Nickel Alloy Welding Consumables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433984 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Nickel Alloy Welding Consumables Market Size

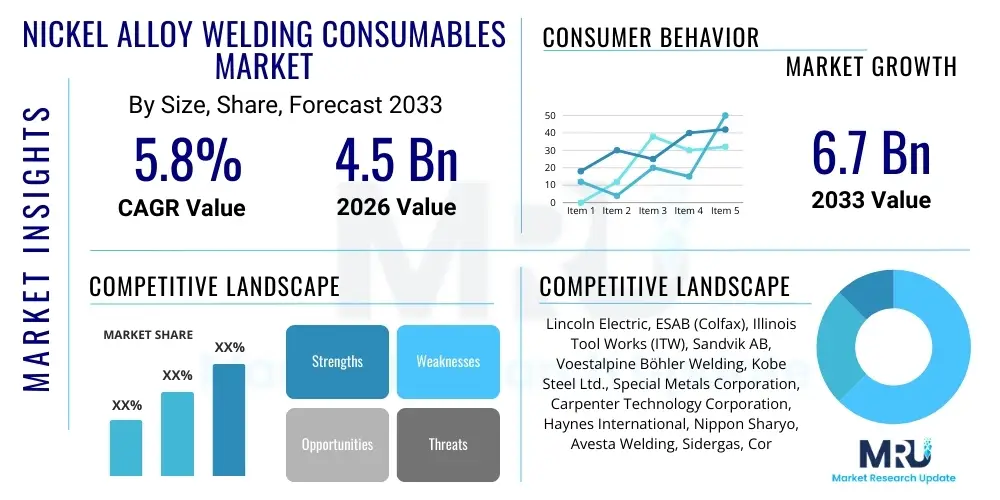

The Nickel Alloy Welding Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Nickel Alloy Welding Consumables Market introduction

The Nickel Alloy Welding Consumables Market encompasses a specialized range of filler metals, electrodes, and fluxes designed specifically for joining, cladding, and repairing components made from nickel-based alloys. These consumables are crucial in industries requiring extreme performance, such as high resistance to heat, corrosion, oxidation, and aggressive chemical environments. Nickel alloys, including Inconel, Monel, Hastelloy, and specialized superalloys, are essential materials in critical infrastructure sectors, dictating the need for equally robust welding solutions that maintain the integrity and inherent properties of the base materials.

The primary applications of nickel alloy welding consumables span across highly demanding sectors, including aerospace, chemical and petrochemical processing, power generation (especially nuclear and gas turbines), and marine engineering. Product descriptions often highlight compliance with stringent international standards (e.g., AWS, ASME) and specific mechanical properties like high tensile strength and creep resistance at elevated temperatures. The inherent benefits of these consumables include superior weld quality, reduced susceptibility to cracking, and enhanced longevity of welded joints under operational stress.

Driving factors for this market growth are directly linked to global industrial expansion and the increased necessity for durable infrastructure. Specifically, the rising investment in complex energy projects (liquefied natural gas terminals, advanced nuclear reactors) and the continuous expansion of the aerospace sector, particularly in commercial and military aviation where lightweight, high-performance materials are mandatory, fuel the demand for specialized nickel alloy welding solutions. Furthermore, increasing regulatory focus on material traceability and safety in chemical processing plants mandates the use of premium, certified consumables, ensuring sustained market impetus.

Nickel Alloy Welding Consumables Market Executive Summary

The Nickel Alloy Welding Consumables Market exhibits robust growth driven primarily by technological advancements in alloy metallurgy and heightened demand from critical end-use industries globally. Business trends indicate a strong move toward high-specification products, emphasizing productivity enhancements and automated welding processes. Key manufacturers are focusing on developing flux-cored arc welding (FCAW) and submerged arc welding (SAW) consumables tailored for nickel alloys, offering improved deposition rates and efficiency, thereby addressing the high labor costs associated with manual welding techniques. Strategic partnerships between consumable manufacturers and major fabrication firms are also defining the competitive landscape, streamlining the supply chain for complex, large-scale projects.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive industrialization, particularly in chemical processing and power generation infrastructure development in China and India. North America and Europe, while mature, maintain strong market shares driven by stringent quality standards in aerospace maintenance, repair, and overhaul (MRO), and significant investments in oil and gas infrastructure modernization, requiring premium, specialized nickel alloy solutions. The Middle East and Africa (MEA) region is also emerging due to substantial investments in petrochemical projects and LNG export facilities, where corrosion resistance is paramount.

Segment trends highlight the dominance of the gas tungsten arc welding (GTAW/TIG) segment in terms of value, favored for its precision and high-quality welds in thin-walled nickel alloy applications, especially in aerospace engine components. However, the shielded metal arc welding (SMAW/Stick) segment continues to hold a significant volume share due to its versatility and lower equipment cost for general repair and maintenance activities. Demand is particularly accelerating for alloys like Alloy 625 and Alloy C-276 due to their exceptional performance in flue gas desulfurization (FGD) systems and demanding chemical reactor environments, underscoring the shift toward consumables optimized for extreme corrosive applications.

AI Impact Analysis on Nickel Alloy Welding Consumables Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Nickel Alloy Welding Consumables Market predominantly center on quality assurance, predictive maintenance of welding equipment, and optimization of welding parameters for complex alloys. Users frequently question how AI can ensure the integrity of critical welds in applications like nuclear reactors or jet engines, which are sensitive to even minute defects. There is also significant interest in AI's role in optimizing filler metal composition design and identifying material defects or inconsistencies prior to the welding process. Overall, the key themes revolve around using AI to enhance precision, reduce material waste, accelerate qualification processes for new welding procedures, and improve overall operational efficiency and safety in environments utilizing expensive nickel alloys.

The adoption of AI and machine learning algorithms is transforming the fabrication segment, indirectly influencing consumable demand and formulation. AI-driven vision systems and sensors are increasingly employed in automated welding cells using nickel alloys to monitor arc stability, bead geometry, and heat input in real-time. This sophisticated monitoring ensures that the weld consistently meets required metallurgical specifications, reducing rework rates, which is especially critical given the high cost of nickel alloy base materials and consumables. Furthermore, predictive modeling powered by AI assists manufacturers in optimizing the formulation of new proprietary nickel-based filler metals, accelerating the research and development lifecycle by simulating performance under various environmental stresses.

In terms of logistics and inventory management, AI algorithms can predict demand fluctuations for specific nickel alloy consumables (e.g., Inconel 718 for aerospace MRO vs. Hastelloy C-276 for chemical processing) based on macro-economic indicators and scheduled industrial project cycles. This leads to more efficient inventory stocking and reduced lead times, enhancing supply chain resilience. While AI does not directly change the chemical composition of the consumables themselves, its role in improving process control and defect detection ensures that every unit of the specialized, high-value nickel alloy consumable is used optimally, increasing the overall value proposition for end-users.

- AI-enhanced Quality Control: Real-time defect detection and analysis in automated welding processes, minimizing expensive rework of nickel alloy joints.

- Predictive Process Optimization: Machine learning algorithms optimize welding parameters (current, voltage, travel speed, heat input) specific to complex nickel alloy microstructures.

- Accelerated R&D: AI simulates performance characteristics of new filler metal compositions, speeding up the development of specialized consumables.

- Supply Chain Forecasting: Predictive modeling improves inventory management and demand forecasting for specific high-value nickel alloy consumables.

- Automated Robotic Welding: AI integration enhances the precision and repeatability of robotic welding systems used for high-integrity nickel alloy applications.

DRO & Impact Forces Of Nickel Alloy Welding Consumables Market

The dynamics of the Nickel Alloy Welding Consumables Market are shaped by a complex interplay of growth drivers, significant constraining factors, and strategic market opportunities, collectively defining the impact forces. Key drivers include the mandatory use of corrosion-resistant materials in critical infrastructure across the chemical, oil and gas, and power generation sectors, coupled with increasing global demand for specialized superalloys in high-thrust aerospace engines. Restraints primarily involve the volatile pricing of raw materials, specifically nickel and other alloying elements (molybdenum, chromium), and the high initial cost and specialized training required for advanced welding techniques necessary for these alloys. Opportunities lie in the shift towards additive manufacturing repair techniques and the development of consumables optimized for automated and robotic welding systems, promising efficiency gains.

The primary driver propelling this market is the continued modernization and expansion of industrial facilities globally, particularly those exposed to harsh operating environments. Nickel alloys are non-negotiable in applications like sour gas pipelines, hydrofluoric acid production units, and high-temperature heat exchangers where failure is catastrophic. This inherent application requirement ensures sustained demand regardless of minor economic fluctuations. Furthermore, stringent safety and environmental regulations in developed economies necessitate the repair and maintenance of existing infrastructure using the highest quality, certified nickel alloy consumables, thereby sustaining the aftermarket segment.

Conversely, the major restraint is the supply chain volatility and associated cost burden. Nickel prices fluctuate significantly based on global mining output and geopolitical events, directly impacting the manufacturing costs of filler metals, which must maintain precise metallurgical compositions. Additionally, the complexity of welding these materials requires highly skilled labor, creating a barrier to widespread adoption in regions lacking specialized technical expertise. These high entry barriers for both manufacturing and application necessitate premium pricing, which sometimes leads end-users to seek alternative materials or repair methods when nickel alloys are not strictly essential.

Strategic opportunities are abundant in technological innovation. Developing advanced metal-cored wires for high-productivity nickel alloy welding processes (like FCAW and SAW) addresses the restraint of high labor costs by significantly increasing deposition rates. Moreover, the growing acceptance of additive manufacturing (AM) for repair of high-value components (e.g., turbine blades) creates demand for specialized, powdered or wire-form nickel alloy consumables suitable for laser or electron beam welding processes. Exploiting these technological niches allows manufacturers to capture high-margin, specialized market segments focused on efficiency and component life extension.

Segmentation Analysis

The Nickel Alloy Welding Consumables Market is extensively segmented based on the product type, welding technique, application, and end-use industry, reflecting the specialized nature of the demand. This detailed segmentation allows manufacturers to tailor products precisely to regulatory requirements and operational demands of specific sectors. Product type classification focuses primarily on the format—such as electrodes, filler wires (solid and cored), and fluxes—each serving distinct welding requirements and efficiency metrics. The welding technique segment highlights the predominance of processes like TIG (GTAW) for precision work, MIG (GMAW) for higher deposition rates, and SMAW for versatility in field repairs.

Further granularity is achieved through application segmentation, differentiating between joining (connecting two base materials), cladding/overlay (adding a protective layer), and repair/MRO (maintenance, repair, and overhaul). The end-use industry segmentation is perhaps the most critical, as it dictates the required alloy type. For example, the aerospace sector demands high-strength, heat-resistant superalloys (Inconel 718/625), whereas the chemical processing industry heavily relies on highly corrosion-resistant alloys (Hastelloy C-276/Monel 400). Understanding these specific industry needs drives R&D efforts and marketing strategies within the market.

- By Product Type:

- Electrodes/Coated Sticks (SMAW)

- Solid Filler Wires (GTAW, GMAW, PAW)

- Flux-Cored Wires (FCAW)

- Submerged Arc Welding (SAW) Fluxes and Wires

- By Welding Technique:

- Shielded Metal Arc Welding (SMAW)

- Gas Tungsten Arc Welding (GTAW/TIG)

- Gas Metal Arc Welding (GMAW/MIG)

- Flux-Cored Arc Welding (FCAW)

- Submerged Arc Welding (SAW)

- By End-Use Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical Processing

- Power Generation (Nuclear, Fossil Fuel, Gas Turbines)

- Aerospace and Defense

- Marine and Shipbuilding

- Other Industries (Pulp & Paper, Pharmaceuticals)

- By Alloy Type:

- Inconel Series Consumables

- Hastelloy Series Consumables

- Monel Series Consumables

- Other High-Performance Nickel Alloys

Value Chain Analysis For Nickel Alloy Welding Consumables Market

The value chain for the Nickel Alloy Welding Consumables Market is characterized by high integration and rigorous quality control, beginning with the extraction and processing of primary raw materials—nickel, chromium, molybdenum, iron, and tungsten. The upstream segment involves major mining and specialty metal refining companies that produce high-purity alloy ingots. Due to the critical performance requirements of nickel alloy welds, the quality and consistency of these raw materials are paramount, making this stage highly specialized and capital-intensive. Manufacturers often maintain long-term supply agreements with certified metal suppliers to ensure material traceability and compositional stability.

The manufacturing stage (midstream) is where the value addition occurs through formulation, extrusion, drawing, and coating processes to transform raw alloy ingots into consumable products (wires, rods, electrodes, fluxes). This stage requires significant metallurgical expertise to ensure the final consumable matches the parent material’s properties while incorporating specific characteristics to handle the welding process (e.g., controlling solidification shrinkage, preventing hot cracking). Quality assurance and certification are intensive at this stage, adhering to standards like ISO 9001 and aerospace-specific certifications.

The downstream segment involves distribution and end-user application. Distribution channels are typically a mix of direct sales to large fabrication yards and major EPC (Engineering, Procurement, and Construction) firms, and indirect distribution through specialized industrial distributors and welding supply houses for smaller job shops and MRO operations. The preference for direct sales to major projects is high due to the need for technical support, application engineering, and specialized inventory management. End-users, such as aerospace component manufacturers and chemical plant builders, constitute the final point in the value chain, where the welding consumables are applied to critical components, underscoring the necessity for flawless product performance and supply reliability.

Nickel Alloy Welding Consumables Market Potential Customers

Potential customers for Nickel Alloy Welding Consumables are predominantly large industrial organizations and specialized fabricators whose core operations depend on equipment exposed to extreme temperature, pressure, or corrosive media. These end-users are not primarily price-sensitive but highly quality-sensitive, prioritizing performance, certification, and long-term reliability. Major buyers include EPC companies executing large-scale infrastructure projects (e.g., LNG facilities, coal-fired power plants transitioning to supercritical technology, or chemical processing units building new reactors). These organizations require bulk quantities of certified consumables for initial construction and fabrication phases.

Another significant customer base includes Original Equipment Manufacturers (OEMs) specializing in critical components, such as manufacturers of gas turbine blades, aircraft engine components, pressure vessels, and specialized heat exchangers. These OEMs integrate welding consumables directly into their assembly lines, often demanding highly customized wire or electrode formulations that meet proprietary specifications. The third major group comprises maintenance, repair, and overhaul (MRO) providers and internal maintenance departments of large refineries or nuclear power plants, which require a steady supply of consumables for routine maintenance, emergency repairs, and lifespan extension projects. Their demand is cyclical and often driven by mandatory inspection schedules and component life limits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lincoln Electric, ESAB (Colfax), Illinois Tool Works (ITW), Sandvik AB, Voestalpine Böhler Welding, Kobe Steel Ltd., Special Metals Corporation, Carpenter Technology Corporation, Haynes International, Nippon Sharyo, Avesta Welding, Sidergas, Corodur, Techalloy, Tianjin Golden Bridge Welding Materials Group, VDM Metals, Polymet Corporation, Jiangsu Wuding Welding Material Co., Ltd., Metrode Products Ltd., Select-Arc, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nickel Alloy Welding Consumables Market Key Technology Landscape

The technological landscape in the Nickel Alloy Welding Consumables Market is centered on enhancing weld integrity, increasing deposition rates, and improving efficiency for high-value applications. A primary focus involves the continuous development of advanced filler metal chemistries. This includes optimizing the ratio of minor alloying elements, such as niobium, titanium, and aluminum, to control solidification cracking and enhance the mechanical properties of the weld metal, particularly the resistance to precipitation hardening and sensitization at high operating temperatures. Manufacturers utilize sophisticated vacuum induction melting (VIM) and electro-slag remelting (ESR) processes during the upstream phase to ensure extremely low levels of impurities (like sulfur and phosphorus) that can compromise weld integrity in critical applications.

Furthermore, technology advancement is highly evident in consumable formats designed for high-productivity mechanized welding. There is a discernible shift towards using metal-cored wires for nickel alloys in GMAW and FCAW processes. These advanced wires incorporate metallic powders within a sheath, allowing for higher current densities, increased deposition rates (often 3 to 4 times faster than solid wires), and reduced fume emission. This technological progression directly addresses the cost constraints associated with manual welding of expensive materials, making automated fabrication more economically viable for nickel alloy users in large-scale vessel construction and shipbuilding.

The market also sees significant innovation in flux formulations, especially for SAW and SMAW consumables. Flux coatings for electrodes and granular fluxes for SAW must be carefully engineered to protect the molten weld pool from atmospheric contamination, manage slag properties for optimal bead shape, and ensure proper arc stabilization while precisely controlling the transfer of minor alloying elements into the weld metal. New flux formulations are being introduced that are low-hydrogen, moisture-resistant, and optimized for specific high-nickel alloy bases (e.g., alloys designed to resist pitting corrosion in chloride environments), ensuring the longevity and certification adherence of critical welded joints.

Regional Highlights

The global demand for nickel alloy welding consumables is geographically diversified, reflecting varying levels of industrial development, regulatory environments, and concentration of specialized end-use sectors like aerospace and chemical processing.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, driven primarily by extensive infrastructure development across China, India, and Southeast Asia. Significant investments in chemical and petrochemical plants, coupled with a growing regional focus on nuclear and advanced thermal power generation, create substantial demand for corrosion and heat-resistant welding materials. The region benefits from a burgeoning shipbuilding industry and a growing domestic MRO sector for aircraft, further fueling the consumption of specialized nickel alloy filler metals.

- North America: This region holds a mature yet highly valuable market share, characterized by stringent quality controls, particularly in the aerospace and military sectors. Demand is consistently high for specialized superalloy consumables (like Inconel 718 and Waspaloy equivalents) used in turbine engine manufacturing and maintenance. Furthermore, the modernization of aging oil and gas infrastructure, particularly processing facilities dealing with highly sour or corrosive fluids, sustains the requirement for premium Hastelloy and Monel consumables.

- Europe: The European market is dominated by the power generation (nuclear decommissioning and maintenance), advanced manufacturing, and high-specification chemical processing industries. Countries like Germany and France are key consumers, driven by rigorous regulatory requirements (e.g., REACH compliance for materials) and a focus on high-efficiency, long-lifespan industrial equipment. The shift towards renewable energy components, such as high-efficiency heat exchangers, also requires advanced nickel alloy welding solutions.

- Middle East and Africa (MEA): MEA is rapidly expanding, fueled by enormous investments in oil and gas upstream and downstream capabilities, including massive refinery and petrochemical expansion projects in Saudi Arabia, UAE, and Qatar. The extremely corrosive nature of the operating environments in this region necessitates the mandatory use of high-performance nickel alloys (e.g., Alloy 825, C-276) for pipelines, storage tanks, and processing equipment, creating a highly specific and high-volume demand for certified consumables.

- Latin America: While smaller than other regions, Latin America exhibits growth tied to energy infrastructure development, particularly offshore oil and gas exploration in Brazil (pre-salt reserves) and general industrial maturation. The market focuses heavily on consumables for repair and localized fabrication, relying substantially on imports of high-grade nickel alloy products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nickel Alloy Welding Consumables Market.- Lincoln Electric

- ESAB (Colfax)

- Illinois Tool Works (ITW)

- Sandvik AB

- Voestalpine Böhler Welding

- Kobe Steel Ltd.

- Special Metals Corporation

- Carpenter Technology Corporation

- Haynes International

- Nippon Sharyo

- Avesta Welding

- Sidergas

- Corodur

- Techalloy

- Tianjin Golden Bridge Welding Materials Group

- VDM Metals

- Polymet Corporation

- Jiangsu Wuding Welding Material Co., Ltd.

- Metrode Products Ltd.

- Select-Arc, Inc.

Frequently Asked Questions

Analyze common user questions about the Nickel Alloy Welding Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the increased demand for high-performance nickel alloy welding consumables?

The primary drivers are the expansion of critical infrastructure in aerospace, chemical processing, and power generation, all of which require materials with exceptional resistance to extreme heat, pressure, and corrosive environments. The global push for plant modernization and adherence to strict safety standards also necessitates certified, high-quality nickel alloy consumables for longevity.

Which nickel alloy consumables are most frequently used in the aerospace industry and why?

The aerospace industry heavily favors consumables based on Inconel 718 and Inconel 625 alloys. Inconel 718 is critical for high-strength, high-temperature applications like jet engine components and fasteners, offering excellent creep and stress-rupture strength. Inconel 625 is used for applications requiring superior corrosion and oxidation resistance, such as exhaust systems and thrust reversers.

How does the volatility of nickel prices affect the market profitability?

Nickel price volatility significantly impacts the manufacturing cost of nickel alloy consumables, as nickel constitutes a substantial portion of the material cost. Manufacturers manage this through hedging, but persistent high volatility often necessitates price adjustments for end-products, potentially constraining volume growth in less critical application sectors.

What are the key technological advancements observed in nickel alloy welding processes?

Key advancements include the development of high-deposition metal-cored wires (FCAW/GMAW) optimized for nickel alloys to improve productivity. Furthermore, AI-driven monitoring systems are increasingly used to ensure precision control over welding parameters, minimizing defects in complex, high-value nickel alloy fabrication projects.

Which region currently dominates the consumption of nickel alloy welding consumables?

The Asia Pacific (APAC) region currently dominates consumption in terms of volume and is the fastest-growing market. This leadership is attributed to massive industrialization efforts, particularly in the construction of new chemical processing facilities, LNG terminals, and general manufacturing expansion across China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager