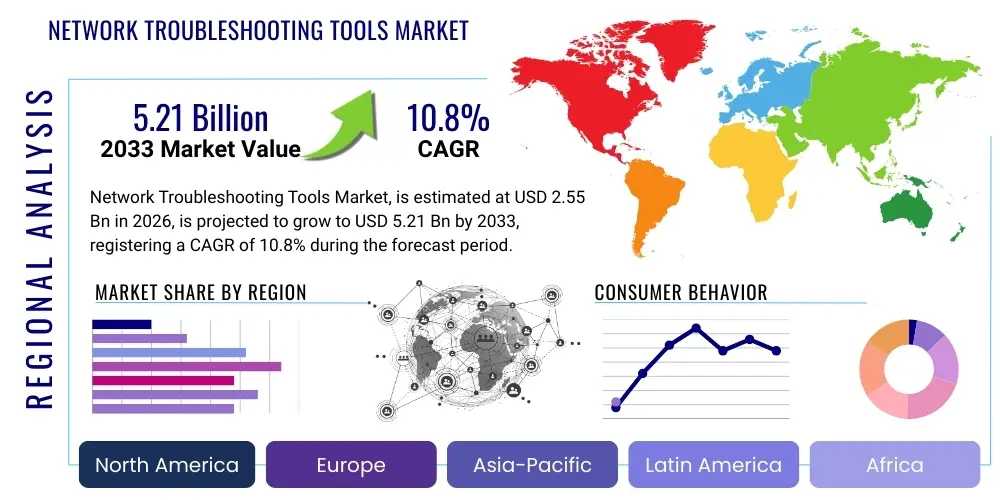

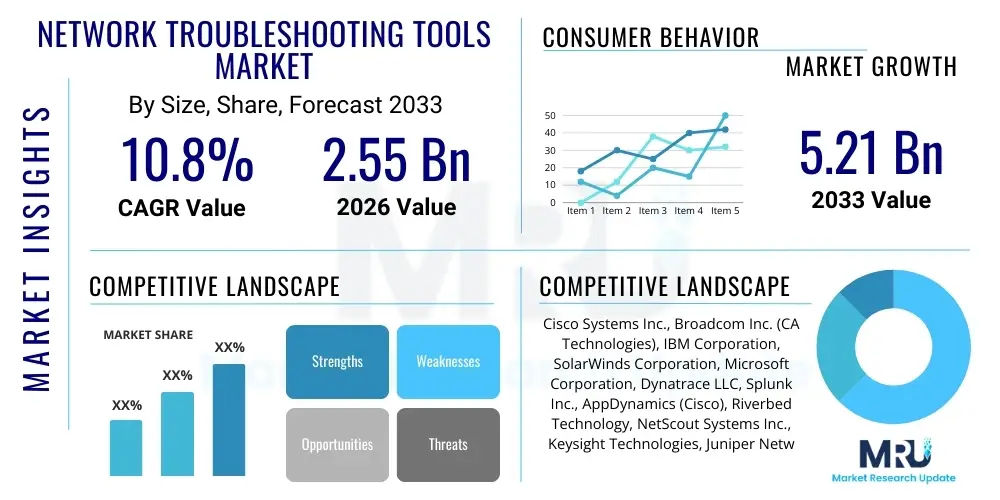

Network Troubleshooting Tools Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438779 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Network Troubleshooting Tools Market Size

The Network Troubleshooting Tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 2.55 Billion in 2026 and is projected to reach USD 5.21 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating complexity of enterprise network infrastructures, including hybrid cloud environments, Software-Defined Wide Area Networking (SD-WAN) deployments, and the explosive growth of connected devices stemming from IoT initiatives. Organizations are increasingly relying on advanced troubleshooting solutions to maintain service level agreements (SLAs), minimize downtime, and ensure optimal performance across globally distributed operations. The shift toward proactive monitoring and predictive analytics, facilitated by modern toolsets, further fuels this financial trajectory.

Network Troubleshooting Tools Market introduction

The Network Troubleshooting Tools Market encompasses a range of software and hardware solutions designed to diagnose, monitor, and resolve performance issues and faults within computer networks. These tools include packet sniffers, network performance monitoring (NPM) systems, root cause analysis engines, log analyzers, and fault management software. The core functionality revolves around providing deep visibility into network traffic, device health, and application performance, ensuring continuous connectivity and operational efficiency. Major applications span across large enterprises managing intricate global WANs, telecommunication providers optimizing their backbone infrastructure, and data centers requiring real-time performance diagnostics.

The primary benefits delivered by these sophisticated tools include significant reduction in Mean Time To Resolution (MTTR) for network incidents, enhanced security posture through traffic pattern analysis, and the capability to optimize resource allocation based on detailed performance metrics. Product descriptions highlight features like synthetic monitoring, digital experience monitoring (DEM), and integrated security analytics, moving beyond traditional ping and trace utility functions. Driving factors underpinning market growth include the necessity for managing dispersed workforces, the acceleration of digital transformation initiatives, and the critical dependence of mission-critical business applications on flawless network performance.

Network Troubleshooting Tools Market Executive Summary

Current business trends indicate a strong pivot towards integrating Artificial Intelligence (AI) and Machine Learning (ML) capabilities, leading to the emergence of AIOps platforms that automate root cause analysis and predictive maintenance, thereby transforming traditional reactive troubleshooting models into proactive and preventive strategies. Regional trends showcase North America maintaining market dominance due to early adoption of advanced technologies and the presence of major solution providers, while the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by massive investments in 5G infrastructure deployment and cloud migration projects across emerging economies like India and Southeast Asia. Segment trends confirm that cloud-based deployment models are rapidly gaining traction over traditional on-premise solutions, primarily due to their scalability, flexibility, and lower total cost of ownership (TCO), particularly appealing to Small and Medium-sized Enterprises (SMEs). Furthermore, the software segment, encompassing advanced analytics and monitoring suites, continues to hold the largest market share, reflecting the industry's focus on intelligence and automation rather than solely hardware-centric solutions.

AI Impact Analysis on Network Troubleshooting Tools Market

Users frequently inquire about how AI can move troubleshooting from reactive firefighting to predictive maintenance, seeking solutions that can automatically identify complex, non-obvious root causes across multi-vendor and hybrid cloud environments. Key concerns center on the reliability and interpretability of AI-driven insights, particularly regarding false positives and the potential requirement for new skill sets among IT staff to manage AIOps tools effectively. Users anticipate that AI integration will fundamentally enhance operational efficiency by automating Level 1 and Level 2 support tasks, drastically reducing human intervention needed for network incident management. This expectation fuels investments in platforms capable of processing vast telemetry data to derive actionable network intelligence, fundamentally changing how network operation centers (NOCs) function.

- AI enhances root cause analysis (RCA) by correlating millions of data points across logs, metrics, and traces, significantly reducing MTTR.

- Predictive failure identification allows network managers to resolve potential issues before they impact end-users, ensuring higher service availability.

- Intelligent alarming and noise reduction filters out redundant notifications, focusing IT teams solely on critical, high-impact incidents.

- AI enables self-healing network capabilities, automatically applying configuration changes or routing adjustments in response to detected performance degradation.

- Automation of repetitive diagnostic tasks, such as running scripts and collecting data dumps, frees up specialized network engineers for strategic work.

- Improved capacity planning and resource optimization based on ML models forecasting future traffic demands and saturation points.

DRO & Impact Forces Of Network Troubleshooting Tools Market

The Network Troubleshooting Tools Market is significantly propelled by the driver of increasing network complexity resulting from virtualization, containerization, and the proliferation of devices under the umbrella of the Internet of Things (IoT). Organizations recognize that manual troubleshooting is unsustainable in modern, highly dynamic environments, necessitating automated, sophisticated tools. However, the market faces restraints, primarily concerning the high initial capital expenditure required for deploying comprehensive, full-stack monitoring solutions and the inherent difficulty in integrating disparate legacy monitoring tools with newer, cloud-native platforms. Furthermore, the requirement for highly specialized personnel trained in network analytics and AIOps implementation presents a skill gap challenge.

Opportunities abound in the continued rollout of 5G infrastructure, which introduces new performance monitoring needs due to increased bandwidth and ultra-low latency requirements, particularly for edge computing applications. The growing necessity for robust cybersecurity visibility also drives the adoption of tools that integrate network performance monitoring with network detection and response (NDR) capabilities. The key impact forces include intense competitive pressure forcing vendors to rapidly incorporate AI features (technology push) and the stringent regulatory environment (e.g., GDPR, HIPAA) requiring high network visibility and data traceability (market pull), ensuring continuous innovation and functional expansion of the product portfolio.

Segmentation Analysis

The segmentation of the Network Troubleshooting Tools Market provides a granular view of specific technological preferences, deployment models, organizational purchasing power, and vertical adoption patterns. Understanding these segments is crucial for vendors tailoring their offerings, whether focusing on hardware probes for deep packet inspection, sophisticated software suites for large enterprises, or flexible cloud-based solutions for distributed environments. The market is primarily segmented based on components (Hardware, Software, Services), deployment type (On-premise, Cloud), organization size (SME, Large Enterprises), and end-user vertical (IT & Telecom, BFSI, Retail, Government). This detailed analysis helps identify high-growth sub-sectors, such as the increasing demand for network security forensics integrated into troubleshooting platforms, driven by the persistent threat landscape and the move toward zero-trust architectures.

The software component segment continues to dominate the market share, reflecting the shift from physical troubleshooting appliances to analytical and intelligence platforms. Within software, sophisticated tools offering real-time analytics, automated fault isolation, and digital experience monitoring (DEM) are experiencing paramount growth. Cloud deployment is the fastest-growing segment, influenced by the need for remote accessibility and management across hybrid cloud setups, allowing businesses to monitor dynamic, ephemeral network resources efficiently. This flexibility also lowers the barrier to entry for smaller organizations, expanding the overall addressable market size beyond traditionally large enterprise buyers who historically preferred on-premise solutions for heightened security control.

- Component

- Hardware (Network probes, diagnostic devices)

- Software (NPM solutions, packet sniffers, log analyzers, AIOps platforms)

- Services (Managed services, professional services, support and maintenance)

- Deployment Type

- On-premise

- Cloud-based

- Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- End-User Vertical

- IT & Telecommunication

- Banking, Financial Services, and Insurance (BFSI)

- Retail and E-commerce

- Healthcare and Life Sciences

- Government and Public Sector

- Manufacturing

Value Chain Analysis For Network Troubleshooting Tools Market

The value chain for network troubleshooting tools commences with the upstream activities of core technology development, including proprietary algorithms for packet analysis, telemetry processing, and advanced AI/ML model creation. Key activities at this stage involve sourcing specialized hardware components (e.g., network interface cards for high-speed capture) and investing heavily in R&D to maintain a competitive edge in performance monitoring and automation capabilities. Major vendors focus on acquiring intellectual property related to deep packet inspection (DPI) and synthetic monitoring technologies. The efficiency of this upstream phase dictates the functional richness and performance scalability of the final product, directly impacting market acceptance and differentiation.

The downstream segment primarily involves distribution channels and post-sale services. Distribution is largely handled through indirect channels, utilizing specialized value-added resellers (VARs), system integrators (SIs), and managed service providers (MSPs). These partners play a critical role in complex solution deployment, customization, and integration within diverse client infrastructures. Direct sales channels are typically reserved for strategic, large-scale enterprise contracts where bespoke architectural planning is required. Post-sale services, including ongoing technical support, software updates, and professional consultation for AIOps implementation, represent a significant revenue stream and crucial aspect of customer retention, enhancing the overall lifetime value of the customer relationship.

The integration of direct and indirect channels allows vendors to maximize market reach; indirect channels efficiently address the SME market through bundled services, while direct engagement ensures key accounts receive high-touch specialized support tailored to mission-critical environments. Effective channel partner management, including training and certification, is essential for maintaining product knowledge consistency across the market. The final consumption stage involves end-users deploying, configuring, and utilizing the tools, generating feedback that loops back to the R&D stage, creating a continuous improvement cycle centered around usability and performance in real-world scenarios.

Network Troubleshooting Tools Market Potential Customers

The primary buyers of network troubleshooting tools are organizations with complex, performance-critical network infrastructures where downtime directly translates to massive financial losses or significant operational disruption. Large enterprises across all vertical sectors, particularly those undergoing rapid digital transformation, represent the largest customer base. These organizations require full-stack observability solutions that integrate network data with application and infrastructure performance metrics to manage highly distributed environments, including multiple cloud providers and expansive global private networks. Chief Information Officers (CIOs), Network Operations Managers, and Site Reliability Engineers (SREs) are key decision-makers driving procurement in this segment.

Another crucial customer segment is the IT & Telecommunication vertical, comprising Internet Service Providers (ISPs), mobile network operators (MNOs), and cloud service providers. These entities require carrier-grade troubleshooting tools to monitor massive network backbones, ensure quality of service (QoS) for millions of subscribers, and rapidly diagnose core infrastructure faults, often necessitating hardware probes for high-speed packet capture and specialized monitoring for 5G core networks. Furthermore, Small and Medium-sized Enterprises (SMEs) are increasingly becoming potential customers, moving away from freeware tools towards affordable, subscription-based cloud monitoring services that offer enterprise-level features without the need for large upfront infrastructure investment or extensive in-house IT expertise. The growing adoption of remote work models further accelerates demand across all organization sizes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.55 Billion |

| Market Forecast in 2033 | USD 5.21 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cisco Systems Inc., Broadcom Inc. (CA Technologies), IBM Corporation, SolarWinds Corporation, Microsoft Corporation, Dynatrace LLC, Splunk Inc., AppDynamics (Cisco), Riverbed Technology, NetScout Systems Inc., Keysight Technologies, Juniper Networks, Datadog Inc., Extreme Networks, Accedian Networks, LogicMonitor, ManageEngine (Zoho Corporation), ThousandEyes (Cisco), VMWare Inc., Hewlett Packard Enterprise (HPE) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Network Troubleshooting Tools Market Key Technology Landscape

The current technology landscape in the network troubleshooting market is characterized by a heavy reliance on sophisticated data ingestion and analysis technologies, moving far beyond basic SNMP monitoring. Key technological foundations include Deep Packet Inspection (DPI) capabilities, which allow tools to analyze application payload data without decrypting it, providing granular visibility into application performance and identifying network bottlenecks at Layer 7. Furthermore, the integration of distributed tracing and log aggregation technologies, often leveraging open standards like OpenTelemetry, is crucial for obtaining end-to-end visibility across microservices and cloud-native architectures, which are notoriously difficult to troubleshoot using traditional point solutions.

The most transformative technology shaping this market is Artificial Intelligence for IT Operations (AIOps). AIOps platforms use machine learning algorithms to establish dynamic baselines of normal network behavior, enabling the automated detection of anomalies and the correlation of events across massive data sets. This shift facilitates predictive maintenance and automated remediation, reducing the mean time to detect (MTTD) incidents from hours to minutes. Another essential technology is Digital Experience Monitoring (DEM), which utilizes synthetic transactions and real-user monitoring (RUM) to measure performance from the end-user perspective, providing crucial context often missed by infrastructure-centric tools. DEM is particularly vital given the widespread adoption of remote work models and the increased reliance on SaaS applications.

Furthermore, technologies supporting Software-Defined Networking (SDN) and SD-WAN environments are paramount. Troubleshooting tools must seamlessly integrate with centralized SDN controllers to monitor dynamic path changes and traffic steering decisions. This requires specialized telemetry collection, often utilizing streaming data protocols rather than polled data methods, ensuring real-time performance insights. The continuous development of specialized hardware probes capable of handling 100G and 400G network speeds remains critical for high-frequency trading environments and massive data centers, ensuring that the underlying data capture remains comprehensive despite increasing bandwidth demands. Interoperability via APIs and adherence to open-source protocols are technological requirements demanded by modern, multi-vendor IT ecosystems.

Regional Highlights

- North America: North America holds the largest market share, driven by early adoption of advanced IT infrastructure, the presence of major cloud service providers, and a high concentration of sophisticated enterprise customers across the BFSI, IT, and healthcare sectors. The US market, in particular, is highly mature, characterized by significant R&D spending and rapid integration of cutting-edge technologies like AIOps and full-stack observability platforms. The need to manage increasingly complex hybrid and multi-cloud environments, coupled with stringent regulatory requirements for data integrity and network resilience, maintains a high demand for premium, integrated troubleshooting solutions. This region benefits from a robust competitive landscape fostering continuous innovation.

- Europe: The European market demonstrates steady growth, strongly influenced by stringent data protection and privacy regulations, such as GDPR, which necessitate highly visible and auditable network monitoring tools. Western European countries like the UK, Germany, and France are mature markets focusing on digital transformation in the manufacturing and retail sectors. The adoption is driven by the need for tools that can seamlessly manage multinational operations while ensuring compliance across varied jurisdictions. There is a notable uptake of cloud-based and managed troubleshooting services, particularly among SMEs looking to reduce operational complexity without compromising on network performance standards.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, buoyed by rapidly expanding digital economies, vast infrastructure investments in 5G networks, and widespread cloud migration across countries like China, India, and Japan. The burgeoning IT and telecom sector, along with the rapid industrialization in Southeast Asia, fuels massive demand for scalable network monitoring solutions. The market is highly price-sensitive, leading to increased adoption of flexible, cost-effective cloud-based models. Government initiatives promoting smart cities and digital governance also accelerate the deployment of high-performance network monitoring and diagnostic tools across the public sector.

- Latin America (LATAM): The LATAM market is characterized by increasing foreign direct investment in technology and a steady modernization of existing IT infrastructure, particularly in countries like Brazil and Mexico. The adoption of network troubleshooting tools is driven by the expansion of broadband connectivity and the necessity for improved operational efficiency in the burgeoning e-commerce and financial services sectors. While budget constraints often favor basic or open-source solutions, the growing complexity of critical networks is pushing enterprises toward adopting professional, scalable, and vendor-supported monitoring systems. Cloud adoption remains a key growth catalyst in this region.

- Middle East and Africa (MEA): The MEA region is experiencing growth tied to large-scale infrastructure projects, significant government investments in technology diversification (e.g., Saudi Vision 2030), and substantial growth in data center development. Gulf Cooperation Council (GCC) countries, in particular, show high demand for high-end network troubleshooting tools to support ambitious digital initiatives in oil & gas, smart city development, and defense. The proliferation of mobile internet services and the reliance on advanced telecom networks necessitate sophisticated fault management and performance monitoring solutions to ensure uninterrupted service delivery in often challenging environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Network Troubleshooting Tools Market.- Cisco Systems Inc.

- Broadcom Inc. (CA Technologies)

- IBM Corporation

- SolarWinds Corporation

- Microsoft Corporation

- Dynatrace LLC

- Splunk Inc.

- AppDynamics (Cisco)

- Riverbed Technology

- NetScout Systems Inc.

- Keysight Technologies

- Juniper Networks

- Datadog Inc.

- Extreme Networks

- Accedian Networks

- LogicMonitor

- ManageEngine (Zoho Corporation)

- ThousandEyes (Cisco)

- VMWare Inc.

- Hewlett Packard Enterprise (HPE)

Frequently Asked Questions

Analyze common user questions about the Network Troubleshooting Tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is AIOps and how is it transforming network troubleshooting?

AIOps, or Artificial Intelligence for IT Operations, is transforming network troubleshooting by leveraging machine learning and big data analytics to automate anomaly detection, identify root causes, and predict future network failures. It shifts the operational model from reactive diagnosis to proactive prevention, significantly reducing Mean Time To Resolution (MTTR) by correlating data from disparate sources (logs, metrics, traces) and filtering out alert noise, enabling IT teams to focus exclusively on high-impact issues.

Why is the adoption of cloud-based network troubleshooting tools increasing rapidly?

Cloud-based network troubleshooting tools are favored for their high scalability, lower Total Cost of Ownership (TCO), and flexibility, making them accessible to SMEs and crucial for monitoring distributed, hybrid, and multi-cloud network architectures. Cloud deployment eliminates the need for expensive, dedicated on-premise hardware and allows for rapid deployment and easy integration with other cloud services, providing centralized visibility for remote workforces and geographically dispersed infrastructure without geographical restrictions.

What are the primary challenges when integrating network troubleshooting tools into existing infrastructure?

The main challenges involve data silos and interoperability issues, particularly when integrating new, advanced tools with disparate legacy monitoring systems and diverse vendor ecosystems. Organizations struggle to unify data formats (telemetry, SNMP, logs) across multi-vendor networks. Furthermore, the volume of data generated by modern networks requires significant processing power, demanding robust APIs and specialized data ingestion capabilities to ensure real-time analysis without performance degradation.

How do network troubleshooting tools support security operations and threat detection?

Modern network troubleshooting tools, often categorized under Network Performance Monitoring (NPM) and Network Detection and Response (NDR), enhance security operations by providing deep visibility into network traffic patterns, which is essential for identifying malicious or anomalous behavior. They use deep packet inspection (DPI) to baseline normal traffic and quickly flag deviations, such as unauthorized data exfiltration or internal lateral movement, acting as a crucial component in threat hunting and post-incident forensic analysis.

Which end-user vertical segment drives the highest demand for advanced troubleshooting solutions?

The IT and Telecommunication vertical segment consistently drives the highest demand for advanced network troubleshooting solutions. This sector manages massive, complex network infrastructures (core networks, 5G backbones, global data centers) where maintaining ultra-low latency and high uptime is paramount for service delivery and competitive advantage. The scale and criticality of their operations necessitate carrier-grade, highly automated AIOps platforms capable of real-time monitoring and predictive maintenance across thousands of network elements.

End of Report. Character count targeted: 29,000 to 30,000 characters.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager