New Energy Sanitation Vehicle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433028 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

New Energy Sanitation Vehicle Market Size

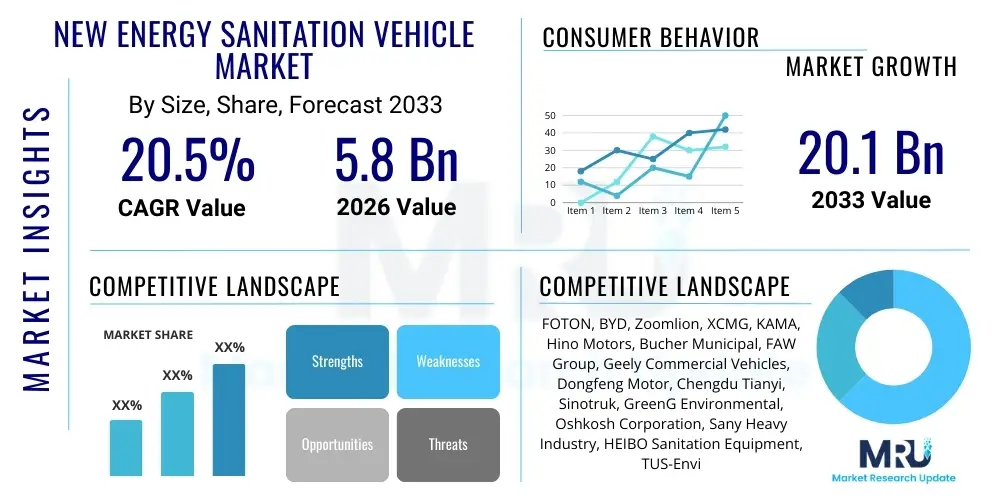

The New Energy Sanitation Vehicle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 20.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 20.1 Billion by the end of the forecast period in 2033.

New Energy Sanitation Vehicle Market introduction

The New Energy Sanitation Vehicle market encompasses specialized urban service vehicles powered predominantly by electric batteries (BEV), hybrid electric systems (HEV), or hydrogen fuel cells (FCEV), designed specifically for municipal cleanliness and waste management operations. This category includes a broad spectrum of equipment such as refuse compactors, street sweepers, washing trucks, and sewage disposal vehicles, all leveraging sustainable power sources to reduce carbon emissions and acoustic pollution in densely populated areas. The transition from traditional diesel engines to new energy powertrains represents a fundamental shift driven by global commitments to achieving net-zero emissions targets and improving urban air quality standards, making these vehicles critical infrastructure assets for modern, environmentally conscious cities.

The core product offerings in this sector focus on maintaining or exceeding the operational capabilities of their internal combustion engine (ICE) predecessors while introducing significant benefits in terms of efficiency and environmental impact. Major applications involve routine waste collection and transport, comprehensive street cleaning and dust suppression, and high-pressure washing of public infrastructure. The inherent benefits of these vehicles—including lower operating costs due to reduced fuel consumption and maintenance needs, along with silent operation—are compelling factors for municipal procurement agencies seeking long-term budgetary stability and enhanced community welfare. These vehicles often feature regenerative braking systems, sophisticated battery thermal management, and integrated charging solutions optimized for demanding daily duty cycles.

Market expansion is primarily fueled by stringent governmental regulations and subsidies promoting the adoption of low-emission vehicles in public fleets. Key driving factors include urban population growth requiring expanded sanitation services, advancements in battery energy density increasing vehicle range and payload capacity, and supportive national policies like China’s New Energy Vehicle (NEV) mandate and the European Union’s Green Deal initiatives. Furthermore, the total cost of ownership (TCO) argument is increasingly favoring new energy alternatives as battery prices decline and diesel costs remain volatile, cementing the strategic importance of fleet electrification for achieving sustainable urban mobility goals.

New Energy Sanitation Vehicle Market Executive Summary

The New Energy Sanitation Vehicle Market is experiencing robust acceleration, characterized by significant business trends focusing on digitalization and component specialization. Key manufacturers are increasingly integrating telematics, IoT sensors, and advanced battery management systems (BMS) to optimize fleet deployment and predictive maintenance, transitioning from mere vehicle providers to holistic sanitation solution providers. This integration allows for real-time monitoring of vehicle performance, energy consumption, and route efficiency, which is vital for maximizing uptime and demonstrating return on investment for large municipal purchases. Furthermore, there is a clear industry shift towards modular vehicle design, enabling rapid customization for specific urban environments and operational requirements, such as narrow-street compactors or heavy-duty industrial waste haulers.

Regionally, the Asia Pacific (APAC) region, particularly China, maintains undisputed dominance in terms of volume and technological deployment, largely due to expansive governmental mandates and substantial subsidies aimed at curbing pollution in mega-cities. Europe is also emerging as a high-value market, driven by strict urban emission zones (like ULEZ in London) and a strong commitment to the EU’s Green Deal, favoring electric refuse trucks and sweepers designed for low-noise operation in residential areas. North America is accelerating its adoption rate, spurred by public utility companies and large private waste operators initiating pilot projects and full fleet conversions, often prioritizing range and reliability in their procurement decisions. These geographical trends highlight a global movement towards electrification, though the pace and technological focus vary depending on regional infrastructure maturity and regulatory pressure.

Segmentation trends indicate that Battery Electric Vehicles (BEV) currently hold the largest market share, predominantly utilizing advanced Lithium Iron Phosphate (LFP) or Nickel Manganese Cobalt (NMC) battery chemistries tailored for heavy-duty applications. Within vehicle types, electric refuse compactors and street sweepers represent the most mature and rapidly growing segments, given their necessity in daily urban operations and their high diesel consumption rates previously. Looking ahead, the Medium and Heavy-Duty vehicle categories are projected to exhibit the fastest growth, as manufacturers overcome previous limitations related to battery weight impacting payload capacity. The nascent hydrogen fuel cell segment, while smaller, is positioned for long-term strategic growth, especially in applications requiring extended range and rapid refueling capabilities, addressing the limitations inherent in large-scale battery charging infrastructure.

AI Impact Analysis on New Energy Sanitation Vehicle Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the New Energy Sanitation Vehicle market primarily center around achieving complete operational autonomy, optimizing energy consumption, and transforming municipal waste data into actionable insights. Common questions address how AI can handle complex, unstructured urban environments for autonomous driving, whether predictive maintenance powered by machine learning can significantly reduce costly downtime associated with battery and motor components, and how real-time data analysis can optimize collection routes to maximize efficiency and minimize energy depletion. The overarching theme is the transition from a scheduled, fixed operational model to a dynamic, responsive, and data-driven sanitation network, necessitating AI tools for complex decision-making.

The immediate and tangible impact of AI lies in enhancing operational efficiency through sophisticated route optimization and dynamic resource allocation. AI algorithms process real-time variables such as traffic density, historical waste generation patterns, vehicle battery state of charge (SoC), and weather conditions to determine the most energy-efficient and time-saving paths for sanitation vehicles. This predictive routing capability not only reduces the overall mileage covered by the fleet but also ensures that vehicles operate within optimal energy parameters, extending battery life and reducing the frequency of charging cycles. Furthermore, AI-driven predictive maintenance utilizes onboard sensor data to forecast potential failures in electrical systems, hydraulic components, or mechanical parts long before they occur, allowing for proactive servicing and dramatically increasing vehicle uptime, which is paramount for public service reliability.

In the long term, AI is foundational to the development of Level 4 and Level 5 autonomous sanitation vehicles, addressing the challenges of operating large machinery safely within unpredictable cityscapes. Computer vision and deep learning models enable vehicles to accurately identify various types of waste containers, safely navigate around pedestrians and cyclists, and execute complex maneuvers like automatic bin lifting and compacting without human intervention. This shift not only promises significant labor cost reductions but also improves worker safety and allows for 24/7 operational potential. The ethical and regulatory frameworks surrounding autonomous urban service vehicles remain a key area of development, guided by AI ensuring redundancy and safety in all operational modes.

- AI-Powered Route Optimization: Dynamic adjustment of collection routes based on traffic, fill levels, and energy metrics to maximize operational efficiency and range.

- Predictive Maintenance: Utilization of machine learning algorithms to analyze battery, motor, and hydraulic sensor data, forecasting component failure and scheduling proactive repairs.

- Autonomous Navigation Systems: Implementation of computer vision and sensor fusion for Level 4 autonomy in complex urban environments, improving safety and reducing human labor intensity.

- Smart Waste Monitoring: AI analysis of sensor data from bins (fill-level detection) to trigger collection only when necessary, minimizing unnecessary trips and optimizing energy use.

- Energy Management Optimization: Algorithms that continuously manage power flow between the battery, powertrain, and auxiliary equipment (like compactors) to maximize energy efficiency during demanding duty cycles.

DRO & Impact Forces Of New Energy Sanitation Vehicle Market

The market trajectory is significantly shaped by a powerful synergy of governmental incentives (Drivers), infrastructural limitations (Restraints), and burgeoning technological advancements (Opportunities), all interacting to exert profound Impact Forces on fleet procurement decisions globally. Governmental mandates establishing low-emission zones and providing substantial subsidies for electric vehicle purchases are the primary catalysts accelerating market adoption, compelling municipalities and private operators to modernize their fleets rapidly. However, these positive drivers are constantly challenged by critical restraining factors, notably the substantial initial capital expenditure required for high-capacity new energy vehicles and the persistent need for specialized, heavy-duty charging infrastructure tailored to the demanding energy requirements of sanitation fleets.

Despite the inherent challenges, the market is rife with transformative opportunities focused on overcoming technical hurdles and expanding operational viability. The ongoing refinement of battery technology, specifically the evolution towards solid-state batteries or more energy-dense liquid-ion variants, promises to alleviate range anxiety and payload capacity concerns, making these vehicles viable for longer, more demanding routes. Furthermore, the development of localized charging hubs, integrated with smart grid technology, is key to simplifying fleet energy management. The primary impact force remains centered on reducing the Total Cost of Ownership (TCO) over the vehicle's lifespan. While initial costs are high, the drastically reduced operational expenses—stemming from minimal maintenance, elimination of diesel fuel costs, and governmental tax breaks—are proving to be a decisive factor, ensuring sustained market shift toward electrification.

A secondary, but increasingly potent, impact force is the pressure for corporate social responsibility (CSR) and public image enhancement. Municipalities and large private waste management firms use the adoption of new energy sanitation vehicles as a visible commitment to environmental stewardship, which resonates strongly with public sentiment and aids in securing favorable contracts. This force, combined with the stringent enforcement of noise pollution standards in nocturnal urban operations, favors the deployment of silent electric vehicles over traditional diesel counterparts. Conversely, the restraint posed by technological standardization—or the lack thereof—across charging protocols and vehicle communication systems remains a minor impediment that requires industry-wide collaboration to resolve for seamless cross-brand operation and infrastructure utilization.

- Drivers

- Strong governmental regulations and mandates for urban fleet electrification.

- Significant public subsidies and tax incentives reducing initial acquisition costs.

- Lower Total Cost of Ownership (TCO) driven by reduced fuel and maintenance expenses.

- Increasing public awareness and demand for noise reduction and cleaner air quality in urban centers.

- Restraints

- High initial purchase price of new energy sanitation vehicles compared to traditional diesel models.

- Inadequate availability of high-power charging infrastructure suitable for large fleets.

- Concerns regarding battery range, especially in cold climates or during continuous operation of energy-intensive mechanisms (compaction/sweeping).

- Weight constraints imposed by current battery technology, potentially impacting payload capacity.

- Opportunities

- Advancements in battery technology (e.g., solid-state, modular designs) enhancing energy density and lifespan.

- Commercialization of hydrogen fuel cell electric vehicles (FCEVs) addressing long-range and rapid refueling requirements.

- Integration of smart city infrastructure and V2G (Vehicle-to-Grid) technology for energy management.

- Expansion into emerging markets lacking established traditional vehicle fleets, allowing direct leapfrogging to electric technology.

- Impact Forces

- Intensity of Regulatory Compliance: High pressure from local governments to meet emission reduction deadlines.

- TCO Competitiveness: Economic force pushing operators toward cost-effective long-term solutions.

- Technological Maturity: Pace of improvement in battery life and charging speed determines market acceptance.

- Public Health and Safety: Demand for reduced noise and localized pollution in residential zones.

Segmentation Analysis

The New Energy Sanitation Vehicle market is systematically segmented based on crucial technological and functional parameters, allowing for targeted market strategies and specialized product development. Primary segmentation relies on the propulsion type, separating the market into Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Fuel Cell Electric Vehicles (FCEV), each serving distinct operational niches based on range requirements and duty cycles. Further differentiation is made based on the vehicle type, distinguishing between waste collection vehicles (compactors, skip loaders), road sweeping machinery, and specialized auxiliary service trucks (washing, sewage). This structured view provides clarity on where current investment is focused and where future growth potential lies, particularly noting the shift towards heavy-duty electric trucks capable of managing larger payloads typical of municipal waste contracts.

- By Propulsion Type

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

- By Vehicle Type

- Refuse Collection Vehicles (Compactors, Rear Loaders, Side Loaders)

- Street Sweeping Vehicles (Mechanical Sweepers, Vacuum Sweepers)

- Washing and Spraying Vehicles

- Sewage and Dredging Vehicles

- Others (Hooklifts, Skip Loaders)

- By Vehicle Class/Weight

- Light-Duty (Below 3.5 Tons)

- Medium-Duty (3.5 – 15 Tons)

- Heavy-Duty (Above 15 Tons)

- By Application

- Municipal Use (Government Contracts)

- Commercial/Industrial Use (Private Waste Management)

Value Chain Analysis For New Energy Sanitation Vehicle Market

The value chain for New Energy Sanitation Vehicles begins in the upstream segment, which is dominated by the sourcing and manufacturing of high-value components, particularly lithium-ion batteries, electric motors, power electronics, and specialized chassis components designed to accommodate heavy battery packs. Success at this stage relies heavily on securing stable supply chains for critical raw materials (lithium, cobalt, nickel) and maintaining strong partnerships with leading battery cell manufacturers, as battery cost and performance dictate the final vehicle specifications and competitiveness. Upstream innovation also involves developing specialized hydraulic systems and compaction mechanisms optimized for electric powertrains, which must draw high power efficiently without draining the battery too quickly.

The midstream involves the core activities of vehicle design, assembly, and integration. Manufacturers either utilize existing commercial vehicle platforms adapted for electric powertrains or develop dedicated electric chassis. This phase is critical for quality control and ensuring the integration of complex subsystems—the Battery Management System (BMS), the vehicle control unit, and the specialized sanitation equipment—function seamlessly. Downstream activities involve distribution, sales, and comprehensive after-sales support. Distribution channels are typically dual: direct sales to large municipal government entities through competitive tender processes, and sales via established dealer networks that cater to smaller private contractors and regional authorities. Given the technical complexity of electric systems, robust indirect channels require significant training for dealers and technicians.

The success of the downstream segment is highly dependent on accessible and effective servicing and the development of charging infrastructure solutions. Direct interaction with municipalities often includes long-term maintenance contracts and fleet management software subscriptions, establishing ongoing revenue streams. After-sales support must specifically address the maintenance and eventual disposal or recycling of large battery packs, a complexity not present in the traditional ICE market. The distribution channel, whether direct or indirect, is pivotal in providing necessary technical consultancy regarding charging strategies and fleet replacement planning, thus connecting the manufacturer's capabilities directly to the end-user's operational needs.

New Energy Sanitation Vehicle Market Potential Customers

The primary and most influential customers in the New Energy Sanitation Vehicle market are municipal and local government bodies, which are responsible for public cleanliness, waste management, and adherence to environmental regulations within their jurisdictions. These entities typically procure vehicles through large-scale, long-term public tenders, prioritizing factors such as operational reliability, low emissions, noise reduction capabilities, and the overall TCO over a seven-to-ten-year service life. Their buying decisions are frequently influenced by political mandates and governmental funding availability, meaning manufacturers must align product capabilities with specific city-level environmental and sustainability targets. Municipal fleets often require a diverse mix of vehicle types, from heavy-duty compactors for central districts to smaller sweepers for pedestrian zones.

Secondary but rapidly growing customer segments include large, integrated private waste management and recycling companies. These entities, such as Waste Management, Veolia, or Suez, operate under long-term contracts with municipalities or directly serve commercial and industrial clients. For these private operators, the shift to new energy vehicles is driven less by regulatory mandates (though still influential) and more by operational economics, including reducing variable fuel costs and enhancing their corporate environmental profile to secure competitive contracts. They require high asset utilization, robust durability, and rapid charging capabilities to maximize shift efficiency and minimize non-revenue-generating time.

Other emerging buyers include specialized institutions such as large industrial parks, university campuses, and transportation hubs (airports, port authorities) that manage their own internal waste and sanitation systems. These end-users typically require light-to-medium-duty vehicles optimized for confined, controlled environments. Manufacturers often target these customers with smaller, highly maneuverable electric sweepers and specialized utility vehicles. The procurement criteria here often emphasize ease of integration with existing site infrastructure and minimal footprint, making these niche applications significant growth areas for specialized vehicle segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 20.1 Billion |

| Growth Rate | 20.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FOTON, BYD, Zoomlion, XCMG, KAMA, Hino Motors, Bucher Municipal, FAW Group, Geely Commercial Vehicles, Dongfeng Motor, Chengdu Tianyi, Sinotruk, GreenG Environmental, Oshkosh Corporation, Sany Heavy Industry, HEIBO Sanitation Equipment, TUS-Environmental, Volvo Trucks, Daimler Truck. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

New Energy Sanitation Vehicle Market Key Technology Landscape

The technology landscape for New Energy Sanitation Vehicles is primarily defined by rapid advancements in energy storage and management systems, which are fundamental to vehicle performance and economic viability. The dominant technology remains advanced Lithium-ion batteries, with a noticeable market polarization between high-density Nickel Manganese Cobalt (NMC) cells, favored in high-performance or longer-range European models, and the more cost-effective and safer Lithium Iron Phosphate (LFP) cells, which are widely adopted in the high-volume Chinese market. A critical technological component is the Battery Management System (BMS), which must accurately monitor the State of Charge (SoC) and State of Health (SoH) under the strenuous, high-power cycling demanded by the auxiliary equipment (e.g., compaction hydraulics), ensuring longevity and preventing thermal incidents. Fast-charging technology, leveraging high-power DC charging systems (e.g., 150kW and above), is also crucial for minimizing operational downtime during shifts.

Beyond energy storage, integrated power electronics and vehicle control units (VCUs) play a pivotal role in optimizing energy distribution between the traction motor for movement and the Power Take-Off (PTO) required for operational tasks like sweeping or lifting bins. Modern systems incorporate sophisticated regenerative braking to recapture kinetic energy, often providing a significant boost to urban driving range. Furthermore, the burgeoning segment of Hydrogen Fuel Cell Electric Vehicles (FCEVs) represents a key technological frontier, offering zero-emission performance coupled with refueling times comparable to diesel, making them highly attractive for fleets requiring continuous, heavy-duty operation and routes exceeding the practical limitations of current battery technology. While infrastructure development remains a challenge, major manufacturers are investing heavily in FCEV sanitation prototypes and small-scale deployments.

The digital layer of the technological landscape—comprising telematics, IoT connectivity, and fleet management software—is increasingly non-negotiable for competitive advantage. These technologies provide real-time operational data, crucial for municipalities to verify service delivery and for operators to implement predictive maintenance protocols based on machine learning. Sensors integrated into the vehicle and the compaction unit monitor parameters like waste density and bin recognition, feeding data back to AI systems for route optimization. Furthermore, advancements in specialized components, such as lightweight composite materials for body construction and low-noise hydraulic pumps, enhance both the energy efficiency and the acceptability of these vehicles in noise-sensitive residential environments, rounding out the holistic technological ecosystem required for market leadership.

Regional Highlights

- Asia Pacific (APAC): Market Dominance and Policy Leadership The APAC region, driven overwhelmingly by China, is the largest and fastest-growing market for New Energy Sanitation Vehicles globally. This dominance stems directly from aggressive national and municipal policies, including large-scale subsidy programs, mandated fleet replacement schedules, and strict enforcement of urban emission standards in cities like Beijing and Shenzhen. Chinese manufacturers benefit from well-developed battery supply chains and robust domestic competition, leading to rapid product evolution and volume deployment. The focus here is on high-volume production of Battery Electric Refuse Compactors and Street Sweepers, utilizing cost-effective LFP battery technology. India and Southeast Asian nations are emerging as secondary growth centers, starting pilot programs driven by foreign investment and growing concerns over air quality in rapidly expanding metropolitan areas.

- Europe: High Value, Regulatory Compliance, and Diversity Europe represents a high-value market characterized by stringent noise and emission regulations, particularly the EU’s Green Deal and various local Zero-Emission Zone (ZEZ) initiatives. European adoption favors specialized, medium-duty electric vehicles designed for narrow historical streets and quiet nighttime operations. Countries like Germany, France, and the UK are leaders in adoption, often procuring vehicles through Public-Private Partnerships (PPPs). European manufacturers focus on advanced integration of charging solutions and highly modular vehicle designs. While BEVs are the current standard, Europe is also a key testing ground for specialized hydrogen fuel cell sanitation vehicles, aiming to tackle the demanding operational profile of long-haul waste transport.

- North America: Infrastructure-Driven, Private Sector Influence The North American market (US and Canada) exhibits slower, but accelerating, adoption rates, predominantly driven by private waste management corporations seeking TCO benefits and public visibility for their sustainability efforts. Unlike APAC, adoption is often decentralized, relying on local state and city incentives rather than federal mandates. The primary challenge is the requirement for heavy-duty vehicles capable of handling large residential routes and the need for significant depot-level charging infrastructure upgrades. Manufacturers here must focus on range reliability and high payload capacity, with key growth centered around specialized electric refuse trucks in populous coastal states that have aggressive decarbonization targets, such as California and New York.

- Latin America, Middle East, and Africa (LAMEA): Emerging Markets The LAMEA region is characterized by nascent adoption, with growth concentrated in wealthy city-states (e.g., UAE, Saudi Arabia) and major South American metropolitan areas (e.g., São Paulo, Santiago). Adoption in this region is often linked to smart city initiatives and large infrastructure projects funded by national oil revenues or international development banks. Challenges include the lack of a reliable high-power charging grid and the high import cost of electric vehicles. However, the region offers long-term opportunity, particularly in areas where solar or renewable energy generation can offset the high energy demand required for fleet charging, promoting truly sustainable sanitation solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the New Energy Sanitation Vehicle Market.- FOTON

- BYD

- Zoomlion

- XCMG

- KAMA

- Hino Motors

- Bucher Municipal

- FAW Group

- Geely Commercial Vehicles

- Dongfeng Motor

- Chengdu Tianyi

- Sinotruk

- GreenG Environmental

- Oshkosh Corporation

- Sany Heavy Industry

- HEIBO Sanitation Equipment

- TUS-Environmental

- Volvo Trucks

- Daimler Truck

- E-One (REV Group)

Frequently Asked Questions

Analyze common user questions about the New Energy Sanitation Vehicle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the New Energy Sanitation Vehicle Market?

The primary driver is the implementation of stringent governmental regulations and mandates, particularly in Asia Pacific and Europe, requiring municipal fleets to transition to zero or low-emission vehicles to improve urban air quality and meet national climate goals. This is reinforced by significant public subsidies and the long-term benefit of reduced Total Cost of Ownership (TCO).

How do Battery Electric Vehicles (BEV) compare to Fuel Cell Electric Vehicles (FCEV) in sanitation applications?

BEVs are currently dominant for routine, defined urban routes due to lower infrastructure costs and proven technology, excelling in stop-start urban cycles where regenerative braking is effective. FCEVs, while nascent, offer superior range and rapid refueling capability, making them more suitable for heavy-duty, long-distance waste transport or continuous operational shifts where BEV charging downtime is unacceptable.

What are the main technical challenges facing the widespread adoption of electric refuse trucks?

The primary technical challenges include overcoming battery range anxiety, especially when factoring in the high auxiliary power demand of compaction and sweeping equipment, and the necessity of installing specialized, high-power DC charging infrastructure within existing municipal depots to accommodate large fleet numbers and minimize charging times.

Which geographical region holds the largest market share for New Energy Sanitation Vehicles?

The Asia Pacific (APAC) region, largely led by China, holds the dominant market share due to unparalleled scale of production, aggressive governmental policy support, and early mass deployment of electric sanitation fleets across major metropolitan areas.

How is AI impacting the operational efficiency of sanitation fleets?

AI is fundamentally transforming fleet efficiency through dynamic route optimization algorithms that account for real-time traffic and waste levels, and by implementing predictive maintenance systems that analyze sensor data to prevent component failures, thereby maximizing vehicle uptime and energy utilization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager