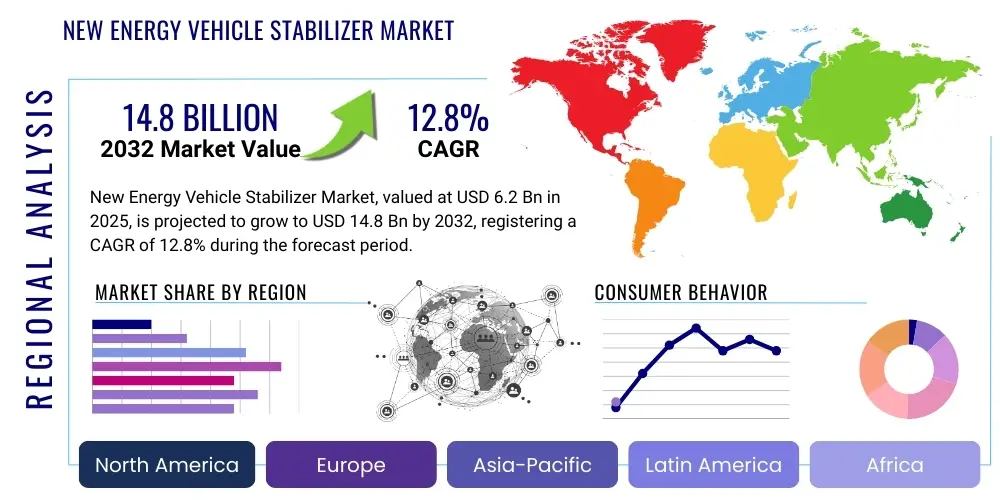

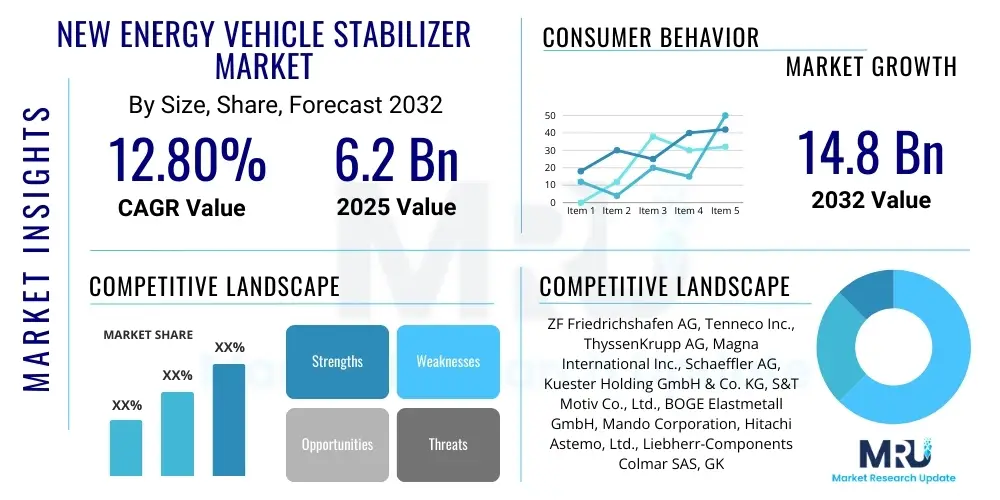

New Energy Vehicle Stabilizer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434723 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

New Energy Vehicle Stabilizer Market Size

The New Energy Vehicle Stabilizer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at $8.9 Billion in 2026 and is projected to reach $36.7 Billion by the end of the forecast period in 2033.

New Energy Vehicle Stabilizer Market introduction

The New Energy Vehicle (NEV) Stabilizer Market encompasses the design, manufacturing, and distribution of components critical for maintaining vehicle stability, managing body roll, and ensuring optimal handling characteristics in electric vehicles (EVs), hybrid electric vehicles (HEVs), and fuel cell electric vehicles (FCEVs). Unlike traditional internal combustion engine (ICE) vehicles, NEVs present unique challenges, primarily due to the heavy, centrally located battery packs which drastically alter the vehicle’s center of gravity and overall mass distribution. Stabilizers, including traditional anti-roll bars, advanced adaptive damping systems, and sophisticated semi-active or fully active suspension systems, are essential for mitigating these mass-related dynamics, improving safety, and enhancing passenger comfort, particularly during high-speed maneuvers or aggressive cornering.

Key applications of NEV stabilizers span passenger cars, commercial electric buses, heavy-duty electric trucks, and specialized utility vehicles. The fundamental shift toward electrification necessitates stabilizers that are lighter, yet stronger, often integrating high-performance materials like high-strength steel alloys, aluminum, and carbon fiber reinforced plastics (CFRPs) to offset the battery weight penalty. Furthermore, the integration with smart vehicle systems is paramount; modern NEV stabilizers often communicate with Electronic Stability Control (ESC) and Traction Control Systems (TCS) to provide instantaneous adjustments, optimizing ride quality and energy efficiency—a critical benefit for range-conscious NEVs. This transition accelerates the demand for mechatronic and software-defined stabilizer components over purely mechanical ones.

The primary driving factor for market expansion is the global push toward decarbonization, leading to massive legislative support and consumer adoption of electric vehicles, particularly in major automotive markets such as China, Europe, and North America. Regulatory requirements focused on vehicle safety (e.g., rollover prevention standards) and performance demands from increasingly sophisticated electric drivetrains further stimulate innovation in stabilization technology. As battery density improves and NEVs gain wider market penetration, the complexity and strategic importance of advanced stabilizer systems, which are foundational to achieving high-performance driving dynamics comparable to or exceeding premium ICE vehicles, will continue to grow, solidifying the market’s robust growth trajectory through the forecast period.

New Energy Vehicle Stabilizer Market Executive Summary

The New Energy Vehicle Stabilizer Market is characterized by intense technological evolution, shifting rapidly from purely passive mechanical systems to complex mechatronic and active control modules driven by sophisticated software algorithms. Key business trends include aggressive mergers and acquisitions among traditional automotive suppliers and high-tech electronics firms aiming to consolidate expertise in integrated chassis control systems. Original Equipment Manufacturers (OEMs) are increasingly prioritizing in-house development or strategic partnerships for active stabilizer components, recognizing their role as a key differentiator in vehicle performance and branding, leading to significant R&D investment focused on lightweighting and energy efficiency improvements for electric powertrains. Supply chain stability, especially concerning high-grade steel and advanced composites, remains a central concern impacting pricing and production capacity, fostering regionalized manufacturing strategies to mitigate geopolitical risks and logistics bottlenecks.

Regionally, Asia Pacific, particularly China, dominates the volume aspect of the market due to unparalleled NEV production scale and supportive government policies emphasizing local manufacturing and technology adoption. Europe exhibits high growth potential in the value segment, driven by stringent safety regulations and strong consumer demand for high-performance and premium EV models that incorporate active anti-roll control systems. North America is poised for significant expansion, fueled by the accelerating electrification of light trucks and SUVs, vehicles that inherently require robust stabilization solutions due to their higher centers of gravity. These regional variations dictate different technological adoption rates, with APAC leading in mass adoption of standardized systems, while Europe and North America drive demand for customization and high-end active stabilization technologies.

Segmentation trends highlight the increasing dominance of the fully active stabilization system sub-segment, driven by consumer expectations for superior ride comfort combined with high-agility handling capabilities essential for heavier NEVs. By vehicle type, the passenger EV segment holds the largest market share, but the commercial vehicle segment (electric buses and heavy trucks) is projected to exhibit the highest CAGR, spurred by fleet electrification mandates and the critical need for stability control in high-mass commercial applications. Material science segments show a clear trajectory toward advanced lightweight materials, including composite stabilizer links and aluminum-intensive components, as manufacturers strive to reduce overall vehicle weight to maximize driving range, indicating a long-term shift away from conventional heavy steel components in high-volume premium and performance NEV models.

AI Impact Analysis on New Energy Vehicle Stabilizer Market

Common user inquiries concerning the influence of Artificial Intelligence on NEV stabilizers revolve around several core themes: 'How does AI optimize dynamic handling?', 'Can AI predict and prevent stabilizer failure?', and 'What role does machine learning play in custom tuning stabilizer stiffness based on driving conditions?'. These questions reflect a general expectation that AI will move stabilization systems beyond simple reactive control into predictive and highly adaptive domains. Users are keenly interested in how deep learning algorithms, utilizing sensor fusion data (from cameras, LiDAR, accelerometers, and gyroscopes), can preemptively adjust active stabilizers—or the stiffness of semi-active ones—milliseconds before a demanding maneuver, such as entering a curve or encountering abrupt road imperfections, thereby maximizing both safety and performance. Concerns often center on the computational cost and the reliability of AI algorithms in safety-critical chassis control, highlighting the need for robust validation and fail-safe mechanisms.

AI's primary impact lies in enabling highly sophisticated, real-time adjustments that mechanical or simple electronic systems cannot achieve. Machine learning models analyze massive datasets on driver behavior, road texture, vehicle speed, and load distribution (crucial for commercial NEVs) to generate optimal damper and stabilizer settings instantaneously. This capability allows vehicle manufacturers to offer personalized driving experiences, where the same stabilizer hardware can deliver vastly different ride characteristics (e.g., comfort mode vs. sport mode) without physical reconfiguration. Furthermore, AI-driven digital twin simulation environments accelerate the design cycle for stabilizer components. Generative AI tools are being utilized in computer-aided engineering (CAE) to design complex, lattice-structured, lightweight parts that optimize stress distribution while minimizing material usage, leading directly to reduced production costs and enhanced performance parameters.

In manufacturing and maintenance, AI algorithms monitor vibrational patterns and operational stresses on stabilizer links and bushings. By analyzing deviations from expected performance signatures, these systems can accurately predict the onset of wear or potential component failure long before audible or tactile degradation is noticed by the driver. This predictive maintenance capability is transforming the aftermarket service model for NEV chassis components, enabling scheduled replacements that maximize vehicle uptime and significantly reduce warranty claims related to stabilizer system failure. Thus, AI integration not only enhances the performance dynamics of the vehicle but also fundamentally improves the lifecycle management and reliability of stabilizer assemblies, contributing to higher overall customer satisfaction and safety standards.

- AI optimizes Active Stabilization Control (ASC) by processing real-time sensor fusion data for predictive adjustments.

- Generative Design algorithms use AI to create topology-optimized, lightweight stabilizer components, improving energy efficiency.

- Machine learning models enable personalized tuning of suspension and stabilizer stiffness based on driver profile and road conditions.

- AI-driven predictive maintenance monitors component wear using vibration analysis, reducing downtime and optimizing replacement cycles.

- Enhances vehicle safety by integrating complex stabilizer adjustments with autonomous driving decision-making units.

DRO & Impact Forces Of New Energy Vehicle Stabilizer Market

The NEV Stabilizer market is primarily driven by rigorous global regulatory pushes toward vehicle electrification and the corresponding need for high-performance stabilization systems capable of handling increased vehicle weight and higher torque delivery inherent in electric drivetrains. Restraints largely center on the premium cost associated with advanced active stabilization technologies and the volatility of raw material prices (steel, aluminum, rare earth magnets for actuators), which inflate manufacturing costs and challenge price parity with conventional vehicles. Opportunities are abundant in the emerging commercial NEV segment (electric trucks and buses) and in developing predictive maintenance solutions integrated with stabilizer functionality. The impact forces shaping this market include stringent government-mandated safety standards (especially for rollover mitigation in heavy-duty EVs) and the powerful competitive dynamics among OEMs who are using superior handling and ride quality—achieved through advanced stabilizers—as a key consumer selling point in the rapidly maturing EV landscape.

Key drivers include the global mandate for reduced emissions, which accelerates EV adoption, directly increasing the demand for tailored NEV components. The unique structure of skateboard platforms, which centralize battery mass, necessitates innovative anti-roll solutions to manage inertial forces effectively without sacrificing ground clearance or passenger space. Furthermore, the rapid advancements in power electronics and sensor technology have made complex mechatronic stabilization systems more viable and responsive, pushing passive systems toward obsolescence in premium and mid-range EV segments. The consumer expectation for 'connected vehicle' features also drives demand, as modern stabilizers must interface seamlessly with overall vehicle dynamics control (VDC) systems and regenerative braking mechanisms to maintain stability under varied driving inputs.

Conversely, significant restraints are imposed by the supply chain complexity, particularly the need for specialized materials and precision manufacturing of actuator components required for active stabilizer bars. The overall cost addition of a fully active stabilization system can be substantial, making it difficult for economy-class NEVs to adopt this technology, thus limiting overall market penetration in price-sensitive segments. Moreover, the need for specialized training for service technicians to maintain and diagnose these complex electronic-mechanical systems poses an operational hurdle for widespread adoption, particularly in developing regional markets. Opportunities, however, are vast in the development of modular stabilizer platforms that can be customized across different NEV architectures (from compact cars to large commercial vehicles) and in leveraging software updates (OTA capabilities) to improve stabilizer performance post-sale, creating new revenue streams and enhancing product lifecycle management.

Impact forces are primarily regulatory and competitive. Regulatory pressure from organizations establishing crash and handling safety standards (e.g., UNECE regulations, NHTSA) forces manufacturers to adopt advanced roll stability technologies, often accelerating the adoption curve for semi-active and active systems. The competitive landscape is defined by the race among Tier 1 suppliers to offer highly integrated, lightweight, and energy-efficient stabilization modules. This intense competition drives down per-unit costs over time but necessitates continuous innovation, ensuring that the market remains dynamic and technologically focused. The political commitment to charging infrastructure development also serves as an indirect positive impact force, as consumer confidence in long-distance EV travel increases, subsequently boosting vehicle sales and the demand for performance-enhancing components like stabilizers.

Segmentation Analysis

The New Energy Vehicle Stabilizer Market is systematically segmented based on technology type, material composition, vehicle type, and distribution channel, providing a granular view of market dynamics and growth potential across various dimensions. Technology segmentation is critical, delineating between passive anti-roll bars, electro-hydraulic semi-active systems, and highly sophisticated fully active stabilization systems (EAS). Material segmentation reflects the ongoing industry efforts toward weight reduction, analyzing the dominance of high-strength steel versus advanced lightweight composites and aluminum alloys. By vehicle type, the market distinguishes between Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs), as well as classifying vehicles into passenger cars, commercial light-duty vehicles, and heavy-duty vehicles. Understanding these segments is crucial for strategic planning, as different NEV categories possess distinct stabilization requirements dictated by weight, payload capacity, and performance targets.

- By Technology Type:

- Passive Stabilizer Bars

- Semi-Active Stabilization Systems

- Fully Active Stabilization Systems (EAS)

- By Material:

- High-Strength Steel Stabilizers

- Aluminum Alloy Stabilizers

- Composite Material Stabilizers (CFRP/GFRP)

- By Vehicle Type:

- Passenger Cars (Sedans, SUVs, Hatchbacks)

- Commercial Vehicles (Light Commercial Vehicles, Heavy-Duty Trucks, Buses)

- By Drivetrain:

- Battery Electric Vehicles (BEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

- Fuel Cell Electric Vehicles (FCEV)

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket

Value Chain Analysis For New Energy Vehicle Stabilizer Market

The value chain for NEV stabilizers is characterized by a high degree of vertical integration among key Tier 1 suppliers, who manage complexities spanning advanced material procurement to software integration. The upstream segment involves the sourcing of specialized raw materials, specifically high-grade, lightweight steel alloys, aluminum billets, and advanced carbon fiber or glass fiber composites, which require specialized processing to meet automotive safety standards while minimizing weight. Component manufacturers transform these materials into precision parts, including torsion bars, linkages, bushings, and, critically, the electromechanical actuators (motors, gears, power control units) for active systems. Given the precise engineering required for stability control, quality control and material traceability at this stage are paramount, particularly for composite stabilizers used in high-performance EVs where weight savings are critical to range optimization.

The midstream involves the design, assembly, and testing of the complete stabilizer module. Tier 1 suppliers often collaborate closely with OEMs during the initial platform design phase to tailor the stabilizer system to the NEV's specific battery placement and suspension geometry. This stage is heavily influenced by software development, as modern active stabilizer systems are defined by their proprietary control algorithms that govern actuator response. Testing and validation are rigorous, simulating diverse road conditions, payload variations, and emergency maneuvers to ensure compliance with safety mandates. This integration process ensures the stabilizer system functions harmoniously with other vehicle safety features, such as ABS, ESC, and sophisticated torque vectoring systems utilized by electric drivetrains.

The downstream segment encompasses distribution channels, which are clearly split into OEM and Aftermarket sales. The OEM channel is dominant, involving direct supply of finished modules to vehicle assembly plants globally. This channel demands just-in-time delivery and strict adherence to manufacturing schedules. The Aftermarket channel, while smaller, is growing, driven by replacement needs (bushings, links) and the demand for performance upgrades, where specialized suppliers offer enhanced passive or semi-active bars for enthusiasts seeking improved handling. Distribution involves specialized logistics due to the size and sensitivity of actuator components, relying on both direct contracts (OEM) and a network of certified distributors and specialized service centers (Aftermarket) to ensure that installation and calibration meet the high technical standards required for NEV chassis components.

New Energy Vehicle Stabilizer Market Potential Customers

The primary customers in the New Energy Vehicle Stabilizer Market are Original Equipment Manufacturers (OEMs) who integrate these components directly into their assembly lines. These customers include established global automotive giants transitioning their portfolios to include full EV lineups (e.g., Volkswagen Group, General Motors, Toyota, Ford) and pure-play electric vehicle manufacturers (e.g., Tesla, BYD, NIO, Rivian). OEMs require high-volume, customized solutions that meet specific performance criteria related to the vehicle’s intended use—ranging from robust, heavy-duty stabilizers for electric trucks to lightweight, high-precision active systems for luxury sports EVs. The purchasing decision for OEMs is driven by long-term supply contracts, reliability, component cost optimization, and the supplier's capability to integrate complex mechatronic systems with the OEM's proprietary vehicle control software architecture.

Secondary, yet rapidly growing, customer segments include commercial fleet operators and specialized commercial vehicle manufacturers. Fleet operators, particularly those managing large electric bus fleets or heavy-duty logistics trucks, require stabilizers designed for constant high-load cycles and durability. Given the enormous weight and high centers of gravity of commercial NEVs, robust stabilization is a non-negotiable safety feature, leading these buyers to prioritize reliability and low total cost of ownership over initial component cost. These commercial buyers typically procure stabilizers either through the OEM during vehicle purchase or through certified aftermarket providers for maintenance and eventual replacement.

Finally, the aftermarket segment includes independent service centers, specialty performance modifiers, and end-user consumers seeking replacement parts or performance upgrades. While this segment deals primarily with passive stabilizer bars and related linkages, the increasing complexity of semi-active systems means service centers are becoming crucial purchasers of replacement actuators and specialized calibration tools. Performance enthusiasts who modify their NEVs to enhance track performance or daily agility also constitute a niche customer base, demanding specialized, stiffness-adjustable stabilizer bars made from high-performance materials like titanium or composite alloys, demonstrating a demand spectrum that ranges from commodity replacement parts to highly specialized, custom-engineered handling components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.9 Billion |

| Market Forecast in 2033 | $36.7 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ZF Friedrichshafen AG, Continental AG, ThyssenKrupp AG, Tenneco Inc., BWI Group, KYB Corporation, Schaeffler Group, Sogefi Group, Eibach Inc., Mando Corporation, Hitachi Astemo, Inc., Mitsubishi Electric Corporation, Hella GmbH & Co. KGaA, BorgWarner Inc., Meritor, Hendrickson, Knorr-Bremse, Wuxi Weifu International, Shandong Zhengyang, VDL Groep |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

New Energy Vehicle Stabilizer Market Key Technology Landscape

The technological landscape of the NEV stabilizer market is rapidly converging on sophisticated mechatronic systems that maximize control authority over body dynamics while minimizing energy consumption. Key innovations are focused on Active Anti-Roll Bar Systems (AARS), often utilizing 48V electric motors or electro-hydraulic actuators to instantly generate counter-roll torque based on real-time vehicle dynamics data. These systems are essential for heavy, high-performance EVs, allowing engineers to decouple ride comfort (requiring soft springs) from handling performance (requiring high roll stiffness). Furthermore, the integration of regenerative braking and electronic stability control (ESC) mandates that stabilizer systems must be intrinsically linked to the central vehicle control unit to ensure seamless transitions between conventional friction braking and battery energy recovery, demanding high-speed communication via CAN bus or Ethernet.

A second crucial technological trend involves advanced material science and manufacturing processes aimed at radical lightweighting. The standard steel stabilizer bar is increasingly being replaced by hollow-core designs, high-strength specialized spring steel (e.g., chromoly), and structural composites, particularly for linkage arms and mounts. Carbon Fiber Reinforced Plastic (CFRP) stabilizers are emerging in the luxury and hyper-performance EV segments, offering substantial weight savings (up to 50% compared to steel) with equivalent or superior torsional stiffness. However, the cost and specialized manufacturing techniques required for composites remain barriers to mass market adoption, currently limiting their use primarily to high-end models where maximizing driving range and reducing unsprung mass justifies the premium investment.

Finally, predictive control algorithms, often leveraging the aforementioned AI techniques, are becoming standard features in premium stabilization systems. These technologies utilize complex models of vehicle behavior and road conditions to anticipate body motion rather than merely reacting to it. Future developments point towards full integration of stabilizer control into comprehensive chassis domain controllers, potentially blurring the lines between active suspension systems, stabilizers, and magnetic ride control. This integration minimizes hardware redundancy and maximizes software efficiency, allowing for OTA updates to improve vehicle handling characteristics throughout the lifespan of the NEV—a major technological differentiator in the modern automotive market.

Regional Highlights

The global New Energy Vehicle Stabilizer market exhibits distinct dynamics across key geographical regions, driven by varied rates of NEV adoption, local manufacturing capabilities, and regulatory environments. Asia Pacific (APAC) stands as the undisputed volume leader, primarily due to the overwhelming market presence and state-driven support for electric vehicles in China. China not only represents the largest manufacturing hub for NEVs but also has a vast domestic supply chain, which includes local stabilizer manufacturers rapidly adopting advanced technologies to meet the demands of domestic giants like BYD and Geely. APAC's focus is currently balanced between reliable, cost-effective passive and semi-active systems for high-volume urban EVs and advanced active systems for export and luxury segments, positioning the region as central to market expansion.

Europe demonstrates significant growth in the value segment, fueled by strict European Union emission standards and strong consumer demand for high-performance and safety features in EVs. European OEMs frequently incorporate advanced active stabilization systems (e.g., 48V electric anti-roll bars) into their mid-to-high-end EV models to manage the heavy mass of battery packs while delivering the traditionally expected European driving dynamics (precision handling and high-speed stability). Germany, France, and the UK are key markets, benefiting from a well-established Tier 1 supplier network (Continental, ZF) that drives technological innovation, particularly in integrating stabilizers with sophisticated electronic control units and utilizing advanced materials for weight optimization.

North America is characterized by accelerating electrification, particularly in the large SUV and light truck segments, which inherently require robust and high-authority stabilization mechanisms due to their size and height. The region, led by the US, presents massive opportunities for advanced semi-active and active systems designed to cope with rougher infrastructure and specific consumer preferences for smooth highway cruising combined with off-road capability in electric trucks (e.g., Ford F-150 Lightning, Rivian R1T). Government investments in EV infrastructure and domestic battery production are further bolstering the market, driving localized manufacturing of stabilizer components to serve the rapidly expanding domestic production capacity of major US OEMs.

- Asia Pacific (APAC): Dominates market volume due to high NEV production in China; focus on local supply chain resilience and mass-market stabilization solutions.

- Europe: Leading in technology adoption and high-value components (Active Systems); driven by stringent safety regulations and premium EV consumer demands.

- North America: High growth trajectory driven by the electrification of large SUVs and light trucks, necessitating specialized, heavy-duty stabilization systems.

- Latin America (LATAM) & Middle East and Africa (MEA): Emerging markets with reliance on imported NEVs; growth is dependent on infrastructure development and local assembly initiatives, primarily demanding standard passive and cost-effective semi-active stabilizers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the New Energy Vehicle Stabilizer Market.- ZF Friedrichshafen AG

- Continental AG

- ThyssenKrupp AG

- Tenneco Inc.

- BWI Group

- KYB Corporation

- Schaeffler Group

- Sogefi Group

- Eibach Inc.

- Mando Corporation

- Hitachi Astemo, Inc.

- Mitsubishi Electric Corporation

- Hella GmbH & Co. KGaA

- BorgWarner Inc.

- Meritor

- Hendrickson

- Knorr-Bremse

- Wuxi Weifu International

- Shandong Zhengyang

- VDL Groep

Frequently Asked Questions

Analyze common user questions about the New Energy Vehicle Stabilizer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between NEV stabilizers and conventional stabilizers?

NEV stabilizers must manage the significantly higher curb weight and altered, lower center of gravity caused by the battery pack. This necessitates the frequent use of active or semi-active systems, lightweight materials (composites, aluminum), and integration with complex electronic vehicle dynamics control (VDC) systems to optimize handling and energy efficiency—challenges less pronounced in lighter, traditionally structured conventional vehicles.

How does the adoption of active stabilization systems benefit the driving range of an electric vehicle?

While active stabilization systems require minor energy input for actuators, they contribute positively to range by allowing vehicle designers to use softer suspension settings, reducing the need for aggressive damping. This leads to reduced rolling resistance and improved aerodynamic efficiency through optimized body positioning, enhancing overall energy management and ride comfort.

Which material segment is expected to show the fastest growth rate in the NEV stabilizer market?

The composite material segment, including carbon fiber reinforced plastic (CFRP) stabilizers, is projected to exhibit the highest CAGR. This growth is driven by the industry's critical need for extreme lightweighting to counteract battery weight and maximize EV driving range, despite the currently higher manufacturing cost of these advanced materials.

What are the key restraint factors limiting the growth of fully active NEV stabilizer systems?

The primary restraints are the high initial component cost of the complex electromechanical actuators and the software development required for these active systems. Additionally, the need for specialized maintenance and diagnosis equipment in the aftermarket limits their widespread adoption in price-sensitive, mass-market NEV models globally.

What role does the 48V architecture play in the development of modern NEV stabilization technology?

The 48V architecture provides the necessary power capacity for high-authority electric motors used in fully active anti-roll bar systems (AARS). This mid-voltage standard allows for the instantaneous generation of significant counter-roll torque, essential for stabilizing heavy EVs during dynamic maneuvers, offering superior performance compared to traditional 12V systems or less responsive hydraulic setups.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager