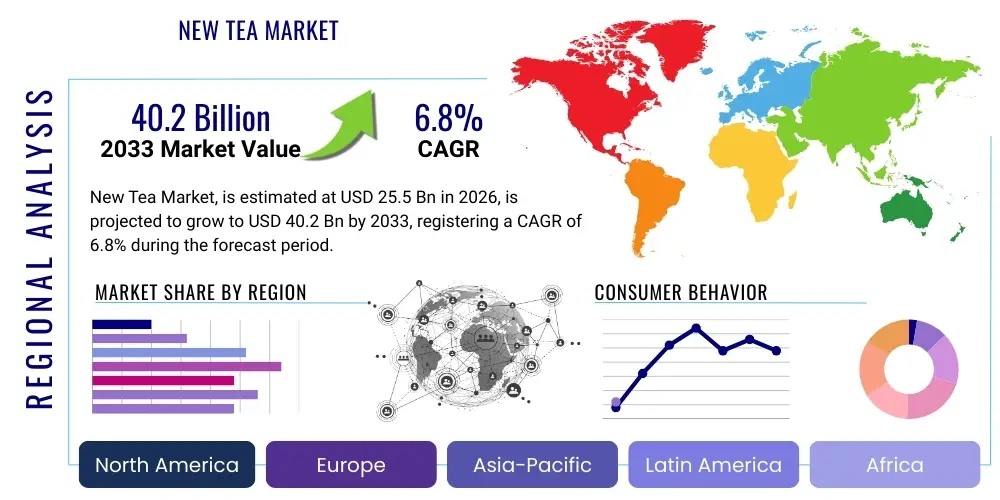

New Tea Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438742 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

New Tea Market Size

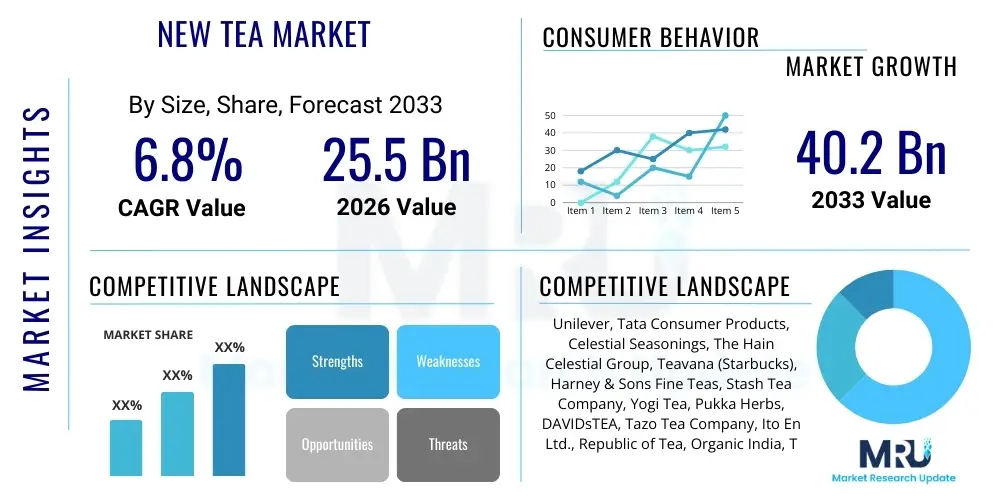

The New Tea Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.2 Billion by the end of the forecast period in 2033.

New Tea Market introduction

The New Tea Market encompasses innovative, functional, and premium tea products that move beyond traditional black, green, and herbal varieties. This market segment is characterized by the integration of novel ingredients such as adaptogens, probiotics, nootropics, and rare botanical extracts, offering enhanced health benefits and specialized flavor profiles. These products often target specific consumer needs, including stress reduction, immune support, cognitive enhancement, and digestive wellness, positioning them as essential components of modern holistic health routines. The continuous innovation in processing techniques, such as cold brewing, flash freezing, and advanced extraction methods, further distinguishes new tea offerings from their conventional counterparts, leading to higher consumer acceptance and premium pricing within retail channels.

Major applications of New Tea products span across various consumption formats, including ready-to-drink (RTD) beverages, loose leaf blends optimized for specific functionalities, and instant powders designed for convenience. The rise in health consciousness globally, coupled with a preference for natural functional beverages over sugary sodas or high-caffeine energy drinks, serves as a fundamental driving factor. Moreover, the strong emphasis on sustainability, ethical sourcing, and transparency in ingredient lists by New Tea brands resonates deeply with Millennial and Gen Z consumers, fostering brand loyalty and expanding the market footprint. These benefits—ranging from sustained energy without crashes to improved mental clarity—are systematically marketed, positioning tea not just as a beverage but as a preventative wellness tool.

The market is actively driven by significant investments in research and development aimed at discovering and incorporating novel, efficacious ingredients that deliver measurable physiological benefits. For instance, the use of rare fermented teas (like Pu-erh) blended with superfoods (like turmeric or ginger) creates complex matrices of flavor and function. Furthermore, the expansion of global distribution networks, including specialized online retailers and health food stores, facilitates wider access to niche and premium products. Regulatory advancements and consumer education initiatives regarding the health potential of ingredients like L-Theanine and various polyphenols are crucial in converting traditional tea drinkers into consumers of specialized New Tea products, accelerating the overall market expansion trajectory across developed and emerging economies.

New Tea Market Executive Summary

The New Tea Market Executive Summary highlights robust growth across all major geographical regions, driven primarily by evolving consumer preferences shifting toward functional and natural ingredients. Business trends indicate a strong move toward product diversification, emphasizing personalized nutrition and convenience formats like premium RTD teas and concentrated shots. Key players are aggressively pursuing mergers and acquisitions to integrate specialized ingredient suppliers and enhance their sustainable sourcing capabilities, ensuring a resilient supply chain amid increasing demand for transparency and ethical production. Furthermore, digital marketing strategies focused on health claims and ingredient provenance are critical for market penetration, particularly in North America and Western Europe, where premiumization is highly valued.

Regionally, Asia Pacific maintains its dominance in terms of volume due to the established tea culture in countries like China, Japan, and India, although the growth rate is highest in North America, driven by rapid acceptance of functional teas infused with CBD, adaptogens, and probiotics. European markets show a significant trend toward organic and certified sustainable tea options, with stringent consumer demand for eco-friendly packaging and reduced sugar content. Emerging markets in Latin America and the Middle East are experiencing accelerated growth as disposable incomes rise and global wellness trends influence local dietary habits, particularly favoring innovative fruit-infused and low-calorie variations of traditional tea. Urbanization and increased retail sophistication are enabling new brands to quickly gain traction in these previously underdeveloped regions.

Segment trends underscore the dominance of the Functional Tea category, specifically those marketed for immunity and stress relief, reflecting global health anxieties post-pandemic. Within the distribution channel segment, e-commerce platforms are experiencing the fastest growth, offering direct-to-consumer (D2C) brands the ability to bypass traditional retail limitations and provide highly customized subscription services. Product Type analysis reveals that specialty blends, incorporating novel ingredients like medicinal mushrooms or exotic herbs, command the highest average selling prices and contribute significantly to overall revenue growth. The B2B segment, focusing on supplying high-quality extracts for use in food service and pharmaceuticals, also represents a substantial, albeit less visible, revenue stream that continues to expand through strategic partnerships and ingredient standardization efforts.

AI Impact Analysis on New Tea Market

Analysis of common user questions related to the impact of AI on the New Tea Market reveals significant themes centered around supply chain efficiency, personalized product recommendations, and automated quality control. Users frequently inquire about how AI can predict crop yields and optimize harvesting schedules, especially for sensitive, rare tea leaves, ensuring consistent quality and availability. There is also substantial interest in AI-driven personalization engines that can recommend specific tea blends based on user-reported health data, fitness goals, and taste preferences, moving beyond simple demographic targeting. Concerns often revolve around data privacy related to personalized recommendations and the potential displacement of traditional agricultural knowledge, though the overarching expectation is that AI will enhance transparency and sustainability in sourcing and production.

AI's primary role is emerging in optimizing the complex supply chain inherent to tea production, which spans multiple geographies and involves time-sensitive agricultural processes. Machine learning algorithms are being deployed to analyze vast datasets covering weather patterns, soil conditions, pest outbreaks, and historical yield data to provide highly accurate forecasts for tea growers. This predictive capability minimizes waste, optimizes fertilizer and water usage, and ensures that premium ingredients are harvested at peak potency. Furthermore, AI-powered quality inspection systems, utilizing computer vision, are increasingly used during processing to rapidly sort and grade tea leaves, identifying defects or contaminants far faster and more consistently than manual inspection, thus upholding the stringent quality standards expected in the New Tea Market.

In the consumer-facing domain, AI is transforming marketing and product development. Natural Language Processing (NLP) is used to analyze consumer feedback, social media sentiment, and search trends in real-time, allowing manufacturers to quickly identify unmet needs or emerging flavor profiles, accelerating the product innovation lifecycle. E-commerce platforms leverage AI-driven recommendation engines to curate personalized tea subscription boxes or suggest functional blends based on purchase history and stated wellness objectives. This enhanced level of personalization significantly improves customer lifetime value (CLV) and strengthens brand differentiation in a highly competitive market, effectively using data to tailor the consumer experience from initial discovery to repurchase.

- Optimization of agricultural processes through predictive yield modeling and resource management (water, fertilizer).

- Enhanced quality control using computer vision and machine learning for rapid sorting and contaminant detection in tea processing.

- Personalized product formulation and recommendation based on real-time consumer health data and preference mapping.

- Forecasting of commodity price volatility and procurement optimization for rare or seasonal ingredients.

- Automation of customer service and engagement via AI-powered chatbots specialized in ingredient and health benefit queries.

- Streamlining logistics and inventory management for sensitive, high-value functional tea components.

- Accelerated new product development (NPD) cycles through AI analysis of market trends and consumer feedback via NLP.

DRO & Impact Forces Of New Tea Market

The dynamics of the New Tea Market are shaped by a powerful confluence of driving forces, significant restraints, and abundant opportunities, creating a highly competitive and innovative landscape. The overarching driver is the global shift toward holistic wellness and preventative healthcare, where consumers are proactively seeking natural alternatives to synthetic supplements and high-sugar drinks. This movement is strongly supported by widespread consumer education regarding the scientifically backed benefits of botanicals and functional ingredients found in new tea formulations, such as adaptogens for stress management and antioxidants for longevity. However, growth is tempered by substantial restraints, notably the high cost associated with sourcing rare, certified organic, or ethically harvested specialized ingredients, which translates into higher retail prices and limits mass-market accessibility. Furthermore, ensuring consistent quality and efficacy across diverse global supply chains presents significant logistical and regulatory challenges.

Impact forces acting upon the market demonstrate high momentum. The immediate impact of health-consciousness trends post-pandemic has created a sustained demand surge for immunity-boosting and calming teas, structurally elevating the market base. Opportunities abound in geographical expansion, particularly leveraging D2C models to penetrate emerging markets that currently lack sophisticated specialty retail infrastructure. Another crucial opportunity lies in ingredient innovation, focusing on bioavailable forms of functional compounds and exploring synergistic combinations that maximize health outcomes, such as pairing turmeric with black pepper for enhanced absorption. Strategic alliances between established tea companies and small-scale botanical farmers or functional food technology firms are becoming critical impact forces, allowing for faster scale-up and diversification.

Specific restraints also include the complexity of navigating varied and often strict national regulations regarding health claims and the use of novel food ingredients, particularly in Europe and parts of Asia, which necessitates costly and time-consuming compliance procedures. Competition from adjacent beverage segments, such as premium coffee and specialized nutrient waters, also acts as a restraint, forcing New Tea players to continually innovate in flavor and function to maintain differentiation. Ultimately, successful players in this market are those who can mitigate the high cost and complexity of premium sourcing (Restraint) while capitalizing on the strong consumer willingness to pay a premium (Driver) for transparency, convenience, and scientifically validated health benefits (Opportunity), thereby harnessing the positive market impact forces effectively.

Segmentation Analysis

The New Tea Market segmentation offers a granular view of consumer behavior and product category preferences, allowing manufacturers to strategically position their offerings. Segmentation is typically performed based on Product Type (e.g., Green Tea, Black Tea, Oolong, Herbal Infusions, Specialized Blends), Ingredient Type (e.g., Traditional, Functional Ingredients like Adaptogens, Nootropics, Probiotics), Distribution Channel (e.g., Supermarkets/Hypermarkets, Specialty Stores, Online Retail), and Form (e.g., Loose Leaf, Tea Bags, Ready-to-Drink (RTD)). This multifaceted approach is essential because consumer demand often intersects multiple categories; for example, a consumer might seek an RTD Black Tea (Form, Product Type) infused with Ashwagandha (Ingredient Type) purchased via Online Retail (Distribution Channel).

The fastest-growing segment in terms of Ingredient Type is demonstrably Functional Ingredients, primarily driven by adaptogenic herbs like Holy Basil and Rhodiola, which cater to the pervasive modern issues of chronic stress and anxiety. Within the Distribution Channel, the Online Retail segment is witnessing explosive growth, propelled by the convenience of subscription services and the ability of digital platforms to educate consumers extensively about the complex benefits of specialized tea blends. This channel reduces reliance on traditional shelf space and allows emerging D2C brands to thrive by focusing on niche, health-focused consumer communities.

Furthermore, segmentation by Form highlights the ongoing premiumization of the RTD category. New Tea RTD products are evolving beyond simple sweetened iced teas; they now include cold-brewed, nitrogen-infused, and sparkling botanical beverages, offering convenience without compromising the perceived quality or functional benefits of the beverage. This trend directly addresses the need for on-the-go wellness solutions among busy, health-conscious urban populations. Understanding these intersecting segments is crucial for market stakeholders aiming to optimize inventory, streamline marketing campaigns, and ensure product portfolio relevance in a constantly shifting consumer landscape.

- By Product Type:

- Green Tea

- Black Tea

- Oolong Tea

- White Tea

- Herbal and Fruit Infusions (Tisanes)

- Specialized Fermented Teas (e.g., Kombucha, Premium Pu-erh)

- By Form:

- Loose Leaf Tea

- Tea Bags/Pods

- Ready-to-Drink (RTD)

- Instant Tea Mixes/Concentrates

- By Ingredient Type:

- Traditional Botanicals

- Functional Ingredients (Adaptogens, Probiotics, Nootropics)

- Organic and Certified Ingredients

- Natural Flavorings and Sweeteners

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores (Health Food Stores, Tea Houses)

- Online Retail (E-commerce, D2C)

- Convenience Stores and Food Service

- By Application:

- Residential Consumption

- Commercial/Institutional Consumption

- Pharmaceutical and Nutraceutical Use

Value Chain Analysis For New Tea Market

The value chain for the New Tea Market is complex and highly specialized, beginning with the upstream activities of raw material sourcing, cultivation, and harvesting, often involving niche farms across diverse global geographies. Upstream analysis focuses intensely on ethical sourcing and certification, particularly for rare botanicals, adaptogens, and high-grade tea leaves. Differentiation in the New Tea segment is often achieved right at the sourcing stage, where companies invest in proprietary farming techniques (e.g., organic, biodynamic) or long-term contracts with specialized growers to secure unique or premium ingredients. The initial processing—curing, drying, and primary blending—is critical in maintaining the functional efficacy and flavor profile of the final product, requiring advanced facilities and stringent quality control protocols.

Moving downstream, the chain involves secondary processing, which includes flavor infusion, specialized functional ingredient addition (like probiotics or vitamins that require careful handling), packaging, and branding. Distribution channels are varied, incorporating both direct and indirect methods. Indirect distribution relies on established retail networks—supermarkets, specialty food distributors, and wholesale channels—requiring robust logistics management for product freshness and shelf-life compliance. Direct distribution, primarily through dedicated e-commerce platforms and brand-owned stores, allows for higher margins, better inventory control, and direct engagement with the consumer, which is crucial for communicating the complex benefits of new tea products.

The distribution network complexity is amplified by the diverse product formats. Loose leaf and tea bag products require standard cold/dry storage, while RTD and functional concentrated shots often necessitate temperature-controlled logistics, increasing operational costs. Direct-to-consumer (D2C) channels are preferred for high-value, niche products as they facilitate targeted marketing and the creation of highly engaged customer communities who seek detailed information on ingredient provenance and health benefits. Conversely, major retailers provide the scale needed for widespread consumer awareness. Successful market players strategically balance these direct and indirect channels to maximize reach while maintaining brand control and margin integrity.

New Tea Market Potential Customers

Potential customers for the New Tea Market are primarily defined by their psychographics, demonstrating a strong alignment with wellness-oriented, educated, and ethically conscious lifestyles, transcending traditional demographic barriers. The core consumer base consists of Wellness Seekers, individuals aged 25-45, often urban professionals with disposable income, who actively invest in preventative health measures, seeking products that offer measurable functional benefits such as stress reduction, energy lift, or improved sleep. This group prioritizes ingredient quality, organic certification, and transparency, frequently utilizing online resources and social media to research product efficacy before purchase. They are the driving force behind the demand for adaptogenic and nootropic teas.

Another significant segment comprises the Gourmet and Specialty Drink Enthusiasts, who value complex flavor profiles and premium experiences. These customers are often replacing traditional afternoon tea or high-sugar beverages with sophisticated, functional infusions, treating tea consumption as a mindful ritual. This group drives demand for rare, single-estate teas, specialized fermentation processes (like high-end kombucha), and aesthetically pleasing, environmentally sustainable packaging. They are typically found frequenting specialty tea houses and high-end grocery stores, demonstrating a willingness to pay a premium for uniqueness and artisanal quality.

Beyond the core retail consumers, the B2B segment represents significant potential customers. These include pharmaceutical and nutraceutical companies seeking standardized tea extracts for use in dietary supplements, functional food manufacturers incorporating tea polyphenols as natural preservatives or colorants, and high-end hospitality sectors (hotels, resorts, corporate wellness programs) looking to offer premium, health-focused beverage options to their clientele. Targeting these commercial customers requires different sales strategies focused on volume, quality standardization, and rigorous documentation of ingredients and supply chain compliance, positioning the tea extract as a key ingredient rather than a finished product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, Tata Consumer Products, Celestial Seasonings, The Hain Celestial Group, Teavana (Starbucks), Harney & Sons Fine Teas, Stash Tea Company, Yogi Tea, Pukka Herbs, DAVIDsTEA, Tazo Tea Company, Ito En Ltd., Republic of Tea, Organic India, Traditional Medicinals, Tetley, Twinings, Art of Tea, Tielka, Vahdam Teas |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

New Tea Market Key Technology Landscape

The technology landscape in the New Tea Market is defined by innovations aimed at maximizing ingredient efficacy, ensuring supply chain integrity, and optimizing consumer convenience. Advanced extraction technologies, such as Supercritical Fluid Extraction (SFE) and Ultrasonic-Assisted Extraction (UAE), are crucial for isolating specific functional compounds (e.g., polyphenols, catechins, L-Theanine) from tea leaves and botanicals while preserving their potency and purity. These methods provide superior yields and concentrate desirable active ingredients far better than traditional hot water or alcohol extraction, making them essential for high-end functional tea formulation where precise dosing of active ingredients is required for scientifically validated claims. Furthermore, these technologies enable the creation of highly bioavailable ingredients, improving absorption by the human body.

Processing and preservation technologies also play a pivotal role, particularly in the rapidly expanding Ready-to-Drink (RTD) segment. High-Pressure Processing (HPP) is increasingly adopted as a non-thermal pasteurization technique, which effectively eliminates pathogens while retaining the delicate flavors, vitamins, and antioxidants that heat processing can often degrade. For sensitive ingredients like probiotics, microencapsulation technology is essential. This technique encloses the fragile functional components in a protective barrier, ensuring their survival through the brewing process and the harsh acidic environment of the stomach, thereby guaranteeing that the product delivers its promised health benefit upon consumption.

On the logistical and consumer engagement side, the technology landscape includes extensive use of Blockchain and IoT (Internet of Things) solutions. Blockchain technology is employed to create immutable records of the tea's journey—from the specific farm and harvest date to processing and final shipment—providing unparalleled supply chain transparency, which is a major expectation for premium tea consumers. IoT sensors deployed in storage and shipping monitor temperature and humidity in real-time, crucial for maintaining the integrity of highly perishable and functional ingredients. Finally, specialized packaging technologies, such as nitrogen flushing and light-blocking materials, are used to extend shelf life and prevent the degradation of antioxidants, ensuring that the final product maintains its peak freshness and potency for the consumer.

Regional Highlights

The New Tea Market demonstrates varied adoption and growth dynamics across key global regions, reflecting cultural differences, regulatory environments, and prevailing health trends. North America, encompassing the United States and Canada, stands out as the fastest-growing market, driven primarily by the strong consumer demand for functional beverages, particularly RTD teas infused with adaptogens, CBD, and high-protein ingredients. The region benefits from high disposable incomes, significant innovation in flavor science, and a rapidly expanding e-commerce infrastructure that supports niche, premium, direct-to-consumer tea brands. Consumers here are highly experimental and willing to pay a substantial premium for products that align with specific lifestyle needs, such as ketogenic, vegan, or low-sugar diets, fueling continuous product diversification.

Asia Pacific (APAC) dominates the market in terms of volume and historical consumption. While traditional tea consumption remains immense, the New Tea segment is flourishing through premiumization and the integration of functional benefits rooted in traditional Asian medicine. Countries like China and Japan are seeing rapid adoption of high-quality, rare teas and modern health-focused blends, often linked to longevity and digestive health. India, with its young, digitally native population, is witnessing a surge in online tea purchasing and a shift towards standardized, convenient tea bags and specialty blends. The competitive landscape in APAC requires local players to master both scale and niche innovation, bridging centuries-old tea culture with modern processing and marketing techniques.

Europe represents a mature but rapidly evolving market, highly influenced by stringent regulations regarding organic certification, environmental sustainability, and ethical sourcing (Fair Trade). Western European countries, particularly Germany, the UK, and France, show immense preference for herbal infusions and botanical teas that are certified sustainable and have minimal environmental impact. The growth here is slower but steady, emphasizing quality and transparency over radical functional claims. Latin America (LATAM) and the Middle East & Africa (MEA) are emerging growth regions. LATAM's market expansion is linked to increased urbanization and disposable income, driving demand for affordable, flavored, and slightly sweetened RTD tea options. MEA, particularly the GCC countries, shows a growing interest in luxury and imported specialty teas, spurred by an influx of global lifestyle trends and sophisticated retail environments.

- North America: Highest growth rate, driven by functional tea segments (adaptogens, CBD infusions), robust e-commerce channels, and high consumer willingness to pay for preventative wellness products.

- Asia Pacific (APAC): Market volume leader; growth spurred by premiumization of traditional teas, adoption of convenient formats, and focus on blends combining traditional herbs with modern functional ingredients. Key markets include China, Japan, and India.

- Europe: Mature market emphasizing stringent quality, ethical sourcing, and organic certifications; strong preference for herbal and botanical infusions, with growth concentrated in Western European countries focused on sustainability.

- Latin America (LATAM): Emerging market characterized by rising middle-class population and increasing demand for ready-to-drink, flavored, and low-sugar tea options.

- Middle East & Africa (MEA): Growth driven by imported specialty teas and premium blends in urban centers, linked to global hospitality trends and increasing discretionary consumer spending on luxury food and beverage items.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the New Tea Market.- Unilever PLC

- Tata Consumer Products (Tetley)

- Celestial Seasonings (The Hain Celestial Group)

- Harney & Sons Fine Teas

- Stash Tea Company

- Yogi Tea

- Pukka Herbs (Unilever)

- DAVIDsTEA Inc.

- Tazo Tea Company (Unilever)

- Ito En Ltd.

- The Republic of Tea

- Organic India

- Traditional Medicinals

- Twinings (Associated British Foods)

- Bigelow Tea Company

- Art of Tea

- Tielka

- Vahdam Teas

- Teavana (Starbucks, focusing on licensed products)

- Wissotzky Tea

Frequently Asked Questions

Analyze common user questions about the New Tea market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific functional ingredients are driving the growth of the New Tea Market?

The primary functional ingredients driving growth are adaptogens (like Ashwagandha, Rhodiola, and Ginseng) for stress management and cognitive health, probiotics and prebiotics for gut wellness, and nootropics for mental clarity. CBD and specific medicinal mushrooms are also gaining significant traction, particularly in North America, as consumers seek scientifically validated, non-pharmaceutical health solutions.

How is the New Tea Market addressing consumer demand for sustainability and ethical sourcing?

Leading New Tea brands are utilizing Blockchain technology for supply chain transparency, allowing consumers to trace their tea back to the farm of origin. Furthermore, there is a strong shift toward certified organic ingredients, Fair Trade certification, and the use of compostable or recyclable packaging materials to minimize environmental impact and meet stringent consumer ethical demands.

Which distribution channel is projected to exhibit the fastest growth for New Tea products?

Online retail, including proprietary brand websites and major e-commerce platforms, is projected to show the fastest growth. This channel facilitates the expansion of D2C models, allowing specialized brands to educate consumers about complex functional ingredients, offer personalized subscription services, and bypass traditional retail gatekeepers, which is ideal for niche premium products.

What are the main regulatory challenges faced by companies in the New Tea Market?

The main challenges involve navigating varied international regulations concerning health claims, particularly when incorporating novel functional ingredients like adaptogens or CBD. Companies must invest heavily in clinical data and compliance documentation to substantiate marketing claims, especially in highly regulated regions such as the European Union and specific Asian countries.

How is technology impacting the quality and consistency of New Tea products?

Technology significantly enhances quality through advanced extraction techniques (SFE, UAE) that maximize ingredient potency and purity. AI-powered computer vision systems ensure consistent sorting and grading of raw tea leaves, while High-Pressure Processing (HPP) extends the shelf life of Ready-to-Drink (RTD) products without compromising the integrity of heat-sensitive functional compounds or delicate flavor profiles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager