New Energy Vehicle Welding in Manufacturing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432837 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

New Energy Vehicle Welding in Manufacturing Market Size

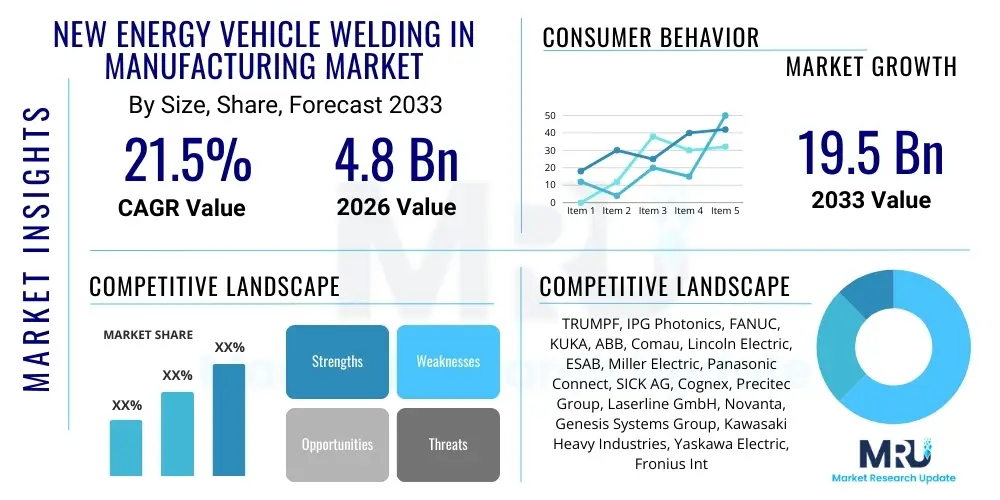

The New Energy Vehicle Welding in Manufacturing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 19.5 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the exponential global increase in the production of Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), and Fuel Cell Electric Vehicles (FCEVs).

The market valuation reflects the increasing investment by Original Equipment Manufacturers (OEMs) and battery gigafactories in high-precision, automated welding systems essential for critical components such as battery packs, motor assemblies, and lightweight body structures. The shift from traditional Internal Combustion Engine (ICE) vehicle manufacturing processes to NEV production demands welding techniques capable of handling dissimilar materials, ensuring hermetic sealing, and maintaining stringent quality standards, particularly in battery module assembly where safety and reliability are paramount.

New Energy Vehicle Welding in Manufacturing Market introduction

The New Energy Vehicle (NEV) Welding in Manufacturing Market encompasses the specialized joining technologies, equipment, and consumables utilized throughout the production life cycle of electric and hybrid vehicles. This sector is defined by its requirement for ultra-high precision and speed, largely necessitating advanced techniques such as laser welding, friction stir welding, and resistance spot welding, distinct from conventional automotive welding practices. These technologies are crucial for assembling complex NEV components, including the battery pack enclosure, internal cell connections (tabs, busbars), lightweight aluminum or carbon fiber Body-in-White (BIW) structures, and electric motor stator and rotor components.

Major applications driving market growth include the sealing and joining of battery cells into modules and modules into packs, where laser welding is the preferred method due to its minimal heat input and high processing speed, ensuring battery integrity and performance. Other key applications involve the precise joining of high-strength, lightweight materials in the vehicle chassis and frame, which directly contributes to extended range and improved energy efficiency. The primary benefit derived from these advanced welding processes is the enhancement of NEV safety, durability, and performance, simultaneously enabling manufacturers to meet aggressive production targets and reduce overall manufacturing costs through automation.

Driving factors propelling this market include stringent global emissions regulations pushing NEV adoption, massive capital investment in battery production infrastructure (gigafactories), and continuous technological advancements in laser sources and robotic integration. The necessity for reliable, repeatable, and scalable manufacturing solutions to meet the surging consumer demand for electric mobility ensures sustained market buoyancy and innovation within the welding ecosystem, establishing it as a critical enabler of the electric vehicle revolution.

New Energy Vehicle Welding in Manufacturing Market Executive Summary

The New Energy Vehicle Welding in Manufacturing Market is characterized by accelerated technological disruption, moving rapidly toward full automation and integration with Industry 4.0 principles. Current business trends indicate a strong preference among major automotive OEMs and battery producers for high-power fiber lasers and advanced monitoring systems, prioritizing weld integrity and traceability, especially in battery manufacturing lines. Regionally, the Asia Pacific (APAC) region, spearheaded by China, maintains undisputed dominance due to its massive production capacity of both electric vehicles and precursor components, while Europe and North America are experiencing rapid localized growth driven by government incentives and the establishment of numerous new gigafactories. Segment trends highlight Laser Welding Technology as the fastest-growing sub-segment, primarily due to its versatility and precision essential for thin-sheet metal joining, dissimilar material welding (like copper and aluminum), and the high-speed requirements of battery cell and module assembly. Furthermore, the segmentation by application shows Battery Pack Assembly commanding the largest market share, underscoring the critical nature of welding in the most valuable and safety-critical NEV component.

Market stakeholders are heavily investing in integrating machine learning and artificial intelligence (AI) into welding processes to achieve zero-defect manufacturing, addressing the inherent complexity of welding new-generation materials and structures designed for lightweighting. This integration spans predictive maintenance for welding systems, real-time quality assurance using vision systems, and autonomous parameter adjustment based on sensor data. The convergence of hardware advancements, such as enhanced optics and scanning heads, with sophisticated software analytics is redefining manufacturing capabilities. Geopolitical considerations, particularly concerning supply chain resilience and localized production mandates, are prompting major investments in turnkey welding solutions across diversified global locations, moving production closer to major NEV consumption centers in the US and Europe, thereby decentralizing manufacturing operations away from current centralized hubs.

AI Impact Analysis on New Energy Vehicle Welding in Manufacturing Market

Common user inquiries regarding the influence of AI on NEV welding center on achieving robust quality control, optimizing complex material joining procedures, and accelerating production throughput while minimizing costs. Users are primarily concerned with how AI can address the challenge of welding highly reflective and dissimilar materials, such as copper and aluminum in battery interconnects, which require extremely precise parameter control to prevent spatter and defects. They seek assurance regarding the viability of AI-driven systems in maintaining high uptime and reducing the need for costly manual inspections and rework. The overarching expectation is that AI and machine learning will enable truly adaptive welding processes capable of instantly adjusting to minor variations in material thickness, fit-up gaps, and ambient conditions, thus moving the industry toward guaranteed, verifiable weld quality and significantly higher manufacturing yields essential for high-volume NEV production.

- Real-time Defect Detection and Quality Assurance: AI-powered vision systems analyze high-speed camera footage and sensor data (acoustic, thermal) during the welding process to immediately identify and classify defects like porosity or spatter, enabling instant process correction.

- Predictive Maintenance: Machine learning algorithms monitor the performance and wear of critical welding components (e.g., laser optics, electrodes, gas nozzles) to forecast potential failures, maximizing equipment uptime and minimizing unplanned downtime in high-volume production lines.

- Autonomous Parameter Optimization: AI models process large datasets relating to material composition and geometry to automatically fine-tune welding parameters (power, speed, focal length) for optimal seam quality, particularly critical when joining dissimilar or novel NEV materials.

- Robotic Path Planning and Collision Avoidance: Advanced algorithms enhance the precision and efficiency of robotic welding cells, optimizing tool paths in congested work envelopes like complex battery pack architectures, reducing cycle times.

- Thermal Management Prediction: AI simulation tools predict heat distribution and thermal stress during laser welding of sensitive components like battery tabs, preventing heat damage to the adjacent battery cells and ensuring long-term electrochemical performance.

DRO & Impact Forces Of New Energy Vehicle Welding in Manufacturing Market

The market dynamics are defined by powerful driving forces centered around global electrification mandates and technological leaps, yet they face considerable restraints concerning capital intensity and material complexity. Key drivers include accelerating NEV adoption globally, massive government investments in charging infrastructure and battery production, and the non-negotiable requirement for high-integrity welding to ensure battery safety and performance. Restraints primarily involve the substantial initial capital expenditure required for advanced laser welding systems and robotic cells, the technical complexity associated with reliably joining dissimilar materials (e.g., aluminum BIW and copper busbars), and the shortage of skilled technicians capable of operating and maintaining these sophisticated automated lines. Opportunities emerge from the ongoing development of solid-state battery technology requiring entirely new welding architectures, the integration of advanced sensors and AI for adaptive manufacturing, and the expansion into emerging NEV markets. These factors collectively exert significant impact forces, accelerating the adoption of high-automation solutions while simultaneously demanding lower cost and higher flexibility from equipment providers.

Segmentation Analysis

The New Energy Vehicle Welding in Manufacturing Market is extensively segmented based on the technology utilized, the specific application within the vehicle structure, and the level of automation deployed. This detailed segmentation allows manufacturers to tailor their investment strategies to specific production needs, balancing required precision with throughput demands. Laser welding dominates the technology landscape due to its ability to deliver high energy density with minimal heat-affected zones (HAZ), crucial for thermally sensitive components like battery cells. Application segmentation emphasizes battery production, which requires robust, high-speed joining methods for busbars, cell housings, and cooling plates. Geographically, manufacturing capacity heavily dictates market size, with APAC leading due to established supply chains and massive governmental support for NEV production and component exports.

- By Welding Technology:

- Laser Welding (Fiber Laser, Disk Laser, Diode Laser)

- Arc Welding (TIG, MIG/MAG)

- Resistance Welding (Spot Welding, Projection Welding)

- Brazing and Soldering

- Friction Stir Welding (FSW)

- By Application:

- Battery Pack Assembly (Cell-to-Cell, Module-to-Module, Pack Housing Sealing, Busbar Joining)

- Body-in-White (BIW) Structure (Aluminum and High-Strength Steel Joining)

- Chassis Components and Underbody Structures

- Motor Stator/Rotor Assembly and Hairpin Welding

- Power Electronics and Inverter Assembly

- By Automation Level:

- Fully Automated Systems (Robotic Cells, Dedicated Production Lines)

- Semi-Automated Systems

- Manual and Benchtop Systems

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For New Energy Vehicle Welding in Manufacturing Market

The value chain for NEV welding systems begins with the upstream segment, dominated by suppliers of core enabling components. This includes high-power laser sources (such as fiber lasers and scanning optics providers), sophisticated sensor and machine vision manufacturers (critical for quality control), and industrial robotics suppliers (FANUC, KUKA, ABB). These upstream suppliers are highly specialized and often possess proprietary technology, forming the foundation of the final welding solution. The midstream is characterized by system integrators and turnkey solution providers, who purchase components and develop customized, automated welding cells tailored specifically for high-volume NEV manufacturing applications, such as dedicated busbar welding lines or battery tray sealing stations. These integrators are crucial for providing the application expertise necessary to transition from component sales to operational production systems.

The distribution channel operates via a combination of direct sales and specialized distributors. Large Tier 1 equipment manufacturers and integrators typically employ direct sales teams to handle major OEM accounts and gigafactories, ensuring tight collaboration during the design and commissioning phases of multi-million dollar production lines. Indirect channels involve local distributors and value-added resellers who provide regional support, maintenance services, and sales to smaller Tier 2 and Tier 3 suppliers focusing on niche NEV components. The efficiency of the distribution channel is heavily reliant on the quality of after-sales service, including spare parts availability and rapid technical support, given the extremely high uptime requirements in NEV assembly plants. Downstream analysis focuses entirely on the end-users—the NEV manufacturers and their specialized component suppliers—who utilize these welding systems to produce safe, high-quality electric vehicles at scale.

New Energy Vehicle Welding in Manufacturing Market Potential Customers

The primary consumers of advanced welding equipment and specialized manufacturing solutions in the NEV sector are the large-scale electric vehicle Original Equipment Manufacturers (OEMs), who require robust, high-throughput systems for their own assembly lines. This includes established automotive giants transitioning their portfolios (e.g., Volkswagen Group, General Motors, Ford) and pure-play EV manufacturers (e.g., Tesla, BYD, Rivian). A second critical customer base comprises the battery cell and module manufacturers (e.g., CATL, LG Energy Solution, Samsung SDI, Panasonic), who invest heavily in laser welding systems for critical cell joining and sealing processes, representing the most technologically demanding segment of the market. Furthermore, Tier 1 automotive suppliers specializing in battery enclosures, power electronics, and lightweight BIW components constitute a significant segment, purchasing highly automated robotic welding cells to supply multiple global OEM platforms. These end-users demand solutions that offer maximum precision, verifiable traceability of every weld, and seamless integration into their existing manufacturing execution systems (MES).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 19.5 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TRUMPF, IPG Photonics, FANUC, KUKA, ABB, Comau, Lincoln Electric, ESAB, Miller Electric, Panasonic Connect, SICK AG, Cognex, Precitec Group, Laserline GmbH, Novanta, Genesis Systems Group, Kawasaki Heavy Industries, Yaskawa Electric, Fronius International, Coherent Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

New Energy Vehicle Welding in Manufacturing Market Key Technology Landscape

The core of the NEV welding market relies on advanced high-power laser technology, specifically fiber and disc lasers, which offer unparalleled beam quality, efficiency, and depth-of-field capabilities necessary for deep penetration welding in battery modules and high-speed processing of thin foils. These systems are invariably coupled with highly dynamic beam steering mechanisms, such as galvanometer scanners, which allow for "on-the-fly" adjustments and wobble techniques essential for mitigating spatter when welding highly reflective materials like copper and aluminum busbars. The shift toward lighter vehicles has also accelerated the adoption of specialized welding heads and process monitoring tools capable of handling hybrid material structures, where traditional joining methods are inadequate, thereby emphasizing the transition toward non-contact, high-energy density processes. Furthermore, technological innovation is concentrated on delivering precise control over the weld pool, often achieved through enhanced gas shielding or vacuum techniques, especially critical for minimizing porosity and maximizing the electrical conductivity of interconnects.

Complementing the high-precision laser hardware, the adoption of sophisticated vision systems and in-process monitoring solutions stands out as a defining technological trend. Machine vision cameras, often integrated directly with the welding head, provide real-time seam tracking and geometric alignment checks, ensuring that the high-speed process is always centered on the intended joint line, crucial for processes requiring micron-level accuracy. Sensor fusion technology, combining acoustic, thermal, and optical sensor inputs, allows for the creation of digital twins of the welding process. This data-intensive approach feeds directly into AI models for quality assurance, enabling immediate shutdown or parameter adjustment if a substandard weld is detected, thereby minimizing scrap and ensuring compliance with stringent NEV safety standards. The ability to record and archive every weld data point provides comprehensive traceability, a requirement increasingly mandated by regulatory bodies and major OEMs for battery safety records.

In addition to laser technology, Resistance Spot Welding (RSW) continues to be vital for joining certain aspects of the aluminum or steel body structure and enclosure parts, though modern RSW utilizes adaptive controls and highly specialized electrodes to handle new, thinner, and high-strength steels (AHSS) used in lightweight NEV chassis. Friction Stir Welding (FSW) is gaining traction, particularly for welding thick aluminum battery trays and cooling plates, where a high-strength, low-distortion, solid-state weld is required. The integration of advanced robotics, capable of payload handling and high-speed movement across large battery pack dimensions, ties all these technologies together, providing the necessary dexterity and scale required for modern automotive production lines operating under rigorous automation standards.

Regional Highlights

- Asia Pacific (APAC): APAC, particularly China, dominates the NEV welding market globally, driven by the world's largest NEV production volumes and an established, robust supply chain for battery manufacturing (gigafactories). The region benefits from substantial government support, leading to rapid technological deployment and fierce competition among domestic and international welding equipment suppliers. South Korea and Japan are also critical centers for high-precision welding technology, focusing on advanced battery cell components and complex power electronics manufacturing.

- Europe: Europe is characterized by a strong governmental and regulatory push toward electrification, resulting in massive investments in new gigafactories across Germany, Hungary, Poland, and Scandinavian countries. This region is a major growth driver for sophisticated, automated welding solutions, emphasizing sustainability and Industry 4.0 integration. The demand is heavily skewed towards high-throughput laser welding systems necessary for localized battery cell and module production, aligning with the EU’s strategy for achieving supply chain independence.

- North America: The market in North America is experiencing explosive growth, significantly accelerated by supportive legislation like the Inflation Reduction Act (IRA), which incentivizes domestic NEV and battery production. Major investments from both legacy automakers and new EV startups are fueling demand for large, dedicated manufacturing lines. The focus here is on integrating highly complex robotic cells and advanced quality control systems to handle the high-volume requirements of the US market while ensuring compliance with stringent safety and localization requirements.

- Latin America, Middle East, and Africa (MEA): While currently representing a smaller share, these regions show emerging potential. Latin American countries, particularly Mexico and Brazil, are positioned as key secondary manufacturing hubs supplying North American markets, driving localized demand for efficient assembly technologies. MEA markets are nascent but display increasing governmental interest in sustainable mobility, paving the way for future capacity expansion, especially in localized assembly plants receiving investment from major global OEMs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the New Energy Vehicle Welding in Manufacturing Market.- TRUMPF

- IPG Photonics

- FANUC

- KUKA

- ABB

- Comau

- Lincoln Electric

- ESAB

- Miller Electric

- Panasonic Connect

- SICK AG

- Cognex

- Precitec Group

- Laserline GmbH

- Novanta

- Genesis Systems Group

- Kawasaki Heavy Industries

- Yaskawa Electric

- Fronius International

- Coherent Corp.

Frequently Asked Questions

Analyze common user questions about the New Energy Vehicle Welding in Manufacturing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What welding technology is most critical for NEV battery pack assembly?

High-power laser welding, specifically using fiber or disc lasers, is the most critical technology. Laser welding offers the necessary precision, speed, and low heat input required for reliably joining sensitive and highly conductive materials like copper and aluminum busbars and for hermetically sealing cell enclosures, directly impacting battery safety and lifespan.

How does AI improve quality control in NEV welding processes?

AI enhances quality control by integrating high-speed vision and sensor systems that monitor the weld process in real time. Machine learning algorithms analyze this data to detect micro-defects, spatter, or porosity instantaneously, allowing for automated parameter adjustments or immediate identification of faulty parts before they proceed down the assembly line, ensuring zero-defect output.

What are the primary challenges when welding dissimilar materials in NEVs?

The primary challenges involve managing significant differences in melting points, thermal expansion coefficients, and electrical conductivity between materials like aluminum (used in housings) and copper (used in busbars). This complexity requires advanced techniques such as laser wobble, precise beam shaping, and specialized process monitoring to create robust, low-resistance metallurgical joints without generating excessive intermetallic compounds.

Which geographic region currently leads the demand for NEV welding equipment?

The Asia Pacific (APAC) region, led overwhelmingly by China, currently holds the largest market share and leads the demand. This dominance is due to China’s vast domestic production volume of electric vehicles and its significant concentration of global battery manufacturing capacity (gigafactories), requiring continuous investment in advanced automation infrastructure.

Is Friction Stir Welding (FSW) relevant for NEV manufacturing?

Yes, FSW is highly relevant, particularly for joining thick sections of aluminum alloys used in large battery trays and cooling plates. FSW provides high-strength, low-distortion, solid-state joints crucial for structural integrity, offering an advantage over fusion welding methods when thermal distortion needs to be strictly minimized.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager