NFT Trading Card games Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437868 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

NFT Trading Card games Market Size

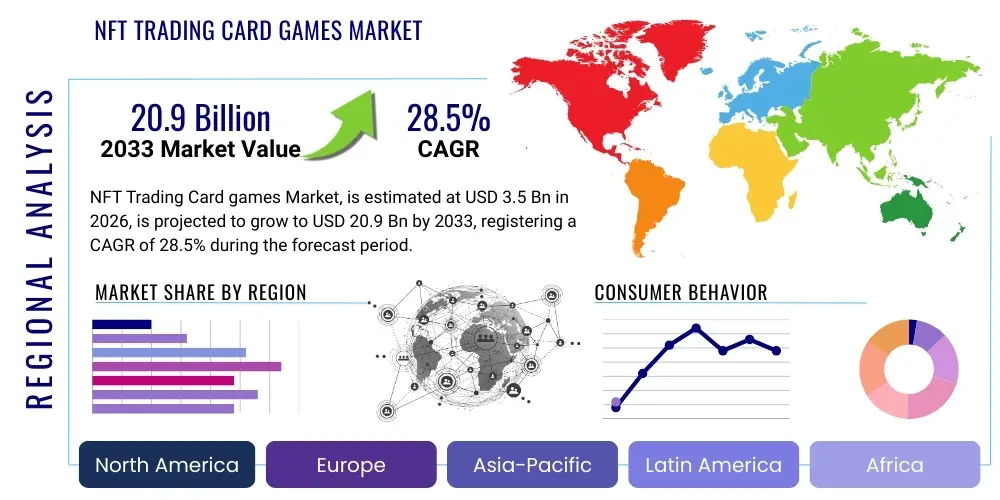

The NFT Trading Card games Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 20.9 Billion by the end of the forecast period in 2033.

NFT Trading Card games Market introduction

The NFT Trading Card Games (TCGs) market represents a significant convergence point between the multi-billion dollar traditional gaming industry and emerging blockchain technology, specifically leveraging Non-Fungible Tokens (NFTs) to confer verifiable digital ownership over in-game assets. This sector fundamentally redefines the relationship between players and game items by transforming digital cards from fungible server data into unique, scarce assets stored on decentralized ledgers. Key applications include competitive play, digital collection, and investment, offering players the ability to trade, sell, or utilize their assets across different platforms or metaverses, depending on the level of interoperability achieved by specific projects. The inherent scarcity and transparent transaction history provided by blockchain technology amplify the intrinsic value associated with owning rare digital cards, mimicking the established mechanics of physical TCG markets like Magic: The Gathering or Pokémon, but enhanced by cryptographic security.

Product descriptions within this market center primarily around digital cards, which function as playable assets with distinct attributes, rarity levels, and artistic designs. These cards are minted as NFTs, typically following standards like ERC-721 or ERC-1155 on platforms such as Ethereum, Polygon, or Solana. Major applications span from strategic player-versus-player (PvP) combat, where card attributes dictate game outcomes, to passive collecting, where high-value assets appreciate based on demand and project development milestones. Furthermore, certain games integrate staking or decentralized finance (DeFi) mechanisms, allowing players to earn governance tokens or yield from their owned card assets, thus broadening the utility beyond mere gameplay.

The market is primarily driven by the robust adoption of the Play-to-Earn (P2E) model, which incentivizes user engagement by offering tangible financial rewards, contrasting sharply with traditional Free-to-Play models where value accrual typically flows only to the publisher. Benefits to users include provable ownership, portability of assets, and the potential for capital appreciation, creating a self-sustaining digital economy. Crucial driving factors encompass increasing global awareness of blockchain technology, the expanding demographic of crypto-native gamers, and significant venture capital investment pouring into game development studios specializing in Web3 infrastructure, which collectively legitimizes the sector and accelerates the pace of innovation and product quality improvement.

NFT Trading Card games Market Executive Summary

The global NFT Trading Card Games market is experiencing rapid expansion, driven primarily by the maturation of the underlying blockchain infrastructure and the increasing mainstream acceptance of digital assets. Key business trends indicate a shift toward higher-quality game production, moving away from simple proof-of-concept projects to fully realized, high-fidelity gaming experiences that appeal to both crypto-native investors and traditional gamers. Furthermore, there is a distinct trend toward multi-chain deployment and cross-game interoperability, as developers seek to maximize liquidity and utility for their NFT assets. Strategic partnerships between established intellectual property (IP) holders and blockchain developers are becoming crucial for market penetration, injecting credibility and established user bases into the volatile Web3 space. The prevailing economic model remains dominated by P2E mechanics, though emerging variations, such as play-and-own or play-and-collect, are gaining traction to mitigate the risks associated with pure speculation.

Regionally, the market exhibits divergent adoption rates and operational dynamics. Asia Pacific (APAC), particularly Southeast Asia, is a critical growth engine, largely due to high rates of mobile crypto adoption and the necessity-driven embrace of P2E models as supplementary income sources. This region often leads in transaction volume and user base size. North America and Europe, while representing high average transaction values per user, focus more on collectibility, competitive esports potential, and high-production-value titles, driven by a demographic with higher discretionary income and established TCG traditions. Regulatory clarity remains a key differentiator; regions that adopt progressive digital asset regulations are seeing faster institutional and developer influx, whereas uncertainty in certain jurisdictions acts as a substantial restraint on market scaling and operational security.

Segment-wise, the market sees robust performance across platforms, though Desktop/PC remains the primary platform for high-complexity, graphically rich TCGs, commanding the largest revenue share due to superior interface capabilities suited for deep strategic gameplay. However, the Mobile segment is projected to exhibit the fastest growth CAGR, mirroring global gaming trends and facilitating access in high-growth, mobile-first economies. In terms of technology, Layer 2 scaling solutions (like Polygon and Arbitrum) are becoming the preferred infrastructure layer, essential for reducing gas fees and increasing transaction throughput, thereby making frequent, small-scale gameplay transactions economically viable for the mass market. Monetization trends show a diversification away from reliance solely on initial asset sales (packs/drops) toward ongoing revenue streams derived from marketplace transaction fees and fractional ownership mechanisms.

AI Impact Analysis on NFT Trading Card games Market

User inquiries regarding the impact of Artificial Intelligence (AI) on NFT TCGs frequently revolve around questions of competitive fairness, market manipulation through autonomous bots, and the potential for AI to influence game design and asset generation. Key themes users are concerned about include whether AI can effectively balance complex card ecosystems in real-time, preventing dominant, meta-breaking strategies, and conversely, whether sophisticated AI bots can create unfair advantages in PvP tournaments or rapidly arbitrage market price fluctuations for NFT cards, thereby disadvantaging human players. Furthermore, there is significant interest in how Generative AI tools (like DALL-E or Midjourney) are being utilized for creating unique, high-quality card art and expansive lore, questioning the authenticity and scarcity of digitally generated assets versus those crafted by human artists. The overarching expectation is that AI should enhance the complexity and sustainability of the game economy, while simultaneously demanding transparency regarding its deployment in match-making and anti-cheat systems.

The integration of AI algorithms fundamentally transforms game operational dynamics, moving game balancing from periodic developer patches to continuous, data-driven optimization. AI can analyze millions of game logs to identify overpowered or underutilized cards, suggesting adjustments to stats, mana costs, or abilities that maintain a dynamic and competitive environment. This capability is crucial for long-term retention in TCGs, which often suffer from stagnation when a single strategy dominates the competitive scene. However, this deployment must be carefully managed to avoid over-reliance on algorithms that might unintentionally stifle player creativity or produce unpredictable meta shifts that frustrate the dedicated user base. Developers are leveraging machine learning to model potential card combinations and predict macro-economic impacts before new sets are released, aiming for a stable yet exciting digital economy from the outset.

On the user interaction and marketplace side, AI influences personalization and security. Sophisticated AI models are used to tailor card recommendations and promotional content based on individual player behavior and collection history, boosting engagement and secondary market liquidity. Conversely, the market must deploy robust AI detection mechanisms to counteract malicious bot activity. Arbitrage bots that instantaneously buy low and sell high across fragmented decentralized marketplaces pose a threat to pricing stability, while P2E farming bots can artificially inflate asset supply, devaluing the time investment of legitimate players. Therefore, the successful integration of AI requires a dual strategy: applying advanced algorithms to enhance gameplay experience and utilizing counter-AI technologies to ensure fairness and market integrity.

- AI-Driven Game Balancing: Real-time analysis of win rates and card utility to ensure diverse competitive metas, preventing stagnation and dominance by single card archetypes.

- Generative Asset Creation: Utilizing generative AI for rapid prototyping of unique card art, token lore, and background story narratives, reducing development cycles.

- Automated Bot Detection: Implementing machine learning models to identify and neutralize malicious P2E farming bots and automated marketplace arbitrageurs, safeguarding economic integrity.

- Dynamic Pricing Mechanisms: AI algorithms assessing market liquidity, trading volume, and card rarity to suggest optimal pricing for initial drops and subsequent secondary market listings.

- Personalized Content Delivery: Using player engagement data to recommend relevant NFT card packs, marketplace listings, or strategic tutorials, improving user retention.

- Enhanced Security Protocols: AI monitoring transaction patterns on the blockchain to detect potential fraud, wash trading, or coordinated attacks on smart contracts.

- Improved Matchmaking Systems: Advanced AI prioritizing skill-based and collection-value-based matchmaking for fairer, more engaging player-versus-player (PvP) experiences.

- Simulated Economic Stress Testing: Utilizing AI models to run complex simulations of new card releases or large player influxes to predict and mitigate economic instability before deployment.

DRO & Impact Forces Of NFT Trading Card games Market

The NFT Trading Card Games market is shaped by a powerful array of interconnected drivers, restraints, and opportunities (DRO), alongside critical external impact forces. Key drivers center on the proven effectiveness of the Play-to-Earn (P2E) model, which acts as a powerful acquisition tool by offering tangible monetary incentives for time invested, transforming gaming from a consumer activity into a potential income stream. This is significantly bolstered by the intrinsic appeal of digital scarcity, where cryptographic proof of ownership via NFTs replicates the collectibility and investment potential of physical TCGs. Restraints largely concern the inherent volatility and speculative nature of cryptocurrency markets, which directly impacts the perceived value and stability of the underlying NFT assets. Regulatory uncertainty across major global jurisdictions presents a major obstacle, as governments grapple with classifying NFTs and P2E tokens—as securities, commodities, or virtual goods—creating legal risks for both developers and players. Opportunities are substantial, stemming from strategic cross-IP collaborations (e.g., integrating major entertainment franchises), the evolution toward cross-chain compatibility, and deep integration into the burgeoning Metaverse, promising novel interactive experiences and utility for card collections outside the primary game environment. These forces interact to define the risk-reward profile of investment in this dynamic sector.

The impact forces driving market development can be categorized into technological, economic, political, and competitive pressures. Technologically, the shift toward more efficient, low-cost Layer 2 (L2) solutions and alternative Layer 1 (L1) chains is critical, as it addresses the scalability and high transaction cost issues that previously plagued major projects built solely on foundational L1 blockchains like Ethereum. Economically, global inflation and the search for alternative income streams, particularly in emerging markets, amplify the attractiveness of P2E mechanics. However, economic downturns can significantly depress investment capital and asset floor prices. Politically, the debate around decentralized autonomous organizations (DAOs) and player governance models, which grant token holders power over game updates and treasury management, is a major force influencing community loyalty and developer accountability. Finally, the competitive landscape is intensely dynamic; the emergence of high-quality, AAA-level Web3 games raises the barrier to entry, forcing existing projects to continuously innovate on both game mechanics and economic sustainability models.

Success in navigating these forces depends heavily on establishing sustainable economic models (tokenomics) that avoid inflationary spirals common in early P2E games. Developers must balance rewarding early adopters without flooding the market, ensuring that the utility of the TCG remains primarily centered on enjoyable, strategic gameplay rather than pure financial speculation. Opportunities in licensing and merging digital collectible IP with established gaming brands (e.g., licensed NFTs based on sports leagues or major fantasy universes) offer crucial paths for mass adoption, bridging the gap between niche crypto audiences and mainstream gamers. Mitigation of restraints involves proactive engagement with regulatory bodies to advocate for sensible digital asset frameworks and employing best-in-class security practices to safeguard smart contracts against exploits, which directly impacts investor confidence and long-term viability.

- Drivers (D)

- Widespread adoption of the Play-to-Earn (P2E) economic model.

- Verifiable digital ownership and provenance provided by NFTs.

- Increasing convergence of traditional gaming IP with blockchain infrastructure.

- Rapid advancements in Layer 2 scaling technologies reducing transaction costs and increasing throughput.

- Strong community engagement fostered by decentralized governance models (DAOs).

- Restraints (R)

- High volatility and speculative risk inherent in crypto and NFT asset markets.

- Regulatory ambiguity and inconsistent legal classification of NFTs across global jurisdictions.

- Technical barriers to entry (e.g., requirement of cryptocurrency wallets, complex onboarding processes).

- Risk of security breaches and smart contract vulnerabilities leading to asset loss.

- Market fatigue and saturation due to the proliferation of low-quality P2E projects.

- Opportunities (O)

- Integration with major Metaverse platforms and cross-game interoperability standards.

- Strategic partnerships with global entertainment and sports franchises for licensed IP TCGs.

- Development of hybrid models (Free-to-Play/P2E) to lower initial investment hurdles.

- Expansion into mobile gaming platforms targeting emerging markets with high mobile penetration.

- Leveraging fractionalized NFT ownership to increase liquidity and accessibility for high-value assets.

- Impact Forces

- Technological Shift: Transition from L1 to highly scalable L2 solutions (e.g., Arbitrum, Immutable X).

- Economic Influence: Global inflation driving demand for asset-backed digital collectibles as alternative stores of value.

- Regulatory Pressure: Increasing scrutiny from financial regulators (e.g., SEC, EU MiCA) mandating greater transparency and consumer protection.

- Competitive Intensity: Maturation of the industry leading to a winner-takes-most scenario, favoring projects with superior gameplay and sustainable tokenomics.

Segmentation Analysis

The NFT Trading Card Games market is extensively segmented based on platform, the underlying blockchain technology utilized, the dominant monetization model, and the specific game genre, allowing for targeted strategic analysis and market positioning. Platform segmentation is crucial as it dictates accessibility and technical requirements, with Desktop/PC and Mobile representing the two primary deployment environments, each attracting distinct user demographics and catering to different game complexities. The underlying technology layer is arguably the most critical structural segment, differentiating between projects built on established high-security chains like Ethereum (L1 and L2 solutions), high-throughput chains like Solana or Flow, and specialized gaming-centric chains such as Immutable X or WAX, which directly influence transaction speeds and gas fees.

Monetization strategy defines the economic flow within the game, separating models heavily reliant on initial asset sales (booster packs, presales), versus those emphasizing ongoing secondary market transaction fees, staking rewards, or subscription/battle pass hybrid models. Pure Play-to-Earn (P2E) models, where token rewards are central, contrast with Play-and-Own models, which prioritize intrinsic gameplay value and asset collection utility. Furthermore, genre segmentation separates the market into core competitive strategic TCGs (e.g., resource management, deck building), collectible-only games focused purely on asset rarity and visual appeal, and hybrid genres integrating RPG or strategy elements, ensuring market offerings cater to diverse player preferences.

This comprehensive segmentation allows developers to optimize distribution channels, align asset rarity mechanics with anticipated liquidity needs, and tailor marketing efforts. For instance, games targeting the Mobile/P2E segment often focus on chains with negligible transaction costs and simple user interfaces, appealing strongly to emerging markets. Conversely, high-value collectible games targeting the Desktop/PC segment may prioritize security and immutable provenance offered by Ethereum L1 or robust Layer 2 solutions, attracting high-net-worth collectors. Understanding the intersection of these segments is vital for predicting market trajectory, identifying underserved niches, and developing robust, future-proof tokenomics designed for sustainable growth rather than speculative bubbles.

- By Platform

- Desktop/PC (High graphics, deep strategic control)

- Mobile (Accessibility, mass adoption in emerging markets)

- Console (Niche, focused on integration with broader gaming ecosystems)

- By Blockchain Technology

- Ethereum (L1)

- Ethereum Layer 2 Solutions (Polygon, Arbitrum, Immutable X)

- Solana

- Flow

- WAX

- Other Specialized Blockchains

- By Monetization Model

- Pure Play-to-Earn (Token rewards focus)

- Collect-to-Earn (Asset scarcity and collection value focus)

- Initial NFT Offering (INO)/Pack Sales

- Marketplace Transaction Fees

- Hybrid (F2P/P2E Mix)

- By Game Genre/Type

- Competitive Strategic TCGs (PvP focus)

- Collectible-Only Card Games

- Role-Playing Game (RPG) Integration TCGs

- Sports/Fantasy League Card Games (Data-driven utility)

Value Chain Analysis For NFT Trading Card games Market

The value chain of the NFT Trading Card Games market is complex, spanning from the creation of the underlying blockchain technology (upstream) to the secondary trading markets and player community interaction (downstream). Upstream analysis begins with the foundational technology providers: the Layer 1 and Layer 2 blockchain developers who provide the security, consensus mechanism, and scalability required for minting and transacting NFTs. This stage also includes specialized middleware providers, smart contract auditors, and wallet infrastructure developers (e.g., MetaMask, hardware wallets). The core creation process involves game design studios and artistic talent (designers, lore writers, programmers) who develop the TCG mechanics, card art, and metadata, culminating in the minting of the specific NFT collections using industry standards (ERC-721/1155). The efficiency and cost of this upstream phase are dictated heavily by the chosen blockchain, with Layer 2 solutions generally offering faster and cheaper minting compared to congested Layer 1 networks.

Midstream activities focus on deployment, distribution, and asset management. The distribution channel is bifurcated into direct sales (Initial NFT Offerings, booster pack drops sold directly by the game publisher) and indirect distribution via established decentralized marketplaces (e.g., OpenSea, Magic Eden, dedicated in-game marketplaces). Smart contracts act as the central operational hub, managing tokenomics (governance, reward distribution), defining card properties, and executing trades securely. Marketing and community building are also critical midstream components, often leveraging social media, streaming platforms, and token airdrops to generate hype and initial liquidity. The effectiveness of the midstream infrastructure—particularly low transaction latency and seamless wallet integration—directly impacts user experience and market adoption rates.

The downstream segment primarily involves end-users and the secondary market economy. Players (the ultimate consumers) interact with the game, utilize the NFTs in gameplay, and determine the intrinsic utility value of the cards through competitive performance. The secondary market, facilitated by centralized and decentralized exchanges, is where the bulk of trading volume occurs, establishing the market price and liquidity for each asset class. Feedback loops from the downstream community, often facilitated through DAO governance mechanisms, influence future card releases, game balancing decisions, and tokenomics adjustments, closing the value chain. Sustainable growth relies on a healthy secondary market that rewards players and attracts new capital, which is directly tied to the perceived long-term value and playability of the game.

NFT Trading Card games Market Potential Customers

The market for NFT Trading Card Games attracts a diverse range of potential customers, segmented primarily into three major categories: traditional collectible enthusiasts, crypto-native investors, and necessity-driven Play-to-Earn participants. Traditional collectible enthusiasts represent the demographic accustomed to the mechanics of physical TCGs (e.g., Magic: The Gathering, Yu-Gi-Oh!), valuing strategic depth, artwork, and collection completeness. They transition to NFT TCGs driven by the added benefits of verifiable digital scarcity, ease of trading, and protection against physical damage or counterfeiting. This group typically prioritizes high-production-value games with complex mechanics and established lore, seeking high utility and competitive satisfaction over immediate financial returns, though they value the potential for asset appreciation as a secondary benefit.

Crypto-native investors and speculators form the second crucial customer segment. These individuals possess established crypto wallets, understand blockchain mechanics, and are motivated primarily by asset liquidity, tokenomics performance, and the potential for rapid return on investment (ROI). They often engage in collecting rare or "alpha" cards during initial presales or drops, focusing on marketplace arbitrage and staking opportunities rather than deep gameplay engagement. This segment is highly reactive to market trends, celebrity endorsements, and fundamental technological shifts (e.g., migration to new blockchains), providing essential liquidity but also contributing significantly to market volatility. Projects must cater to this segment by ensuring clear, transparent tokenomics and providing ample liquidity pools.

The third significant group comprises necessity-driven P2E participants, predominantly located in emerging economies where the rewards earned from playing NFT TCGs can represent a meaningful supplementary or even primary source of income. For this demographic, accessibility (often mobile-based gaming), low entry costs, and the efficiency of the P2E loop are paramount. They prioritize games with low initial investment thresholds, stable reward tokens, and straightforward gameplay mechanics that maximize time-to-payout. Projects that successfully cater to this mass market segment achieve immense user numbers and daily active users (DAU), although the average transaction size per user may be lower than those of collectors or investors. Understanding and balancing the needs of these three diverse customer groups is central to achieving a broad and sustainable market presence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 20.9 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sky Mavis (Axie Infinity), Dapper Labs (NBA Top Shot/Flow), Immutable X, Animoca Brands, WAX Studios, Splinterlands, Mythical Games, Gala Games, Sorare, The Sandbox, Enjin, Zero to Play, Illuvium, Gods Unchained (Immutable), Parallel, Dr. Seuss Enterprises, XPLA, Com2uS, Square Enix, and Konami (Exploration Phase) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

NFT Trading Card games Market Key Technology Landscape

The foundational technological landscape of the NFT Trading Card Games market is defined by sophisticated blockchain infrastructure designed to handle high transaction volumes and ensure asset security. Core to this is the evolution of Layer 1 (L1) and Layer 2 (L2) solutions. While initial major projects often launched on Ethereum L1, the prohibitive gas fees and slow transaction throughput quickly necessitated a shift. Consequently, the market is now dominated by high-performance L2 scaling solutions, such as Polygon, Arbitrum, and specifically gaming-focused infrastructure like Immutable X (leveraging zk-Rollups). These technologies are paramount because TCGs require frequent, micro-transactions (e.g., opening packs, playing cards, small trades) that would be economically non-viable on congested L1 networks. The choice of blockchain dictates the speed, cost, and overall scalability of the game's economy, directly influencing mass market adoption and retention rates, particularly in regions where transaction costs are a major barrier.

Beyond the underlying consensus layer, the technology landscape heavily relies on specialized smart contract standards and secure wallet integration. The use of the ERC-721 standard ensures true non-fungibility for unique card assets, while ERC-1155 is increasingly utilized for semi-fungible items like common card packs or game resources, optimizing batch transfers and reducing deployment costs. Security technology, including formal verification of smart contract code and utilization of decentralized oracle networks, is essential to mitigate the high risk of exploits that have plagued the wider DeFi and NFT space. Furthermore, advancements in cross-chain bridge technology are crucial for achieving true interoperability, allowing card assets minted on one chain to be recognized and utilized (or traded) on another, fostering a more unified and liquid digital asset ecosystem and increasing the potential utility of collectibles.

Emerging technologies, specifically zero-knowledge (ZK) proofs, are beginning to play a transformative role, offering solutions for privacy and trustless computation, which could enable private match statistics or confidential card ownership data—features highly valued by competitive players. Data analytics and machine learning tools are also integral, used by developers to manage complex tokenomics by predicting inflation, tracking player behavior, and ensuring the health of the game's economic loop (the crucial resource sinks and faucets). Collectively, the technological landscape emphasizes scalability, security, and interoperability. The competitive advantage is increasingly held by platforms that offer seamless, low-friction user experiences, effectively masking the underlying blockchain complexity from the average gamer, moving the focus back to quality gameplay rather than technical hurdles.

Regional Highlights

- Asia Pacific (APAC): APAC remains the undisputed global leader in terms of active user volume and transaction frequency, particularly driven by economies in Southeast Asia (e.g., Philippines, Vietnam, Indonesia). This region exhibits strong adoption of the Play-to-Earn (P2E) model, often viewed as a viable source of supplementary income due to high mobile penetration and favorable demographic structures. Key drivers include a high cultural acceptance of digital assets and a necessity-driven search for alternative income streams. Market success here favors mobile-friendly games utilizing low-cost blockchains (like WAX or Polygon). However, regional success is heavily reliant on effective localization and compliance with diverse, rapidly evolving national regulations concerning digital currencies.

- North America (NA): Characterized by high average transaction values and substantial investment in high-production-value TCG titles. The NA market emphasizes collectibility, competitive esports potential, and brand collaborations (licensed IP). Users here prioritize high-fidelity graphics and sophisticated gameplay mechanics, aligning with the traditional high-end gaming market. While adoption is slower than in APAC, institutional investment and developer funding are concentrated here. A key factor is navigating the increasing regulatory scrutiny from bodies like the SEC regarding the classification of game tokens and NFTs as potential securities.

- Europe: The European market displays a balanced approach, showing interest in both the investment and competitive aspects of NFT TCGs. Countries like Germany, the UK, and France are hubs for development and consumer interest, focusing particularly on regulatory compliance, spurred by initiatives like the Markets in Crypto-Assets (MiCA) regulation. The emphasis is on environmental sustainability (favoring PoS chains) and projects offering strong artistic integrity. The market is moderately mature, attracting sophisticated investors and core crypto enthusiasts, though mainstream gamer adoption is still cautious.

- Latin America (LATAM): LATAM is a high-growth region, mirroring some of the P2E dynamics seen in Southeast Asia, driven by economic instability in certain countries which makes crypto rewards highly attractive. Brazil and Argentina are leading the adoption curve. The market favors accessible games with clear financial incentives. Challenges include ensuring robust fiat on-ramps and off-ramps, and dealing with varying levels of internet and technological infrastructure maturity, making mobile accessibility a key determinant of market success.

- Middle East and Africa (MEA): This region is characterized by high, yet fragmented, potential. Countries like the UAE and Bahrain are positioning themselves as global hubs for blockchain innovation, providing welcoming regulatory sandboxes that attract major development studios and capital. Conversely, adoption in many African nations is often grassroots, focused heavily on P2E as an economic tool, similar to LATAM and APAC emerging markets. Investment in infrastructure and government support for digital assets are critical variables influencing future market expansion in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the NFT Trading Card games Market.- Sky Mavis (Axie Infinity)

- Dapper Labs (Flow Blockchain, NBA Top Shot)

- Immutable X (Gods Unchained)

- Animoca Brands (Vast Portfolio of Web3 Investments)

- Splinterlands (Hive Blockchain TCG)

- Mythical Games

- Gala Games

- Sorare (Fantasy Sports TCG)

- Parallel (NFT Trading Card Game)

- XPLA (Game Development Ecosystem)

- Com2uS Holdings

- Konami (Exploring NFT TCGs)

- Square Enix (Active in Blockchain Gaming)

- Enjin

- Zero to Play

- Illuvium

- WAX Studios

- Dr. Seuss Enterprises (Licensed TCGs)

- Decentraland Games

- The Sandbox (Metaverse Integration)

Frequently Asked Questions

Analyze common user questions about the NFT Trading Card games market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between traditional TCGs and NFT TCGs?

The primary difference lies in ownership and scarcity. Traditional TCGs offer centralized digital assets tied to a server, whereas NFT TCGs utilize blockchain technology to grant verifiable, decentralized ownership of cards (NFTs). This allows players to freely trade assets outside the game's official marketplace and potentially use them across multiple platforms, creating genuine digital scarcity and investment potential.

How sustainable is the Play-to-Earn (P2E) model in the NFT TCG market?

The sustainability of the P2E model hinges on effective tokenomics that balance inflation and deflationary pressures. Sustainable models require high utility for in-game assets, substantial resource sinks (mechanisms to burn or use tokens), and continuous new player influx. Projects focused only on speculation often collapse, while those prioritizing deep, strategic gameplay alongside balanced economic loops demonstrate greater long-term resilience.

Which blockchain technology is currently leading the NFT TCG development space?

Ethereum Layer 2 (L2) solutions, such as Polygon and Immutable X (utilizing zk-Rollups), are currently leading the market. L2 technologies provide the necessary scalability and low transaction fees required for frequent gameplay actions, mitigating the high gas costs associated with Layer 1 networks like standard Ethereum, thereby facilitating mass market adoption.

What are the major regulatory risks impacting the future growth of NFT TCGs?

The major regulatory risk is the potential classification of certain P2E tokens and highly valuable NFTs as unregistered securities by global financial regulators (e.g., the SEC). Regulatory ambiguity concerning consumer protection, anti-money laundering (AML) compliance, and taxation rules creates operational hurdles and investment reluctance, potentially constraining mass market acceptance until clearer guidelines are established.

How does AI contribute to the competitive fairness and game design of NFT TCGs?

AI significantly contributes by optimizing game balancing through real-time analysis of millions of gameplay interactions, ensuring a dynamic and fair competitive environment. Conversely, advanced AI algorithms are also deployed as counter-measures to detect and neutralize malicious P2E farming bots and marketplace arbitrageurs, protecting the market integrity and ensuring fair rewards for human players.

Is investment in NFT Trading Cards purely speculative or based on intrinsic value?

Investment is a mix of both. The speculative component is driven by market hype and perceived asset appreciation linked to overall crypto market trends. However, intrinsic value is derived from a card's utility within the game (its playability, power level, and strategic rarity) and its community-driven collectibility, which offers genuine long-term value beyond short-term financial fluctuations.

What role does intellectual property (IP) play in the NFT TCG market?

IP plays a crucial role in driving mass adoption and building instant trust. Collaborations with established entertainment, sports, or gaming franchises (licensed IP) significantly reduce the marketing friction required to attract non-crypto native players. Licensed TCGs often command higher initial sales prices and enjoy greater liquidity due to the pre-existing, dedicated fan bases associated with the brand.

What is cross-chain interoperability and why is it important for NFT card games?

Cross-chain interoperability refers to the ability for NFT cards minted on one blockchain (e.g., Ethereum L2) to be recognized, verified, and potentially utilized or traded on a different blockchain or metaverse platform (e.g., Flow or Solana). This is critical because it enhances the liquidity, utility, and portability of digital assets, maximizing the long-term value proposition for collectors and minimizing platform lock-in effects.

How do developers ensure the scarcity of digital cards in a decentralized environment?

Scarcity is ensured cryptographically through the smart contract code deployed on the blockchain. This code dictates the maximum supply of each card type or collection (minting limits). Once the predefined number of NFTs has been created (minted), the contract prevents the creation of any more, providing auditable proof of rarity and ensuring that no single entity, including the developer, can unilaterally inflate the supply.

What is the current trend regarding the user interface (UI) design in NFT TCGs?

The current UI trend is focused on simplification and masking blockchain complexity. Developers are striving for AAA-gaming quality interfaces that resemble traditional video games, minimizing the visible steps related to wallet connectivity, gas fee management, and transaction confirmations. A seamless, familiar user experience is considered paramount for attracting the mainstream gamer demographic.

What is fractional ownership and how is it used in the NFT TCG sector?

Fractional ownership involves dividing a single, highly valuable NFT card into multiple fungible tokens (ERC-20 standard), allowing numerous investors to collectively own a piece of the high-value asset. In TCGs, this increases the accessibility of extremely rare cards, boosts liquidity, and allows smaller investors to participate in the upside of blue-chip collectibles, thereby broadening the investment base.

How do decentralized autonomous organizations (DAOs) impact game development decisions?

DAOs allow holders of the game's native governance token to vote on key development decisions, including game balancing patches, future expansion roadmaps, and allocation of community treasury funds. This structure shifts power away from centralized developers towards the player base, increasing transparency, fostering community loyalty, and theoretically ensuring long-term alignment with player interests.

What is the competitive landscape like for new NFT TCG startups?

The competitive landscape is intensely challenging, characterized by a high barrier to entry. New startups must compete not only on innovative tokenomics but increasingly on game quality and production value, necessitating significant venture capital funding. The market favors established projects with proven communities and robust blockchain infrastructure partnerships, pushing newcomers to find highly specialized niches or secure major IP licenses.

What methods are used to prevent market manipulation, such as wash trading, in NFT TCG marketplaces?

Marketplaces combat manipulation by implementing advanced monitoring systems, often utilizing AI and machine learning, to detect suspicious transaction patterns, rapid circular trading (wash trading), and coordinated pump-and-dump schemes. Dedicated fraud detection teams and mandatory KYC (Know Your Customer) procedures for high-volume traders are also employed, especially by centralized marketplaces, to enhance transparency.

What is the role of the ‘Metaverse’ in the future of NFT TCG cards?

The Metaverse integration is expected to extend the utility of NFT cards beyond the native game environment. Cards could function as avatars, digital display items in virtual galleries, or grant access rights to exclusive virtual events within interconnected 3D environments, fundamentally enhancing their value by providing cross-platform utility and social status in the broader Web3 ecosystem.

Why is mobile optimization critical for market expansion?

Mobile optimization is critical because it unlocks massive user bases in fast-growing emerging markets (APAC, LATAM) where smartphone usage heavily outweighs PC ownership. Mobile accessibility reduces the barriers to entry, making P2E models viable for a global audience and significantly boosting daily active user counts and transaction volume, thereby ensuring greater market liquidity.

How do economic ‘sinks’ help stabilize the tokenomics of a P2E TCG?

Economic 'sinks' are mechanisms designed to permanently or temporarily remove the game's native token from circulation, combating inflation. Examples include mandatory token burning for creating higher-tier cards, paying entry fees for high-stakes tournaments, or staking tokens for governance rights. Effective sinks are vital for maintaining the token's value and stabilizing the entire game economy.

What is the significance of the ERC-1155 standard compared to ERC-721 in TCGs?

ERC-721 ensures every asset is unique (true NFT), ideal for rare, one-of-a-kind cards. ERC-1155, or Multi Token Standard, allows for both unique and semi-fungible assets (e.g., multiple identical common cards or packs). ERC-1155 is highly significant for TCGs as it optimizes efficiency by enabling batch transactions and lowering the cost of minting large volumes of common or repeatable in-game assets.

Do traditional gaming giants view NFT TCGs as a threat or an opportunity?

Traditional gaming giants increasingly view NFT TCGs as a significant opportunity for revenue diversification and enhancing player engagement. Major entities like Square Enix and Konami have actively explored or launched blockchain initiatives, recognizing the potential for new monetization streams through digital ownership and the attraction of the P2E demographic, signaling a strategic shift toward Web3 integration.

What are the typical entry barriers for new players entering the NFT TCG market?

Typical entry barriers include the initial financial cost of acquiring starter NFT cards or packs, the technical complexity of setting up and securing a crypto wallet (private key management), and the high learning curve associated with understanding blockchain concepts, decentralized finance, and the specific tokenomics of each game.

How are environmental concerns addressed by current NFT TCG developers?

Developers primarily address environmental concerns by utilizing blockchains that operate on Proof-of-Stake (PoS) consensus mechanisms (e.g., Solana, Polygon, most Ethereum L2s) instead of energy-intensive Proof-of-Work (PoW) chains. This shift minimizes the carbon footprint associated with minting and transacting NFTs, aligning projects with broader corporate social responsibility goals and appealing to environmentally conscious consumers.

In what ways do governance tokens add value to NFT card ownership?

Governance tokens add value by granting card owners voting rights in the game's Decentralized Autonomous Organization (DAO). This means the asset owner can directly influence the game's future direction, economic policies, and development priorities. This stake in governance transforms players from mere consumers into genuine stakeholders, aligning their long-term success with that of the game.

What is the risk associated with relying on single-token economies in P2E TCGs?

Relying on a single utility token creates a high risk of hyperinflation, often termed the 'death spiral.' As player numbers increase, the supply of the single reward token inflates rapidly, causing its value to plummet, devaluing player effort and leading to an exodus of both players and investors. Multi-token systems (separating governance from utility tokens) are the preferred model for mitigating this risk.

How does the resale royalty mechanism function in NFT TCG secondary markets?

The resale royalty is programmed directly into the NFT's smart contract. Every time the NFT card is sold on a secondary marketplace, a small, fixed percentage of the transaction value is automatically and immutably sent back to the original creator or game publisher. This mechanism ensures ongoing revenue for developers, incentivizing long-term support and further game development.

What is the typical lifecycle of an NFT card from minting to the secondary market?

The lifecycle begins with the developer minting the card on the chosen blockchain, often releasing it in an Initial NFT Offering (INO) or pack sale. The card then enters primary ownership. Players can utilize it in gameplay to earn rewards. Finally, the card is listed on a secondary marketplace where its price is determined by player demand, rarity, and utility, leading to trading between collectors and players.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager