Niacin and Niacinamide Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440475 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Niacin and Niacinamide Market Size

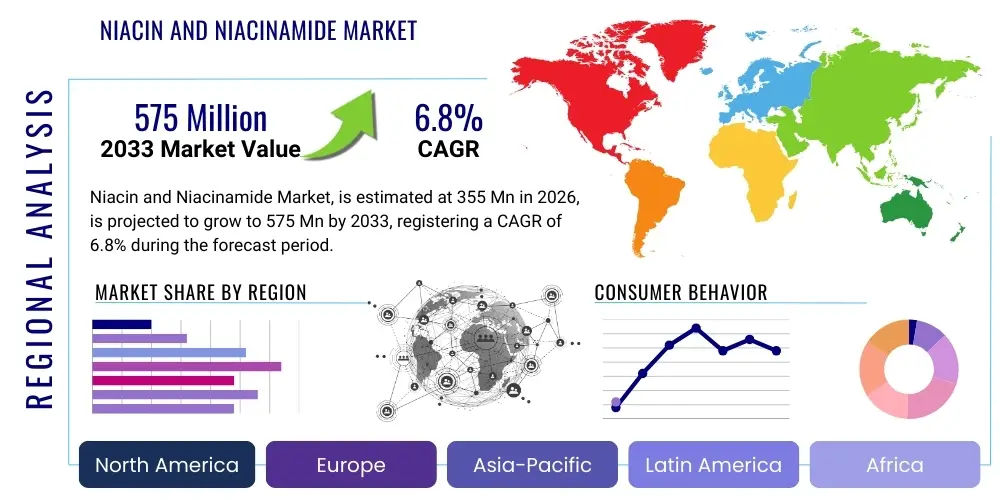

The Niacin and Niacinamide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 355 Million in 2026 and is projected to reach USD 575 Million by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing global health consciousness, the rising prevalence of chronic diseases such as cardiovascular issues and metabolic disorders, and the growing demand for functional food and dietary supplements across various demographics. Consumers are increasingly proactive about health management, leading to a higher adoption rate of essential vitamins for preventative care and overall well-being.

Furthermore, the versatile applications of niacin and niacinamide significantly contribute to this market growth. These compounds are indispensable in pharmaceuticals for their lipid-modulating effects, particularly in lowering LDL cholesterol and triglycerides, and in treating conditions like pellagra. They are critical components in the animal feed industry, enhancing the health and productivity of livestock, which directly correlates with global protein demand from an expanding human population. The burgeoning cosmetics and personal care sector also presents a substantial growth avenue, with niacinamide being a star ingredient in anti-aging, skin brightening, and barrier-repair formulations due to its proven dermatological benefits. This multi-faceted utility ensures sustained demand and a broad market reach for both forms of Vitamin B3 across diverse industrial segments.

The market's trajectory is also bolstered by continuous research and development efforts aimed at uncovering new therapeutic benefits and optimizing delivery systems. Innovations in sustained-release formulations and improved bioavailability are actively addressing past limitations and enhancing consumer acceptance, particularly by mitigating the "niacin flush" side effect. Government initiatives promoting nutritional fortification in food products, especially in developing regions where micronutrient deficiencies are prevalent, further fuel consumption and expand market penetration. The synergistic interplay of these factors solidifies the market's strong position and forecasts a consistent upward trend throughout the projection period, establishing niacin and niacinamide as foundational elements in both health and industrial sectors alike.

Niacin and Niacinamide Market introduction

Niacin, scientifically known as nicotinic acid, and its amide derivative, niacinamide (also referred to as nicotinamide), represent the two primary forms of Vitamin B3. These water-soluble vitamins are indispensable coenzymes in over 400 enzymatic reactions, playing pivotal roles in cellular metabolism, DNA repair processes, and the synthesis of fatty acids and cholesterol. Their fundamental importance in supporting overall physiological function in both humans and animals underpins their widespread application. The global market for these essential compounds encompasses their entire lifecycle, from advanced chemical synthesis and purification to diverse applications in consumer and industrial products, making them critical ingredients in the health and nutrition landscape. The market's evolution is closely tied to advancements in biochemical understanding and increasing global awareness of nutritional health, driving continuous innovation and expanding utility.

The applications for niacin and niacinamide are remarkably broad and impactful, spanning several key industries. In the pharmaceutical sector, niacin is widely prescribed for its ability to significantly lower low-density lipoprotein (LDL) cholesterol and triglyceride levels, while simultaneously raising high-density lipoprotein (HDL) cholesterol, thereby offering crucial benefits in cardiovascular health management. Niacinamide is utilized in dermatology for its anti-inflammatory and skin-barrier enhancing properties, making it a staple in numerous cosmetic and personal care products for treating conditions like acne, rosacea, and hyperpigmentation. Beyond human health, both forms are integral to the animal feed industry, where they bolster livestock health, improve growth rates, and enhance feed conversion efficiency, contributing to sustainable animal agriculture and global food security. Furthermore, as essential micronutrients, they are extensively used in food and beverage fortification programs globally to combat nutrient deficiencies and improve public health outcomes, making a tangible difference in nutritional security across various populations.

Several robust factors are collectively driving the substantial growth of the Niacin and Niacinamide market. A primary driver is the accelerating global trend towards preventative healthcare and heightened health consciousness among consumers, leading to increased demand for dietary supplements and functional foods. The demographic shift towards an aging global population, coupled with the rising prevalence of lifestyle-related chronic diseases, further fuels the need for effective nutritional interventions. Continuous innovation in the pharmaceutical sector, exploring new therapeutic targets for niacin and niacinamide, alongside the burgeoning demand from the cosmetics industry for efficacious ingredients, significantly contributes to market expansion. Moreover, supportive regulatory environments in many regions, emphasizing food safety and nutritional guidelines, coupled with rising disposable incomes in emerging markets, create a fertile ground for sustained market development. These multifaceted drivers highlight the enduring value and critical role of these vitamins in modern society and their adaptability to evolving consumer and industry needs.

Niacin and Niacinamide Market Executive Summary

The Niacin and Niacinamide Market is currently undergoing a period of dynamic transformation, characterized by significant business trends that underscore its strategic importance. Leading manufacturers are intensely focused on product differentiation through advanced research and development, particularly in creating innovative delivery systems like microencapsulated and sustained-release formulations. These innovations are designed to enhance bioavailability, minimize side effects such as the common "niacin flush," and improve consumer compliance. Furthermore, strategic alliances, collaborations, and mergers and acquisitions are becoming increasingly prevalent as companies seek to consolidate market share, expand their geographical footprint, and integrate vertical capabilities across the value chain, from raw material sourcing to specialized finished products. The emphasis on sustainable and green manufacturing processes is also gaining traction, driven by both regulatory pressures and growing corporate social responsibility initiatives, influencing investment decisions and operational strategies across the industry, aiming for long-term competitiveness.

Regional dynamics play a crucial role in shaping the market landscape. Asia Pacific continues its trajectory as the undeniable powerhouse, not only serving as the primary global manufacturing hub due to cost efficiencies and robust chemical industrial infrastructure but also emerging as the largest and fastest-growing consumption market. This growth is propelled by an expanding middle class, increasing disposable incomes, and heightened health awareness across its populous nations. In contrast, North America and Europe represent mature markets, characterized by sophisticated consumer demand for high-purity, premium-grade ingredients predominantly for pharmaceutical applications and advanced dietary supplements. These regions boast stringent regulatory frameworks and a strong inclination towards evidence-based health solutions, driving innovation in product efficacy and safety. The Middle East & Africa and Latin America are poised for significant future growth, albeit from a smaller base, as healthcare infrastructure improves and nutritional awareness permeates these developing economies, creating new avenues for market penetration and expansion in the coming years.

An in-depth analysis of market segments reveals distinct growth patterns and strategic priorities. The dietary supplements segment is anticipated to exhibit the most rapid growth, fueled by the accelerating trend of self-care and preventative health measures among a globally aging population. Niacinamide's versatility and skin benefits are driving substantial expansion within the cosmetics and personal care industry, marking it as a high-growth niche with significant product development. The animal feed sector remains a foundational and stable segment, with consistent demand driven by global protein consumption and the need for efficient livestock management. While the pharmaceutical segment is mature, ongoing clinical research into novel therapeutic applications, such as for neurological disorders and metabolic syndromes, ensures a steady demand for high-purity niacin and niacinamide, emphasizing the market's adaptability and diverse revenue streams. The interplay of these trends necessitates a nuanced and adaptive approach for market participants aiming for sustained success.

AI Impact Analysis on Niacin and Niacinamide Market

Users frequently express considerable curiosity regarding the transformative potential of Artificial Intelligence (AI) across the Niacin and Niacinamide market. Common inquiries center on how AI can accelerate complex research and development cycles, particularly in discovering novel therapeutic applications or optimizing existing formulations to improve bioavailability and reduce side effects. There is also significant interest in AI's capability to enhance supply chain resilience and efficiency through predictive analytics, anticipating raw material fluctuations and demand shifts. Furthermore, the advent of personalized nutrition, enabled by AI algorithms that can recommend precise niacin or niacinamide dosages based on individual genetic profiles and lifestyle data, represents a key theme of user expectation. The overarching sentiment points towards AI as a powerful tool for precision, efficiency, and innovation, promising a new era of product development and market operation.

However, alongside these positive expectations, users also raise pertinent concerns about the broader implications of AI adoption. Ethical considerations surrounding data privacy and the security of sensitive health information collected for personalized nutrition recommendations are paramount. The potential for a widening gap between large corporations with substantial AI investment capabilities and smaller manufacturers who might struggle to access or implement such advanced technologies is another concern, raising questions about market equity. Additionally, there are questions regarding the potential for AI-driven automation to lead to job displacement in traditional manufacturing, quality control, and distribution roles, prompting a discussion on workforce reskilling and adaptation. These concerns underscore the need for responsible and equitable integration of AI technologies within the market, ensuring broad benefits without exacerbating existing disparities.

- AI-powered predictive modeling for optimizing chemical synthesis pathways, reducing waste, and improving reaction yields in niacin and niacinamide production.

- Development of advanced algorithms for early detection of impurities and contaminants, ensuring higher product purity and compliance with pharmaceutical standards.

- Personalized nutrition platforms leveraging AI to analyze individual health data, genetic predispositions, and dietary habits to recommend optimal dosages and forms of Vitamin B3.

- AI-driven demand forecasting and inventory management systems to minimize stockouts and overstocking, enhancing supply chain resilience and reducing operational costs.

- Robotics and automation integration in manufacturing facilities for precise dosing, mixing, and packaging, leading to increased efficiency, consistency, and reduced human error.

- Accelerated discovery of novel therapeutic targets and applications for niacin and niacinamide through machine learning analysis of vast biological and clinical datasets.

- Smart packaging solutions utilizing AI to monitor product degradation, optimize storage conditions, and provide real-time information to consumers regarding freshness and potency.

- AI-enhanced quality control systems for real-time, non-destructive testing, improving product quality assurance and compliance with industry regulations.

- Optimization of marketing and sales strategies through AI-driven consumer behavior analysis, enabling targeted product promotions and market segment identification.

- Virtual clinical trials and simulations powered by AI to evaluate the efficacy and safety of new niacin and niacinamide formulations, expediting market entry.

DRO & Impact Forces Of Niacin and Niacinamide Market

The Niacin and Niacinamide market is propelled by a confluence of robust drivers, reflecting heightened global awareness of health and nutrition. A significant driver is the escalating consumer demand for dietary supplements and functional foods, fueled by a growing understanding of preventative healthcare and the desire for enhanced wellness. The increasing prevalence of lifestyle-related chronic diseases, such as cardiovascular issues, diabetes, and certain neurological conditions, further stimulates the demand for therapeutic and supplementary forms of Vitamin B3. Moreover, the critical role of niacin and niacinamide in supporting optimal health and productivity within the vast animal feed industry—essential for livestock growth and disease prevention—provides a stable and substantial demand base. The burgeoning use of niacinamide in the lucrative cosmetics and personal care sector, owing to its proven benefits for skin health and anti-aging properties, introduces a dynamic new growth avenue, expanding the market's traditional revenue streams significantly. These diverse demand-side factors are foundational for the market's projected sustained expansion and underscore its multifaceted value.

Despite these powerful drivers, the market faces several notable restraints that could temper its growth trajectory. The inherent volatility in the prices of key raw materials, particularly precursors like 3-cyanopyridine, poses a significant challenge, directly impacting manufacturing costs and profit margins for producers. Stringent and evolving regulatory frameworks, especially those governing pharmaceutical and food-grade applications across different geographies, necessitate substantial investment in compliance and can prolong product development and market entry timelines. Furthermore, the market is subject to competition from a wide array of alternative vitamins and dietary supplements, which can divert consumer interest. A persistent public misconception regarding the "niacin flush"—a harmless yet uncomfortable side effect associated with high doses of nicotinic acid—continues to present an educational barrier, potentially hindering wider acceptance among uninformed consumers, thereby requiring concerted efforts in consumer education and product formulation to mitigate these effects and ensure broader market appeal.

Notwithstanding the restraints, significant opportunities abound for stakeholders within the Niacin and Niacinamide market. Rapidly growing economies in the Asia Pacific and Latin American regions offer vast, untapped consumer bases with increasing disposable incomes and improving healthcare infrastructure, presenting fertile grounds for market expansion and new product penetration. Innovations in delivery technologies, such as sustained-release formulations, microencapsulation, and advanced coating techniques, promise to enhance product efficacy, improve bioavailability, and reduce undesirable side effects, thereby boosting consumer acceptance and adherence. Moreover, ongoing, intensive research into novel therapeutic applications for both niacin and niacinamide, particularly in areas like metabolic syndrome, neurodegenerative diseases, and inflammatory conditions, is expected to unlock entirely new market segments and medical indications. The burgeoning trend of personalized nutrition and nutrigenomics also creates bespoke opportunities for tailored vitamin solutions, allowing for more precise and effective health interventions, which represents a significant long-term growth catalyst for the industry.

Segmentation Analysis

The Niacin and Niacinamide market is meticulously segmented to provide a comprehensive and granular understanding of its intricate structure, allowing for a detailed examination of diverse market components and their individual growth trajectories. This methodical breakdown is essential for identifying key trends, assessing competitive landscapes, and pinpointing areas of strategic investment and operational focus for market participants. The market's structure reflects the multifaceted utility of these essential vitamins, catering to distinct requirements across various industries, from high-purity pharmaceutical applications to large-volume animal feed formulations, thereby underscoring their broad economic significance and adaptability in meeting varied market demands. Such an analytical approach enables stakeholders to develop targeted strategies for product development, market entry, and supply chain optimization.

Each segment is influenced by unique drivers and challenges, necessitating tailored approaches for success. For instance, the 'By Type' segment differentiates between niacin (nicotinic acid) and niacinamide (nicotinamide), acknowledging their distinct biochemical properties and primary applications—niacin for lipid modulation and niacinamide for broader metabolic support and dermatological uses. The 'By Application' segment categorizes the market based on its end-use industries, highlighting the critical demand from sectors such as pharmaceuticals, dietary supplements, food & beverage fortification, animal feed, and cosmetics & personal care. This allows for an understanding of which industries are experiencing the most robust growth and which require specialized product formulations and regulatory compliance. The 'By Form' segment, encompassing powder, liquid, and granular forms, addresses the varying preferences and manufacturing requirements of different end-user industries, offering flexibility in product integration and delivery while optimizing cost-effectiveness and stability.

- By Type: This segment distinguishes between the two primary forms of Vitamin B3 based on their chemical structure and specific biological effects.

- Niacin (Nicotinic Acid): Primarily recognized for its role in cholesterol management, including lowering LDL and raising HDL, and as a treatment for pellagra. It is often associated with the temporary "niacin flush" side effect. Demand is particularly strong in pharmaceutical formulations.

- Niacinamide (Nicotinamide): Widely utilized in dietary supplements for general B3 benefits without the flushing effect, and extensively in cosmetics for its anti-inflammatory, skin barrier repair, and anti-aging properties, making it highly versatile.

- By Application: This segmentation focuses on the key industries and end-uses that drive the consumption of niacin and niacinamide, showcasing their versatile utility across diverse sectors.

- Pharmaceuticals: For lipid-lowering therapies, treatment of pellagra, and potential use in other metabolic disorders and neurological conditions, requiring exceptionally high-purity grades and strict regulatory compliance.

- Dietary Supplements: Incorporated into multivitamins, B-complex supplements, and standalone formulations to support energy metabolism, nervous system function, cellular repair, and overall wellness for health-conscious consumers.

- Food & Beverage Fortification: Added to cereals, flours, bread, dairy products, and various beverages to enhance nutritional content, combat micronutrient deficiencies, and meet public health objectives in many countries.

- Animal Feed: Essential for livestock and poultry to improve growth rates, feed conversion efficiency, disease resistance, and overall animal health, playing a critical role in the global meat and dairy industries.

- Cosmetics & Personal Care: Niacinamide is a popular ingredient in serums, creams, and lotions for its benefits in anti-aging, acne treatment, hyperpigmentation reduction, pore minimization, and skin barrier improvement.

- Others (e.g., Agrochemicals): Includes niche applications in specialized industrial processes and certain agricultural formulations, demonstrating the broader chemical utility.

- By Form: This category differentiates the market based on the physical state in which niacin and niacinamide are supplied, catering to diverse manufacturing and formulation requirements of end-user industries.

- Powder: The most common and versatile form, preferred for its ease of handling, storage stability, and precise dosing in various solid formulations, particularly for supplements, feed, and tablets.

- Liquid: Utilized in certain beverage fortifications, liquid supplements, and specific industrial applications where high solubility and ease of homogeneous mixing are paramount.

- Granular: Offers improved flowability and reduced dust during handling and processing, making it particularly suitable for tablet compression in pharmaceuticals and certain large-scale feed mixes.

Value Chain Analysis For Niacin and Niacinamide Market

The value chain for the Niacin and Niacinamide market is a complex, multi-stage process that systematically transforms basic raw materials into highly specialized end-products, eventually reaching diverse consumer and industrial applications. This intricate chain begins with the critical upstream segment, which involves the meticulous sourcing and processing of fundamental chemical precursors. Key raw materials include pyridine, 3-cyanopyridine, and various essential catalysts, all of which are subject to global commodity market dynamics and supply chain vulnerabilities. The quality, purity, and consistent availability of these initial inputs are paramount, directly influencing the overall cost-effectiveness, purity, and regulatory compliance of the final niacin and niacinamide products. Strategic relationships with reliable raw material suppliers are therefore crucial for manufacturers to ensure operational stability, mitigate supply risks, and maintain competitive pricing in the market.

Moving downstream, the core of the value chain is the manufacturing segment, where sophisticated chemical synthesis or biotechnological fermentation processes are employed to produce niacin and niacinamide in various grades, tailored for specific applications such as pharmaceutical, food, feed, or cosmetic. This stage demands significant capital investment in advanced production facilities, sophisticated purification technologies like crystallization, chromatography, and membrane filtration, and robust quality control systems to meet stringent global regulatory standards (e.g., GMP, FSSC). Manufacturers continuously invest in research and development to optimize synthesis pathways, enhance yields, reduce production costs, and minimize environmental impact through the adoption of green chemistry principles. The competitive landscape in this segment is characterized by a drive for efficiency, innovation in processing technology, and the ability to consistently deliver high-purity, safe products to a discerning global clientele, ensuring compliance with diverse industry requirements.

The distribution segment acts as the crucial link connecting manufacturers to end-users, encompassing a multifaceted network of channels. These include direct sales to large-scale pharmaceutical companies, food manufacturers, or animal feed producers who require bulk quantities and specialized delivery. Alongside, a robust indirect distribution network involves wholesalers, specialized ingredient distributors, and brokers who serve smaller-scale manufacturers, regional markets, and facilitate broader market penetration. The advent of e-commerce platforms has also created new avenues for distribution, particularly for B2B ingredient sales and for direct-to-consumer sales in the dietary supplement and cosmetic sectors, enhancing market accessibility. Effective logistics, warehousing, and transportation management are vital in this stage to ensure timely delivery, maintain product integrity, and manage inventory efficiently. Finally, the value chain culminates with the end-users, which comprise pharmaceutical companies, nutraceutical manufacturers, food and beverage producers, animal feed formulators, and cosmetic brands. Their varied demands for specific grades, forms, and quantities of niacin and niacinamide dictate the entire flow and specialization within the value chain, constantly driving innovation and adaptation from upstream suppliers to downstream distributors and retailers.

Niacin and Niacinamide Market Potential Customers

The Niacin and Niacinamide market caters to an exceptionally diverse and extensive array of potential customers, reflecting the broad and fundamental utility of these essential vitamins across a multitude of industrial sectors. These end-users are driven by a complex interplay of factors, including specific functional requirements for their product formulations, stringent regulatory compliance mandates, evolving consumer demand for health-enhancing and performance-improving products, and the continuous pursuit of ingredient efficacy and safety. A comprehensive understanding of the distinct needs, operational scales, and purchasing behaviors of each customer segment is absolutely vital for niacin and niacinamide manufacturers. This detailed insight enables them to strategically tailor their product offerings, develop targeted marketing campaigns, and optimize their supply chain solutions to effectively meet varied market demands, thereby solidifying their position within this dynamic market landscape and ensuring sustained growth and competitive advantage.

Within the pharmaceutical industry, large-scale pharmaceutical companies represent a primary customer segment, relying on pharmaceutical-grade niacin for its proven efficacy in lipid-lowering therapies and the treatment of pellagra. These customers demand the highest purity, strict adherence to pharmacopoeial standards, and comprehensive regulatory documentation to ensure product safety and therapeutic effectiveness. Similarly, nutraceutical and dietary supplement manufacturers form a substantial customer base, incorporating both niacin and niacinamide into a wide range of products, from daily multivitamins and B-complex supplements to specialized formulations targeting specific health benefits such as energy metabolism, digestive health, or mood regulation. This segment is particularly sensitive to consumer trends and requires innovative, bioavailable, and often clean-label forms of the vitamins. Moreover, food and beverage manufacturers are critical customers, utilizing niacin and niacinamide for food fortification programs aimed at enhancing the nutritional value of staples like flours, cereals, milk, and various beverages, playing a crucial role in public health initiatives globally and meeting mandatory fortification requirements in many regions to address micronutrient deficiencies.

Beyond human consumption, the animal feed industry constitutes another significant and consistently growing customer segment. Livestock and aquaculture producers are major buyers, integrating niacin and niacinamide into feed formulations for poultry, swine, cattle, and fish to improve animal health, growth rates, feed conversion efficiency, and stress resistance, which directly impacts the profitability and sustainability of animal agriculture. This sector requires feed-grade products that are stable, cost-effective, and meet specific animal nutritional requirements based on species and life stage. The burgeoning cosmetics and personal care industry has also emerged as a high-growth customer segment, with cosmetic formulators actively seeking niacinamide for its scientifically validated benefits in skin health, including reducing hyperpigmentation, improving skin barrier function, minimizing pores, and providing anti-aging effects in a variety of topical products. Lastly, contract manufacturing organizations (CMOs) and contract development and manufacturing organizations (CDMOs) serve as vital indirect customers. These organizations specialize in producing finished goods for various brands across all the aforementioned end-user industries, acting as crucial intermediaries that amplify the demand for high-quality niacin and niacinamide raw materials, thereby broadening the market's reach and complexity and supporting diverse product launches.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 355 Million |

| Market Forecast in 2033 | USD 575 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lonza Group, DSM, Jubilant Life Sciences, Zhejiang NHU Co. Ltd., Vertellus Specialties Inc., Brothers Pharmaceutical Co. Ltd., Lasons India, Tianjin Tianyao Pharmaceutical Co. Ltd., Vanetta, Shandong Xinhua Pharmaceutical Co. Ltd., Ningbo Tianmu Global Chemical Co. Ltd., Bluebonnet Nutrition, NOW Foods, The Nature's Bounty Co., Archer Daniels Midland (ADM), BASF SE, Hebei Jucheng Biotechnology Co. Ltd., Brother Enterprises Holding Co. Ltd., Resonance Specialties, Spectrum Chemical Mfg. Corp. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Niacin and Niacinamide Market Key Technology Landscape

The technological landscape of the Niacin and Niacinamide market is characterized by relentless innovation aimed at optimizing every stage of the product lifecycle, from initial synthesis to final delivery. At the core are the manufacturing processes, primarily relying on advanced chemical synthesis routes starting from precursors like 3-cyanopyridine or pyridine, coupled with sophisticated catalytic systems. Recent advancements in green chemistry principles, including the use of environmentally benign solvents, renewable feedstocks, and energy-efficient reaction conditions, are becoming increasingly prevalent. These innovations not only reduce the ecological footprint but also enhance the economic viability of production by improving yield, minimizing waste, and reducing energy consumption. Furthermore, continuous process technologies, such as flow chemistry, are being explored to move away from traditional batch processing, promising higher throughput, better consistency, and increased safety in large-scale vitamin production.

Beyond synthesis, significant technological efforts are channeled into enhancing product purity, stability, and bioavailability. Advanced purification and isolation techniques are paramount to achieve the ultra-high-grade niacin and niacinamide required for pharmaceutical and specialized nutraceutical applications. These include state-of-the-art crystallization methods, multi-stage chromatographic separation (like HPLC prep systems), and sophisticated membrane filtration processes designed to remove trace impurities and isomers effectively. A major area of technological focus is the development of novel delivery systems. This encompasses microencapsulation technologies to protect the active ingredients from degradation and provide controlled release, sustained-release formulations to mitigate side effects like the "niacin flush" and improve patient adherence, and advanced coating techniques for masking taste or enhancing stability in complex food matrices. These formulation innovations are critical for differentiating products, expanding application possibilities, and improving consumer experience across various end-user segments.

Moreover, the integration of cutting-edge analytical technologies is fundamental for ensuring robust quality control and regulatory compliance throughout the entire production chain. High-performance liquid chromatography (HPLC), gas chromatography (GC), mass spectrometry (MS), and nuclear magnetic resonance (NMR) spectroscopy are routinely employed for precise identification, quantification of active ingredients, and detection of potential impurities down to trace levels. The adoption of Process Analytical Technology (PAT) tools, such as in-line and at-line spectroscopy (e.g., Near-Infrared, Raman), allows for real-time monitoring and control of critical process parameters, ensuring consistent product quality and reducing the need for extensive post-production testing. Automation and robotics are also increasingly being implemented in manufacturing and packaging to enhance efficiency, minimize human error, and ensure sterile conditions, especially for pharmaceutical-grade products. These comprehensive technological advancements collectively drive product innovation, enhance operational excellence, and maintain the competitive edge of market players in a rapidly evolving global market, meeting ever-higher standards of safety and efficacy.

Regional Highlights

- North America: This region consistently represents a mature yet highly dynamic market for niacin and niacinamide, characterized by significant consumption driven by a well-established and innovation-intensive dietary supplements industry. The United States and Canada lead in the adoption of fortified foods and functional beverages, supported by high consumer awareness regarding preventative health and wellness trends, alongside a robust healthcare infrastructure. The pharmaceutical sector also contributes substantially, with ongoing research and development into niacin's lipid-modifying properties and new therapeutic applications. Stringent regulatory frameworks and a strong preference for clinically backed ingredients further shape this market, driving demand for high-purity, traceable products. The expanding personalized nutrition market also offers new growth avenues for tailored Vitamin B3 solutions, leveraging advanced data analytics.

- Europe: The European market for niacin and niacinamide is distinguished by its strong emphasis on quality, sustainability, and adherence to rigorous regulatory standards set by bodies like the European Food Safety Authority (EFSA). Key markets such as Germany, France, and the UK exhibit robust demand across the functional food, nutraceutical, and pharmaceutical sectors, with a growing consumer inclination towards natural and clean-label ingredients, influencing product formulations. Niacinamide's versatility in the rapidly expanding cosmetics and personal care industry is a notable growth driver, with consumers increasingly seeking science-backed ingredients for skin health and anti-aging benefits. Innovation in manufacturing processes to meet environmental standards and consumer expectations for ethical sourcing also plays a critical role in shaping market dynamics and investment strategies in this region.

- Asia Pacific (APAC): APAC stands out as the most vibrant and rapidly expanding region in the Niacin and Niacinamide market, serving as both the leading global production hub and the largest consumer market. Countries like China and India dominate manufacturing, leveraging cost-effective production capabilities and a robust chemical industry infrastructure. The region's immense population, coupled with rapidly rising disposable incomes, improving healthcare access, and a burgeoning middle class, fuels substantial demand for dietary supplements, fortified food and beverages, and particularly for animal feed due to the expanding livestock industry. Japan and South Korea also contribute significantly, especially in high-value segments such as advanced nutraceuticals and premium cosmetic formulations, demonstrating the region's diverse market landscape and its critical role as the primary engine of global market growth and innovation.

- Latin America: This region is emerging as a promising growth market for niacin and niacinamide, driven by increasing health consciousness, improving economic conditions, and the expansion of its animal agriculture sector. Brazil and Mexico are at the forefront of this growth, experiencing rising consumer spending on health and wellness products, alongside a greater demand for fortified food items to combat nutritional deficiencies. Government initiatives aimed at enhancing public health and nutrition, coupled with foreign investments in the regional pharmaceutical and food processing industries, are contributing to a steady increase in the adoption of essential vitamins. The development of local manufacturing capabilities and distribution networks is also fostering market maturity in the region, indicating significant future potential for market participants.

- Middle East and Africa (MEA): The MEA region represents a developing market for niacin and niacinamide, with significant growth potential, albeit from a relatively smaller base. Countries like Saudi Arabia, the UAE, and South Africa are experiencing increasing demand, primarily influenced by growing investments in healthcare infrastructure, the expansion of the pharmaceutical and nutraceutical sectors, and a strong emphasis on improving animal health and productivity in the livestock industry. The market is currently largely reliant on imports to meet its demands. However, rising health awareness, government support for public health programs, and increasing disposable incomes are expected to drive substantial market development and localized production capabilities in the forecast period, making it a region to watch for future investment opportunities as economic diversification progresses.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Niacin and Niacinamide Market.- Lonza Group

- DSM

- Jubilant Life Sciences

- Zhejiang NHU Co. Ltd.

- Vertellus Specialties Inc.

- Brothers Pharmaceutical Co. Ltd.

- Lasons India

- Tianjin Tianyao Pharmaceutical Co. Ltd.

- Vanetta

- Shandong Xinhua Pharmaceutical Co. Ltd.

- Ningbo Tianmu Global Chemical Co. Ltd.

- Bluebonnet Nutrition

- NOW Foods

- The Nature's Bounty Co.

- Archer Daniels Midland (ADM)

- BASF SE

- Hebei Jucheng Biotechnology Co. Ltd.

- Brother Enterprises Holding Co. Ltd.

- Resonance Specialties

- Spectrum Chemical Mfg. Corp.

Frequently Asked Questions

What is the primary difference between Niacin and Niacinamide?

Niacin (nicotinic acid) and niacinamide (nicotinamide) are both forms of Vitamin B3, essential for human and animal health. The key difference lies in their chemical structure and biological effects. Niacin can cause a temporary "niacin flush" (redness, itching, tingling) due to its vasodilatory properties, often used to manage cholesterol levels and treat pellagra. Niacinamide, lacking this vasodilatory effect, is primarily used in supplements for general B3 benefits and extensively in topical skincare for its anti-inflammatory and skin barrier-supporting properties, offering broader applications without the common side effect of flushing.

What are the main applications driving the Niacin and Niacinamide market?

The market is predominantly driven by applications in dietary supplements, pharmaceuticals, food and beverage fortification, and animal feed. Dietary supplements leverage their role in energy metabolism and overall wellness, catering to increased health consciousness. Pharmaceuticals utilize niacin for lipid-lowering therapies and pellagra treatment. In food, they fortify various products like cereals and flours to prevent deficiencies, while in animal feed, they enhance livestock growth and health. The cosmetics industry is also a rapidly growing application area for niacinamide due to its dermatological benefits.

Which geographical region holds the largest market share, and why?

Asia Pacific (APAC) currently holds the largest market share and is projected to continue its dominance throughout the forecast period. This is primarily due to the presence of major manufacturing hubs, particularly in China and India, offering cost-effective production capabilities and a robust chemical industry infrastructure. Additionally, the region experiences high consumption driven by a large and growing population, increasing disposable incomes, rising health awareness, and expanding demand from the animal feed and food fortification sectors, making it a pivotal growth engine for the global market.

What are the key factors restraining the growth of this market?

Key restraints include the inherent volatility in raw material prices, particularly for precursors like 3-cyanopyridine, which can significantly impact manufacturing costs and profitability. Stringent regulatory frameworks for pharmaceutical and food-grade products across various regions also pose challenges, requiring extensive compliance and potentially delaying market entry. Furthermore, competition from alternative vitamin forms and dietary supplements, along with consumer misconceptions about the "niacin flush" side effect of nicotinic acid, can limit market acceptance and growth, necessitating targeted consumer education and product development strategies.

How is artificial intelligence (AI) impacting the Niacin and Niacinamide market?

AI is increasingly impacting the market by optimizing production processes, improving supply chain efficiency through predictive analytics for raw material management and demand forecasting, and accelerating research and development for new formulations and applications. AI-driven personalized nutrition platforms can recommend tailored dosages based on individual health data, while advanced analytics assist in market forecasting and identifying emerging trends. This leads to more efficient operations, innovative product development, enhanced quality control, and better-targeted consumer solutions, fostering market evolution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager