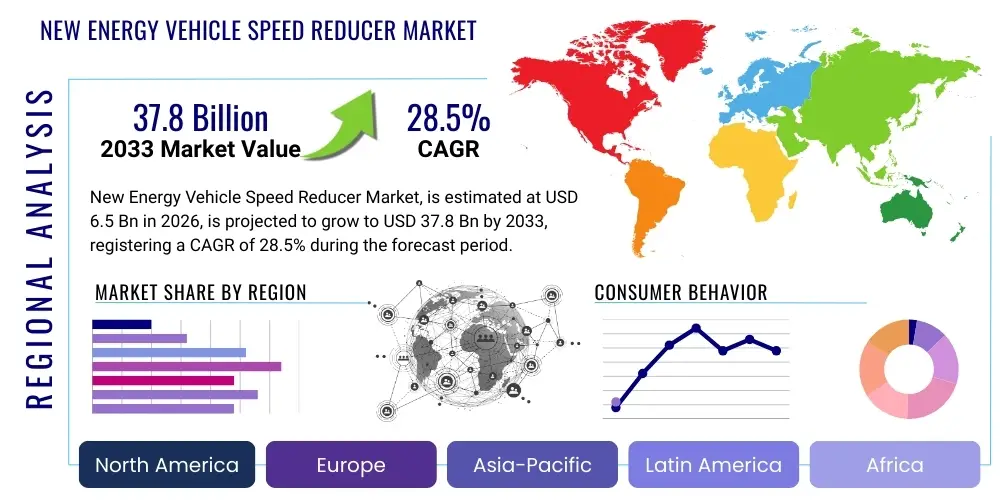

New Energy Vehicle Speed Reducer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435577 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

New Energy Vehicle Speed Reducer Market Size

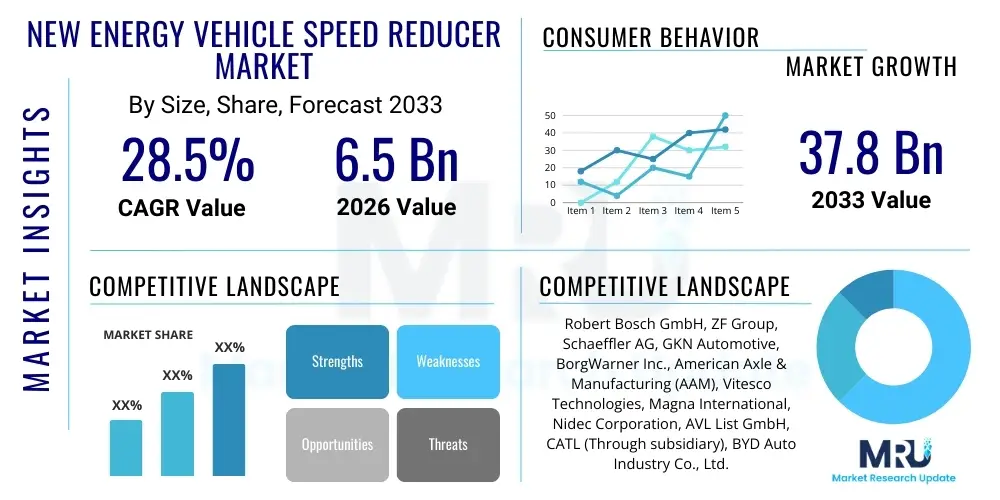

The New Energy Vehicle Speed Reducer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 37.8 Billion by the end of the forecast period in 2033.

New Energy Vehicle Speed Reducer Market introduction

The New Energy Vehicle (NEV) Speed Reducer Market encompasses the manufacturing and supply of specialized gearing systems designed for Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs). Unlike traditional internal combustion engine (ICE) vehicles that rely on complex multi-speed transmissions, NEVs typically utilize a fixed-ratio or single-speed speed reducer. This component is crucial for adjusting the high rotational speeds of the electric motor down to usable speeds for the wheels, simultaneously multiplying torque to ensure effective acceleration and climbing capability. The fundamental design objectives revolve around achieving high torque density, minimizing Noise, Vibration, and Harshness (NVH) characteristics, and optimizing energy efficiency within a compact and lightweight package. The shift toward higher voltage architectures (e.g., 800V systems) and integrated electric drive axles (e-Axles) is fundamentally reshaping the demands placed on speed reducer performance and design, making advanced material science and precision manufacturing essential differentiators in the competitive landscape.

The primary applications of these speed reducers are within the powertrain of battery electric vehicles, where they form an integral part of the e-drive unit, often combined with the motor and power electronics into a unified system. Benefits derived from optimized speed reducers include enhanced driving range due to reduced energy losses, superior acoustic performance critical for the quiet nature of EVs, and improved vehicle safety through reliable torque delivery. Furthermore, the compact design facilitates better vehicle packaging, allowing designers greater flexibility in platform architecture. The rapid global adoption of NEVs, driven by stringent emissions regulations, government incentives, and increasing consumer interest in sustainable mobility solutions, stands as the most significant factor propelling the market forward. Technological advancements focusing on helical gears, planetary gear sets, and lubrication systems further contribute to efficiency gains necessary for widespread EV acceptance.

Driving factors fueling this market growth include mandatory global targets for vehicle electrification, especially across major automotive hubs such as China, Europe, and North America. Regulatory frameworks requiring lower fleet emissions compel Original Equipment Manufacturers (OEMs) to escalate their EV production volumes, thereby increasing demand for critical components like speed reducers. Moreover, continuous innovation aimed at improving power density—the ability to handle higher input torque within the same spatial footprint—is crucial. As electric motors become more powerful and lightweight, the speed reducers must evolve to manage increased thermal loads and dynamic stresses. The development of advanced thermal management solutions and the incorporation of novel materials, such as specific grades of steel and composite components, are becoming standard practice to ensure durability and maintain high efficiency over the vehicle's lifespan, solidifying the market's robust trajectory.

New Energy Vehicle Speed Reducer Market Executive Summary

The New Energy Vehicle Speed Reducer Market is experiencing transformative growth, underpinned by fundamental shifts in the global automotive value chain toward electrification. Business trends indicate a strong move toward vertical integration, where major Tier 1 suppliers and automotive OEMs are increasingly designing and manufacturing proprietary e-Axle systems that incorporate speed reducers tailored to specific vehicle platforms and performance requirements. Mergers, acquisitions, and strategic partnerships centered around gearbox technology and electric motor control algorithms are prevalent, aiming to consolidate expertise in high-precision gear manufacturing and noise suppression techniques. Furthermore, there is a pronounced trend towards standardization in certain low-power BEV segments while high-performance and luxury EVs continue to drive demand for highly customized, multi-speed reducers that maximize motor efficiency across a broader operational spectrum, thus challenging the single-speed paradigm in niche segments. Investment in advanced manufacturing technologies, such as micro-finishing and specialized heat treatment, is accelerating to meet the stringent quality demands of NVH performance.

Regional trends clearly position the Asia Pacific (APAC) region, particularly China, as the dominant market for NEV speed reducers, primarily due to massive government support, the concentration of major battery and EV manufacturing operations, and substantial consumer uptake of electric vehicles. Europe follows as a mature market driven by strict CO2 emission standards and well-established automotive supply chains that emphasize high quality and efficiency, particularly in the premium EV segment. North America is rapidly catching up, fueled by significant domestic policy support (e.g., Inflation Reduction Act in the US) encouraging localized production and investment in electric vehicle components. These regional dynamics mean that suppliers must establish diversified production and logistics footprints to effectively cater to localized OEM demands and adhere to varying regional content regulations, influencing sourcing decisions and pricing strategies globally.

Segment trends highlight the dominance of single-speed parallel-axis reducers due to their simplicity, reliability, and cost-effectiveness, especially in mainstream passenger BEVs. However, the planetary gear segment is gaining traction, particularly in compact urban vehicles and higher torque applications where space constraints necessitate maximum power density. The increasing market share of Plug-in Hybrid Electric Vehicles (PHEVs), especially in markets like Europe, introduces complexity, demanding integrated transmission units that manage power flow from both the electric motor and the combustion engine, often featuring specialized multi-mode gearboxes. The key technological focus across all segments remains the reduction of gear weight and volume without compromising torque handling capabilities, pushing innovation toward lighter aluminum casings, improved bearing systems, and optimized gear tooth geometry through advanced computational simulation methods like Finite Element Analysis (FEA) and computational fluid dynamics (CFD) for lubrication optimization.

AI Impact Analysis on New Energy Vehicle Speed Reducer Market

User queries regarding the impact of Artificial Intelligence (AI) on the NEV Speed Reducer Market frequently center on how AI optimizes design efficiency, predicts component failure, and enhances the manufacturing processes associated with these high-precision components. Common concerns revolve around whether AI-driven simulations can replace traditional testing, how machine learning (ML) models improve NVH characteristics, and the extent to which AI enables the rapid prototyping of novel gear designs optimized for power density. Users often seek clarification on the practical integration of AI in quality control (QC) during the production of gears, bearings, and casings, expecting insights into defect detection and predictive maintenance capabilities within EV powertrains.

The direct impact of AI is most profound in the early design and simulation phases. AI and machine learning algorithms are utilized extensively to explore vast design spaces, optimizing gear tooth geometry, helical angles, and contact ratios to minimize friction losses and maximize torque transmission efficiency, simultaneously reducing noise levels. Generative design techniques, powered by AI, allow engineers to quickly iterate on lightweight housing structures that meet strict strength requirements while saving material costs. Furthermore, in manufacturing, AI-driven vision systems monitor micro-finishing processes to ensure tight tolerances are met, providing real-time feedback that adjusts machining parameters, minimizing waste and guaranteeing the required surface quality critical for NVH reduction. This integration of predictive analytics into the design-to-production lifecycle significantly shortens development cycles and improves overall product performance.

Operationally, AI contributes significantly to the long-term reliability of speed reducers. Machine learning models analyze sensor data collected from e-Axle units regarding temperature, vibration, and current draw to predict potential failure modes, such as bearing wear or gear pitting, enabling highly accurate predictive maintenance schedules. This capability shifts the service model from reactive repair to proactive intervention, substantially enhancing vehicle uptime and reducing warranty costs for OEMs. While AI cannot replace the core material science and mechanical engineering principles, its role as an optimization engine—handling highly complex variables related to lubrication flow, thermal management, and dynamic load balancing—is indispensable for pushing the boundaries of what integrated e-drive systems can achieve in terms of efficiency and longevity under high-stress EV driving conditions.

- AI-Driven Generative Design: Optimizing gear housing topology and gear geometry for lightweighting and maximum strength-to-weight ratio.

- Predictive Maintenance (PdM): Utilizing ML models on real-time vibration and temperature data to forecast bearing and gear failure, extending service life.

- Enhanced NVH Reduction: AI-powered acoustic simulation optimizing gear meshing characteristics to minimize electromagnetic and mechanical noise interference.

- Quality Control Automation: Deployment of AI vision systems for high-speed, high-precision inspection of gear surface finish and dimensional accuracy during manufacturing.

- Supply Chain Optimization: ML algorithms predicting component demand fluctuations based on vehicle production forecasts, optimizing inventory and logistics for specialty materials.

DRO & Impact Forces Of New Energy Vehicle Speed Reducer Market

The dynamics of the NEV Speed Reducer Market are profoundly shaped by a powerful interplay of drivers, restraints, and opportunities, all contributing to significant market impact forces. The primary drivers include aggressive global electrification mandates and corresponding OEM commitments to phase out ICE vehicles, creating sustained, high-volume demand for reliable e-drive components. The continuous reduction in battery costs, making EVs more accessible to the mass market, further amplifies this demand across all vehicle classes. Technological advancements, particularly in increasing the power density of electric motors, directly necessitate improved speed reducer performance capabilities, pushing suppliers to innovate in materials and precision engineering. These factors collectively establish a strong foundational growth trajectory, characterized by high investment in dedicated EV production facilities and component supply chains across established automotive regions and emerging markets.

However, significant restraints temper this exponential growth. The critical technical challenge is managing Noise, Vibration, and Harshness (NVH). Since EVs operate quietly, gear whine and mechanical vibration become much more noticeable to occupants, requiring extraordinarily high manufacturing precision (often sub-micron tolerances) which increases production complexity and cost. Furthermore, the limited availability of highly specialized, heat-treated materials (like high-performance steel alloys) required for high-stress gears poses supply chain risks and cost fluctuations. Another major restraint is the standardization challenge; while single-speed reducers dominate, the ongoing development of multi-speed reducers for optimizing highway cruising efficiency introduces complexity and requires significant Research and Development (R&D) investment that not all suppliers can sustain, leading to market fragmentation and technology divergence between premium and mass-market segments.

The market opportunities lie in the accelerating demand for integrated e-Axles, offering suppliers a chance to provide complete system solutions rather than isolated components, thus capturing higher value. Opportunities also exist in the development of specialized lubrication and cooling systems designed specifically for the unique thermal profiles of high-speed EV motors, optimizing gear life and efficiency. Furthermore, the emerging market for commercial NEVs (trucks and buses) demands heavy-duty speed reducers that can handle significantly higher torque loads and greater operational durability, opening up a high-value niche market. Addressing the NVH constraint through innovative gear tooth profiles and advanced material damping technologies presents a competitive advantage and a substantial opportunity for differentiation. The overall impact forces are high, characterized by rapid technological obsolescence, intense competition, and stringent performance metrics dictated by OEM requirements for range and acoustic comfort.

Segmentation Analysis

The New Energy Vehicle Speed Reducer market is rigorously segmented based on crucial factors including component type, vehicle application, output torque capacity, and integration architecture. This segmentation reflects the technological diversity and application specificity inherent in the evolving EV landscape, where the choice of reducer directly impacts vehicle performance, cost structure, and NVH characteristics. Understanding these segments is vital for suppliers to target specific market niches, ranging from high-volume standardized BEV platforms utilizing parallel-axis designs to specialized, high-performance EVs demanding complex planetary systems for superior power density. The segmentation framework captures the differentiation strategies employed by manufacturers to meet varying demands for torque, space, and cost efficiency across the global automotive spectrum.

- By Type:

- Planetary Gear Reducers

- Parallel Axis Gear Reducers (Single-speed/Fixed Ratio)

- Harmonic Drive Reducers (Emerging/Niche)

- Multi-speed Gear Reducers (2-speed, 3-speed)

- By Vehicle Type:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

- Commercial Electric Vehicles (Bus, Truck, Van)

- By Position/Architecture:

- Central Drive Units

- Wheel-Side Drive Units (In-Wheel Motor Applications)

- Axle-Integrated Systems (e-Axle)

- By Output Torque Capacity:

- Low Torque (Below 200 Nm)

- Medium Torque (200 Nm – 500 Nm)

- High Torque (Above 500 Nm)

Value Chain Analysis For New Energy Vehicle Speed Reducer Market

The value chain for the New Energy Vehicle Speed Reducer Market is characterized by a complex structure starting with specialized upstream suppliers providing high-grade raw materials and sophisticated manufacturing equipment, extending through precision component fabrication, and concluding with downstream integration into the final electric vehicle. Upstream analysis focuses heavily on the procurement of critical materials, primarily high-strength steel alloys (e.g., specific grades of chrome-molybdenum or nickel steel) essential for producing durable gears and shafts capable of handling high rotational speeds and torque density. The quality and purity of these metals directly influence the reliability and NVH performance of the final speed reducer unit. Additionally, specialized suppliers provide precision bearings, sealing elements, and proprietary lubricants designed for EV operating environments. The dependency on a limited number of global material suppliers, especially those providing specialized forging and casting services, introduces a degree of vulnerability within the early stages of the supply chain, requiring meticulous inventory management and strategic long-term contracts.

The midstream segment involves the core manufacturing process, encompassing precision machining, grinding, hobbing, heat treatment (e.g., carburizing and nitriding), and micro-finishing of the gear sets. Tier 1 and Tier 2 suppliers, many of whom are traditional automotive component manufacturers, utilize highly advanced computer numerical control (CNC) machines and inspection systems to achieve the micron-level tolerances demanded by OEMs for minimizing NVH. Assembly of the gear sets, housing (often aluminum die-casting for lightweighting), and integration of lubrication and thermal management components define this stage. Distribution channels primarily consist of direct sales (Business-to-Business, B2B) between the Tier 1 suppliers (e.g., ZF, Bosch, GKN) and the major electric vehicle Original Equipment Manufacturers (OEMs) such as Tesla, BYD, and legacy automakers transitioning to electric platforms. The complexity of the product generally precludes significant involvement from indirect distribution channels, though specialized aftermarket service and repair parts may be distributed through authorized networks.

Downstream analysis centers on the integration of the speed reducer into the electric drive unit (e-Axle), which is subsequently assembled into the vehicle chassis by the OEM. The strong trend towards integrated systems means that suppliers offering fully validated e-Axle solutions hold a competitive advantage over those providing only discrete gearboxes. Potential customers are the major automotive OEMs, who demand stringent quality control, reliable high-volume supply, and deep collaboration during the platform design phase. The relationship is typically highly collaborative and long-term, driven by specific platform requirements rather than off-the-shelf component purchasing. Direct sales and technical support are paramount, reflecting the critical, performance-defining nature of the speed reducer within the electric powertrain architecture. This highly centralized, direct distribution model underscores the technical complexity and strategic importance of the speed reducer market.

New Energy Vehicle Speed Reducer Market Potential Customers

The potential customers for New Energy Vehicle Speed Reducers are predominantly Original Equipment Manufacturers (OEMs) spanning across passenger vehicle, commercial vehicle, and specialized mobility sectors. These customers are categorized by their scale of electrification commitment and the technological sophistication of their e-drive systems. Major global automotive conglomerates, including those historically focused on ICE vehicles but now aggressively transitioning (e.g., Volkswagen Group, General Motors, Ford), represent the largest volume buyers, demanding both standardized and highly customized speed reducers for their diverse BEV and PHEV portfolios. Simultaneously, dedicated electric vehicle manufacturers (e.g., Tesla, Lucid Motors, Rivian, and numerous Chinese EV start-ups) are critical customers who often prioritize high performance, advanced integration, and lightweight designs, frequently requiring close development partnerships with speed reducer specialists to meet aggressive power density targets.

A rapidly growing customer segment comprises the manufacturers of commercial electric vehicles, including heavy-duty trucks, buses, and specialized delivery vans. These applications impose exceptionally high demands on torque capacity, durability, and thermal management due to sustained heavy loads and continuous operation cycles. Suppliers targeting this segment must offer ruggedized, potentially multi-stage reduction systems that ensure reliability over long operational lifetimes. The demand here differs from passenger cars by prioritizing robustness and lower total cost of ownership (TCO) over absolute acoustic perfection, though efficiency remains paramount. Furthermore, smaller, specialized mobility manufacturers, such as those producing electric agricultural equipment, construction machinery, and specialized autonomous shuttles, also constitute niche buyers requiring tailored, low-volume solutions.

In addition to the vehicle builders themselves, certain Tier 1 system integrators who specialize in manufacturing complete e-Axles (but do not manufacture the final vehicle) also serve as crucial intermediate customers. These integrators source the speed reducer components—either as complete units or as gear sets—to package them with electric motors and inverters before supplying the integrated system to the final OEM. Therefore, successful market penetration requires engaging with both the final vehicle manufacturers (who dictate specifications) and the large system integrators (who manage procurement and assembly volume), necessitating a dual-pronged sales and technical support strategy tailored to differing volume and technological requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 37.8 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, ZF Group, Schaeffler AG, GKN Automotive, BorgWarner Inc., American Axle & Manufacturing (AAM), Vitesco Technologies, Magna International, Nidec Corporation, AVL List GmbH, CATL (Through subsidiary), BYD Auto Industry Co., Ltd., Sumitomo Drive Technologies, Renk AG, Tsubaki Nakashima Co., Ltd., Continental AG, Eaton Corporation, Cummins Inc., JTEKT Corporation, Hitachi Astemo, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

New Energy Vehicle Speed Reducer Market Key Technology Landscape

The technology landscape for NEV speed reducers is defined by continuous innovation aimed at reducing volume, increasing efficiency, and minimizing acoustic signature. Central to this innovation is the refinement of gear geometry and manufacturing processes. High-contact ratio (HCR) gearing is increasingly adopted as it spreads the load over more teeth, reducing localized stress and significantly lowering gear whine, a critical NVH factor in silent EVs. Furthermore, specialized manufacturing techniques such as super-finishing, honing, and grinding are employed to achieve surface roughness profiles measured in nanometers, which reduces friction and associated energy loss, directly contributing to extended driving range. The push towards 800V architectures and higher motor speeds (often exceeding 15,000 RPM) requires materials that can handle exceptional dynamic loads and thermal stresses, necessitating advanced material science in the selection of specialty high-performance steels and innovative heat treatment protocols.

A second major technological area involves the evolution of the lubrication and thermal management systems within the speed reducer. High-speed operation generates considerable heat, and maintaining optimal lubricant temperature is crucial for efficiency and component longevity. Passive lubrication methods (splash lubrication) are being challenged by active, pump-driven lubrication systems, especially in high-performance or commercial vehicle applications. Suppliers are designing integrated oil cooling circuits that often share cooling fluid with the electric motor and inverter, ensuring compact thermal management. Furthermore, the selection of low-viscosity, specialized EV transmission fluids (ETFs) is paramount. These fluids must possess excellent dielectric properties to prevent electrical shorting if they come into contact with the motor windings, alongside superior thermal stability and lubricating performance under extreme shear forces, representing a crucial chemical engineering challenge within the overall mechanical system.

Finally, the competitive landscape is increasingly driven by the capability to design highly integrated e-Axle units. Technological advancement here focuses on coaxial designs and tightly packaged gear sets (such as planetary systems) that maximize power density and minimize the overall footprint of the drive unit. The debate between single-speed fixed ratio and multi-speed reducers (e.g., 2-speed transmissions for EVs) continues; while single-speed dominates due to cost and simplicity, multi-speed systems leveraging electro-mechanical shifting mechanisms are becoming viable for optimizing motor operation across a wider vehicle speed range, particularly for heavy-duty commercial vehicles or performance-oriented passenger cars. These multi-speed systems require sophisticated electronic control units (ECUs) and control algorithms that seamlessly manage torque interruption during shifting, requiring deep integration expertise between mechanical, electrical, and software disciplines.

Regional Highlights

- Asia Pacific (APAC): The APAC region, led overwhelmingly by China, serves as the global epicenter for the NEV Speed Reducer market. China's robust governmental support, coupled with the presence of massive domestic EV manufacturers (BYD, NIO, SAIC), drives unprecedented volume demand for speed reducers. The market here is characterized by high price sensitivity and rapid capacity expansion. Furthermore, significant investment in South Korea and Japan focuses on advanced e-Axle components and precision manufacturing technology, specifically aiming for ultra-high efficiency and low NVH characteristics for global export and domestic premium EV production.

- Europe: Europe represents a technologically mature and quality-focused market, driven by the EU's aggressive fleet CO2 emission reduction targets and the strong presence of established premium automotive manufacturers (Germany, France, Italy). This region demands speed reducers with extremely low NVH characteristics, prioritizing acoustic comfort and system efficiency, often leading the adoption of multi-speed technologies in performance segments. Localization and adherence to strict environmental and labor standards are critical entry barriers for non-European suppliers.

- North America: The North American market is experiencing accelerated growth, largely spurred by the US government's supportive policies and the localized production mandates established by major OEMs. While historically trailing Asia and Europe, significant investments in Gigafactories and EV manufacturing hubs (e.g., in the US Midwest and South) are generating substantial demand. The focus is balanced between cost-effectiveness for mass-market trucks and SUVs, and high performance for specialized premium EV manufacturers, requiring suppliers to adapt product lines for large vehicle platforms and high torque loads.

- Latin America (LATAM), Middle East, and Africa (MEA): These regions currently hold smaller market shares but represent high growth potential, dependent largely on the development of charging infrastructure and regional government policies favoring electrification. Current demand is concentrated in key urban centers and driven by imported vehicles or local assembly operations relying on established global supply chains. As local manufacturing and infrastructure investment accelerates, opportunities for simplified, robust, and cost-effective speed reducers suitable for local road conditions will emerge, focusing primarily on commercial fleet applications and public transport electrification initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the New Energy Vehicle Speed Reducer Market.- ZF Group

- Robert Bosch GmbH

- Schaeffler AG

- GKN Automotive

- BorgWarner Inc.

- American Axle & Manufacturing (AAM)

- Vitesco Technologies (Continental AG)

- Magna International

- Nidec Corporation

- AVL List GmbH

- Sumitomo Drive Technologies

- Renk AG

- Tsubaki Nakashima Co., Ltd.

- JTEKT Corporation

- Hitachi Astemo, Ltd.

- Eaton Corporation

- Cummins Inc.

- Dana Incorporated

- CATL (Contemporary Amperex Technology Co. Limited)

- BYD Auto Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the New Energy Vehicle Speed Reducer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a speed reducer in a New Energy Vehicle (NEV)?

The primary function is to efficiently convert the high rotational speed of the electric motor into lower, usable rotational speeds for the wheels while simultaneously multiplying the output torque. This component is essential for optimizing vehicle acceleration, ensuring energy efficiency, and reducing motor stress in fixed-ratio EV powertrains.

Why are NVH (Noise, Vibration, and Harshness) considerations so critical for NEV speed reducers?

NVH is critical because electric vehicles operate much more quietly than ICE vehicles, making mechanical noises like gear whine significantly more perceptible to occupants. Achieving superior acoustic performance requires extremely high-precision gear manufacturing, optimized tooth geometry (e.g., helical gears), and careful thermal management to maintain lubrication stability.

What is an e-Axle and how does it relate to the speed reducer market?

An e-Axle (Electric Drive Axle) is an integrated electric powertrain system combining the electric motor, power electronics (inverter), and the speed reducer/gearbox into a single, compact unit. The market is increasingly shifting towards e-Axle solutions, offering suppliers opportunities to provide integrated systems rather than discrete components, thereby improving system efficiency and packaging space.

Are multi-speed transmissions gaining traction in the electric vehicle market?

While single-speed reducers currently dominate for simplicity and cost-effectiveness, multi-speed transmissions (e.g., 2-speed systems) are gaining traction, particularly in high-performance EVs and heavy-duty commercial vehicles. They offer benefits by keeping the electric motor operating within its optimal efficiency band across a wider range of vehicle speeds, potentially extending highway range and improving towing capabilities.

Which regional market holds the largest share and what drives its dominance?

The Asia Pacific (APAC) region, specifically China, holds the largest market share. This dominance is driven by high volume production of EVs, strong government policy support for electrification (subsidies and mandates), and the presence of major domestic EV manufacturers contributing to significant localized demand and rapid market adoption rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager