Next Generation Optical Biometry Devices Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434024 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Next Generation Optical Biometry Devices Market Size

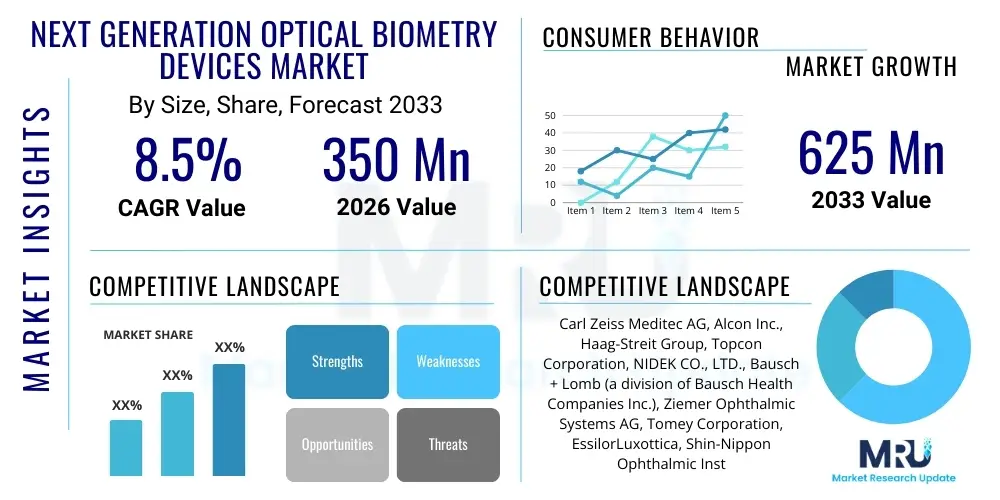

The Next Generation Optical Biometry Devices Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $350 Million USD in 2026 and is projected to reach $625 Million USD by the end of the forecast period in 2033. This substantial growth is primarily fueled by the increasing global geriatric population, which directly correlates with a rising incidence of cataracts, demanding advanced and highly accurate preoperative measurement tools. Furthermore, the continuous shift towards refractive cataract surgery, where precision in Intraocular Lens (IOL) calculation is paramount for optimal visual outcomes, significantly boosts the adoption rate of these sophisticated biometry systems.

The valuation reflects the increasing investment by healthcare providers in cutting-edge diagnostic equipment that utilizes technologies like Swept-Source Optical Coherence Tomography (SS-OCT). These new-generation devices offer superior penetration depth, faster acquisition times, and comprehensive visualization of ocular structures compared to traditional methods. Market expansion is also supported by enhanced reimbursement policies in developed economies and a burgeoning demand for premium IOLs, which require validated, high-accuracy biometry measurements for customization and successful implantation. The competitive landscape focuses on developing integrated platforms that combine multiple diagnostic modalities, driving up the average selling price and overall market value.

Next Generation Optical Biometry Devices Market introduction

The Next Generation Optical Biometry Devices Market encompasses highly advanced non-contact measurement systems utilized in ophthalmology, primarily for accurate determination of axial length, corneal curvature (keratometry), anterior chamber depth, and lens thickness. These measurements are crucial inputs for calculating the power of an Intraocular Lens (IOL) before cataract surgery or refractive procedures. Products in this category leverage advanced light-based technologies such as Swept-Source Optical Coherence Tomography (SS-OCT) and enhanced Partial Coherence Interferometry (PCI) to deliver unparalleled precision, depth penetration, and repeatability, significantly improving surgical predictability and patient outcomes.

Major applications of these next-generation devices include routine preoperative assessment for standard and premium IOL implantation in cataract patients, screening for potential post-refractive surgery complications, and aiding in the diagnosis of various ocular diseases that affect axial dimensions. The primary benefit of these devices lies in their ability to provide highly accurate and comprehensive biometric data, often integrating topography and pachymetry, thus reducing calculation errors associated with standard biometers. This high accuracy is essential, especially for patients with challenging ocular geometries, such as eyes previously undergoing LASIK or PRK. The devices also enhance workflow efficiency due to rapid, non-mydriatic measurements.

Driving factors for market growth are multifaceted and include the accelerating global prevalence of age-related eye disorders, particularly cataracts; the growing preference among surgeons and patients for high-quality, customized visual rehabilitation using toric and multifocal IOLs; and continuous technological breakthroughs that reduce measurement variability and improve performance in dense cataracts. Furthermore, increasing healthcare expenditure across emerging economies and rising awareness about the importance of accurate preoperative diagnostics are key elements sustaining the strong positive trajectory of the Next Generation Optical Biometry Devices Market.

Next Generation Optical Biometry Devices Market Executive Summary

The Next Generation Optical Biometry Devices Market is experiencing robust expansion driven by technological convergence and the escalating global volume of cataract surgeries. Business trends indicate a strong move toward consolidated, all-in-one diagnostic platforms that offer SS-OCT biometry combined with corneal analysis and wavefront sensing, allowing for streamlined clinical workflows and enhanced diagnostic certainty. Key industry players are focusing on strategic partnerships and mergers to integrate advanced AI algorithms into their devices, improving data interpretation, automated quality checks, and sophisticated IOL calculation methodologies, thus gaining a competitive edge based on superior accuracy and predictive capabilities.

Regionally, North America and Europe remain the dominant markets, attributed to high healthcare expenditure, established clinical guidelines favoring advanced biometry, and rapid adoption of premium surgical technologies. However, the Asia Pacific (APAC) region is poised for the fastest growth, driven by massive untapped patient populations, improving healthcare infrastructure, and rising medical tourism. Emerging economies in APAC are increasingly investing in next-generation devices to meet the growing demands for modern cataract procedures. Latin America and MEA are showing steady growth, primarily focused on upgrading existing infrastructure to SS-OCT platforms.

Segment trends reveal that the Swept-Source OCT (SS-OCT) segment dominates the technology landscape due to its ability to penetrate dense cataracts and provide sectional imaging, offering superior anatomical context. The application segment remains dominated by cataract surgery preparation, though applications in post-refractive eye assessment are rapidly gaining traction. End-user demand is heavily concentrated in Specialty Eye Clinics and Ambulatory Surgical Centers (ASCs), which prioritize efficiency and high patient throughput inherent in these advanced biometers, while large hospitals continue to serve as major procurement hubs for high-volume units.

AI Impact Analysis on Next Generation Optical Biometry Devices Market

Users frequently inquire about how Artificial Intelligence (AI) will fundamentally alter the accuracy and clinical utility of optical biometry. Common questions center on the ability of AI to resolve measurement challenges in complex cases (e.g., post-refractive surgery or mature cataracts), automate IOL selection and power calculation, and integrate predictive models for refractive outcomes. Users are concerned about data security, algorithm validation, and the transition phase required for clinicians to trust AI-driven recommendations. The consensus expectation is that AI will move biometry beyond mere measurement to sophisticated, personalized surgical planning. Key themes reveal a desire for AI to minimize human error, standardize complex measurement protocols, and optimize the selection of advanced IOL formulas, especially those requiring complex inputs.

The primary concern surrounding AI implementation revolves around the black-box nature of some machine learning models and the need for explainable AI in clinical decision-making. Clinicians seek confirmation that AI will enhance, not replace, clinical judgment, particularly when dealing with outliers or rare ophthalmic conditions. Furthermore, the industry is grappling with the necessity of establishing large, standardized, high-quality datasets required to train effective deep learning algorithms specifically tailored for diverse global populations and device types. Successful integration hinges on seamless connectivity between biometers, Electronic Health Records (EHR), and surgical planning software, ensuring data integrity and interoperability across hospital systems.

Ultimately, the impact of AI is seen as transformative, shifting the focus from manual data acquisition and entry to automated quality assurance and sophisticated predictive analytics. AI is anticipated to significantly reduce the standard deviation of refractive prediction errors, allowing for consistently excellent outcomes, which is critical for the uptake of premium intraocular lenses. This technological enhancement is expected to solidify the market position of manufacturers who successfully integrate robust, clinically validated AI platforms into their next-generation biometry devices.

- AI enhances IOL calculation accuracy, especially in post-refractive surgery eyes, using sophisticated pattern recognition.

- Automated workflow optimization reduces manual intervention, speeds up measurement time, and flags poor quality scans automatically.

- Predictive modeling capabilities offer surgeons personalized refractive outcome forecasts based on patient-specific historical data.

- Deep learning algorithms improve signal processing and image quality in eyes with dense media opacities, extending the utility of optical biometry.

- AI integration facilitates seamless data transfer and centralized surgical planning across different diagnostic devices and platforms.

DRO & Impact Forces Of Next Generation Optical Biometry Devices Market

The market is primarily driven by the escalating global incidence of age-related vision impairment, coupled with significant advancements in surgical techniques demanding higher precision instruments. However, high initial capital expenditure acts as a primary restraint, particularly in budget-constrained healthcare settings. The market opportunities lie predominantly in adopting AI/ML integration for enhanced accuracy and expanding market penetration into emerging economies with growing middle-class populations seeking advanced eye care. These factors collectively exert substantial impact forces across technology adoption, pricing strategies, and competitive positioning within the ophthalmic industry.

Key drivers include the technological shift towards SS-OCT, which provides highly repeatable measurements and superior visualization; the rising adoption of premium IOLs (toric, multifocal) that necessitate highly precise biometry for successful refractive outcomes; and increasing patient awareness regarding the potential for spectacle independence after cataract surgery. These drivers create an imperative for ophthalmologists to upgrade their equipment. Conversely, the market is restrained by the steep price point of high-end SS-OCT biometers, which limits rapid replacement cycles in smaller clinics, and the complexity of regulatory pathways for novel medical devices, which can delay market entry for innovative products.

Opportunities for sustained growth stem from the vast potential of applying advanced biometry systems in screening for other ophthalmic conditions like glaucoma and diabetic retinopathy, thereby expanding their clinical utility beyond cataract surgery. Furthermore, strategic opportunities exist for manufacturers to develop and market compact, portable, and cost-effective devices tailored specifically for mobile eye clinics or remote healthcare settings in underserved regions. The impact forces are currently skewed heavily toward technological advancement and aging demographics, compelling continuous innovation and price rationalization to maintain market accessibility and competitive relevance.

Segmentation Analysis

The Next Generation Optical Biometry Devices Market is comprehensively segmented based on technology, which dictates performance capabilities; application, detailing clinical use cases; and end-user, identifying key institutional buyers. The core segmentation reflects the dynamic shifts within ophthalmology towards non-contact, high-precision measurement methods. Understanding these segments is critical for manufacturers to tailor their product development, marketing, and distribution strategies effectively. The continuous evolution of technology, particularly the shift from older PCI systems to advanced SS-OCT, is the most defining characteristic influencing market shares across these segments.

The segmentation by technology is crucial as it directly relates to the device’s ability to measure eyes with challenging characteristics, such as dense cataracts or irregular corneas. SS-OCT technology, offering deeper penetration and imaging capabilities, is gaining substantial dominance over older PCI and OLCR methods. By application, cataract surgery preparation remains the revenue backbone, absorbing the vast majority of devices, while the secondary, high-growth segment of post-refractive surgery assessment requires specialized algorithms and is driving innovation in software integration.

The end-user segmentation highlights the varying procurement needs and operational scale of healthcare facilities. Hospitals often purchase multi-functional systems that integrate with broader EMR networks, whereas Ambulatory Surgical Centers (ASCs) and Specialty Clinics prioritize speed, precision, and a smaller footprint to maximize patient throughput and efficiency. This diversity necessitates flexible product offerings, ranging from high-throughput integrated consoles to modular, purpose-built biometers.

- By Technology:

- Partial Coherence Interferometry (PCI)

- Optical Low-Coherence Reflectometry (OLCR)

- Swept-Source Optical Coherence Tomography (SS-OCT)

- By Application:

- Cataract Surgery Preoperative Assessment

- Post-Refractive Surgery Assessment

- Refractive Error Diagnosis and Screening

- Other Applications (e.g., Ocular Disease Monitoring)

- By End-User:

- Hospitals

- Specialty Eye Clinics

- Ambulatory Surgical Centers (ASCs)

- Academic & Research Institutes

Value Chain Analysis For Next Generation Optical Biometry Devices Market

The value chain for Next Generation Optical Biometry Devices begins with upstream activities focused on complex component manufacturing, particularly light source fabrication (e.g., tunable lasers for SS-OCT) and sophisticated optical lens systems. Key upstream suppliers include specialized photonics companies and software developers providing advanced algorithms (often AI-driven) for data processing and IOL calculation. Integration of these highly precise components requires substantial R&D investment by device manufacturers to ensure clinical accuracy and regulatory compliance. The intense dependency on high-quality, specialized components often leads to high material costs, influencing the final retail price of the biometers.

Midstream activities involve the core device assembly, regulatory approval processes (FDA, CE Mark), and integration testing. Distribution channels are typically complex, utilizing a mix of direct sales forces for large hospital systems and specialized indirect distributors or dealers, particularly in geographically diverse or emerging markets. Direct channels allow manufacturers to maintain greater control over pricing and customer relationships, while indirect channels provide essential market access and localized support. The choice of channel strategy heavily impacts market penetration rates and post-sales service quality, which is paramount for high-precision medical devices.

Downstream activities focus on the end-users—hospitals, specialty clinics, and ASCs. These institutions demand comprehensive installation, extensive clinical training for technicians and surgeons, and robust maintenance contracts. Post-sales support and software updates, especially those incorporating new IOL formulas or AI enhancements, are critical value-added services that influence long-term customer loyalty and repeat purchases. The entire value chain is characterized by high barriers to entry due to the technical complexity, regulatory burden, and established relationship networks between major manufacturers and key opinion leaders (KOLs) in ophthalmology.

Next Generation Optical Biometry Devices Market Potential Customers

The primary end-users and buyers of Next Generation Optical Biometry Devices are ophthalmologists and ophthalmic technicians within various clinical settings who require ultra-precise measurements for surgical planning. The largest segment of potential customers comprises high-volume cataract surgical centers, including large private specialty eye clinics and dedicated Ambulatory Surgical Centers (ASCs). These entities seek devices that offer rapid, reliable, and high-accuracy measurements to support efficient patient flow and ensure optimal refractive outcomes, which are essential for maintaining a competitive reputation and managing premium IOL inventory.

Secondary but highly valuable customers include academic medical centers and university teaching hospitals. These institutions often require the most advanced, research-grade devices capable of supporting clinical trials, teaching advanced surgical techniques, and accommodating complex cases. Their purchasing decisions are often driven by technological superiority and the ability to integrate advanced features such as anterior segment OCT imaging and density mapping. Furthermore, public sector hospitals, particularly those in developed countries, represent significant procurement opportunities, although their decisions are often subject to lengthy tender processes and strict budget constraints favoring value and longevity.

An emerging customer base includes optometrists and general ophthalmologists focused on refractive screening and pre-surgical workup in a referral network model. While they may not perform the surgery, they are increasingly utilizing advanced biometers to provide comprehensive baseline measurements before referring patients to surgical specialists. This segment requires user-friendly, robust devices that can integrate seamlessly into existing practice management software, focusing on ease of use and automated interpretation to minimize the need for specialized technical staff.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $350 Million USD |

| Market Forecast in 2033 | $625 Million USD |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Carl Zeiss Meditec AG, Alcon Inc., Haag-Streit Group, Topcon Corporation, NIDEK CO., LTD., Bausch + Lomb (a division of Bausch Health Companies Inc.), Ziemer Ophthalmic Systems AG, Tomey Corporation, EssilorLuxottica, Shin-Nippon Ophthalmic Instruments, CSO Costruzione Strumenti Oftalmici, Sonomed Escalon, Vissum, Optovue, Rexxam Co., Ltd., Ellex Medical Lasers (now part of Quantel Medical), Visionix (Luneau Technology Group), Moptim. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Next Generation Optical Biometry Devices Market Key Technology Landscape

The technological landscape of the Next Generation Optical Biometry Devices Market is overwhelmingly dominated by Swept-Source Optical Coherence Tomography (SS-OCT). SS-OCT utilizes a long-wavelength, frequency-sweeping light source, typically operating around 1050 nm, which allows for significantly faster scanning speeds and deeper tissue penetration compared to older technologies like Partial Coherence Interferometry (PCI) or time-domain OCT. This deep penetration capability is critical for accurately measuring axial length in eyes with dense media opacities, such as mature cataracts, where conventional methods often fail to achieve reliable fixation or signal acquisition. The speed of SS-OCT enables comprehensive volumetric scans of the entire anterior segment in a single pass, providing not just axial length but also detailed images of the cornea, lens, and anterior chamber geometry.

Another crucial technological development involves the integration of advanced keratometry and topography functions directly into the biometer platform. Modern devices incorporate multiple measurement rings or sophisticated LED projections to capture highly precise corneal curvature data, which is essential for calculating toric IOL power and addressing pre-existing astigmatism. Furthermore, dynamic compensation algorithms are being continually refined to automatically correct for subtle eye movements during measurement acquisition, drastically improving repeatability and reducing the impact of patient cooperation variability. This integrated approach, often termed multi-modal biometry, offers a single-device solution for all preoperative diagnostic needs, enhancing clinical efficiency and data correlation.

The future technology trajectory is strongly focused on enhanced software capabilities, particularly the application of artificial intelligence and machine learning (AI/ML) within IOL calculation formulas. These algorithms analyze vast datasets to refine prediction models, especially for complicated cases like post-refractive eyes, where conventional formulas often yield unpredictable results. AI also powers enhanced quality control features, automatically identifying and rejecting suboptimal scans, ensuring that only the highest quality biometric data is used for surgical planning. Manufacturers are heavily investing in connectivity standards to allow seamless integration of these high-tech biometers into digital operating rooms and electronic health record systems, forming the backbone of modern refractive surgery management.

Regional Highlights

The global market exhibits significant regional disparities in terms of technological adoption, market maturity, and growth trajectory. North America maintains market dominance, characterized by high adoption rates of premium SS-OCT devices, favorable reimbursement scenarios, and a robust concentration of key market players and leading ophthalmic research institutions. The region’s focus on refractive outcomes and high patient expectations drives the continuous upgrade cycle for next-generation systems, ensuring sustained revenue generation.

Europe represents the second-largest market, with countries like Germany, France, and the UK serving as major hubs for advanced eye care technology. Strict regulatory standards ensure high product quality, while aging populations across Western Europe fuel consistent demand for cataract and refractive procedures. Eastern European markets are showing accelerated growth as they harmonize healthcare standards with the EU, leading to increased procurement of modern diagnostic devices to replace legacy equipment.

Asia Pacific (APAC) is projected to be the fastest-growing region. This explosive growth is attributed to the presence of vast, aging populations (especially in China, India, and Japan), rapid expansion of healthcare infrastructure, and rising medical tourism activities. While price sensitivity remains a factor, increasing disposable incomes and government initiatives promoting eye health are pushing clinical facilities to invest in high-precision biometry devices. Manufacturers are strategically partnering with local distributors to establish a stronger foothold and provide localized training and support to meet this surging demand.

- North America: Dominant market share due to advanced infrastructure, high premium IOL adoption, and established clinical guidelines favoring advanced biometry.

- Europe: Strong, mature market characterized by stringent quality standards and substantial investment in medical technology driven by aging demographics.

- Asia Pacific (APAC): Highest growth potential driven by large patient pools, improving economic conditions, and increasing access to modern ophthalmic care.

- Latin America: Moderate growth driven by increasing health insurance coverage and a rising preference for modern surgical solutions in major economies like Brazil and Mexico.

- Middle East and Africa (MEA): Emerging growth area, highly dependent on governmental health initiatives and private sector investment in specialty hospitals, particularly in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Next Generation Optical Biometry Devices Market.- Carl Zeiss Meditec AG

- Alcon Inc.

- Haag-Streit Group

- Topcon Corporation

- NIDEK CO., LTD.

- Bausch + Lomb (a division of Bausch Health Companies Inc.)

- Ziemer Ophthalmic Systems AG

- Tomey Corporation

- EssilorLuxottica

- Shin-Nippon Ophthalmic Instruments

- CSO Costruzione Strumenti Oftalmici

- Sonomed Escalon

- Vissum

- Optovue

- Rexxam Co., Ltd.

- Ellex Medical Lasers (now part of Quantel Medical)

- Visionix (Luneau Technology Group)

- Moptim

Frequently Asked Questions

Analyze common user questions about the Next Generation Optical Biometry Devices market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key technological driver in the Next Generation Optical Biometry Devices Market?

The key technological driver is Swept-Source Optical Coherence Tomography (SS-OCT), which offers superior speed, deeper tissue penetration, and enhanced visualization of the anterior segment, enabling more accurate measurements in complex cases like dense cataracts or post-refractive eyes.

How does the integration of AI impact the clinical application of these devices?

AI integration significantly enhances clinical application by automating quality control, improving IOL calculation accuracy, especially for complex geometries, and offering predictive modeling for personalized refractive outcomes, thereby minimizing refractive surprises post-surgery.

Which geographic region is expected to show the highest growth rate during the forecast period?

The Asia Pacific (APAC) region is projected to register the fastest CAGR, driven by the massive aging population, improving healthcare spending, and increasing adoption of advanced ophthalmic technologies across key markets like China and India.

What are the primary restraints limiting the rapid market adoption of these advanced biometers?

The primary restraints include the high initial capital investment required for purchasing SS-OCT biometry systems, which can be prohibitive for smaller specialty clinics, and the need for specialized technical training and maintenance contracts.

What is the main application area driving revenue in the Next Generation Optical Biometry Devices Market?

The main application area driving the vast majority of revenue is the preoperative assessment and planning for cataract surgery, particularly for implantation of premium intraocular lenses (IOLs) such as toric, multifocal, and extended depth of focus (EDOF) IOLs.

What are the advantages of SS-OCT over Partial Coherence Interferometry (PCI) in biometry?

SS-OCT offers advantages such as superior ability to penetrate media opacities (dense cataracts), faster measurement acquisition times, and comprehensive cross-sectional imaging of the ocular structures, providing anatomical context that PCI systems generally lack.

Which end-user segment is prioritizing device efficiency and high patient throughput?

Ambulatory Surgical Centers (ASCs) and Specialty Eye Clinics are the end-user segments most prioritizing device efficiency, throughput, and a small physical footprint to manage high patient volumes effectively and maximize operational profitability.

How do Next Generation Biometers handle challenging post-refractive surgery eyes?

Next Generation Biometers utilize specialized software algorithms and advanced IOL calculation formulas, often enhanced by AI, to more accurately estimate effective lens position and compensate for surgically altered corneal geometries, leading to improved refractive predictability.

What role do academic and research institutes play in this market?

Academic and research institutes serve as key centers for clinical validation, testing new biometry algorithms and IOL formulas, and providing essential clinical training, often being the first adopters of breakthrough, research-grade biometry technology.

Why is high precision critical for premium IOL implantation?

High precision is critical because premium IOLs (e.g., multifocal and toric) are highly sensitive to small errors in axial length or keratometry measurements. A slight error can significantly compromise the patient's visual quality and the intended refractive outcome, leading to dissatisfaction.

What specific measurement data do these biometers provide beyond axial length?

In addition to axial length, next-generation devices provide comprehensive data including corneal thickness (pachymetry), corneal curvature (keratometry), white-to-white diameter, lens thickness, and anterior chamber depth (ACD), all integrated for comprehensive surgical planning.

How are manufacturers addressing the complexity of regulatory approvals?

Manufacturers are addressing regulatory complexity by investing heavily in rigorous multi-site clinical trials, standardizing data collection protocols, and pursuing harmonized regulatory compliance (such as FDA and CE Mark) simultaneously to expedite global market entry for their advanced devices.

What strategic shift is evident among market competitors?

The strategic shift is moving away from standalone devices toward developing integrated diagnostic platforms that combine biometry, topography, and diagnostics, offering a unified, streamlined workflow solution for ophthalmologists, enhancing efficiency and reducing the need for multiple instruments.

What impact does the integration of biometers with EHR systems have on healthcare providers?

Integration with Electronic Health Record (EHR) systems significantly improves workflow efficiency, minimizes manual data entry errors, ensures seamless data retrieval for longitudinal patient tracking, and facilitates compliance with digital health regulations for healthcare providers.

Is there an emerging market for portable or handheld biometry devices?

Yes, there is an emerging market, particularly in developing countries and for mobile eye care services, where demand is growing for portable, user-friendly biometry devices that maintain high accuracy while being more cost-effective and suitable for outreach programs.

What is the significance of the 1050 nm wavelength used in SS-OCT biometry?

The 1050 nm wavelength is significant because it allows the light to penetrate deeper into the ocular media with less scattering, improving the signal quality and ensuring reliable measurements even when the patient has dense cataracts or vitreous floaters.

How do manufacturers ensure the accuracy and calibration of these high-precision instruments?

Manufacturers ensure accuracy through rigorous factory calibration, adherence to international metrology standards, and providing specialized calibration check tools and standardized testing eyes for periodic verification in clinical settings, alongside stringent quality assurance protocols.

What are the key components identified in the upstream analysis of the value chain?

The key components identified upstream include high-precision optical systems (lenses, mirrors), specialized Swept-Source laser modules, advanced high-speed detectors, and proprietary software algorithms for signal processing and interpretation.

How does rising medical tourism influence the market for these devices?

Rising medical tourism encourages clinics in developing nations, particularly in APAC and MEA, to invest in state-of-the-art biometry devices to ensure high-quality outcomes and meet international patient expectations, thereby enhancing their competitive edge.

What is the role of key opinion leaders (KOLs) in the market adoption cycle?

KOLs are crucial as they drive adoption by publishing clinical validation studies, presenting technological advancements at major conferences, and influencing purchasing decisions among their peers, significantly impacting the credibility and market acceptance of new biometry platforms.

How does the market address variability in human error during biometry measurements?

The market addresses human error through automated alignment systems, sophisticated software algorithms that filter out poor-quality scans, and AI-driven systems that provide immediate feedback and confidence scores on measurement reliability, standardizing the technique.

What is the expected long-term impact of AI on IOL calculation formulas?

The long-term impact is the shift towards personalized, data-driven IOL calculation. AI will move beyond fixed formulas to utilize machine learning for custom modeling based on large, diverse patient datasets, leading to previously unattainable levels of refractive outcome precision.

Beyond cataracts, what other application area is growing significantly?

Assessment for eyes that have previously undergone refractive procedures (e.g., LASIK, PRK) is growing significantly. These eyes require specialized biometry and calculation methods due to altered corneal geometry, posing a complex challenge that advanced biometers are designed to solve.

Why is the ability to measure through dense cataracts important for SS-OCT devices?

The ability to measure through dense cataracts is vital because traditional methods (ultrasound or older optical biometers) often fail in these cases, requiring the inconvenient and less precise immersion ultrasound method. SS-OCT's deeper penetration ensures non-contact, high-accuracy measurements even in advanced cataract stages.

How do reimbursement policies affect the market growth in North America?

Favorable reimbursement policies in North America, particularly for advanced cataract procedures involving premium IOLs and associated necessary diagnostics like SS-OCT biometry, incentivize healthcare providers to invest in high-end, next-generation equipment, fueling continuous market expansion.

What competitive strategy are manufacturers employing to differentiate their products?

Manufacturers are differentiating products by emphasizing integrated functionality (combining biometry, topography, and tomography), incorporating proprietary, highly accurate AI-enhanced calculation software, and focusing on superior speed and ease of use to streamline clinical workflow.

Describe the current trend regarding device form factor in the market.

While large console units remain standard, there is an increasing trend toward developing more compact, integrated tabletop units and highly sophisticated portable devices that offer near-console performance, addressing space constraints in smaller clinics and the needs of outreach programs.

What is the primary function of keratometry integration in these biometry devices?

The primary function of integrated keratometry is the accurate measurement of corneal curvature and astigmatism, which is essential for determining the correct axis and power of toric IOLs and ensuring the patient achieves targeted uncorrected vision post-surgery.

In the value chain, why is post-sales support critical for this market?

Post-sales support is critical because these complex devices require specialized technical maintenance, frequent software updates to incorporate new IOL formulas, and continuous clinical training to maximize staff proficiency and minimize downtime in high-throughput surgical centers.

How does the increasing prevalence of diabetes influence the market?

The increasing prevalence of diabetes contributes to the market as diabetic patients often develop cataracts earlier and require comprehensive ophthalmic assessment, including precise biometry, which is complicated by potential concurrent diabetic retinopathy and macular edema, necessitating advanced diagnostic tools.

What is the role of data centralization in modern biometry platforms?

Data centralization allows for all preoperative diagnostic measurements—biometry, topography, wavefront—to be stored and analyzed on a single, unified platform, facilitating streamlined surgical planning, reducing data transcription errors, and enabling complex AI analysis across various inputs.

Why are Ambulatory Surgical Centers (ASCs) major customers for next-generation devices?

ASCs are major customers because they operate under intense pressure to maximize efficiency, reduce turnaround time, and maintain high-quality patient outcomes, making the speed, accuracy, and reliability of SS-OCT biometers highly valuable for their business model.

What limitations are still present in current next-generation optical biometry?

Limitations include the inability to provide accurate readings in eyes with extremely dense vitreous hemorrhage or severe media opacities where even SS-OCT fails to achieve reliable signal lock, necessitating a fallback to immersion ultrasound methods, though this is becoming rarer.

How are manufacturers addressing the complexity of IOL formula selection?

Manufacturers are addressing this by integrating multiple IOL formulas directly into the device software and providing sophisticated guidance tools, often utilizing AI, to recommend the optimal formula based on the specific eye geometry (e.g., normal, short, long, post-refractive).

What is the projected trend for the price point of SS-OCT devices over the forecast period?

While the initial cost remains high, the projected trend suggests a slight decrease in the average selling price for basic SS-OCT models due to increased competition, while premium models incorporating AI, full anterior segment OCT, and integrated topography will maintain a high price point.

Which component is considered the most technologically advanced and expensive upstream component?

The Swept-Source laser module, which provides the high-speed, tunable light source necessary for SS-OCT imaging, is considered the most technologically advanced and typically the most expensive upstream component of these biometry devices.

In the context of the supply chain, what risk is associated with specialization?

The high degree of specialization required for components (like photonics and specialized sensors) creates supply chain risk, as reliance on a limited number of specialized upstream suppliers can lead to vulnerability regarding component shortages, quality control issues, or price volatility.

How does the concept of "refractive predictability" relate to biometry market growth?

Refractive predictability—the ability to accurately forecast the patient’s final refractive error—is the core value proposition. Increased predictability achieved through next-generation biometry drives surgeon confidence and encourages greater adoption of premium IOLs, directly fueling market growth.

What type of training is essential for clinical staff using these advanced biometers?

Essential training includes proficiency in device operation, quality assurance protocols for optimal measurement acquisition, understanding the nuances of different IOL formulas, and troubleshooting complex data outputs, typically provided through comprehensive manufacturer-led programs.

How do manufacturers customize their offerings for the price-sensitive APAC market?

For the price-sensitive APAC market, manufacturers often introduce streamlined versions of their devices, focusing on core biometry functions while offering modular upgrades or utilizing specialized regional distribution partners to reduce cost and provide localized support infrastructure.

What differentiates optical biometry from traditional A-scan ultrasound biometry?

Optical biometry is non-contact, provides much higher resolution and repeatability, and measures the anatomical axis, whereas A-scan ultrasound is a contact method that is less accurate and measures the acoustic axis, often leading to greater variability in IOL power calculation.

What is the significance of the "white-to-white" measurement provided by biometers?

The "white-to-white" measurement (corneal diameter) is significant as it is a crucial input for determining the appropriate size of phakic IOLs or sulcus-implanted IOLs, and also informs the design of various IOLs to ensure optimal fit and stability within the eye.

How is environmental sustainability influencing the manufacturing aspect of biometry devices?

While not a primary driver, manufacturers are increasingly focusing on reducing energy consumption in their devices, using more sustainable, long-lasting materials, and optimizing the supply chain to minimize the environmental footprint, aligning with global corporate social responsibility trends.

What are the implications of miniaturization in optical biometry?

Miniaturization allows for smaller, more portable devices, making advanced biometry accessible outside traditional hospital settings, improving outreach potential, and enabling easier integration into high-density clinical environments where space optimization is critical.

Which regulatory bodies are most critical for market entry in the biometry sector?

The most critical regulatory bodies are the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA) which oversees the CE marking process, and China's National Medical Products Administration (NMPA) due to the size and strategic importance of these markets.

How are potential customers assessing the ROI of high-cost biometry systems?

Customers assess ROI based on increased patient throughput, reduced refractive enhancement rates (leading to higher patient satisfaction and reduced costs), and the ability to attract and successfully manage premium IOL patients, which yield higher revenue streams per surgery.

What constitutes "Next Generation" features compared to older optical biometers?

"Next Generation" features include SS-OCT technology, integrated anterior segment imaging (AS-OCT), advanced AI-driven IOL calculation capabilities, automated data capture quality control, and connectivity with digital health platforms, far exceeding the capabilities of simple PCI devices.

How is competition intensifying in the SS-OCT technology segment?

Competition is intensifying as major players release faster, more integrated SS-OCT platforms, and smaller, specialized companies focus on niche areas like portable SS-OCT or superior AI software, leading to a constant battle for technological supremacy and patent protection.

What is the primary risk associated with relying solely on indirect distribution channels?

The primary risk is losing control over pricing consistency, reduced direct feedback loops from end-users, and potential variations in the quality and speed of localized technical support, which can damage the brand reputation of a high-precision device.

Why is lens thickness measurement important in modern biometry?

Lens thickness measurement is important because it is a key input for several advanced IOL formulas (such as Haigis Suite and Barrett formulas) that use physical metrics to predict the Effective Lens Position (ELP) more accurately, essential for optimizing refractive outcomes.

How do global economic factors affect capital expenditure on biometry devices?

Global economic factors, such as interest rate fluctuations or recessionary pressures, can lead to deferred capital expenditure, causing hospitals and clinics to postpone purchases of high-cost biometry systems, impacting short-term market growth and sales cycles.

What are the ethical considerations surrounding AI use in biometry?

Ethical considerations include data privacy and security (especially patient biometric data), algorithmic bias that might affect specific demographic groups, and the need for transparency (explainability) in AI recommendations to maintain surgeon accountability.

What is the expected lifespan and replacement cycle for these advanced devices?

The expected physical lifespan of a high-end biometer is generally 7-10 years, but the replacement cycle tends to be shorter (4-6 years) due to rapid technological obsolescence, driven by the continuous introduction of superior models with enhanced accuracy and integrated features like AI.

How is the market responding to the demand for improved post-refractive IOL calculations?

The market is responding by developing and integrating sophisticated, often proprietary, IOL formulas (like the Barrett True K and specialized SS-OCT based formulas) that rely on comprehensive posterior corneal surface measurements and advanced data extrapolation techniques to handle the altered corneal profiles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager