Next-Generation Advanced Batteries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432496 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Next-Generation Advanced Batteries Market Size

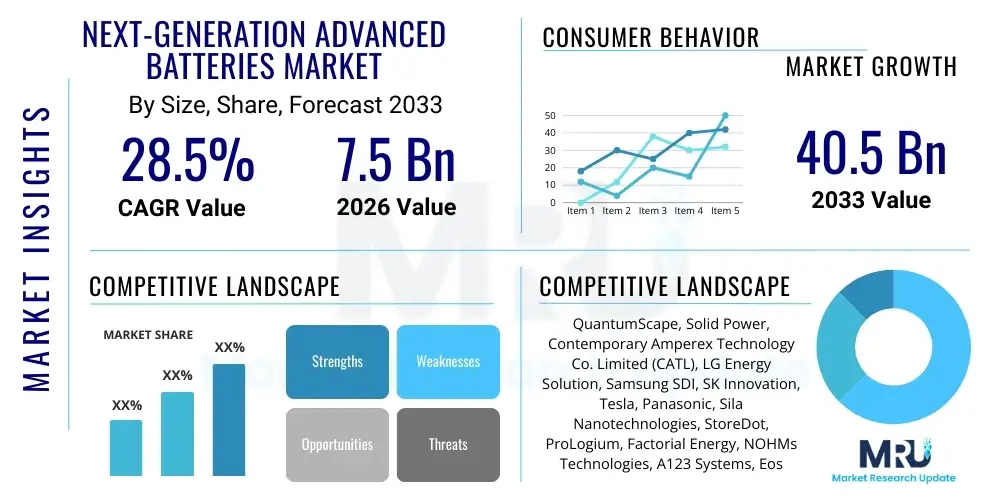

The Next-Generation Advanced Batteries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $40.5 Billion by the end of the forecast period in 2033.

Next-Generation Advanced Batteries Market introduction

The Next-Generation Advanced Batteries Market encompasses innovative energy storage solutions designed to surpass the energy density, safety, and lifespan limitations inherent in traditional lithium-ion technology. These advanced systems, including solid-state batteries, lithium-sulfur batteries, and flow batteries, are critical for enabling the global energy transition by providing enhanced performance necessary for high-demand applications such as long-range electric vehicles (EVs) and large-scale renewable energy grid stabilization. The fundamental shift is driven by the urgent need for safer, faster-charging, and more environmentally sustainable power sources, paving the way for ubiquitous electrification across transportation and utility sectors.

Key products within this domain, such as solid-state electrolytes, revolutionize safety by eliminating flammable liquid components, thereby addressing one of the major concerns associated with current battery technology. Major applications span electric mobility, where superior range and reduced charging times are paramount competitive advantages, and utility-scale energy storage systems (ESS), which require high cycle life and deep discharge capabilities to effectively integrate intermittent renewable sources like solar and wind power. The superior volumetric and gravimetric energy density offered by these new battery architectures makes them indispensable for weight-sensitive applications like aerospace and high-end consumer electronics.

The market benefits significantly from reduced operational costs over the battery lifecycle, improved thermal management, and inherent scalability, which attracts substantial investment from both private venture capital and governmental R&D initiatives. Driving factors include increasingly stringent global emission standards, significant governmental subsidies promoting EV adoption and grid modernization, and the fierce competition among automotive original equipment manufacturers (OEMs) to deliver EVs that match or exceed the convenience metrics of internal combustion engine vehicles. Furthermore, the imperative to establish energy independence and resilient power infrastructure in developed and developing economies accelerates the deployment of these disruptive battery technologies.

Next-Generation Advanced Batteries Market Executive Summary

The Next-Generation Advanced Batteries Market is experiencing exponential growth, primarily fueled by the rapid expansion of the Electric Vehicle (EV) sector and critical demands from grid modernization efforts globally. Business trends indicate a strong focus on strategic vertical integration, where technology developers are collaborating directly with material suppliers and automotive giants to rapidly scale pilot production facilities. Investment trends skew heavily towards solid-state battery technology, viewed as the nearest-term successor to liquid Li-ion, attracting billions in funding aimed at solving dendrite formation and interface resistance challenges necessary for commercialization. Furthermore, sustainability is becoming a core business driver, pushing companies towards developing batteries utilizing less critical raw materials (like cobalt and nickel) and focusing intensely on end-of-life recycling infrastructure, transforming the battery from a product into a sustainable service model.

Regionally, Asia Pacific (APAC) currently dominates the manufacturing and supply chain landscape, driven by established giants in China, South Korea, and Japan, who are aggressively expanding capacity in advanced lithium-ion and early-stage solid-state manufacturing. North America and Europe, however, are exhibiting the fastest growth rates due to significant policy support (e.g., Inflation Reduction Act in the US, European Green Deal), massive investment in gigafactories, and a strategic push to localize the battery value chain to reduce dependency on APAC suppliers. These Western regions are becoming crucial innovation hubs for novel material science and next-generation battery architectures, aiming for technological leadership over mass production volume in the immediate future.

Segment trends reveal that the Electric Vehicle segment remains the largest end-user, prioritizing high energy density batteries for long-range performance, followed closely by the Grid Energy Storage segment which values long cycle life and safety features, making flow batteries particularly attractive for stationary applications. Technology segmentation confirms solid-state batteries hold the highest projected CAGR, primarily due to intense research solving technical barriers and aggressive timelines set by major automotive partners for mass market integration post-2028. Material trends are shifting towards silicon and lithium metal anodes, coupled with high-voltage cathodes, indicating a continuous pursuit of higher energy density metrics across all battery chemistries.

AI Impact Analysis on Next-Generation Advanced Batteries Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) on the Next-Generation Advanced Batteries Market often center on how AI accelerates material discovery, optimizes manufacturing efficiency, and enhances battery performance and safety throughout the lifecycle. Users are keen to understand the extent to which machine learning (ML) models can predict optimal electrolyte compositions, identify stable solid-state interfaces, and simulate complex degradation pathways faster than traditional lab-based methods. Key concerns include data security in collaborative R&D environments and the accessibility of complex AI tools to smaller innovators. Expectations are high regarding AI’s ability to drastically reduce the time-to-market for novel battery chemistries, moving beyond incremental improvements to achieving fundamental breakthroughs necessary for widespread EV adoption and grid reliability.

AI’s role is increasingly pivotal in solving the intricate challenges associated with scaling up next-generation battery manufacturing, particularly for sensitive chemistries like solid-state and lithium-sulfur. Machine learning algorithms are deployed for predictive maintenance, analyzing real-time sensor data from production lines to detect anomalies, optimize cell uniformity, and minimize defect rates, which is crucial given the high costs of advanced materials. Furthermore, AI-driven process control optimizes parameters like mixing speeds, drying temperatures, and pressure application during stacking, ensuring quality control that is impossible to achieve with standard statistical methods, thereby accelerating yield improvements essential for commercial viability.

Beyond manufacturing, AI significantly contributes to the operational phase of advanced batteries. Sophisticated battery management systems (BMS) utilize neural networks to accurately predict state-of-charge (SOC) and state-of-health (SOH), adapting charging and discharging protocols dynamically based on usage patterns and environmental conditions. This not only extends the calendar and cycle life of expensive battery packs but also enhances safety by preemptively identifying thermal runaways or degradation patterns. The ability of AI to analyze vast datasets from deployed fleets allows researchers to feed real-world performance metrics back into the R&D loop, creating a continuous improvement cycle essential for validating the long-term reliability of novel battery chemistries.

- AI accelerates new material discovery by screening millions of potential chemical combinations virtually, significantly reducing R&D cycles.

- Machine Learning (ML) models optimize solid-state electrolyte formulation and interface stability prediction.

- AI-driven predictive maintenance enhances gigafactory yield rates and manufacturing efficiency for complex battery architectures.

- Advanced Battery Management Systems (BMS) use AI for precise State of Health (SOH) and degradation prediction, maximizing battery longevity.

- Computational chemistry, supported by AI, simulates thermal runaway scenarios to enhance safety protocols in battery design.

DRO & Impact Forces Of Next-Generation Advanced Batteries Market

The Next-Generation Advanced Batteries Market is propelled by powerful macro-economic and technological drivers (D), yet constrained by significant cost and scalability hurdles (R), while emerging material science and sustainable practices present substantial opportunities (O). The most impactful force is the regulatory environment globally, particularly aggressive decarbonization targets set by major economies, which mandate a swift transition away from fossil fuels and necessitate highly efficient, reliable energy storage. This regulatory push creates an irreversible market trajectory, forcing rapid innovation and industrial scaling despite the inherent technical difficulties and high initial capital expenditure required for establishing new manufacturing facilities suitable for these advanced technologies.

Key drivers include the global mandate for decarbonization, led by the massive penetration of electric vehicles and the exponential growth required in utility-scale energy storage for grid stability and renewable energy integration. The demand for batteries offering significantly higher energy density (especially gravimetric density) is acute in sectors like aviation, heavy-duty transport, and long-range personal mobility, pushing the boundaries of lithium-ion successors. However, the market faces significant restraints, primarily revolving around the high initial capital investment required for dedicated solid-state and lithium-sulfur manufacturing lines, and persistent technical challenges related to long-term cyclability and managing internal resistance at scale, which still impede full commercial viability. Supply chain fragility, particularly for precursor materials and rare elements, also poses a significant risk.

Opportunities are vast, centered on the commercialization potential of chemistries less reliant on conflict minerals (e.g., sodium-ion and zinc-air), the development of advanced in-situ monitoring and diagnostic tools leveraging AI, and substantial improvements in end-of-life battery recycling processes (closed-loop manufacturing). The strongest impact forces shaping the market trajectory are governmental incentives (subsidies and tax credits) that de-risk early adoption and accelerate capital deployment, coupled with immense pressure from consumers and investors demanding products that are both high-performing and ethically sourced. These combined forces ensure continuous, disruptive innovation remains the defining characteristic of this market.

Segmentation Analysis

The Next-Generation Advanced Batteries Market segmentation offers a granular view of diverse technological pathways being pursued to address varied application requirements. Segmentation by battery type reveals the technological competition between solid-state, lithium-sulfur, and flow batteries, each optimized for different performance metrics, such as energy density versus cycle life. Solid-state technology is attracting the most capital for mobile applications, whereas flow batteries hold dominance in stationary grid storage due to their inherent scalability and non-flammability. The market is also segmented comprehensively by material, focusing on advancements in novel anode materials like silicon and lithium metal, and high-voltage cathode materials that push overall cell performance beyond current limits, alongside innovations in polymer and inorganic solid electrolytes crucial for safety.

Application segmentation clearly distinguishes demand profiles, highlighting the automotive sector's need for high power and rapid charging capabilities, contrasted with the utility sector's prioritization of longevity, safety, and levelized cost of storage (LCOS). This divergence in requirements ensures a mosaic of technological solutions will coexist, rather than a single technology dominating all end-use segments. Furthermore, the segmentation by end-user includes Original Equipment Manufacturers (OEMs), battery manufacturers, and specialized component suppliers, illustrating the complex ecosystem required to bring these sophisticated technologies to commercial readiness.

Geographic analysis remains critical, differentiating between the manufacturing prowess of Asia Pacific, the technological innovation focus of North America, and the regulatory-driven demand creation in Europe. This regional segmentation underscores varying adoption rates and strategic investment priorities globally. Understanding these segment dynamics is essential for stakeholders to position investments optimally, targeting high-growth chemistries and applications that align with regional regulatory tailwinds and established manufacturing bases, thereby maximizing market penetration and return on investment in a rapidly evolving technological landscape.

- By Battery Type:

- Solid-State Batteries (SSBs)

- Lithium-Sulfur Batteries (Li-S)

- Flow Batteries (RFBs)

- Metal-Air Batteries (Zinc-Air, Lithium-Air)

- Sodium-ion Batteries (Na-ion)

- By Component:

- Cathode Materials (High-Nickel, Lithium-rich)

- Anode Materials (Silicon, Lithium Metal)

- Electrolytes (Solid Polymer, Inorganic Oxide)

- Separators and Binders

- By Application:

- Electric Vehicles (BEVs, PHEVs, Commercial Fleets)

- Grid Energy Storage (Utility-Scale ESS, Distributed Generation)

- Consumer Electronics (Smartphones, Wearables)

- Industrial and Telecommunication

- Aerospace and Defense

- By End-User:

- Automotive OEMs

- Utility Providers and Independent Power Producers (IPPs)

- Battery Manufacturers

- Specialty Chemicals and Materials Providers

Value Chain Analysis For Next-Generation Advanced Batteries Market

The value chain for Next-Generation Advanced Batteries begins significantly upstream with the sourcing and refining of critical raw materials, including specialized lithium compounds, advanced cathode precursor materials (e.g., high-purity nickel and manganese), and novel electrolyte components tailored for solid-state architectures. This upstream phase is characterized by intense geopolitical scrutiny due to the concentration of mining and refining operations in specific regions, necessitating diversification strategies and significant investment in sustainable sourcing and processing technologies. Innovation at this stage focuses on enhancing material purity and consistency, which is paramount for the performance of sensitive next-generation chemistries like all-solid-state cells.

The midstream segment involves cell manufacturing and module assembly, dominated by specialized battery developers and major established players (e.g., CATL, LGES). This is where the core value addition occurs, involving complex processes such as solid-electrolyte fabrication, lithium metal anode protection, and precision cell stacking within sophisticated gigafactories. Direct distribution channels are prevalent when major automotive OEMs form joint ventures or enter into long-term supply agreements directly with battery manufacturers to secure capacity and influence specific design parameters for their EV platforms. Indirect channels involve distributors providing packaged modules to smaller integrators or specialized industrial clients.

Downstream analysis focuses on system integration, deployment, and end-of-life management. System integrators combine battery modules with sophisticated Battery Management Systems (BMS) and power conversion equipment to create finished energy storage solutions for EVs, utility grids, or industrial applications. The distribution network extends to dealerships, utility companies, and specialized energy service providers. A critical emerging downstream component is recycling and repurposing (second-life applications), which closes the loop, reducing dependency on primary raw materials and addressing the mounting environmental impact concerns associated with battery waste, driving the long-term sustainability of the entire advanced battery ecosystem.

Next-Generation Advanced Batteries Market Potential Customers

Potential customers for Next-Generation Advanced Batteries are primarily entities requiring high-performance, safe, and long-duration energy storage solutions that surpass the limitations of conventional lithium-ion technologies. The most significant end-users are global Electric Vehicle (EV) manufacturers, including established automotive Original Equipment Manufacturers (OEMs) and new entrants, who are fiercely competing on vehicle range, charging speed, and long-term battery reliability. These buyers demand batteries that offer at least a 30% increase in energy density and significantly enhanced safety profiles to justify the premium cost associated with new technologies like solid-state batteries.

The second major category of customers includes utility companies, Independent Power Producers (IPPs), and grid operators seeking large-scale energy storage systems (ESS). These customers prioritize flow batteries and high-durability sodium-ion solutions, valuing cycle life (often exceeding 10,000 cycles), low degradation rates, and non-flammability for safe integration into crowded substations or large solar/wind farms. Their purchasing decisions are primarily driven by the Levelized Cost of Storage (LCOS), emphasizing longevity and operational efficiency over peak energy density.

Furthermore, specialized sectors such as aerospace (drones, electric vertical takeoff and landing vehicles - eVTOL), defense contractors, and high-end industrial equipment manufacturers represent niche, high-value customer segments. These buyers demand extremely high power density and lightweight characteristics, making advanced lithium-sulfur and compact solid-state cells particularly appealing for applications where mass minimization is critical for mission success and operational feasibility. Their purchasing criteria often prioritize technical specification and performance reliability above immediate cost concerns.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $40.5 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | QuantumScape, Solid Power, Contemporary Amperex Technology Co. Limited (CATL), LG Energy Solution, Samsung SDI, SK Innovation, Tesla, Panasonic, Sila Nanotechnologies, StoreDot, ProLogium, Factorial Energy, NOHMs Technologies, A123 Systems, Eos Energy Enterprises, Northvolt, Faradion, OXIS Energy, Sion Power, Varta AG, Britishvolt, Enovix, Toyota. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Next-Generation Advanced Batteries Market Key Technology Landscape

The technological landscape of the Next-Generation Advanced Batteries Market is highly dynamic, characterized by several parallel innovation tracks aimed at replacing or significantly augmenting conventional liquid electrolyte lithium-ion cells. The most prominent technology is Solid-State Batteries (SSBs), which utilize solid electrolytes (polymers, sulfides, or oxides) instead of flammable organic liquids. This shift fundamentally addresses safety concerns and enables the use of highly energetic lithium metal anodes, theoretically boosting energy density up to 500 Wh/kg. The primary focus of R&D in SSBs is achieving stable, low-resistance interface contact between the electrodes and the solid electrolyte, and developing cost-effective, high-throughput manufacturing processes necessary for automotive integration post-2027.

Another crucial technology gaining traction is Lithium-Sulfur (Li-S) batteries. Li-S technology promises extremely high theoretical energy density (up to 600 Wh/kg) by leveraging sulfur, an abundant and cheap cathode material. However, commercial viability hinges on overcoming critical challenges such as the dissolution of polysulfides into the electrolyte (shuttle effect) and the volumetric expansion of the sulfur cathode during cycling. Innovation is centered on using specialized functional membranes, porous scaffolds, and unique electrolyte formulations to confine polysulfides and extend cycle life, making Li-S highly relevant for drone and potentially commercial aviation applications where weight reduction is critical.

Furthermore, Flow Batteries (RFBs) are dominating the long-duration stationary storage segment. Unlike conventional batteries, flow batteries store energy in external tanks of liquid electrolyte (typically vanadium or zinc-bromine based), allowing power and energy capacity to be scaled independently. The core technological advancement involves developing new, cheaper electrolyte chemistries (e.g., organic or iron-based) and optimizing stack design to increase power density and reduce system complexity. While less suitable for mobile applications, their inherent safety, non-degradation over time, and long lifespan make them the preferred solution for utility-scale grid integration and energy management, driving significant investment in infrastructure deployment globally.

Regional Highlights

Geographic analysis reveals distinct strategic focus areas and growth trajectories influenced by governmental policy, established industrial capacity, and consumer adoption rates of electric vehicles and renewable energy.

- Asia Pacific (APAC): APAC, particularly China, South Korea, and Japan, commands the largest market share due to established manufacturing infrastructure (gigafactories), dominance in raw material processing, and significant governmental backing for EV and ESS adoption. China is a leader in sodium-ion battery deployment and vertical integration across the entire Li-ion and advanced battery value chain. Japan and South Korea lead R&D and early commercialization efforts in high-performance solid-state batteries (e.g., Toyota, Samsung SDI) targeting premium EV segments. The region is the global epicenter for volume production and price competition.

- North America: North America is poised for the fastest growth rate, heavily incentivized by policy frameworks like the Inflation Reduction Act (IRA), which mandates local content sourcing and production. This has sparked a "gigafactory boom," attracting massive foreign direct investment and fostering indigenous technological development in solid-state (QuantumScape, Solid Power) and flow battery systems (Eos Energy). The focus is strategically shifting towards achieving supply chain independence and technological leadership, moving rapidly from research validation to commercial scale-up and securing long-term supply contracts with major automotive OEMs.

- Europe: Europe is highly focused on sustainability and localization, driven by the European Green Deal and associated battery regulations. The region is rapidly building its domestic manufacturing base (e.g., Northvolt, Verkor) to supply the massive, mandated transition to electric transport and replace imported battery cells. European innovation is strong in recycling technologies and sustainable sourcing, particularly for advanced materials and specialized chemistries like lithium-sulfur, catering to stringent environmental and ethical standards imposed across the continent.

- Latin America (LATAM): Growth in LATAM is primarily focused on resource extraction (Lithium Triangle: Chile, Argentina, Bolivia) and early-stage utility grid integration projects. While manufacturing capacity remains nascent, the region holds critical importance in the upstream supply chain. Market potential is concentrated in deploying ESS to enhance grid stability and reliability in regions with rapidly expanding renewable energy capacity.

- Middle East and Africa (MEA): MEA is an emerging market for next-generation batteries, largely focused on large-scale renewable energy storage projects, particularly in the Gulf Cooperation Council (GCC) states investing heavily in massive solar facilities. Demand is driven by governmental mandates to diversify economies away from oil and gas, requiring robust, reliable, and often high-temperature tolerant battery solutions for grid stabilization and remote industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Next-Generation Advanced Batteries Market.- QuantumScape Corporation

- Solid Power, Inc.

- Contemporary Amperex Technology Co. Limited (CATL)

- LG Energy Solution

- Samsung SDI Co., Ltd.

- SK Innovation Co., Ltd. (SK On)

- Panasonic Corporation

- Toyota Motor Corporation

- Sila Nanotechnologies Inc.

- StoreDot Ltd.

- ProLogium Technology Co., Ltd.

- Factorial Energy

- A123 Systems LLC

- Eos Energy Enterprises, Inc.

- Northvolt AB

- Faradion Limited (Sodium-ion)

- OXIS Energy (Lithium-Sulfur)

- Sion Power Corporation

- Varta AG

- ACC (Automotive Cells Company)

- General Motors (GM)

- Ford Motor Company

Frequently Asked Questions

Analyze common user questions about the Next-Generation Advanced Batteries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Next-Generation Advanced Batteries over conventional Lithium-ion?

The primary advantage is significantly higher energy density, enabling longer range for electric vehicles (EVs) and extended operation for electronics, coupled with enhanced safety due to the use of solid or non-flammable electrolytes, mitigating thermal runaway risks inherent in liquid lithium-ion cells.

When are Solid-State Batteries (SSBs) expected to achieve mass commercialization for Electric Vehicles?

SSBs are projected to begin phased commercial introduction in high-end and specialized EV models between 2027 and 2029, with widespread mass market penetration expected post-2030, pending successful resolution of scalable, cost-effective manufacturing techniques and long-term cycle life stability issues.

Which battery type is best suited for large-scale Grid Energy Storage Systems (ESS)?

Flow Batteries (RFBs), such as Vanadium Redox Flow Batteries, are optimally suited for large-scale ESS due to their inherent scalability, safety (non-flammability), ability to sustain deep discharge cycles without degradation, and independent sizing of power and energy capacity, leading to low Levelized Cost of Storage (LCOS).

How is supply chain sustainability addressed in the Next-Generation Advanced Batteries market?

Sustainability is addressed through the development of chemistries utilizing more abundant and less controversial materials (like Sodium-ion), significant investment in closed-loop recycling infrastructure (hydrometallurgy and pyrometallurgy), and stringent tracking of materials to ensure ethical sourcing practices across the global value chain.

What is the role of AI in accelerating the development of Next-Generation Advanced Batteries?

AI, specifically Machine Learning (ML), is critical for simulating millions of potential material compositions, optimizing electrolyte formulas, predicting cell degradation pathways, and enhancing efficiency and yield in complex gigafactory manufacturing processes, thereby drastically reducing the time required for R&D breakthroughs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager