- Latin America (LATAM): Moderate growth driven by increasing cloud migration and investment in IT modernization, especially in Brazil and Mexico, though constrained by economic instability and infrastructure limitations.

- Middle East and Africa (MEA): Emerging market driven by substantial government investments in smart city projects and energy sector protection; rising demand for cloud-based security to secure critical national infrastructure and digital services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Network Security as a Service Market.- Zscaler

- Palo Alto Networks

- Fortinet

- Cisco Systems

- Juniper Networks

- Check Point Software Technologies

- McAfee (now owned by Symphony Technology Group)

- Symantec (Broadcom)

- Barracuda Networks

- Forcepoint (now part of Forcepoint LLC)

- Akamai Technologies

- Versa Networks

- CATO Networks

- Cloudflare

- SonicWall

- Trend Micro

- Microsoft

- Google Cloud

- AWS

- IBM Security

Frequently Asked Questions

Analyze common user questions about the Network Security as a Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Network Security as a Service (NSaaS) and how does it differ from traditional security solutions?

NSaaS is a cloud-delivered model providing essential network security functions, such as firewall, intrusion prevention, and web filtering, distributed via a global network of cloud points of presence. Unlike traditional solutions, NSaaS eliminates hardware appliances, offering centralized management, infinite scalability, and subscription-based consumption, making it ideal for securing remote users and hybrid cloud environments efficiently.

What is the relationship between NSaaS and Secure Access Service Edge (SASE)?

SASE (Secure Access Service Edge) is the overarching architectural framework that defines the convergence of network services (like SD-WAN) and cloud-delivered security services (NSaaS components like FWaaS, SWG, and ZTNA) into a unified, global platform. NSaaS represents the security component layer within the broader SASE framework, delivering the security functions necessary for a comprehensive SASE implementation.

Which industries are driving the highest adoption of NSaaS?

The Banking, Financial Services, and Insurance (BFSI) sector, along with IT & Telecommunication and Healthcare, are leading adoption. These industries handle vast amounts of sensitive data, face stringent regulatory compliance requirements (GDPR, HIPAA, PCI DSS), and rely heavily on distributed application access, necessitating the robust, scalable, and policy-driven security enforcement that NSaaS provides.

What are the primary benefits of migrating from a legacy security stack to NSaaS?

Key benefits include significant reduction in capital expenditure (CapEx), enhanced scalability to accommodate rapid business growth or remote workforce fluctuations, reduced operational complexity through centralized policy management, and improved security efficacy via access to real-time, AI-driven global threat intelligence delivered seamlessly to all users and devices.

What is Zero Trust Network Access (ZTNA) and why is it critical in NSaaS?

ZTNA is a core NSaaS component that enforces the "never trust, always verify" principle, providing granular, context-aware access to specific applications rather than broad network segments. It is critical because it secures access for remote users and minimizes lateral threat movement within the network, drastically improving the security posture over traditional, perimeter-based VPN architectures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager