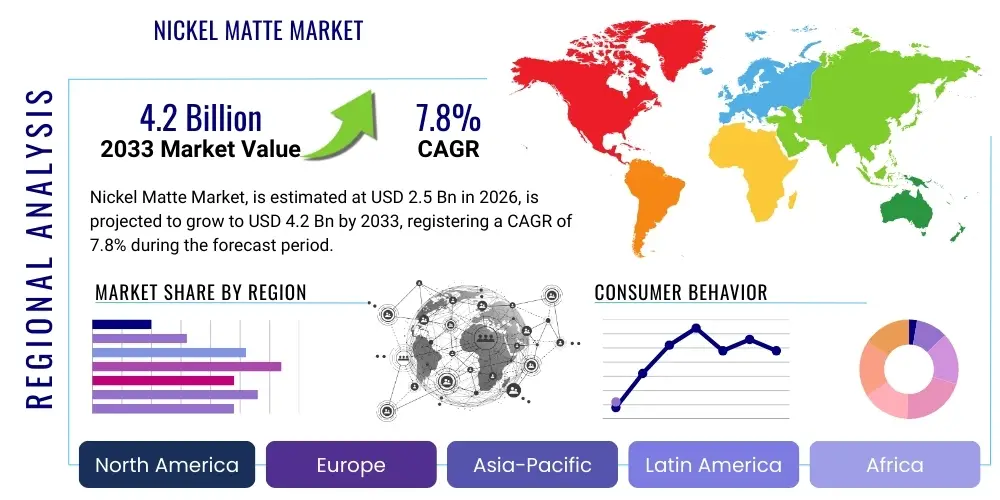

Nickel Matte Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434658 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Nickel Matte Market Size

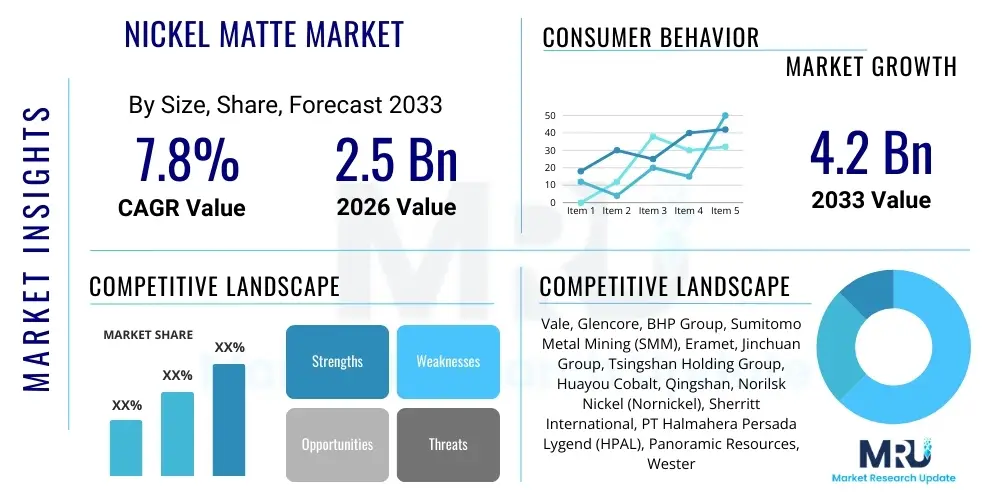

The Nickel Matte Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating global demand for high-ppurity nickel intermediates, which are essential raw materials for the production of nickel sulfate utilized in lithium-ion battery cathodes. The structural shift in nickel consumption patterns, moving away from traditional stainless steel towards the electric vehicle (EV) supply chain, is the central dynamic underpinning this growth.

Nickel Matte Market introduction

The Nickel Matte Market encompasses the trade and utilization of a semi-finished nickel product, characterized by a high concentration of nickel (typically 75% to 80%) coupled with sulfur. Nickel matte serves as a critical intermediate product, often refined from primary nickel ores, particularly laterites or sulfides, before being further processed into high-purity Class I nickel products such as nickel sulfate, which is indispensable for the modern electric vehicle (EV) battery sector. Unlike ferro-nickel or nickel pig iron (NPI), nickel matte possesses the requisite chemical composition and purity level that makes its conversion into battery-grade materials economically and technically feasible. Its utility in the battery supply chain has significantly elevated its strategic importance compared to a decade ago, establishing it as a key commodity linking mining operations to high-tech manufacturing.

Major applications of nickel matte are overwhelmingly concentrated in the production of Precursor Cathode Active Materials (PCAM) necessary for high-nickel chemistry lithium-ion batteries (e.g., NMC 811, 622). Secondary applications include specialized alloying, plating, and the manufacturing of certain high-performance stainless steels requiring specific impurity profiles. The primary benefit of using nickel matte is its ability to bypass certain costly and environmentally intensive steps in the refining process when aiming for high-purity end-products, streamlining the supply chain for battery manufacturers seeking reliable, high-volume inputs.

Driving factors propelling the market include aggressive regulatory mandates globally promoting vehicle electrification, substantial investment by automotive original equipment manufacturers (OEMs) into battery Gigafactories, and technological advancements that enhance the efficiency and purity of converting matte into nickel sulfate. Furthermore, the development and deployment of newer processing technologies, specifically adapted to utilizing abundant but difficult-to-process laterite ores for matte production, are contributing significantly to expanding the available supply and influencing global trade flows, particularly emanating from Southeast Asia.

Nickel Matte Market Executive Summary

The Nickel Matte Market is undergoing a rapid, supply-side-driven transformation, shifting its epicenter towards Southeast Asia, predominantly Indonesia, which leverages advancements in refining technologies, such as RKEF coupled with matte conversion or HPAL, to utilize its vast laterite reserves. This geopolitical and technological shift defines current business trends, with major miners and stainless steel producers rapidly integrating backward and forward to secure battery-grade nickel feedstocks. The primary risk observed in the market is the concentration of supply and the associated environmental scrutiny related to energy-intensive processing methods, which necessitates the adoption of greener energy sources and enhanced waste management practices to maintain market acceptance.

Regionally, Asia Pacific (APAC) dominates the consumption landscape, primarily due to the concentration of EV battery manufacturing facilities in China, South Korea, and Japan, coupled with the raw material supply chain originating from Indonesia. North America and Europe, while currently net importers, are aggressively investing in localized nickel matte processing and nickel sulfate refining capacity to mitigate supply chain vulnerabilities and capitalize on domestic EV incentives. This investment wave aims to establish resilient, localized supply chains, often integrating with neighboring mining operations in Canada, Australia, or Nordic countries, driving demand for high-specification matte suitable for advanced refining processes.

Segmentation trends reveal that the Battery Application segment is overwhelmingly the fastest-growing sector, eclipsing the traditional dominance of the Stainless Steel industry in terms of growth rate and strategic investment focus. Furthermore, the market shows a clear preference for nickel matte produced via methods that assure exceptionally low iron and cobalt impurities, catering specifically to the strict quality control requirements of high-performance cathode manufacturing. The production technology segment is observing a shift towards optimized pyrometallurgical routes and accelerated adoption of advanced hydrometallurgy to handle diverse ore types efficiently and economically.

AI Impact Analysis on Nickel Matte Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Nickel Matte Market center on how AI can optimize the notoriously complex and energy-intensive smelting and refining processes, ensure raw material consistency from diverse geological sources, and mitigate the environmental footprint of production. Users are keenly interested in predictive analytics for equipment failure in high-temperature environments (like rotary kilns and electric furnaces), optimization of reagent consumption in hydrometallurgical routes (such as HPAL), and the ability of AI to model future demand based on nuanced EV adoption rates and shifting battery chemistries. These questions highlight a collective expectation that AI will deliver significant operational efficiencies and bolster the reliability and sustainability of the nickel supply chain.

AI is being deployed across the entire nickel matte value chain, from initial resource extraction to final product quality control. In mining, AI-driven algorithms analyze geological data to optimize ore blending, ensuring consistent feed quality for processing plants, which is crucial for maintaining the efficiency of RKEF or HPAL operations. During the refining stage, machine learning models continuously monitor temperature, pressure, and chemical composition in real-time, allowing operators to make micro-adjustments that maximize nickel recovery and minimize energy use, directly impacting the cost structure of nickel matte production.

Furthermore, the integration of AI extends into strategic planning and supply chain resilience. Predictive maintenance scheduling, powered by AI analyzing sensor data from machinery, drastically reduces unexpected downtime in continuous operations, which is critical given the high capital expenditure associated with nickel processing facilities. On the demand side, AI models utilize macroeconomic indicators, geopolitical events, and OEM production forecasts to accurately predict future nickel sulfate requirements, enabling matte producers to align production volumes and purity specifications precisely with market needs, thereby optimizing inventory and minimizing price volatility exposure.

- AI optimizes ore blending processes for consistent feed quality in smelting.

- Machine learning models enhance real-time control over chemical reactions and temperature in RKEF and HPAL.

- Predictive maintenance driven by AI minimizes costly equipment downtime in refining facilities.

- AI-powered demand forecasting improves inventory management and alignment with EV manufacturer requirements.

- Advanced image recognition systems use AI to automate quality control and ensure high matte purity levels.

- Algorithm-based energy management reduces the substantial power consumption inherent in nickel processing.

DRO & Impact Forces Of Nickel Matte Market

The Nickel Matte Market is critically driven by the relentless expansion of the global electric vehicle sector and the corresponding demand for high-energy density batteries, creating an unprecedented requirement for battery-grade nickel sulfate derived from matte. However, this growth is significantly restrained by stringent environmental regulations concerning the carbon footprint of nickel production, particularly related to the energy intensity of smelting processes and the management of large volumes of tailings and spent acids. Opportunities arise from technological breakthroughs in sustainable and cost-effective processing routes, such as optimizing HPAL for laterite ores and developing dry-stack tailing solutions. The market is impacted by the concentrated supply risk stemming from geopolitical developments in key producing regions, necessitating diversification and strategic resource agreements globally.

The primary driver is the accelerating penetration rate of EVs globally, which mandates a stable, long-term supply of Class I nickel. Nickel matte provides the most effective transitional feedstock to meet this demand, bridging the gap between abundant but lower-grade laterite ores and the high-purity requirements of battery makers. Conversely, restraints include the high capital expenditure required to establish and maintain efficient nickel matte refining capacity, the volatility of commodity prices (especially sulfur and energy inputs), and the growing societal pressure for ‘green nickel,’ penalizing producers with high CO2 emissions or poor sustainability records.

Opportunities are robust in the development of closed-loop recycling processes for spent batteries, creating a secondary source of high-purity nickel that can supplement primary matte production. Furthermore, producers who successfully implement technological upgrades—such as pressure oxidation (POX) or biological leaching methods—that offer lower environmental impact while maintaining competitive costs are strategically positioned for long-term dominance. These impact forces collectively dictate investment patterns, favoring resilient, integrated supply chains capable of navigating complex regulatory environments and commodity price fluctuations while maintaining rigorous quality control standards for the battery sector.

Segmentation Analysis

The Nickel Matte Market segmentation provides a granular view of demand and production characteristics, primarily categorized by Application and Production Method. Segmentation by Application highlights the crucial divergence between traditional industrial uses (like specialized stainless steel and superalloys) and the burgeoning high-growth sector of Battery Manufacturing. This distinction is critical as battery applications require significantly higher purity standards, influencing pricing and technological investment. Segmentation by Production Method, dividing the market between Pyrometallurgy and Hydrometallurgy, reflects the inherent differences in the raw materials utilized (sulfide vs. laterite ores) and the resulting product specifications and associated operational costs and environmental impacts. Understanding these segments is key to deciphering future market evolution and supply chain integration strategies.

- By Application

- Battery Manufacturing (Nickel Sulfate Production)

- Specialized Stainless Steel

- Superalloys and Aerospace Components

- Plating and Catalysts

- By Production Method

- Pyrometallurgy (Smelting)

- Hydrometallurgy (e.g., HPAL and Atmospheric Leaching)

- By Purity Grade

- High Purity (Battery Grade Feedstock)

- Standard Industrial Grade

Value Chain Analysis For Nickel Matte Market

The Nickel Matte value chain commences upstream with the mining and concentration of nickel ore, predominantly high-grade sulfide ores or lower-grade laterite ores. The choice of ore type dictates the subsequent processing route; sulfide ores are typically concentrated via flotation before smelting, while laterites often require energy-intensive RKEF or complex HPAL techniques. Upstream activities are characterized by heavy capital investment, geological risk, and logistical challenges related to raw material transport, especially for laterite projects often located in remote tropical regions. Securing long-term, stable access to quality ore reserves is the primary value driver at this stage.

The midstream phase involves the conversion of ore or intermediate products into nickel matte. This manufacturing step, encompassing the RKEF-to-Matte conversion or specialized hydrometallurgical leaching and precipitation, is the core of the market and demands sophisticated technical expertise and significant energy inputs. Distribution channels for nickel matte are highly specialized, often involving long-term, direct contracts between the producer (miner/smelter) and the downstream refiner/converter. Due to the high value and specific handling requirements of the matte, indirect distribution through general commodity traders is less common than direct, B2B procurement agreements, emphasizing traceability and quality assurance.

Downstream, the matte is dissolved and refined, often through chemical leaching and crystallization, into battery-grade nickel sulfate or high-purity nickel metal. The final consumption stage involves battery cathode active material (CAM) producers or specialized alloy manufacturers. The shift towards EV batteries has tightened the downstream requirements dramatically, making the purity and consistency of the nickel matte feedstock paramount. This tight integration means that downstream refiners exert significant influence over upstream specifications, driving investment in clean, efficient processing technologies capable of guaranteeing the necessary purity standards.

Nickel Matte Market Potential Customers

Potential customers for nickel matte are predominantly sophisticated industrial entities that require high-grade nickel inputs for conversion into specialized chemicals or high-performance metallic alloys. The primary and fastest-growing customer segment consists of nickel sulfate refiners and integrated chemical producers who supply the EV battery industry. These buyers demand matte with exceptionally low levels of undesirable elements such as iron, cobalt, and magnesium, ensuring the final nickel sulfate product meets the stringent specifications for Precursor Cathode Active Materials (PCAM).

A significant, though less rapidly growing, customer base includes specialized stainless steel manufacturers, particularly those focusing on high-end 300-series stainless steel or duplex grades, where nickel matte can be used as a feed, although nickel pig iron (NPI) remains common for lower-grade production. Furthermore, manufacturers in the aerospace and defense sectors, requiring superalloys (such as those based on Inconel or Monel) for high-temperature and high-stress applications (like jet engine components), represent a niche but highly lucrative customer base, prioritizing quality and reliability over price volatility.

In summary, the purchasing decisions of these potential customers are driven by three main factors: the purity and traceability of the matte (critical for battery makers); the long-term contractual price stability; and the supplier’s commitment to sustainable sourcing and production practices, which is increasingly mandatory for satisfying end-user regulatory and corporate responsibility mandates in the automotive sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vale, Glencore, BHP Group, Sumitomo Metal Mining (SMM), Eramet, Jinchuan Group, Tsingshan Holding Group, Huayou Cobalt, Qingshan, Norilsk Nickel (Nornickel), Sherritt International, PT Halmahera Persada Lygend (HPAL), Panoramic Resources, Western Areas, Nickel West (BHP), Anglo American, First Quantum Minerals, Gecamines, Jiangxi Copper, Zhejiang Huayou Cobalt. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nickel Matte Market Key Technology Landscape

The technological landscape for Nickel Matte production is defined by efforts to efficiently process lower-grade, abundant laterite ores into high-purity battery feedstock, a shift demanding significant process innovation. Historically, the pyrometallurgical route, utilizing sulfide ores through roasting and electric furnace smelting, has been standard. However, the critical emerging technology is the adaptation and optimization of the Rotary Kiln Electric Furnace (RKEF) process specifically for laterite ores to yield high-quality nickel matte instead of traditional nickel pig iron (NPI). This RKEF-to-Matte conversion requires precise control over sulfur addition and impurity removal, significantly enhancing the utility of laterite resources for the battery supply chain.

Parallelly, advanced hydrometallurgical techniques are gaining prominence, most notably High-Pressure Acid Leaching (HPAL). HPAL is crucial for handling nickel limonite ores (a type of laterite) and producing mixed hydroxide precipitate (MHP) or nickel matte feedstock with high efficiency. Recent technological advancements in HPAL focus on improving equipment longevity, minimizing acid consumption, and critically, managing the environmental footprint associated with pressure oxidation and subsequent neutralization. Producers are investing heavily in closed-loop systems and novel tailings management solutions (like dry stacking) to address environmental concerns inherent to acid leaching.

Furthermore, technology is playing a vital role in refining the matte downstream. New chemical refining techniques are being implemented to dissolve the nickel matte efficiently and separate trace impurities (especially Cobalt and Manganese) through solvent extraction or ion exchange, ensuring the subsequent crystallization of ultra-high purity nickel sulfate. The competitive advantage in the future will rest heavily on proprietary technologies that minimize energy expenditure and chemical consumption across both the matte production and final refining stages, ensuring a cost-competitive and environmentally responsible Class I nickel product.

Regional Highlights

The Asia Pacific (APAC) region is the undisputed leader in the Nickel Matte Market, characterized by its dual role as the primary production hub and the dominant consumer base. Southeast Asia, particularly Indonesia, drives the global supply, leveraging government policies and technological breakthroughs (especially RKEF and HPAL developments) to convert its vast laterite reserves into nickel matte suitable for battery applications. China is the largest refining and consumption center, transforming matte into nickel sulfate for its massive domestic EV battery industry. This concentration creates high efficiency but also introduces significant geopolitical supply risk, which is actively monitored by global consumers.

North America and Europe are pivotal regions in terms of strategic demand and rapidly growing localization efforts. While their current production capacity for nickel matte is comparatively smaller than APAC, they are heavily investing in new domestic projects to secure resilient supply chains free from external geopolitical turbulence. In North America, this includes expanding mining operations in Canada and the U.S. and building integrated refining facilities (Gigafactories) designed to convert domestically sourced raw materials, including nickel matte, directly into battery components, often supported by critical mineral legislation and subsidies.

Europe’s focus is similar, driven by the ambitious European Green Deal and the need to localize the entire EV battery value chain. Key areas in Northern Europe (e.g., Finland, Norway) are prioritizing sustainable nickel production, often utilizing established sulfide resources and aiming for the lowest possible carbon footprint (Green Nickel). This region emphasizes premium pricing for environmentally superior matte and nickel sulfate, setting a benchmark for global sustainability standards. Latin America and MEA, while containing significant reserves, remain nascent in terms of large-scale matte production suitable for the battery market but represent potential future growth areas should investment in advanced processing infrastructure materialize.

- Asia Pacific (APAC): Dominates both supply (Indonesia, Philippines) and demand (China, South Korea) due to concentrated EV battery production and aggressive raw material processing expansion.

- North America: Focuses on securing domestic and allied supply chains; strong investment in localized refining capacity and responsible sourcing initiatives, particularly in Canada and the United States.

- Europe: Driven by localization policies and the demand for ‘Green Nickel’; emphasizing sustainability in production and high-purity standards for its rapidly growing Gigafactory network.

- Latin America (LATAM): Potential future sourcing region; currently faces infrastructure challenges but holds significant unexploited nickel reserves.

- Middle East & Africa (MEA): Emerging market; regional governments are attracting foreign direct investment into mining and initial processing to move up the value chain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nickel Matte Market.- Vale

- Glencore

- BHP Group

- Sumitomo Metal Mining (SMM)

- Eramet

- Jinchuan Group

- Tsingshan Holding Group

- Huayou Cobalt

- Qingshan

- Norilsk Nickel (Nornickel)

- Sherritt International

- PT Halmahera Persada Lygend (HPAL)

- Panoramic Resources

- Western Areas

- Nickel West (BHP)

- Anglo American

- First Quantum Minerals

- Gecamines

- Jiangxi Copper

- Zhejiang Huayou Cobalt

Frequently Asked Questions

Analyze common user questions about the Nickel Matte market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Nickel Matte and why is it crucial for the EV battery industry?

Nickel Matte is a high-purity, sulfur-containing nickel intermediate (typically 75-80% Ni content). It is crucial for the EV industry because it is the most efficient and cost-effective feedstock for converting laterite ores into ultra-high purity nickel sulfate, which is essential for modern lithium-ion battery cathodes (e.g., NMC chemistries).

How does the production of Nickel Matte impact global nickel supply concentration?

The production landscape has fundamentally shifted towards Indonesia, which utilizes laterite ores and RKEF/HPAL technology to produce matte. This reliance on one major region concentrates global supply, increasing geopolitical risk and scrutiny regarding supply chain resilience for North American and European automotive manufacturers.

What are the primary technological challenges in Nickel Matte production?

Key challenges include managing the high energy consumption and associated carbon emissions of pyrometallurgical methods, minimizing impurities (like iron and cobalt) to meet stringent battery specifications, and safely and sustainably managing large volumes of acidic waste from hydrometallurgical processes like HPAL.

What role does High-Pressure Acid Leaching (HPAL) play in the future of the Nickel Matte market?

HPAL is critical as it enables the use of abundant, lower-grade laterite ores (limonite) to produce high-purity intermediate products (like MHP or matte feedstock), directly addressing the massive demand growth from the battery sector where traditional high-grade sulfide reserves are becoming scarcer.

Which application segment is expected to show the highest growth rate in the Nickel Matte Market?

The Battery Manufacturing segment, specifically for the production of nickel sulfate used in Precursor Cathode Active Materials (PCAM) for electric vehicles, is projected to exhibit the highest and most sustained growth rate throughout the forecast period due to rapid global EV adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager