Nickel Alloy Wires Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439324 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Nickel Alloy Wires Market Size

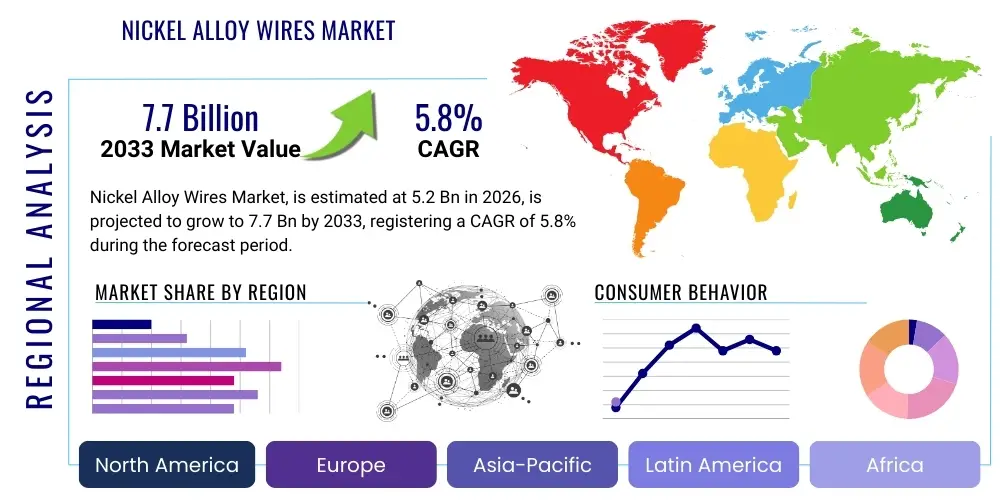

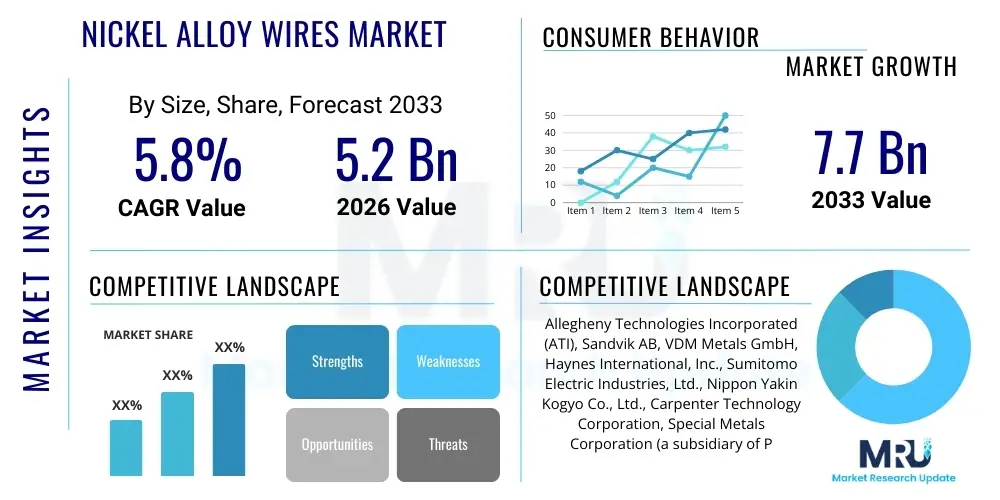

The Nickel Alloy Wires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

Nickel Alloy Wires Market introduction

The Nickel Alloy Wires Market encompasses a wide range of specialized metallic wires manufactured from various nickel-based alloys, renowned for their exceptional properties. These alloys, including but not limited to Inconel, Monel, Hastelloy, Nichrome, and pure nickel, are engineered to withstand extreme conditions, making them indispensable across numerous high-performance industries. Their superior resistance to corrosion, high temperatures, and oxidation, coupled with excellent mechanical strength and ductility, positions them as critical components in demanding applications where conventional materials fail. The versatility of these wires is further enhanced by their availability in diverse forms such as welding wires, spring wires, resistance wires, filler wires, and fine wires, each tailored for specific functional requirements.

Major applications for nickel alloy wires span critical sectors, significantly contributing to the advancement of aerospace, medical devices, chemical processing, oil and gas, electronics, and energy production. In aerospace, they are vital for engine components and structural parts due to their heat resistance and strength-to-weight ratio. The medical industry utilizes them in surgical instruments, implants, and orthodontic applications for their biocompatibility and corrosion resistance. Chemical processing plants rely on them for their resistance to aggressive corrosive media, while electronics benefit from their electrical resistivity in heating elements and resistors. The inherent benefits of these wires, such as their longevity, reliability, and performance under harsh environments, drive their adoption.

The market's growth is primarily driven by the escalating demand from these expanding end-use industries, which increasingly require materials that offer superior performance and durability. Rapid industrialization, particularly in emerging economies, coupled with significant technological advancements in manufacturing processes and alloy development, further fuels market expansion. The continuous pursuit of efficiency and enhanced performance across critical infrastructure and specialized equipment necessitates the use of high-grade materials like nickel alloy wires, thereby securing their integral role in modern industrial applications and driving sustained market growth.

Nickel Alloy Wires Market Executive Summary

The Nickel Alloy Wires Market is experiencing robust growth, propelled by significant business trends such as strategic mergers and acquisitions aimed at consolidating market share and enhancing technological capabilities, alongside substantial investments in research and development to innovate new alloy compositions and manufacturing techniques. Industry players are increasingly focusing on sustainability practices, optimizing production processes to reduce environmental impact and improve resource efficiency, while also exploring new product development tailored for niche high-performance applications. Regionally, the market exhibits dynamic growth patterns, with the Asia Pacific region emerging as a dominant force due to rapid industrialization and burgeoning manufacturing sectors, particularly in China and India, while established markets in North America and Europe continue to show steady demand driven by advanced aerospace, medical, and energy industries. Segment-wise, welding wires maintain a dominant position due to their widespread use in fabrication across heavy industries, concurrently, the medical and aerospace segments are witnessing accelerated growth, driven by stringent performance requirements and continuous technological advancements necessitating high-purity and precision-engineered nickel alloy solutions.

AI Impact Analysis on Nickel Alloy Wires Market

User inquiries regarding the impact of AI on the Nickel Alloy Wires Market frequently revolve around how artificial intelligence can optimize manufacturing processes, enhance material properties, and streamline supply chain management. Common themes include the potential for AI to reduce production costs, improve quality control, and accelerate new alloy development. Users are keen to understand if AI can predict material performance under various conditions, thereby reducing experimental cycles and time-to-market for specialized wires. There's also significant interest in AI's role in predictive maintenance for manufacturing equipment, minimizing downtime, and ensuring consistent product quality, ultimately leading to greater operational efficiency and competitive advantage within the industry.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to revolutionize the Nickel Alloy Wires Market by introducing unprecedented levels of efficiency, precision, and innovation throughout the entire value chain. In manufacturing, AI algorithms can analyze vast datasets from production lines to identify patterns and anomalies, leading to real-time process optimization. This includes fine-tuning parameters for melting, drawing, annealing, and surface treatment, thereby minimizing defects, reducing material waste, and enhancing the consistency and quality of the final product. Predictive analytics, powered by AI, can anticipate equipment failures, enabling proactive maintenance that drastically cuts downtime and operational costs, ensuring uninterrupted production cycles and improving overall throughput for wire manufacturers.

Furthermore, AI plays a pivotal role in accelerating material science research and development within the nickel alloy sector. By leveraging AI-driven simulations and data analysis, researchers can rapidly screen countless alloy compositions and microstructures, predicting their mechanical, thermal, and corrosion resistance properties with high accuracy. This capability significantly shortens the discovery phase for new high-performance nickel alloys tailored for emerging applications, such such as those in electric vehicles or advanced nuclear energy. Beyond R&D and manufacturing, AI also optimizes supply chain logistics by forecasting demand, managing inventory more effectively, and identifying potential disruptions, ensuring a more resilient and responsive supply of critical raw materials and finished wires to global markets.

- AI-driven optimization of manufacturing parameters for enhanced wire quality and reduced defects.

- Predictive maintenance programs for production equipment, minimizing downtime and increasing operational efficiency.

- Accelerated material discovery and alloy design through AI-powered simulations and data analysis.

- Improved supply chain management and demand forecasting using machine learning algorithms.

- Enhanced quality control and inspection processes through computer vision and AI analytics.

- Development of smart materials with self-optimizing properties.

- Data-driven insights for strategic decision-making and market trend analysis.

- Automation of repetitive tasks, freeing up human resources for complex problem-solving.

DRO & Impact Forces Of Nickel Alloy Wires Market

The Nickel Alloy Wires Market is significantly influenced by a complex interplay of drivers, restraints, opportunities, and various impact forces that shape its trajectory. Key drivers include the escalating demand from critical end-use industries such as aerospace, medical, and chemical processing, which require materials exhibiting superior performance characteristics like high-temperature resistance, corrosion resistance, and exceptional mechanical strength. The continuous innovation in these sectors, coupled with the global push for lightweight, durable, and reliable components, further propels the adoption of nickel alloy wires. Restraints, conversely, primarily involve the inherent volatility of nickel prices on global commodity markets, which can impact production costs and overall market stability. Additionally, the high capital investment required for specialized manufacturing facilities and the intricate, energy-intensive production processes contribute to higher product costs, potentially limiting broader market penetration. Supply chain disruptions, often exacerbated by geopolitical events or natural disasters, also pose a significant challenge to consistent material availability and timely delivery.

Opportunities within this market are substantial and diverse. The burgeoning demand from emerging applications, particularly in electric vehicles (EVs) for battery components and charging infrastructure, as well as in renewable energy systems (e.g., wind turbines, solar power installations) and advanced nuclear reactors, presents considerable avenues for growth. The trend towards miniaturization and increasing complexity in electronic devices and medical implants further creates a need for ultra-fine and high-precision nickel alloy wires. Manufacturers are also exploring additive manufacturing techniques for complex geometries, which could open new markets for nickel alloy powders and specialized wires used in these processes. These evolving technological landscapes necessitate advanced materials that only nickel alloys can reliably provide, driving new demand fronts.

Impact forces such as Porter's Five Forces significantly influence the competitive dynamics. The bargaining power of buyers, especially large original equipment manufacturers (OEMs), can be moderate to high, as they often procure large volumes and seek competitive pricing and customization. Conversely, the bargaining power of suppliers, particularly for specialized raw materials like high-purity nickel and other alloying elements, can be substantial due to limited sources and complex extraction processes. The threat of substitutes is relatively low for high-performance applications where nickel alloys are critical, given their unique combination of properties that are difficult to replicate by other materials. However, for less demanding applications, stainless steel or other specialty alloys might pose a threat. The threat of new entrants is moderate, as the market requires significant capital investment, advanced technical expertise, and established distribution networks, creating barriers to entry. Finally, the intensity of rivalry among existing competitors is high, driven by product differentiation, technological leadership, and global market reach, necessitating continuous innovation and strategic positioning to maintain market share.

Segmentation Analysis

The Nickel Alloy Wires Market is comprehensively segmented across various dimensions to provide a granular understanding of its dynamics, identifying key areas of growth, demand, and competitive activity. This segmentation allows for targeted market strategies and helps stakeholders understand the specific needs and opportunities within different niches. The primary segmentation criteria typically include the type of alloy, the form or product type of the wire, the specific application it serves, and the end-use industry that procures and utilizes these specialized wires. Each segment presents unique market characteristics, growth drivers, and competitive landscapes, reflecting the diverse utility and demand for nickel alloy wires across global industries.

The segmentation by alloy type differentiates between various nickel-based compositions, each offering distinct properties optimized for specific environments. For instance, Inconel alloys are known for high-temperature strength and oxidation resistance, critical in aerospace and gas turbines, while Monel alloys excel in corrosive environments like marine and chemical processing. Hastelloy offers superior resistance to strong acids and localized corrosion, making it invaluable in harsh chemical industries. Nichrome wires, primarily nickel-chromium alloys, are fundamental in heating elements due to their high electrical resistivity and oxidation resistance. Pure nickel wires are favored for their excellent electrical conductivity, magnetic properties, and corrosion resistance in specific electronic and electrochemical applications. This classification underscores the material science expertise required in the market.

Further segmentation by product form, application, and end-use industry provides deeper insights. Product forms include welding wires, essential for joining high-performance components; spring wires for resilient mechanical parts; resistance wires for heating and electronic applications; and fine wires for precision instruments and medical devices. Applications range from general industrial fabrication to highly specialized uses in nuclear reactors or advanced medical implants. End-use industries such as aerospace, medical, oil and gas, chemical processing, and electronics are pivotal, with each having distinct requirements for performance, quality, and regulatory compliance, thereby influencing market demand and product specifications. This multi-faceted segmentation is crucial for comprehensive market analysis and strategic planning.

- By Alloy Type:

- Nickel-Chromium Alloys (e.g., Nichrome, Inconel 600/601)

- Nickel-Iron-Chromium Alloys (e.g., Incoloy 800/825)

- Nickel-Copper Alloys (e.g., Monel 400/K-500)

- Nickel-Molybdenum-Chromium Alloys (e.g., Hastelloy C-276/C-22)

- Pure Nickel (e.g., Nickel 200/201)

- Other Nickel Alloys (e.g., Titanium-stabilized alloys, precipitation-hardened alloys)

- By Product Type/Form:

- Welding Wires (Filler Wires)

- Spring Wires

- Resistance Wires (Heating Elements)

- Fine Wires

- Rod & Bar Wires

- Shaped Wires

- By Application:

- Welding & Joining

- Heating Elements

- Springs & Fasteners

- Filtration & Screening

- Medical Implants & Devices

- Electronics & Electrical Components

- Chemical Processing Equipment

- Aerospace Components

- Oil & Gas Exploration

- Other Industrial Applications

- By End-Use Industry:

- Aerospace & Defense

- Medical

- Chemical Processing

- Oil & Gas

- Electronics & Telecommunications

- Energy & Power Generation (Nuclear, Thermal, Renewables)

- Automotive (Electric Vehicles)

- Consumer Goods

- Manufacturing & Fabrication

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Nickel Alloy Wires Market

The value chain for the Nickel Alloy Wires Market is intricate, beginning with the upstream analysis that primarily focuses on the extraction and initial processing of raw materials. This stage involves mining nickel ore and other alloying elements such as chromium, molybdenum, iron, and copper, followed by their refining and smelting into high-purity ingots or master alloys. Key players at this stage are major mining companies and primary metals producers, whose operations are capital-intensive and subject to global commodity price fluctuations. The quality and purity of these raw materials are paramount, directly influencing the final properties and performance of the nickel alloy wires, making supplier relationships and quality control critical components of this upstream segment. Ensuring a stable and ethical supply of these essential elements is a constant challenge and a significant strategic consideration for wire manufacturers.

Moving downstream, the value chain encompasses the sophisticated manufacturing processes involved in transforming raw ingots into specialized wires. This includes multiple stages such as vacuum induction melting (VIM) or vacuum arc remelting (VAR) to ensure alloy homogeneity and purity, followed by hot rolling, cold drawing, annealing, and various surface treatments to achieve the desired wire dimensions, mechanical properties, and surface finish. Manufacturers in this segment employ advanced metallurgical techniques and precision engineering to produce wires that meet stringent industry specifications, often for critical applications. This stage also involves extensive quality assurance and testing to comply with international standards and customer requirements, which are particularly rigorous in sectors like aerospace and medical, highlighting the specialized expertise required by producers.

The distribution channel for nickel alloy wires is a critical link between manufacturers and end-users, involving both direct and indirect sales. Direct sales are typically preferred for large-volume orders, highly customized products, or strategic partnerships with major OEMs, allowing for direct technical support and closer customer relationships. Indirect channels involve a network of specialized distributors, agents, and wholesalers who maintain inventories, provide local logistics, and offer value-added services such as cutting, packaging, and just-in-time delivery. These distributors often possess deep market knowledge and technical expertise, catering to a broader customer base, including smaller fabricators and maintenance, repair, and overhaul (MRO) operations. The selection of appropriate distribution channels is vital for market reach, efficiency, and ensuring that the right product reaches the right customer with the necessary support, ultimately impacting market penetration and customer satisfaction.

Nickel Alloy Wires Market Potential Customers

The Nickel Alloy Wires Market serves a diverse and specialized customer base, with potential customers predominantly being end-users and buyers in industries that demand materials with exceptional performance characteristics. These customers are typically manufacturers of complex systems, components, or devices where standard metals cannot withstand the operating conditions. The primary end-users value specific properties such as high-temperature strength, superior corrosion resistance, excellent electrical resistivity, or biocompatibility, which nickel alloy wires uniquely provide. Therefore, understanding the specific technical requirements and application environments of these industries is crucial for manufacturers to tailor their product offerings and marketing strategies effectively.

Key sectors driving demand include the aerospace and defense industry, where manufacturers of jet engines, airframes, and missile components utilize nickel alloy wires for their high strength-to-weight ratio and ability to perform in extreme thermal and corrosive environments. The medical industry is another significant customer segment, comprising manufacturers of surgical instruments, orthopedic implants, stents, and orthodontic devices, who require wires with high biocompatibility, corrosion resistance to bodily fluids, and precise mechanical properties. In the energy sector, particularly in oil and gas exploration, nuclear power generation, and renewable energy (e.g., geothermal, concentrated solar power), nickel alloy wires are essential for components exposed to aggressive chemicals, high pressures, and elevated temperatures. These industries represent sophisticated buyers who prioritize reliability, safety, and performance over cost, indicating a strong willingness to invest in premium materials.

Furthermore, the chemical processing industry relies heavily on nickel alloy wires for their exceptional resistance to a wide range of corrosive media, finding applications in heat exchangers, reactors, and piping systems. The electronics and telecommunications sectors also represent a growing customer base, utilizing nickel-chromium wires for heating elements in industrial furnaces, resistors in electronic circuits, and specialized connectors due to their stable electrical properties. The automotive industry, with the rapid expansion of electric vehicles (EVs), is emerging as a new growth area, demanding nickel alloy wires for battery connections, sensor wiring, and high-temperature components in power electronics. These diverse applications underscore the critical role nickel alloy wires play in enabling technological advancements and ensuring operational integrity across multiple high-stakes industrial landscapes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Allegheny Technologies Incorporated (ATI), Sandvik AB, VDM Metals GmbH, Haynes International, Inc., Sumitomo Electric Industries, Ltd., Nippon Yakin Kogyo Co., Ltd., Carpenter Technology Corporation, Special Metals Corporation (a subsidiary of Precision Castparts Corp.), Fort Wayne Metals Research Products Corp., Heraeus Holding GmbH, WAFIOS AG, Voestalpine AG, Kanthal (a brand of Sandvik AB), Fisk Alloy, Inc., C. Waas GmbH & Co. KG, Elgiloy Specialty Metals, Ulbrich Stainless Steels & Special Metals, Inc., Branford Wire & Manufacturing Company, Inc., BOHLER Edelstahl GmbH & Co KG (a part of Voestalpine AG), Shanghai Nickel-Based Alloy Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nickel Alloy Wires Market Key Technology Landscape

The Nickel Alloy Wires Market is characterized by a sophisticated technological landscape, driven by continuous innovation in material science, manufacturing processes, and quality control. At the foundational level, advanced melting techniques are crucial for producing high-purity and homogeneous nickel alloys. Technologies such as Vacuum Induction Melting (VIM) and Vacuum Arc Remelting (VAR) are widely employed to remove impurities, control alloy composition precisely, and achieve superior metallurgical integrity, which is essential for the demanding applications these wires serve. These melting processes ensure that the alloys exhibit the desired mechanical properties and corrosion resistance, minimizing defects that could compromise performance in critical environments like aerospace engines or medical implants. The control over microstructural features during solidification is paramount for subsequent processing stages.

Further along the manufacturing chain, advanced drawing and annealing technologies play a vital role in transforming alloy ingots into fine wires with precise dimensions and desired mechanical properties. Cold drawing, often involving multiple stages, reduces the wire diameter while increasing its strength and achieving tight tolerances. Intermediate annealing treatments are meticulously controlled to relieve work hardening, recrystallize the material, and optimize its ductility, allowing for further drawing without fracture. Specialized surface treatment techniques, including pickling, polishing, and coating, are also employed to enhance surface finish, improve corrosion resistance, and prepare wires for specific applications, such as improving adhesion for subsequent insulation or plating. These processes require highly specialized machinery and deep metallurgical expertise to prevent surface defects and maintain the integrity of the alloy.

Emerging technologies are also shaping the future of nickel alloy wire production. Additive manufacturing, specifically wire arc additive manufacturing (WAAM) or laser powder bed fusion for related components, is influencing the demand for specialized wire feedstock and opening up possibilities for complex geometries not achievable through traditional methods. Advanced non-destructive testing (NDT) techniques, such as eddy current testing, ultrasonic inspection, and digital radiography, are increasingly integrated into production lines to ensure the highest quality and reliability of the finished wires. Furthermore, the adoption of Industry 4.0 principles, including sensor integration, real-time data analytics, and automation, is optimizing production efficiency, reducing waste, and enabling predictive maintenance across the entire manufacturing process, leading to more cost-effective and high-quality nickel alloy wire production.

Regional Highlights

The global Nickel Alloy Wires Market exhibits distinct regional dynamics, influenced by varying industrial landscapes, technological adoption rates, and economic development. Each region contributes uniquely to the market's growth, driven by localized demand from key end-use industries and the presence of prominent manufacturers and research institutions. Understanding these regional highlights is crucial for market participants to tailor their strategies, identify growth opportunities, and address specific challenges pertinent to each geographical area, ensuring effective market penetration and sustained business expansion in a diverse global marketplace.

North America is a mature market characterized by robust demand from high-tech industries, particularly aerospace and defense, medical devices, and oil & gas. The region benefits from significant R&D investments, stringent quality standards, and the presence of leading global players. The United States, in particular, is a major consumer due to its advanced manufacturing capabilities and continuous innovation in critical sectors requiring high-performance materials. The emphasis on technological superiority and material reliability drives consistent demand for specialized nickel alloy wires in this region. Europe also represents a strong market, propelled by its advanced automotive sector (especially for electric vehicles), extensive chemical processing industry, and well-established aerospace and medical device manufacturing bases. Countries like Germany, France, and the UK lead in consumption, supported by strong regulatory frameworks and a focus on sustainability and high-quality engineering. The region's commitment to industrial modernization further underpins demand.

The Asia Pacific (APAC) region is projected to be the fastest-growing market for nickel alloy wires, primarily due to rapid industrialization, burgeoning manufacturing sectors, and increasing infrastructure development, particularly in China, India, and Southeast Asian countries. The expansion of electronics, automotive, and energy industries in APAC fuels significant demand. Lower labor costs and government support for manufacturing also attract foreign investments, leading to increased production and consumption. Latin America and the Middle East & Africa (MEA) regions, while smaller in market share, present emerging opportunities. Latin America's growth is often linked to its expanding energy (oil & gas) and mining sectors, while MEA benefits from investments in oil & gas, infrastructure, and diversification efforts into manufacturing and technology, driving a gradual but steady increase in demand for specialized nickel alloy materials. These regions are increasingly becoming strategic markets for global nickel alloy wire producers.

- North America: Dominant market share driven by aerospace, medical, and oil & gas industries; strong R&D infrastructure; stringent quality requirements.

- Europe: Significant demand from automotive (EVs), chemical processing, and general engineering; strong focus on high-quality and sustainable production.

- Asia Pacific (APAC): Fastest-growing region due to rapid industrialization, expanding electronics, automotive, and energy sectors; significant manufacturing hub, especially China and India.

- Latin America: Emerging market with growth driven by energy, mining, and infrastructure development.

- Middle East & Africa (MEA): Growing demand from oil & gas, infrastructure, and diversification into manufacturing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nickel Alloy Wires Market.- Allegheny Technologies Incorporated (ATI)

- Sandvik AB

- VDM Metals GmbH

- Haynes International, Inc.

- Sumitomo Electric Industries, Ltd.

- Nippon Yakin Kogyo Co., Ltd.

- Carpenter Technology Corporation

- Special Metals Corporation (a subsidiary of Precision Castparts Corp.)

- Fort Wayne Metals Research Products Corp.

- Heraeus Holding GmbH

- WAFIOS AG

- Voestalpine AG

- Kanthal (a brand of Sandvik AB)

- Fisk Alloy, Inc.

- C. Waas GmbH & Co. KG

- Elgiloy Specialty Metals

- Ulbrich Stainless Steels & Special Metals, Inc.

- Branford Wire & Manufacturing Company, Inc.

- BOHLER Edelstahl GmbH & Co KG (a part of Voestalpine AG)

- Shanghai Nickel-Based Alloy Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Nickel Alloy Wires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are nickel alloy wires primarily used for?

Nickel alloy wires are primarily used in applications requiring superior resistance to high temperatures, corrosion, and oxidation, along with excellent mechanical strength. Key industries include aerospace, medical devices, chemical processing, oil & gas, and electronics, for components like engine parts, surgical instruments, heating elements, and corrosive fluid handling systems.

What types of nickel alloys are commonly used in wire manufacturing?

Common nickel alloys used in wire manufacturing include Inconel, Monel, Hastelloy, Nichrome, and pure nickel. Each alloy offers a unique combination of properties tailored for specific performance requirements, such as high-temperature strength, corrosion resistance, or electrical resistivity.

What factors drive the growth of the Nickel Alloy Wires Market?

The market's growth is driven by increasing demand from high-performance end-use industries (aerospace, medical, chemical processing), rapid industrialization in emerging economies, and continuous technological advancements necessitating materials with superior durability and performance under extreme conditions.

What are the main challenges faced by the Nickel Alloy Wires Market?

Key challenges include the volatility of nickel raw material prices, the high production costs associated with specialized manufacturing processes, and potential disruptions in the global supply chain. These factors can impact profitability and market stability.

How is AI impacting the Nickel Alloy Wires manufacturing process?

AI is impacting manufacturing by optimizing production parameters, improving quality control through predictive analytics, accelerating the discovery and development of new alloys, and enhancing supply chain efficiency. This leads to reduced defects, lower costs, and faster innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager