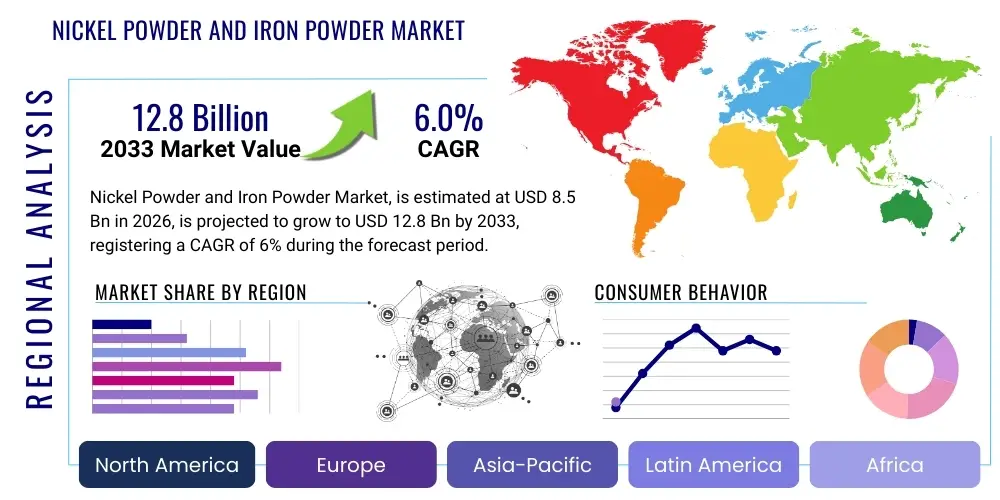

Nickel Powder and Iron Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438384 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Nickel Powder and Iron Powder Market Size

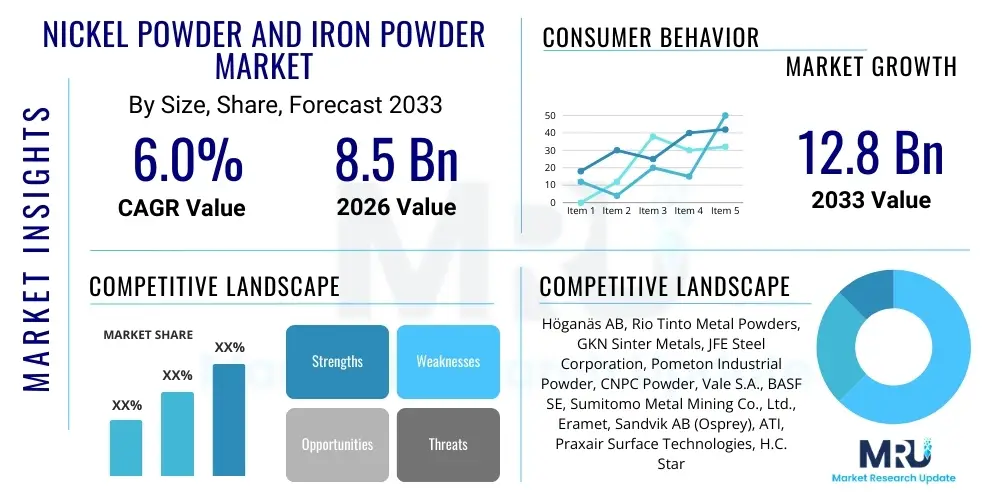

The Nickel Powder and Iron Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $12.8 Billion by the end of the forecast period in 2033.

Nickel Powder and Iron Powder Market introduction

The Nickel Powder and Iron Powder Market encompasses the production, distribution, and consumption of finely processed metallic powders used across various industrial applications, primarily driven by advancements in powder metallurgy (PM) and additive manufacturing (AM). Nickel powder is highly valued for its exceptional resistance to corrosion, high tensile strength, and magnetic properties, making it indispensable in electronics, battery electrodes (especially in nickel-metal hydride and lithium-ion batteries), and specialized alloys. Iron powder, conversely, is consumed in significantly larger volumes, serving as a fundamental raw material for structural components, magnetic materials, welding electrodes, and chemical catalysis. The market’s dynamism is intrinsically linked to global manufacturing output, technological innovation in material processing, and the shift towards components with superior mechanical performance and lighter weight, particularly within the automotive and aerospace sectors.

Product descriptions within this market vary significantly based on particle size, purity level, shape (spherical, dendritic, irregular), and method of production (e.g., atomization, reduction, carbonyl process, electrolysis). High-purity nickel powders are critical for demanding applications like thermal spraying, fuel cells, and high-frequency inductors, requiring rigorous quality control during manufacturing. Iron powders range from low-purity grades utilized in ballast and chemical applications to high-purity, low-alloy grades essential for press-and-sinter processes in automotive transmission parts. The synergy between nickel and iron powders is often observed in sintered alloys and composites, where they provide tailored magnetic, thermal, and structural attributes, enabling complex geometries that are unachievable through traditional casting or machining methods.

Major applications driving market growth include the production of soft magnetic components for electric vehicles (EVs) and consumer electronics, the fabrication of wear-resistant coatings, and the use as feedstocks in binder jetting and selective laser sintering (SLS/SLM) processes. The primary benefit these powders offer is the ability to create near-net-shape components, significantly reducing material waste and post-processing requirements. Key driving factors include the electrification of transportation, massive infrastructure spending requiring superior welding materials, and the relentless miniaturization trend in electronic devices, necessitating high-performance magnetic and conductive materials. Furthermore, the push towards sustainable manufacturing processes favors powder metallurgy due to its energy efficiency compared to traditional material removal techniques.

Nickel Powder and Iron Powder Market Executive Summary

The global Nickel Powder and Iron Powder Market is experiencing robust growth fueled by irreversible technological shifts in manufacturing, particularly the pervasive adoption of Additive Manufacturing (AM) and the global transition towards electrified transportation. Business trends indicate a strong focus on capacity expansion, especially in Asia Pacific, where EV battery and consumer electronics production is centralized. Companies are investing heavily in advanced atomization and plasma technologies to meet the stringent demands for spherical, highly pure powders required by high-end 3D printing applications, driving up average selling prices for specialized grades. Geopolitical stability and fluctuating raw material costs (nickel and iron ore) pose persistent risks, necessitating robust supply chain risk mitigation strategies and long-term procurement contracts to ensure continuous production and pricing predictability across the value chain.

Regionally, Asia Pacific maintains its dominance, spurred by burgeoning automotive production, especially in China and India, and the immense scale of the electronics manufacturing hubs in South Korea, Japan, and Taiwan. North America and Europe are pivotal markets characterized by high demand for high-value applications, including aerospace components, medical devices, and high-performance energy storage solutions, leveraging sophisticated material science and advanced PM techniques. European regulation focusing on emissions reduction further propels the demand for lighter, complex structural parts manufactured using specialized iron powders in powertrain components, while the U.S. market emphasizes defense and infrastructure applications, requiring robust, certified material feedstocks.

Segment trends reveal that the spherical powder segment is growing at the fastest pace due to its criticality in AM and metal injection molding (MIM), surpassing traditional irregular or dendritic particle shapes in growth velocity. By application, the Automotive sector remains the primary volume consumer of both nickel and iron powders, focusing on sintered structural parts and soft magnetic cores. However, the Battery segment, specifically requiring ultra-fine nickel powder for cathode manufacturing, presents the most significant future revenue growth potential. By production method, gas atomization and plasma atomization technologies are gaining prominence, offering superior control over particle morphology and purity compared to conventional electrolytic or reduction processes, catering to the exacting standards of next-generation industrial processes.

AI Impact Analysis on Nickel Powder and Iron Powder Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the historically labor-intensive and quality-sensitive production processes of metallic powders, particularly focusing on mitigating batch-to-batch variability and enhancing material yield. Key concerns revolve around AI's ability to predict and control critical parameters during the atomization process, such as gas flow dynamics, melt temperature, and cooling rates, which directly influence particle size distribution and morphology—crucial factors for AM feedstock performance. Expectations are high that AI-driven quality control systems will replace manual inspection, leading to faster throughput and significantly reduced scrap rates. Furthermore, common questions address AI’s role in optimizing supply chain logistics and predicting volatile raw material price fluctuations (nickel prices), enabling manufacturers to make more informed procurement decisions and maintain competitive pricing strategies in a volatile commodity market.

- AI-driven optimization of atomization processes: Utilizing machine learning algorithms to fine-tune production parameters in real-time, resulting in precise control over powder characteristics (size, sphericity, purity).

- Predictive Maintenance (PdM): Deploying AI models to monitor wear and tear on atomizers, furnaces, and sifters, minimizing unscheduled downtime and improving overall equipment effectiveness (OEE).

- Enhanced quality control: Implementing computer vision and AI classifiers for rapid, automated analysis of particle morphology and composition, ensuring compliance with stringent aerospace and medical standards.

- Supply chain resilience: Using predictive analytics to forecast demand fluctuations and potential geopolitical disruptions affecting raw material (nickel/iron ore) availability and pricing, facilitating proactive inventory management.

- Accelerated R&D: Leveraging AI to simulate new alloy compositions and predict the performance of sintered components based on varied powder inputs, dramatically speeding up material development cycles for PM and AM applications.

DRO & Impact Forces Of Nickel Powder and Iron Powder Market

The Nickel Powder and Iron Powder Market is shaped by significant Drivers, Restraints, and Opportunities (DROs), which collectively constitute the critical Impact Forces determining market trajectory. The primary driver is the exponentially growing demand from the Additive Manufacturing sector, where specialized, spherical metal powders serve as the fundamental feedstock for high-value components in aerospace and healthcare. This is coupled with the mass electrification of vehicles, necessitating large quantities of nickel powder for lithium-ion battery cathodes and high-purity iron powders for soft magnetic components in motors. However, the market faces significant restraints, notably the high energy intensity required for powder production (especially atomization) and the intense volatility of raw material prices, particularly for LME-traded nickel, which can severely impact profit margins and long-term investment planning. Furthermore, the stringent quality and particle size requirements for AM applications require massive initial capital expenditure on advanced processing equipment, limiting market entry for smaller players.

Opportunities abound in developing cost-effective production methods, such as utilizing recycled scrap metal as feedstock for iron powders, aligning with global sustainability goals and mitigating commodity price risks. Furthermore, there is significant potential in expanding the application scope into green technologies, including hydrogen fuel cells (requiring nickel catalysts) and advanced energy storage systems. Strategic investments in research and development aimed at producing composite powders (pre-alloyed or mechanically alloyed) that offer enhanced performance characteristics—such as improved density or reduced porosity after sintering—will unlock new high-margin application areas in demanding industrial environments. The interplay between these factors creates potent impact forces, favoring companies capable of maintaining technological leadership, optimizing energy consumption, and securing stable, diversified raw material sources.

Impact forces currently skew positively due to strong underlying structural demand from electrification and digitalization. However, regulatory shifts concerning heavy industry emissions and recycling mandates could act as both drivers (for new, cleaner processes) and restraints (for existing, less efficient facilities). The need for specialized powder grades for sophisticated technologies necessitates continuous innovation, making technological superiority a key competitive impact force. Companies that successfully navigate raw material price cycles through efficient hedges and backward integration will solidify their market positions and dictate future pricing dynamics, reinforcing consolidation among major producers.

Segmentation Analysis

The Nickel Powder and Iron Powder Market is comprehensively segmented across several key dimensions including type, production method, application, and geography, enabling granular analysis of demand patterns and strategic market positioning. The Type segmentation distinguishes between pure metal powders and their pre-alloyed variants, reflecting differences in end-use requirements for mechanical, magnetic, or catalytic properties. The Production Method segmentation highlights the shift towards advanced technologies like gas and plasma atomization, which produce high-purity, spherical powders, contrasting with traditional methods like water atomization or chemical reduction that yield irregular or dendritic shapes. The application segmentation provides insight into the major consuming sectors, with Powder Metallurgy and Additive Manufacturing being the most critical high-growth segments, demonstrating where future investment and innovation are concentrated globally.

- By Type:

- Nickel Powder (Pure Nickel, Nickel Alloys)

- Iron Powder (Pure Iron, Sponge Iron, Pre-alloyed Iron Powder, Steel Powder)

- By Production Method:

- Water Atomization

- Gas Atomization

- Plasma Atomization

- Electrolytic Deposition

- Chemical Reduction (Carbonyl Process)

- By Application:

- Powder Metallurgy (PM)

- Additive Manufacturing (3D Printing)

- Metal Injection Molding (MIM)

- Electronics and Electrical Components (Soft Magnetic Cores, Inductors)

- Batteries and Energy Storage

- Welding and Brazing

- Chemical and Catalytic Applications

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy)

- Asia Pacific (China, Japan, South Korea, India)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Nickel Powder and Iron Powder Market

The value chain for Nickel Powder and Iron Powder begins with the upstream procurement and processing of raw materials—primarily nickel ore/matte and iron ore/scrap—which is highly capital-intensive and susceptible to global commodity price volatility and geopolitical influences. Upstream analysis focuses on refining and extraction processes, where purity levels are critically established, impacting the final powder quality and cost. Major producers often engage in vertical integration, securing long-term contracts or owning mining assets to stabilize feedstock supply. This initial stage dictates the base cost structure and environmental footprint of the final powder product. Efficiency in primary production, such as utilizing lower-energy processes for sponge iron or optimizing nickel refining, is a critical competitive advantage.

Midstream activities involve the highly specialized manufacturing of the powders themselves, utilizing diverse production technologies such as atomization (gas, water, plasma), chemical processes (carbonyl), or electrolysis. This stage adds the most value by controlling particle size, morphology, and distribution, tailoring the powder’s characteristics for specific end applications (e.g., spherical for AM, irregular for standard PM). Distribution channels are multifaceted, involving direct sales to large, integrated manufacturers (like automotive OEMs or major battery makers) and indirect sales through specialized technical distributors who provide smaller volumes, technical support, and tailored blends to job shops and specialized AM bureaus. The choice of channel depends heavily on the volume, complexity, and required technical service level.

Downstream analysis centers on the end-user applications—from large-scale Powder Metallurgy facilities producing automotive gears and structural components, to aerospace companies leveraging 3D printing for complex engine parts, and battery manufacturers using nickel powder in cathodes. Success in the downstream market requires close collaboration between powder producers and end-users to optimize the powder-to-part manufacturing process (sintering, hot isostatic pressing, binder removal). The feedback loop from downstream performance requirements drives midstream innovation, particularly regarding alloy development and purity standards. The market increasingly favors direct sales for strategic partnerships and technical collaboration, while indirect channels provide necessary reach to fragmented, specialized industrial sectors.

Nickel Powder and Iron Powder Market Potential Customers

Potential customers for nickel powder and iron powder span a diverse range of high-technology and high-volume industrial sectors, driven by the need for superior material properties, complex geometries, and cost-effective mass production. The Automotive industry is arguably the largest consumer, utilizing high volumes of iron powder for sintered engine components, transmission parts, and increasingly, soft magnetic cores for electric vehicle (EV) motors. Nickel powder is crucial for EV battery manufacturers, serving as a primary component in advanced cathode materials (NMC and NCA chemistries) and in specialized brazing and welding applications required for structural battery pack assembly. These end-users typically require large, consistent batches and engage in long-term supply agreements with established powder manufacturers.

The Aerospace and Defense sectors represent high-margin customers, demanding ultra-high-purity, spherical nickel and iron-based superalloy powders suitable for critical, performance-intensive Additive Manufacturing (AM) applications. These customers require rigorous certification, traceability, and specialized particle size distributions (often <45 µm) to achieve optimal density and mechanical performance in components like turbine blades, structural brackets, and specialized heat exchangers. Medical device manufacturers also fall into this category, requiring high-pgrade powders for surgical tools, implants, and customized patient-specific components fabricated via AM, prioritizing biocompatibility and reliability above all else.

Other substantial segments include the Electronics and Electrical industries, utilizing both iron and nickel powders for magnetic cores, choke coils, and specialized conductive pastes crucial for printed circuit boards and electronic packaging. Chemical and Petrochemical sectors rely on nickel powders as catalysts for various industrial hydrogenation and cracking processes. These diverse end-users emphasize different critical success factors: volume and cost for automotive, purity and certification for aerospace/medical, and specific catalytic performance for chemical industries, ensuring a broad and resilient demand base for specialized metal powder producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $12.8 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Höganäs AB, Rio Tinto Metal Powders, GKN Sinter Metals, JFE Steel Corporation, Pometon Industrial Powder, CNPC Powder, Vale S.A., BASF SE, Sumitomo Metal Mining Co., Ltd., Eramet, Sandvik AB (Osprey), ATI, Praxair Surface Technologies, H.C. Starck Solutions, Alfa Aesar (Thermo Fisher Scientific), Erasteel, Ametek Inc., voestalpine BÖHLER Edelstahl GmbH & Co KG, Materion Corporation, Mitsui Kinzoku |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nickel Powder and Iron Powder Market Key Technology Landscape

The technological landscape of the Nickel Powder and Iron Powder Market is undergoing rapid evolution, primarily driven by the need to meet the ultra-high purity and precise particle size distribution requirements mandated by Additive Manufacturing (AM) and high-performance electronics. Conventional technologies like water atomization, while cost-effective for high-volume iron powder production used in structural Powder Metallurgy (PM), are being supplemented or replaced by advanced methods. Gas atomization, using inert gases like argon or nitrogen, is the prevailing technology for producing the highly spherical, fine powders necessary for laser powder bed fusion (LPBF) and electron beam melting (EBM), as it minimizes oxygen content and ensures superior flowability—a non-negotiable trait for AM feedstock. Plasma atomization represents the pinnacle of current technology, offering the highest level of sphericity, cleanliness, and control over ultrafine particle sizes, although at a significantly higher operational cost, typically reserved for superalloys and high-value nickel-based powders.

Further technological advancements focus heavily on post-processing techniques, including spheroidization, advanced sieving, and surface treatment to enhance powder characteristics. Spheroidization processes are critical for irregular powders created via reduction or electrolysis to make them suitable for sophisticated processes like Metal Injection Molding (MIM), which requires high packing density. Furthermore, the market is seeing increased adoption of powder coating and blending technologies designed to create composite or functionally graded materials. These processes involve coating core iron particles with nickel or other alloys to improve corrosion resistance or enhance magnetic properties, offering tailored material solutions that cannot be achieved through traditional alloying methods, significantly expanding the material science possibilities in PM and AM.

The convergence of material science and digital technology is profoundly influencing the landscape, particularly through the implementation of in-situ monitoring and closed-loop control systems integrated into atomization units. These systems leverage sensors and AI algorithms to monitor parameters like particle velocity, temperature, and melt stream characteristics in real-time, drastically reducing process variability and improving batch consistency—a key challenge in metallic powder production. The development of sustainable technologies, such as utilizing hydrogen reduction processes instead of carbon-based reduction for iron powder, is also a focal point, aiming to lower the carbon footprint of production, positioning manufacturers favorably in markets with stringent environmental, social, and governance (ESG) standards.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, supply, and technological trajectory of the Nickel Powder and Iron Powder market, influenced significantly by localized industrial concentration and regulatory frameworks.

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, dominating both consumption and production volumes, primarily due to the massive automotive manufacturing bases (especially in China and India) and the global hub for consumer electronics and battery production (Korea, Japan, China). The immense investment in EV manufacturing mandates high demand for nickel powder for battery cathodes and soft magnetic iron powders for motor components.

- North America: Characterized by high-value, specialized applications. The region exhibits strong demand from the Aerospace and Defense sectors, driving the need for ultra-high-purity nickel and iron-based superalloys suitable for certified Additive Manufacturing. Technological leadership in AM adoption ensures high average selling prices for sophisticated powder grades.

- Europe: A mature market focused on innovation and environmental compliance. Germany leads in high-performance automotive PM components and precision engineering. European demand is driven by stringent environmental standards, pushing manufacturers toward lighter, high-strength parts created via MIM and specialized PM processes. Investments in green hydrogen projects also increase demand for nickel catalysts.

- Latin America (LATAM): Primarily a growing consumer of standard-grade iron powders for mining, construction, and basic automotive applications. Brazil, with its mining resources, plays a key role in the upstream supply chain of raw materials but remains a net importer of high-end finished powders.

- Middle East and Africa (MEA): A nascent market with localized demand centered on oil and gas infrastructure (requiring specialized welding and coating materials) and basic manufacturing. Growth is anticipated, driven by economic diversification efforts in the UAE and Saudi Arabia, including nascent ventures into localized AM and defense production capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nickel Powder and Iron Powder Market.- Höganäs AB

- Rio Tinto Metal Powders

- GKN Sinter Metals

- JFE Steel Corporation

- Pometon Industrial Powder

- CNPC Powder

- Vale S.A.

- BASF SE

- Sumitomo Metal Mining Co., Ltd.

- Eramet

- Sandvik AB (Osprey)

- ATI

- Praxair Surface Technologies

- H.C. Starck Solutions

- Alfa Aesar (Thermo Fisher Scientific)

- Erasteel

- Ametek Inc.

- voestalpine BÖHLER Edelstahl GmbH & Co KG

- Materion Corporation

- Mitsui Kinzoku

Frequently Asked Questions

Analyze common user questions about the Nickel Powder and Iron Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized spherical metal powders?

The primary driver is the rapid global expansion and industrial adoption of Additive Manufacturing (3D Printing), particularly in the aerospace, medical, and high-performance automotive sectors, which strictly require spherical powder morphology for optimal flowability and density in powder bed fusion processes.

How does the electrification of vehicles impact the demand for nickel and iron powders?

The EV transition significantly boosts nickel powder demand as it is essential for advanced lithium-ion battery cathodes (NMC, NCA). Iron powder demand rises for producing high-efficiency soft magnetic cores and complex sintered structural components required in electric motors and lightweight chassis designs.

Which production method yields the highest purity and spherical Nickel Powder?

Gas atomization, often using inert argon or nitrogen gas, is the leading technology for producing high-purity, spherical nickel powders necessary for sensitive applications like 3D printing and fuel cells. Plasma atomization offers even greater purity but is reserved for ultra-high-end superalloys due to higher costs.

What major restraints affect the market profitability of metallic powders?

The most significant restraint is the extreme volatility and unpredictability of raw material pricing, particularly the LME Nickel price, which directly impacts procurement costs and profitability. Additionally, the high energy consumption and stringent quality control requirements for advanced powder grades add complexity.

Where is the largest consuming market for standard iron powder volumes?

The largest consuming market for high-volume, standard-grade iron powders remains the traditional Powder Metallurgy (PM) industry, primarily centered in the global automotive sector for manufacturing precision sintered components such as gears, cams, and structural brackets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager