Nipple disinfectant spray Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431371 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Nipple disinfectant spray Market Size

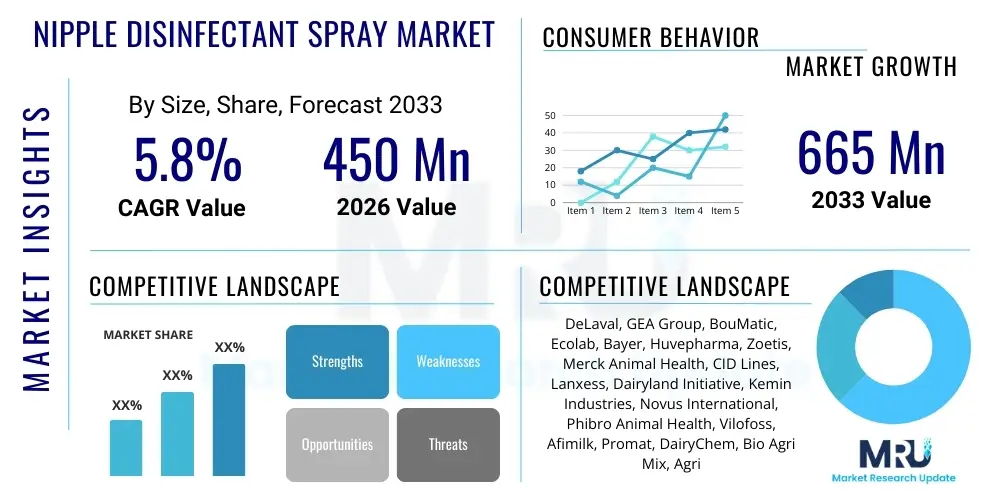

The Nipple disinfectant spray Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Nipple disinfectant spray Market introduction

The Nipple disinfectant spray market encompasses specialized chemical formulations designed to maintain udder hygiene in dairy cattle, significantly reducing the incidence of mastitis and other mammary infections. These products are crucial for ensuring milk quality and promoting the overall health and productivity of the herd. They typically contain active antimicrobial ingredients suchles as iodine (iodophors), chlorhexidine, or specialized acids, formulated for rapid action and minimal irritation to the delicate teat skin. The primary function involves eradicating pathogenic microorganisms immediately following milking (post-dipping) or preparing the teats before milking (pre-dipping), creating a critical protective barrier against environmental contaminants and microbial transfer during the milking process.

The product description highlights solutions available in ready-to-use spray or foam formats, offering convenience and efficiency compared to traditional dipping methods, especially in large-scale automated milking operations. These sprays often incorporate emollients and skin conditioners, such as glycerin or lanolin, to counteract the drying effects of disinfectants, thereby maintaining teat health and integrity. Major applications are predominantly centered around commercial dairy farming, where stringent hygiene protocols are mandated by regulatory bodies to comply with food safety standards. Furthermore, these disinfectants are used in cattle breeding facilities and veterinary clinics for therapeutic and preventive hygiene management.

The market benefits from significant drivers, particularly the increasing global demand for high-quality, safe dairy products and stringent regulatory environments governing milk production hygiene across developed and developing economies. Rapid adoption of advanced milking technologies and the continuous effort by farmers to minimize economic losses associated with mastitis—a major cost burden in the dairy industry—further propels market expansion. The long-term profitability of dairy operations is intrinsically linked to effective mastitis prevention, positioning nipple disinfectant sprays as an indispensable component of modern dairy management systems worldwide.

Nipple disinfectant spray Market Executive Summary

The Nipple disinfectant spray market exhibits robust growth driven by escalating global dairy production and heightened awareness regarding bovine health management. Current business trends indicate a strong shift toward formulations emphasizing sustainability, biological efficacy, and lower environmental impact, favoring non-iodine based solutions and naturally derived antiseptics. Key market players are investing heavily in research and development to create advanced barrier film technologies within the sprays, offering extended protection between milking cycles. Consolidation among major agricultural chemical suppliers and dairy equipment manufacturers is shaping the competitive landscape, aiming for integrated hygiene solutions that combine spraying apparatus with disinfectant products for maximized efficiency and ease of use on farms of various scales.

Regionally, North America and Europe maintain dominance, characterized by highly mechanized dairy industries and rigorous quality standards, necessitating premium hygiene products. However, the Asia Pacific region, led by rapidly expanding dairy sectors in India and China, is projected to register the highest growth rate due to the modernization of traditional farming practices and the subsequent increased demand for professional udder hygiene solutions. Economic factors, such as fluctuating raw material costs for antimicrobial agents, pose minor challenges, but the critical importance of mastitis control ensures stable pricing power for specialized, highly effective products across all geographies.

Segment trends reveal that the post-dipping application segment holds the largest market share, serving as the final and most critical step in preventing pathogen entry into the teat canal immediately after milking. Concurrently, there is rising momentum in the use of automated spray systems over manual application, particularly in large dairy farms, driving demand for specialized high-volume, low-viscosity spray formulations. The iodophor segment, while established, faces competition from chlorhexidine and innovative acid-based disinfectants, which are increasingly preferred for their broad-spectrum efficacy and reduced staining potential, catering to diverse farmer preferences and specific environmental challenges.

AI Impact Analysis on Nipple disinfectant spray Market

Common user questions regarding AI's impact on the nipple disinfectant spray market center around how technology can optimize application efficiency, predict disease outbreaks, and personalize hygiene protocols. Users are primarily concerned with the integration of AI-powered monitoring systems (like automated vision systems for teat condition assessment) with disinfectant spray usage. Key themes emerging include the potential for AI to minimize product wastage by adjusting spray volume based on individual cow needs or historical mastitis risk profiles, the reliability of AI algorithms in detecting subtle changes in teat health that necessitate immediate intervention, and the data privacy implications of collecting comprehensive milking and hygiene data. Expectations are high for AI to move the industry from reactive treatment to proactive, precision hygiene management, significantly enhancing efficiency and reducing the reliance on broad-spectrum applications.

- AI integration with robotic milking systems optimizes spray timing and coverage based on precise robotic arm positioning.

- Predictive analytics utilize environmental data and individual cow somatic cell counts (SCC) to forecast mastitis risk, guiding targeted disinfection frequency.

- Computer vision systems analyze teat integrity post-milking, signaling automated spray mechanisms only when required, minimizing disinfectant overuse.

- Machine learning processes refine formulation effectiveness by correlating specific disinfectant chemical compositions with real-world pathogen resistance trends observed on farms.

- Supply chain optimization using AI forecasting ensures timely delivery of hygiene products to high-demand regions, adjusting for seasonal milking cycles.

DRO & Impact Forces Of Nipple disinfectant spray Market

The dynamics of the Nipple disinfectant spray market are governed by a complex interplay of internal and external forces. The primary driving force (D) is the continuous pressure to control mastitis, which remains the most costly disease in the global dairy industry, compelling farmers to invest in high-quality preventative hygiene solutions. Furthermore, increasing consumer demand for milk produced under high animal welfare and hygiene standards globally necessitates rigorous adoption of disinfectant protocols. Restraints (R) mainly include the high initial cost associated with implementing automated spray systems, especially for smaller dairy operations, and potential concerns regarding chemical residue limits in milk, though modern formulations are engineered to mitigate this risk. Additionally, the emergence of antimicrobial resistance poses a long-term challenge, pushing R&D toward novel non-antibiotic antiseptic agents.

Opportunities (O) abound in developing sustainable, organic-certified, and natural ingredient-based disinfectants that align with growing consumer preference for organic dairy products. Geographic expansion into emerging economies, where traditional manual dipping methods are prevalent, offers significant scope for market penetration with cost-effective spray technologies. Strategic partnerships between chemical manufacturers and dairy technology providers to offer integrated, data-driven hygiene management solutions present another vital avenue for growth, focusing on precision application and waste reduction. The rising adoption of robotics in milking facilities naturally creates a demand for specialized, highly compatible spray formulations and hardware.

The overall impact forces are strongly positive, primarily dictated by economic necessity and regulatory mandate. The critical need for improved herd health (impact force 1) directly translates into resilient market demand, regardless of minor economic downturns in the agricultural sector. Regulatory stringency (impact force 2), particularly in regions enforcing strict standards on somatic cell count (SCC) in milk, acts as a perpetual market accelerator. However, price sensitivity among smaller farmers (impact force 3) exerts downward pressure on pricing in generic segments, fostering a dual market structure where premium, technologically advanced products coexist with commodity alternatives. Technological innovation remains the chief multiplier, constantly enhancing product safety and efficacy.

Segmentation Analysis

The Nipple disinfectant spray market is comprehensively segmented based on product type, application method, end-user type, and distribution channel, reflecting the diverse needs and operational scales within the dairy industry. This stratification allows manufacturers to tailor formulations and marketing strategies specifically. Product segmentation, covering iodophors, chlorhexidine compounds, and emerging acid-based or organic alternatives, is fundamental, as efficacy and cost vary significantly across these chemical categories. Application segmentation distinguishes between pre-dipping (cleaning prior to milking), which ensures pathogen removal, and post-dipping (disinfection after milking), which seals the teat canal and provides environmental protection, with post-dipping dominating volume sales due to its crucial role in mastitis prevention.

End-user segmentation differentiates between the scale and sophistication of farming operations, recognizing that large commercial dairy farms, utilizing advanced automation, prioritize high-volume, automated spray formulations, whereas smaller farms may rely on manual application methods and seek cost-efficiency. Furthermore, the segmentation by distribution channel highlights the critical role of veterinary pharmacies and specialized distributor networks in reaching the farming community, contrasted with the emerging role of direct online sales for standard bulk products. Understanding these segments is vital for effective market penetration and optimizing supply chain logistics within the highly specific agricultural environment.

- By Product Type: Iodophor-Based, Chlorhexidine-Based, Acid-Based, Non-Iodine/Non-Chlorhexidine (e.g., Lactic Acid, Hypochlorous Acid), Others.

- By Application: Pre-Dipping, Post-Dipping, General Udder Hygiene.

- By Formulation: Spray, Foam, Gel.

- By End-User: Large Commercial Dairy Farms, Small & Medium Dairy Farms, Veterinary Clinics and Hospitals, Cattle Breeding Centers.

- By Distribution Channel: Veterinary Pharmacies, Distributor Networks (Agricultural Suppliers), Direct Sales, Online Retail Channels.

Value Chain Analysis For Nipple disinfectant spray Market

The value chain for the Nipple disinfectant spray market begins with upstream activities involving the sourcing and procurement of key raw materials, primarily active pharmaceutical ingredients (APIs) such as iodine, chlorhexidine gluconate, and various acidulants, along with excipients like emollients (glycerin, lanolin), thickeners, and colorants. Suppliers of these commodity chemicals operate globally, impacting the manufacturing cost based on volatile petrochemical and commodity pricing. Manufacturers then engage in formulation and blending processes, which require specialized chemical expertise to ensure stability, safety, and optimal pH balance for effective antimicrobial action without causing teat irritation. Quality control is paramount at this stage to meet stringent regulatory standards imposed by agricultural and health authorities.

Midstream activities involve the conversion of formulated concentrates into end-user products, including packaging into specific volumes (e.g., drums, canisters, spray bottles) suitable for different farm sizes, and ensuring compliance with regional labeling requirements. Downstream analysis focuses on the distribution and sale of the finished products. The distribution channel is heavily reliant on specialized agricultural distributor networks and veterinary supply houses, which possess the necessary expertise and logistical infrastructure to handle bulk agricultural chemicals and provide technical support to farmers. Direct channels, facilitated by large-scale manufacturers, cater primarily to the largest commercial farms with established purchasing contracts, providing volume discounts and dedicated service.

Both direct and indirect distribution channels play crucial roles. Indirect channels, through independent distributors and veterinary pharmacies, serve as the primary route for reaching small to medium-sized farms, offering convenience and localized technical advice on product selection and application protocols. Direct distribution, on the other hand, ensures stringent control over product handling and provides manufacturers with direct feedback loops necessary for rapid product iteration and large-scale customized solutions. The efficiency of the downstream segment is critical, as the shelf life and correct storage conditions of chemical disinfectants directly affect their efficacy on the farm. Consequently, optimizing logistics and inventory management is a core competitive factor within this specialized agricultural value chain.

Nipple disinfectant spray Market Potential Customers

The primary end-users and buyers of nipple disinfectant spray products are entities directly involved in dairy production and bovine health maintenance. This group is dominated by commercial dairy farms, ranging from large, industrial-scale operations housing thousands of cattle to smaller, family-owned farms. Large commercial operations are high-volume consumers, often procuring products in bulk and utilizing advanced automated spraying or dipping equipment integrated into their robotic or conventional milking parlors, prioritizing efficacy, automation compatibility, and cost-efficiency per milking cycle. These customers view the disinfectant as a fundamental operating expense directly tied to milk quality premiums and veterinary costs avoidance.

The second major category of customers includes small and medium-sized dairy farms. Although their individual purchase volumes are lower, their collective demand forms a substantial part of the market. These end-users are often more price-sensitive and may rely on manual application methods, favoring formulations that offer ease of handling and multipurpose functionality. They typically purchase through local veterinary pharmacies or regional agricultural cooperatives, relying heavily on local experts for recommendations regarding the best product to combat common regional mastitis-causing pathogens and address specific seasonal challenges, such as environmental bacteria proliferation during wet seasons.

Furthermore, specialized segments such as veterinary clinics and hospitals represent important, albeit lower-volume, customers. These institutions use nipple disinfectants for therapeutic hygiene purposes, particularly in the treatment and post-operative care of bovine patients. Additionally, cattle breeding centers and research institutions require these products to maintain the highest standards of hygiene for their valuable genetics stock. These niche end-users prioritize high-efficacy, premium products regardless of cost, focusing on minimizing all possible risks of infection transmission and ensuring optimal animal welfare standards within controlled environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DeLaval, GEA Group, BouMatic, Ecolab, Bayer, Huvepharma, Zoetis, Merck Animal Health, CID Lines, Lanxess, Dairyland Initiative, Kemin Industries, Novus International, Phibro Animal Health, Vilofoss, Afimilk, Promat, DairyChem, Bio Agri Mix, Agri-Labs |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Nipple disinfectant spray Market Key Technology Landscape

The technology landscape for the Nipple disinfectant spray market is characterized by innovations aimed at enhancing efficacy, improving skin conditioning, and enabling precision application. In terms of chemical formulation technology, there is a pronounced focus on stabilizing active ingredients to maintain effectiveness across varying environmental temperatures and optimizing pH levels to reduce teat irritation, leading to the proliferation of buffered iodine and advanced quaternary ammonium compounds. A significant development is the incorporation of sophisticated film-forming agents, such as specialized polymers, which create a persistent physical barrier or seal over the teat orifice after milking. This barrier technology provides extended protection against environmental pathogens between milking sessions, surpassing the capabilities of simple liquid disinfectants.

Application technology represents another crucial area of innovation, particularly with the widespread adoption of robotic milking systems. This includes the development of sensor-driven, automated spray nozzles that ensure precise coverage of the entire teat surface while minimizing spray drift and product waste. Advanced systems often incorporate vision technology to detect teat position and size dynamically, adjusting the spray volume and angle accordingly. Furthermore, manufacturers are focusing on creating formulations specifically designed for use in automated systems—characterized by low viscosity and high solubility—to prevent clogging and ensure consistent machine performance, distinguishing them from traditional manual dipping solutions.

The convergence of digitalization and chemical delivery is fundamentally altering the technology landscape. New solutions involve smart monitoring systems that track disinfectant usage, correlate it with farm-wide herd health data (like Somatic Cell Count trends), and provide real-time reporting to farm managers. This data integration allows for proactive adjustments to the hygiene regimen. Future technological advances are anticipated in the field of non-chemical disinfection methods, such as utilizing ozone or specific wavelengths of UV light in conjunction with traditional sprays, though chemical sprays with superior barrier properties remain the dominant and most cost-effective preventative measure against common mastitis pathogens in high-throughput dairy operations globally.

Regional Highlights

The market exhibits distinct regional dynamics shaped by varying dairy farming structures, regulatory environments, and adoption rates of automation. North America and Europe currently represent the most established markets, commanding significant revenue shares due to their advanced dairy infrastructure, high regulatory requirements for milk quality (driving demand for effective post-dipping sprays), and high penetration of robotic milking technology, which necessitates automated spray solutions. These regions prioritize sophisticated, low-irritation formulations and sustainable product profiles.

Asia Pacific (APAC) is forecast to be the fastest-growing region, propelled by the rapid modernization of dairy sectors in countries like India, China, and Southeast Asian nations. As smallholder farms consolidate and transition to commercial practices, the adoption of basic and intermediate hygiene protocols, including disinfectant sprays, is accelerating dramatically. While price sensitivity remains high, the sheer volume of dairy cattle and governmental focus on improving food safety standards are massive market expansion drivers.

Latin America (LATAM) and the Middle East & Africa (MEA) offer substantial untapped potential. LATAM, particularly Brazil and Argentina, possesses large cattle populations, and increasing foreign investment in dairy modernization is bolstering demand. MEA faces challenges related to infrastructure and water scarcity but shows growing interest in hygiene technologies due to governmental initiatives aimed at enhancing regional food security and complying with international trade standards for dairy exports. Products suitable for harsh environmental conditions are often preferred in these regions.

- North America: Market leader in automated spray systems; strong focus on R&D for barrier technology and sustainable ingredients.

- Europe: Driven by stringent EU regulations (e.g., low SCC targets); high uptake of organic-certified disinfectant products.

- Asia Pacific (APAC): Highest growth potential; modernization of large farm complexes in China and India driving mass market adoption.

- Latin America (LATAM): Emerging market characterized by large cattle inventories; increasing investment in mechanization boosting demand for bulk solutions.

- Middle East and Africa (MEA): Growth fueled by food security initiatives and adoption of specialized disinfectants suitable for challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Nipple disinfectant spray Market.- DeLaval

- GEA Group

- BouMatic

- Ecolab

- Bayer

- Huvepharma

- Zoetis

- Merck Animal Health

- CID Lines

- Lanxess

- Dairyland Initiative

- Kemin Industries

- Novus International

- Phibro Animal Health

- Vilofoss

- Afimilk

- Promat

- DairyChem

- Bio Agri Mix

- Agri-Labs

Frequently Asked Questions

Analyze common user questions about the Nipple disinfectant spray market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between pre-dipping and post-dipping disinfectant sprays?

Pre-dipping sprays are applied before milking to clean the teats and reduce environmental bacteria contamination prior to machine attachment. Post-dipping sprays are applied immediately after milking to disinfect and seal the open teat canal, creating a barrier against pathogens that cause infectious mastitis. Post-dipping typically includes emollients for skin conditioning.

Which chemical formulation is most effective for mastitis prevention?

Effectiveness varies by pathogen type and local resistance. Iodophor-based solutions (iodine) are traditionally effective and broad-spectrum. However, Chlorhexidine-based sprays offer similar efficacy with less staining, while advanced acid-based formulations are gaining preference for their rapid kill rates and low irritation potential, especially when addressing environmental bacteria like E. coli.

How does the increasing automation in dairy farming impact the demand for disinfectant sprays?

Automation, particularly robotic milking, significantly increases the demand for specialized, low-viscosity spray formulations designed for automated application systems. These systems require consistent quality and minimal foaming to ensure precise delivery and efficient operation, driving innovation in delivery technology and product stability.

What are the key factors driving the shift toward organic and sustainable nipple disinfectant solutions?

The shift is driven by escalating consumer demand for organic dairy products, stricter environmental regulations concerning chemical runoff, and the desire among farmers to enhance animal welfare by using formulations with lower toxicity and non-irritating natural ingredients, such as lactic acid or botanical extracts.

What role does the somatic cell count (SCC) in milk play in the nipple disinfectant spray market?

Somatic Cell Count (SCC) is a direct indicator of udder health and mastitis prevalence. Strict regulatory limits on SCC levels globally compel dairy farmers to use highly effective nipple disinfectants as a core preventative measure to keep SCC low, directly driving market demand for high-performance and reliable products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager