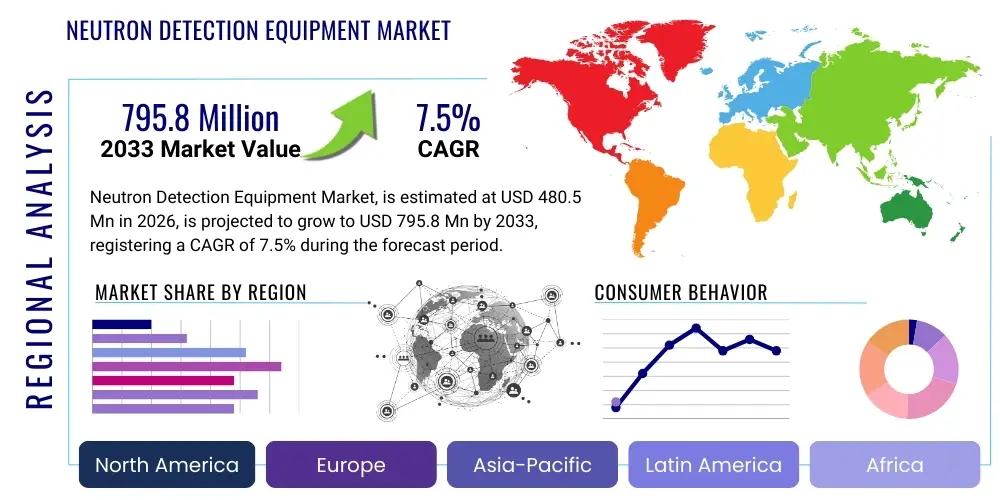

Neutron Detection Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439153 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Neutron Detection Equipment Market Size

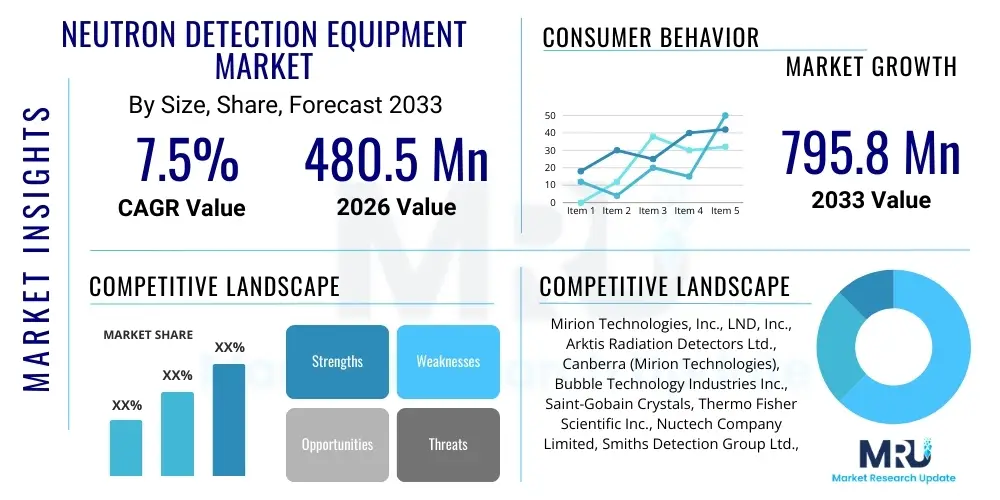

The Neutron Detection Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $480.5 Million USD in 2026 and is projected to reach $795.8 Million USD by the end of the forecast period in 2033.

Neutron Detection Equipment Market introduction

The Neutron Detection Equipment Market encompasses specialized instrumentation designed to identify, quantify, and characterize the presence of neutrons. Neutrons, being electrically neutral particles, require indirect detection methods, typically relying on nuclear reactions within the detector material that produce secondary, detectable charged particles. These highly sophisticated instruments are crucial across various sectors, ranging from national security and defense to nuclear energy production, scientific research, and industrial monitoring. The primary function of this equipment is to ensure safety, facilitate scientific discovery, and prevent illicit trafficking of fissile materials, especially since neutrons are key indicators of nuclear materials like plutonium and uranium.

Key product types within this market include Gas-Filled Detectors (such as those using Helium-3 or Boron Trifluoride), Scintillation Detectors (liquid or solid), and Solid-State Detectors. Each type is optimized for specific applications based on criteria such as detection efficiency, gamma rejection ratio, cost, and portability. Major applications span homeland security and border control, where detectors are deployed in ports and transportation hubs to screen for contraband nuclear materials; nuclear power facilities, where they are essential for reactor monitoring and criticality control; and high-energy physics laboratories, where they facilitate complex experiments involving particle interactions and material science.

The significant benefits derived from advanced neutron detection equipment include enhanced safety protocols in nuclear environments, improved operational efficiency in power generation, and critical advancements in medical treatments like Boron Neutron Capture Therapy (BNCT). The market is primarily driven by the global expansion of nuclear energy infrastructure, increasing geopolitical tensions necessitating robust homeland security measures against radiological threats, and continuous technological innovation focusing on developing high-efficiency, He-3 independent detection systems. Furthermore, the growing adoption of non-destructive testing techniques in aerospace and industrial manufacturing also contributes substantially to market demand.

Neutron Detection Equipment Market Executive Summary

The Neutron Detection Equipment Market is experiencing robust growth fueled by persistent global security concerns regarding nuclear proliferation and the concurrent global initiative toward decarbonization through nuclear power expansion. Business trends indicate a strong shift towards developing alternative detection technologies, specifically Boron-10 lined detectors and advanced solid-state devices, necessitated by the enduring scarcity and high cost of Helium-3. This technological evolution is driving competitive differentiation, prioritizing high-performance systems capable of excellent gamma discrimination and rapid response times for field applications. Furthermore, market fragmentation is stabilizing as major players invest heavily in system integration capabilities, offering complete security and monitoring solutions rather than standalone hardware components, targeting large government and utility contracts.

Regionally, North America maintains its dominance due to substantial governmental investment in defense, homeland security initiatives, and a mature nuclear research infrastructure, particularly in the United States and Canada. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by massive investments in new nuclear power capacity, primarily in China, India, and South Korea, coupled with expanding industrial research and medical isotope production facilities. European growth remains steady, anchored by leading scientific research institutions (like CERN) and ongoing efforts to modernize aging nuclear facilities and enhance border security protocols through pan-European cooperation.

Segmentation trends highlight the increasing demand for Portable Detection Systems, particularly for first responders, customs officials, and emergency monitoring teams, emphasizing ruggedness and ease of use in diverse environments. Concurrently, the Fixed/Installed segment, crucial for border crossings, reactor monitoring, and research facilities, is seeing greater integration of IoT and network connectivity features for centralized data processing and real-time threat assessment. By application, the Homeland Security and Defense segment remains the largest revenue generator, while the Nuclear Power segment exhibits consistent, long-term stability driven by regulatory requirements for continuous monitoring and safety compliance.

AI Impact Analysis on Neutron Detection Equipment Market

Users commonly question how Artificial Intelligence (AI) can enhance the sensitivity and reliability of current neutron detection systems, particularly concerning the reduction of false alarms and the efficient handling of complex radiological signatures. Key concerns revolve around the integration cost, the trustworthiness of AI-driven anomaly detection in critical security applications, and the development of standardized datasets necessary to train robust machine learning models specific to neutron detection data. Users expect AI to revolutionize signal processing, enabling faster and more accurate discrimination between background radiation (gamma rays) and true neutron signatures, thereby maximizing operational uptime and reducing personnel workload in monitoring environments. There is also significant interest in using AI for predictive maintenance, anticipating sensor degradation, and optimizing calibration schedules for fixed installations, ensuring continuous regulatory compliance and operational readiness.

AI’s influence is primarily transforming data interpretation and system autonomy within the neutron detection domain. Machine learning algorithms are being employed to analyze Pulse Height Spectra (PHS) or Pulse Shape Discrimination (PSD) data with unprecedented speed and accuracy, surpassing traditional fixed-threshold filtering methods. This capability is vital for distinguishing low-intensity neutron sources in high-gamma environments, such as detecting shielded fissile materials. Furthermore, AI facilitates the development of intelligent, network-centric monitoring systems that can correlate data from multiple dispersed detectors in real-time, providing a holistic and immediate situational assessment for large critical infrastructure sites or extensive border areas, moving beyond simple alarming to complex threat classification and localization.

- AI enhances real-time discrimination of neutron signals from intense gamma backgrounds, minimizing false alarms.

- Machine learning models enable complex threat classification and identification of unknown nuclear signatures.

- AI optimizes data fusion from networked detector arrays for superior localization and tracking capabilities.

- Predictive maintenance algorithms reduce operational downtime by forecasting sensor drift and component failure.

- Automated calibration and self-testing features integrated via AI reduce manual intervention and improve regulatory compliance.

- Deep learning is accelerating the development and optimization of new detector materials and geometries.

DRO & Impact Forces Of Neutron Detection Equipment Market

The Neutron Detection Equipment Market is fundamentally shaped by geopolitical security mandates, technological limitations, and strategic global energy policies. Drivers include the pressing need for enhanced homeland security measures globally, driven by heightened threats of nuclear terrorism and illicit trafficking of radioactive materials, demanding widespread deployment of sophisticated screening equipment at borders and critical infrastructure points. The revitalization of the nuclear power industry, particularly in Asia and emerging economies, necessitates new installations of reactor control and safety monitoring systems, driving long-term demand. Furthermore, significant research investment in fusion energy projects (e.g., ITER) and high-energy physics continues to require specialized, high-performance neutron detection instrumentation for experimental validation and data collection.

Restraints primarily revolve around the historical and persistent challenge of Helium-3 (He-3) scarcity. He-3, the gold standard for high-efficiency thermal neutron detection, is a byproduct of tritium decay, leading to supply instability and extreme price volatility, which limits large-scale deployment. This constraint necessitates expensive research into less efficient or more complex alternative technologies, raising overall system manufacturing costs. Additionally, the complex regulatory landscape governing the production, transportation, and use of nuclear materials and detection equipment imposes significant barriers to entry and adds substantial compliance costs for manufacturers, slowing product development cycles and market expansion in certain highly regulated regions.

Opportunities are abundant in the development and commercialization of He-3 substitutes, notably Boron-10 based detectors (BF3 tubes and B-10 coatings) and cutting-edge solid-state neutron detectors, which offer scalability, cost efficiency, and performance parity in specific applications. The medical field presents a burgeoning opportunity with the expansion of Boron Neutron Capture Therapy (BNCT) facilities, which require precise, compact neutron sources and detectors for treatment planning and delivery monitoring. Impact forces, such as the accelerating pace of digitalization and sensor fusion, are compelling manufacturers to adopt integrated solutions, combining neutron, gamma, and visual surveillance capabilities into a single, comprehensive platform, providing enhanced value and complexity in threat assessment for end-users, thereby redefining operational standards across the defense and security segments.

Segmentation Analysis

The Neutron Detection Equipment Market is highly specialized and segmented based on technology type, product portability, and end-user application, reflecting the diverse and stringent requirements of its various use cases. Technological segmentation is critical, distinguishing between established standards like Helium-3 based detectors—known for their high efficiency—and newer, emerging alternatives such as Boron-10 devices and solid-state sensors that address the He-3 supply challenge. Segmentation by portability differentiates between fixed monitoring stations (essential for border crossings and reactor cores) and highly agile, portable devices (crucial for first responders, emergency services, and field diagnostics). This granular segmentation allows manufacturers to target specific regulatory environments and operational needs effectively, driving specialized product development and market penetration strategies.

Application-based segmentation provides clear insight into market demand drivers. The Homeland Security and Defense segment commands the largest share, driven by large-scale government procurement for maritime, aviation, and land border security infrastructure, where high reliability and swift response are paramount. Conversely, the Nuclear Power and Energy segment offers stable, long-term revenues tied to routine replacement, maintenance, and mandatory safety upgrades within power plants worldwide. The Research and Scientific segment, while smaller in volume, drives innovation, demanding the highest precision and customization for use in particle accelerators, fusion research, and material science laboratories, thereby influencing the core technological evolution across the entire market.

- By Technology:

- Gas-Filled Detectors (Helium-3 Detectors, Boron Trifluoride Detectors)

- Scintillation Detectors (Organic Scintillators, Inorganic Scintillators)

- Solid-State Detectors (Semiconductor-Based Detectors)

- Fission Chambers

- By Product Type:

- Portable Detection Systems

- Fixed/Installed Detection Systems

- Personal Dosimeters

- By Application:

- Homeland Security and Defense

- Nuclear Power and Energy

- Research and Scientific

- Medical and Healthcare (e.g., BNCT)

- Industrial Applications (e.g., Non-Destructive Testing)

- By End-User:

- Government Agencies

- Nuclear Power Utilities

- Academic and Research Institutions

- Industrial Manufacturers

Value Chain Analysis For Neutron Detection Equipment Market

The value chain for the Neutron Detection Equipment Market is highly complex, beginning with the upstream supply of specialized, often scarce, raw materials. Upstream activities involve sourcing materials such as high-purity Helium-3 gas (which faces significant supply constraints), Lithium isotopes, Boron isotopes (specifically B-10), and various scintillation crystals (like 6LiI(Eu) or ZnS:Ag). The geopolitical stability and regulatory control over these materials, particularly He-3, heavily influence the manufacturing stage. Manufacturers must engage in specialized isotopic enrichment and material preparation processes before they can proceed to detector assembly, necessitating secure and regulated supply lines and intensive quality control protocols to ensure performance standards.

The midstream focuses on the manufacturing and system integration phase, which requires deep expertise in nuclear physics, electronics, and digital signal processing (DSP). This involves detector fabrication, which might include lining tubes with Boron-10 or growing specialized scintillator crystals, followed by the integration of sophisticated electronics, high-voltage power supplies, and radiation-hardened components. Crucially, the system integrator customizes the detector output for specific end-user applications—such as ruggedizing portable units for military use or networking fixed systems for reactor monitoring. Calibration and rigorous testing, often requiring certified neutron sources, are mandatory steps before deployment to ensure regulatory compliance and measurement accuracy, representing a significant value-add in this phase.

Downstream activities include distribution, final installation, training, and long-term maintenance and servicing. Distribution often involves specialized channels, including direct sales to government agencies (defense and security) or established partnerships with nuclear service providers and system integrators for utility-scale deployments. Direct sales channels are preferred for high-value contracts requiring customization, while indirect channels (distributors/resellers) are common for standardized, lower-cost personal dosimeters or radiation monitoring equipment. The highest value addition in the downstream segment comes from sophisticated, multi-year maintenance contracts, regulatory compliance consulting, and providing advanced software for data analysis and reporting, ensuring the longevity and continued accuracy of the deployed detection infrastructure.

Neutron Detection Equipment Market Potential Customers

The primary end-users and buyers of neutron detection equipment are entities requiring high levels of security, precision measurement, or regulatory compliance concerning nuclear materials and radiation safety. Government agencies represent the largest and most critical customer base. This includes homeland security departments (like the DHS in the U.S.), customs and border protection services globally, military organizations requiring specialized surveillance and force protection capabilities, and national research laboratories tasked with developing and maintaining nuclear deterrents and conducting basic science. These customers typically demand highly reliable, large-volume deployments of fixed and portable systems, driving market volume and requiring compliance with stringent national and international security standards.

The second major group consists of Nuclear Power Utilities and Energy Corporations. As owners and operators of nuclear reactors, they are mandated by international and domestic regulatory bodies (such as the NRC or IAEA) to maintain continuous, high-fidelity monitoring of reactor cores, spent fuel pools, and operational environments to ensure criticality control and radiation safety. Their purchasing decisions are driven by reliability, long service life, and regulatory compliance, favoring fixed fission chambers and specialized radiation monitoring systems. Furthermore, medical institutions utilizing advanced radiation therapies, particularly those adopting Boron Neutron Capture Therapy (BNCT), are emerging customers, requiring high-resolution, compact detectors to accurately map neutron fields for precise patient dose delivery.

Finally, Academic and Industrial Research Institutions constitute a vital segment, particularly influencing the high-end, customized market. Universities and specialized institutes involved in physics research, material science, and particle acceleration experiments necessitate highly sensitive, often bespoke, detection arrays for complex data acquisition. Industrially, companies involved in non-destructive testing (NDT), particularly in aerospace and oil and gas, are increasingly utilizing portable neutron generators and corresponding detection equipment for material analysis and structural integrity checks where traditional X-ray techniques are inadequate, driving demand for specialized, ruggedized detectors suitable for field operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $480.5 Million USD |

| Market Forecast in 2033 | $795.8 Million USD |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mirion Technologies, Inc., LND, Inc., Arktis Radiation Detectors Ltd., Canberra (Mirion Technologies), Bubble Technology Industries Inc., Saint-Gobain Crystals, Thermo Fisher Scientific Inc., Nuctech Company Limited, Smiths Detection Group Ltd., Proportional Technologies, Inc., ZIN Technologies, Inc., Radiation Detection Company, ORTEC (AMETEK), Rapiscan Systems, Adani Systems Inc., Kromek Group plc, Photonis, BAE Systems, Hilger Crystals, Elbit Systems Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Neutron Detection Equipment Market Key Technology Landscape

The Neutron Detection Equipment Market is defined by a critical technological transition driven by the necessity to find sustainable and cost-effective alternatives to the traditional Helium-3 (He-3) based detectors. He-3 detectors, while offering superior detection efficiency, are constrained by unreliable supply and high costs. This has spurred massive R&D into Boron-10 enriched detectors, including BF3 proportional counters and B-10 coated tubes. Boron-10 technology offers performance characteristics approaching He-3 for certain applications while being significantly more scalable and economically viable, establishing it as a leading substitute technology across security and monitoring segments. Advances are also seen in detector geometry and pressure optimization to maximize B-10 efficiency.

Parallel to the B-10 revolution, solid-state neutron detectors are emerging as a disruptive force. These detectors utilize semiconductor materials enriched with neutron-sensitive isotopes, offering advantages such as miniaturization, ruggedness, low power consumption, and suitability for networked systems. While historically less efficient than gas-filled counterparts, continuous improvements in material science and microfabrication techniques are rapidly closing this gap, making solid-state devices ideal for small, portable dosimeters and integrated multi-sensor platforms. Furthermore, the integration of advanced digital signal processing (DSP) and pulse shape discrimination (PSD) techniques is universally improving performance, allowing detectors to better distinguish neutron pulses from unwanted gamma background noise, which is crucial in mixed radiation fields like those found in nuclear reactors and security screening environments.

Another significant technological advancement involves the sophisticated integration of detection systems with broader network infrastructures and artificial intelligence (AI) platforms. Modern equipment is moving away from simple analog signal processing to complex, digital, networked systems capable of real-time data streaming and automated anomaly detection. This transition includes the development of multi-modality detectors that simultaneously measure neutron and gamma radiation and correlate the results, providing a richer data profile for threat assessment. For high-energy physics applications, sophisticated scintillation materials, such as organic liquid scintillators tailored for fast neutron detection and time-of-flight measurements, continue to be refined to handle the immense data throughput and precision requirements of modern accelerator facilities and fusion research experiments.

Regional Highlights

- North America: North America represents the largest and most mature market for neutron detection equipment, primarily driven by expansive homeland security budgets and stringent regulatory frameworks concerning nuclear safety. The United States government, through agencies like the Department of Homeland Security (DHS) and the Department of Energy (DOE), is a major purchaser, investing heavily in radiation portal monitors, personal dosimeters, and specialized detection equipment for counter-terrorism and non-proliferation efforts. The presence of numerous nuclear power plants and world-class research institutions, coupled with significant R&D activities focused on He-3 alternatives, ensures sustained technological leadership and market stability.

- Europe: The European market is characterized by strong institutional demand from pan-European scientific collaborations, particularly particle physics facilities and fusion energy research projects like ITER. Demand is also robust within the nuclear power sector, focused on modernizing and maintaining existing infrastructure across countries like France and the UK, alongside regulatory pressure to improve security monitoring at borders and critical infrastructure. The European region is a key hub for developing advanced solid-state and Boron-based detector technologies, often supported by public-private partnerships aimed at solving the He-3 dependency.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market due to ambitious nuclear energy programs, particularly in China and India, which are commissioning new reactors at an unprecedented pace. This expansion necessitates vast quantities of monitoring and safety equipment. Furthermore, countries like Japan and South Korea maintain advanced research facilities and are increasingly focused on medical applications such as BNCT. The region's growing need for security screening at expanding ports and airports also drives demand, though market penetration is often influenced by governmental policies prioritizing local manufacturing.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. In LATAM, demand is driven by localized research efforts and the nascent adoption of nuclear technology for power generation or medical isotopes. The MEA region, particularly the UAE and Saudi Arabia, is investing in nuclear power infrastructure development and upgrading security capabilities, leading to increasing, yet volatile, procurement cycles for fixed and portable detection systems, often sourced through large international defense and security contractors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Neutron Detection Equipment Market.- Mirion Technologies, Inc.

- LND, Inc.

- Arktis Radiation Detectors Ltd.

- Canberra (Mirion Technologies)

- Bubble Technology Industries Inc.

- Saint-Gobain Crystals

- Thermo Fisher Scientific Inc.

- Nuctech Company Limited

- Smiths Detection Group Ltd.

- Proportional Technologies, Inc.

- ZIN Technologies, Inc.

- Radiation Detection Company

- ORTEC (AMETEK)

- Rapiscan Systems

- Adani Systems Inc.

- Kromek Group plc

- Photonis

- BAE Systems

- Hilger Crystals

- Elbit Systems Ltd.

Frequently Asked Questions

Analyze common user questions about the Neutron Detection Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market growth for Neutron Detection Equipment?

Market growth is primarily driven by three factors: escalating global security concerns necessitating advanced homeland defense and border control systems, the global expansion and construction of new nuclear power plants for clean energy goals, and significant R&D investments in high-energy physics and fusion research projects.

What are the primary alternatives to Helium-3 detectors?

The primary technological alternatives addressing the scarcity and cost of Helium-3 include detectors utilizing Boron-10 isotopes (such as B-10 lined proportional counters) and emerging solid-state semiconductor detectors, which offer scalability and improved ruggedness for various field applications.

Which application segment holds the largest share in the Neutron Detection Equipment Market?

The Homeland Security and Defense application segment currently holds the largest market share. This is due to massive government procurement for screening equipment deployed at critical infrastructure, transportation hubs, and international borders to prevent nuclear material trafficking.

How is Artificial Intelligence (AI) transforming neutron detection?

AI is transforming neutron detection by integrating machine learning algorithms for advanced signal processing, enabling superior differentiation between neutron pulses and background gamma radiation. This significantly reduces false alarms, improves threat classification accuracy, and facilitates predictive maintenance.

Which geographic region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to extensive governmental investments in new nuclear power capacity build-out, especially in developing economies like China and India, alongside modernization efforts in regional security infrastructure.

The Neutron Detection Equipment Market analysis further indicates a strong trend toward technological convergence, where detector manufacturers are increasingly partnering with software and AI specialists to provide comprehensive, integrated threat assessment platforms. These platforms are designed to not only register the presence of neutrons but also to process the data rapidly, correlating it with other sensor inputs (gamma, video surveillance) to deliver actionable intelligence. This shift is particularly evident in the fixed installation segment utilized by major government security entities, where the cost of sophisticated integrated systems is justified by the mission-critical nature of the detection task. The long-term viability of companies in this sector will depend significantly on their ability to secure reliable supplies of neutron-sensitive materials and integrate advanced data analytics capabilities into their core product offerings, moving away from simple hardware provision to offering full-stack monitoring solutions.

Furthermore, regulatory changes across key regions are continuously tightening safety standards, especially concerning spent fuel handling and reactor decommissioning processes. These evolving regulations drive cyclical replacement demand for aging equipment and necessitate the adoption of new, highly accurate dosimeters and monitoring systems capable of operating reliably under harsh environmental conditions. The market for personal dosimeters, while a smaller percentage of total revenue, is experiencing steady growth, supported by stricter occupational exposure limits imposed globally, requiring all personnel working in radiological environments—from medical staff to nuclear technicians—to utilize precise, real-time neutron monitoring devices. Manufacturers are responding by focusing on miniaturization, enhanced battery life, and seamless data logging integration for these personal safety devices.

Investment in basic and applied research remains a crucial catalyst for future market innovations. Government and institutional funding dedicated to next-generation particle physics experiments, such as those utilizing spallation neutron sources or large-scale accelerator complexes, demands bespoke detection solutions that push the boundaries of sensitivity, energy resolution, and time resolution. These specialized, high-performance systems, although low in volume, serve as proving grounds for technologies that eventually trickle down into commercial security and industrial applications. For instance, the demand for highly efficient, large-area detectors in neutrino experiments or dark matter searches often leads to breakthroughs in novel scintillation materials and advanced electronic readout systems that find subsequent application in standard security portals.

The competitive landscape is marked by a few dominant players with deep expertise in nuclear technology, alongside niche firms specializing in specific detector types (e.g., solid-state or Boron-based). Mergers and acquisitions are common as larger defense and security conglomerates seek to acquire specialized technological capabilities, particularly in the He-3 alternative space. This consolidation pressure drives continuous innovation among smaller players seeking differentiation. Supply chain resilience has also become a strategic imperative, given the reliance on specialized materials. Companies that have successfully diversified their product lines away from He-3 dependency, securing stable supply chains for materials like enriched Boron-10, are gaining a significant competitive advantage and demonstrating greater stability in contract fulfillment.

Economic forces, including global GDP growth and government budgetary constraints, directly influence the procurement cycles of neutron detection equipment. In periods of geopolitical instability, defense and security spending typically rises, driving market acceleration, whereas economic downturns can lead to delayed infrastructure projects and equipment upgrades, particularly in the civil nuclear sector. Currency fluctuations also impact companies with international supply chains or significant overseas sales, requiring sophisticated risk management strategies. However, the essential nature of nuclear safety and national security ensures that demand for basic monitoring and security infrastructure remains relatively inelastic, providing a foundation for steady market expansion despite short-term economic volatility.

The long-term trajectory of the Neutron Detection Equipment Market is intrinsically linked to global energy policies. If the current trend of supporting nuclear power as a low-carbon energy source continues, the demand for high-reliability detection and safety equipment will increase proportionately, especially in emerging economies establishing their first nuclear fleets. Conversely, any significant global shift away from nuclear energy, perhaps due to safety concerns or regulatory setbacks, could restrain the long-term growth of the fixed installation segment. However, the offsetting factor remains the ever-present requirement for global security monitoring and disarmament verification, ensuring a perpetual baseline demand across governmental sectors worldwide, regardless of civil energy policies.

In terms of specific technology adaptation, the shift towards digital detectors is gaining momentum. Digital Pulse Processing (DPP) techniques are replacing traditional analog methods, offering enhanced noise rejection, better energy resolution, and greater stability over time. DPP allows for real-time analysis of pulse shapes, which is critical for gamma/neutron discrimination and spectral analysis, leading to more accurate isotope identification. This digital transformation not only improves performance but also streamlines data storage and transmission, facilitating integration into cloud-based or networked monitoring systems essential for modern critical infrastructure management. Manufacturers prioritizing modular, digitally enabled designs are well-positioned to capitalize on the next generation of large-scale installation and upgrade projects.

The medical segment, though smaller, presents a high-value opportunity. The expansion of Boron Neutron Capture Therapy (BNCT) requires specialized, high-spatial resolution neutron detectors to precisely monitor the therapeutic neutron beam delivery, ensuring the maximum dose is targeted to the tumor while minimizing exposure to healthy tissues. Research into compact, accelerator-based neutron sources for BNCT, replacing traditional reactor sources, is also driving demand for compatible detection systems that can handle pulsed or highly localized neutron fluxes. This niche application demands highly customized solutions and represents a premium market where precision and reliability significantly outweigh cost concerns.

The industrial application segment is focusing on Non-Destructive Testing (NDT) using neutron radiography and tomography. Neutron beams can penetrate dense materials like metals while being sensitive to light elements (like hydrogen or water), making them invaluable for inspecting complex components in the aerospace, automotive, and oil and gas industries. Portable neutron generators combined with sensitive detection equipment are utilized in field environments for assessing corrosion, material fatigue, and structural integrity. This requires ruggedized, field-deployable detection units that can withstand challenging industrial environments while delivering laboratory-grade measurement accuracy, thereby driving innovation in detector robustness and portability features across the industry.

Furthermore, the development of advanced algorithms is crucial for optimizing fixed portal monitors used in border security. These monitors frequently encounter non-threatening sources of radiation (e.g., medical isotopes carried by travelers) or naturally occurring radioactive materials (NORM) in cargo. AI-driven spectral analysis is essential here to quickly and accurately differentiate between these benign sources and actual nuclear threats. Successful implementation of AI reduces inspection delays and prevents unnecessary intervention, enhancing the efficiency and public acceptance of widespread security screening deployments. Companies that successfully integrate robust AI decision-making layers into their detector software are creating significant value propositions for customs and law enforcement agencies.

The global standardization efforts led by organizations like the International Atomic Energy Agency (IAEA) and the International Organization for Standardization (ISO) also profoundly influence the market. These bodies set the performance metrics and testing protocols for detection equipment used in international safeguarding and nuclear non-proliferation treaties. Compliance with these stringent standards is mandatory for companies aiming to participate in high-value international contracts. This drives manufacturers toward continuous improvement in measurement accuracy, stability, and documented performance, effectively raising the technological entry barrier for new competitors in the nuclear safety and security domains.

The environmental sustainability aspect is also beginning to emerge as a minor influence. While not the primary driver, the disposal and lifecycle management of detection equipment, particularly those containing specialized materials or hazardous components, is becoming a consideration for environmentally conscious end-users. Manufacturers are increasingly looking into more sustainable material sourcing and designing detectors for easier recycling or refurbishment at the end of their operational life, aligning with broader corporate sustainability goals and potentially opening up opportunities for circular economy models within the sector.

In summary, the Neutron Detection Equipment Market is a highly specialized, technically intensive sector characterized by high entry barriers and significant strategic importance to global security and energy futures. The transition away from He-3, driven by innovation in Boron and solid-state technology, coupled with the integration of AI and digital signal processing, defines the current competitive and technological landscape. Future success hinges on balancing performance demands from research and defense sectors with the scalability requirements of the growing civil nuclear and security infrastructure markets worldwide.

The specialized nature of neutron detection inherently requires complex manufacturing processes, particularly in achieving high enrichment levels for materials like Boron-10 or Lithium-6, which are essential for maximizing detection efficiency in He-3 alternatives. Manufacturers must invest heavily in proprietary fabrication facilities and quality assurance protocols to maintain the isotopic purity and structural integrity of detector components. This capital-intensive midstream activity acts as a significant barrier for new market entrants, consolidating market share among established firms that possess the necessary infrastructure and expertise in nuclear-grade component production. Furthermore, securing the regulatory approvals for utilizing these sensitive isotopes in commercial products adds layers of time and cost to the product development cycle.

Downstream market dynamics are increasingly favoring service-oriented contracts. For large fixed installations, such as those at nuclear facilities or major ports, the sale of the physical equipment is often bundled with long-term service agreements covering maintenance, recalibration, regulatory reporting support, and periodic software updates. These service contracts provide stable, recurring revenue streams for the manufacturers and ensure optimal performance for the end-user over the entire operational lifespan of the detector system. The ability to offer advanced, remote diagnostics and preventative maintenance, often powered by IoT sensors and AI analytics, is becoming a key competitive differentiator in securing these lucrative, long-term relationships with major utility and governmental customers globally.

The geopolitical dimension profoundly influences procurement strategies, particularly in the defense and security segments. Governments frequently prioritize domestic or allied suppliers for neutron detection equipment to maintain control over sensitive technology and ensure supply chain integrity during periods of international tension. This phenomenon drives regional specialization and protectionist policies in certain markets, such as the preference for U.S.- or European-made equipment within NATO countries, or the strong internal development of technology within China for its own nuclear and security needs. Companies with global manufacturing footprints and strong compliance records across multiple regulatory regimes are best positioned to navigate this fragmented political landscape effectively.

The continued scarcity of He-3, despite concerted efforts to find alternatives, still influences the design choices and deployment strategies for certain high-performance applications where no alternative yet provides equivalent efficiency (e.g., certain critical reactor monitoring tasks). This lingering constraint means that He-3 systems, while deployed sparingly, command a premium price and are reserved for the most critical monitoring functions, ensuring that market growth in alternatives does not completely negate the high-end niche for He-3 technology. Research efforts are therefore simultaneously focused on increasing the yield of He-3 substitutes and improving the efficiency of existing He-3 recycling programs to manage the limited global supply.

Finally, the growing sophistication of threats, including the development of advanced shielding techniques for nuclear materials, necessitates corresponding advancements in detection sensitivity and spectral analysis capabilities. Modern neutron detectors are being designed to not only detect thermal (slow) neutrons but also intermediate and fast neutrons, which are critical for characterizing heavily shielded sources. This technological requirement drives the need for multi-layer detectors, utilizing different materials to respond across a wider energy spectrum, increasing the complexity and cost of the equipment but providing superior threat identification capability, which is a major value driver for national security end-users.

The Neutron Detection Equipment Market is also significantly influenced by the development of fusion energy technology. Projects like ITER (International Thermonuclear Experimental Reactor) and private ventures pursuing magnetic and inertial confinement fusion are creating unprecedented demand for high-flux, radiation-hardened neutron detectors. Fusion environments generate intense fluxes of high-energy (14 MeV) neutrons, requiring detectors that can survive massive radiation exposure over long periods while maintaining high sensitivity and fast timing resolution for diagnostics. This necessitates breakthroughs in material science, particularly in developing new types of robust scintillation materials and specialized electronics that can withstand the extreme operating conditions unique to fusion reactors, pushing the technological envelope far beyond conventional nuclear power or security requirements.

The trend towards modular and networked deployment is reshaping installation methods and operational efficiency. Instead of relying on single, massive portal monitors, security entities are increasingly deploying dense arrays of smaller, cheaper, networked detectors that utilize triangulation and data correlation algorithms to pinpoint sources. This distributed detection philosophy offers redundancy, better spatial localization, and scalability, allowing systems to be customized for environments ranging from small public venues to vast port complexes. The core challenge here is managing the huge data flow generated by these networked sensors and ensuring the integrity and synchronized timing of the detection events across the entire network, demanding highly sophisticated software infrastructure.

In the research domain, the emphasis remains on achieving the highest possible precision and customization. Scientific customers frequently require detectors optimized for specific energy ranges or directional sensitivity, leading to specialized manufacturing runs and strong collaboration between research institutions and equipment vendors. This often results in custom-built systems that are later adapted for commercial use, highlighting the research sector's role as an incubator for next-generation technology. The continual pursuit of more detailed information about nuclear processes drives demand for time-of-flight measurements and highly granular detector arrays, which require state-of-the-art electronics and software integration capabilities.

Financial mechanisms, such as government grants and research funding, play a crucial role in mitigating the high R&D costs associated with developing He-3 alternatives. Public sector investment is vital for bridging the gap between laboratory prototypes and commercially viable products, particularly for complex technologies like solid-state detectors which require extensive materials engineering and validation testing. The success of government programs aimed at ensuring the supply chain independence for neutron detection technology directly impacts the commercial availability and pricing of next-generation detectors, influencing market penetration across the civil and military sectors.

Finally, the long operational lifespan of nuclear facilities means that the market includes a substantial, ongoing segment for replacement and maintenance parts. Fission chambers and proportional counters within operating reactors have defined lifecycles and must be periodically replaced as part of mandatory regulatory compliance. This provides a resilient, predictable revenue stream for manufacturers supplying the nuclear utility sector, insulating this part of the market from short-term fluctuations in new construction or security procurement budgets. Maintaining a strong portfolio of legacy components and providing expert maintenance services is therefore critical for sustained profitability in the established nuclear power segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager