Nicotine Gums and Lozenges Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434747 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Nicotine Gums and Lozenges Market Size

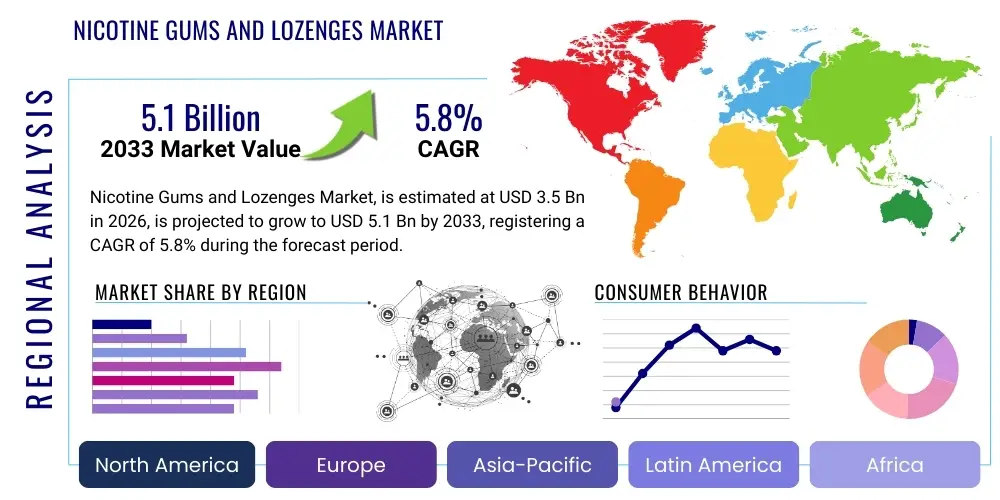

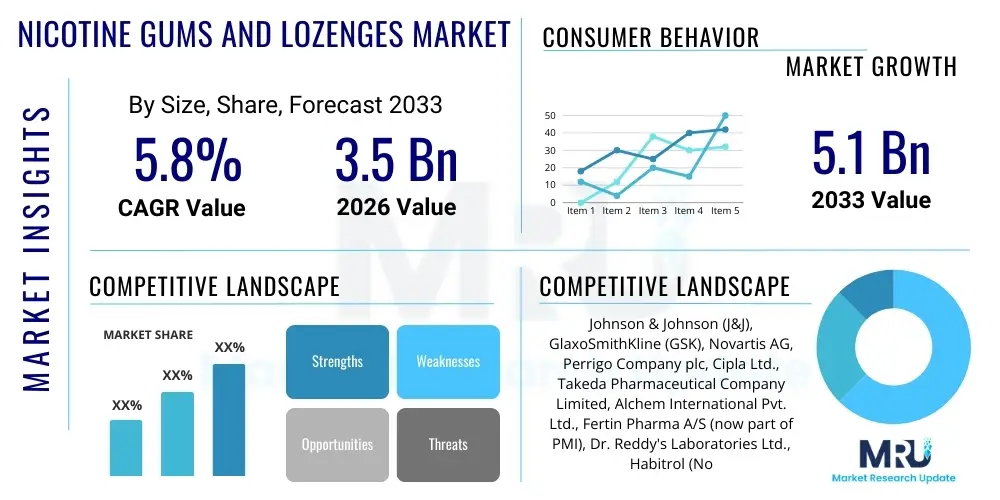

The Nicotine Gums and Lozenges Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.1 Billion by the end of the forecast period in 2033.

Nicotine Gums and Lozenges Market introduction

The Nicotine Gums and Lozenges Market constitutes a pivotal segment within the broader Nicotine Replacement Therapy (NRT) landscape, providing critical aids for smoking cessation. These products are scientifically designed to deliver therapeutic doses of nicotine to the body without the harmful carcinogens found in tobacco smoke. Nicotine gums, which require specialized chewing techniques (chew and park), and lozenges, which dissolve slowly in the mouth, address the physiological dependence on nicotine, mitigating withdrawal symptoms and increasing the likelihood of successful quitting attempts. The primary application of these products is in healthcare and consumer wellness settings, serving individuals motivated to discontinue tobacco use. Their accessibility as over-the-counter (OTC) products in many jurisdictions has significantly contributed to their market penetration and acceptance as a mainstream method for managing nicotine addiction.

The core benefit driving the widespread adoption of nicotine gums and lozenges is their proven clinical efficacy in doubling the quit rate compared to placebo, coupled with their discrete usability. Unlike patches or inhaled nicotine products, gums and lozenges offer an oral fixation component, addressing both the chemical dependency and the behavioral aspects associated with smoking. Furthermore, the variable dosage options available, typically ranging from 2 mg to 4 mg of nicotine, allow users to tailor their therapy based on their level of addiction, providing a personalized approach to cessation. This customization capability enhances patient compliance and improves overall outcomes, positioning these products as a highly flexible solution in the global fight against tobacco use. Driving factors include intensifying anti-smoking campaigns by public health organizations and supportive governmental policies aimed at reducing the public health burden of smoking-related illnesses.

The market dynamics are further influenced by continuous product innovation, particularly in flavor profiles and aesthetic design, to enhance consumer appeal and overcome historical complaints regarding taste and texture. Manufacturers are investing heavily in research and development to create formulations that improve nicotine absorption rates while minimizing gastrointestinal side effects, which can sometimes occur with incorrect usage. The convenience factor of these oral dosage forms allows users to manage cravings instantly, making them a preferred option over prescription drugs that require strict schedules. As global smoking prevalence declines in developed nations, the focus shifts towards encouraging current smokers, especially heavy users, to adopt NRT, maintaining steady demand across key geographic areas like North America and Europe. This evolving consumer landscape necessitates ongoing adaptation in marketing and distribution strategies, emphasizing ease of access and effective patient education on usage protocols.

Nicotine Gums and Lozenges Market Executive Summary

The Nicotine Gums and Lozenges Market is experiencing robust expansion, primarily fueled by supportive governmental cessation programs and increasing health consciousness among consumers globally. A significant business trend observed is the growing diversification of product offerings, moving beyond traditional mint flavors to incorporate fruit, cinnamon, and specialty profiles to attract a broader consumer base, particularly younger demographics attempting to quit. The market structure remains competitive, dominated by established pharmaceutical companies that hold substantial patent protection and brand recognition in the NRT space, although rising demand has also created entry opportunities for private label and generic manufacturers, contributing to price stabilization and increased accessibility across various economic strata. Furthermore, the increasing integration of digital health solutions, such as companion apps and remote counseling integrated with NRT usage, represents a pivotal trend aimed at improving adherence rates and overall therapeutic success.

Regionally, North America and Europe currently represent the highest revenue share due to well-established regulatory frameworks, comprehensive healthcare coverage supporting cessation therapies, and high awareness levels regarding the dangers of tobacco use. However, the Asia Pacific region is projected to exhibit the fastest growth trajectory, driven by rapidly increasing smoking cessation rates in populous nations like China and India, coupled with rising disposable incomes making NRT products more affordable. Regional trends also show a distinct preference difference; while gums remain dominant in certain Western markets due to historical adoption, lozenges are rapidly gaining popularity globally for their perceived convenience and more discreet usage. Emerging markets are heavily influenced by the availability of low-cost NRT alternatives, necessitating localized competitive strategies focused on affordability and community-level educational outreach programs.

Segmentation trends reveal that the 4 mg dosage segment is registering the fastest growth, correlating with data indicating a higher proportion of heavy smokers seeking effective cessation aids, thereby requiring stronger initial nicotine replacement doses. In terms of distribution, the Over-The-Counter (OTC) segment, primarily through retail pharmacies and e-commerce platforms, maintains overwhelming dominance over prescription channels, highlighting the consumer preference for immediate self-treatment without medical intervention. E-commerce in particular is transforming the segment distribution landscape, offering greater privacy for purchases and comparative shopping capabilities. The transition of many NRT products from prescription-only to OTC status across major economies has been the most critical factor influencing current segmental distribution dynamics, making these products staple items in general retail environments and expanding market reach beyond clinical settings and specialized pharmacies, further accelerating volume growth.

AI Impact Analysis on Nicotine Gums and Lozenges Market

User queries regarding the impact of Artificial Intelligence (AI) on the Nicotine Gums and Lozenges Market predominantly center on personalized cessation protocols, efficiency improvements in clinical trials, and optimization of supply chains to prevent stockouts of critical therapeutic doses. Users are highly interested in how AI can move beyond simple tracking to genuinely personalize the NRT journey, specifically asking about AI algorithms analyzing usage patterns, craving triggers, and co-morbid substance use to recommend precise combinations of gum/lozenge dosages and flavors. There is also significant consumer interest in AI-driven chatbots and virtual assistants that provide 24/7 support and motivation, customizing motivational messages and cognitive behavioral therapy (CBT) techniques based on real-time biometric and self-reported data. Furthermore, manufacturers are exploring AI’s ability to predict future demand for specific dosage strengths or novel flavors, thereby optimizing production and reducing waste while ensuring therapeutic continuity for the consumer.

The application of AI extends significantly into the research and development phase, addressing critical pain points like the taste and texture of NRT products, which often lead to high rates of early discontinuation. AI-driven predictive modeling is being utilized to analyze millions of flavor compounds and texture agents, rapidly identifying combinations that mask the inherent bitterness of nicotine effectively and improve mouthfeel, significantly shortening the development cycle for new product launches. In clinical trials, AI assists in patient selection, predicting adherence rates based on historical data, and monitoring real-world usage through connected packaging or companion apps, providing richer, more accurate data sets for regulatory submissions. This capability not only speeds up the time-to-market for innovative formulations but also lowers the cost associated with traditionally lengthy and resource-intensive human trials, redirecting investment towards market expansion and patient access initiatives globally.

Ultimately, the key themes summarizing user expectations about AI’s influence revolve around enhanced efficacy, greater personalization, and improved consumer experience. Users expect AI to transform the cessation experience from a standardized regimen into a highly adaptive, individually tailored program that maximizes the chances of success. This shift demands sophisticated data integration between usage data, physiological response, and psychological triggers. The long-term expectation is that AI will make NRT products fundamentally more effective by addressing the major non-adherence challenge, which currently limits the real-world success rates of even the best cessation aids. The focus is moving from 'what product should I use?' to 'how should I use this product optimally for my unique needs?'—a question AI is poised to answer through data analytics.

- AI-Powered personalized dosage recommendation based on real-time craving analysis.

- Optimization of NRT supply chain and inventory management using predictive demand analytics.

- AI-driven flavor and formulation optimization to mask nicotine bitterness and improve palatability.

- Development of intelligent companion apps offering personalized behavioral support and motivation (CBT integration).

- Accelerated clinical trial recruitment and real-world evidence collection through machine learning algorithms.

- Automated regulatory compliance checks and risk assessment for new product market entry.

DRO & Impact Forces Of Nicotine Gums and Lozenges Market

The Nicotine Gums and Lozenges Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. Key drivers include stringent anti-smoking regulations enforced by health authorities worldwide, substantial government investment in public health campaigns promoting smoking cessation, and the clear clinical evidence demonstrating the safety and effectiveness of NRT products compared to continued smoking. The rising prevalence of chronic smoking-related diseases, such as COPD and lung cancer, acts as a continuous impetus for current smokers to seek cessation methods, directly driving demand for easily accessible, non-prescription aids like gums and lozenges. Furthermore, the expansion of healthcare access and insurance coverage for smoking cessation products in developed economies significantly lowers the financial barrier for consumers, making NRT a viable option for a wider socioeconomic demographic, thereby sustaining market growth momentum over the forecast period.

Conversely, the market faces several notable restraints. High upfront costs associated with a full NRT course compared to the immediate cost of cigarettes can deter consumers, particularly in low-income brackets, despite the long-term savings. The presence of common side effects, such as jaw pain (from gum) or hiccups and throat irritation (from lozenges), coupled with patient non-adherence due to misuse or poor taste, leads to discontinuation and reduced success rates, negatively impacting market perception. A significant competitive restraint is the rapid rise of alternative cessation methods, most notably prescription medications like varenicline and bupropion, and, controversially, the growing adoption of vaping products which, while not primarily cessation aids, are often used by consumers seeking a transition away from traditional cigarettes. Regulatory complexity across different regions regarding dosage limits, flavor restrictions, and classification (medical device vs. drug) also acts as a constraint, slowing down product introduction and market standardization.

Opportunities abound, centering primarily on geographical expansion into emerging economies where smoking rates are still high, and regulatory environments are evolving to support cessation. Product innovation represents a major opportunity, specifically the development of long-lasting, fast-acting, and highly palatable formulations that overcome current taste complaints, coupled with combination therapies integrating gum/lozenge usage with patches for comprehensive craving management. The shift towards preventive healthcare and wellness trends provides fertile ground for market penetration, positioning NRT not just as a treatment but as part of a broader wellness journey. Additionally, capitalizing on the vast potential of e-commerce and direct-to-consumer (D2C) models offers manufacturers a direct line to consumers, allowing for personalized marketing and educational delivery, essential for maximizing the therapeutic success of cessation aids in a competitive landscape.

Segmentation Analysis

The Nicotine Gums and Lozenges Market is primarily segmented based on Dosage Strength, Product Type, Distribution Channel, and End-User, reflecting the diverse needs and usage patterns of the global smoking cessation population. Analyzing these segments provides crucial insights into consumer behavior, pricing sensitivities, and optimal distribution strategies. The segmentation by Product Type, distinguishing between gums and lozenges, highlights differential preferences based on convenience, preferred delivery mechanism, and efficacy perception, with lozenges increasingly favored for their ease of use and discretion, particularly among office workers or those requiring frequent, immediate craving relief. The segmentation by Dosage Strength (2mg vs. 4mg) is critical for matching the product to the user's dependency level, directly impacting therapeutic success and market volume share distribution between light and heavy smokers. Understanding these internal market divisions is essential for strategic planning and targeted product development efforts by key industry stakeholders.

The Distribution Channel segmentation is arguably the most dynamic area, primarily divided between Over-The-Counter (OTC) sales and Prescription sales. The overwhelming dominance of the OTC channel underscores the consumer's self-directed approach to managing addiction, favoring accessibility through retail pharmacies, supermarkets, and increasingly, online platforms. The growth of e-commerce specifically represents a pivotal shift, allowing for easier procurement, comparative pricing, and access to subscriptions, bypassing the traditional healthcare system entirely for initial treatment. Analyzing the End-User segment, predominantly distinguishing between individuals seeking cessation and those using the products for harm reduction or temporary abstinence (e.g., in smoke-free environments), helps refine marketing messages, emphasizing either long-term cessation success rates or immediate relief from environmental restrictions. This intricate segmentation allows manufacturers to precisely align their offerings with specific consumer profiles, maximizing return on investment in product innovation and promotional activities.

Further granular analysis within these segments reveals specific opportunities. For instance, within the Product Type segment, flavored varieties drive higher initial adoption and adherence compared to traditional unflavored options, indicating that sensory characteristics are a major determinant of consumer choice. In the Dosage Strength segment, while 4mg holds strong value share due to higher pricing and heavy smoker reliance, the 2mg strength contributes significantly to volume due to its use in step-down regimens and for light to moderate smokers. These nuances dictate that successful market players must maintain a broad portfolio catering to the entire cessation journey, from high-dose initiation to low-dose maintenance. Future segmentation efforts will increasingly incorporate behavioral data, leveraging AI tools to segment users based on their likelihood of adherence and responsiveness to different support mechanisms, thus refining the targeting capabilities of cessation programs.

- By Product Type

- Nicotine Gums (2mg, 4mg)

- Nicotine Lozenges (2mg, 4mg, Mini Lozenges)

- By Dosage Strength

- 2 mg

- 4 mg

- Other Strengths (e.g., 1 mg, 3 mg formulations)

- By Distribution Channel

- Over-The-Counter (OTC)

- Retail Pharmacies

- Supermarkets/Hypermarkets

- E-commerce/Online Pharmacies

- Prescription

- Over-The-Counter (OTC)

- By Flavor

- Mint/Menthol

- Fruit

- Cinnamon

- Unflavored/Original

Value Chain Analysis For Nicotine Gums and Lozenges Market

The value chain for the Nicotine Gums and Lozenges Market begins with the upstream activities centered on the sourcing and purification of pharmaceutical-grade nicotine, often derived from tobacco plants or, increasingly, produced synthetically to meet purity standards and regulatory requirements. Key upstream processes involve rigorous quality control of raw materials, including bulk excipients, flavoring agents, and polymers necessary for gum base or lozenge formulation. Due to the stringent nature of pharmaceutical production (even for OTC NRT), suppliers must adhere to Good Manufacturing Practices (GMP) and maintain reliable supply continuity, especially for high-purity nicotine. This upstream segment is characterized by specialized chemical manufacturing, high capital investment in processing facilities, and a dependency on reliable agricultural or synthetic sources, directly impacting the final cost structure and consistency of the therapeutic product.

The midstream segment involves the core manufacturing, formulation, and primary packaging of the final dosage form. This stage is dominated by specialized pharmaceutical manufacturers who possess the proprietary technology required to embed nicotine consistently within the gum base or lozenge matrix, ensuring predictable release kinetics and stability over the product's shelf life. Quality assurance and regulatory compliance checks form a continuous, intensive part of this stage, as slight deviations can alter the therapeutic effectiveness and safety profile. Packaging design focuses on child resistance, portability, and attractive branding to facilitate successful OTC sales. The efficiency of the manufacturing process—including high-speed tablet pressing for lozenges and complex mixing/curing for gums—is critical in determining the final production cost per unit and the overall responsiveness to market demand fluctuations.

The downstream activities involve distribution and final sales. Distribution channels are highly varied, encompassing direct sales to major pharmacy chains and wholesalers, sales through specialized pharmaceutical distributors, and increasingly, direct-to-consumer (D2C) fulfillment via e-commerce platforms. The dominance of the indirect channel, particularly large retail chains, grants them significant bargaining power regarding shelf placement and promotional pricing. Direct distribution through online channels, however, offers manufacturers higher margin potential and better access to consumer data, enabling precise demand forecasting and personalized customer engagement. Marketing and promotion, particularly focused on educating consumers about proper usage and maximizing therapeutic benefits, conclude the value chain, ensuring that the high efficacy of the product translates into successful real-world cessation rates and sustained brand loyalty among users.

Nicotine Gums and Lozenges Market Potential Customers

The primary cohort of potential customers for the Nicotine Gums and Lozenges Market consists of adult smokers who are motivated and actively planning to quit tobacco use within the next 30 to 90 days. This group is often categorized by their level of nicotine dependence, with heavy smokers (consuming 20 or more cigarettes per day) typically targeting the 4 mg dose, and moderate or light smokers preferring the 2 mg dose, frequently utilizing these products as the foundational element of their smoking cessation plan. These individuals are actively seeking accessible, proven, and self-managed aids that address intense physiological cravings while providing a degree of oral substitution. This customer segment places high value on convenience, speed of craving relief, and discreet usage, making gums and lozenges particularly appealing over visible delivery methods like patches or inhalers. Marketing efforts directed towards this group emphasize efficacy rates and the ease of incorporating NRT into daily life.

A secondary, yet rapidly expanding, segment of potential customers includes smokers who are not actively pursuing permanent cessation but are engaged in harm reduction strategies or temporary abstinence. This encompasses individuals who use NRT products to manage cravings during periods when smoking is restricted, such as long flights, non-smoking workplaces, or extended social events. While this usage pattern deviates from the intended cessation goal, it still drives significant market volume, particularly for lower-dose or flavored lozenges that are perceived as less clinical. This group is highly sensitive to product attributes like taste and texture and is less concerned with long-term adherence protocols. Furthermore, healthcare professionals, including primary care physicians, pharmacists, and specialized cessation counselors, are crucial potential customers as they act as key intermediaries, recommending and prescribing these products, underscoring the necessity for robust medical education and professional outreach programs.

The third significant customer segment encompasses long-term users of NRT, sometimes referred to as 'nicotine maintainers.' These individuals have successfully quit smoking but continue to use gums or lozenges for extended periods (sometimes years) to prevent relapse, often utilizing the lowest dose available. Although less common, this segment represents a stable, continuous demand stream. Finally, the growing population of electronic cigarette users attempting to step down their nicotine intake or transition completely away from vaping forms a new, high-potential segment. As regulators increasingly scrutinize the long-term health effects of vaping, a subset of e-cigarette users are turning back to established, pharmaceutically regulated NRT products like gums and lozenges for a controlled, medically recognized path to nicotine abstinence. Targeting this segment requires specialized marketing that addresses the unique behavioral patterns developed during their time as vapers, emphasizing the proven track record of NRT.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson (J&J), GlaxoSmithKline (GSK), Novartis AG, Perrigo Company plc, Cipla Ltd., Takeda Pharmaceutical Company Limited, Alchem International Pvt. Ltd., Fertin Pharma A/S (now part of PMI), Dr. Reddy's Laboratories Ltd., Habitrol (Novartis Consumer Health), Pfizer Inc., McNeil Consumer Healthcare, Rusan Pharma Ltd., BGP Products (Viatris Inc.), Revolymer (now part of Aptar Pharma), Torrent Pharmaceuticals Ltd., Amneal Pharmaceuticals Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nicotine Gums and Lozenges Market Key Technology Landscape

The technological landscape of the Nicotine Gums and Lozenges Market is predominantly defined by specialized drug delivery systems and formulation technologies aimed at controlling the release profile of nicotine and improving patient sensory acceptance. Key advancements focus on microencapsulation techniques and advanced polymer matrix systems. Microencapsulation, for instance, is crucial for wrapping nicotine molecules, protecting them from degradation, and most importantly, masking the inherently harsh and bitter taste of pure nicotine, which historically has been a major cause of non-adherence. This technology allows for the creation of smoother, more palatable products that appeal to modern consumers. Furthermore, the selection and blending of various gum base polymers (e.g., polyisobutylene, butyl rubber) or lozenge excipients (e.g., mannitol, xylitol) are highly technical processes that dictate the physical characteristics, dissolution rate, and overall mouthfeel, distinguishing premium products from standard generic offerings in the marketplace.

Another area of intense technological focus is the development of fast-acting and sustained-release capabilities within the oral dosage forms. While standard gums and lozenges rely on buccal absorption, technological breakthroughs are centered on optimizing the pH environment in the mouth to maximize the permeability of nicotine across the mucous membranes, ensuring rapid delivery to quell acute cravings quickly. This involves incorporating specific buffers, such as sodium carbonate or sodium bicarbonate, into the formulation. For lozenges, the technology emphasizes high-pressure tableting and granulation techniques to ensure structural integrity while maintaining a consistent dissolution profile over a set period, offering a controlled, steady stream of nicotine. Innovation in packaging technology also plays a vital role, including advanced blister packs and containers designed to maintain product stability and freshness over extended shelf life, especially important for OTC products stored under varying environmental conditions.

Looking ahead, the technological landscape is increasingly incorporating digital integration to enhance therapeutic outcomes. The development of 'smart' NRT products, although nascent, involves embedding sensors or utilizing specialized packaging that connects to smartphone applications via Bluetooth. This connectivity allows for precise tracking of consumption patterns, dosage adherence, and correlations between usage and reported cravings, providing rich data for both the user and the manufacturer. This digital layer facilitates personalized coaching and adherence reminders, leveraging data analytics to optimize the cessation plan in real-time. This blend of pharmaceutical formulation mastery with digital technology represents the forefront of innovation, ensuring that the physical product is supported by a robust, intelligent ecosystem designed to maximize the patient's likelihood of achieving long-term nicotine abstinence. These technological investments are crucial for maintaining market competitiveness and efficacy claims against alternative cessation methods.

Regional Highlights

The global Nicotine Gums and Lozenges Market exhibits distinct regional dynamics driven by varying regulatory environments, smoking prevalence rates, and healthcare expenditure priorities. North America, particularly the United States and Canada, remains the largest revenue contributor. This dominance is attributable to high consumer awareness, widespread insurance coverage for NRT, and well-established distribution channels, notably large retail pharmacies and drugstores. Aggressive marketing campaigns and continuous product introductions by major pharmaceutical players also ensure a steady replacement rate of the smoking population turning to cessation aids. The regulatory environment strongly supports OTC access to NRT, further cementing the region’s market leadership.

Europe holds a strong second position, characterized by high adoption rates in Western European countries like the UK, Germany, and France, often underpinned by robust national health services that subsidize or fully cover NRT products as part of comprehensive smoking cessation strategies. However, the European market is highly fragmented, with diverse national regulations governing flavor approvals and advertising standards, requiring manufacturers to tailor product portfolios and marketing messaging specifically for each country. Central and Eastern Europe present considerable growth opportunities as smoking rates remain higher than the West and governments begin implementing stricter anti-smoking policies, increasing the demand for accessible NRT solutions.

The Asia Pacific (APAC) region is projected to be the fastest-growing market over the forecast period. This accelerated growth is primarily driven by the enormous population base of smokers in countries such as China, India, and Indonesia. While NRT adoption traditionally lagged due to lower awareness and accessibility barriers, rising disposable incomes, improving healthcare infrastructure, and escalating governmental efforts to combat tobacco use are rapidly changing the landscape. Manufacturers are focusing on localized marketing strategies, educational initiatives, and adapting pricing points to make NRT affordable and competitive against illicit or unregulated tobacco alternatives, making APAC a crucial future revenue stream.

- North America: Dominant market share fueled by strong regulatory support, extensive OTC distribution, and high consumer awareness of cessation programs. The US maintains high volume sales of both 2mg and 4mg dosages.

- Europe: High adoption rates driven by government subsidies and integration of NRT into national healthcare cessation services, particularly in Western European nations. Focus on specific flavor preferences and compliance with stringent EU product standards.

- Asia Pacific (APAC): Highest growth potential due to large smoking populations in developing economies. Market expansion focuses on increasing affordability, localized product offerings, and public health education campaigns.

- Latin America (LATAM): Emerging market characterized by increasing regulatory scrutiny on smoking and gradual economic improvement, leading to rising uptake of NRT, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): Nascent but growing market, constrained by regulatory barriers and lower general health expenditure. Growth is concentrated in Gulf Cooperation Council (GCC) countries due to high disposable income and expatriate populations adopting Western health habits.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nicotine Gums and Lozenges Market.- Johnson & Johnson (J&J)

- GlaxoSmithKline (GSK)

- Novartis AG

- Perrigo Company plc

- Cipla Ltd.

- Takeda Pharmaceutical Company Limited

- Alchem International Pvt. Ltd.

- Fertin Pharma A/S (now part of PMI)

- Dr. Reddy's Laboratories Ltd.

- Habitrol (Novartis Consumer Health)

- Pfizer Inc.

- McNeil Consumer Healthcare

- Rusan Pharma Ltd.

- BGP Products (Viatris Inc.)

- Revolymer (now part of Aptar Pharma)

- Torrent Pharmaceuticals Ltd.

- Amneal Pharmaceuticals Inc.

- Stada Arzneimittel AG

- Hikma Pharmaceuticals PLC

- Sandoz (Novartis subsidiary)

Frequently Asked Questions

Analyze common user questions about the Nicotine Gums and Lozenges market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between nicotine gums and lozenges, and which is more effective?

Nicotine gums require specific chewing (chew and park method) and offer an oral fixation substitute, while lozenges dissolve slowly in the mouth without chewing. Both delivery mechanisms are clinically proven forms of NRT with comparable effectiveness in doubling quit rates, but lozenges are often considered more discreet and easier to use, leading to slightly better adherence rates among some users who struggle with the taste or technique required for gum.

How is the growth of the Nicotine Gums and Lozenges Market affected by the rise of vaping products?

The rise of vaping products introduces significant competition, especially in the harm reduction segment, partially restraining the growth of traditional NRTs. However, NRT gums and lozenges maintain a strong position due to their pharmaceutical regulation, established safety profile, and proven track record as cessation aids, particularly among consumers who distrust unregulated e-cigarette products or require clinical guidance for quitting.

What dosage strength (2mg or 4mg) should consumers typically choose?

The choice between 2mg and 4mg dosage strength depends on the individual's level of nicotine dependence. Generally, heavy smokers consuming their first cigarette within 30 minutes of waking are recommended to start with the 4mg strength, whereas light or moderate smokers (first cigarette after 30 minutes) should begin with the 2mg dose. Starting with the appropriate dose is critical for managing withdrawal symptoms effectively and maximizing the chance of long-term cessation success.

Which geographical region is expected to drive the fastest future growth for these products?

The Asia Pacific (APAC) region is projected to drive the fastest future growth. This accelerated trajectory is due to massive smoking populations, rapidly improving healthcare access, and increasing government interventions aimed at controlling tobacco consumption in large economies like China and India, creating enormous untapped potential for OTC NRT market penetration.

What technological innovations are currently impacting the palatability and efficacy of nicotine gums and lozenges?

Key technological innovations focus on microencapsulation and advanced polymer matrices. Microencapsulation technology effectively masks the bitter taste of nicotine, significantly improving palatability and adherence. Additionally, buffered formulations that optimize oral pH levels are used to maximize the buccal absorption rate, ensuring quicker relief from cravings compared to earlier, less advanced NRT formulations, thereby enhancing overall therapeutic efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager