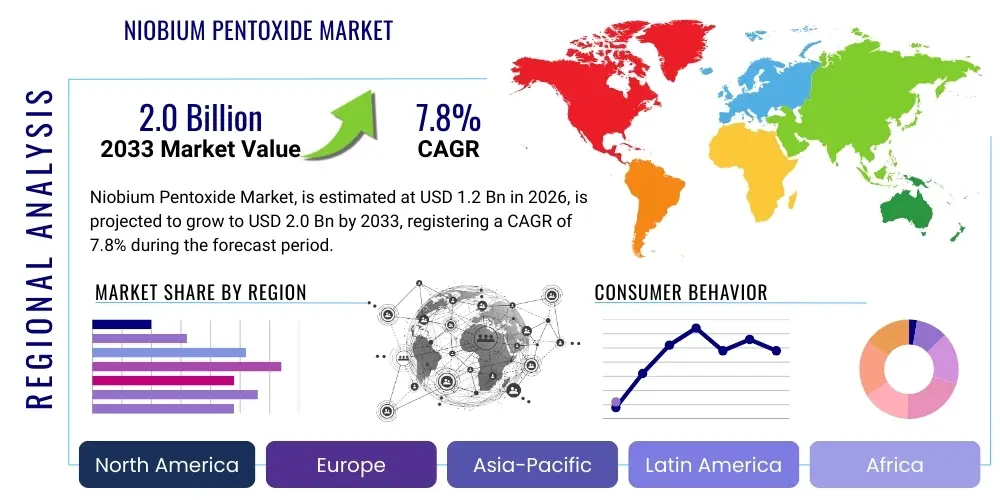

Niobium Pentoxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435987 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Niobium Pentoxide Market Size

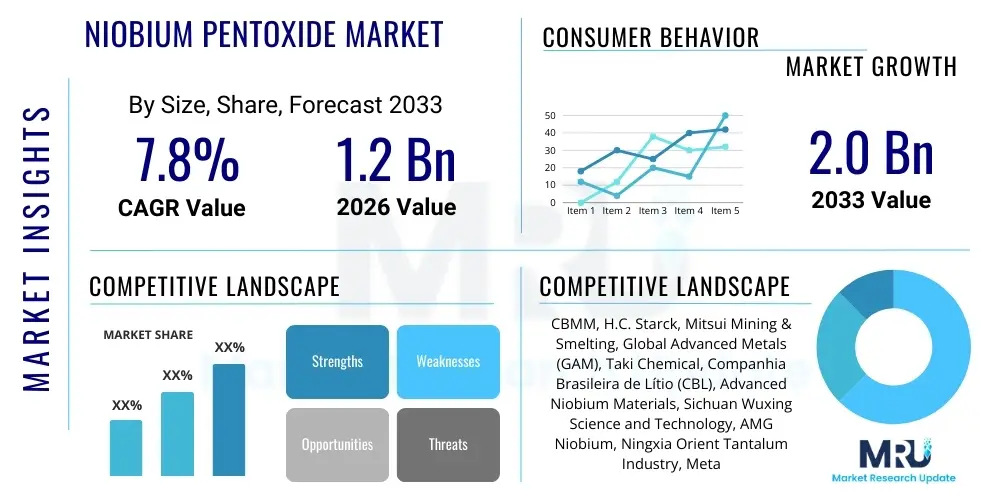

The Niobium Pentoxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.0 Billion by the end of the forecast period in 2033.

Niobium Pentoxide Market introduction

Niobium Pentoxide (Nb₂O₅) is a highly stable inorganic compound, primarily known for its high dielectric constant, thermal stability, and semiconductor properties, making it indispensable across several high-technology sectors. It is typically derived from the processing of Niobium ores such as columbite and pyrochlore, undergoing refining and calcination processes to achieve various purity grades necessary for specific end-use applications. The increasing sophistication required in miniaturized electronic components and the concurrent global pivot toward advanced energy storage solutions are central drivers shaping the current market landscape. Nb₂O₅ serves as a critical functional material, essential for manufacturing high-performance electronic components and advanced optical systems, reflecting its unique position in the specialty chemicals market.

The product is commercially available in various grades, including high-purity (>99.99%) material utilized in superconducting alloys and electro-optic devices, and industrial grades used in the formulation of specialized glasses and pigments. Major applications leverage its high dielectric constant, notably in multilayer ceramic capacitors (MLCCs) and other advanced memory devices, which are fundamental to the operation of modern communication infrastructure, 5G networks, and consumer electronics. Furthermore, the role of Niobium Pentoxide as a precursor material for producing ferroniobium and high-pstrength steel alloys, although indirect, sustains demand from the metallurgical sector.

Key benefits driving market adoption include its chemical inertness, high melting point, and excellent catalytic activity, particularly in processes involving hydrogenation and oxidation. The primary driving factors for market expansion are the exponential growth of the global electronics industry, driven by digitalization and IoT proliferation, and the accelerating investments in electric vehicle (EV) battery technology, where Niobium Pentoxide is explored as an anode material to enhance charging speed and cycle life. Geopolitical stability regarding sourcing, coupled with technological advancements in purification methods that improve yield and quality, further influences supply dynamics and market profitability, positioning Nb₂O₅ as a strategic material for future technological evolution.

Niobium Pentoxide Market Executive Summary

The Niobium Pentoxide market is experiencing robust growth fueled by transformative shifts in electronics and energy storage sectors globally. Business trends indicate a strong emphasis on supply chain security and vertical integration among major producers to mitigate risks associated with raw material sourcing, predominantly centered in Brazil and Canada. There is a discernible trend toward the development of ultra-high purity grades (4N to 5N) to meet stringent quality requirements set by semiconductor and aerospace manufacturers. Strategic partnerships between Niobium miners and specialized chemical processors are becoming commonplace to optimize the conversion process and cater to customized requirements from high-growth sectors such as advanced battery manufacturing, which demands highly consistent and specialized powders.

Regional trends highlight the Asia Pacific (APAC) region as the primary consumption hub, driven by massive manufacturing bases for consumer electronics, automotive components, and solar energy infrastructure, particularly in China, South Korea, and Japan. North America and Europe demonstrate significant demand, focused on specialized high-value applications, including advanced aerospace alloys, defense systems, and high-frequency communication devices. Investment in R&D, particularly concerning Niobium Pentoxide's integration into solid-state battery electrolytes and high-k gate dielectrics, is concentrated in these developed regions. Furthermore, environmental regulations are subtly influencing production methods, encouraging lower energy consumption in processing and promoting responsible sourcing practices.

Segment trends reveal that the Capacitors/Electronics application segment maintains the largest market share due to ubiquitous demand for MLCCs and advanced memory chips; however, the Lithium-Ion Batteries segment is poised for the highest Compound Annual Growth Rate (CAGR). Within the Purity segment, the high-purity (99.99%) grade is gaining traction, reflecting the move towards higher performance and smaller-sized components across all end-use industries. The Aerospace & Defense end-use industry remains a stable, high-value consumer, demanding highly specialized Niobium Pentoxide for superalloys and ceramic composites designed for extreme operating conditions. These combined trends underscore a shift in market focus from purely bulk industrial applications toward sophisticated, performance-critical material science requirements, sustaining high profit margins for specialized suppliers.

AI Impact Analysis on Niobium Pentoxide Market

User queries regarding AI's influence on the Niobium Pentoxide market predominantly revolve around three key themes: optimization of production processes, prediction of raw material price volatility, and the creation of demand through advanced electronic applications. Users frequently ask how AI can enhance the efficiency of refining rare earth metals and derivatives like Niobium Pentoxide, specifically targeting energy consumption and yield optimization in complex chemical processes. Another major concern relates to using machine learning algorithms to forecast demand fluctuations driven by the highly cyclical nature of the semiconductor industry, a significant consumer of Nb₂O₅. Furthermore, there is substantial interest in how AI-driven simulation and material science platforms are accelerating the discovery and development of novel Niobium-based compounds for next-generation computing hardware, such as quantum processors and high-k dielectrics necessary for advanced AI chipsets.

The core expected impact of Artificial Intelligence deployment across the Niobium Pentoxide value chain centers on improving operational efficiency and driving technological innovation that creates new, high-demand applications. In the upstream mining and refining stages, AI algorithms are being integrated for predictive maintenance of complex machinery, optimizing flotation and separation processes, and analyzing sensor data in real-time to maintain strict quality control on purity levels, which is crucial for electronic applications. Downstream, AI-powered computational material science is dramatically reducing the time and cost associated with synthesizing and testing new Nb₂O₅ formulations for enhanced capacitor performance or faster-charging battery anodes, directly accelerating product development cycles in key consuming industries. This confluence of operational optimization and accelerated innovation positions AI as a multiplier effect on both supply efficiency and market demand.

- AI-driven optimization of chemical refining parameters enhances Niobium Pentoxide yield and reduces energy costs.

- Machine learning algorithms improve raw material price forecasting, mitigating supply chain risk for manufacturers.

- AI-enabled material design speeds up the discovery of novel Nb₂O₅ applications in advanced high-k dielectrics and ferroelectric memory (FeRAM).

- Predictive maintenance in processing plants minimizes downtime, ensuring consistent supply of high-purity grades.

- Increased demand for AI infrastructure (data centers, advanced GPUs) drives consumption of Nb₂O₅ in high-performance capacitors and semiconductors.

DRO & Impact Forces Of Niobium Pentoxide Market

The Niobium Pentoxide market is shaped by significant drivers stemming from technological advancements, offset by intrinsic restraints related to supply concentration and processing complexities, while vast opportunities emerge from the transition to sustainable energy technologies. The fundamental driving force is the relentless demand for smaller, more powerful electronic devices, necessitating materials with superior dielectric properties—a role ideally filled by Nb₂O₅ in MLCCs and thin-film memory devices. Conversely, the market’s primary restraint involves the highly concentrated supply of Niobium ore, with a few key geographical regions controlling the majority of global production, creating potential geopolitical vulnerabilities and price manipulation risks. Opportunities are particularly salient in energy storage, where Nb₂O₅ offers improved thermal stability and fast-charging capability when utilized in lithium-ion and solid-state batteries, paving the way for mass adoption in the EV sector.

Impact forces acting upon this market are multilayered, affecting both cost structures and competitive dynamics. The substitution impact is moderate; while certain applications, particularly in catalysis, might utilize alternatives like Tantalum or Zirconium compounds, Niobium Pentoxide’s unique combination of high dielectric constant and thermal stability makes it difficult to replace entirely in cutting-edge electronics. The intensity of rivalry among existing competitors is moderate to high, primarily segmented by product purity; specialized suppliers compete intensely for high-margin, ultra-high-purity contracts, while bulk producers focus on efficiency and scale for industrial applications. The bargaining power of buyers is significant in large-volume sectors like electronics manufacturing and aerospace, where procurement decisions are heavily influenced by stringent quality specifications and long-term supply contracts, demanding cost-efficiency from suppliers.

Technological change serves as a critical impact force, constantly creating and shifting demand centers. Innovations in thin-film deposition techniques, such as Atomic Layer Deposition (ALD), are making the integration of Niobium Pentoxide layers into advanced semiconductor architecture more precise and cost-effective, thus expanding its potential addressable market. Furthermore, sustainability pressures represent an emerging force, prompting both producers and consumers to ensure ethical sourcing and environmentally sound processing methods, potentially increasing short-term production costs but strengthening long-term market access. These forces together dictate the strategic roadmap for market participants, emphasizing R&D investment and geopolitical risk management as crucial success factors in this specialized commodity market.

Segmentation Analysis

The Niobium Pentoxide market is broadly segmented based on Purity Grade, which fundamentally dictates its applicability and price point; Application, reflecting its diverse end-use functional roles; and End-Use Industry, indicating the final consumer sector. High-purity grades are essential for sensitive electronic components and optical systems where minute impurities can significantly degrade performance, commanding premium pricing. Conversely, industrial grades are employed in larger volume applications such as glass manufacturing and pigment production where tolerance for impurities is higher. The segmentation reflects the highly specialized nature of the material, requiring manufacturers to maintain diverse product portfolios to serve distinct technological niches, from high-performance aerospace ceramics to mass-produced consumer electronics.

- Purity Grade

- 99.9% (3N Grade)

- 99.99% (4N Grade)

- 99.999% (5N Grade and above)

- Industrial Grade

- Application

- Capacitors and Electronics (MLCCs, Sensors)

- Optical Glass and Lenses

- Catalysts and Chemical Processing

- Superalloys and Special Ceramics

- Pigments and Coloring Agents

- Lithium-Ion and Solid-State Batteries

- End-Use Industry

- Electronics and Semiconductors

- Aerospace and Defense

- Chemical Processing and Petrochemicals

- Automotive (EVs and traditional)

- Glass and Ceramics

- Medical Devices

Value Chain Analysis For Niobium Pentoxide Market

The Niobium Pentoxide value chain begins with the upstream activities centered on the mining and concentration of Niobium-bearing ores, primarily pyrochlore and columbite, which are geographically constrained, impacting initial supply dynamics. This raw material is then subjected to complex chemical processing, including fluorination, solvent extraction, and precipitation, followed by calcination to produce high-purity Niobium Pentoxide powder. This refining stage is energy-intensive and requires significant technical expertise to achieve the stringent purity levels demanded by the electronics and optical sectors, representing a major value addition point. Midstream focuses on intermediate product suppliers and specialized chemical companies that convert crude Niobium compounds into tailored powder specifications (e.g., specific particle size distribution and crystal structure) required by various downstream manufacturers.

The downstream segment involves the incorporation of Nb₂O₅ into final products. Direct channels include sales to large original equipment manufacturers (OEMs) in the aerospace industry for high-temperature superalloys, or direct supply agreements with major capacitor manufacturers for thin-film deposition. Indirect distribution channels utilize specialized distributors and chemical brokers who manage logistics and inventory for smaller end-users across diverse geographies, particularly those in the catalysts and specialty glass sectors. Due to the high value and sensitive nature of the material, efficient inventory management and adherence to strict international trade regulations are paramount across all distribution methodologies. The close technical collaboration between refined Niobium Pentoxide suppliers and component manufacturers further characterizes the downstream phase, ensuring material compatibility with cutting-edge manufacturing processes.

Understanding the value chain highlights the critical role of refining technology in determining market competitiveness. Companies that control both the raw material source (upstream integration) and possess proprietary, energy-efficient refining technologies (midstream capability) typically enjoy superior cost advantages and supply reliability. The technical complexity of the product means that direct sales (B2B) involving technical consultation are preferred for high-purity grades, while indirect distribution supports market penetration into dispersed industrial applications. The concentration of both mining and advanced refining processes creates significant barriers to entry, reinforcing the dominance of established players who can consistently guarantee product quality and manage the volatile supply risks inherent to rare metal derivatives.

Niobium Pentoxide Market Potential Customers

The primary potential customers and end-users of Niobium Pentoxide are large multinational corporations operating within the high-technology manufacturing spectrum, primarily seeking materials for enhanced performance and miniaturization. These buyers typically fall into categories such as advanced electronics manufacturers who use Nb₂O₅ as a high-k dielectric in capacitors and non-volatile memory chips (like FeRAM), crucial for 5G devices, servers, and consumer electronics. Another significant customer base includes aerospace and defense contractors that require Niobium Pentoxide as a precursor for vacuum-grade Niobium metal and high-performance superalloys essential for jet engine components, rocket nozzles, and high-temperature structural parts, where reliability is non-negotiable.

Beyond these high-tech sectors, the rapidly expanding electric vehicle (EV) industry represents a high-potential customer segment. EV battery manufacturers are keenly investigating Niobium Pentoxide's capability to improve lithium-ion battery characteristics, particularly enhancing thermal runaway resistance and enabling ultra-fast charging capabilities, appealing directly to mass-market consumer needs. Chemical processors and catalyst manufacturers form another stable customer segment, purchasing industrial-grade Nb₂O₅ for use in heterogeneous catalysis in petrochemical refining and specific organic synthesis reactions, leveraging its stability and surface area characteristics. For these buyers, consistency in particle size and pore structure is critical for maintaining catalytic efficiency.

In essence, the buying behavior of Niobium Pentoxide customers is characterized by stringent quality assurance protocols, long qualification cycles, and reliance on long-term supplier relationships. They prioritize suppliers who can guarantee geopolitical stability of sourcing, provide certificates of analysis confirming ultra-high purity, and offer technical support for integration into advanced manufacturing lines. Emerging customers in the solar energy and advanced materials science fields are looking for specialized powders for novel applications, such as thin-film solar cells and high-refractive-index optical coatings, indicating a future diversified customer portfolio relying on specific product grades tailored to their novel material specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CBMM, H.C. Starck, Mitsui Mining & Smelting, Global Advanced Metals (GAM), Taki Chemical, Companhia Brasileira de Lítio (CBL), Advanced Niobium Materials, Sichuan Wuxing Science and Technology, AMG Niobium, Ningxia Orient Tantalum Industry, Metalurgica de Berilo, Huajing Niobium, Jiujiang Non-Ferrous Metals, Shanghai Tankii New Materials, Pioneer Solutions, Treibacher Industrie AG, KEMET (Yageo), TANIOX. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Niobium Pentoxide Market Key Technology Landscape

The technological landscape surrounding the Niobium Pentoxide market is defined by advanced processing techniques crucial for achieving ultra-high purity levels and innovative application technologies utilizing its unique dielectric properties. Upstream technology focuses on efficient ore beneficiation and extraction methods, primarily solvent extraction and fractional distillation, aimed at separating Niobium from Tantalum and other impurities with high precision. Recent advancements include the deployment of membrane separation technologies and ion exchange resins that offer higher selectivity and reduced environmental impact compared to traditional hydrofluoric acid-based methods. These innovations directly contribute to reducing production costs and meeting the escalating demand for 5N (99.999%) purity grades essential for advanced semiconductor applications, ensuring minimal defect density in thin-film devices.

In the midstream processing segment, powder morphology control is a dominant technological focus. Manufacturers are increasingly utilizing precipitation techniques, such as controlled hydrolysis and hydrothermal synthesis, to precisely tailor the particle size, shape, and crystalline phase of Nb₂O₅ powders. This control is vital for optimizing the performance of Niobium Pentoxide when used as an additive in battery cathodes or as a precursor for ALD processes in chip manufacturing. Furthermore, vacuum thermal processing and controlled atmosphere sintering technologies are employed to ensure phase purity and superior thermal stability, particularly for materials destined for aerospace and high-temperature catalyst applications. The ability to customize the structural properties of the powder is a significant competitive differentiator in the market.

Downstream technology emphasizes integration methods, most prominently Atomic Layer Deposition (ALD) and Physical Vapor Deposition (PVD). ALD, specifically, is a breakthrough technology for the semiconductor industry, enabling the deposition of ultra-thin, highly conformal Niobium Pentoxide films with exceptional uniformity, critical for high-k gate dielectrics and advanced memory architectures. This precision allows device miniaturization while maintaining high capacitance density, directly supporting the scaling trends in semiconductor manufacturing (Moore's Law). Research is also heavily focused on incorporating Nb₂O₅ into solid-state battery electrolytes and high-performance glass ceramics (e.g., optical fibers and specialty lenses), leveraging its high refractive index and stability under aggressive environmental conditions, thereby expanding its application portfolio across multiple high-growth technology fronts.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the Niobium Pentoxide market, primarily due to the overwhelming presence of global electronics manufacturing hubs in countries like China, South Korea, Japan, and Taiwan. The region’s massive output of consumer electronics, 5G infrastructure components, automotive electronics, and a rapidly expanding EV market dictates high consumption of both industrial and ultra-high-purity Nb₂O₅ for capacitors and high-k dielectrics. China, in particular, acts as both a major producer (though secondary to Brazil in raw ore) and the largest consumer, utilizing Niobium Pentoxide extensively in its domestic semiconductor development programs and specialty glass manufacturing. The increasing investment in battery Gigafactories across Southeast Asia and China further solidifies APAC’s commanding market position, driven by localized production and competitive cost structures that favor large-scale deployment of Niobium-enhanced materials.

- North America: North America represents a market segment characterized by high value, high specification requirements, largely driven by the aerospace, defense, and advanced research sectors. Demand is focused heavily on ultra-high-purity grades for specialized applications such as satellite communication systems, military electronic warfare components, and high-performance superalloys manufactured primarily in the United States and Canada. The region also hosts leading semiconductor companies and material science research institutions that are driving innovation in next-generation solid-state battery technology and quantum computing, creating localized demand for experimental and highly specialized Niobium Pentoxide formulations. Supply chain resilience and geopolitical concerns mandate reliable, high-quality domestic or friendly-source procurement, often favoring specific global suppliers with transparent supply chains.

- Europe: The European market for Niobium Pentoxide is robust, underpinned by strong automotive and chemical industries, alongside significant research and development initiatives focused on sustainability and materials engineering. Germany, France, and the UK are key consumers, particularly in the manufacturing of high-quality optical glass, precision catalysts used in complex chemical synthesis, and specialized components for the renewable energy sector. Europe is also a leader in enforcing strict environmental and regulatory standards, which influences the procurement process, favoring suppliers who demonstrate sustainable mining and refining practices. The regional push toward electrification and sophisticated industrial digitalization ensures steady, quality-focused demand for Nb₂O₅ in high-performance capacitors and advanced battery research initiatives aiming for technological autonomy.

- Latin America (LATAM): LATAM’s relevance in the Niobium Pentoxide market is defined primarily by its substantial role in the upstream supply chain. Brazil is the undisputed global leader in Niobium ore mining and primary processing, supplying the vast majority of the world’s Niobium raw materials. While consumption within LATAM itself remains relatively low compared to APAC or North America, its strategic importance lies entirely in its resource control and export capabilities. Market dynamics in this region are heavily influenced by mining policies, infrastructural development related to transport, and international commodity pricing, making it a critical geopolitical factor for the global Niobium Pentoxide market's stability and overall cost structure.

- Middle East and Africa (MEA): The MEA market currently exhibits modest consumption, concentrated mainly in petrochemical catalyst applications and specialized construction materials. However, the region is emerging as a potential future consumer due to significant investments in industrial diversification, particularly in high-tech manufacturing, aerospace development (e.g., UAE's space program), and large-scale renewable energy projects (solar power). Growth in MEA will be paced by industrialization policies and the establishment of local electronics assembly and manufacturing capabilities, which will gradually increase the local demand for Niobium Pentoxide in both industrial and specialized applications, moving beyond simple raw material exports or rudimentary processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Niobium Pentoxide Market.- CBMM (Companhia Brasileira de Metalurgia e Mineração)

- H.C. Starck GmbH (Treibacher Industrie AG)

- Mitsui Mining & Smelting Co., Ltd.

- Global Advanced Metals (GAM)

- Taki Chemical Co., Ltd.

- Companhia Brasileira de Lítio (CBL)

- Advanced Niobium Materials (ANM)

- Sichuan Wuxing Science and Technology Co., Ltd.

- AMG Niobium

- Ningxia Orient Tantalum Industry Co., Ltd.

- Metalurgica de Berilo S.A.

- Huajing Niobium Industry Co., Ltd.

- Jiujiang Non-Ferrous Metals Co., Ltd.

- Shanghai Tankii New Materials Co., Ltd.

- Pioneer Solutions Co., Ltd.

- KEMET (Yageo Corporation)

- TANIOX GmbH

- Materion Corporation

- A.M.E.T. srl

- Alkane Resources Ltd.

Frequently Asked Questions

Analyze common user questions about the Niobium Pentoxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the Niobium Pentoxide Market growth?

The market growth is primarily driven by the escalating demand from the global electronics sector for high-performance capacitors (MLCCs) and semiconductors, alongside robust R&D investments in advanced lithium-ion and solid-state battery technologies requiring Niobium Pentoxide for enhanced charging speeds and safety.

In which applications is high-purity Niobium Pentoxide most critical?

High-purity Niobium Pentoxide (99.99% and above) is most critical in semiconductor manufacturing for high-k gate dielectrics, advanced optical coatings for precision lenses, and aerospace superalloys, where even minimal impurities can compromise material performance and device reliability.

Which geographical region dominates the consumption of Niobium Pentoxide?

The Asia Pacific (APAC) region dominates the consumption of Niobium Pentoxide, largely due to its concentrated electronics, automotive, and high-tech manufacturing bases, particularly in China, South Korea, and Japan, which utilize the material extensively in component production.

How does Niobium Pentoxide contribute to advancements in electric vehicle batteries?

Niobium Pentoxide is utilized in electric vehicle (EV) batteries to enhance thermal stability and enable ultra-fast charging capabilities. When incorporated into anode or cathode materials, it promotes better ion diffusion kinetics and structural integrity, improving overall battery life and performance.

What is the biggest supply chain risk facing the Niobium Pentoxide market?

The most significant supply chain risk is the high geographical concentration of Niobium ore reserves and primary processing facilities, with Brazil controlling a majority of the global raw material supply, making the market susceptible to geopolitical and logistical disruptions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager